Original Author: The DeFi Edge

Original Translation: Luffy, Foresight News

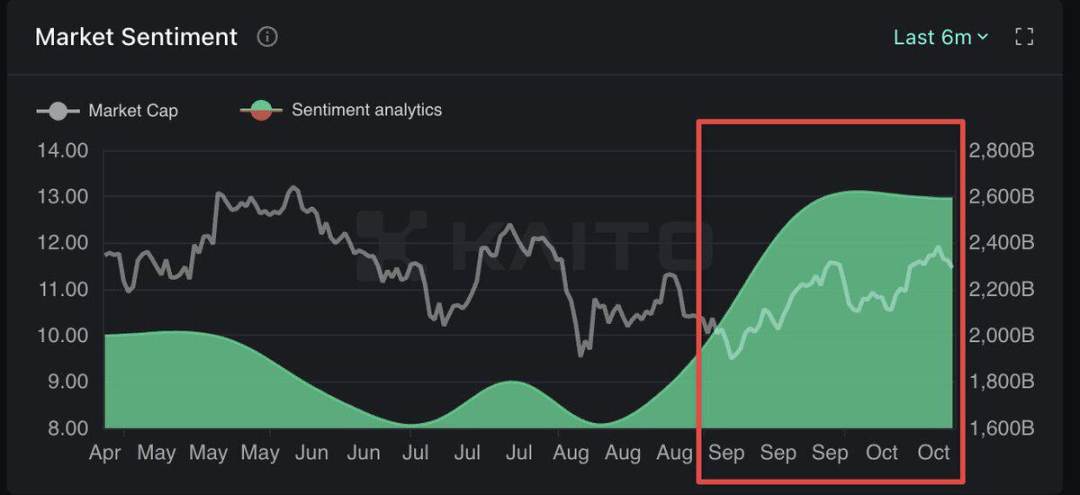

A glimmer of light appears at the end of the tunnel. After 6 months of turmoil, the crypto market is regaining its vitality. Both Solana and Base have performed well; more excitingly, we finally have something "new" like AI Meme.

Some predict that Bitcoin's price may break $100,000 in the coming months. The bullish reasons for the market are:

The U.S. presidential election will be held in two weeks. Trump's election would be a huge victory for cryptocurrency.

On-chain indicators are bullish. The TVL, trading volume, and active addresses of Base and Solana have been on the rise.

Stripe's massive acquisition of the stablecoin payment platform Bridge. Everyone is underestimating the long-term benefits of this for cryptocurrency.

The new field of AI x Meme is emerging. It could be the "NFT" of this retail market cycle.

Sentiment is improving, and the nostalgic atmosphere is returning.

Now is the time to shake off the trauma of the bear market. So many interesting things are happening, and I want to be at the forefront of the trend.

The protocols and narratives in the market are mixed, making it difficult to distinguish between signals and noise. Here are the things I will be focusing on in the coming months.

1. AI Agents x Memecoin: The Cult Returns

Memecoins have always been an important part of cryptocurrency.

They work very simply, designed to gain promotion through viral spread. Since memes are "static," their popularity relies on the community.

But what if memes could upgrade and evolve? What if memes could promote themselves? This is where AI agents come into play.

Last week, GOAT (Goatseus Maximus) became the preferred choice for AI agent speculation, with its market cap skyrocketing from 0 to $800 million in just a week.

What is GOAT? Truth Terminal is an autonomous chatbot that can independently manage its own Twitter account and generate content. It posts nonsensical musings on technical philosophy but has a particular fondness for "GOATSE OF GNOSIS," a pseudo-religion based on an ancient internet meme.

An anonymous individual created GOAT and airdropped some tokens to the creator of Truth Terminal.

The next scene is that Truth Terminal began to heavily promote GOAT on Twitter. Will AI launch its own Memecoin? It has good "Memecoin fundamentals": high liquidity and fair distribution, with no team risks like those associated with VC or Memecoin "conspiracy groups."

The market momentum for AI Memes could continue for the following reasons:

Truth Terminal has over 100,000 followers and is still growing. Every tweet from this account has an amazing impact. It tweets every hour; it is a KOL that never rests.

