Content & Review | Ethereum Chinese Weekly

Organization & Editing | Connie

Image Source: Internet

"Ethereum Chinese Weekly"

——Building an Information Bridge for Chinese Ethereum

Introduction to "Ethereum Chinese Weekly"

Every Monday at 2 PM (UTC+8), the Ethereum Chinese Weekly invites renowned project engineers, KOLs, and others from the Web3 industry to share insights on Ethereum industry topics, interpretations of reports from well-known institutions, analyses of new projects, hot topic reviews, and more.

The "Ethereum Chinese Weekly" (hereinafter referred to as "Weekly") gathers the exciting content from the "Ethereum Chinese Weekly Meeting," capturing the latest news and in-depth analyses, continuously delivering fresh and substantial content to you.

The Ethereum Chinese Weekly Meeting and the "Weekly" are jointly initiated by Web3BuidlerTech and ETHPanda, with support from communities like LXDAO.

Together with you, we are building an information bridge for Chinese Ethereum.

Ethereum Chinese Weekly Videos

Bilibili:

https://www.bilibili.com/video/BV1NeyVYPEA5

YouTube:

https://youtu.be/RRog-awII

This issue's sharing materials:

https://www.notion.so/web3buidler/Web3BuidlerTech-702bd1ab80a7422586f1edac1917fa9c

Table of Contents

This issue of the "Weekly" consists of 2 parts, taking approximately 10 minutes to read.

- Overview of Industry Information from Last Week

Blockchain News

Data Trends

- In-Depth Content Analysis

Vitalik's New Article: The Possible Future of the Ethereum Protocol (Part 1) The Merge

Vitalik's New Article: The Possible Future of Ethereum (Part 2) The Surge

Debate between Sreeram and Lily Liu on ETH vs SOL

Analyzing Whether to Raise Ethereum Gas Limit Again from Three Perspectives: Storage, Bandwidth, and Computation

a16z: 2024 Crypto Industry Report

Four Product Development Directions for Base in the Coming Year

Overview of Industry Information from Last Week

(October 14 to October 21)

Blockchain News

- Vitalik published a new article "The Possible Future of the Ethereum Protocol: The Merge." It discusses what improvements can be made to the technical design of proof of stake and the ways to achieve these improvements.

Learn more:

https://x.com/VitalikButerin/status/1845710232959492310

- Vitalik released the second part of "The Possible Future of the Ethereum Protocol": The Surge, with key goals as follows:

Achieve 100,000+ TPS on L1+L2; maintain decentralization and robustness of L1;

At least some L2s fully inherit Ethereum's core attributes (trustless, open, censorship-resistant);

Maximum interoperability between L2s;

Ethereum should function as an ecosystem, not as 34 different blockchains. The article states that the current task is to complete the rollup-centric roadmap and address related issues while maintaining the decentralization of Ethereum L1.

Learn more:

https://x.com/VitalikButerin/status/1846713513097810296

- On October 20, Vitalik published the third part of "The Possible Future of the Ethereum Protocol": The Scourge, proposing two key goals:

Minimize the centralization risk of the Ethereum staking layer (especially in block construction and capital supply, i.e., MEV and staking pools);

Minimize the risk of extracting excessive value from users;

Vitalik emphasized that addressing issues such as the centralization bottleneck in block construction, economic reasons for staking centralization, the 32 ETH minimum staking requirement, and hardware requirements will help Ethereum's decentralized development;

Previously, it was reported that in December 2023, Vitalik will announce an updated 2023 Ethereum development roadmap, which includes six parts: The Merge, The Surge, The Scourge, The Verge, The Purge, and The Splurge.

Learn more:

https://x.com/VitalikButerin/status/1847811676164542857

- At the "10th Global Blockchain Summit" hosted by Wanxiang Blockchain Lab, Vitalik Buterin stated in his speech that "in the future, Ethereum can achieve over 100,000 TPS through L2, with transfers between any chains possible within 2 seconds, and a unified user experience will also be formed. The infrastructure of Ethereum is also expanding, and the security link is more important than EVM."

Learn more:

https://www.blockchainlabs.org/week2024/live/zh

- Vitalik Buterin responded to Biconomy's co-founder, stating, "Undoubtedly, quantum computing is the biggest driving force. Whether we like it or not, external accounts (EOA) will eventually disappear in the long-term future, as quantum computing will ultimately break ECDSA."

