Binance's cumulative spot and derivatives trading volume has surpassed $1 trillion.

Written by: Nancy, PANews

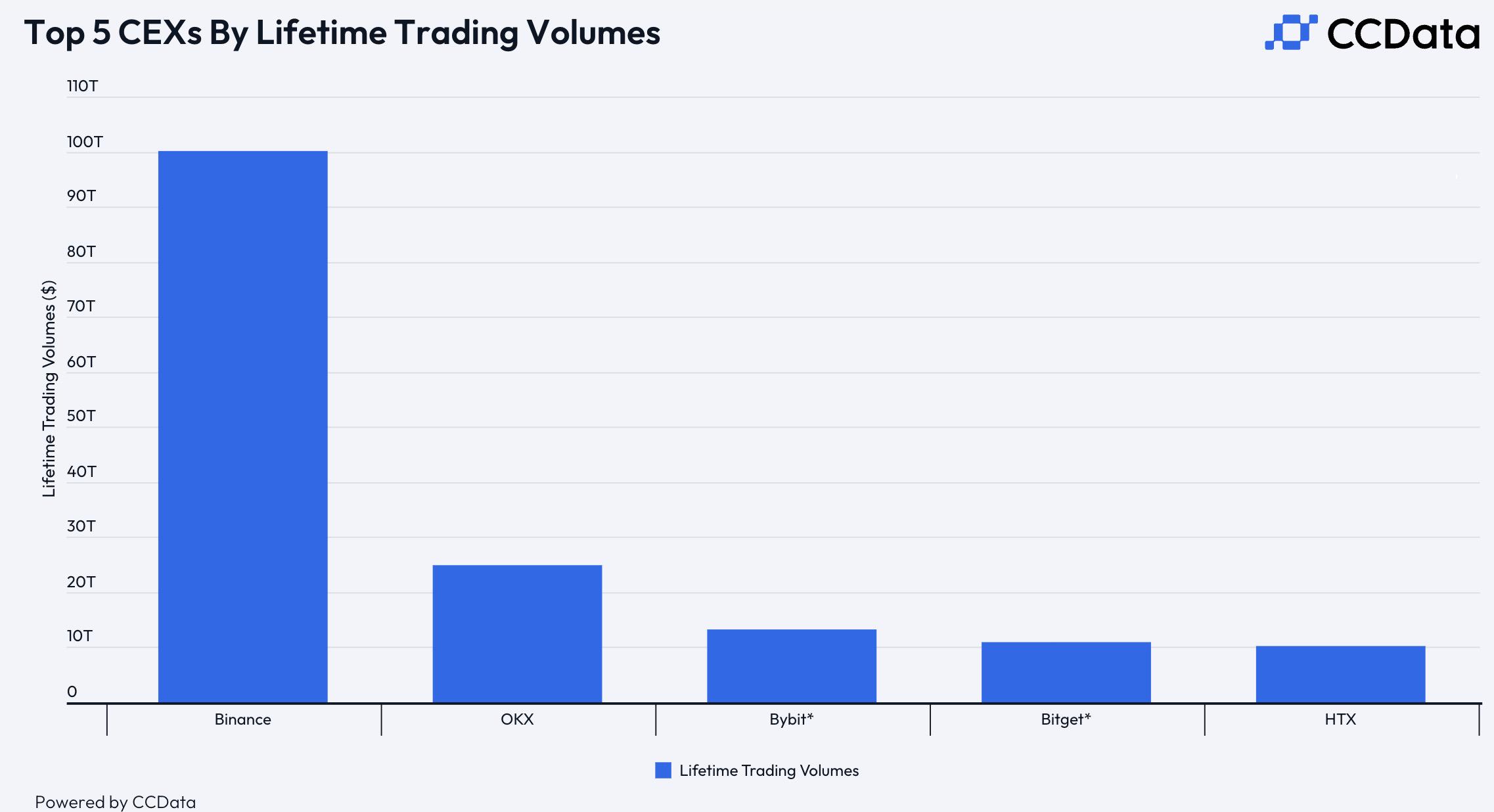

Trading is undoubtedly the main narrative of the cryptocurrency industry, with the primary users and capital in the industry revolving around this core. Currently, the leading trading platforms in the industry have achieved trading volumes as high as trillions of dollars. Recent data released by CCData shows that Binance's cumulative spot and derivatives trading volume has exceeded $1 trillion, a figure that far surpasses other mainstream exchanges, firmly securing its position as the top global cryptocurrency exchange. This not only reflects Binance's strength but also indicates the rapid development and growing recognition of the cryptocurrency industry.

