This is the largest cryptocurrency acquisition in history and also Stripe's biggest acquisition.

Author: Yash Agarwal

Compiled by: Deep Tide TechFlow

Stripe has acquired Bridge for $1.1 billion. Let me explain why this company is worth paying attention to, even if you may have never heard of it.

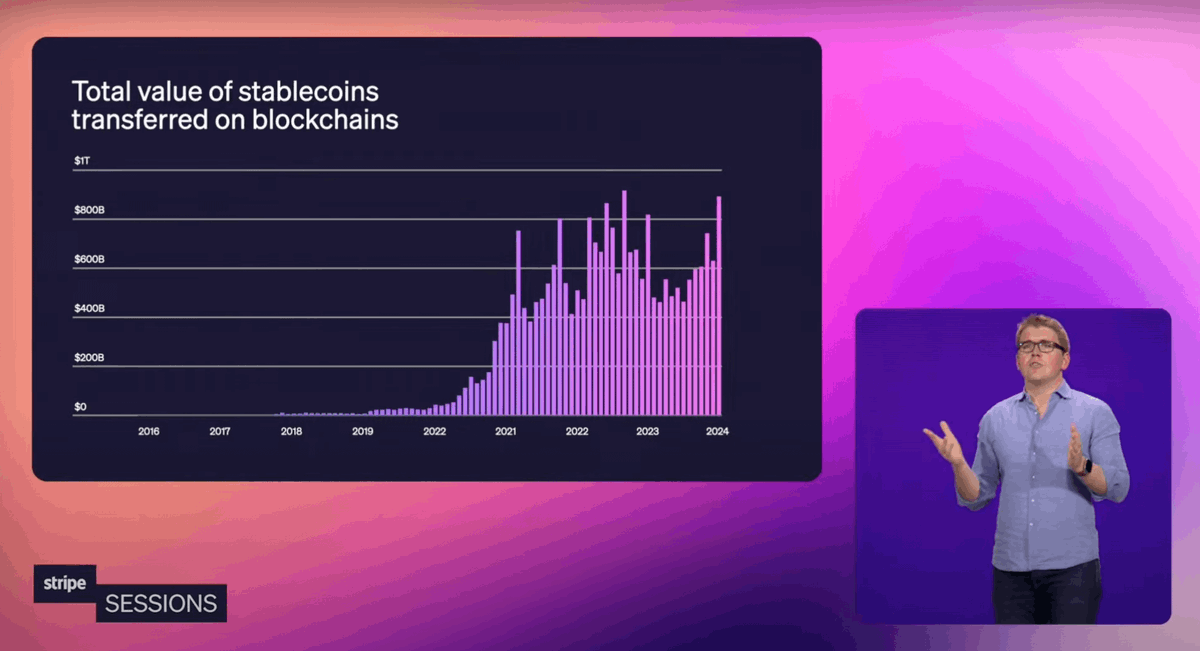

First, Stripe is heavily investing in the stablecoin space

—— Stripe's co-founder demonstrated earlier this year how to accept stablecoins on @solana through @phantom.

—— They have launched payment and receipt functions for cryptocurrencies, meaning any U.S. merchant can accept stablecoins like USDC and settle in dollars.

Even during bear markets, trading volume for stablecoins continues to rise, and with the support of efficient blockchains like Solana/Base, they are confident in the market adaptability of stablecoins.

