This article will provide a systematic analysis of the Pendle mechanism, examining how Pendle quickly captures market demand, facilitates the direct transmission from fundamentals to token price, and how it has been negatively impacted by the cooling of the Ethereum ecosystem, leading to a continuous decline.

Written by: @charlotte_zqh

This research report is supported by international crypto media and primary investor @RomeoKuok

1 Pendle 101: How to Achieve Separation of Principal and Yield

1.1 Separation of Yield-Generating Assets

Pendle is a decentralized finance protocol that allows users to tokenize and sell future yields. In the specific business process, the protocol first wraps yield tokens into SY tokens (Standardized Yield Tokens), which are tokens under the ERC-5115 standard that can encapsulate most yield-generating assets; thereafter, the SY tokens are split into two parts, namely PT (Principal Token) and YT (Yield Token), representing the principal and yield portions of the yield-generating asset, respectively.

PT is similar to a zero-coupon bond, allowing users to purchase it at a certain discount and redeem it at face value on the maturity date. Its yield is implicit in the difference between the purchase price and the redemption price. Therefore, if a user holds PT until maturity, they will receive a fixed return. For example, if PT-cDAI is purchased at a price of $0.9, the user will receive 1 DAI at maturity, resulting in a yield of (1-0.9)/0.9=11.1%. The act of purchasing PT is a short yield behavior, indicating that the user believes the future yield of the asset will decline below the current yield of PT. This fixed yield is suitable for users with a low-risk preference. However, this behavior differs from actual short selling; it is more of a value preservation action.

YT holders can receive all the yields of the yield-generating asset during the holding period, corresponding to the yield rights of the principal. If the yield is settled in real-time, YT holders can claim settled yields at any time. If the yield is settled at maturity, users can only claim the yield after maturity with YT, and once the corresponding yield is fully claimed, the YT asset will become invalid. The act of purchasing YT is a long yield behavior, indicating that the user believes the future yield of the yield-generating asset will increase, and the total yield obtained will exceed the current purchase price of YT. YT provides users with a yield leverage, allowing them to directly purchase yield rights without needing to buy the entire yield-generating asset. However, if the yield significantly declines, YT assets face the risk of loss, making YT a high-risk, high-reward asset compared to PT assets.

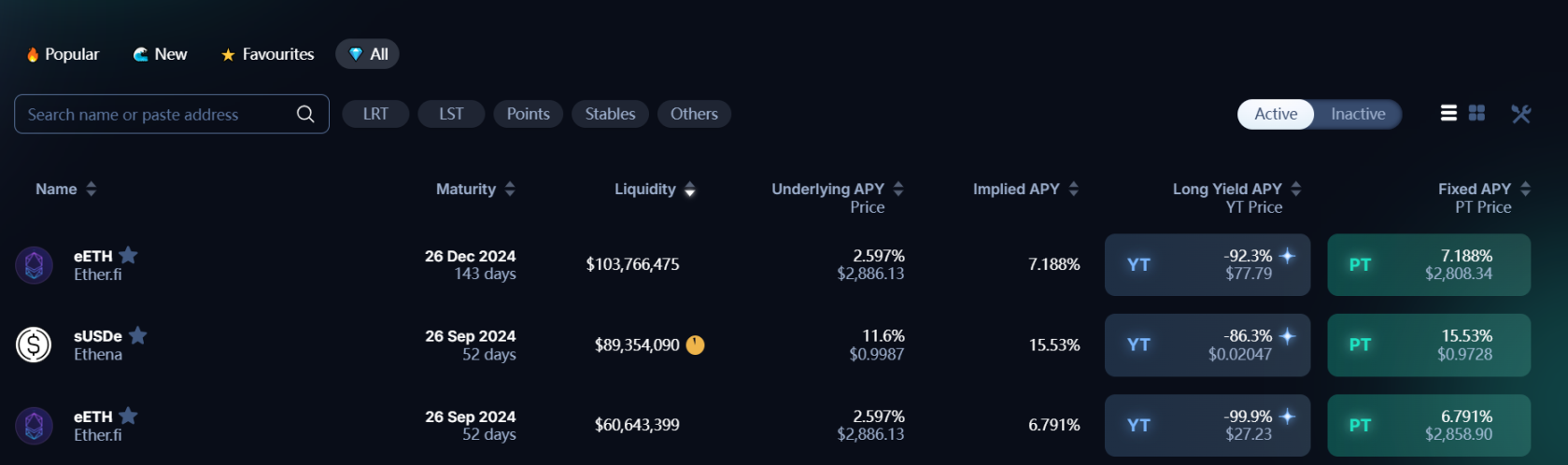

Pendle provides tools for both long and short yield strategies, allowing users to choose corresponding investment strategies based on their yield predictions and judgments. Therefore, yield is an important indicator for participating in this protocol, and Pendle also offers various APYs to reflect the current market situation:

- Underlying APY: The actual yield of the asset, taken as the 7-day moving average yield, to help users estimate the future yield trend of the asset.

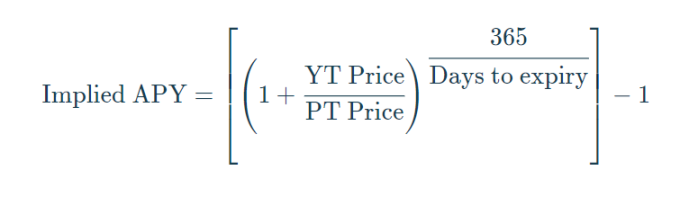

- Implied APY: The market consensus on the future APY of the asset, reflected in the prices of YT and PT assets. Its calculation formula is:

- Fixed APY: Specifically for PT assets, the fixed yield that can be obtained by holding PT, which is equal to the value of Implied APY.

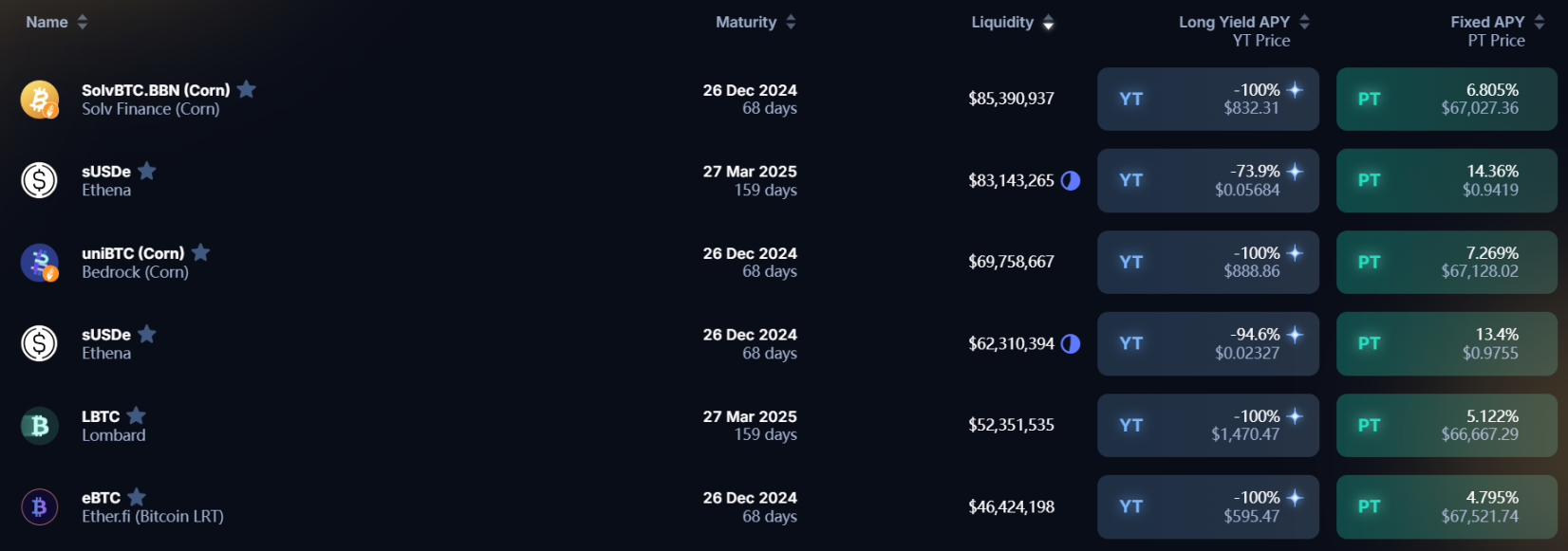

- Long Yield APY: Specifically for YT assets, the annual yield rate of purchasing YT at the current price, but this yield rate is constantly changing because the yield of the yield-generating asset itself is changing (this value could be negative, indicating that the current YT price is too high, exceeding the project's future yield). It is worth noting that many YT assets currently have potential yields from airdrops and points, making their value unquantifiable; therefore, many YT assets have a Long Yield APY of -100%.