The first exchange to reach a trillion-dollar trading volume: User surge and strong market growth go hand in hand

For cryptocurrency exchanges, trading volume is an important metric for measuring market influence and user activity. It not only reflects the platform's liquidity and trading depth but has also become a key indicator for market participants to assess the platform's stability and reliability.

According to the latest data from CCData, Binance's cumulative spot and derivatives trading volume has surpassed $1 trillion. What does this figure mean? The GDP of the United States in 2023 is approximately $27.36 trillion, meaning that Binance's trading volume is four times that of the U.S. GDP. For an exchange that has been established for seven years, this indicates extremely high trading activity, a massive pool of market capital, and a large user base.

Top 5 CEX by historical trading volume Source: CCData

In fact, Binance CEO Richard Teng announced back in September that Binance had surpassed the $1 trillion mark in historical trading volume. This trading scale not only showcases Binance's leading position in the market but also serves as a direct reflection of the overall prosperity of the cryptocurrency industry.

A large trading volume signifies substantial user participation. Binance announced in June that its global user base had surpassed 200 million, and in September, it further revealed that this number had exceeded 225 million. Since the beginning of this year, Binance has added over 45 million new users, demonstrating its strong growth momentum and continued appeal. Previously, it took Binance five years to accumulate its first 100 million users, but in just over two years, the user count has achieved a leap from 100 million to 200 million.

"This milestone is not just a victory for Binance; it is also a sign of the strong growth and maturity of the entire cryptocurrency industry. In this process, cryptocurrencies have transitioned from 'early adopters' to 'early mainstream,' indicating that an increasing number of people around the world are beginning to accept cryptocurrencies and their limitless possibilities," Richard Teng emphasized. Looking ahead, Binance's focus remains on leading efforts to promote financial inclusion and innovative initiatives.

The key to the dual growth of trading volume and user numbers lies not only in the mainstreaming of the cryptocurrency industry but also in Binance's continuous iteration and innovation of trading products, which is a profound insight and active response to user needs.

User-centered evolution and innovation of Binance's trading products this year

From the historical perspective of trading product iteration in cryptocurrency exchanges, it has long evolved from the initial single function of spot trading to a diverse range of trading options, including contract trading, leveraged trading, futures trading, staking and lending, dollar-cost averaging, and NFT markets, to meet the needs of different types of investors.

In addition to the above functions, Binance has also launched numerous new products this year, including the token issuance platform Megadrop, trading bots, HODLer airdrops, liquid staking tokens BNSOL, pre-market trading, and expanded derivatives trading.

Megadrop: In April this year, Binance launched the token issuance platform Megadrop, which combines the Binance Earn platform and Web3 wallet, allowing users to subscribe to BNB fixed-term products or complete tasks from project parties in the Binance Web3 wallet to interact directly with selected project parties and receive airdrop rewards, providing users with a friendly and multifaceted channel.

Trading Bots: Cryptocurrency trading bots have significant advantages such as executing trades more efficiently, eliminating emotional biases in trading decisions, and enabling round-the-clock trading. Their popularity has surged. In May, Binance also launched trading bot services that cater to various goals, including spot grid, arbitrage bots, smart holdings, dollar-cost averaging plans, and algorithmic orders. According to Binance's official website, as of October 21, Binance has over 112,000 running strategies involving asset values exceeding $6.1 billion.

HODLer Airdrop: To enhance the trust and loyalty of BNB holders, Binance launched the HODLer airdrop program, where users who use BNB to subscribe to fixed or flexible products on the Earn platform can receive airdrop tokens issued by projects with high token circulation supply that plan to list on the Binance platform.