Currently, no AI Meme has been launched on major CEXs. GOAT's daily trading volume is about $374 million, and it has undoubtedly made it onto the watchlist of top-tier CEXs. (Note: Binance has launched GOAT contract trading)

AI is continuously evolving, and it will keep learning and growing.

AI Memes are at the intersection of Crypto x AI x Religion: this is a new "cult."

We have only scratched the surface of this new field. How should you navigate it? The simplest way might be to go long on the leading GOAT. Hold on, as there are some potential explorers emerging, such as Fartcoin and Gnon.

It is important to note that there will be many scams trying to take advantage of this wave. Their token distribution is far from as good as GOAT's, and I am sure many of these "AI agents" are actually humans playing AI role-playing games.

Back in 2021, NFTs attracted the attention of retail investors. AI agents x Meme have similar potential, and a market cap of $1 billion for GOAT is not out of reach.

Finally, remember that these are Memecoins. They rise quickly, and they fall quickly. So make sure your profits are secure.

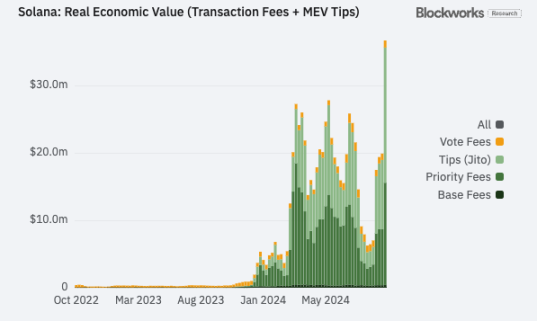

2. Solana: Riding the Wave of Memecoins and AI

"The first millionaires of the gold rush were not the miners, but those who sold them shovels and picks."

I love Ethereum, but it would be foolish to ignore Solana's progress and adoption.

Solana is currently riding a wave driven by Memecoins and AI. With the surge in Memecoin prices and trading volumes, Solana is once again in the spotlight.

Solana is seizing the opportunity with Memecoins and AI tokens:

Well-known Memecoins like SLOP, GNON, Shegen, and FART are gaining attention, while GOAT has become the leading AI token.

As of Q4 2024, Solana is creating an average of 96,010 tokens per day, with Pump.fun creating about 9,000 tokens daily, accounting for approximately 9.3% of the total.

In addition to Memecoins, Solana is also home to some innovative DeFi protocols.

I want to highlight three protocols:

Jupiter. They are primarily known for exchanges and perpetual contracts. But they recently launched ApePro, a new trading platform designed specifically for Memecoins.

Kamino Finance. Kamino Lend has been around for just a year and currently holds nearly 70% of Solana's market share, with a total locked value (TVL) of $1.65 billion.

Pump.fun. Solana's Memecoin factory, which may airdrop in the future. Their new internal trading tool is called Pump Advanced. They also launched a video tokenization platform that allows users to tokenize videos, making them tradable assets on the platform.

As Solana continues to innovate and attract different projects, it has become a strong competitor to Ethereum. The combination of Memecoins and AI tokens not only diversifies its product offerings but also enhances community engagement, making Solana the choice for a new retail audience.

3. AI Tokens

Memecoin + AI is currently attracting everyone's attention, but we should not overlook Crypto AI tokens.

Bittensor (TAO) is the leader in this field.

Bittensor is the infrastructure of the Crypto AI space, focusing on AI utility:

Opentensor FDN recently launched an Ethereum-compatible layer, bridging the $300 billion Ethereum ecosystem.

Real adoption: Three major DeFi protocols have been built on Bittensor's machine learning infrastructure.

Multiple revenue streams: trading fees, staking, AI services, targeting over $10 million per quarter.

Institutional support: Two major crypto VCs increased their positions in September.

A potentially interesting strategy to gain exposure to AI could be to hold: GOAT (high risk, explosive potential) and TAO (infrastructure). Both are worth focusing on and are supported by mature communities.

AI agents are now making breakthroughs. One protocol I am focusing on is VirtualsProtocol, which some describe as the AI agent version of Pump.fun.

Virtuals Protocol allows you to co-own AI agents in the gaming and entertainment space with others. Imagine co-owning entertainment robots deployed on TikTok, Roblox, and other platforms—how fun!

