Cryptocurrency News

October 23 Hot Topics:

1. Market news: Polymarket will impose restrictions on U.S. users, focusing on high-stakes players.

2. High-frequency execution layer Aori announces collaboration with the full-chain Rollup network Initia.

3. The UK's FCA elaborates on the cryptocurrency asset registration process: strict anti-money laundering reviews do not hinder industry innovation and development.

4. Fox reporter: The U.S. SEC will prioritize cryptocurrency in its 2025 review, possibly focusing on Bitcoin and Ethereum ETFs.

5. Avalanche Foundation launches Visa crypto payment card, initially supporting Latin America and the Caribbean.

Trading Insights

If you plan to stay in the cryptocurrency space for the next three years and aim to treat trading as a second career, you must read these 10 iron rules. They are practical tips for making a living from trading, and it's recommended to save them!

Assume you have 1 million. When your returns reach 100%, your assets will be 2 million. If you then lose 50%, your assets will return to 1 million. Clearly, losing 50% is easier than gaining 100%.

If you have 1 million, after a 10% increase on the first day, your assets will be 1.1 million, and then a 10% drop the next day will leave you with 990,000. Conversely, if you drop 10% on the first day and then gain 10% the next day, your assets will still be 990,000. If you have 1 million, earn 40% in the first year, lose 20% in the second, earn 40% in the third, lose 20% in the fourth, earn 40% in the fifth, and lose 20% in the sixth, your assets will remain at 1.405 million, with a six-year annualized return of only 5.83%, even lower than the 5-year treasury bond coupon rate.

If you have 1 million, and you can earn 1% daily and exit, then after 250 days, your assets could reach 12.032 million, and after 500 days, your assets will reach 145 million.

If you have 1 million and achieve a 200% return for five consecutive years, your assets will reach 243 million after five years, but such high returns are difficult to sustain.

If you have 1 million and hope to reach 10 million in ten years, 100 million in twenty years, and 1 billion in thirty years, you need to achieve an annualized return of 25.89%.

Assume you buy a cryptocurrency at 10 with 10,000, and it drops to 5. If you buy another 10,000, your average cost will drop to 6.67, not the 7.5 you might expect.

If you have 1 million and invest in a cryptocurrency with a 10% profit, when you decide to sell, you can leave 100,000 worth of chips, making your holding cost zero, allowing you to hold long-term without pressure.

If you are extremely optimistic about this cryptocurrency and leave 200,000 worth of chips, you will find your profit rises from 10% to 100%. However, don't get complacent; if the currency drops 50% later, you may still incur losses.

A sharp decline is a litmus test for quality cryptocurrencies. If the market crashes and your cryptocurrency only slightly declines, it indicates that the market maker is protecting the price, so you can hold this cryptocurrency with confidence, and you will surely reap rewards.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White Community this week. Congratulations to those who followed along. If your trades are not going well, you can come and test the waters.

The data is real, and each trade has a screenshot from when it was issued.

