Original Author: Mensh, ChainCatcher

Original Editor: Nianqing, ChainCatcher

On October 18, the U.S. Securities and Exchange Commission (SEC) approved the applications of the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE), allowing 11 approved Bitcoin ETF providers to engage in options trading. Currently, Bitcoin continues to rise, with highs surpassing $69,000.

ETF analyst Seyffart stated at the Permissionless conference that Bitcoin ETF options may be launched by the end of the year; however, the CFTC and OCC do not have strict deadlines, which could lead to further delays, with a more likely launch in Q1 2025.

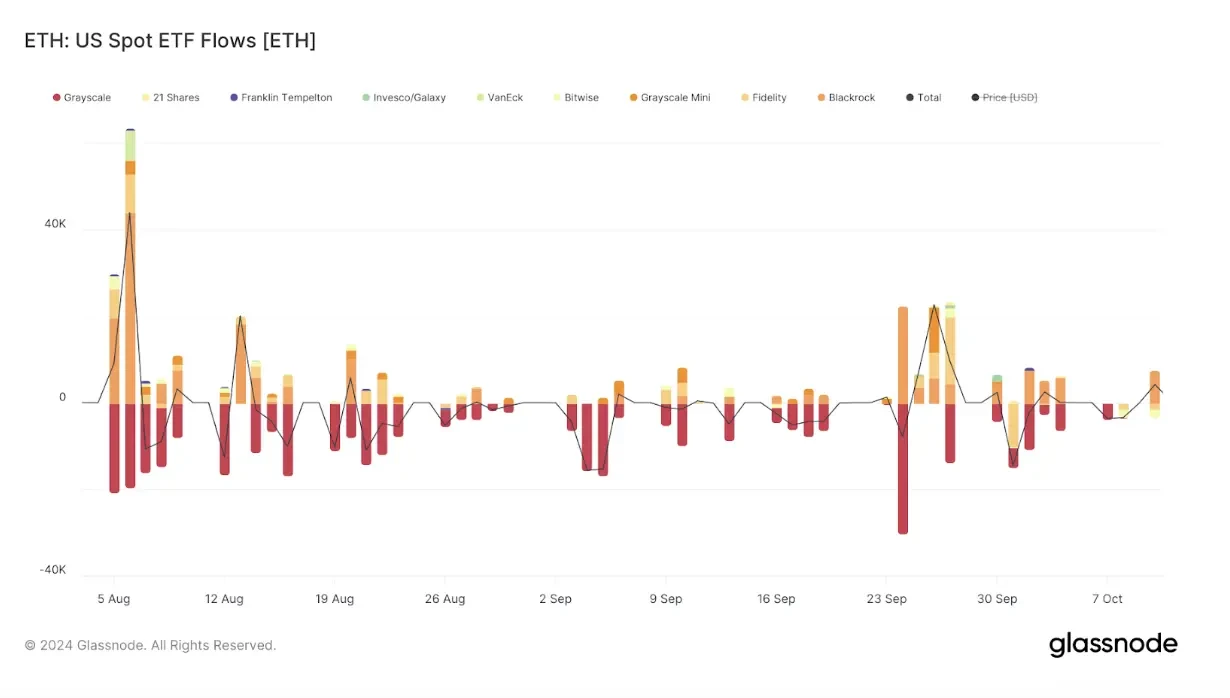

At the same time, the SEC has postponed the approval of Bitwise and Grayscale Ethereum ETF options, with the market speculating that this is due to the lower-than-expected influx of funds following the approval of the Ethereum ETF. The SEC aims to further investigate the impact of this proposal on market stability and will make a ruling on November 10.