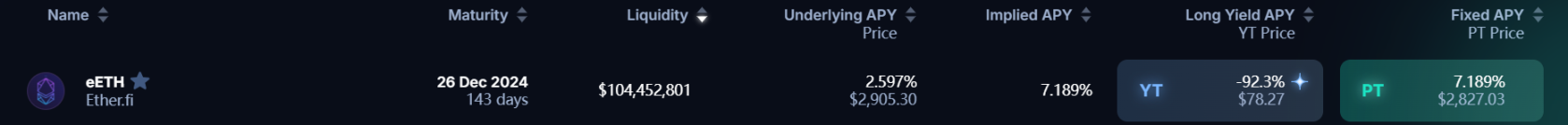

These four yield rates are displayed simultaneously on the Pendle Market interface. When Underlying APY > Implied APY, it indicates that holding the asset will yield more than holding PT, at which point a long yield strategy can be adopted, i.e., buying YT and selling PT. Conversely, when Underlying APY < Implied APY, the opposite strategy should be considered. However, it should be reiterated that these yield measurements do not account for future airdrop expectations, so the above strategies are only applicable to pure interest rate swap assets.

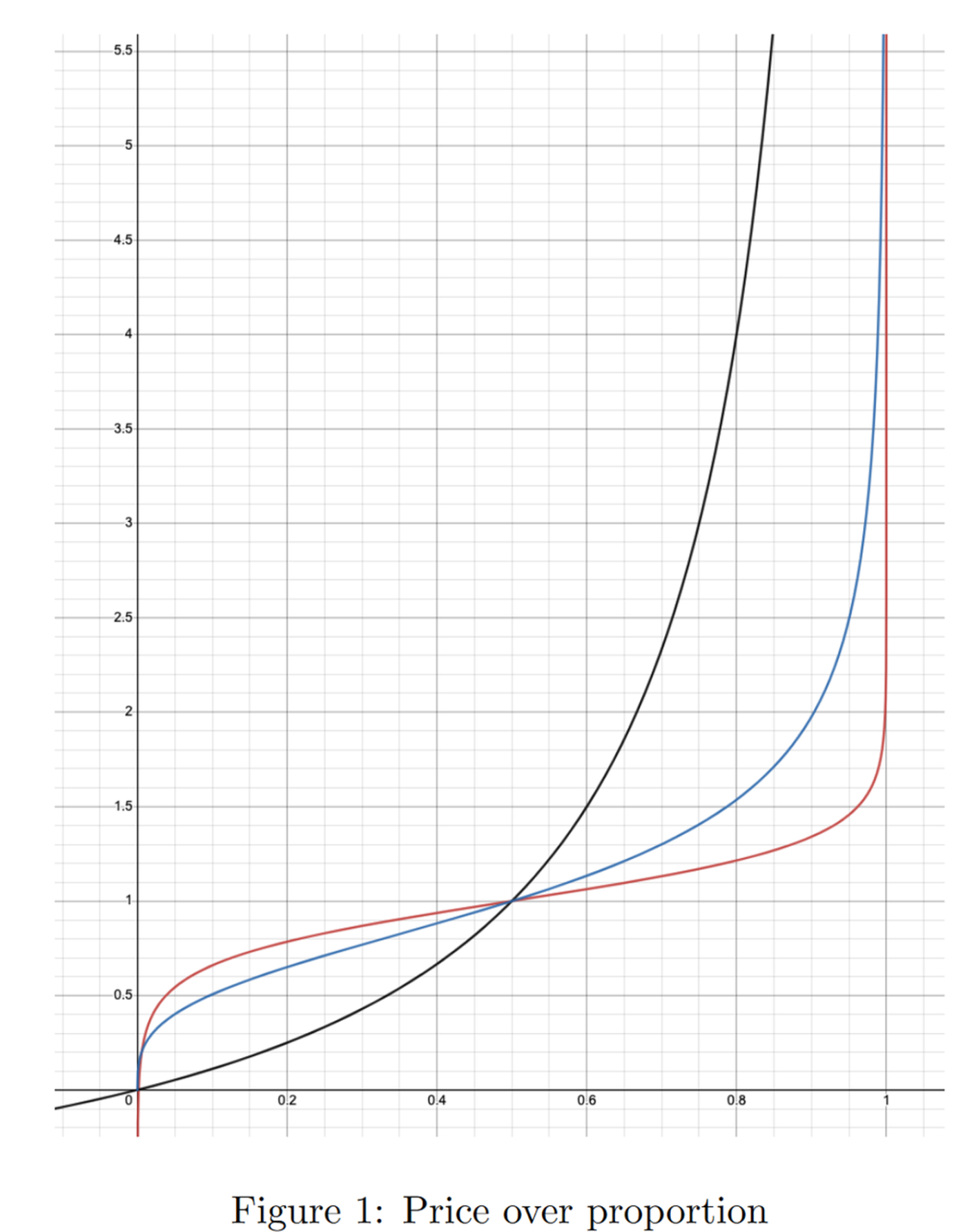

1.2 Pendle AMM: Facilitating Trading of Different Asset Types

Pendle AMM is used to facilitate trading between SY, PT, and YT tokens. According to the Pendle whitepaper, in version V2, Pendle improved the AMM mechanism by drawing on the AMM model of Notional Finance, enhancing capital efficiency and reducing slippage. The three AMM models for fixed income protocols in the market are illustrated below, where the X-axis represents the proportion of PT assets in the pool, and the Y-axis represents the Implied Interest Rate. Currently, Pendle adopts the AMM model corresponding to the red curve, while the black curve represents the V1 model, and the blue curve represents other fixed income protocols' AMM models.

