Stripe acquires Bridge for $1.1 billion, aiming to take control of the stablecoin ecosystem, enhance payment efficiency, and promote global merchant acceptance of stablecoin payments.

Written by: @yashhsm

Translation: Plain Language Blockchain

Stripe has acquired Bridge for $1.1 billion, a company you may have never heard of. Next, I want to discuss the reasons behind this.

1. Stripe is aggressively developing its stablecoin business

First, Stripe is aggressively developing its stablecoin business. Earlier this year, Stripe's co-founder showcased the ability to accept stablecoin payments on @solana using the @phantom wallet. Stripe has launched cryptocurrency payment services, allowing U.S. merchants to accept stablecoins like USDC and settle in dollars.

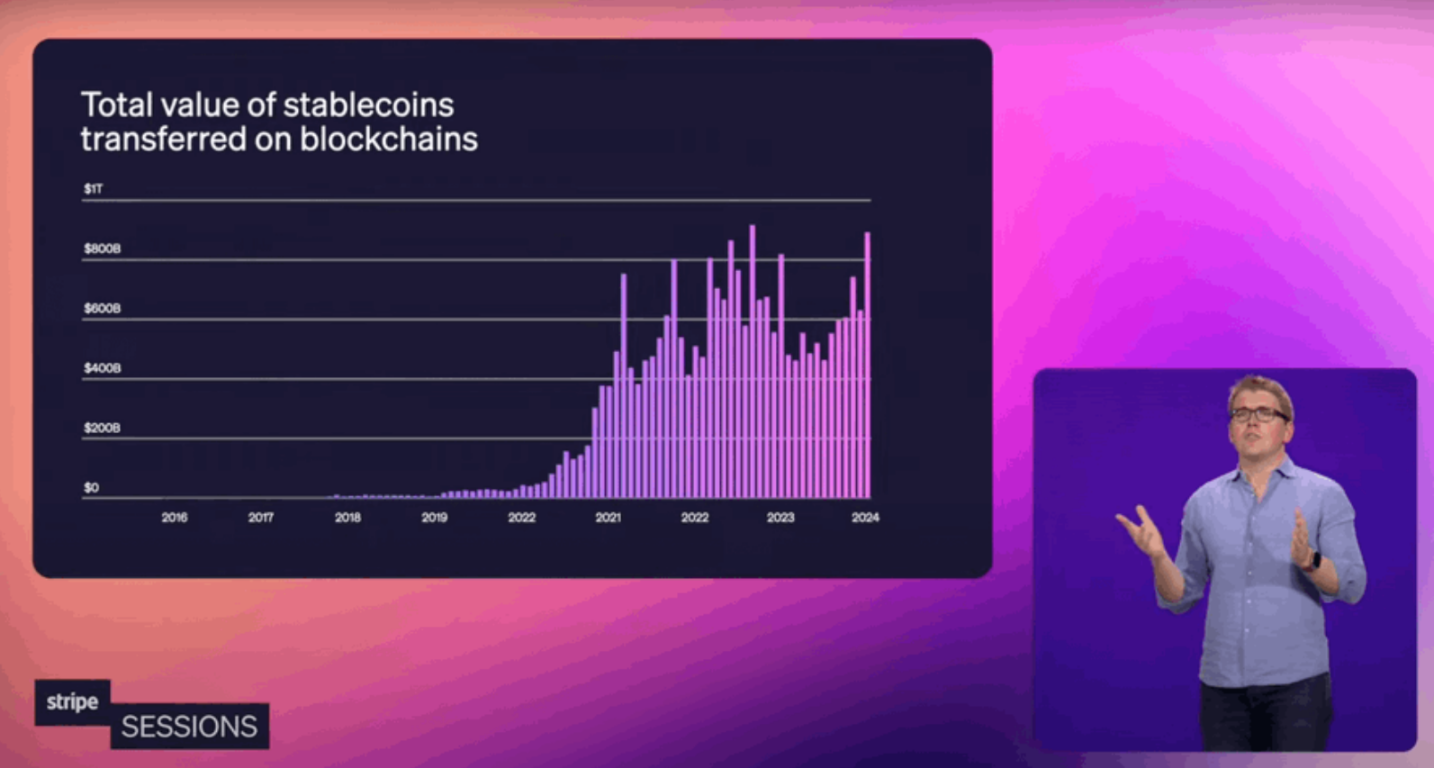

During the bear market, the continuous rise in stablecoin trading volume, combined with high-performance blockchains like Solana and Base, has given Stripe confidence in the product-market fit (PMF) of stablecoins.

