Master Discusses Hot Topics:

Today, continuing from yesterday's article by the Master about the impact of the US dollar, US Treasury yields, and inflation on the macro trends of Bitcoin, many fans have been asking the Master whether a bull market is coming and if so, when it might arrive.

Here, the Master gives a conclusion: after Bitcoin finds its bottom before the end of the year, from now until the first quarter of 2025, long-term bears should fasten their seatbelts! Because your opponent is likely to be the "deep-pocketed" US Treasury Department, yes, the giant that has so much money it doesn't know how to spend it.

As of October 23, the US Treasury's TGA account still has $817.41 billion. What does that mean? It's like a wealthy tycoon sitting on a mountain of cash, ready to start a spree of dollar distribution at any moment.

Imagine, in the coming months, the US Treasury waving around $800 billion, injecting liquidity into the market like a tycoon throwing money around. It’s quite a vivid picture, right? It’s like how we used to set off firecrackers during the New Year, but now it’s turned into dollar firecrackers, and as they go off, Bitcoin might just soar to the sky.

Moreover, in January next year, the two parties in the US will start discussing the debt ceiling, which is expected to last about 100 days. During this period, the Treasury can only spend money, essentially just going out without coming in, which is a perfect opportunity for a liquidity surge.

Think back to the crazy bull market after July 2021 and the small bull market in mid-2019; both were results of the Treasury acting as a "white knight."

So, my friends, after Bitcoin finds its bottom, you can still prepare to welcome the bull market. This $800 billion divine money distribution operation might just send Bitcoin rocketing to the moon.

Now the question arises: when will the correction bottom out, and at what price? It sounds like a soul-searching question. The Master wants to say that after writing articles in various markets for so many years, most small retail investors won’t like my content, and of course, it’s not meant for them.

It’s more for friends with logical thinking and understanding to reference, while too many retail investors prefer to see where to go long today and where to short tomorrow. In the end, they follow the wrong direction, switch to another analyst's signals, and end up losing more than they gain.

This is just one outcome; more often, you lose money in the process and learn nothing. It’s like many people know that developed countries are paradises, but they don’t understand that wealthy and knowledgeable people can find paradise anywhere.

Markets with abundant opportunities are indeed like developed countries, but they don’t rely on luck or gambling to improve their lives. Wealth is a compensation for understanding, not a reward for hard work!!!

Master Observes Trends:

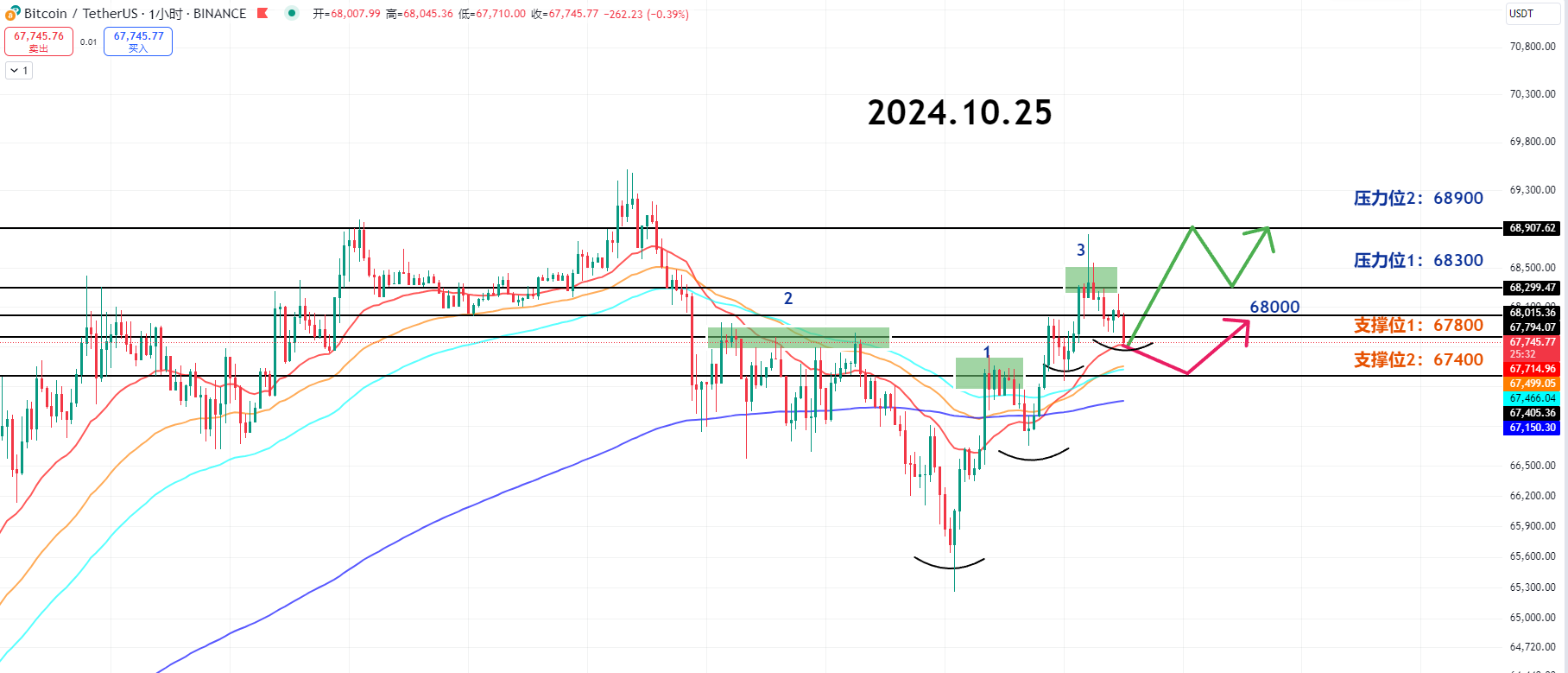

Bitcoin received perfect support at 67.4K in the short term, and the rebound was as strong as eating three bowls of rice! According to the 20-day moving average trend, appropriate adjustments and rises can reserve space for future increases.

However, the crypto market is still like life, with the thrill of roller coasters. Every time it breaks through a previous high, it’s like passing a level; the previous high should be treated as a new support point, and you need to keep an eye on new highs to see if it can break through resistance and surge again.

When the price of the coin rises, if it’s not a sudden influx of buyers (i.e., a large trading volume), the market usually stagnates like you don’t want to move after a big meal, forming a consolidation range. So the Master suggests taking it easy, observing before taking action, and not rushing like you’re trying to grab a train ticket.

Based on my trading experience, the 1st to 3rd waves usually have profits, but the 4th to 5th waves are like a party nearing its end, prone to flipping, so wait until you have a clear understanding before acting.

Resistance Levels Reference:

First Resistance Level: 68300

Second Resistance Level: 68900

If it can break through the short-term high of the first resistance level, then the probability of retesting 69K is as high as getting an extra point on an exam! I hope it can stabilize at the support level I mentioned and then welcome a successful "retest" at a new high!

If the indicated resistance levels are broken, the support levels will naturally need to be raised as well, after all, we need to prevent losses. Trading is like cooking; if the heat isn’t right, you need to take a step back, or else you’ll burn the pot.

Support Levels Reference:

First Support Level: 67800

Second Support Level: 67400

With the breakthrough at 68K, we can boldly raise the support level to 67.8K, and in the short term, we can take a gamble expecting a rebound. If it drops to 67.4K, don’t rush; stay calm, as this is a small adjustment opportunity given by the market.

If 68K doesn’t hold, don’t rush in like an ant on a hot pot. Instead, you can hope for it to drop a bit more, giving you a better entry opportunity. After all, who doesn’t want to pick up a bargain?

Today's Trading Advice:

Today’s operational advice is to maintain a short-term bullish view when entering the market, but don’t be foolishly stubborn; it’s best to quietly position near the support level and wait for the opportunity to strike decisively when it arises.

In any case, when volatility is low, don’t rush to go all in, lest you end up waiting like fishing without catching anything. So remember to enter near the support levels indicated by the Master; a good mindset is the hard truth.

10.25 Master’s Wave Pre-Order:

Long Entry Reference: 67000-67400 Long, Stop Loss 66500, Target: 68300-68900

Short Entry Reference: 68900-69300 Short, Stop Loss 69800, Target: 68300-67800

This article is exclusively planned and published by Master Chen (WeChat Official Account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。