Master Discusses Hot Topics:

Today, let's talk about my personal views on the recent surge in the US dollar index and US Treasury yields:

Economic Data's Face-Slap: Recent economic data from the US seems to be mocking recession expectations. Non-farm payrolls, service sector PMI, and retail data have all been surprisingly good, making everyone hesitant to mention the word "recession." The expectation of a soft landing has shifted to "not landing at all." In this situation, the dollar is naturally strong, and Treasury yields have soared accordingly.

Trump's Dramatic Preview: As the election anticipation heats up, the market seems to be watching a new season of Trump's "White House Drama." Everyone is guessing that if he wins, he will continue to raise tariffs, cut taxes, and implement energy policies. As inflation expectations rise, Treasury yields bounce along. Coupled with an increase in US Treasury supply, Treasury prices have been pressured significantly.

Sudden Brake on Expectations: Previously, the market's expectations for interest rate cuts were running too fast, and as soon as the economic data was released, everyone slammed the brakes, causing the dollar and Treasury yields to rebound immediately. It's like one moment everyone is thinking about buying a house, and the next moment house prices have risen again, completely unable to keep up with the pace.

Possible Future Plot Developments:

Treasury Department Refinancing: At the end of the month, we will look at the Treasury's financing plan, but don't expect too much, as the debt ceiling expires in January. The fourth quarter is unlikely to be too aggressive, and the market may breathe a sigh of relief in the short term.

Federal Reserve's "Fine-Tuning": There is a high probability of a 25 basis point rate cut in November, and the market may continue to adjust.

Election Plot Developments:

Trump Wins + Republicans Control Congress: Market volatility will be like a trampoline, with high expectations for policy implementation, making it difficult for yields to rise further.

Trump Wins + Divided Congress: Policies will be hard to implement, and yields may decline, leading to better mid-term market performance.

Harris Wins + Divided Congress: The market will "restart" current expectations and readjust.

Impact Fluctuations on the Crypto Market:

Strong Dollar Suppresses Bitcoin: With the dollar so strong, who is still looking at Bitcoin? This may suppress its price increase potential.

Rising Treasury Yields, Risk Sentiment Cools: High-yield US Treasuries are cooling investors' interest in cryptocurrencies, and the crypto market may face pressure in the short term.

Inflation Expectations May Save Cryptocurrencies: If the market anticipates rising inflation again, cryptocurrencies may become a safe haven against inflation.

Macroeconomic Uncertainty, Strategic Moves: Uncertainties such as the election and global trade policies may lead investors to consider the crypto market as a last resort.