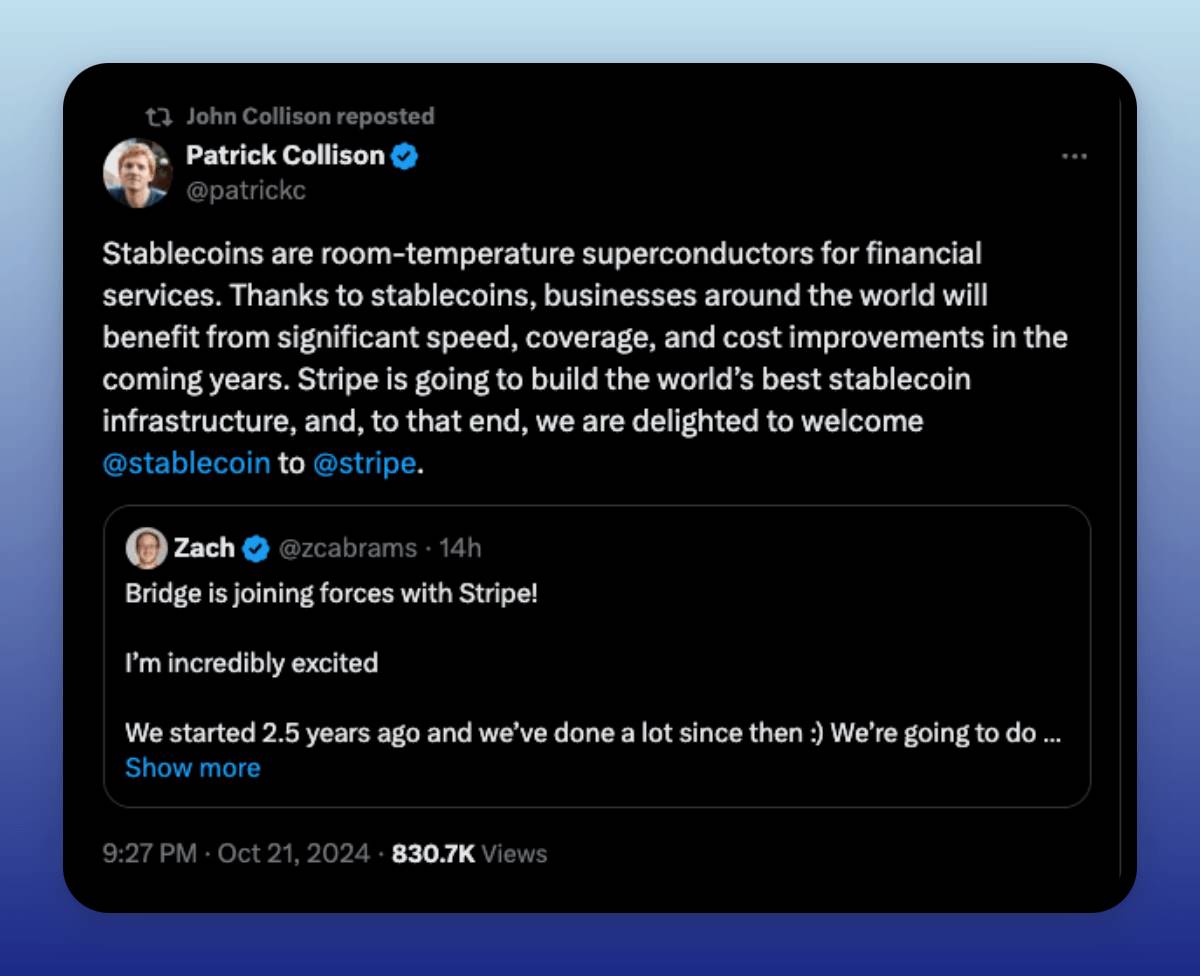

These will become some of the most iconic statements in financial history:

“Stablecoins are the room-temperature superconductors of financial services.”

Why did Stripe choose stablecoins?

