Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

At the beginning of 2024, Binance began frequently listing new tokens through the Launchpool section, with Binance Labs investment projects becoming the main force behind these listings, including Fusionist (ACE), Sleepless AI (AI), NFPrompt (NFP), and others. Mid-year, due to market downturns and controversies over VC tokens "sucking blood" from the market, Binance paused new listings. Recently, Launchpool has returned, and the frequency of new listings has significantly increased.

Yesterday, Binance Labs "designated" 12 projects from its investment portfolio, which will be showcased on the innovation stage at the Dubai Binance Blockchain Week to help them gain exposure and feedback.

Interestingly, the most liked and exposed reply under Binance Labs' tweet was "I'm tired, can KiloEx hurry up and issue tokens" (one of the 12 invested projects). Therefore, based on the relatively high probability of new listings, Binance Labs' renewed focus on support, and strong calls for token issuance, Odaily will summarize the project backgrounds and latest developments of these 12 projects in this article for readers to reference and judge whether there are still opportunities for interaction.

The 12 projects are aPriori, KiloEx, MilkyWay, Movement, OpenEden, Puffer Finance, Solayer, StakeStone, UXUY, ZEROBASE, Zest Protocol, and Zircuit.

aPriori

Project Business: aPriori is a liquid staking platform within the Monad ecosystem, aimed at providing users with efficient staking solutions while maintaining asset liquidity.

Funding Situation: On July 30, received strategic investment from Binance Labs; on July 25, completed $8 million seed round financing, led by Pantera Capital; on January 30, completed $2.7 million Pre-Seed round financing, led by Hashed and Arrington Capital.

Latest Developments: Currently, there are no direct developments due to the Monad network being temporarily unavailable.

KiloEx

Project Business: A GMX-like perpetual contract DEX, primarily listing mainstream cryptocurrencies due to counterparty issues.

Funding Situation: On March 21, received investment from Foresight Ventures; on August 4, 2023, received investment from Binance Labs. The amounts have not been disclosed.

Latest Developments: KiloEx was initially deployed on the BNB chain and opBNB chain, with subsequent business development focusing on multi-chain expansion. In reverse chronological order, it has launched on networks such as Base, B², Taiko, and Manta, and has also integrated with dappOS's intent network (a two-for-one opportunity).

MilkyWay

Project Business: MilkyWay is a liquid staking solution within the Celestia ecosystem, initially deployed and operated on Osmosis, currently expanding asset use cases and types.

Funding Situation: On April 30, completed $5 million seed round financing, with participation from Binance Labs, Polychain, Hack VC, and others.

Latest Developments: The main development direction includes expanding the core asset milkTIA use cases, introducing this asset to Demex, Flame, and other protocols; launching new liquid staking assets, such as milkINIT (INIT is the token of the module network Initia, which raised $22.5 million and will have its TGE next month).

Movement

Project Business: A modular network based on the Move language, aimed at connecting EVM networks with Move networks.

Funding Situation: On May 1, received investment from Binance Labs; on April 25, completed Series A financing, led by Polychain; on September 13, 2023, completed $3.4 million Pre-Seed round financing, led by dao5, Borderless Capital, Blizzard Fund, and Varys Capital.

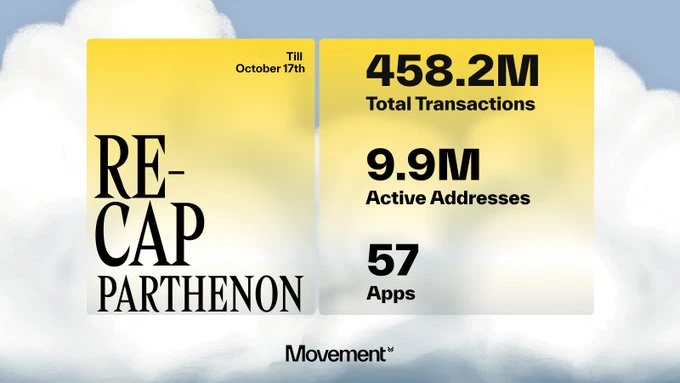

Latest Developments: The Movement testnet Odyssey is ongoing, with the official disclosure stating that there are currently 10 million addresses and over 458 million transactions.

OpenEden

Project Business: An RWA tokenization protocol, currently considered a protocol for on-chain US Treasury bonds, allowing users to invest in US Treasury securities through its native stablecoin TBILL.

Funding Situation: Received strategic investment from Binance Labs on September 12.

Latest Developments: In June of this year, Moody's Ratings granted its tokenized US Treasury bond licensed fund an "A" rating, making it the first RWA token to receive a Moody's rating. Cumulative TVL reached $150 million (using its products requires KYC compliance, not a yield farming project).

