There is a village where the village chief is highly respected, and the villagers are willing to lend money to him to earn some interest to supplement their household expenses. The village chief spends the borrowed money extravagantly, and at first, everyone lives happily, each getting what they need! However, as time goes on, the village chief's game of borrowing new money to pay off old debts encounters trouble, and paying the interest on the borrowed money becomes a problem. The village chief tells the villagers, "If you lend me some more money, I will use the new borrowed money to pay you back your previous principal; otherwise, this money might go down the drain." In order for the village chief to continue repaying, the villagers lend him more money from their homes. The village chief repays part of the previous loans and continues to squander the rest.

Now, the villagers are worried that one day the village chief will go bankrupt, and the borrowed money will be lost. They start secretly selling their IOUs at a discount and are unwilling to buy new debts from the village chief, meaning they are no longer willing to lend him money. The village chief has no choice but to extend the interest payments, and it is clear that bad debts are imminent.

This is the current situation facing the U.S. Treasury. Last Friday, the latest data from the U.S. Treasury Department showed that as of September this year, the U.S. debt has reached a staggering $8.82 trillion, averaging $2.4 billion per day, accounting for 3% of the U.S. GDP, the highest level since 1996.

Moreover, current interest payments account for 18% of federal tax revenue, meaning nearly one-fifth of the government's annual income is needed to pay interest, let alone repay the principal. This is more than double the proportion from two years ago.

Regarding the U.S. presidential election, neither of the presidential candidates has made reducing the fiscal deficit a core campaign issue. The focus is mainly on taxing the wealthy, trade deficits, and healthcare, with no comments on the high debt and deficit situation. Why is there a "selective blindness" to fiscal issues during the presidential campaign, avoiding discussions about the global trust crisis in the U.S., while repeatedly emphasizing American supremacy? I believe there are several reasons:

The difference in voter attention. For ordinary voters, they only care about their direct interests. Compared to the government's debt, they care more about who can provide benefits for them, such as healthcare, education, and job creation. These issues resonate more. If a candidate proposes reducing social welfare to cut fiscal spending, voters will want them out of the White House.

For the wealthy, tax cuts and tax increases are the topics of concern. Advocating for tax increases can appeal to those who believe the wealth gap is too large, while advocating for tax cuts can attract voters who hope to reduce economic burdens and promote business development to create more jobs.

Reducing the fiscal deficit is a long-term policy implementation process. The causes of fiscal deficits are multifaceted, such as military aid to the Middle East, reducing social welfare, and taxing the wealthy, all of which face significant resistance. Those with vested interests will try to block the implementation of such policies.

Therefore, presidential candidates rarely choose to focus on reducing the fiscal deficit. The 42nd President George H.W. Bush in 1992 and the 39th President Jimmy Carter in 1980 both left the White House due to the implementation of fiscal policies, losing their presidential positions to voters.

The reality is that no matter how the president avoids fiscal issues, the fact before us is that U.S. debt has reached a historic high and is on the brink of collapse. Whether it is Harris or Trump who is elected, fiscal issues are unavoidable topics. Gold has risen over 32% this year, and the trend of global capital allocation towards gold has arrived. The dollar is facing unprecedented skepticism, and non-U.S. countries are beginning to form a consensus, no longer believing that the U.S. has the ability to repay its debts or resolve the debt situation. In addition to gold, there is also the allocation of Bitcoin. In general, Bitcoin has mostly moved in the same direction as gold.

This is the fundamental reason for the recent rise in gold and Bitcoin. Geopolitical risks only serve as a catalyst; historically, the Middle East has never been quiet! Recently, many places have continued to fight, and Bitcoin has not reacted as sensitively to conflicts as it did before. The context of the times has changed, and past thinking struggles to explain the current surge in Bitcoin and gold, which is just beginning in the context of the dollar's decline!

