Author: andrew.moh, Crypto KOL

Compiled by: Felix, PANews

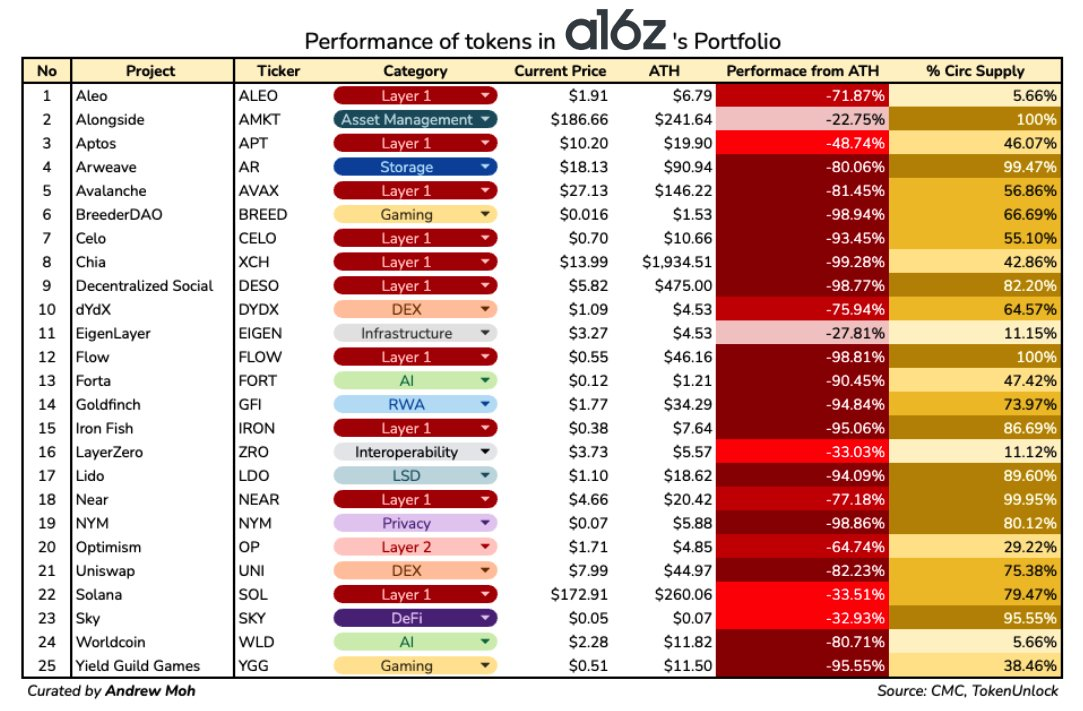

a16z is considered a top-tier VC. Following their investment footsteps may be a wise strategy. The performance of tokens in the a16z portfolio is as follows:

Why choose a16z?

Marc Andreessen and Ben Horowitz are top entrepreneurs and investors. They have invested in major companies like Airbnb, Github, Skype, and Stripe, and their investment performance was impressive even before the emergence of cryptocurrencies. a16z has over 100 team members, including well-known figures like Tim Roughgarden.

