Bitcoin price falls below the $67,000 mark!

This drop has caused many to worry whether Bitcoin's upward trend is about to pause.

Last night during the European session, sellers suddenly intensified their efforts, pushing Bitcoin's price down significantly. As a result, over $200 million was liquidated in the derivatives market, with $61.87 million in leveraged positions (mostly long) being cleared in just the past four hours.

In terms of market conditions, after two consecutive days of correction, the price has tested the $66,000 level without breaking it.

As long as this range holds, the market can be considered stable in the short term.

If Ethereum holds above $2,560, the market remains intact. Individual risk-takers can manage their operations accordingly; this is for reference only and does not constitute investment advice.

Once the market shows signs of correction, various negative news will flood in, and all sorts of scare tactics will emerge to intimidate people.

Still, the key point is to observe the trend. Various conspiracy theories are circulating in the market, suggesting that the Federal Reserve will lower interest rates first and then suddenly raise them, leading global capital to a point of no return.

In this regard, there is no need for excessive worry. As the global superpower, such shameless actions are unlikely to occur. It is recommended to keep an eye on BlackRock during your free time to see what they are doing; following their lead is likely to be a safe bet.

Analyzing Bitcoin's upcoming trends, everyone knows that October is a month of explosive growth for Bitcoin. So what will November be like? Let's look at the chart.

Bitcoin's average increase in November reaches as high as 46.8%, with a median increase of 9%. Based on the conservative median, a 9% increase from Bitcoin's current price would bring it to $76,000, which would break its historical high and initiate a larger rally. As you can see, Bitcoin rose by 43% in 2020, 5.5% in 2016, and several thousand times in 2012, which is quite astonishing.

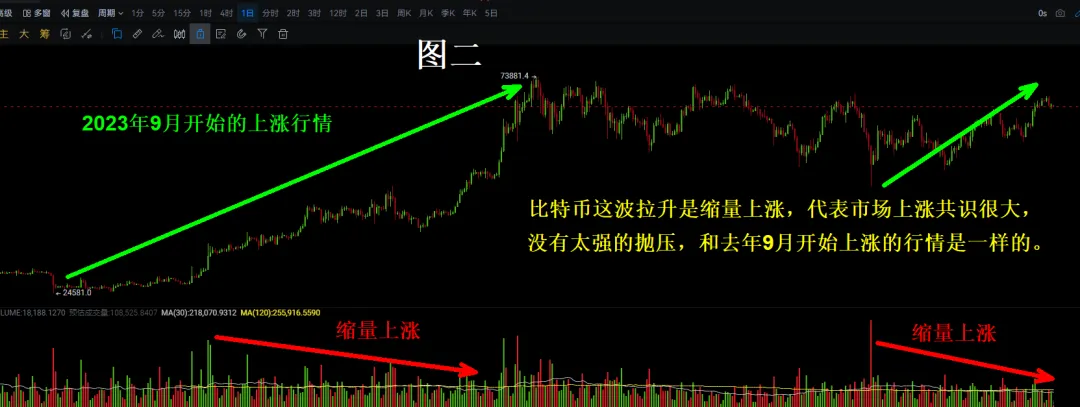

So, regardless of which data you look at, there is a strong consensus for significant growth in November. Returning to the current October market, we are already more than halfway through, with an increase of 6%. However, you should know that the average increase in October is as high as 21%, so in the next week or two, Bitcoin actually has considerable room for growth. Additionally, the relationship between volume and price is very important; this recent rally in Bitcoin has been accompanied by a decrease in volume, which is very healthy, indicating a strong market consensus for growth without significant selling pressure. This is similar to the upward trend that began in September last year.

(Chart 2) An increase in volume often indicates a reversal, as seen in the classic bottom reversals in August last year and this year. In March of this year, Bitcoin also saw a significant increase in volume, signaling the end of the bullish trend. So remember, volume marks both the beginning and the end; if we see a surge in volume now, we should be quite concerned.

Regarding altcoins

The current accumulation structure of altcoins indicates that this round of market growth will not disappoint, even if it may not be the most exaggerated in history.

The accumulation period has significantly extended; previously around one month, it is now generally between two to three months. Moreover, this round of market activity has experienced extreme shakeouts, with various fluctuations over the past year causing considerable anxiety.

For leading altcoins in various sectors, it is advisable to actively buy during downturns, keeping leverage below three times. From a weekly perspective, many cryptocurrencies are at their bottoms, and altcoin seasons typically see sharp rebounds before the end of an upward trend, potentially multiplying several times within a month, similar to the rotations of Ape and dYdX.

If your cryptocurrency has not yet had its turn, be patient; eventually, all will experience a rally. Although the inscriptions and Telegram ecosystem coins may seem underwhelming, those who endure will emerge from adversity.

People often ask: Will the bull market still be present in 2024? It is like the wind; it has always been there!

As long as you believe and remain steadfast, it will surely arrive as expected.

In conclusion, I wish all friends success in seizing this wealth opportunity.

This article is time-sensitive and for reference only; it will be updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Official account: Crypto悟饭

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。