"The Onchain Interfacing Layer," filling the missing link in DeFi.

Written by: Deep Tide TechFlow

In the fierce battles of Meme PVP, don't forget to observe the new protocols in the market.

Currently, as the narrative of major infrastructure gradually becomes aesthetically fatigued, optimizing the trading experience, small and medium infrastructure projects centered around asset trading are beginning to gain market favor, such as the recently popular Meme trading platform moonshot.

In addition to these trading platforms specifically targeting Memes, some comprehensive DeFi trading projects are also starting to emerge.

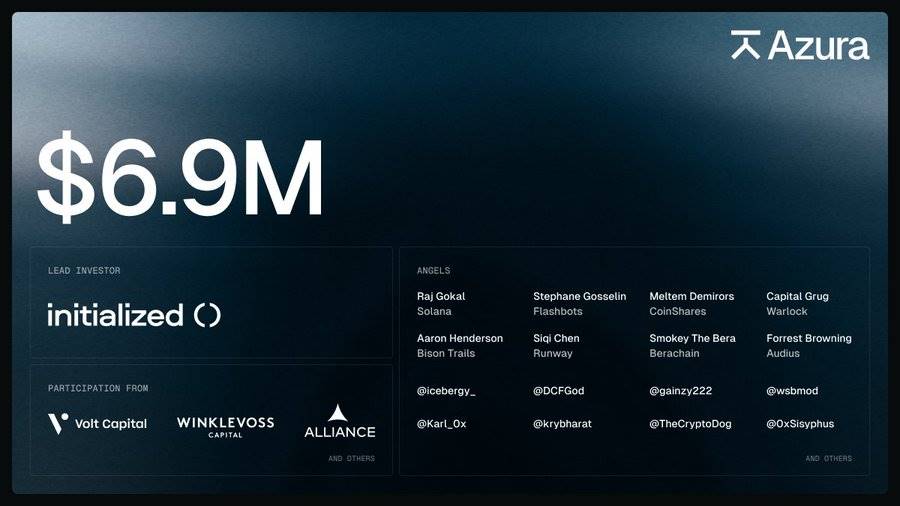

For example, yesterday, the protocol Azura, which focuses on being a one-stop entry for DeFi, announced a $6.9 million seed round financing led by Initialized, with participants including Volt Capital, Winklevoss Capital, AllianceDAO, Raj Gokal (co-founder of Solana), Meltem Demirors (co-chair of the World Economic Forum's Cryptocurrency Council), Stephane Gosselin (co-founder of Flashbots), and others.

Azura's official self-introduction is even more sophisticated and narrative-rich:

"The Onchain Interfacing Layer," filling the missing link in DeFi.

So the question arises, what link is missing in DeFi? How does Azura differ from other DeFi protocols, and what new assistance does it provide for everyone's on-chain asset trading?

We quickly experienced this project and will share the key information with everyone.

A DeFi Entry Point, A Grand Integration of Multi-Chain and Multi-Protocol

What link is currently missing in DeFi? There is a statement in Azura's tweet about the project's goals that may indirectly answer the question:

"Our goal is to allow anyone, anywhere, to trade any asset—achieved through DeFi."

Clearly, the three bolded conditions cannot be fully satisfied simultaneously in most cases within the asset trading scenario; we also need to mention some well-known issues:

First, the fragmentation of the DeFi ecosystem is becoming increasingly severe. You trade your Solana, I trade my ETH. Different Degen players have corresponding DEXs in their ecosystems, often requiring multiple wallets and assets.

Secondly, fragmentation inevitably leads to dispersed liquidity. Some platforms have good liquidity, while others have poor liquidity, making it difficult to find the optimal path and liquidity when you want to trade an Alpha.

Finally, the more places there are, the higher the risk. As users need to interact with more smart contracts and platforms, the opportunities to be exposed to potential security vulnerabilities also increase.

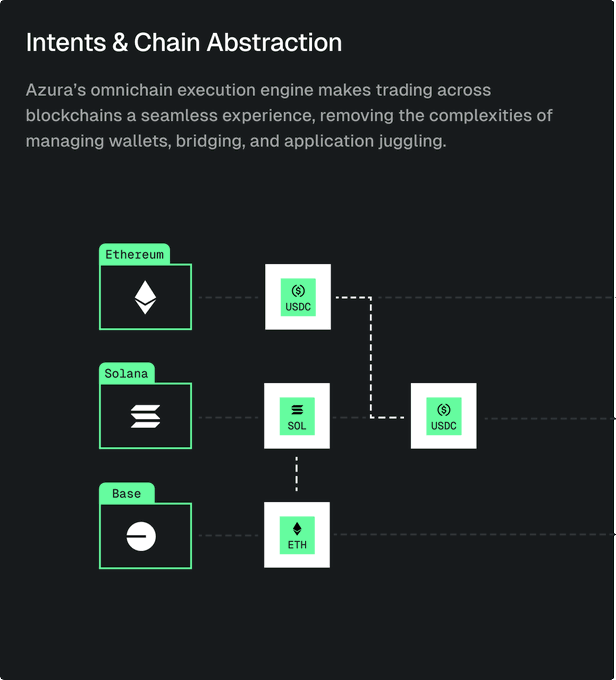

In simple terms, the missing link in DeFi is actually ---- a unified one-stop entry protocol that can connect multiple protocols across multiple chains, allowing you to trade whatever you want.