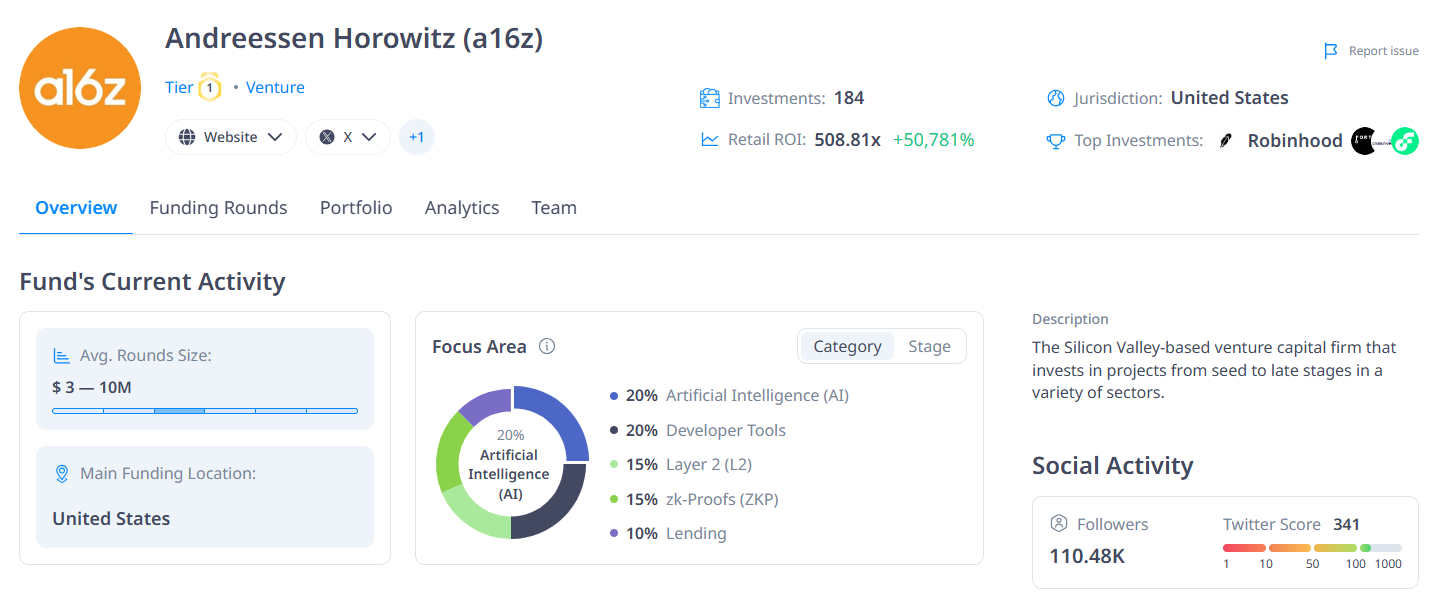

According to CryptoRank, a16z has invested in 184 crypto projects.

- Led 106 projects

- 55% of the investment sizes are between $3 million and $10 million

- Their favorite co-investment partner is Coinbase Ventures (32 co-investments)

- Return on Investment (Retail ROI): 508.81 times (+50,781%)

