"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past seven days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

Overview of Crypto VC Investments: Who Performed Best?

a16z: How Many Real Crypto Users Are There Among 220 Million Active Addresses?

According to a16z's analysis using various methods, it is currently estimated that there are 30 million to 60 million real monthly active crypto users.

Instead of focusing on active addresses to study blockchain activity, it is better to look at network fee metrics. Fees reflect the total gas consumption of using the protocol, without considering the issue of "quality" users.

Considering that users on PoS chains can also easily obtain token issuance rewards, the alternative metric of Real Economic Value (REV) can be used. REV combines network fees and MEV tips given to validators, but does not treat token issuance as a cost. REV can be said to be a better metric for assessing the real demand of the network and is more comparable to income metrics in traditional finance (TradFi).

Bitcoin ETF Options Approved: Will Bitcoin Experience Explosive Growth?

Although there are already many crypto options products on the market, most of them lack regulation, making institutional investors reluctant to participate due to compliance requirements. Additionally, there are currently no options products that combine compliance and liquidity.

The most liquid options products are offered by Deribit, the world's largest Bitcoin options exchange. Deribit supports 24/7/365 trading of Bitcoin and Ethereum options. The options are European-style and settled in physical underlying cryptocurrencies. However, since it is limited to cryptocurrencies, Deribit users cannot cross-margin with assets in traditional investment portfolios like ETFs and stocks. Moreover, it is not legal in many countries, including the United States.

Without the backing of a settlement institution, counterparty risk cannot be effectively addressed. There is still demand in the market for Bitcoin hedging trades. What Bitcoin ETF options can offer the market is a product that combines compliance and trading depth.

Options expiration will indeed affect market volatility.

Scam Sniffer's Fees Spark Controversy: How to Balance Revenue from Security Tools?

The 0.25% fee charged by the Scam Sniffer plugin for specific DEX trades is the same as the fee charged by Uniswap's frontend and does not alter user transactions.

However, the community still shows significant division over Scam Sniffer's sudden paid plan. Some users believe that changing the fee model to a recharge method, charging based on the number of detections or dates, would be better, stating that Scam Sniffer "is a security plugin that makes users worry about security." Another user pointed out the monopolistic issues behind the fees, arguing that "such an exaggerated rate can only be charged by a monopolistic position."

However, some users are not sensitive to the fees themselves and are more focused on the product improvements and long-term benefits that payment can bring. When "issuing tokens" is no longer the only business model, the project's ability to generate revenue becomes particularly important, and many products that already have PMF are starting to explore their monetization paths, with the crypto security field being one of them.

Currently, C-end security services are still fragmented, requiring users to integrate different security tools. This fragmentation leads to inconsistent experiences between different services and high integration costs. In the future, security services may expand horizontally, integrating into a unified solution, allowing enterprises to reference this layer of security services to handle all security issues, thus focusing on their core business without having to separately address user-side security needs.

20 Lessons for Crypto Founders: Do Things That Can't Scale

Don't aim for a huge market from the start; instead, focus on solving a small, specific problem. Starting small allows you to gain deep insights into user needs and optimize the product without the noise and complexity of a large market. Before investing significant resources (such as money and time), validate your core assumptions with a minimum viable product. A 30-day rapid deployment will force you to prioritize core features and avoid the trap of over-planning. After optimizing and growing, refine your business model, maintain continuous interaction, and keep the team lean.

Meme

Meme Mastery Manual: Rebirth as a Diamond Hand (Part II) | Produced by Nan Zhi

Ten times in ten days, all thanks to critical hits. It is essential to set limits on single account positions for follow-up orders and stop-loss orders. Do not take profits prematurely; stick to being a diamond hand.

Also recommended: "Interpreting Smart Money Buy Addresses on GOAT: MEME Trading Strategies Matter More Than Luck" and "a16z Discusses GOAT: How Our Funded AI Turned $50,000 into Millions?".

Chains Compete to "pump.fun": Is the Memecoin About to Peak?

Chains rushing to "pump.fun" is merely a "top signal" for this type of hype play, not even a top signal for the hype play or the meme coin itself. Just like after the inscription bull market ended, leading inscription assets like ORDI still have reasonable market value and liquidity, but assets that rely solely on "inscribing" as their only consensus point have no consensus to support long-term value once the hype around that play fades, making their demise foreseeable.

Meme coins are actually the best rebuttal and "rectification" of the market against "VC value tech coins"—perhaps Crypto is not strong enough to become the second U.S. stock market. It has convinced our generation, but it still needs to attract and persuade more young people. Updating the public's serious impression of Crypto with light and fun content.

Ethereum

Corporate Illness, Narrative Void: Is the Market Starting to Sing the Blues for Ethereum Again?