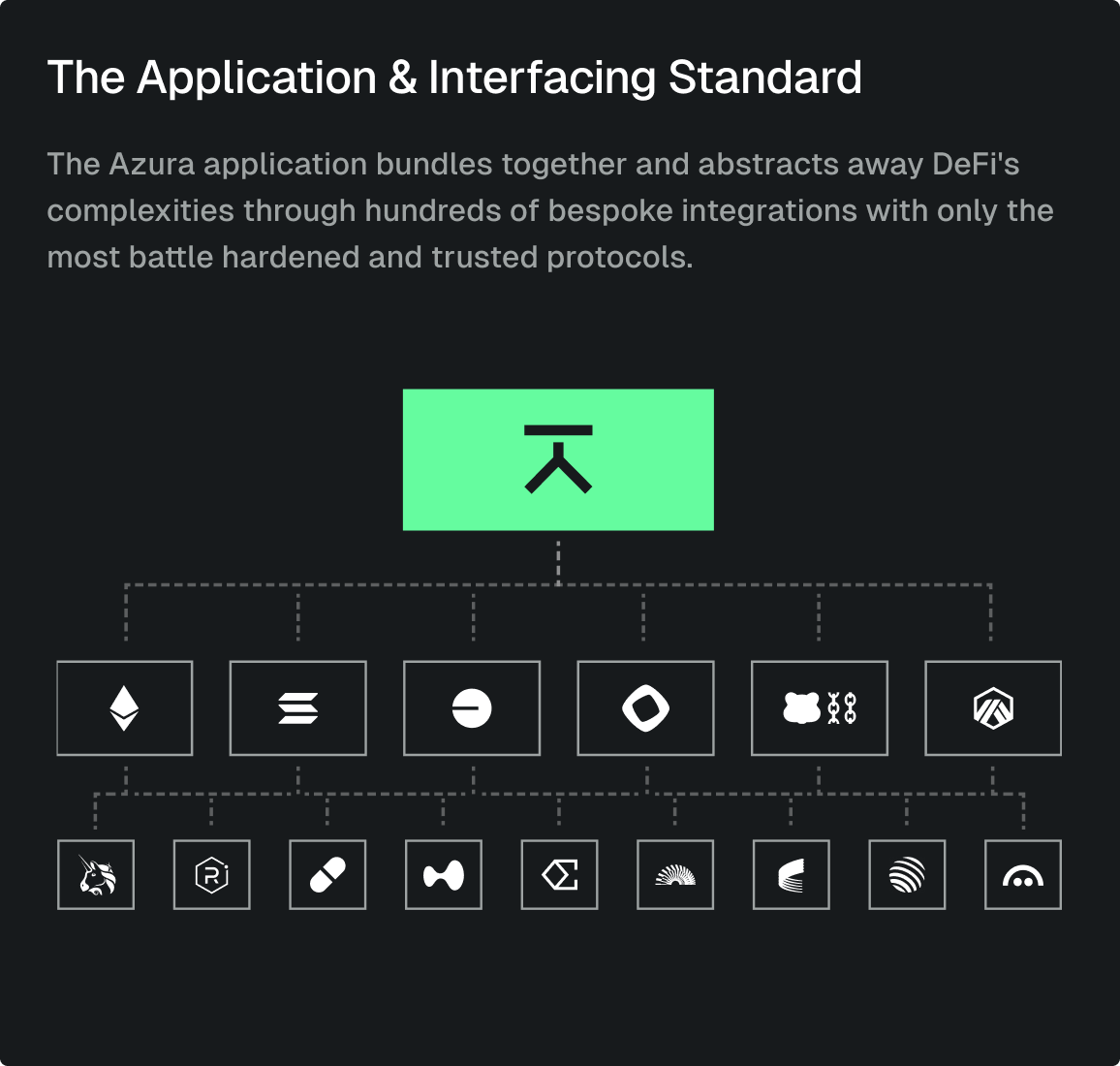

Thus, Azura's Onchain Interfacing Layer becomes easier to understand; simply put, it is an application that enables users to log in from a single platform to trade and discover any on-chain investment opportunities.

From the product interface on the official website, Azura currently supports the integration of hundreds of DeFi protocols across 7 EVM chains and Solana, providing users with an end-to-end experience, including fiat deposits and withdrawals, embedded wallets, advanced order execution and routing, cross-chain swaps, and a unified dashboard for managing the entire DeFi portfolio across chains.