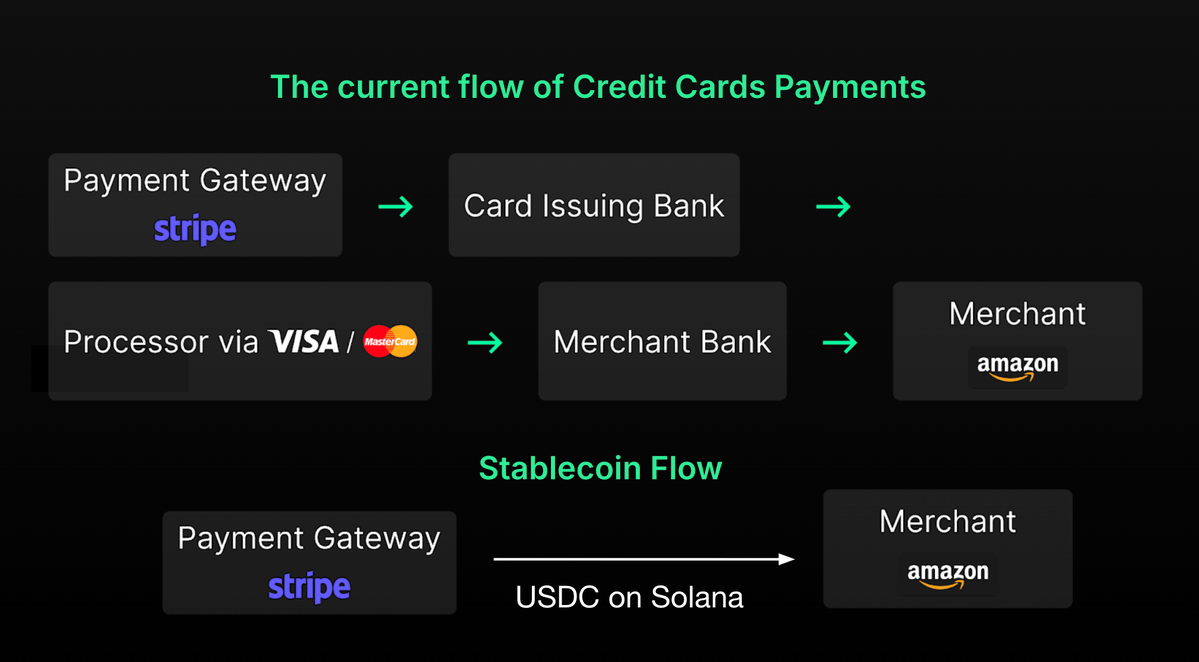

Stripe is currently just a payment gateway that relies on networks like Visa and Mastercard:

—— Charging an additional fee of about 1-3%

—— Relying on banks and local partners

—— Low authorization rates

Stablecoins can eliminate all intermediaries, allowing Stripe to control the entire tech stack.

However, to allow Stripe to also control the stablecoin tech stack, they need to build:

—— On/Off ramps (conversion between fiat and cryptocurrency)

—— Stablecoin issuance (for example, Tether generates $10 billion in profits annually)

—— Complex stablecoin infrastructure (involving over 20 blockchains, more than 10 stablecoins, etc.)

They could spend years building these, or achieve it directly through acquisition.

Introducing Bridge

Bridge was founded in 2022 by two successful entrepreneurs (whose previous company was acquired by Square), with the founding team including former Brex Chief Product Officer @zcabrams and Airbnb engineer Sean.

Their vision is to create various types of stablecoin APIs.

Initially, they operated by helping businesses accept stablecoin payments and build stablecoin infrastructure (similar to Stripe's approach in traditional finance).

In 2023, they secured an undisclosed seed round of funding (estimated at around $18 million, led by Sequoia).

Over the past two and a half years, they have developed the following APIs:

—— Orchestration (On/Off ramp conversion, i.e., converting any form of dollars into other forms, such as converting USDC on Solana to USD)

—— Issuance (minting stablecoins and investing reserves)

8/ They have completed over $5 billion in transaction volume for the following clients:

Stablecoin fintech applications, such as @getdolarapp (virtual accounts provided by Leeds Bank)

Global financial operations (such as @SpaceX and the U.S. government)

Payment services (such as @scale_AI paying its contractors)

They support the operation of many on/off ramps and cryptocurrency cards.

Who are their competitors?

There are many!

@ZeroHashX (larger scale but lacks credibility)

@Brale_xyz and @Paxos (stablecoin issuance; Paxos assisted in the issuance of PayPal's PYUSD)

And any vendor providing on/off ramps and stablecoin infrastructure.