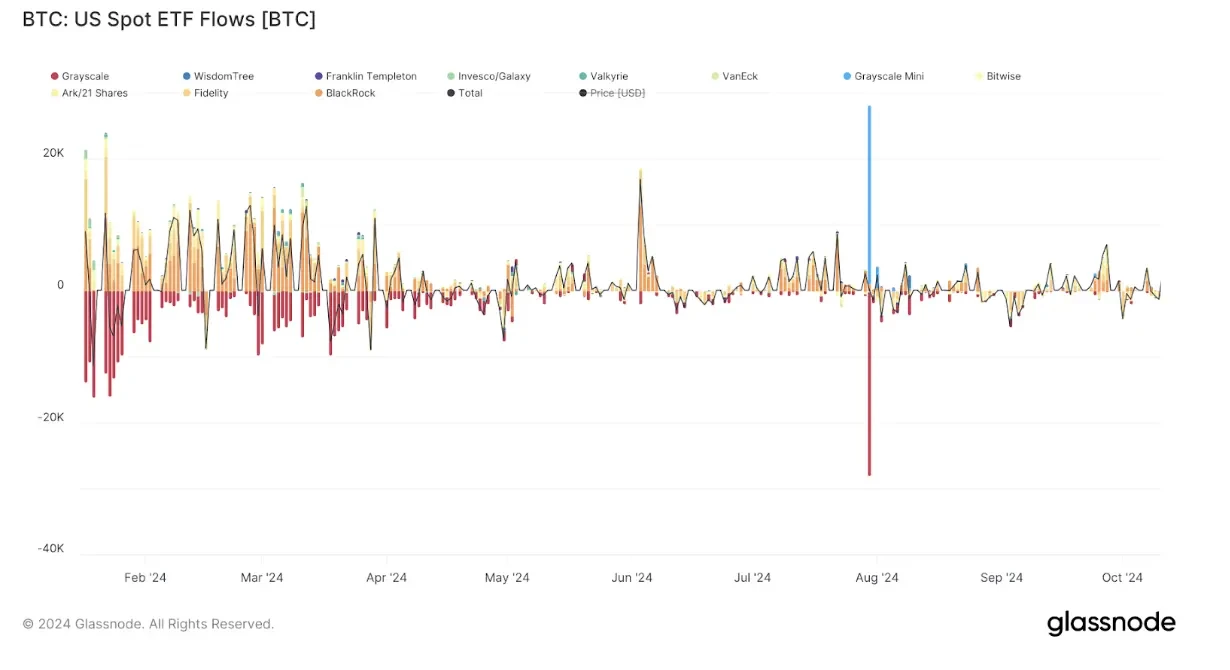

Bitcoin and Ethereum ETF Inflows and Outflows:

Why are Bitcoin ETF options important?

Bitcoin options are contracts that give holders the right, but not the obligation, to buy or sell Bitcoin at a predetermined price within a certain timeframe. For institutional investors, these options provide a means to hedge against price volatility or speculate on market trends without holding the underlying asset. These Bitcoin index options offer institutional investors and traders a quick and cost-effective way to expand their investment exposure to Bitcoin, providing an alternative method to hedge their exposure to the world's largest cryptocurrency.

Why is the approval of Bitcoin ETF options particularly important? Although there are already many crypto options products on the market, most lack regulation, making institutional investors reluctant to participate due to compliance requirements. Additionally, there have been no compliant and liquid options products available in the market.

The most liquid options products are offered by Deribit, the world's largest Bitcoin options exchange. Deribit supports 24/7/365 trading of Bitcoin and Ethereum options. The options are European-style and settled in physical underlying cryptocurrency. However, since they are limited to cryptocurrencies, Deribit users cannot cross-margin with assets in traditional portfolios like ETFs and stocks. Moreover, this is illegal in many countries, including the United States. Without the endorsement of a clearinghouse, counterparty risk cannot be effectively mitigated.

The bid-ask spreads for Bitcoin futures options on the CME and Bitcoin options on the CFTC-regulated crypto options exchange LedgerX are very large. Their functionalities are limited; for example, LedgerX lacks a margin mechanism. Each call option on LedgerX must be sold in a cash form (holding the underlying Bitcoin), and each put option must be sold in cash (holding the cash value of the exercise price), resulting in high trading costs.

Options related to Bitcoin assets, such as MicroStrategy options or BITO options, have significant tracking errors.

The substantial rise in MSTR stock prices since the beginning of the year also indirectly indicates a demand for Bitcoin hedging trades. What Bitcoin ETF options can provide the market is a product that combines compliance and trading depth. Bloomberg researcher Jeff Park pointed out, "With Bitcoin options, investors can now engage in term-based portfolio allocation, especially for long-term investments."

Enhancing or Reducing Volatility?

There is a debate about what impact the listing of Bitcoin ETF options will have on Bitcoin volatility, with both sides holding firm opinions.