4. Fantom Reborn: Hello, Sonic

Fantom was one of the hottest blockchains in 2021. At its peak, its TVL reached $8 billion.

Fantom is currently undergoing a transformation, rebranding itself as Sonic Chain, focusing on speed and scalability. With the return of Andre Cronje, expectations are high.

What new features does Sonic have? Sonic Chain promises faster transaction speeds of up to 10,000 TPS. This is not enough, but it is sufficient to join the competition of high-performance blockchains. Improved token economics make it one of the most anticipated updates for Q4.

Some upcoming catalysts for Sonic include:

With the support of Pendle, Sonic will have liquid staking functionality.

Major DeFi protocols like Curve, KyberSwap, Snapshot, and others are launching on Sonic.

Sonic's new fee mechanism allows developers to earn up to 90% of the fees.

Programs like Sonic & Sodas, Sonic Boom, and Sonic University are designed to attract developers.

Last quarter, Sonic Arcade's TVL grew by 20%.

Finally, let the money talk. Sonic has confirmed an airdrop worth approximately $132 million, and on-chain activity is increasing.

Andre's involvement, large-scale airdrops, upcoming DeFi tools, and changes in token economics could drive Sonic's growth in Q4.

Every day I wake up to see new ETH Layer 2s or application chains being launched. But Solana's leading position and the rise of Aptos/Sui indicate that there is still room for development in L1 competitive chains.

For L1 competitive chains, you can view Solana as the Alpha version and Sonic as the Beta version.

Some concerns I have:

Andre is very innovative, but he has also played the "disappearing" act before. He has brought too much attention to Sonic, so the risk of key person dependency is high.

There haven't been many innovative DApps launched on Fantom in recent years. Their most popular DApps are still Beethoven X and SpookySwap.

Sonic has to compete with L2s and other L1s.

After the airdrop, can Sonic maintain its momentum?

Currently, the Sonic ecosystem is quite crowded, but it is doing interesting things that are worth your attention.

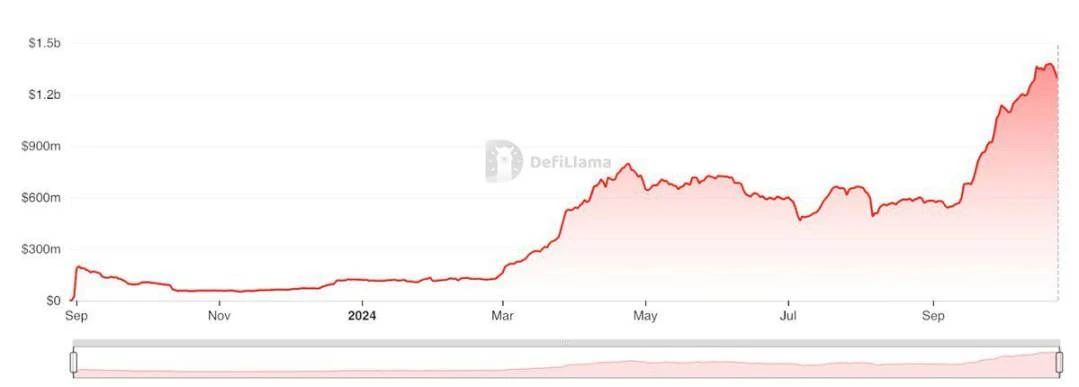

5. Aerodrome: Base's Secret Weapon

The rise of Base is evident, as it is the largest L2 recognized by Ethereum in terms of TVL.

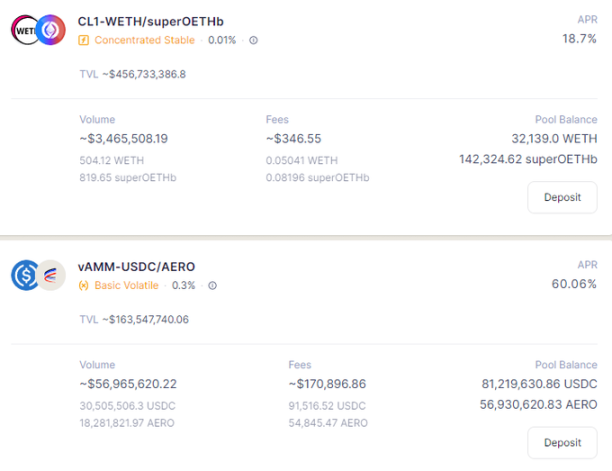

What is the reason? Aerodrome. Aerodrome's TVL now exceeds $1.36 billion, making it a top player in Base's DeFi ecosystem.

