Author: Frank, PANews

Several DeFi project governance tokens within the Solana ecosystem have seen significant increases, with JUP's price rising by 57% over the past two weeks, RAY reaching a maximum increase of 102%, and ORCA also rising by 33%. It seems that DeFi products in the Solana ecosystem have become the first sector to radiate after the MEME craze? Are these noticeable increases specifically due to MEME coins or are there other reasons? PANews conducted an investigation on this.

80% of Transactions Come from MEME

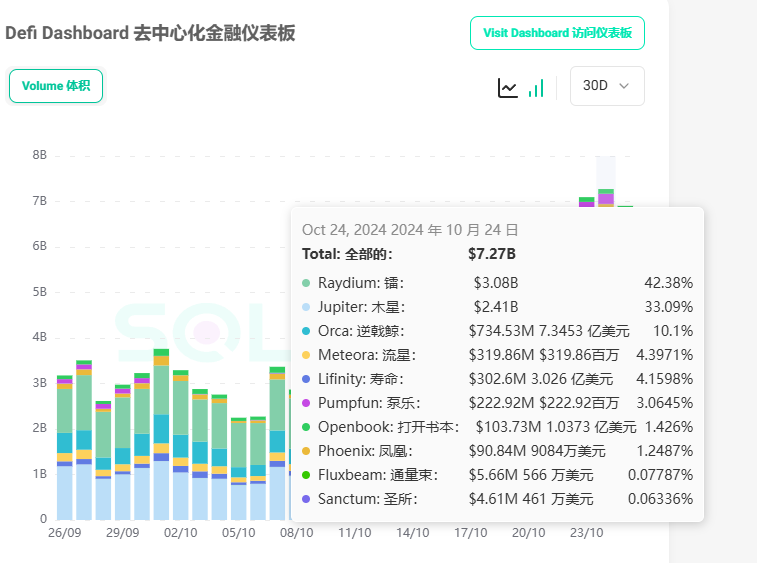

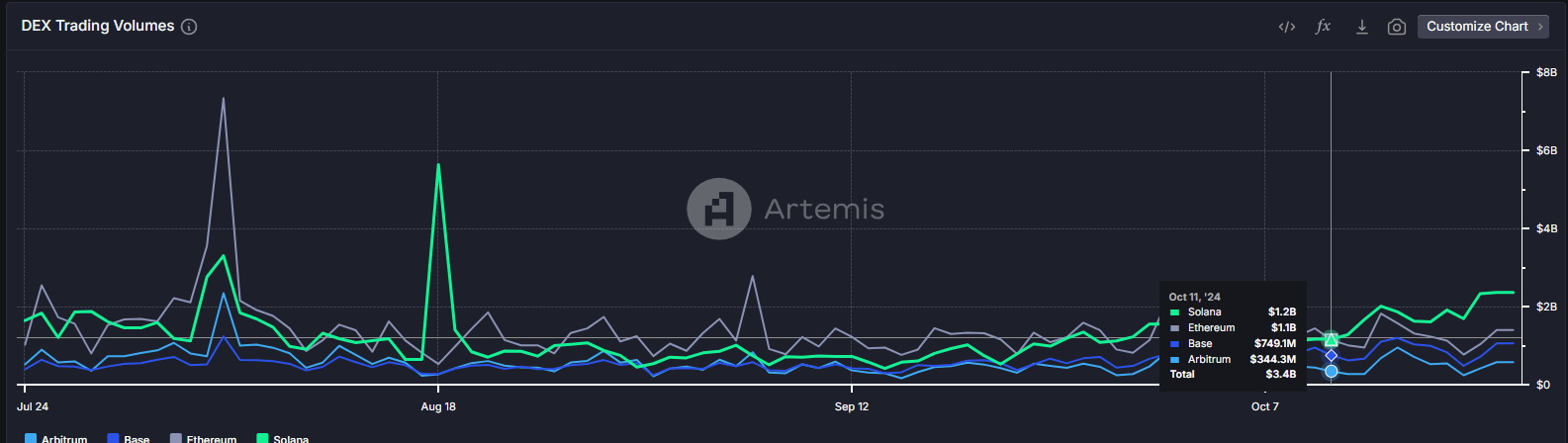

Overall, the rise of DeFi tokens in the Solana ecosystem is closely linked to changes in data. Over the past month, DeFi data on the Solana chain has seen substantial growth, with a trading volume of $2.8 billion on September 24, which increased to $7.27 billion by October 24, marking a monthly growth of 259%. Currently, Solana's DeFi trading volume has far surpassed that of Ethereum, becoming the public chain with the largest trading volume.