Ethereum is an experimental product of decentralized governance architecture in Crypto, not controlled by centralized companies or organizations, with global project developers, researchers, node operators, ETH holders, and others participating and contributing together.

From the perspective of public chain technology, the entire upgrade process of Ethereum has met expectations in terms of security stability and engineering quality delivery results. However, even if the Cancun upgrade is very successful, it has not brought about the expected Layer 2 prosperity. Ideally, Layer 2 would see a multitude of chains launching simultaneously, with user ecosystems achieving exponential breakthroughs, allowing Ethereum to achieve deflationary boosts through "taxation" and "Gas Burn." But the reality is that the threshold for launching chains has lowered, the narrative of RaaS has fermented, and the ideal Mass Adoption is still a long way off. Frankly, this has exceeded the constraints of Ethereum's pure technical framework.

"Narrative" is the evolutionary development context, a derivative of commercial thinking layered on top of technology.

Recommended: "Vitalik Speaks in Chinese: L2 on Mars, Living to 200 by Exercising and Avoiding Sugar, What to Do When Your Mind Breaks?"

Multi-Ecosystem

In October 2024, leading trading platforms such as Binance, Bybit, and Bitget announced the launch of their respective SOL liquid staking tokens, entering the Solana re-staking track.

Bitget currently offers the highest interest rates in the market. In terms of application scenarios, there are currently no significant differences among the liquid staking tokens of major trading platforms.

DeFi

ArkStream Capital Research Report: How PayFi Unlocks a New Chapter in Crypto Payments

The stablecoin market continues to grow, and crypto payments will not completely replace traditional fiat currency systems;

The true significance of PayFi lies in promoting the application and innovation of crypto assets in real-world scenarios;

Solana is not necessarily the only option in the PayFi or crypto payment track; Ton Network and Sui, with their respective advantages, are likely to catch up;

The future imagination space of the PayFi track is enormous, and as a multi-track composite innovation application, its potential market value may exceed ten billion dollars.

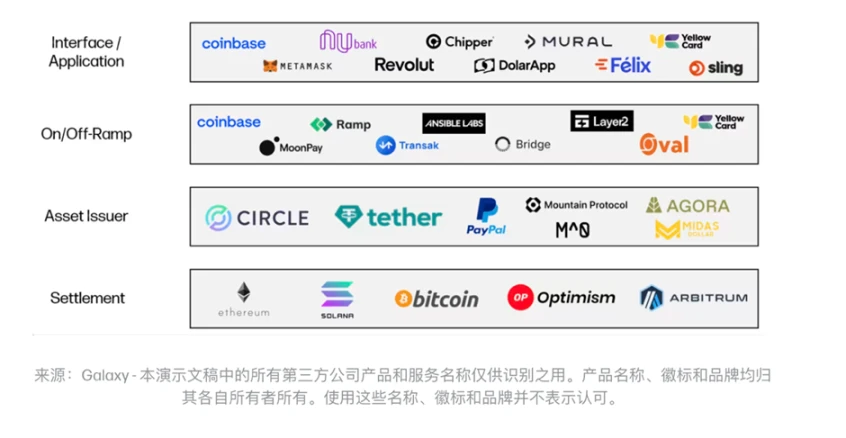

The Four-Layer Architecture of Cryptocurrency Payments

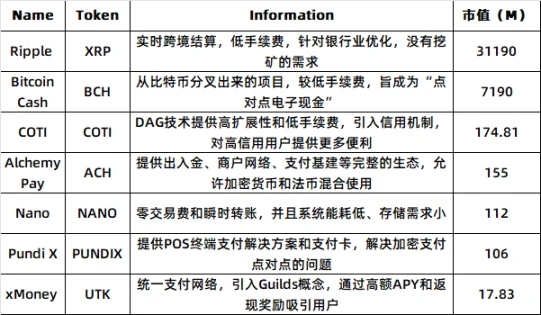

Native Crypto Projects

PayFi is not an independent concept but an innovative application that integrates Web3 payments, DeFi, and RWA. RWA enables the seamless 1:1 flow of value on the blockchain by tokenizing assets on-chain and using smart contracts to build transaction and settlement processes. DeFi focuses on innovating traditional financial products within the on-chain economy and around decentralization, with mainstream purposes such as trading through automated market makers, flash loans, and liquidity mining. Web3 Payment focuses on using cryptocurrencies as a medium for payment transactions, enhancing efficiency in traditional finance through cross-border remittances, crypto payment cards, and more.

The two core concepts that PayFi emphasizes are the tokenization of real-world assets and the time value of released funds.

Projects within PayFi are divided into two application scenarios: cross-border trade and credit finance.

Stablecoin Startups Go Separate Ways: Choose TradFi or DeFi?