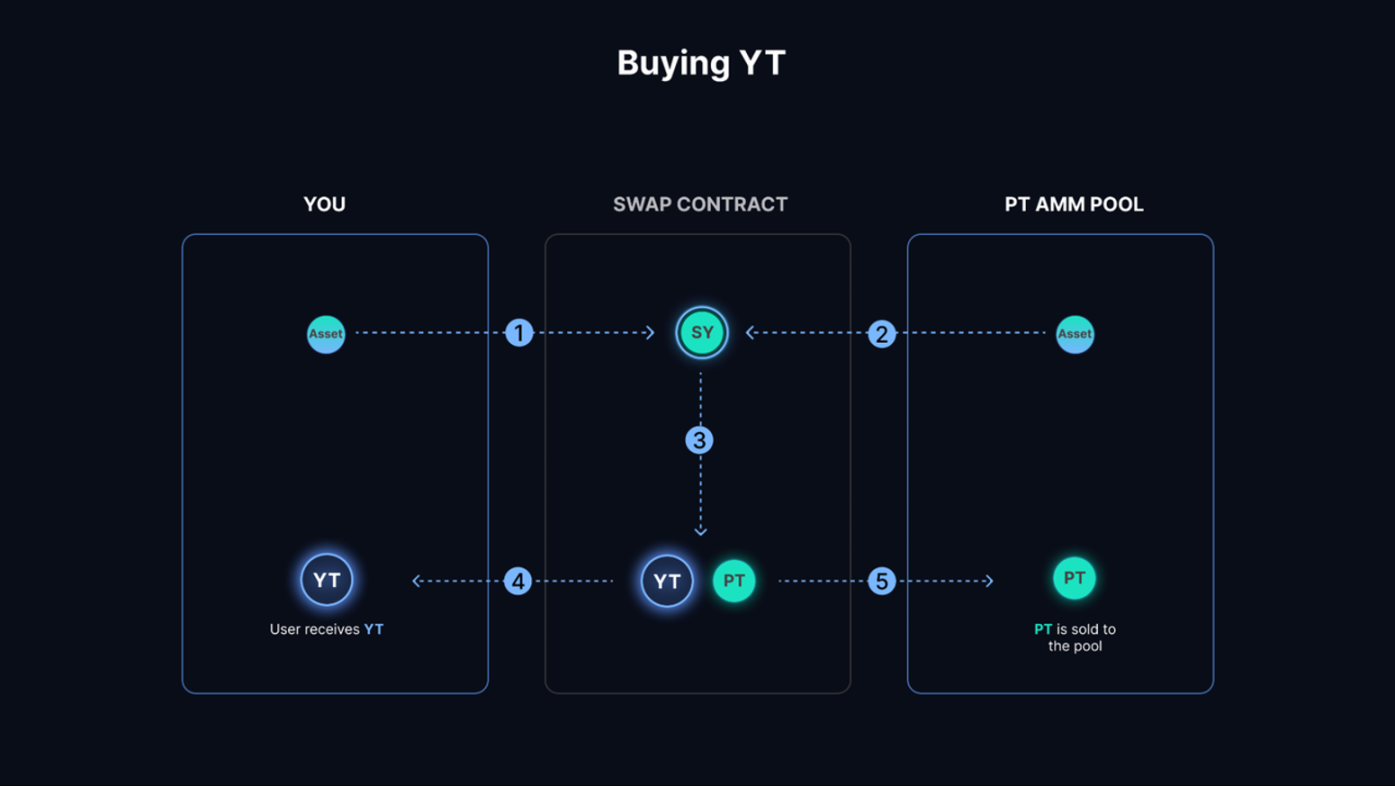

In specific pools, Pendle V2 uses PT-SY trading pairs, such as PT-stETH and SY-stETH, which can significantly reduce LP's impermanent loss (to be analyzed in detail later). Since SY = PT + YT, YT can be exchanged through Flash Swap. The specific process is as follows: if a user needs to purchase YT-stETH worth 1 ETH, they need to realize the exchange from ETH to YT-stETH. Assuming 1 ETH = N YT-stETH, the contract will borrow N-1 SY-stETH from the pool and convert the user's ETH into SY-stETH (the specific process is to first exchange ETH for stETH through Kyberswap, and then wrap it into SY-stETH within the protocol), then split all SY-stETH (N tokens) into PT and YT, giving the appropriate number of YT (in this case, N) to the user, and returning PT (N tokens) to the pool. What is actually completed in the pool is the exchange of SY-PT (N-1 SY exchanged for N PT).

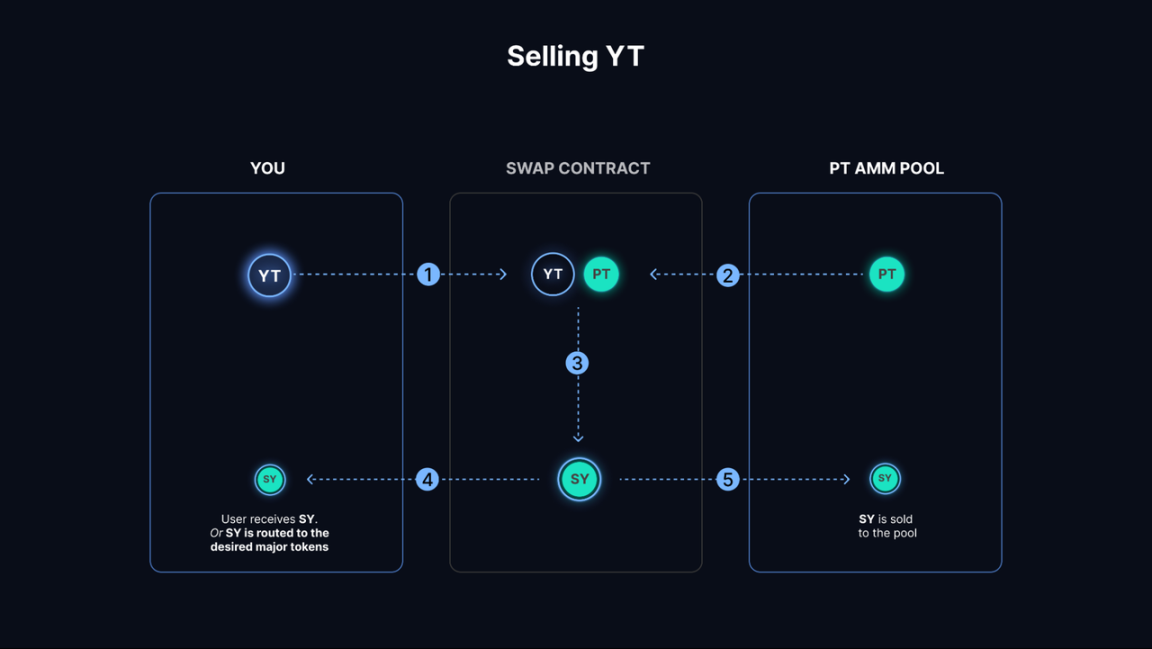

The process of selling YT is the opposite. If a user wants to sell N YT (assuming the value of N YT is currently 1 SY), the contract will borrow N PT from the pool, combine them into N SY, give one SY to the user, and return N-1 SY to the pool. At this point, what is actually completed in the pool is the exchange of PT-SY (N PT exchanged for N-1 SY).

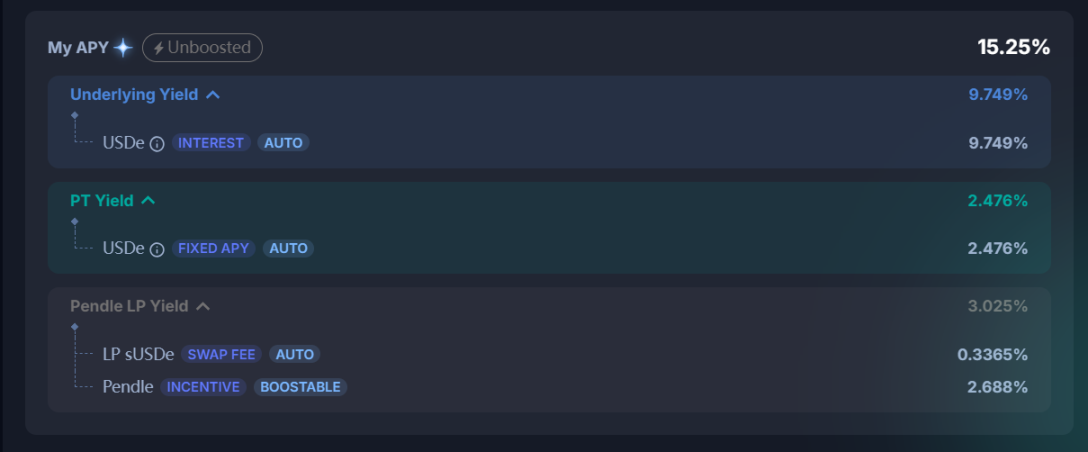

Like other AMMs, Pendle AMM also requires LPs to provide liquidity to the pool. However, since at maturity, one PT will always equal one SY, there is no impermanent loss for LPs at maturity. When users provide liquidity, the assets provided are SY and PT assets, thus automatically capturing the native yield of these assets, in addition to transaction fees and PENDLE liquidity mining rewards, which include four sources of income:

- PT fixed yield: The yield from purchasing PT itself

- Underlying yield: The yield from SY assets

- Swap fees: 20% of transaction fees

- PENDLE token incentives

2 Token Economics: How Does Business Revenue Drive Token Price Up?

2.1 Token Economic Mechanism: How to Achieve an Economic Flywheel?

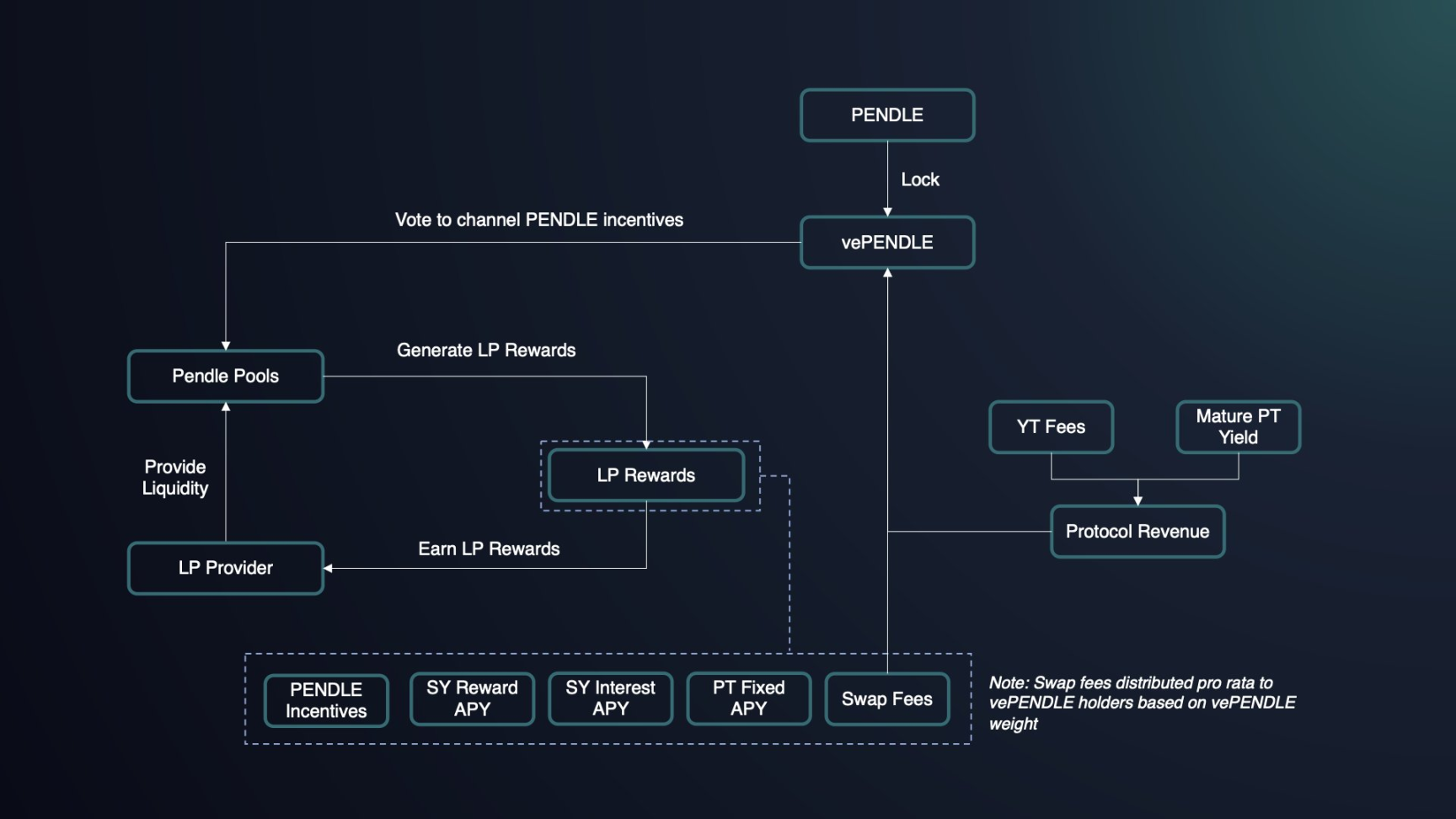

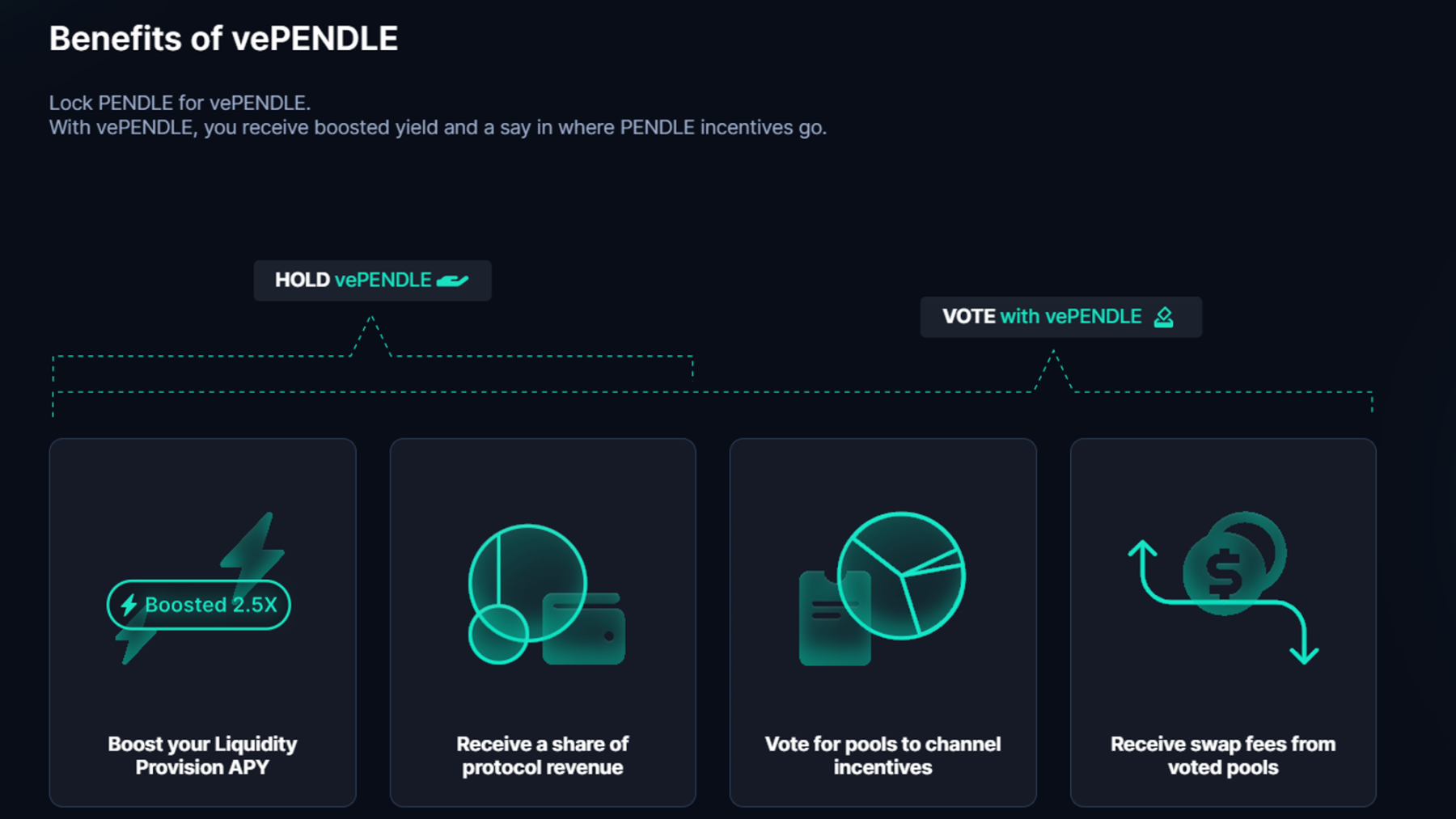

The token economic mechanism of PENDLE mainly revolves around obtaining vePENDLE through locking, which allows participation in protocol revenue sharing and governance decisions. Similar to Curve's veCRV model, users can lock PENDLE to receive vePENDLE, with longer lock-up times yielding more vePENDLE, ranging from 1 week to 2 years.

The benefits of holding vePENDLE include:

- Boost yield: Users can boost their LP yields, with a maximum multiplier of 2.5 times.

- Voting rights: Users can vote on the distribution of PENDLE incentives across different pools.

- Revenue sharing: Holders of vePENDLE can receive the following benefits:

- 80% of transaction fee sharing from the voted pool: vePENDLE holders vote on the flow of PENDLE incentives, and only those who complete the voting can receive rewards from the selected trading pool.

- 3% of all YT yields.

- A portion of PT yields: This portion comes from unredeemed PT, for example, if a user purchases PT assets and does not redeem them at maturity, after a period, this portion of assets is acquired by the protocol.