Learn more:

https://x.com/VitalikButerin/status/1847258820634189948

- On October 18, Galaxy Research Vice President Christine Kim summarized the 144th Ethereum Core Developer Consensus (ACDC) conference call. This week, developers discussed and coordinated modifications to the Ethereum consensus layer (CL).

Developers agreed to add EIP 7742 changes to Pectra, allowing the beacon chain to dynamically set the network's target and maximum Blob Gas fee limits;

EF developer operations engineer Barnabas Busa stated that he plans to immediately shut down Pectra Devnet 3;

Currently, Geth and Ethereum JS clients are ready, and the Lighthouse, Teku, and Nimbus clients on the CL side are also ready.

Learn more:

https://x.com/christine_dkim/status/1847288086562218046

- On October 15, according to official news, the Uniswap Foundation announced the launch of the Unichain Developer Grant Program to accelerate the work of DeFi developers. The Unichain Developer Grant Fund will support developers in exploring:

1. Novel exchange mechanisms;

2. Innovations in DeFi experiences;

3. Improvements in liquidity infrastructure.

Learn more:

https://x.com/UniswapFND/status/1845878197851934756

PancakeSwap officially launched PancakeSwapX, providing zero transaction fees and gas-free trading services on Ethereum and Arbitrum. PancakeSwapX aggregates liquidity from multiple sources, including PancakeSwap's AMM pools, other decentralized exchanges (DEX), and external liquidity providers, offering users better execution prices. Users do not need to pay gas fees, and during the initial launch period, trading of over 150 tokens is supported with zero fees.

On October 17, the rollup deployment platform Conduit announced the launch of the sorter Conduit G2, which can achieve a throughput of up to 100 Mgas/s and maintain this performance over the long term, creating new possibilities for on-chain applications. · Performance is 10 times that of existing sorters; · 100% compatible with OP Stack and Arbitrum Orbit; · Not theoretical or "coming soon," but already in production.

ZKsync released its first governance proposal, named ZKsync Ignite. This proposal plans to transform ZKsync Era into a liquidity hub for Elastic Chains. To achieve this goal, 300 million ZK tokens will be distributed to DeFi users over the next nine months. The proposal has been published on the ZK Nation forum, aiming to further promote and expand the development of the ZKsync ecosystem.

Scroll announced that it will soon launch the next incentive program, stating that this time it will bring the largest rewards and new rules to the community to accelerate project growth, speed up asset onboarding, and provide retroactive rewards for original products.

Data Trends

- L2BEAT Data (as of October 21, 2024):

The total locked value (TVL) is $38.89 billion, up 5.92% over the past week.

Arbitrum One ranks first with a TVL of $14.18 billion, a 7.57% increase over the week;

Base ranks second with a TVL of $7.95 billion, a 2.84% increase over the week;

OP Mainnet ranks third with a TVL of $6.55 billion, a 4.99% increase over the week;

Scroll has a TVL of $1.38 billion, down 2.59%.

Learn more:

https://l2beat.com/scaling/activity

- Blockchain Financing: As of October 21, there were a total of 25 transactions, amounting to $402 million, with 8 transactions exceeding $10 million, and Blockstream raised $210 million.

Learn more:

https://www.rootdata.com/zh/Fundraising

- According to CoinDesk, Galaxy Digital's latest report shows that global investment in cryptocurrency startups reached $2.4 billion in Q3 2024, a 20% decrease from the previous quarter, with the number of investment deals down 17%.

In the first three quarters of this year, the crypto industry has accumulated $8 billion in investments, and the total financing scale for the year is expected to be roughly the same as in 2023, far below the levels of over $30 billion per year in 2021 and 2022.

85% of the funds flowed into early-stage projects, with exchanges, lending, and trading platforms attracting the most investment, approximately $460 million. The United States remains the primary source of investment, accounting for 56% of the total investment. Projects combining crypto and artificial intelligence received about $270 million in investment, a fivefold increase from the previous quarter.

Learn more:

https://www.rootdata.com/zh/Fundraising

- Michael Nadeau, founder of The DeFi Report, stated on the X platform that last year, Uniswap generated nearly $1.3 billion in trading and settlement fees across Ethereum, Base, Arbitrum, Polygon, and Optimism.

However, these fees were not earned by the protocol and token holders; 100% flowed to liquidity providers, Ethereum validators, MEV bots, and L2 sorters. But with the launch of Unichain later this year, all of this will change.