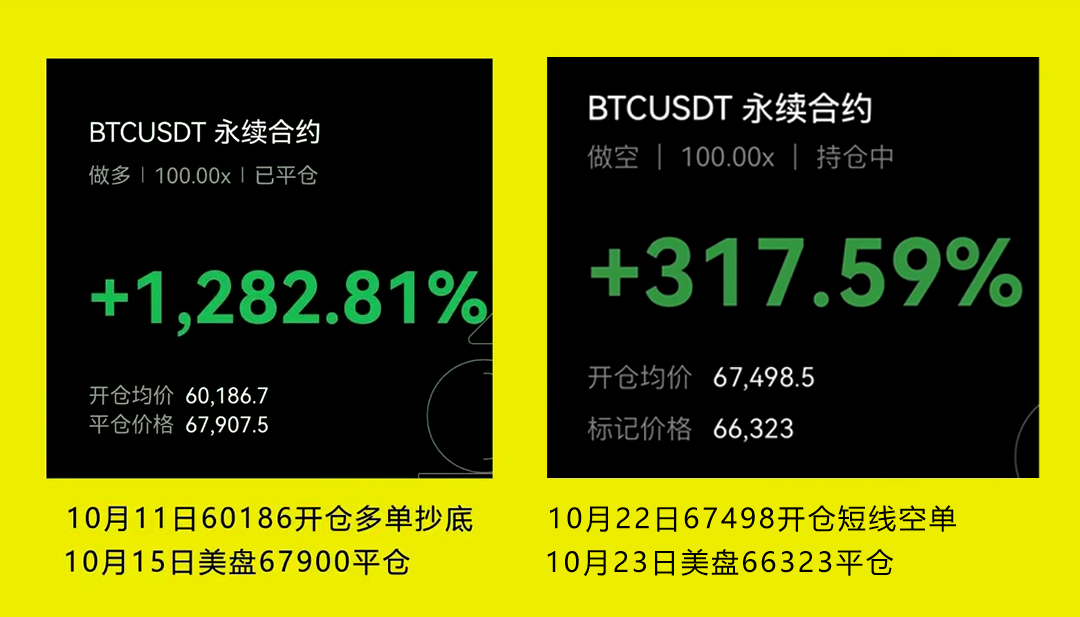

Looking back now, Bitcoin has indeed risen very high. From a future perspective, the current price is just the starting point. At the beginning of the year, some thought $50,000 was too high, and $60,000 was unimaginable. By February, it reached $64,000, and in March, people thought $69,000 was unmovable, yet it reached $73,800. After the drop in early September, many said a bear market had arrived and that it couldn't rise anymore. However, by the end of the month, it rose from $53,000 to $69,000 in this round. Looking back at the end of the year, what is considered a high point now? In the later stages, Bitcoin will easily reach $75,000, whether you believe it or not. Of course, it won't rise that high this month; there will be some speculation around next month's U.S. election, and then we'll see if there are opportunities for new highs! Note that I am talking about the long-term direction of Bitcoin, not day trading. As for the medium to short-term direction, my track record and previous trades are well-known to everyone. Just in the past two weeks, on October 13, I published an article titled "Trader Sean: Bitcoin Adjustment Ends, Last Chance for Bulls to Enter, Aiming for $68,000 This Month," starting to bottom out, and in the following days, I repeatedly published articles clearly targeting $68,000. On October 22, I published that the market was facing a short-term adjustment and turning bearish, all solid operations!

Time has come to Friday again, and the market has gone through great ups and downs. Many people's accounts have suffered significant losses; past gains and losses are now just a fleeting memory. Adjusting to the current state and grasping the upcoming market is what we should and must do!

Let me share my thoughts for the future:

Under the premise that the U.S. fiscal deficit has not been resolved, the economic environment determines the general direction of Bitcoin's future. Since the monthly line turned positive in September, it has been strengthening continuously since the beginning of this month. Last week, it closed with a large bullish candle, and this week it is under pressure at the $70,000 mark. After a minimum pullback to around $65,200, it reversed and is currently oscillating around $67,000. It is worth noting that although the price pulled back to $65,200, the closing price on the four-hour cycle was $66,186, which is a support level formed since September. It has not effectively broken down, and the pattern constitutes conditions for a second bottoming. Although the weekly line currently shows a bearish candle, there are still three trading days left until the close. Since the pattern has completed the bottoming action, the weekly line is likely to strengthen in the coming days, and it is highly probable that the weekly line will show a lower shadow direction at Monday's close. In the subsequent trading process, we only need to pay attention to the gains and losses around $66,200. My view is that the adjustment has ended, and we will start to gradually bottom out!

October 24th Recommendations:

Bitcoin: Go long at around $66,800, and if given the opportunity, add positions at $66,300. The wave target is $71,800, short-term self-manage!

For Ethereum: Gradually buy in at $2,500-$2,470, targeting $2,800.

The above is just my logic and viewpoint. Feel free to exchange and discuss. Welcome to follow my WeChat public account: Trader Sean.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。