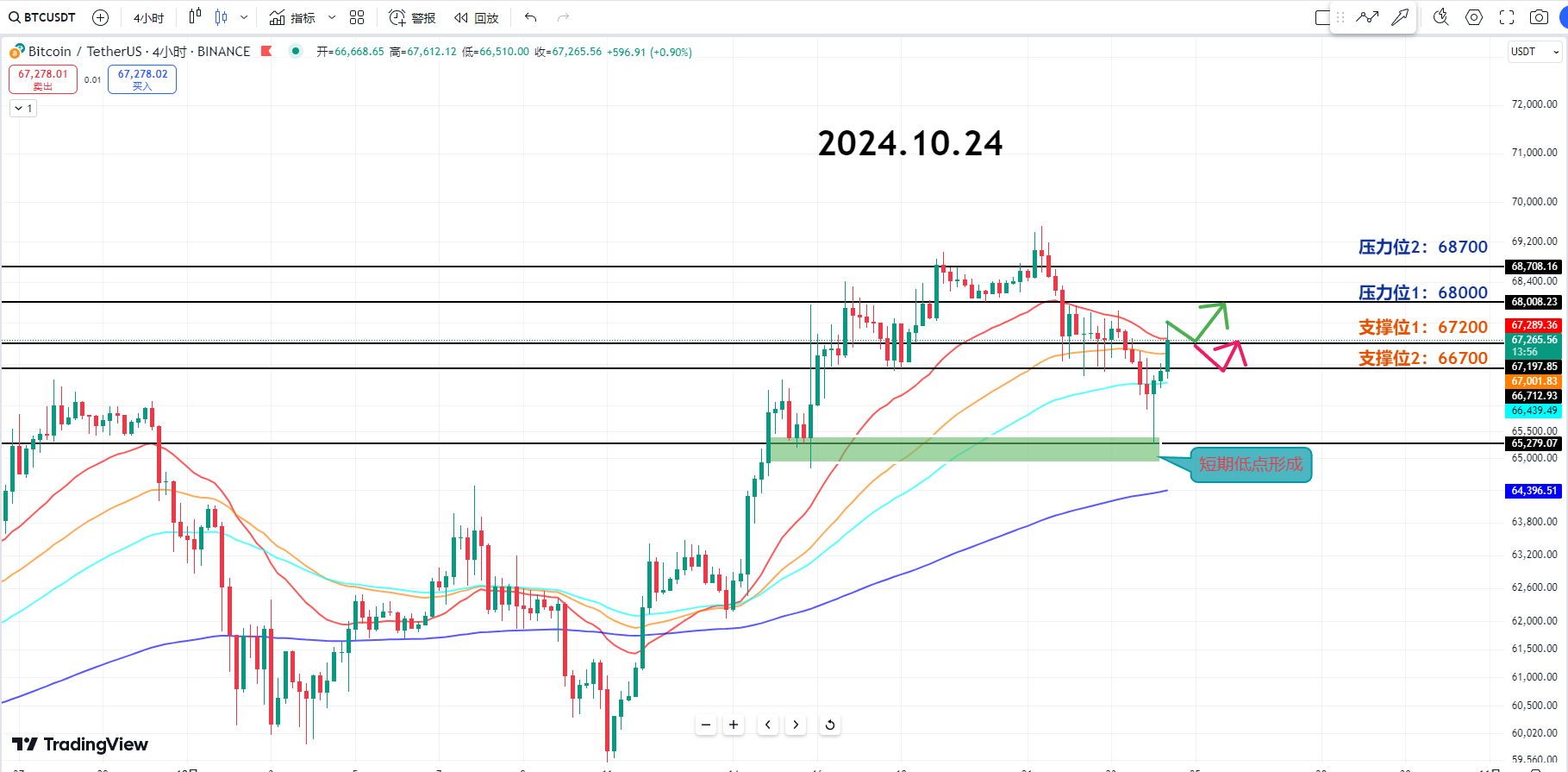

Master's Trend Analysis:

Yesterday, Bitcoin experienced a sharp drop, reaching around 65,200, but finally started to rebound after getting tired of falling. It's like a marathon runner finally catching their breath near the finish line.

Initially, it was thought that Tesla had sold off its Bitcoin, but then Elon Musk said, "You guys are overthinking it; we are not selling," and Bitcoin immediately jumped back up!

Since this rebound is a long bullish candle, everyone should not act impulsively; those looking for a pullback point should still look for it. After all, in business, you can't eat all the food at once; adjustments should be made in a timely manner.

Resistance Levels Reference:

First Resistance Level: 68,000

Second Resistance Level: 68,700

If the price breaks through the first resistance, it indicates an increase in combat effectiveness. This can be set as the first target, and profits should be taken off the table first while maintaining expectations for further rebounds.

Although the possibility of testing 68K again has increased, whether it breaks through still depends on the market. Currently, Bitcoin is still oscillating within the range, so it is recommended that everyone not rush and instead wait patiently below the range for an opportunity to act, discussing it again when it reaches 68K.

Support Levels Reference:

First Support Level: 67,200

Second Support Level: 66,700

In the short term, if it stabilizes in the 67-67.2K area during a pullback, we can expect it to rebound again.

Currently, the adjustment is right between the first and second support levels, so everyone should keep an eye on the critical defense line at 67.2K. If it holds, the hope for a rebound later will be greater. A suitable adjustment range can be set at 66.7K, as you need to give the market some buffer time.

Today's Trading Suggestions:

Since a long bullish candle has already emerged, we will continue to hold our rebound view. Bitcoin is still playing Tai Chi within the range, and there is still some pressure to break through the high point. Those sell orders above are still waiting, so we need to take profits in a timely manner and gradually accumulate gains.

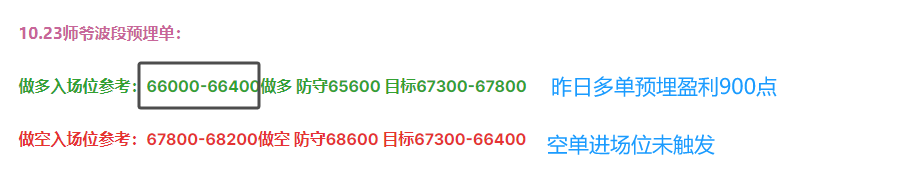

10.24 Master’s Swing Trading Orders:

Long Entry Reference: Not applicable, limited to real-time short-term longs.

Short Entry Reference: Short at 68,000-68,500, stop loss at 69,000, target at 67,200-66,700.

This article is exclusively planned and published by Master Chen (WeChat: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above). Any advertisements at the end of the article or in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。