Why choose Bridge?

—— Prioritizing APIs; integrating with Stripe's tech stack

—— Acquiring potential competitors (e.g., integrating Bridge's stablecoin fintech companies that plan to disrupt Stripe)

—— Offering complementary products (such as treasury services with stablecoin issuance, BaaS with cryptocurrency acceptance)

—— Having common investors: Sequoia and tech founders from San Francisco

—— Having a concise social media username @stablecoin

Thanks to @gizmothegizzer for the contribution

So, why spend $1.1 billion?

Mainly because of the strong team—founders who have held leadership roles or worked at top startups like Airbnb, Brex, Coinbase, and Square—they are the best candidates to lead "Stripe's crypto infrastructure."

Licenses, products, market appeal, and customer base

I suspect this deal will be primarily equity-based rather than cash-based.

From a strategic perspective, acquiring Bridge helps to:

—— Compete more quickly with crypto-friendly giants like BlackRock, Revolut, and PayPal

—— Achieve 24/7 global operations; break through the limitations of localized payment systems (Stripe has faced significant challenges in expanding to long-tail markets like Asia and Latin America)

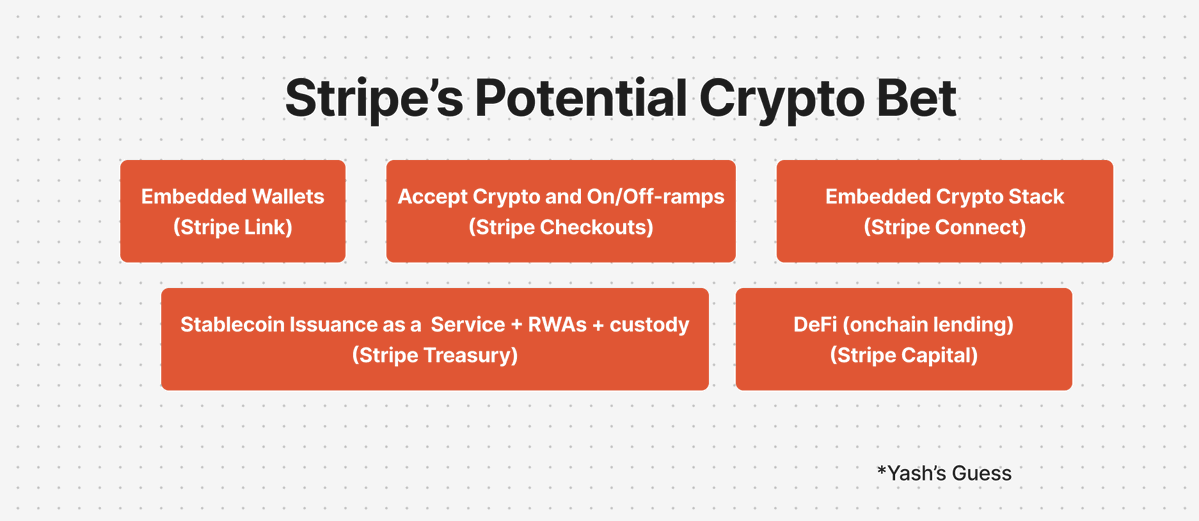

What’s Stripe's next move? My guess:

→ Continue supporting on/off ramps and acceptance of cryptocurrencies, and master Bridge's APIs

→ Deepen the development of stablecoin infrastructure (enabling global fintech companies to launch stablecoins, and possibly even issuing their own stablecoin STUSD to fully control the ecosystem)

→ Advocate for stablecoin payments, allowing every convenience store to accept stablecoins

As a stablecoin enthusiast, I believe this is good news for the cryptocurrency market:

—— This is the largest cryptocurrency acquisition in history (more M&A activity is expected)

—— It is also Stripe's largest acquisition (showing a grand vision for cryptocurrency)

Will this become a historic great acquisition like Instagram and truly elevate the internet's GDP?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。