Those who believe it may enhance volatility argue that once options are listed, many retail investors will flock to very short-term options, leading to a gamma squeeze similar to that seen with meme stocks like GME and AMC. A gamma squeeze refers to a situation where if volatility accelerates, the trend will continue because investors buy these options, and their counterparties, large trading platforms and market makers, must continuously hedge their positions by buying stocks, further driving prices up and creating more demand for call options.

However, since there are only 21 million Bitcoins, Bitcoin is absolutely scarce. If a gamma squeeze occurs, the only sellers will be those who already own Bitcoin and are willing to trade at a higher dollar price. Because everyone knows that no more Bitcoins will be available to drive prices down, these sellers will also choose not to sell. The existing options products have not shown signs of a gamma squeeze, which may indicate that this concern is unwarranted.

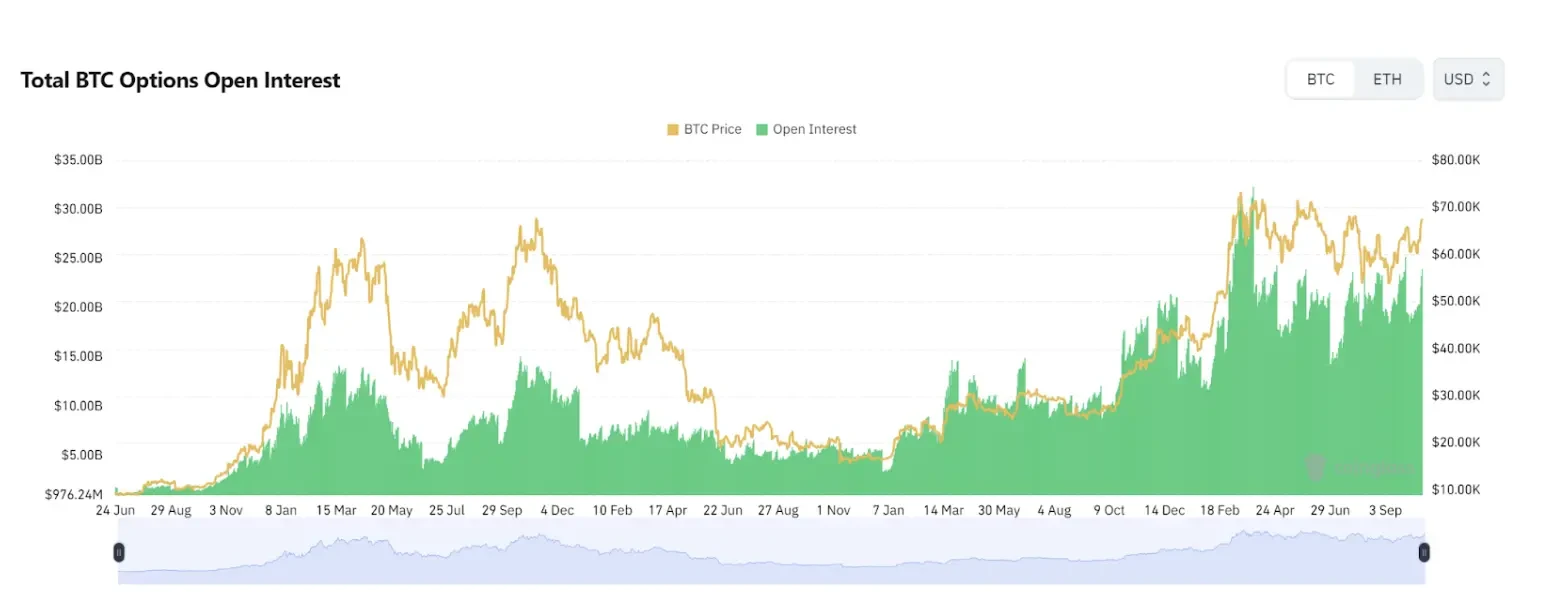

The concentration of options expiration can also cause market volatility in the short term. Deribit CEO Luuk Strijers stated that the open interest for Bitcoin options expiring at the end of September is the second largest in history, with approximately $58 billion in open interest currently on Deribit. He believes that this expiration may result in over $5.8 billion in options expiring worthless, which could trigger significant market volatility after expiration.

https://www.coinglass.com/options

Historically, options expiration has indeed affected market volatility. As the expiration date approaches, traders must decide whether to exercise their options, let them expire, or adjust their positions, which typically increases trading activity as traders attempt to hedge their bets or capitalize on potential price movements. Particularly, if Bitcoin's price is close to the exercise price at the time of options expiration, option holders may exercise their options, potentially leading to significant buying and selling pressure in the market. This pressure may trigger price volatility after options expiration.