BNSOL: The liquid staking market for Solana has shown strong growth this year, attracting participation from various parties due to rapidly growing capital. In September, Binance launched the BNSOL service, allowing users to receive liquid staking tokens BNSOL after staking SOL, enabling them to earn staking rewards while flexibly using Binance products (such as Binance dollar-cost averaging, staking borrowing, and one-click buying) and external DeFi platforms.

Pre-market Trading: Thanks to the surge in airdrop projects and star projects, the pre-market trading feature has become a popular market play, allowing users to trade projects that have not yet launched. For investors, pre-market trading serves not only as a rehearsal for capital flow but is also crucial for capturing market opportunities and adjusting trading strategies. Binance recently officially launched the pre-market trading feature and introduced the first pre-market trading token Scroll, allowing users to buy and sell before the Launchpool token is listed.

These new products not only enrich Binance's product line but also reflect its product culture of simplicity, transparency, innovation, speed, and community orientation. Moreover, in response to market trends, Binance has successively launched multiple projects in popular sectors such as TON and MEME ecosystems, actively responding to more user investment needs while exploring more avenues for growth.

The ultimate reflection of user demand for the platform lies in the products themselves, which can most intuitively reflect the platform's systemic capabilities. From this perspective, Binance's user experience-driven product innovation model not only broadens users' trading choices and significantly enhances trading flexibility and efficiency but also effectively promotes the platform's continuous growth and helps the cryptocurrency trading market move towards further maturity.

CZ's "exit" and Binance's compliance advancement

The phrase "GM" is not only CZ's freedom but also the beginning of a new compliance cycle for Binance. Compliance has always been an important guarantee for products to gain user trust and competitive advantage, as well as a safe foundation for driving product innovation.

After experiencing the rapid development phase of the early cryptocurrency era, Binance, under CZ's leadership, demonstrated remarkable growth. However, as global compliance gradually takes shape, Binance has also undergone significant changes in the era of tightening cryptocurrency regulations. Now, under the leadership of new head Richard Teng, Binance is responding to the evolving regulatory environment from a new compliance height.

For instance, this year, Binance has obtained compliance licenses in multiple jurisdictions worldwide, including the virtual asset service provider license issued by the Dubai Virtual Assets Regulatory Authority in April; in September, Binance Kazakhstan received formal approval for comprehensive regulatory licensing from the Astana Financial Services Authority (AFSA), becoming the first digital asset platform to obtain comprehensive regulatory licensing from AFSA; the following month, Binance was included in the virtual asset service provider registration center of the Argentine National Securities Commission (CNV), achieving its 20th global regulatory milestone… These announcements highlight Binance's compliance momentum globally.

Moreover, Binance is also working on compliance within its own operations. For example, in June, Binance announced that it would implement stricter monitoring policies, including technological improvements and establishing channels for reporting abusive behavior, to address account abuse issues on the platform.

To this end, Binance has invested significant human and financial resources in compliance. According to Richard Teng, Binance plans to have over 700 compliance staff by the end of 2024, with annual expenditures exceeding $200 million to meet regulatory requirements (including U.S. regulations based on plea agreements).

"The rising tide applies to the compliance upgrades across the entire industry. Once all major participants in this field are fully compliant, irresponsible participants will either be forced to meet new standards or exit the market, allowing the industry to enter a virtuous cycle of increasing trust, thereby promoting the adoption of cryptocurrencies. In the long run, abandoning best compliance practices will lead to a decline in user trust and business downturns. More importantly, regardless of how much tactical benefit these participants can gain from lax anti-money laundering and identity verification policies, such behavior will ultimately hinder the development and maturity of the entire industry, resulting in greater negative impacts on all participants and users. The industry should learn from Binance's past mistakes, not be a small boat waiting for the tide to lift it, but become the tide itself," Richard Teng reiterated the necessity of compliance on Binance's seventh anniversary.

The tide of the times continues to surge. Looking back over the past seven years, with a profound understanding of user needs, a rich product line, flexible adaptability, and continuous innovation, Binance has consistently adjusted its course in the cryptocurrency journey, avoiding the "reefs" and "storms" of the market while daring to create winds to ensure a "smooth sailing" experience. Now, facing a volatile market environment and complex regulatory landscape, Binance is embracing the next development cycle with a more robust and mature posture.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。