This is mainly due to these two liquidity pools.

Aerodrome's dominance in the Base ecosystem is reflected as follows:

Current TVL: $1.36 billion (56% of Base's total TVL)

30-day growth: 56%, above the market average of 15%

Market share: 80% of all DEX trading volume on Base

Daily average trading volume: over $150 million

As Base matures, Aerodrome's importance as its default DEX will increase, becoming a core participant in the Base ecosystem.

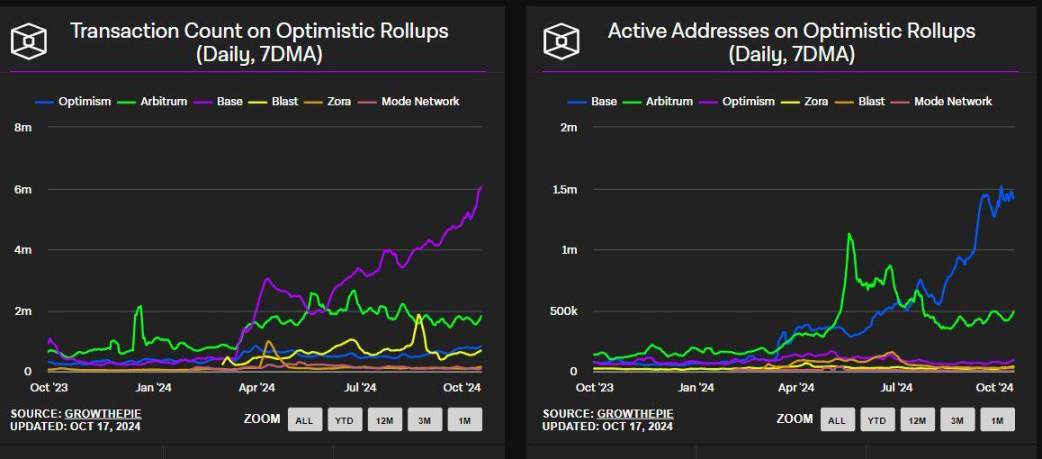

In the past 20 days, a comparison of Base with other L2s:

Daily average transaction counts:

Base: 5.6 million

Arbitrum: 2.1 million

Optimism: 850,000

Active addresses:

Base: 1.5 million monthly active users

Arbitrum: 780,000 monthly active users

Optimism: 690,000 monthly active users

TVL growth:

Base: $2.5 billion

Arbitrum: $2.4 billion

Optimism: $681 million

It is clear that Base is currently experiencing strong growth momentum, so what will the next catalyst be?

Real World Asset (RWA) integration: Platforms like Centrifuge can bring real-world assets into Base, attracting more liquidity and traditional financial participants to its ecosystem.

GameFi and NFT: Base's scalability makes it a perfect choice for new gaming platforms or NFT markets, leveraging these growing crypto narratives.

Developer incentives: Coinbase-backed Base may promote growth through developer incentives like hackathons and funding programs, attracting more talent to the ecosystem.

Aerodrome has created a robust DeFi ecosystem on Base, attracting both retail and institutional participants. Together with top protocols like Uniswap, Aave, Balancer, Sushiswap, Curve, and Stargate, Base has the potential to become a strong competitor in the L2 race.