Learn more:

https://x.com/JustDeauIt/status/1845565893050270134

- Tether released a new article stating that the adoption rate of USDT has significantly increased. As of the end of Q3 2024, there are 330 million on-chain wallets and accounts (equivalent to the number of users) that have received USDT, with an average growth rate of 9% over the past four quarters. The number of new users in Q3 2024 reached a record high of 36.25 million.

In-Depth Content Analysis

Vitalik's New Article: The Possible Future of the Ethereum Protocol (Part 1) The Merge

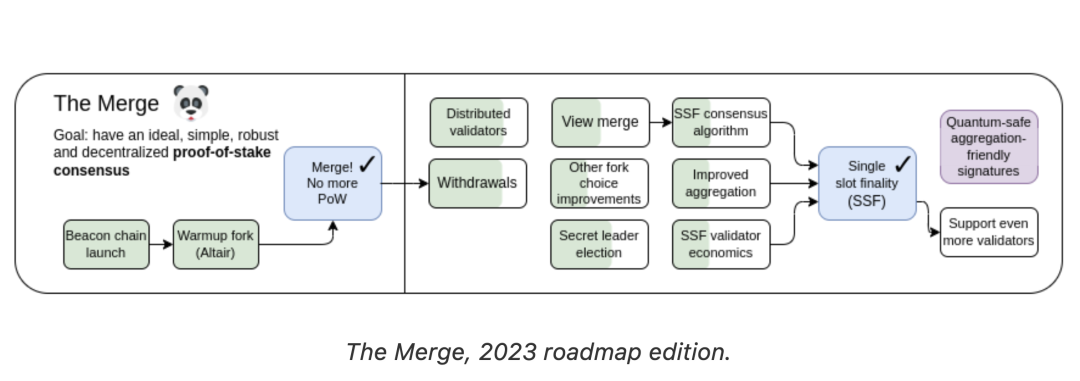

In his new article, Vitalik Buterin reviews Ethereum's transition from PoW to PoS. Over the past two years, Ethereum's PoS system has maintained excellent stability, reducing transaction confirmation times and optimizing network processing capabilities while avoiding decentralization risks. At the same time, Vitalik proposed further improvement directions, including achieving single-slot finality to accelerate transaction confirmation, democratizing staking to lower the threshold for independent stakers, electing a single secret leader to enhance validator security, and achieving faster transaction confirmations. The article also explores areas such as 51% attack recovery, increasing voting effectiveness thresholds, and resistance to quantum attacks.

Learn more:

https://vitalik.eth.limo/general/2024/10/14/futures1.html

Chinese translation from LXDAO (authorized by Vitalik), or click here to view:

https://mirror.xyz/lxdao.eth/SUlAuF-3-7GYwZksz5qRvBxMUx2UF8JU-Pvv7pop7rQ

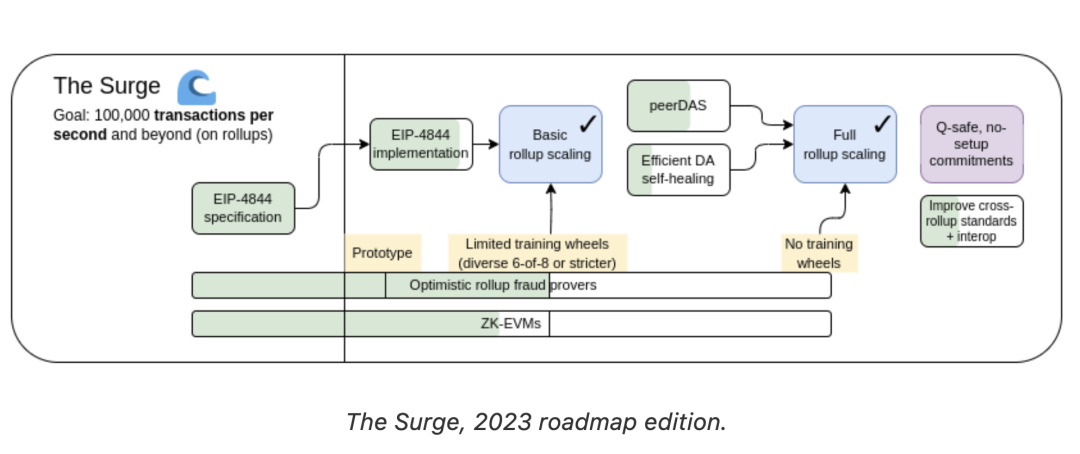

Vitalik's New Article: The Possible Future of Ethereum (Part 2) The Surge

The second part mainly discusses Ethereum's scaling roadmap, with the core goal of achieving over 100,000 TPS through L1+L2 while maintaining the decentralization and security of L1. The article analyzes technical challenges such as data availability sampling, data compression, the maturity of L2 proof systems, and improvements in cross-L2 interoperability, and discusses how Ethereum can maintain robustness while scaling performance, ensuring consistency and efficiency within the ecosystem.