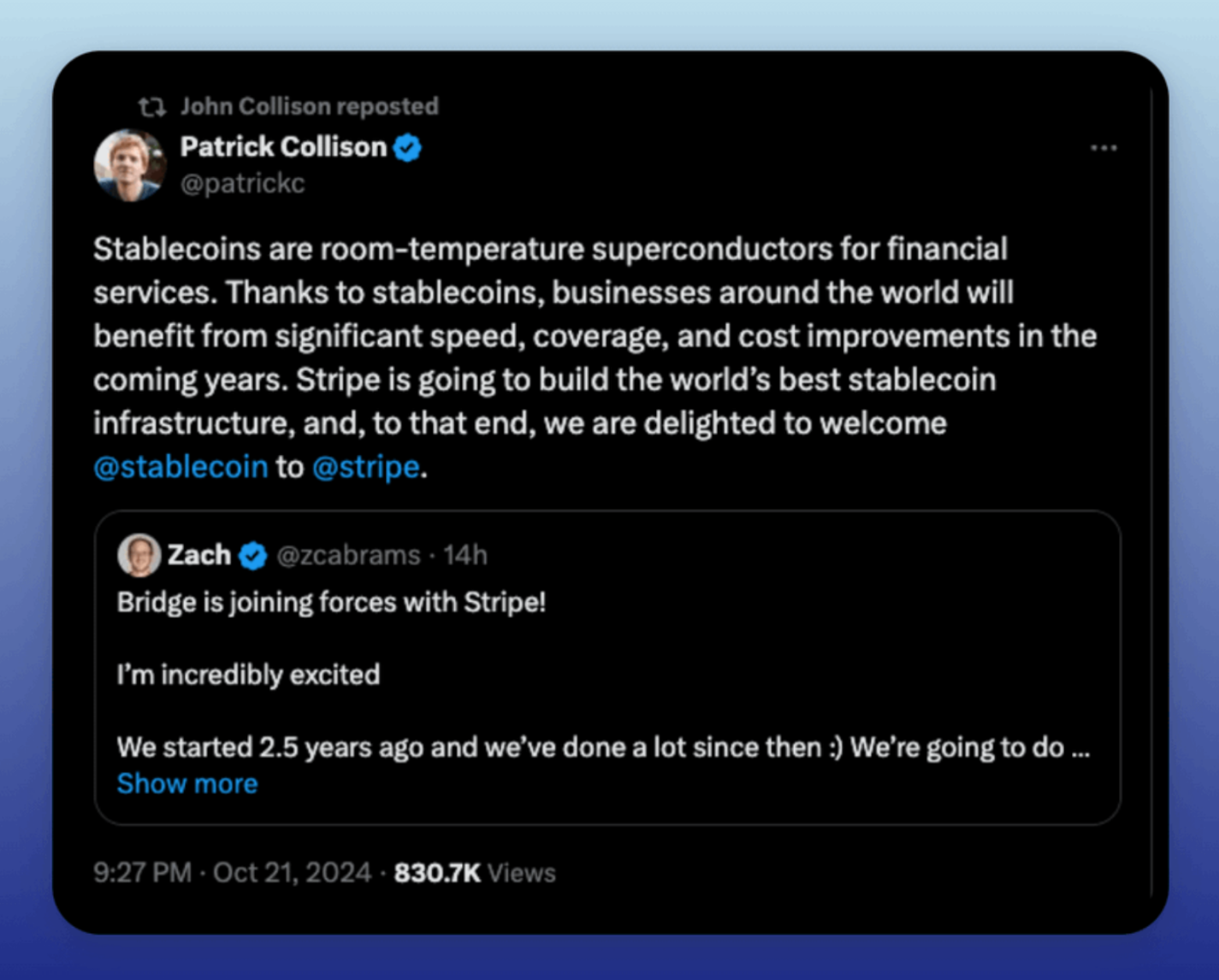

The following statement will become one of the most iconic expressions in financial history: "Stablecoins are the room-temperature superconductors of financial services."

