The purpose of contract trading is to leverage small amounts for large gains. It is a professional skill, and like any other skill, it requires learning and practice to achieve proficiency and success.

Since it is a skill, recklessly entering into large trades with real money without fully mastering it is a very wrong and dangerous behavior, with a high chance of failure. Many people rush in with large amounts, leading to enormous losses that are immeasurable, causing widespread fear. Consequently, many leave quietly before they have properly learned and mastered this skill.

Futures contract leverage speculation requires a scientific trading method, involving capital position management, mastery and application of trading techniques, principled buying and selling, and control and cultivation of mindset. All of these are essential.

Unlike other skills, where someone can tell you how to do it and you can learn by imitation, the advancement in trading concepts and speculative understanding must come from the accumulation of experiences and lessons learned personally. Of course, having a mentor can help avoid detours.

Bitcoin closed with a bearish candle at the 70,000 mark. Is this a continuation of the downtrend or a bottom? Can we buy the dip?

The author reviewed articles from most analysis authors on AICoin today, with the majority being bullish, providing strategies for long positions along with stop-loss suggestions.

They offered strategies but did not provide an accurate interpretation of the market conditions or the logical reasoning behind their views. This is akin to guesswork and is very unprofessional.

What readers need is not opinions but a correct interpretation of the market and the logic behind the operations.