This is somewhat like a fusion dish made by stacking these raw materials together under well-developed infrastructure conditions (such as oracles, DEXs, chain abstraction, cross-chain bridges, aggregators, etc.).

At first glance, it seems somewhat similar to Dexscreener, but there are indeed differences in the actual product.

Product Experience

Azura is not a cryptocurrency exchange. Instead, it provides a standardized application and interface layer that allows users to easily interact with open and permissionless protocols like Uniswap, Curve, or Raydium.

- Login/Register

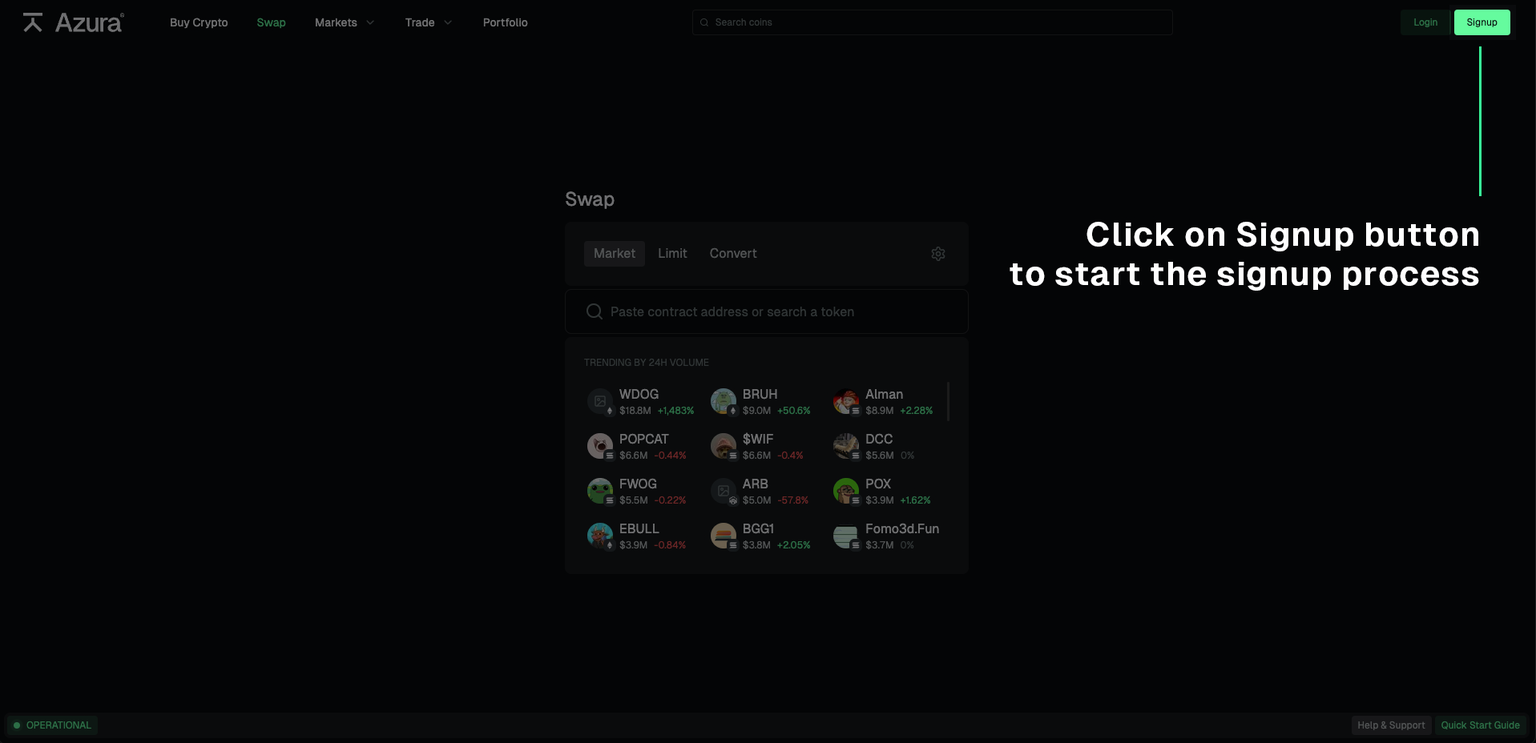

On the front-end interface, the first step is the registration process.

It adopts the popular Web2 registration/login method, using an email or Google account, etc.; then during the login process, you will be given a series of words similar to a mnemonic phrase, along with a wallet bound to your account.

It is worth mentioning that this Passkey is generated on the user's own hardware device (like your computer) and is supported by iCloud Keychain and Google Password Manager for key recovery, somewhat similar to the multi-signature and private key shard management of MPC wallets.

This means you can still log in with an account password, while the mnemonic-like information is stored in your computer's hardware, allowing you to recover it using the cloud at critical moments.