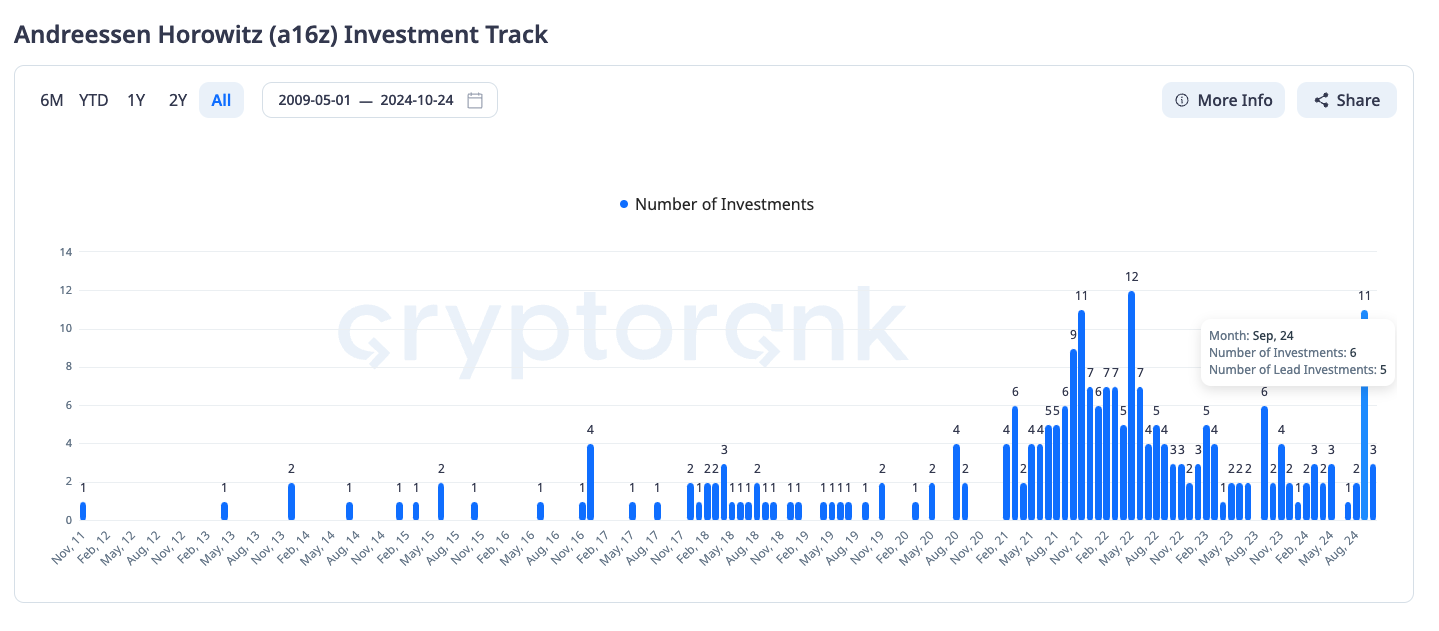

2021 and 2023 are their "active investment" years:

- Completed 128 investments

- Led 84 projects

With the shift in the crypto market landscape in 2023, a16z's investment activities have significantly decreased. On September 24, they made a strong return with 11 investment activities.

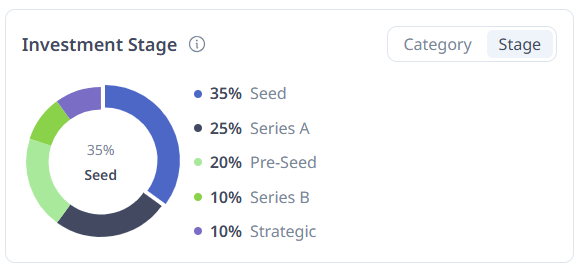

Overall, a16z has participated in various rounds of investment. However, like most other crypto venture capital firms, seed rounds, Series A, and pre-seed investments still dominate. Among them, 35% of the investments are in seed rounds, and Series A investments account for 25%. They start engaging with projects early on, providing steadfast support from the startup phase.

From a16z's portfolio, it can be seen that:

- L1 is one of their favorite areas

- Although AI and RWA are the two hottest topics for 2024, they seem less interested in these