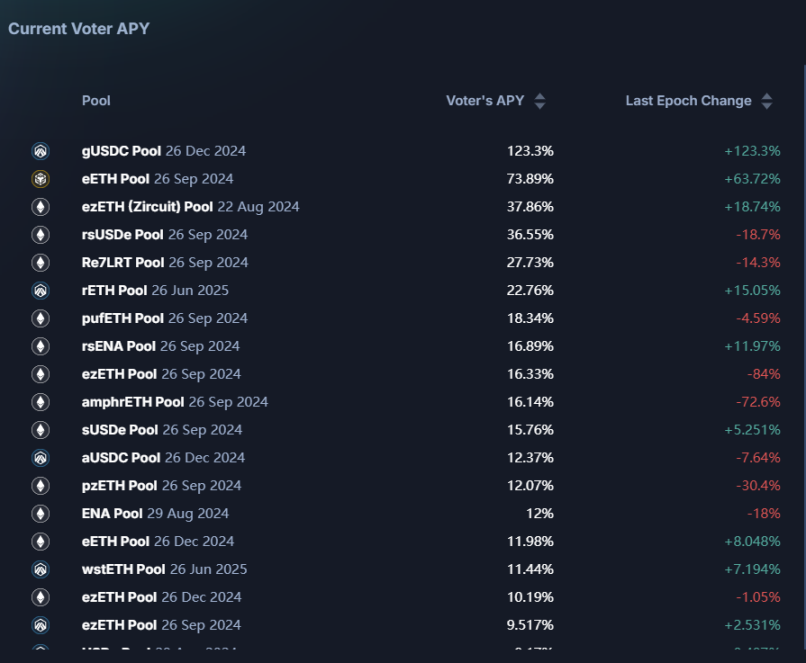

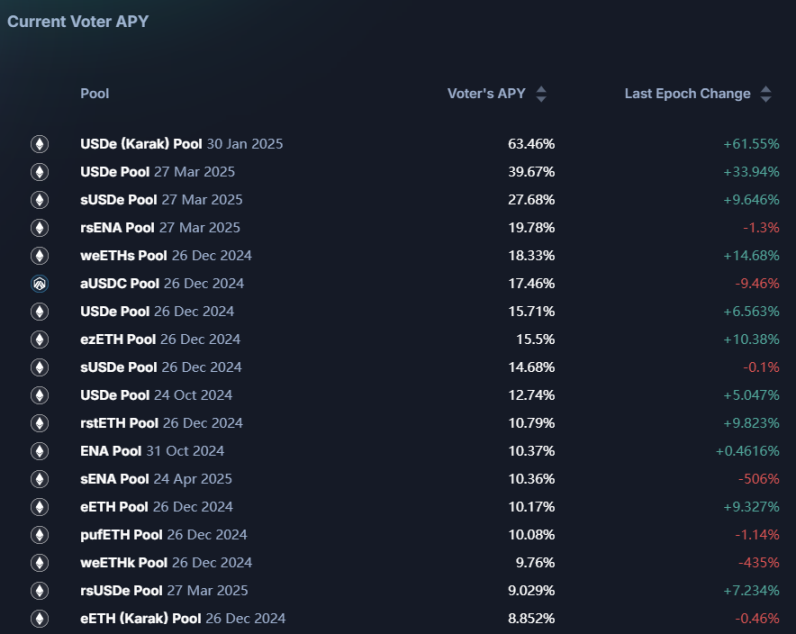

In the calculation of yield, the Total APY for holding vePENDLE = Base APY + Voter’s APY, where Base APY comes from the yields of YT and PT, and Voter’s APY comes from the transaction fee sharing of designated pools, which is also a major component of APY—currently, the Base APY is only around 2%, while Voter’s APY can reach 30% or more.

Pendle's ve model has also facilitated the emergence of bribery platforms, with Penpie and Equilibria engaging in related businesses, similar to the business processes between Convex and Curve. However, compared to Curve, the core project parties trading assets on Pendle do not have a need for bribery. Curve, as the main trading platform for stablecoins and other pegged assets, ensures that the depth of the pool is crucial for maintaining the peg of the token price, which drives project parties to have a strong demand to participate in bribery to guide liquidity. However, maintaining trading depth in Pendle AMM seems to hold little significance for related project parties like LSD and LRT, so the main motivation for participating in bribery will come from LPs on Pendle. The establishment of bribery platforms primarily optimizes two aspects: 1) Pendle LPs can achieve higher yields without needing to purchase and lock PENDLE; 2) Holders of PENDLE can obtain liquid ePENDLE/mPENDLE to gain incentives for vePENDLE. Since this article focuses solely on Pendle, we will not elaborate further on the bribery ecosystem here.