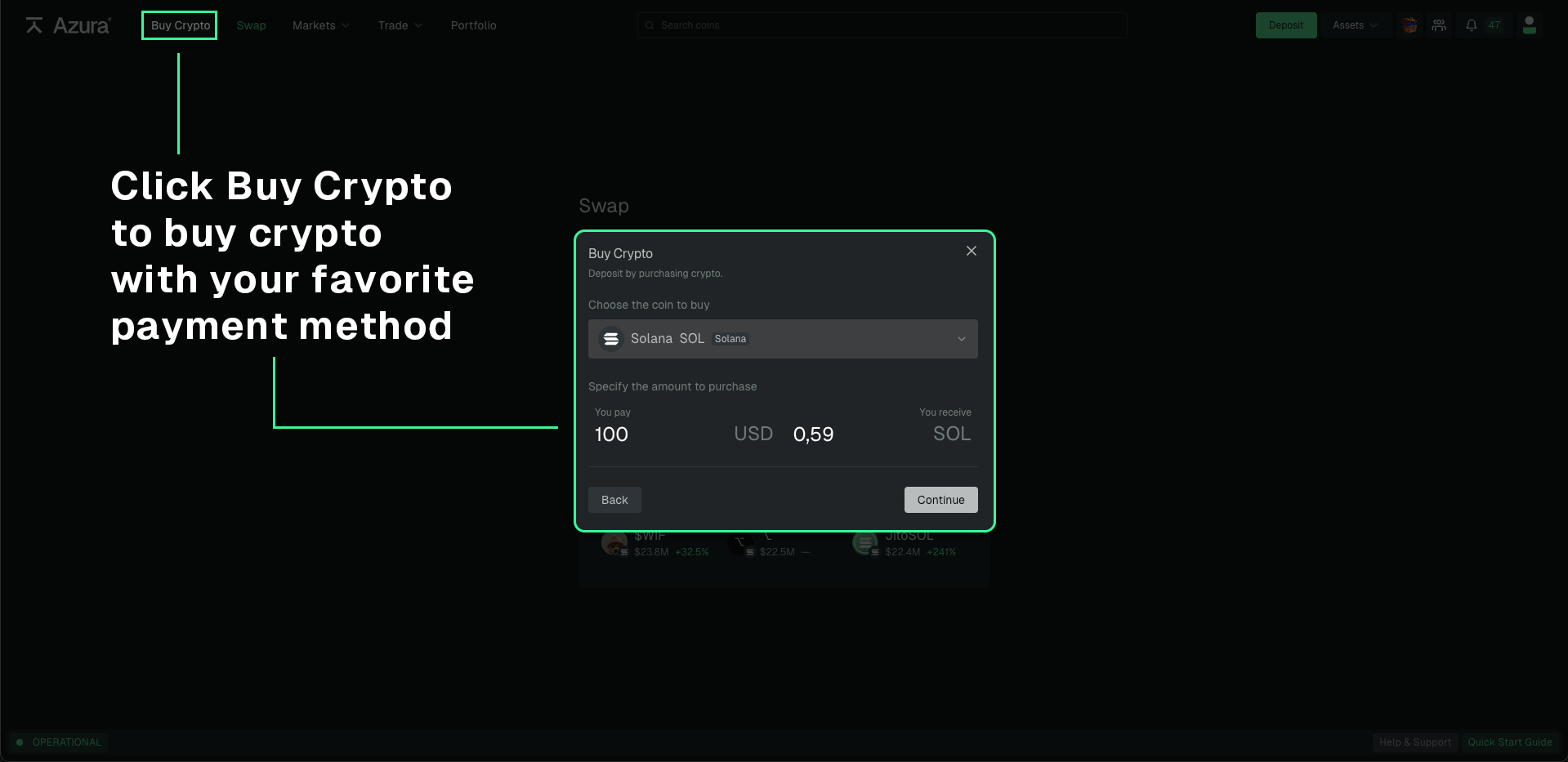

- Deposits

If there are no cryptocurrency tokens in the corresponding account's wallet, you can directly click the purchase button, which will bring up a fiat deposit and withdrawal page supported by Moonpay. After filling in personal identity information, you can proceed with the purchase (Note: This service is not applicable in China, this is for informational purposes only), currently supporting SOL, ETH, and USDC.

