Crypto Circle News

October 26 Hot Topics:

1. Michael Saylor claims Microsoft could make the "next trillion dollars" using Bitcoin.

2. Tether CEO: There are no signs that the U.S. Treasury is investigating stablecoin issuers.

3. ZachXBT: Funds returned by the attacker of the U.S. government address do not include those already transferred to exchanges.

4. Wintermute now accepts USDe as collateral for cryptocurrency trading.

5. Mantle announces a partnership with stablecoin issuer Agora, AUSD has been deployed on the Mantle network.

Trading Insights

Slow bull market and chip absorption!!! A slow bull market typically refers to a sustained and stable rise in stock prices or asset prices over a long period, rather than significant fluctuations in the short term. In the Bitcoin market, this type of market may be achieved through continuous oscillation and washout processes, gradually increasing the average holding cost in the market. Institutions can gradually collect chips to control a larger market share without causing excessive market reactions. This helps them gain greater profits when prices rise in the future. As institutional participation in the Bitcoin market increases, they may gradually gain pricing power. This means that institutions can influence Bitcoin's price trends through buying and selling actions. The pricing power of institutions may stem from their financial strength, market analysis capabilities, and extensive trading networks. These factors enable them to play a significant role in the market. The U.S. is gradually collecting chips through Bitcoin spot ETFs, indicating that institutional interest in Bitcoin is increasing. ETFs, as an investment tool, allow investors to indirectly hold Bitcoin by purchasing fund shares, thereby reducing the risks and barriers of directly holding Bitcoin. The active participation of institutions like BlackRock further proves their optimism about the Bitcoin market. By purchasing large amounts of Bitcoin, they not only increase their holdings but also drive the overall market up. Bitcoin, as an emerging digital asset, may have market potential different from traditional assets like gold. However, in terms of speculation and market attention, Bitcoin indeed has enormous potential. Currently, Bitcoin has not seen a significant rise, possibly because institutions do not have enough chips yet, or the market is still waiting for a trigger point to push prices up. Once institutions collect enough chips and market confidence increases, Bitcoin's price may experience a significant rise.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White Community this week. Congratulations to the friends who followed along; if your operations are not going well, you can come and try it out.

The data is real, and each order has a screenshot from the time it was issued.

Search for the public account: Big White Talks About Coins

BTC

Analysis

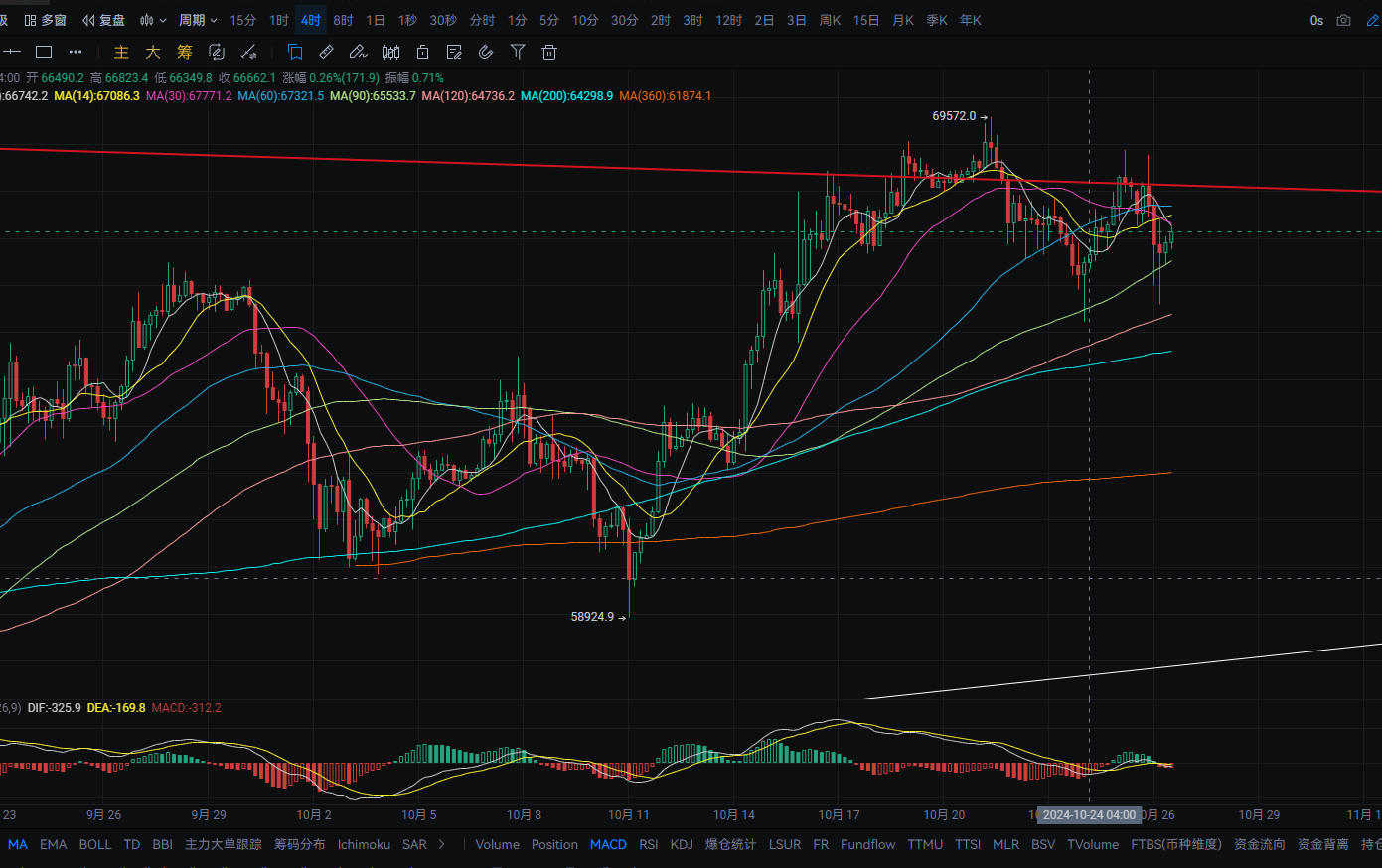

Yesterday, the group suggested buying near 65600, and the current position is profitable. Buying near 66260 has reached the profit target. The daily line showed a pullback yesterday, dropping from a high of around 68750 to a low of around 65580, closing near 66700. The support level is near MA30, and a pullback can be bought nearby. The resistance level is near the MA7 moving average; a breakout could lead to the upper trend line. MACD bullish volume is decreasing, forming a death cross. On the four-hour chart, the support level is near MA90; if it breaks, it could drop to MA120. A pullback can be bought nearby. The resistance level is near MA30, with MACD bearish volume increasing.

ETH

Analysis

Ethereum suggested buying near 2456.7 yesterday, and it has now reached the profit target near 2500. The daily line showed a pullback yesterday, dropping from a high of around 2565 to a low of around 2380, closing near 2440. The resistance level is near MA60; a breakout could lead to MA30. The support level is near 2400; a pullback can be bought nearby. MACD bearish volume is increasing, forming a death cross. On the four-hour chart, the support level is at 0.786 (around 2430); a pullback can be bought nearby. The resistance level is near the MA360 annual line; a breakout could lead to MA14. MACD bearish volume is increasing.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。