Read the original:

https://vitalik.eth.limo/general/2024/10/17/futures2.html

Chinese translation from Forsight News:

https://foresightnews.pro/article/detail/69763

Debate between Sreeram and Lily Liu on ETH vs SOL

Sreeram Kannan, founder of EigenLayer, and Lily Liu from the Solana Foundation engaged in a debate about ETH and SOL. In terms of scaling architecture, ETH achieves asynchronous scaling through L2, while SOL relies on a fully replicated architecture, which, although fast, has scaling bottlenecks. ETH emphasizes decentralization, public innovation, and a culture of trusted neutrality, while SOL focuses more on speed and individual benefits. In terms of trust and stability, ETH builds long-term trust through stable rules, while SOL's centralization may pose risks of changing rules. ETH's openness also attracts more innovators, while SOL focuses on rapid iteration. This debate highlights the core differences between ETH and SOL: ETH emphasizes sustainable development through multi-layer asynchronous scaling, decentralization, and long-term trust, while SOL focuses more on speed and individual interests.

Learn more:

https://x.com/sreeramkannan/status/1846577833641914531

Debate video:

https://youtu.be/oLrcxVjfzZU?si=jlJ4isOOoewheJrs

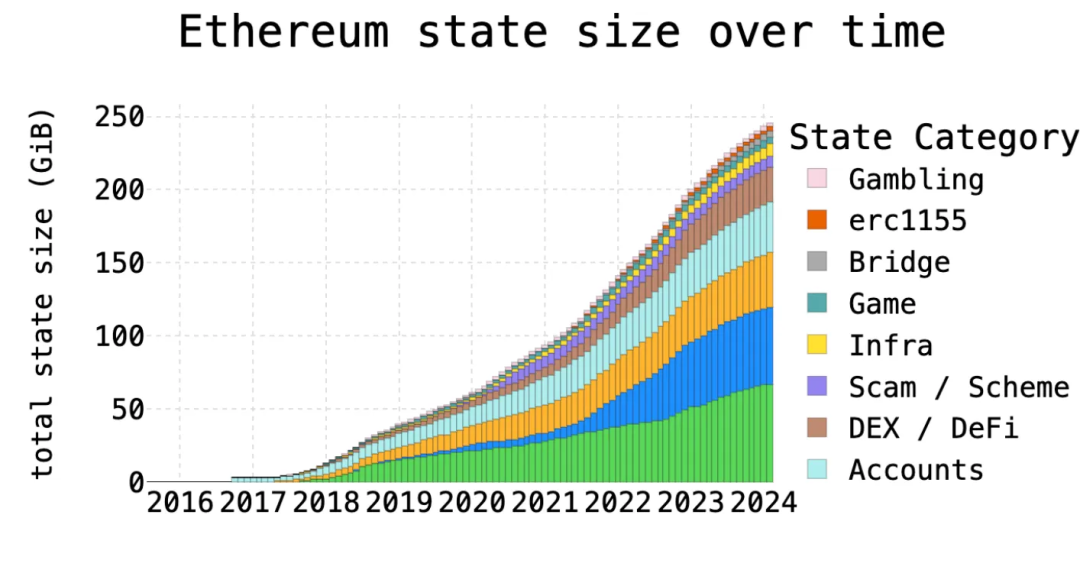

Analyzing Whether to Raise Ethereum Gas Limit Again from Three Perspectives: Storage, Bandwidth, and Computation

Giulio Rebuffo, head of the Ethereum client Erigon team, wrote an article discussing whether the Ethereum gas limit should be raised again, suggesting that a 33% or 50% increase could be considered, but caution should be taken to avoid rapid increases to ensure the stability of the Ethereum network. The author pointed out that storage growth is not the main bottleneck, as the speed of hardware upgrades can meet these demands, while bandwidth is a more challenging issue. However, EIP-7783 provides effective mechanisms to control these risks. At the same time, the author believes that it is still too early to reduce slot time through EIP-7782, as this may negatively impact decentralized validation technology (DVT) and single-slot finality (SSF).