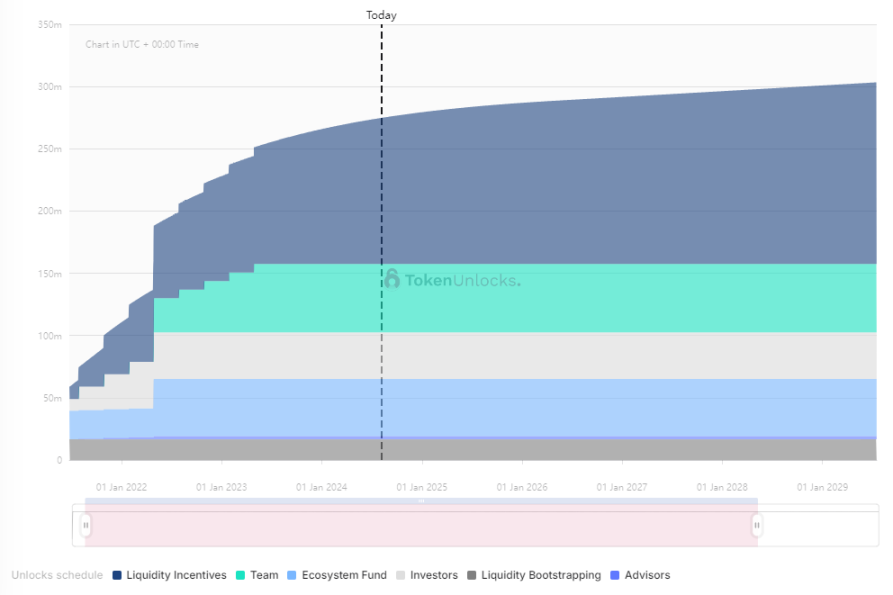

2.2 Token Distribution and Supply: No Major Unlock Events Ahead

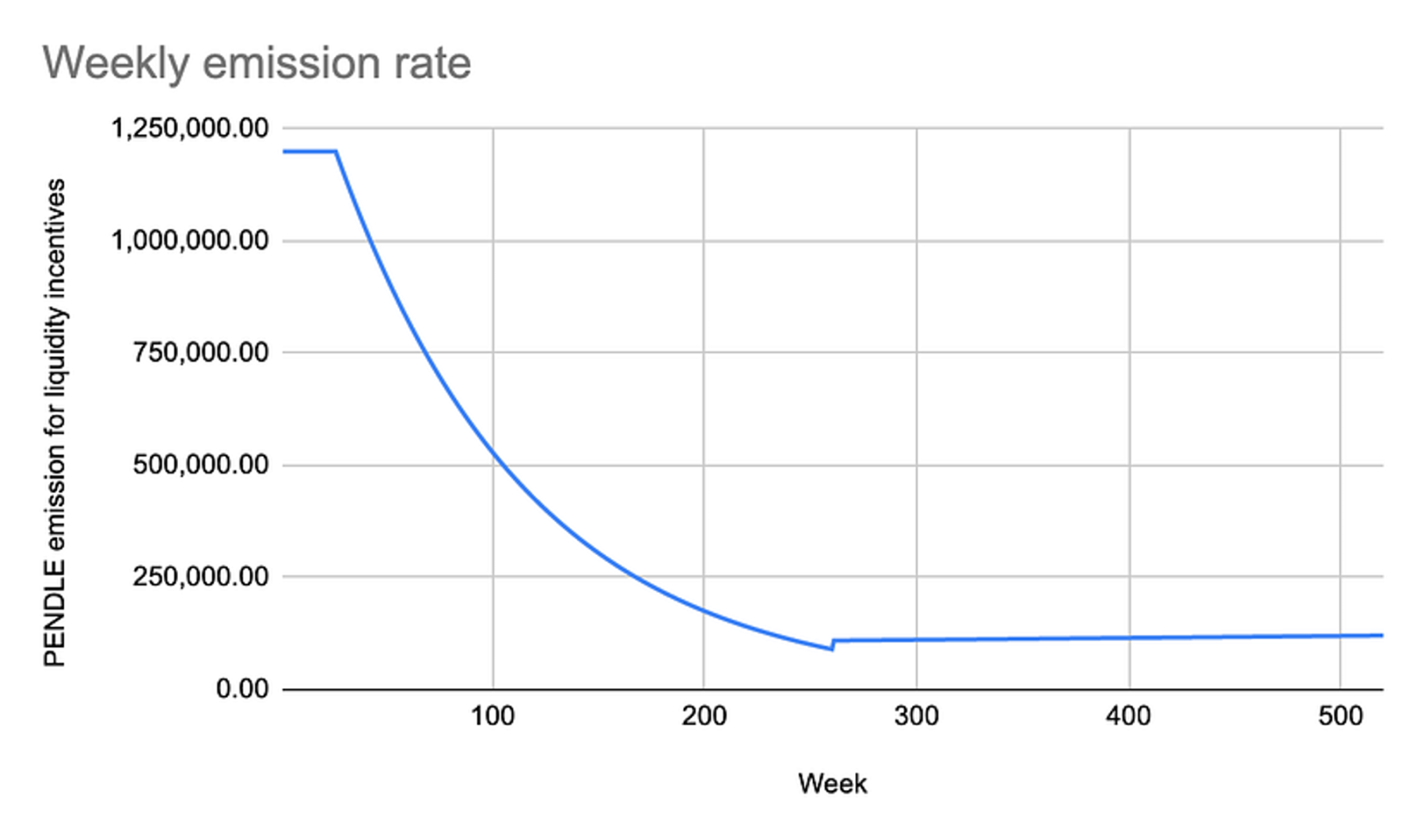

The PENDLE token was launched in April 2021, adopting a hybrid inflation model with no upper limit on token supply. It provided a stable incentive of 1.2 million PENDLE per week for the first 26 weeks, after which (weeks 27-260), liquidity incentives will decrease by 1% per week until week 260. After that (from week 261 onwards), the inflation rate will be 2% per year for incentives.

According to Token Unlock data, the initial token distribution allocated to the team, ecosystem, investors, advisors, etc., has now fully unlocked. If we do not consider OTC trading and only look at the initial distribution, PENDLE will not face significant concentrated unlocks in the future. Currently, daily inflation comes solely from liquidity mining incentives, with a daily emission of approximately 34.1k PENDLE. Based on the coin price on August 5 ($2), the daily unlock selling pressure is $68.2k, which is relatively small.

3 Application Scenario Development: Stable Wealth Management, Interest Rate Trading, and Points Leverage

The development of Pendle can be roughly divided into three stages:

- Pendle was established in 2021, during which time, although it was the DeFi Summer, DeFi was in its infrastructure phase, with major projects revolving around DEX, stablecoins, and lending, and interest rate swap products did not receive much attention.

- By the end of 2022, as Ethereum completed its transition to PoS, Ethereum staking rates became the native interest rates in the crypto space, leading to a rapid emergence of various LSD assets. This resulted in: (1) interest rates becoming one of the focal points in the crypto space; (2) a large number of yield-generating assets being born, allowing Pendle to find its PMF; (3) Pendle becoming a small-cap target for speculation in the LSD track, with relatively few competitors in the segmented track. The listing on Binance during this period further increased Pendle's valuation ceiling.

- From the end of 2023 to the beginning of 2024, Eigenlayer initiated the narrative of re-staking on Ethereum, leading to the birth of various liquidity re-staking (LRT) projects. Both Eigenlayer and LRT projects announced points and airdrop plans, triggering a points war. This resulted in: (1) the birth of more yield-generating assets, effectively broadening Pendle's path to increase TVL; (2) most importantly, Pendle captured the intersection of principal and interest trading and points leverage, finding a new PMF. The following sections will further discuss how Pendle plays a role in the points war and how it empowers the PENDLE token.

In summary, besides becoming an LP and a holder of vePENDLE, Pendle's main use cases currently include three: stable wealth management, interest rate trading, and points leverage.

3.1 Stable Wealth Management

This primarily corresponds to the function of PT assets. By holding PT assets, users can receive a fixed amount of the corresponding asset at maturity, and this fixed interest rate is determined on the day of purchase, allowing users not to constantly monitor changes in APR. This function offers stable yields with low risk and low returns. After the launch of points trading, this function has further increased users' yields: for example, with eETH, users choose to forgo the yield from holding eETH in exchange for a higher fixed yield. Therefore, the current yield of PT assets (7.189%) is much higher than (2.597%), providing a wealth management tool for users seeking higher fixed income in Ethereum. Some users who are not optimistic about the future token performance of LRT projects can buy PT assets at a low price when the market FOMO drives up YT prices, effectively shorting LRT tokens.

3.2 Interest Rate / Yield Expectation Trading

Users can achieve long and short positions on interest rates by trading YT assets. When they believe future yields will significantly increase, they buy YT assets and sell them when the price of YT assets rises. This strategy is suitable for trading assets with high yield volatility, such as sUSDe, which is a staking certificate for the stablecoin issued by Ethena. The staking yield mainly comes from the funding rate for ETH; the higher the funding rate, the higher the staking yield. The funding rate depends on changes in market sentiment, so the staking yield also exhibits some volatility. By trading YT-sUSDe, users can quickly profit from swing trading. Additionally, after the introduction of points yield rights, trading YT assets also includes pricing changes based on airdrop expectations. For example, before the ENA token launch, early purchases of YT-USDe can be sold after the market starts to FOMO for the ENA airdrop, yielding high returns. However, this swing trading faces high returns and risks; for instance, the price of YT-sUSDe has recently declined repeatedly, partly because the points earned from holding YT assets decrease as the holding period shortens, and partly due to the continuous decline in ENA prices, leading to a decrease in market expectations for airdrop value. Early buyers may face significant losses.

3.3 Points Leverage and Trading

The most significant impact on Pendle in this cycle comes from the points trading function, which provides users with potentially high leverage for points and airdrops. This article will focus on this function and aims to answer the following questions:

(1) Which projects are suitable for Pendle's points trading?

Points have become the main form of airdrop distribution in this cycle, with methods for obtaining points including interaction-based, volume-based, and deposit-based, among which deposit-based methods have become the most significant. With the emergence of various LRT protocols, BTC Layer 2, and staking protocols, the TVL battle has become a main theme this year. Some protocols directly lock related assets, such as BTC Layer 2 directly locking BTC and inscription assets, and Blast directly depositing ETH, while others return corresponding liquid assets as deposit certificates after deposits, allowing users to earn points through holding. Pendle's principal-yield separation mechanism is more suitable for the second type, which requires an underlying asset to serve as a medium for accumulating points.

(2) In what ways has Pendle's points trading achieved PMF?

Pendle has primarily achieved PMF in two aspects: first, it has leveraged points; second, it has enabled early pricing and expectation trading for airdrops. The TVL battle is a game for whales, and ordinary retail investors cannot hold enough ETH to deposit. Pendle supports directly obtaining points yield rights by purchasing YT assets, allowing users to earn points without needing principal, achieving dozens of times the points leverage in projects like LRT and Ethena. Furthermore, Pendle essentially provides the earliest market pricing for points, and trading YT assets also involves trading expectations for project airdrops and token prices. This can be further divided into two situations: ① For tokens that have not yet undergone TGE, most airdrop rules are unclear, so they include market expectations for potentially obtainable tokens and early pricing for these tokens; ② For tokens that have already undergone TGE, the token price has a clear market price, but the unknown information may be how many tokens correspond to a point airdrop. If the airdrop rules are relatively clear, and it is known how many tokens can be obtained from the underlying asset at maturity, then this YT asset is equivalent to an option, with the current price reflecting the pricing expectations for the token price at maturity.

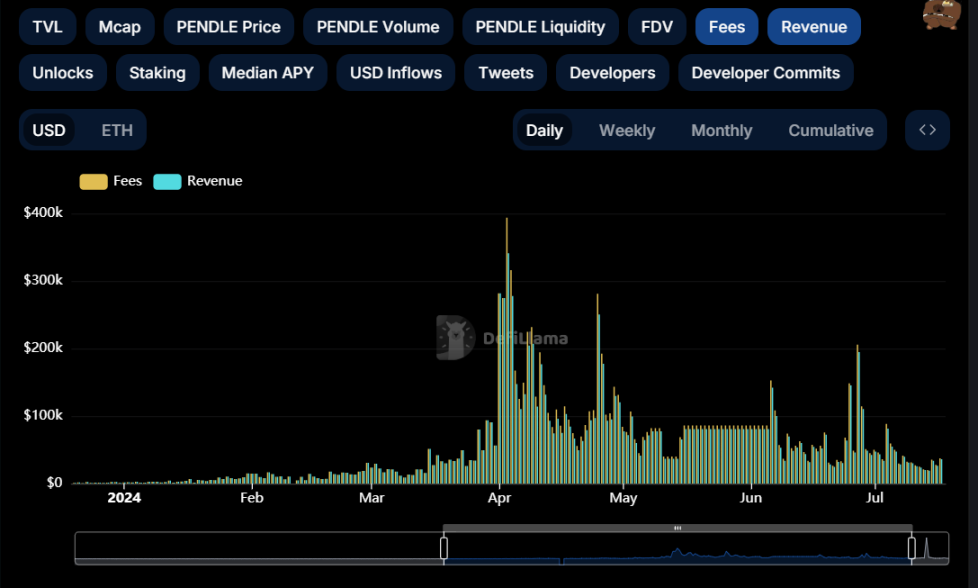

(3) How does points trading affect Pendle's business revenue and token price?