Stripe's acquisition of Bridge for $1.1 billion is the largest acquisition in cryptocurrency history. The scale of the stablecoin ecosystem far exceeds that of common players like Circle (USDC) and Bitfinex (USDT).

Stripe merely made online payments feasible. Bridge enables them to eliminate excessive moving parts and integrate their payment processes.

The author speculates that Stripe's acquisition of Bridge has accelerated the stablecoin strategies of these large traditional finance/fintech companies' crypto teams.

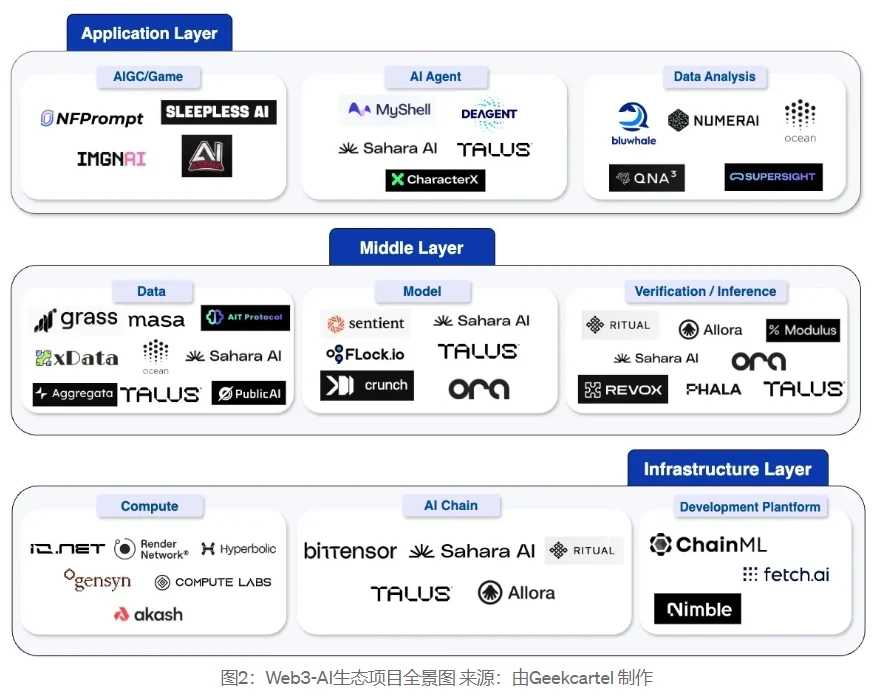

Web3 & AI

The article highlights AI blockchain platforms dedicated to the collaborative economy, such as Sahara AI, Bittensor, which provides highly competitive incentive structures for AI product producers, Talus, an on-chain AI agent ecosystem based on Move, ORA, a verifiable AI on-chain, Grass, the data layer for AI models, IO.NET, a decentralized computing resource platform, and MyShell, an AI agent platform connecting consumers and creators.

Challenges that the Web3×AI track urgently needs to address include balancing AI resource supply and demand, data quality, security, and user experience.

Weekly Hotspot Recap

In the past week, in terms of policy and macro markets, Elon Musk announced randomly distributing $1 million to U.S. voters daily until election day;

In terms of opinions and statements, Federal Reserve Governor Waller stated that DeFi could profoundly impact financial market trading; Fed's Schmid remarked that cryptocurrencies are a risk asset, not a currency; Consensys wrote to the future U.S. president, calling for clear regulation and cooperation; Vitalik published an article discussing the future development of the Ethereum protocol, titled The Scourge, with goals including minimizing centralization risks in Ethereum staking; Vitalik released another article on the future development of the Ethereum protocol, titled The Verge, with goals including achieving a stateless client; Truth Terminal's founder stated that the 1.25 million GOAT tokens held personally will not be sold for now, temporarily safeguarding AI's wallet; Coinbase's CEO interacted with Truth Terminal on the topic of crypto wallets; BlackRock stated that attempting to trade the U.S. election is "foolish behavior";

Regarding institutions, large companies, and leading projects, Kraken plans to launch its own blockchain next year; pump.fun launched a premium trading terminal, pump advanced, and revealed future plans to issue tokens; ApeChain launched an official cross-chain bridge and Top Trader, providing automatic yield models for ApeCoin holders; Scroll opened airdrop claims;

In terms of data, on October 19, Bitcoin's dominance exceeded 65%, reaching its highest level in three years; as of October, Polymarket's trading volume exceeded $1.1 billion, setting a new record; on October 24, GOAT surged past 0.8 USDT, with a market cap exceeding $800 million;

In terms of security, Arkham reported that a U.S. government address was suspected to be hacked, with losses reaching $20 million; Trust Security found that LayerZero has a vulnerability similar to Across Protocol… Well, it was another eventful week.

Attached is the portal for the "Weekly Editor's Picks" series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。