Puffer Finance

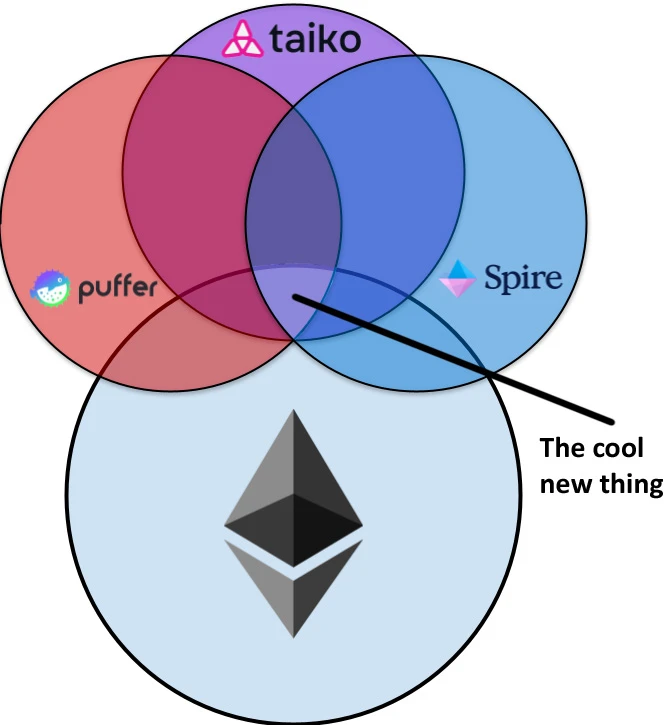

Project Business: One of the re-staking protocols based on Eigenlayer. Its unique feature compared to other re-staking protocols is the launch of the Based Rollup solution UniFi, aimed at solving the liquidity fragmentation problem on Ethereum, bringing value back to Ethereum L1.

Funding Situation: Completed four rounds of financing, with $18 million raised in Series A financing on April 16, led by Electric Capital and Brevan Howard Digital; received strategic investment from Binance Labs on January 30.

Latest Developments: On October 22, UniFi Devnet went live, open to whitelisted users and protocols, with the testnet and mainnet launching soon. Last week, the protocol token PUFFER airdrop claim was opened, along with the withdrawal function for pufETH.

Solayer

Project Business: A liquidity re-staking protocol on the Solana network.

Funding Situation: Completed $12 million seed round financing on August 27, led by Polychain, with participation from Binance Labs and others; completed Pre-seed round financing in July, with participation from Anatoly (founder of Solana) and others.

Latest Developments: Launched liquidity re-staking SOL in collaboration with multiple exchanges, including Binance (BNSOL), Bybit (bbSOL), Bitget (BGSOL), etc., allowing users to convert their SOL tokens into these tokens within the exchange, earning staking rewards, liquidity incentives, AVS delegation, and MEV rewards after staking.

Collaborated with OpenEden to launch the RWA yield-bearing dollar sUSD, which allows for re-staking and will earn interest through US Treasury bonds.

StakeStone

Project Business: An LSD (liquid staking derivative) protocol supported by ETH staking rewards.

Funding Situation: On March 25, received investments from Binance Labs, OKX Ventures, and Skyland Ventures.

Latest Developments: The main development direction is multi-chain expansion, with SBTC and STONEBTC launched on the berachain bArtio testnet yesterday; announced integration plans with Sonic (the new version of Fantom), among others.

UXUY

Project Business: A multi-chain DEX based on MPC wallets.

Funding Situation: Completed $8 million Pre-A round financing on May 9, with participation from Binance Labs, Bixin Ventures, and others; received investment from MEXC Ventures in August 2023; completed $3.2 million seed round financing in April 2023, with participation from Waterdrip Capital and others.

Latest Developments: According to co-founder 0xKevin—UXUY “All in TG** (Telegram)**,” launched the first self-custody multi-chain wallet on TG, supporting any Bot to connect to any ecosystem without permission through the UXUY Wallet Bot, including EVM/Solana/TRON/TON, etc.

ZEROBASE

Project Business: ZEROBASE is a real-time ZK prover network designed for speed, decentralization, and compliance, allowing ZK proofs to be generated in hundreds of milliseconds and ensuring decentralization and fast consensus through mechanisms for large-scale commercial use.

Funding Situation: Completed $5 million financing on October 19, with participation from Binance Labs and others.

Zest Protocol

Project Business: Zest Protocol is a native Bitcoin lending protocol on the Stacks network. The protocol itself is not particularly remarkable, but when it received investment from Binance Labs in May, it was one of the few investment projects in the Bitcoin ecosystem by Binance Labs in recent years (see “Binance Labs invests, an analysis of the Stacks lending market Zest”). However, with Binance Labs investing in projects like Hemi Network and Lombard, investments in the Bitcoin ecosystem by Binance Labs are no longer rare.

Funding Situation: On May 13, completed $3.5 million seed round financing, led by Tim Draper, with participation from Binance Labs and others.

Latest Developments: Launched the points system RoboZester, where users can earn points called Oranges through various social media tasks, but no further details have been provided.

Zircuit

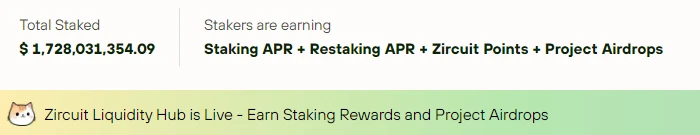

Project Business: Zircuit is an EVM-compatible ZK rollup that allows users to earn various incentives in one place, including staking rewards, protocol tokens, points, and future airdrops. Zircuit points out that new LRT protocols are constantly emerging, making it difficult even for experienced users to track and choose the safest and best protocols to deploy their funds. Zircuit aims to solve this problem by becoming the main liquidity hub for staking assets (ETH, BTC, LST, and LRT), where user funds will be deployed by Zircuit into secure, high-quality protocols.

Funding Situation: Completed a financing round on July 22, with participation from Binance Labs, Mirana Ventures, and others; received a separate investment from Binance Labs on June 11. The amounts and valuations have not been disclosed.

Latest Developments: Launched the Zircuit Liquidity Hub, where staking users will receive airdrops from partners, including ZeroLend, Elara, Avalon Labs, Circuit, Ocelex, Gamma, and others. Users staking on the Ethereum mainnet can migrate for free to the Liquidity Hub on Zircuit L2.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。