On the other hand, those who believe volatility will be smoothed out tend to look at it from a long-term perspective. This is because option prices reflect implied volatility, which is investors' expectations of future volatility. The introduction of IBIT brings new liquidity, attracting more structured note issuances, which may lead to a potential reduction in volatility, as more options products enter the market to level out if implied volatility is too high.

A Larger Pool Attracts Bigger Fish

The launch of options will further attract liquidity, and the trading convenience brought by liquidity will further attract liquidity, creating a positive cycle of liquidity. Currently, there is almost a consensus in the market that the launch of options, both in itself and in its additional consequences, has an attractive effect on liquidity.

As options market makers engage in dynamic hedging strategies, options will create more liquidity for the underlying assets. This continuous buying and selling by options traders provides stable trading flow, smooths price fluctuations, and increases overall market liquidity, allowing larger pools of capital to enter the market while reducing slippage.

The introduction of IBIT options may also attract more institutional investors, especially those managing large portfolios, as they typically require complex tools to hedge their positions. This capability lowers perceived risk barriers, allowing more capital to flow into the market.

Many institutional investors manage large portfolios and have very specific requirements for risk management, purchasing power, and leverage. A spot ETF alone cannot solve these issues. Options can create very complex structured products, allowing more institutional capital to participate in Bitcoin.