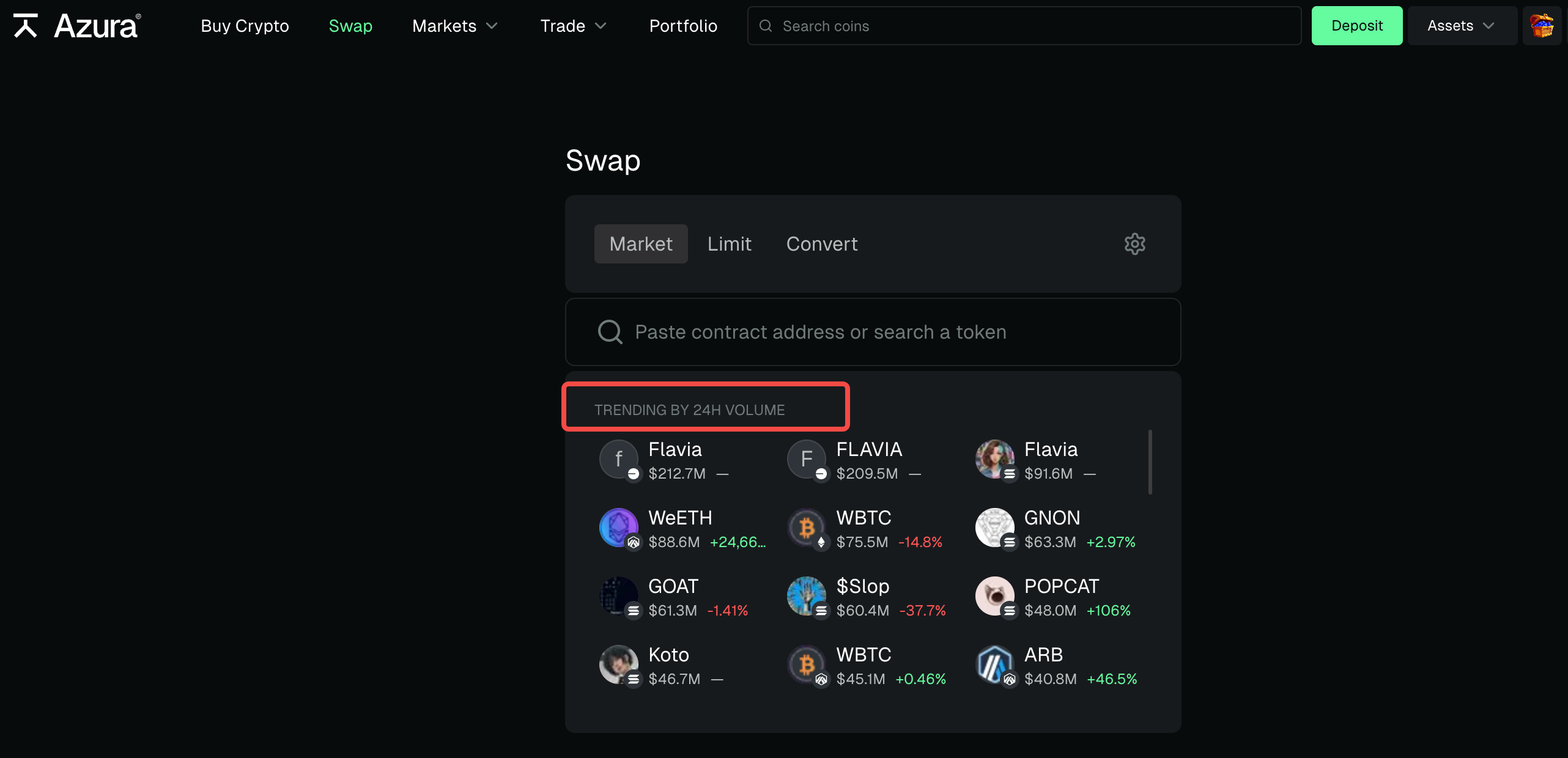

- Swap

Similar to other DEXs, you can use your USDC and ETH/SOL to exchange for any other tokens in the ecosystem.

One area where Azura excels is that it directly lists the most popular tokens across all supported chains during your exchange, supporting quick swaps; it also supports market orders and limit orders.

For example, the recently popular AI Meme new coins Flavia and GNON appear directly on the page, allowing you to click and exchange them directly. The underlying intention and chain abstraction are at work, helping to find the best quotes and complete transactions.