- Their diversified portfolio includes LSD, gaming, and infrastructure

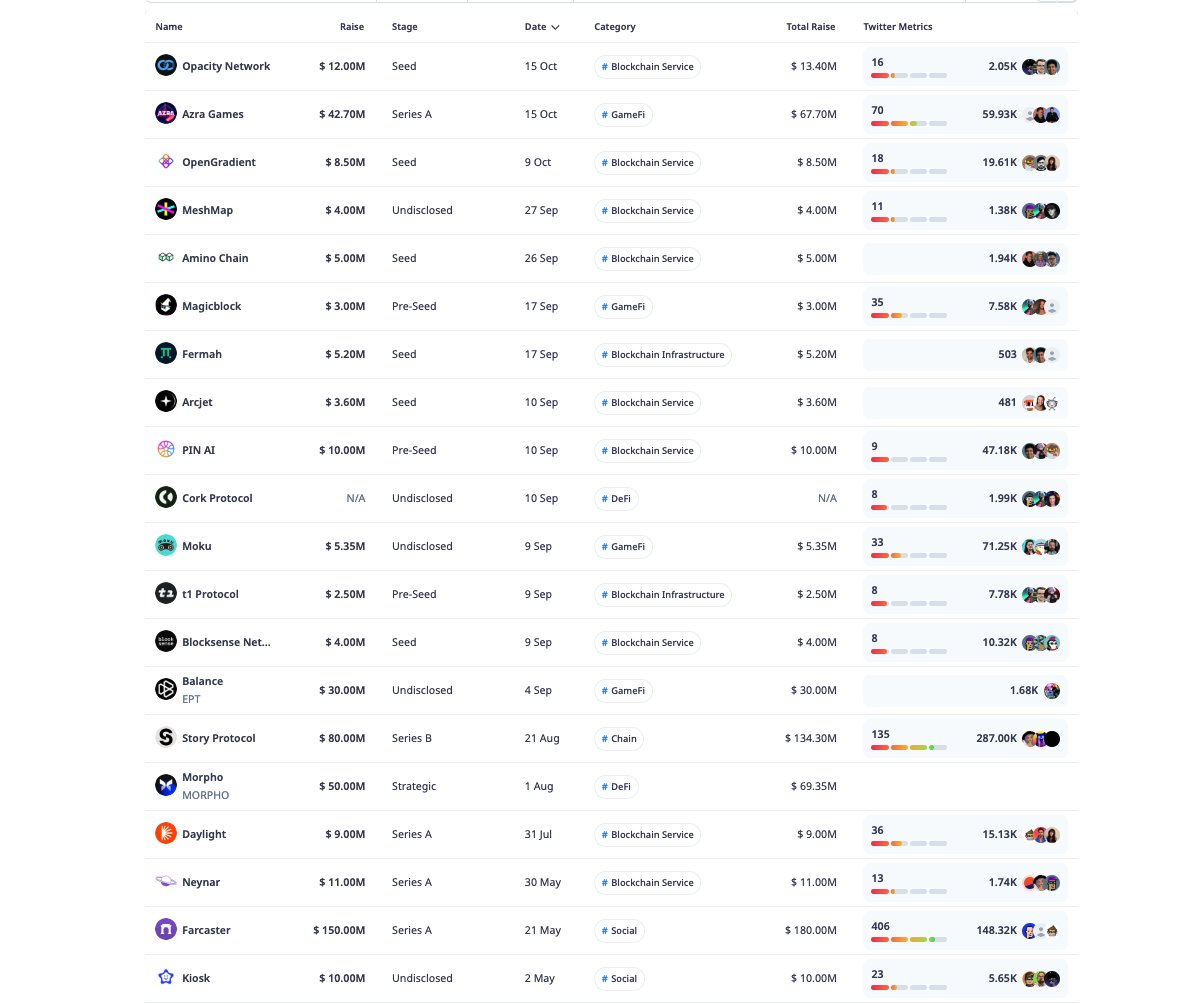

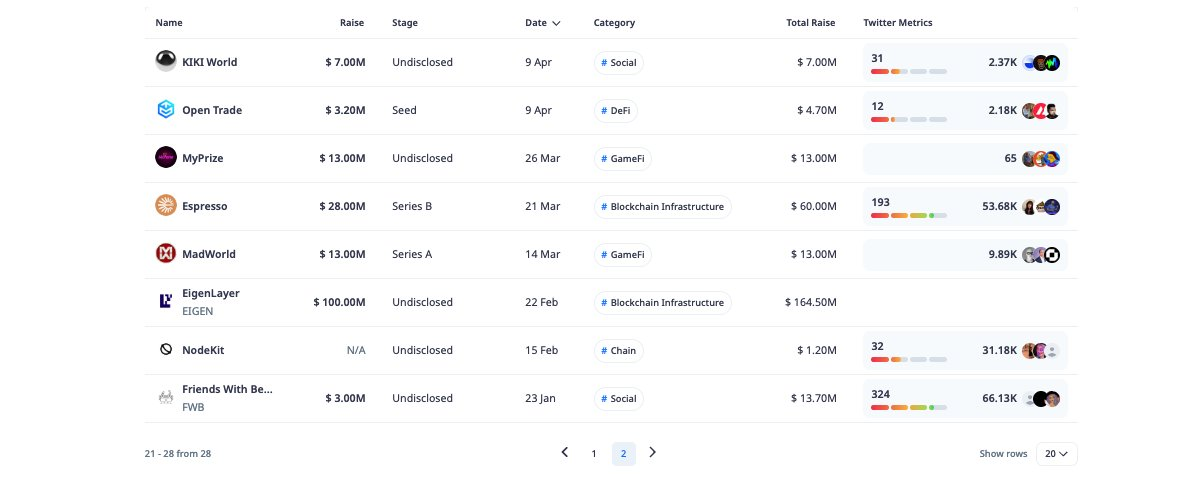

In 2024, a16z invested in 28 projects:

- 6 gaming projects

- 4 blockchain infrastructure projects

- 9 blockchain service projects

- 9 other projects

These include: EigenLayer, Story Protocol, Morpho Labs, Farcaster, etc.