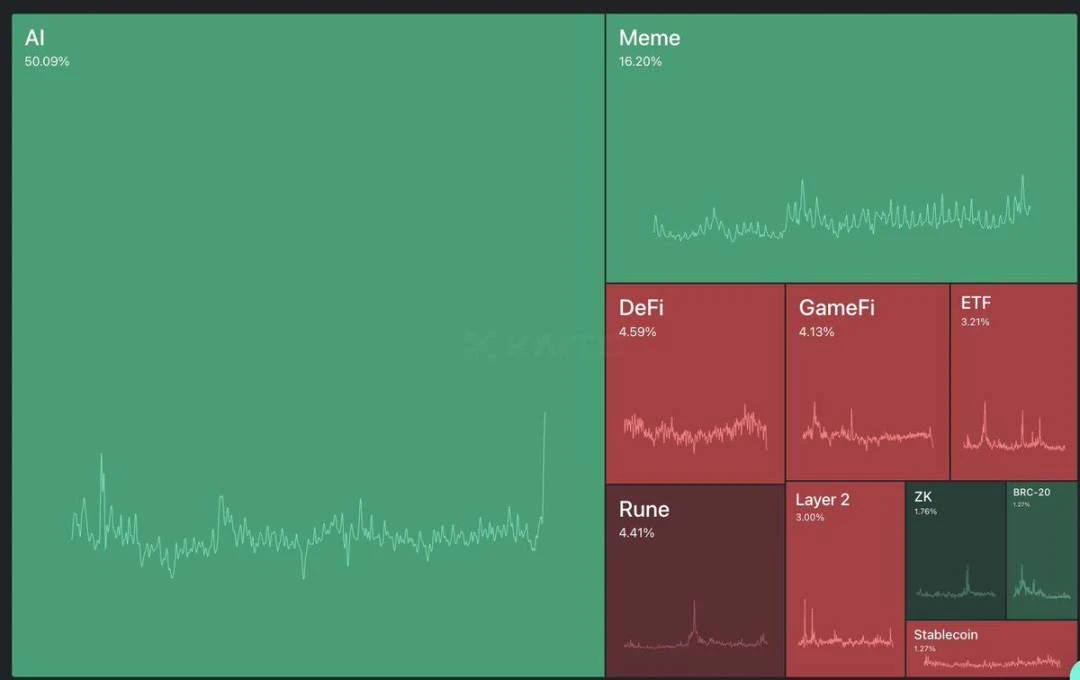

6. DeFi 1.0: Don't Underestimate the Old Guard

Do you remember when Aave and Uniswap dominated DeFi? That was a time full of innovation and endless possibilities. Now, they are ambitiously making a comeback.

Aave plans to push its native stablecoin GHO into new ecosystems like Base and Avalanche.

At the beginning of 2024, GHO's market cap was $35 million, growing by 350% over the past ten months, currently at $160.1 million.

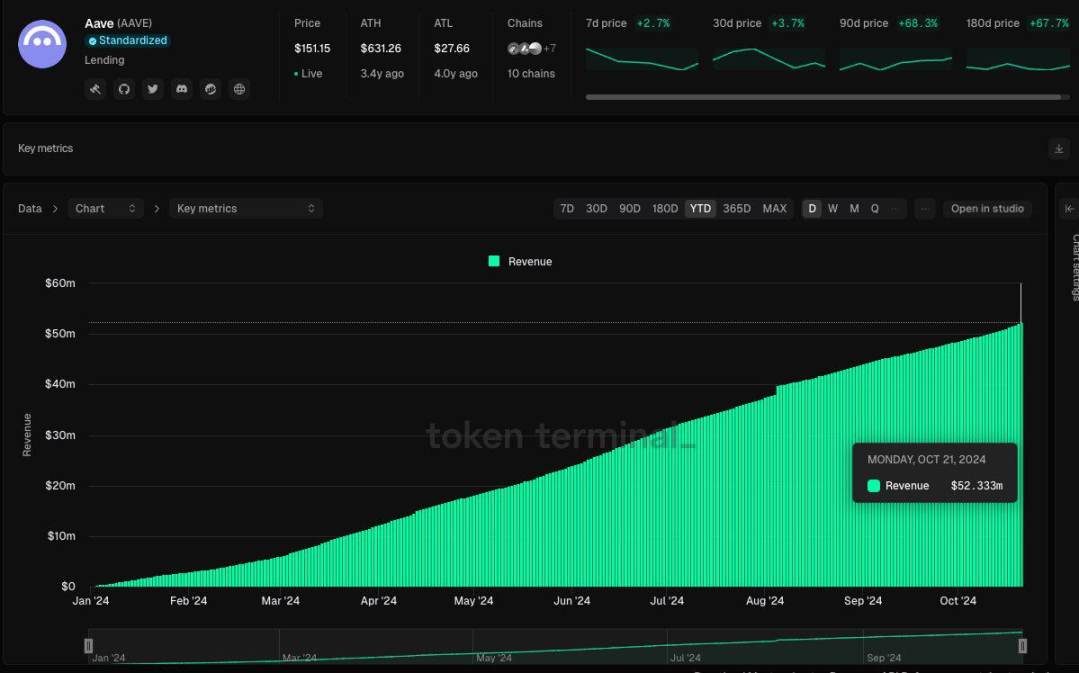

Aave protocol's revenue growth. Source: Token Terminal

Aave's growth metrics:

Year-to-date revenue of $50 million, the highest among all lending protocols;

Stablecoin GHO's circulating supply reached $160 million;

ETH TVL continues to grow, currently at 5.1 million ETH (over $11 billion), nearing previous highs;

Grayscale announced the launch of Aave Trust;

GHO is currently competing with the top 15 stablecoins, with increased interest from institutional investors.

As for Uniswap, it recently announced the launch of its own blockchain: Unichain.

We previously explored the updates of the Uniswap v4 ecosystem and the response to the launch of Unichain. Here are the updated strategic initiatives for Uniswap:

After the launch of Unichain, a large-scale liquidity migration is expected;

One of Unichain's main goals is to help users reduce gas costs by about 95%;

The launch of Unichain may introduce new staking mechanisms;

Introducing a revenue-sharing model could boost UNI prices;

The number of wallets holding UNI tokens exceeds 400,000.

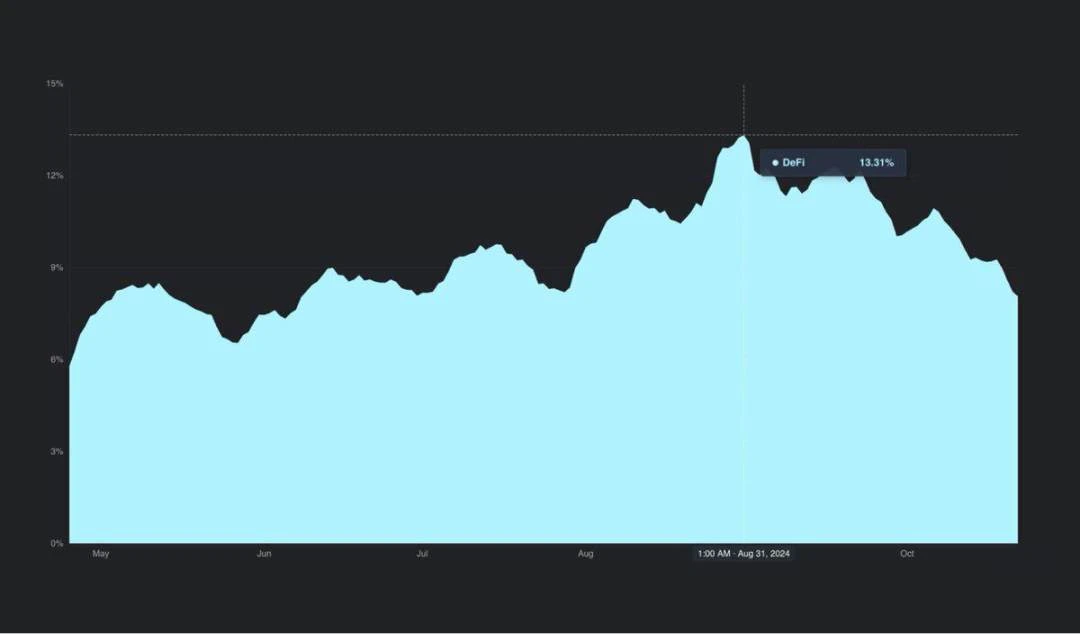

DeFi's user mind share peaked in August. Source: KaitoAi

Aave's GHO and Uniswap's Unichain plans could revitalize DeFi 1.0, bringing these giants back into the spotlight. These initiatives could redefine the dynamics of stablecoins and reshape the DEX landscape.

Riding the Wave

The crypto market has been very tough in recent years. Countless Ponzi schemes, the collapses of Terra and FTX have plunged us into a long bear market. The entire field has focused on building more Ethereum Layer 2s. Now, I can feel the tide is turning.

We must also change accordingly: stop the nonsense, shake off the trauma of the bear market, and stand at the forefront of the wave.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。