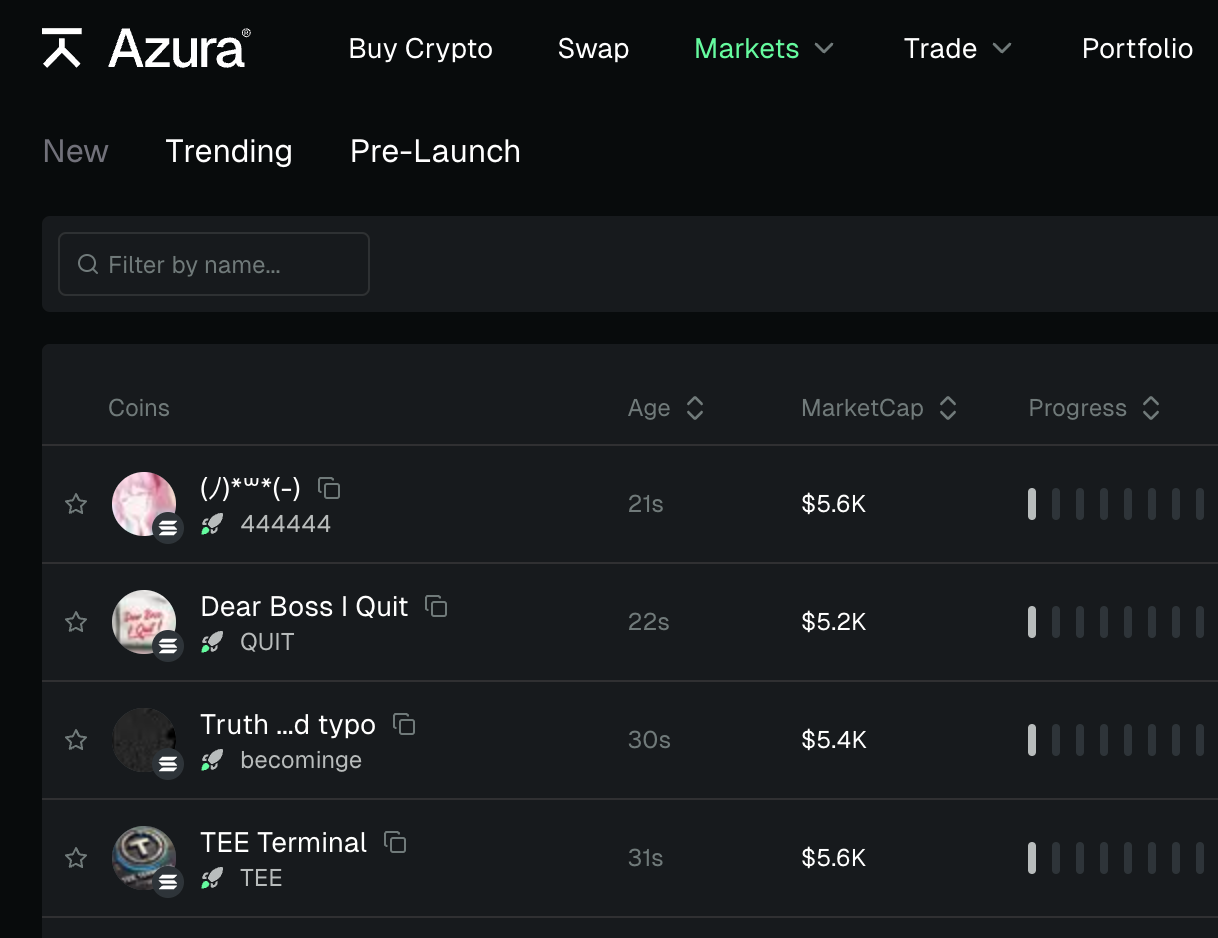

- Market Exploration

This interface resembles a coin recommendation, containing detailed information about newly deployed, upcoming, or already popular tokens across all supported chains.

From the specific page, it is clear that Azura has also aggregated Pump.fun, synchronizing new information and internal progress.