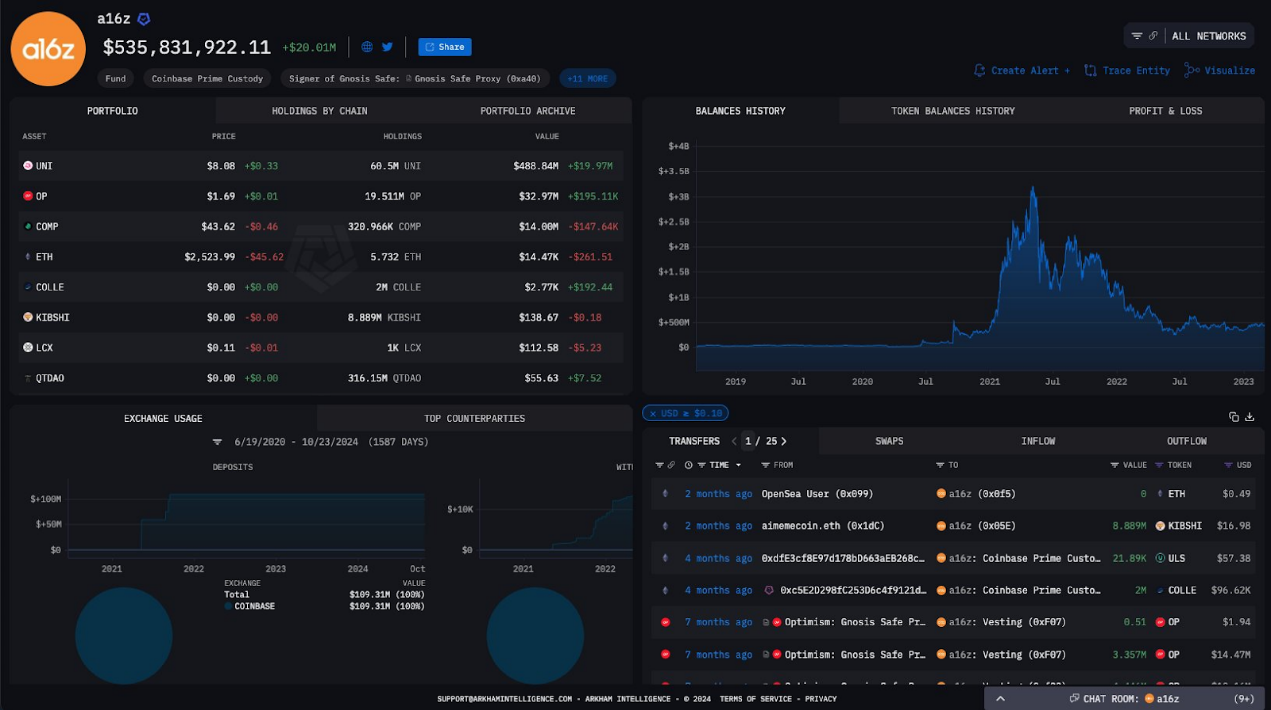

The a16z portfolio is now valued at over $535 million, among which:

- UNI is their largest holding, with 60.5 million UNI

- OP is their second-largest holding, valued at $32.97 million

Source: Arkham

Summary

a16z has long been regarded as the leading venture capital firm. They have been involved in projects early on, providing unwavering support from the startup phase. Their investment focus includes infrastructure projects like L1s/L2s, as well as many of the hottest trends such as AI and RWA.

Following the investment footsteps of top VCs like a16z seems to be a wise strategy. However, it is essential to carefully study the current market conditions and trends. Let a calm mind and a warm heart guide investment decisions.

Related reading: Is the effect of listing on Binance weakening? The three key factors for market, project quality, and narrative to drive up token prices

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。