Search for the public account: Big White Talks Coins

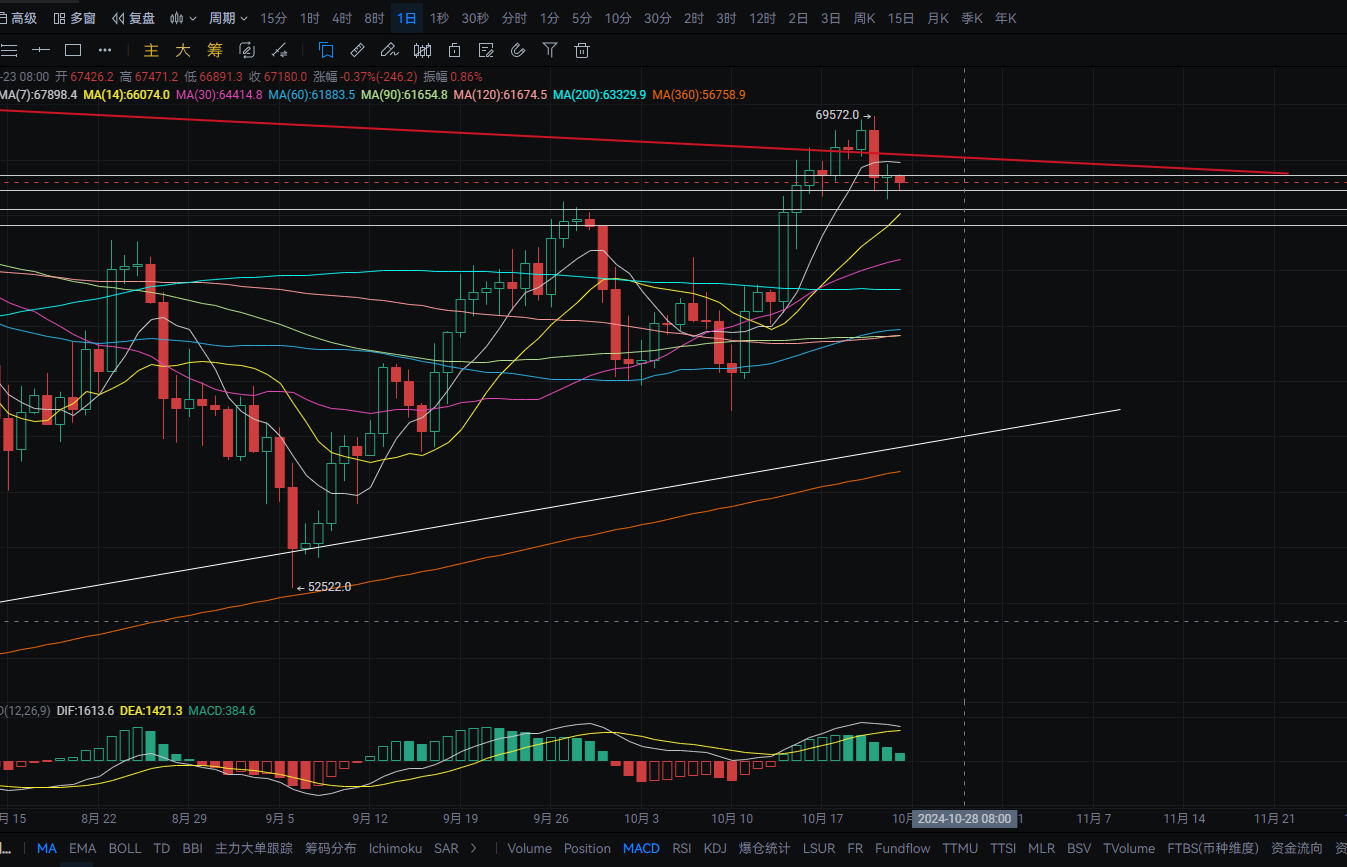

BTC

Analysis

Bitcoin's daily chart formed a doji yesterday, with a high spike to around 67,850 and a low drop to around 66,550, closing near 67,400. The upper resistance is near the MA7 moving average, while the lower support is near the MA14. A pullback can be bought near this area. The MACD shows a decrease in bullish momentum and is showing signs of forming a death cross. On the four-hour chart, the upper resistance is near the MA14; a breakout could see it reach the MA30. The lower support is near the MA90; a pullback can be bought near this area. The MACD shows a decrease in bearish momentum and is showing signs of forming a golden cross. Short-term buying can be done near 66,230-65,680, with a rebound target of 66,900-67,400.

ETH

Analysis

Ethereum's daily chart showed a pullback yesterday, dropping from around 2,670 to a low of around 2,605, closing near 2,625. The lower support is near the MA90; if it breaks, it could reach the MA30. A pullback can be bought near this area. The upper resistance is near the MA7 moving average. The MACD shows a decrease in bullish momentum and is showing signs of forming a death cross. On the four-hour chart, there have been multiple tests of support near 0.382; if it breaks, it could reach the MA200. A pullback can be bought near this area. The upper resistance is near the MA7 moving average; a breakout could see it reach the MA30. The MACD shows a decrease in bearish momentum. Short-term buying can be done near 2,558, with a rebound target of 2,650-2,720.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific trading advice and does not bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。