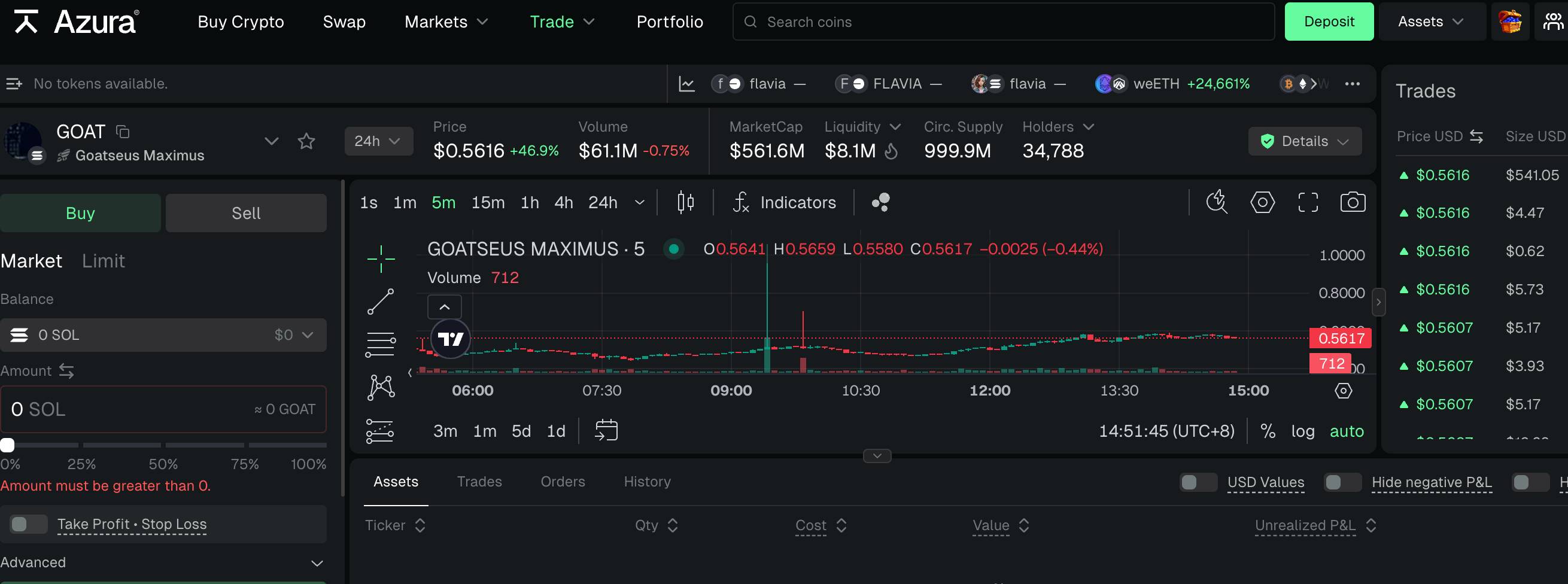

- Trading

Trading appears to be a more detailed version of Swap, listing the current trends, trading volumes, and order distributions of tokens, similar to the trading interfaces of other DEXs/CEXs, while also allowing you to see your profits and losses and order status.

The difference is that you can search for any token across all chains and exchange it using any supported asset; in contrast, Dexscreener is more like a pure aggregation page, pulling up the corresponding DEX platforms like Uniswap or Kyber when it comes to purchasing.

Azura, on the other hand, provides the capability to handle routing and optimal trading, acting as a general contractor.

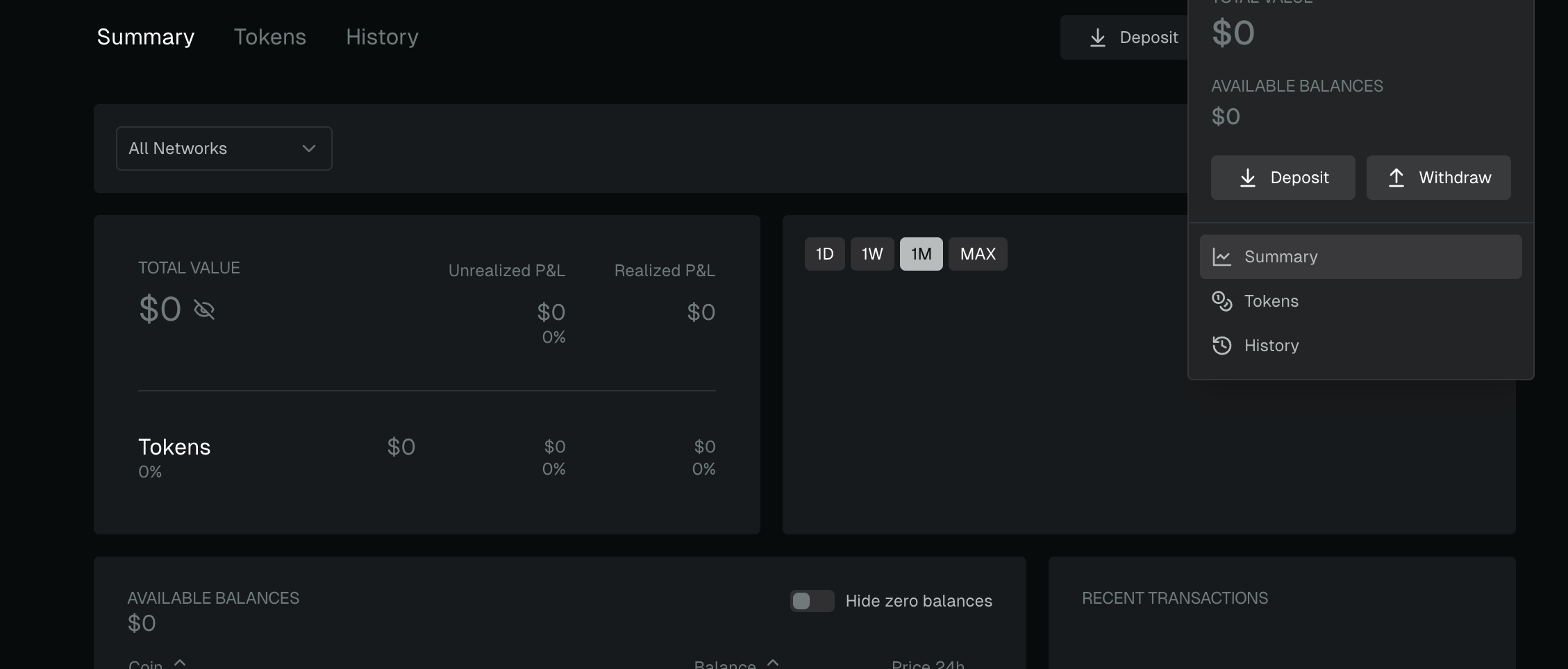

- Funds Dashboard

Summarizing the overall trading situation, it displays your win rate, positions, and past trading history, somewhat similar to the performance page provided by GMGN.