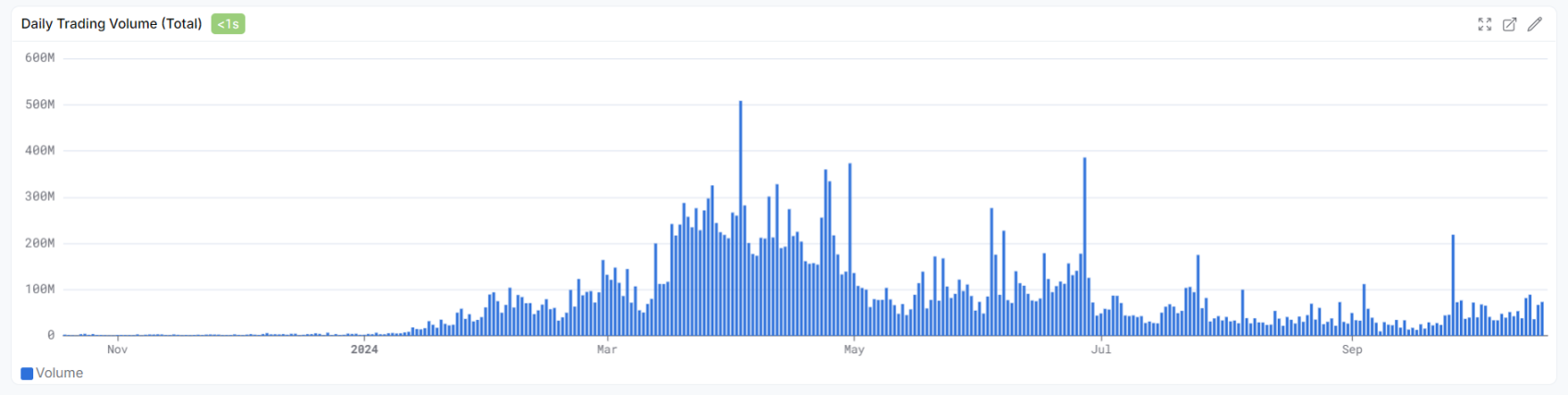

As analyzed earlier, the introduction of points trading has brought about trading expectations for future airdrops, which, compared to yield rates, change and fluctuate rapidly, leading to higher speculation and trading demand. Most directly, this has rapidly expanded Pendle's trading volume and transaction fee revenue, and the diversification of asset classes has also increased Pendle's TVL.

The empowerment of PENDLE is more evident. The income of vePENDLE holders mainly comes from the sharing of transaction fees. Without sufficient volatility and speculative demand, there won't be enough trading, leading to very low yields for vePENDLE. In July 2023, the total APY for vePENDLE was only around 2%. Therefore, although Pendle was hotly speculated in the LSD track at that time, the token price still could not benefit from the business. The introduction of points trading has changed this predicament, and currently, the APY for vePENDLE in multiple pools exceeds 15%, with some related asset pools for LST assets even reaching over 30%.

(4) How do the performances of related projects affect Pendle?

The two core negative impacts surrounding Pendle include: the airdrop landing of major assets (LRT and Ethena); and the continuous decline in the prices of major project tokens. The landing of airdrops has reduced speculative demand. Although the points program will continue for multiple periods, the combination of declining token prices has significantly lowered market confidence and expectations for the project, leading to a decrease in users choosing to deposit, and related trading volumes have also shrunk significantly. Currently, Pendle's TVL and trading volume have both seen a substantial decline, and the same predicament is reflected in the token price.

4 Data Analysis: TVL and Trading Volume are Pendle's KPIs

This article believes that the business data surrounding Pendle can be mainly divided into two parts: stock and flow. The stock is primarily represented by TVL, and it is also necessary to closely monitor indicators that affect the health and sustainability of TVL, such as the composition structure of TVL, the maturity dates of asset pools, and the rollover ratio; the flow is mainly represented by trading volume, including trading volume, transaction fees, and the composition of trading volume. Changes in trading volume will directly impact token empowerment.

4.1 TVL and Related Indicators

The TVL priced in ETH rapidly increased after mid-January 2024 and maintained a high correlation with the price of PENDLE. At its peak, TVL exceeded 1.8M ETH, experiencing rapid declines on June 28 and July 25, primarily due to a large number of asset pools maturing. After maturity, the demand for reinvestment was insufficient, leading to a rapid outflow of TVL. Currently, Pendle's TVL is approximately 1M ETH, nearly a 50% drop from its peak, and the downward trend has not been effectively alleviated.

Specifically, on June 27, 2024, multiple LRT asset pools, including Ether.Fi's eETH, Renzo's ezETH, Puffer's pufETH, Kelp's rsETH, and Swell's rswETH, matured, and users redeemed their principal investments. Although there are still asset pools with other maturity dates for related assets, the rollover ratio among users is low, and TVL has shown no signs of recovery to date. This confirms the previous analysis that as the token issuance and price performance of LRT projects decline, users' demand for further participation in related asset management and investment decreases. In this cycle, the lack of innovation in the Ethereum ecosystem and the market's pessimism towards ETH prices mean that if the market's investment demand for ETH weakens, it will directly impact Pendle's business revenue level, thus Pendle is strongly bound to Ethereum.

In terms of Pendle's TVL composition, Pendle's total TVL is $2.43B, with 11 asset pools having TVL exceeding $10M. The pool with the highest TVL is SolvBTC.BBN, accounting for approximately 3.51% of the total TVL. The structure of the TVL composition is relatively healthy, with no single asset pool occupying a large portion of the TVL. Regarding the maturity of asset pools, the next significant maturity date will be December 26, 2024, and Pendle's TVL may show a relatively stable trend in the near term.

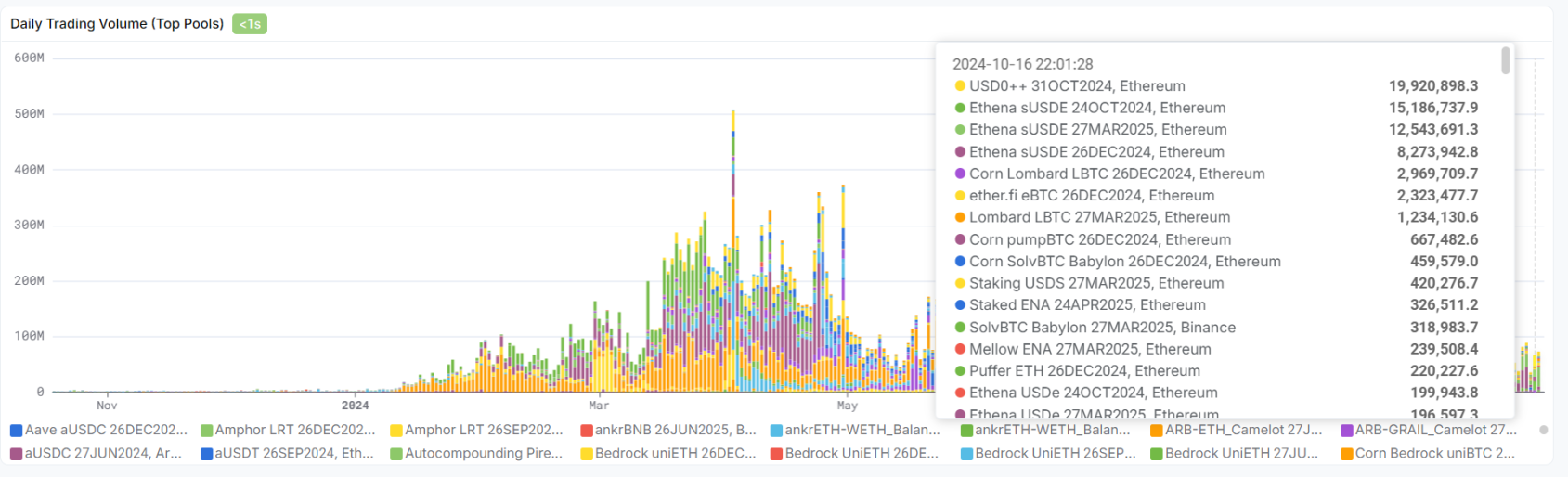

After the wave of Ethereum re-staking ended, Pendle smoothly transitioned to stablecoin assets like BTCfi and USDe/USD0. Although the business data and market sentiment are not as strong as in April, the TVL data has been maintained without significant declines. However, with the issuance of various Ethereum LRT protocols and the entry of EIGEN into trading, the imagination for the re-staking track is diminishing, which has also compressed speculative enthusiasm for the BTC staking track, reflected in the decline of Pendle's trading volume. The next event that may impact Pendle could be the issuance of Babylon and the BTC staking track. After the end of BTC re-staking, can Pendle find new application scenarios?