2. Why did Stripe choose stablecoins?

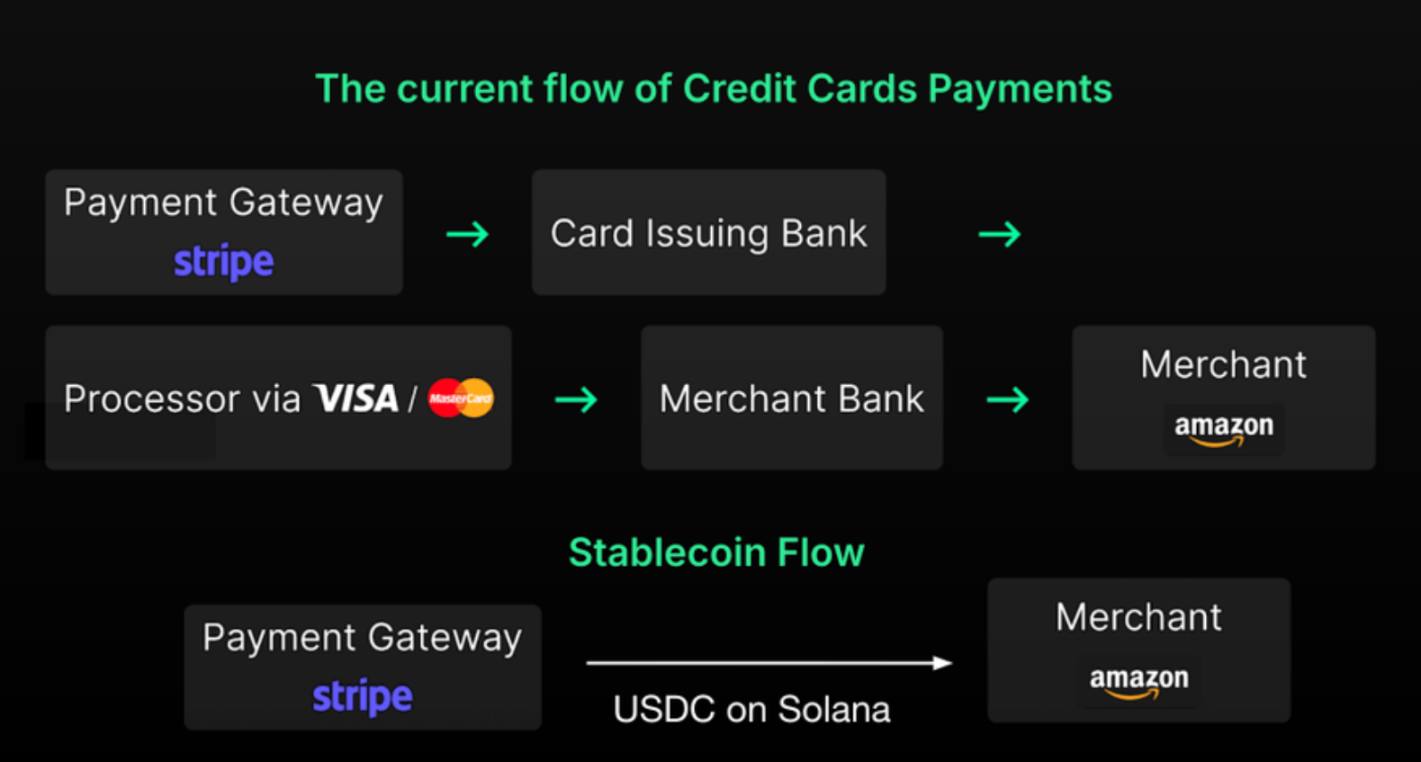

Currently, Stripe is just a payment gateway, relying on networks like Visa and Mastercard, which charge an additional 1% to 3% fee and depend on banks and local partners—resulting in low authorization rates.