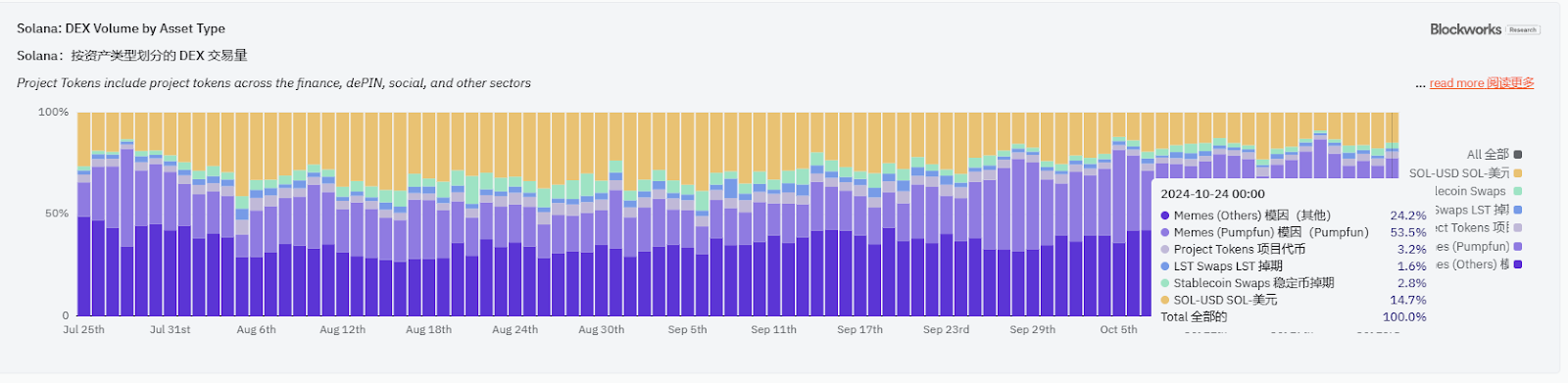

Among this, nearly 80% of the trading volume comes from MEME coins. According to data from Blockworks, on October 24, 53.5% of the trading volume on Solana DEX was from Pump.fun related MEME, while 24.2% came from other MEME transactions. Raydium is undoubtedly still the biggest beneficiary, holding a 65.9% market share.

Multiple data changes indicate that the main shift in Solana occurred on October 11, with the recently popular GOAT created on October 10, surging 153 times on the 11th, becoming the new king of MEME. Overall, MEME coins remain the biggest driving force behind Solana DeFi.

Whales Contribute 70% of Trading Volume, 10U War God Contributes About One Ten-Thousandth

From the perspective of address numbers, data from October 23 shows that there are approximately 4.48 million active addresses with less than $10, accounting for 83% of the total active addresses of 5.38 million, while the number of trading addresses exceeding $500,000 is only 26,000, accounting for about 0.4%.

However, a large number of addresses does not equate to significant power. On October 23, addresses on the Solana chain with more than $500,000 contributed a trading volume of $3.11 billion, while the total DEX trading volume that day was $4.25 billion, accounting for over 73%. In contrast, addresses with less than $10 contributed only $580,000, accounting for about one ten-thousandth.

In summary, on Solana, addresses representing 0.4% of the total contributed over 73% of the trading volume, while the retail addresses, which account for over 83%, contributed only about one ten-thousandth.

Retail trading is concentrated on Raydium, with 84% of the trading volume from addresses under $10 occurring on Raydium, while the trading volume from addresses over $500,000 is mainly concentrated on DEXs like Raydium and Orca. Another data point shows that 74% of the trading volume on Solana's DEX comes from MEME coin transactions, indicating that most of the funds from large addresses on Solana are also used for trading MEME.

Jupiter's Continuous Actions Promote Growth, Rayium Wins by Relying on MEME

Specifically regarding these DEX products, these changes do not seem to be entirely driven by MEME. PANews analyzed several major Solana DEX products.