4.2 Trading Volume and Composition

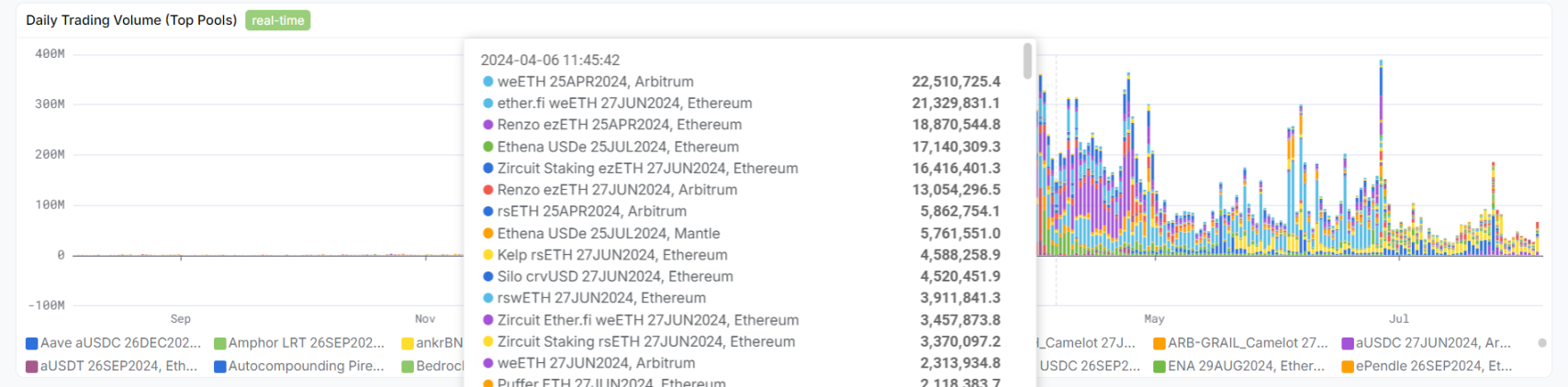

The trading volume of Pendle AMM also rapidly increased after January 2024, peaking around April. At the end of April, after Eigenlayer announced its token issuance and the airdrop expectations for LRT projects like Ether.fi landed, trading volume saw a significant decline, and it has further decreased, reaching a low level since 2024.

In terms of the composition of trading volume, in the first half of 2024, trading volume was mainly composed of transactions related to Renzo and Ether.fi assets. Currently, Pendle AMM's trading volume mainly comes from the Ethena and USD0 protocols, with limited trading volume generated from BTCfi assets. Trading volume directly affects transaction fees and the annualized returns for vePENDLE holders, making it a more direct transmission factor compared to TVL.

4.3 Token Locking Ratio

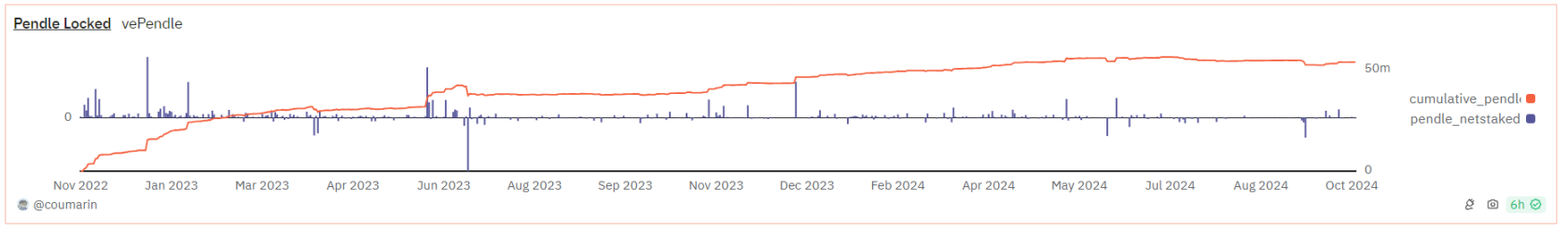

The token locking ratio directly affects the supply and demand relationship of the token. With a relatively stable daily release of tokens, the more PENDLE that is locked as vePENDLE, the more positive the stimulus effect on the token price. Changes in the amount of PENDLE locked show a similar trend to changes in business data and token prices. Starting in November 2023, the amount of PENDLE locked began to rise rapidly, increasing from 38M to a peak of 55M. After reaching 54M in April 2024, the growth rate of PENDLE locked began to slow down, and there was even a net outflow of vePENDLE. This aligns with the previous analysis of the business— as TVL and trading volume decrease, the yield of vePENDLE starts to decline, thus reducing the attractiveness of locking PENDLE. Currently, there has not been a significant outflow of vePENDLE, partly due to the restrictions of the locking period, which causes this indicator to lag compared to TVL, trading volume, and token price, making it unable to show significant changes in the short term. On the other hand, top asset pools still have decent yields, which mitigates the outflow of vePENDLE. However, it should be noted that both the business data and the growth data of vePENDLE reflect that Pendle is facing short-term business pains, and it has yet to find new growth points after the cooling of re-staking and points.

5 Conclusion: Pendle Urgently Needs to Find New Scenarios After Re-staking

In summary, Pendle's success lies in accurately identifying its PMF. More importantly, business revenue directly empowers the token, finding a direct factor for transmitting token price—packaging YT products as points trading targets, increasing AMM trading volume, and boosting the income of vePENDLE.

Since starting to decline from $7.5, Pendle has not reversed its downward trend. It cannot be denied that Pendle is a great DeFi product, combining wealth management and speculative attributes, meeting the needs of investors with different risk preferences. However, after the decline in Ethereum-based TVL, there are no signs of recovery. The poor performance of re-staking projects and Ethena has lowered market expectations for subsequent airdrops, leading to a decrease in demand for Pendle's usage, and thus, the price of PENDLE is also seeking a new position. Pendle needs to find new product packaging or expand into new ecosystems like Solana to increase its TVL and trading volume to potentially find new growth space.

Pendle's other positioning is Ethereum Beta, but it is currently undergoing a transformation: during the Ethereum re-staking era, Pendle was an important wealth management product for Ethereum and derivative assets. Even Ethena, although a stablecoin, has its USDe staking yield directly related to ETH's funding rate. If the market temporarily loses information about the Ethereum ecosystem and ETH struggles to rise, Pendle will also be powerless. It is also important to point out that Pendle differs from MEME-type Ethereum Betas like PEPE; the price of ETH has a direct transmission effect on the price of PENDLE: ETH struggles to rise → demand for ETH-based wealth management decreases / re-staking track performance cools → demand for Pendle usage decreases → Pendle's business revenue decreases → PENDLE price decreases. However, Bitcoin staking assets have already replaced Ethereum on Pendle, which may weaken this transmission effect.

Finally, this article provides key points to focus on from a fundamental perspective:

- Pay attention to the progress of points programs for LRT projects and stablecoin projects like Ethena and USD0; the end of the points season may again reduce Pendle's business revenue.

- Monitor changes in Pendle's TVL and trading volume; if multiple asset pools mature again, it may lead to a significant drop in TVL, at which point it may be prudent to sell part of the PENDLE position in advance to hedge.

- Continuously pay attention to Pendle's product developments, including but not limited to: the launch of Pendle V3; the introduction of new asset pools and trading strategies; the possibility of expanding into new public chain ecosystems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。