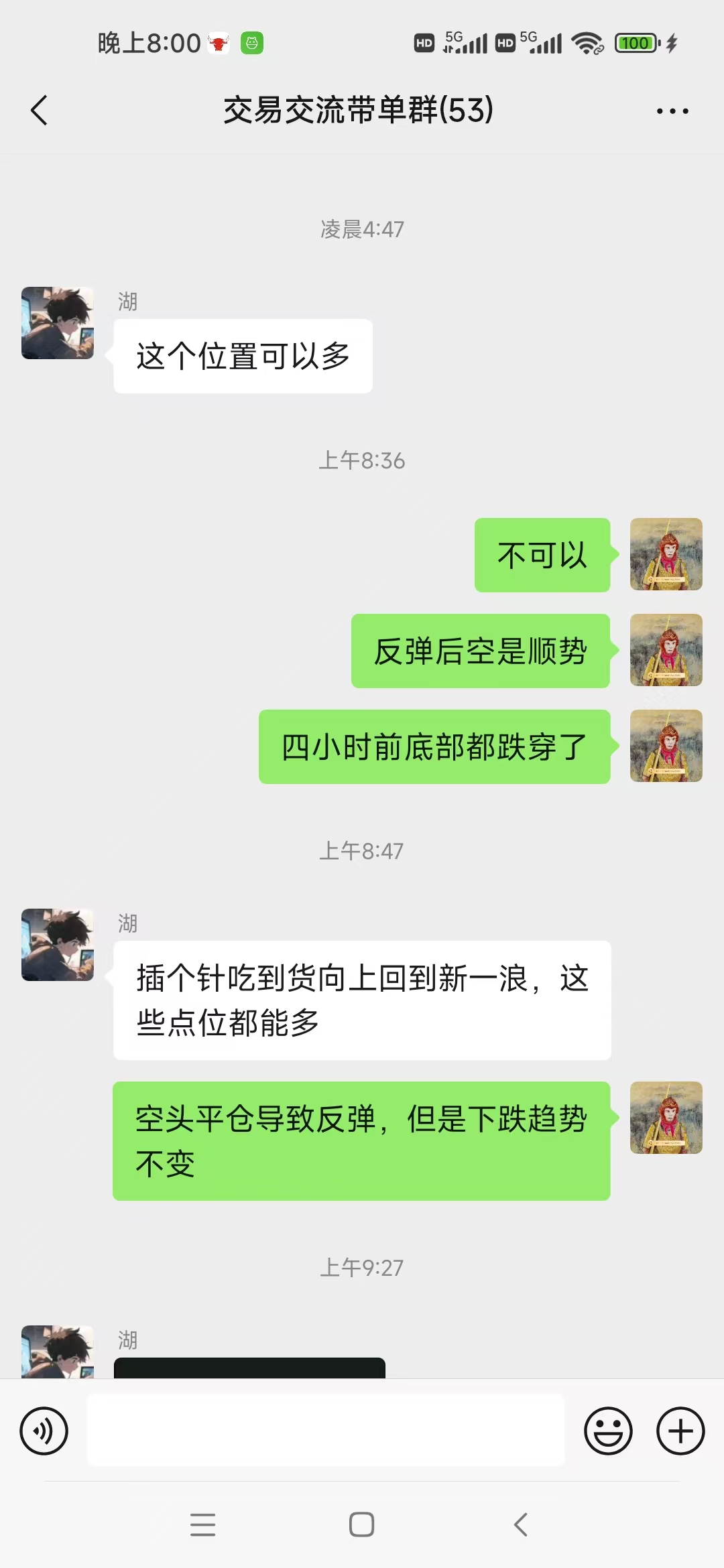

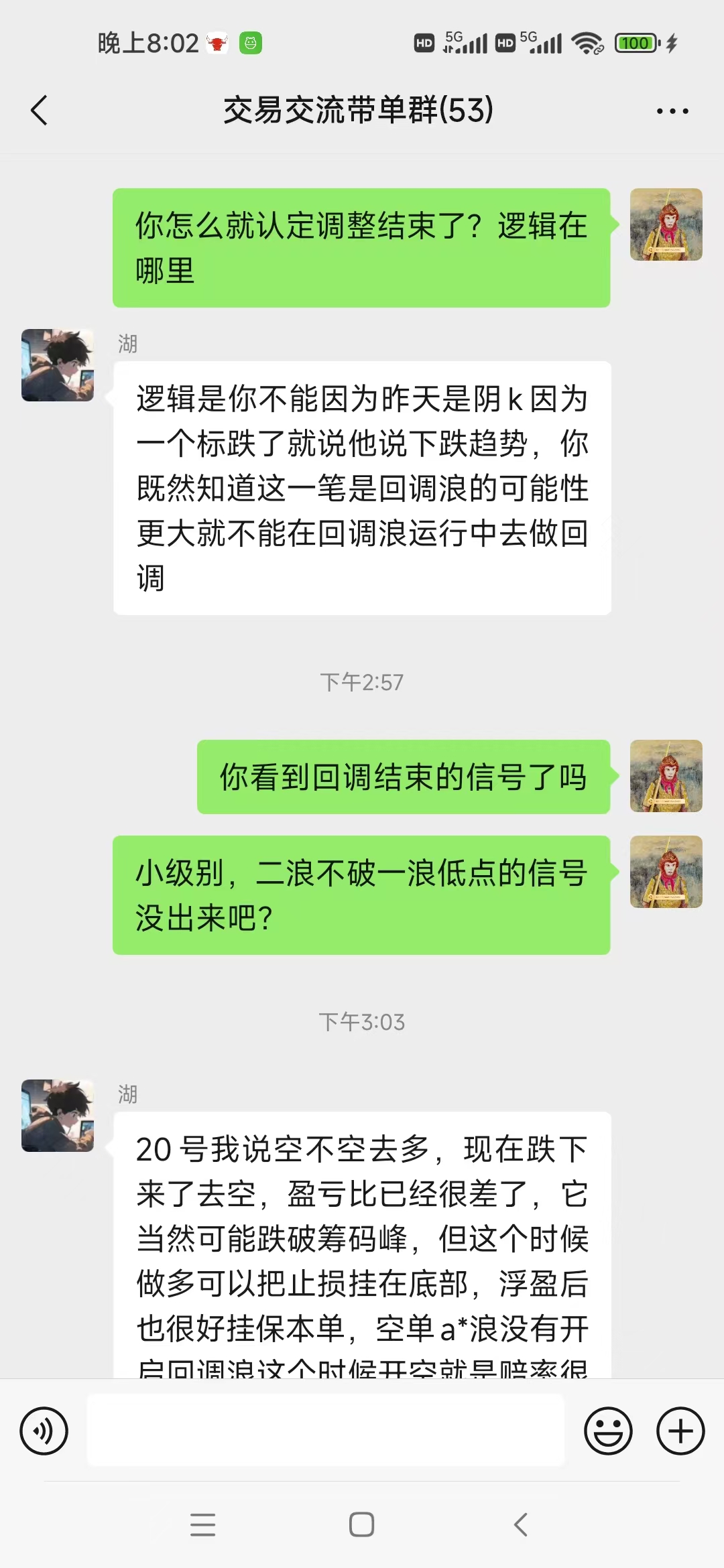

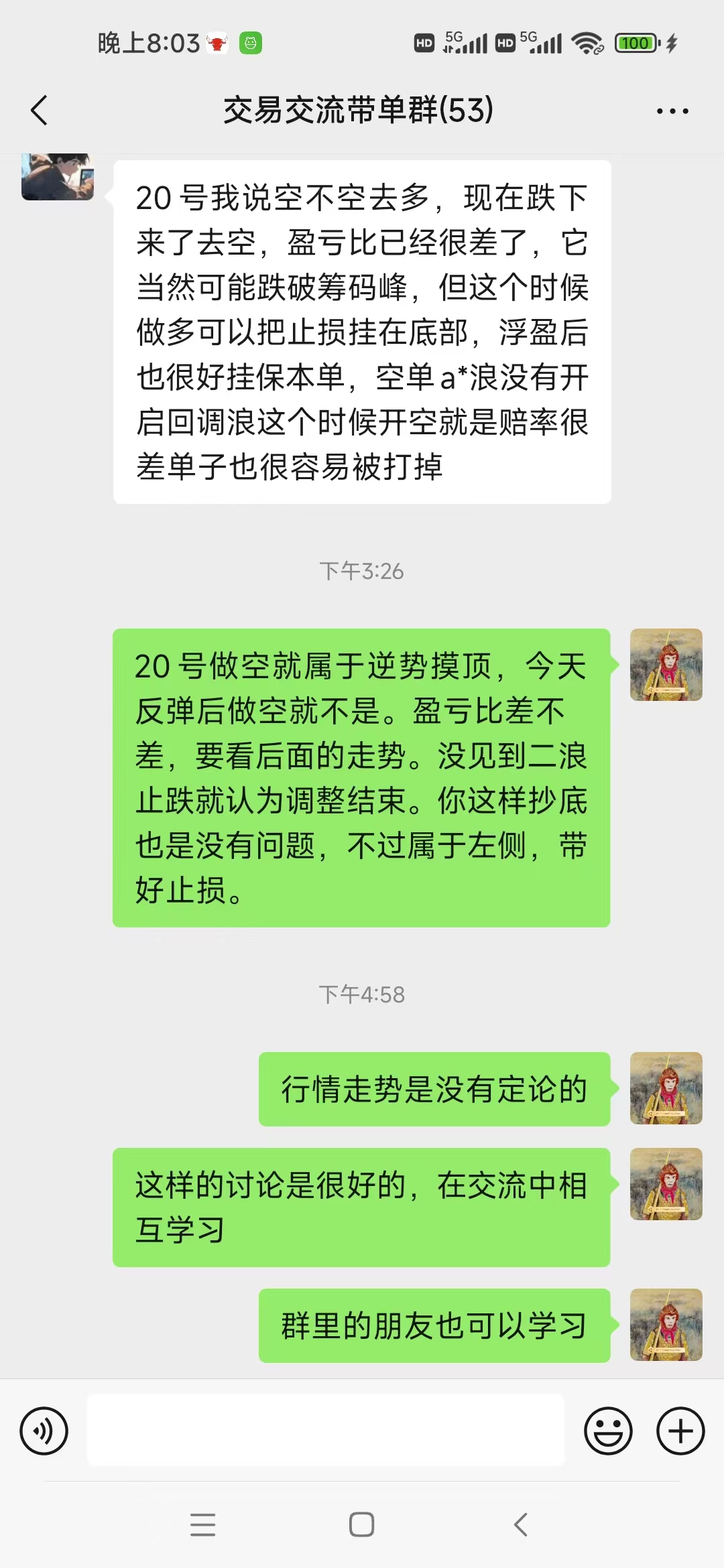

How to choose between long and short positions? There are two relative sides discussing in this group, providing methods for analyzing market evolution:

This dialogue between bulls and bears shows the basis of their market analysis, and both have placed orders based on their views. It is clear that the adjustment has not reached a low; trading the rebound is possible, but a reversal cannot be made. Shorting at high levels on smaller timeframes is a reasonable trend-following strategy.

Contract players are welcome to follow and join: Share a bit

Related Articles

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。