Stablecoins eliminate all intermediaries, allowing Stripe to control the entire payment process.

However, if Stripe wants to take control of the entire stablecoin ecosystem, they need to build the following:

1) On/Off ramps (conversion between fiat and cryptocurrency)

2) Stablecoin issuance (for example, Tether earns $10 billion in profit annually)

3) Complex stablecoin infrastructure (involving over 20 blockchains, more than 10 stablecoins, etc.)

Stripe could spend years developing these systems on its own or achieve its goals quickly through acquisition.

This is where Bridge comes in: Founded by serial entrepreneurs in 2022 (with a previous company acquired by Square), the founding team members previously served as Chief Product Officer at Brex (@zcabrams) and engineers at Airbnb (Sean). Their vision is to build the infrastructure for various "stablecoin APIs."

Bridge's initial business was to help merchants accept stablecoin payments and build stablecoin infrastructure (similar to what Stripe does in traditional finance).

They raised an undisclosed amount in seed funding in 2023 (my guess is around $18 million, led by Sequoia Capital).

Over the past two and a half years, Bridge has built the following APIs:

1) Orchestration API (On/Off ramps, converting any form of dollar into another form, such as converting USDC on Solana to dollars)

2) Issuance API (minting stablecoins and investing their reserves)

Bridge has processed over $5 billion in transaction volume, serving clients including:

1) Stablecoin fintech applications, such as @getdolarapp (which provides virtual accounts through Leeds Bank)

2) Global fund management businesses (like @SpaceX and the U.S. government)

3) Payment businesses (like @scale_AI paying its contractors)

They support multiple on/off ramps and cryptocurrency cards.

You ask about their competitors? Many!

@ZeroHashX (larger in scale but lacking credibility)

@Brale_xyz and @Paxos (stablecoin issuance; Paxos helped issue PayPal's PYUSD)

@CoinflowLabs

Basically, any on/off ramp and stablecoin infrastructure provider is their competitor.

3. Why choose Bridge?

- API-first; integrates with Stripe's tech stack

- Acquiring future competitors (e.g., fintech companies integrated with Bridge's stablecoin, aimed at competing with Stripe)

- Complementary products (e.g., fund management services with stablecoin issuance, banking as a service (BaaS) with cryptocurrency acceptance)

- Common investors: Sequoia Capital and tech founders from San Francisco

- Clear brand image @stablecoin

4. Why pay $1.1 billion?

Mainly because of the strong team—founders who have held leadership positions at top startups (like Airbnb/Brex/Coinbase/Square) are best suited to oversee "Stripe's crypto infrastructure."

Additionally, there are licenses, products, market appeal, and customer base. I guess this deal may be primarily equity-based rather than cash-based.

Strategically, acquiring Bridge helps to:

- Compete faster with crypto-supporting giants like BlackRock, Revolut, and PayPal

- Achieve 24/7 global service;

- Break reliance on local payment systems (Stripe has faced significant issues when expanding into long-term markets like Asia and Latin America)

5. What are Stripe's next steps?

My guess:

- Continue supporting on/off ramps and cryptocurrency acceptance, leveraging Bridge's API

- Deepen stablecoin infrastructure (enabling global fintech companies to launch stablecoins, and possibly even issue their own stablecoin STUSD, thus fully controlling the entire ecosystem)

- Advocate for stablecoin payments, enabling every small store to accept stablecoin payments

As a stablecoin enthusiast, I see this as a bullish crypto deal:

- This is the largest crypto acquisition (more mergers and acquisitions are expected)

- This is Stripe's largest acquisition (showing their vision for crypto)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。