As the largest DEX aggregator on Solana, Jupiter's movements have always been an important indicator of activity on the Solana chain. Since October, Jupiter has been very active, first announcing the launch of a new mobile version on October 8, with major updates including zero platform fees and built-in on-chain functionality. The built-in on-chain functionality supports various payment methods such as Apple Pay and credit cards. The introduction of payment features like Apple Pay and credit cards is seen as a new fiat channel.

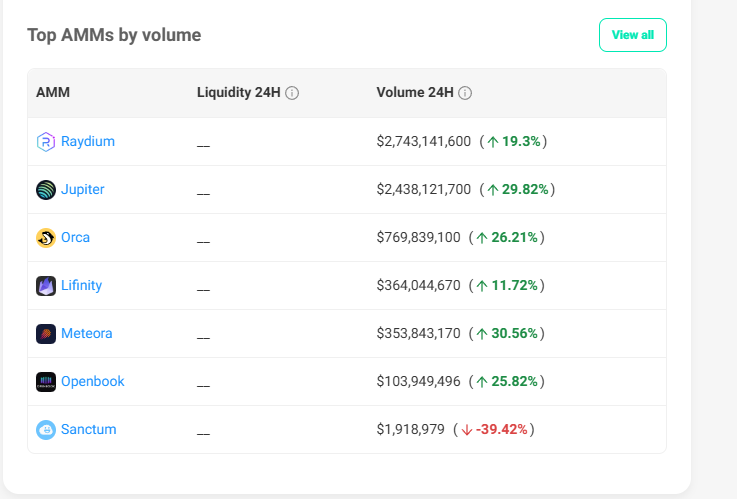

Following that, on October 17, Jupiter announced the launch of the Solana Memecoin terminal "Ape Pro," with the main update being the implementation of MEV protection, which can significantly improve the issue of sandwich attacks. Additionally, on October 21, it opened the application for the third quarter's active equity staking rewards. Multiple updates or rewards led to Jupiter's trading volume surging from $790 million on October 6 to $2.4 billion by October 24, a threefold increase in monthly trading volume. With the growth in data, the price of the token JUP rose by 57% from October 11 to October 24, outpacing many other mainstream tokens.

Rayium's governance token has also performed outstandingly recently, with a maximum increase of 102% from October 10 to October 24. From a news perspective, Rayium has not announced any major actions. The primary growth still comes from the data side, first with the GOAT token created on October 10 bringing the MEME craze back to the Solana ecosystem. With the explosive growth of the GOAT token, the trading volume from this single project approached $1.5 billion. Since October 10, Rayium's trading volume has seen exponential growth, starting from around $1 billion daily to over $3 billion by October 24. On the 23rd, Rayium officially announced that its total trading volume exceeded $300 billion, earning $620 million for liquidity providers and stating it would spend $50 million to repurchase RAY tokens.

Orca's market share has been significantly squeezed over the past six months. Currently, DEX users on Solana are primarily concentrated on Rayium, whereas six months ago, both Orca and Rayium had market shares of around 35%, together accounting for over 70% of trading volume. However, with Pump.fun becoming increasingly popular, it continuously brings new trading volume to Rayium. Orca's market share now remains only between 10% and 15%. From the user structure perspective, Orca's trading volume is mainly maintained by large addresses. On October 23, another one-click token issuance platform, GoFundMeme, chose Orca as its trading pool after breaking through the curve, and Orca's official account provided a lengthy introduction to GoFundMeme. It seems that Orca is hoping to regain its original market share by supporting another MEME launch platform.

In addition to the aforementioned major DEXs, the growth of Lifinity is also worth noting. Lifinity is an active market maker on Solana, using oracles as a key pricing mechanism. Since October 14, Lifinity's on-chain trading volume has grown from less than $100 million daily to about three times that in half a month, reaching $363 million by October 23. In terms of trading popularity, Lifinity's main trading pairs are still concentrated on SOL staking tokens and stablecoin pairs, and Lifinity's yield protocol Sandglass announced on October 24 that it currently offers a fixed yield of over 9% on USDC, which may be related to the recent data growth and such high-yield products.

Overall, the growth of Solana's DeFi ecosystem is still driven by the recent hot AI-themed MEME coins. Although the TVL data has also seen growth, the overall change is not significant. The growth in data is certainly a good thing, but if it only relies on the speculative liquidity of MEME to achieve market prosperity, how long can it last is perhaps a question worth pondering. However, the MEME craze seems to have become a periodic explosive event on Solana; who knows what the next round of "MEME+" will bring for growth?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。