Participatory Opportunities

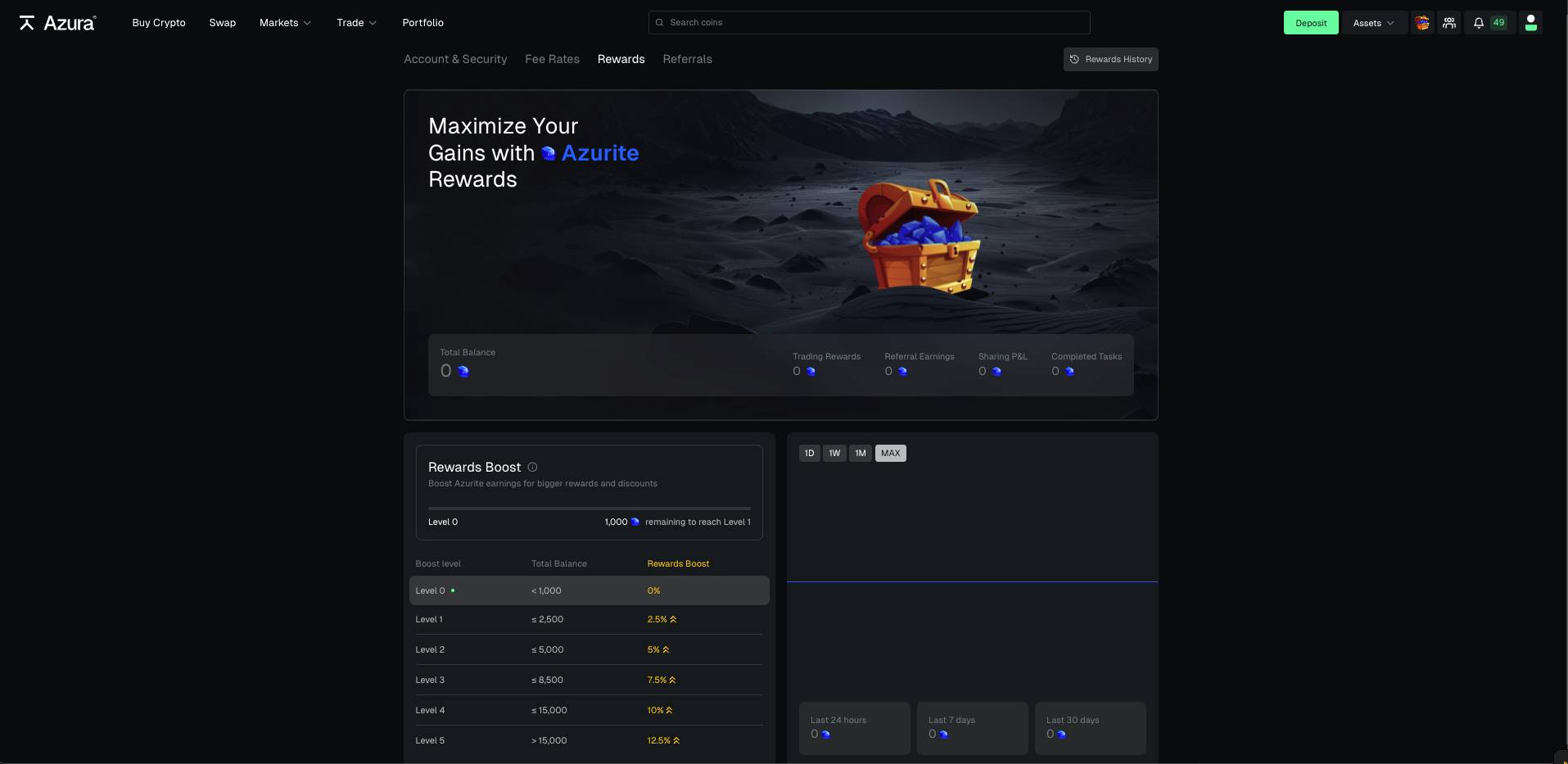

Currently, the project has not announced more airdrop rules, so the only participatory space is the Azurite gem feature.

Users will receive varying amounts of Azurite gems after completing trades, inviting others, sharing their performance, and completing other tasks given by the official, which can be understood as points.

The higher your account balance, the more Azurite gem rewards you can earn for completing the same tasks. Specific reward rules can be referenced in the official documentation.

Overall, Azura is functionally similar to other aggregation-focused DeFi protocols, and the specific user experience and comparisons will need to be observed and feedbacked in the future.

However, for this type of DEX entry to capture the market, the biggest challenge lies in shaking existing user habits.

Cross-chain and venue-switching trading can indeed be cumbersome, but when Pump.fun, Raydium, and Uniswap have already taken root in people's minds, getting everyone to use Azura will require greater marketing efforts and more easily spread narrative points.

In this regard, for the project itself, collaborating with top Memes and projects to launch more trading-related activities may be the next competitive strategy.

For crypto players, engaging in small interactions while ensuring security and waiting for rewards, as well as actively trying new things, is also a daily essential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。