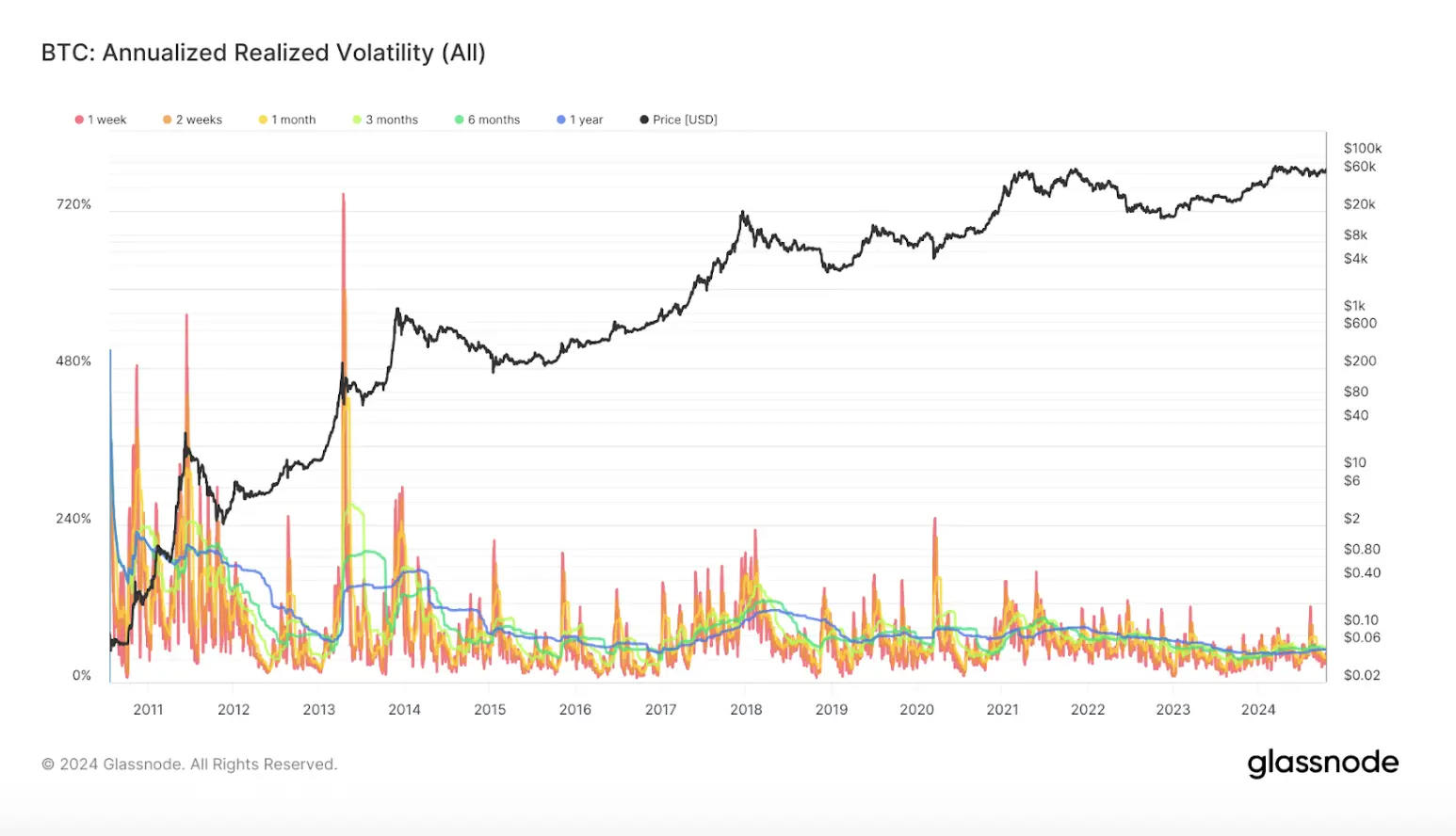

With the approval of IBIT options, investors can invest in Bitcoin's volatility, and considering Bitcoin's volatility is higher than that of other assets, this could yield substantial returns.

Bitcoin Annual Realized Volatility:

Bloomberg analyst Eric Balchunas pointed out that the approval of options is a significant victory for Bitcoin ETFs, as it will bring deeper liquidity while attracting "bigger fish."

At the same time, the approval of IBIT options is another clear statement from regulators. Mike Novogratz, CEO of Galaxy Digital, stated in a CNBC interview, "Unlike traditional Bitcoin futures ETFs, these options allow trading at specific intervals, which may attract more interest due to Bitcoin's inherent volatility. The approval of ETF options may attract more investors. The trading volume of MicroStrategy reflects strong demand for Bitcoin. Regulatory clarity may pave the way for future growth in digital assets."

For the existing options market, the approval of ETF options will also bring greater gains. In an Unchained podcast, Joshua Lim, co-founder of Arbelos Markets, speculated that the growth of liquidity in CME options will be most evident, as both face traditional investors, and the arbitrage opportunities formed will simultaneously increase liquidity in both markets.

Mutated Price Performance

The launch of options not only provides investors with more diverse operational space but also brings previously unanticipated price performances.

For example, Joshua Lim found that many people were buying call options after the election, indicating that people are willing to make some hedging bets, believing that after the November 5 election, the regulatory environment for cryptocurrencies will relax. Typically, there will be some price fluctuations around the expiration dates of these options, and these fluctuations are usually highly concentrated. If many people buy options with a $65,000 exercise price for Bitcoin, due to traders hedging their risks at this level, traders will usually buy when the price is below $65,000 and sell when the price is above this level, causing Bitcoin's price to be pinned at the exercise price.

If there is a certain trend, it usually delays its manifestation until after the options expiration for various reasons. For instance, options typically expire on the last Friday of the month, but this does not necessarily align with the end of the calendar month, which is particularly important as it marks performance evaluations and share transactions for hedge funds, creating inflows of funds and buying pressure into that asset class. Due to all these dynamics, the spot market does indeed experience volatility after options expiration, as many traders' hedging activities may weaken after expiration.

Options do not trade over the weekend, and if the IBIT gamma value is very high at market close on Friday, it may force traders to buy Bitcoin spot over the weekend to hedge their delta. Since IBIT is cash-settled, transferring Bitcoin between IBITs may carry some risks. All these risks may ultimately spill over into the Bitcoin market, potentially leading to wider bid-ask spreads.

Conclusion

For institutions, Bitcoin ETF options can significantly expand hedging methods, allowing for more precise control of risk and returns, making more diversified portfolios possible. For retail investors, Bitcoin ETF options provide a way to participate in Bitcoin's volatility. The versatility of options may also trigger bullish sentiment in the market's classic reflexivity, with liquidity bringing more liquidity. However, whether options can effectively attract funds, possess sufficient liquidity, and create a positive cycle of attracting capital still requires market validation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。