Yesterday, BTC continued to decline, reaching 65,200. Currently, the resistance level at 68,000 is quite strong. Yesterday, Bitcoin's daily line closed with a long lower shadow doji candlestick, indicating that the bullish trend at this position is strong and the upward movement will continue. Therefore, the downward pressure is likely coming to an end, and the bulls will start to exert their strength.

If it drops to around 66,600, boldly enter a long position. Even if wrong, we must act, placing the stop loss at the previous low. If it breaks below, we will stop out, and if it goes up, there will be profits of over 1,000 points.

From the momentum of this decline, the one-hour level has absorbed most of the downward momentum in the range of 66,600 to 67,700. At this point, signals of a shift from bearish to bullish have already appeared, and the moving average indicators have completed their convergence. Next, we will see a divergence again. A breakout of the downward trend line will be a bullish signal, and a breakout followed by a retest will also be a buying opportunity.

Will the market reach the 69,000 phase peak again?

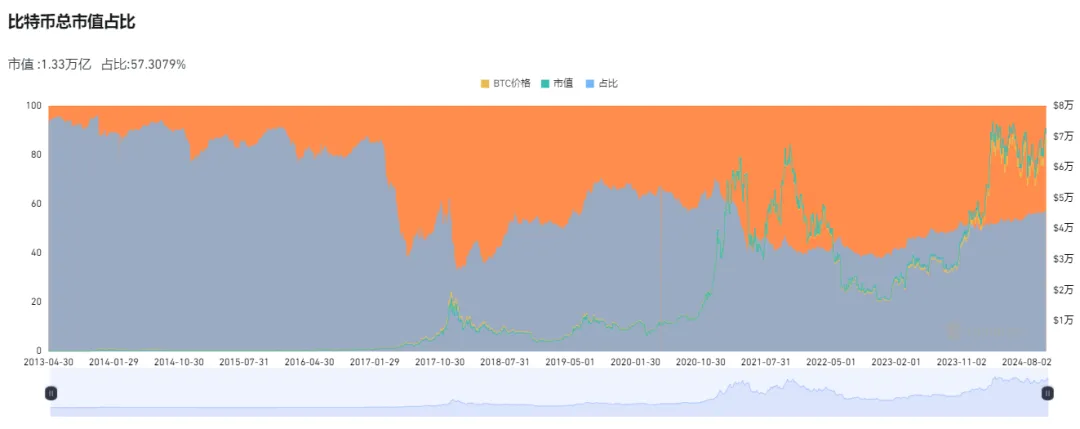

Bitcoin's market share rises to a three-year high

Since around September 2022, BTC's market share has been on an overall upward trend. Data shows that recently, BTC's market share has approached 58%, increasing over 8% for the year, reaching the highest point since April 2021.

The early stages of a bull market cycle are usually accompanied by an increase in Bitcoin's market share, while during altcoin seasons, Bitcoin's market share typically declines. At the same time, when Bitcoin's market share reaches a peak, the market often enters a consolidation or correction phase.

This reflects a critical point of market liquidity and investment sentiment, resulting from Bitcoin attracting a large influx of funds, leading to higher prices and a natural outcome of profit-taking in the market.

Expectations for the future market:

A sudden halt here definitely does not conform to logic; theoretically, after a bulldozer pattern, there should be an expansion of bullish candlesticks.

There may be news impacts from the U.S. elections; thus, the market makers might manipulate the situation before and after the elections, delaying the market until November.

If the incumbent wins, he will promise to buy Bitcoin with 100E, which would be a significant bullish factor, indicating an upward trend. Therefore, this sudden halt in the market could have ulterior motives.

If there are signals of a bottom in the short term, we will establish positions in line with the trend, then observe the stretching situation. If the trend improves, we will continue to hold the bottom positions; otherwise, we will act when the short-term signals arise.

Two aspects of altcoins to pay attention to:

1- Gaming sector: Most of the tokens launched by a certain platform since the end of last year are in the gaming sector, but during the first wave of altcoins at the beginning of the year, the gaming sector hardly made any moves. After more than half a year of cleansing, the highs have dropped nearly 90%, and now it is starting to gain some momentum.

2- MEME sector: Initially, various animals were hyped, such as frogs, hippos, BOME, etc., followed by the hype around the election PEOPLE on a certain platform. Now it has turned to AI+MEME, and it is highly likely that MEME will run through the entire cycle.

Other smarter altcoins are starting to transform into MEME launch platforms, such as APE following the SUI and APT routes, which have boosted the price of B, along with DYDX and BAKE. These will also benefit from a wave of profits later. Now, you can either follow the trend, switch to slightly more stable large-cap MEMEs, or blue-chip DEX types, or look for short-term opportunities for a rise, summarizing based on news. If you really don’t want to switch or move, then just wait for Bitcoin to reach new highs before considering other options.

Aside from MEME, the public chain performance is decent, with SOL being the absolute leader here, and it is one of the few projects that can rise with BTC. TIA, ICP, TRON, and ADA are also performing well. Most other altcoins are basically in a downtrend. In summary, the market is not yet in a full altcoin bull phase, but I still expect a significant move in Q4. Let's all look forward to it.

This article is time-sensitive and for reference only; it will be updated in real-time.

Focusing on candlestick technical research, sharing global investment opportunities. Public account: Crypto悟饭

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。