Learn more:

https://erigon.tech/are-we-finally-ready-for-a-gas-limit-increase/

Chinese translation from ChainFeeds:

https://www.chainfeeds.xyz/feed/detail/3d78f66d-17de-4493-a61d-f2b1f2b97011

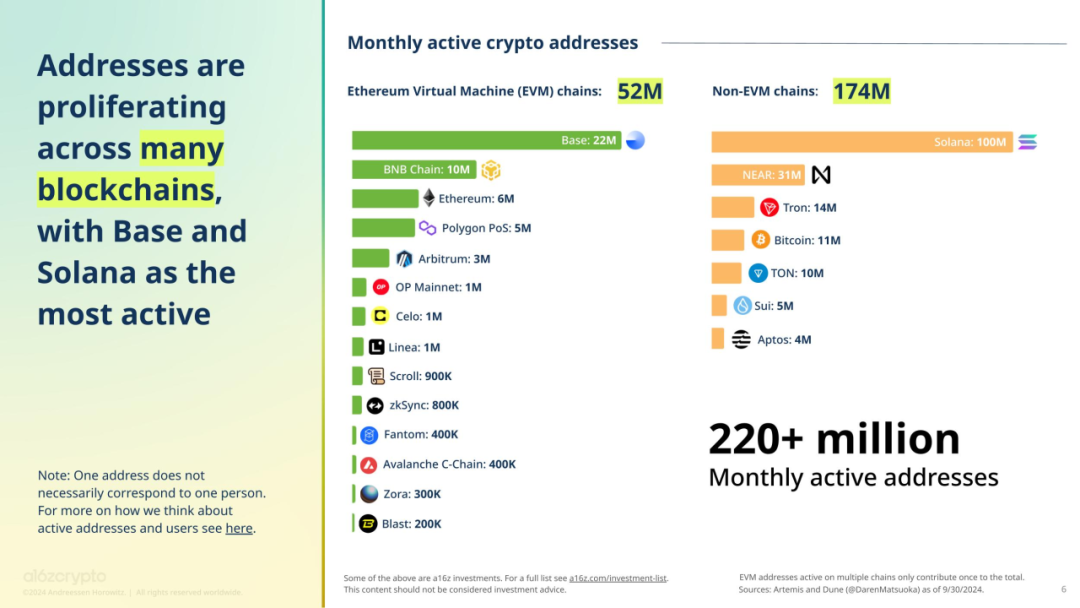

a16z: 2024 Crypto Industry Report

a16z's latest "2024 Crypto Report" reveals significant growth in the cryptocurrency ecosystem, with the number of active addresses exceeding 220 million, the use of stablecoins gradually finding market fit, and L2 payment costs significantly decreasing by 94%. Ethereum's Dencun upgrade has driven a 36% increase in ETH value on L2, while NFT market behavior is shifting towards low-cost, social collectibles. This report further illustrates that the rapid expansion of crypto infrastructure is driving new applications and user activities.

Read the original:

https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

In the Coming Year, Four Product Development Directions for Base

At the beginning of October, Jesse answered 100 questions from the community on Warpcast, covering a wide range of topics. Joe Zhou, deputy editor of Foresight News, selected four product development directions for Base in the coming year to share: the development of unsecured credit products to enhance the on-chain lending experience based on user credit and transaction history; promoting the on-chain integration of local stablecoins in different countries, such as the OAK stablecoin currently launched in Auckland; further developing on-chain social media and creator tools to enhance the transmission of users' private information; and reducing payment costs for small businesses through PayFi, bringing more profits to merchants. Base will continue to expand in the fields of financial and social innovation.

Read the original:

https://www.chainfeeds.xyz/feed/detail/c95141e3-8de6-4657-bbd2-fb741ea31aa6

Related article "Base Founder Jesse Answers 100 Questions from the Community":

https://foresightnews.pro/article/detail/69190

This concludes the content of this issue of the Ethereum Chinese Weekly. Thank you for reading!

Next Monday at 14:00 (UTC +8), we look forward to sharing the new issue with you! (Joining instructions are at the end of the article)

Image source: Internet, please delete if infringing.

Co-initiated Community

Supporting Community

LXDAO is a research and development DAO focused on sustainably supporting valuable Web3 public goods and open-source projects.

Join Us

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。