Future M&A deals will be even crazier.

Written by: Will 阿望

For some, Stripe's acquisition of the stablecoin API provider Bridge for $1.1 billion seems like a surprising move. But the reality is that stablecoins are sweeping the globe, with a year-on-year growth rate exceeding 50%, and their global transaction settlement volume is already more than twice that of Visa.

As the saying goes, "The early bird catches the worm." As one of the three major payment giants in the U.S., Stripe has finally placed a big bet after experimenting with Pay with Crypto this year. The acquisition of the two-year-old stablecoin API company Bridge.xyz for $1.1 billion creates the largest acquisition deal in the crypto industry.

This article will start with the rise of stablecoins, look at Bridge's business logic, and finally examine Stripe's acquisition logic.

1. The Rise of Stablecoins

The recent State of Crypto Report 2024 released by A16z Crypto clearly states that stablecoins have become one of the most obvious "killer applications" in the Web3 space. Thanks to the proliferation of smartphones and the implementation of blockchain technology, stablecoins may become the greatest financial empowerment movement in human history.

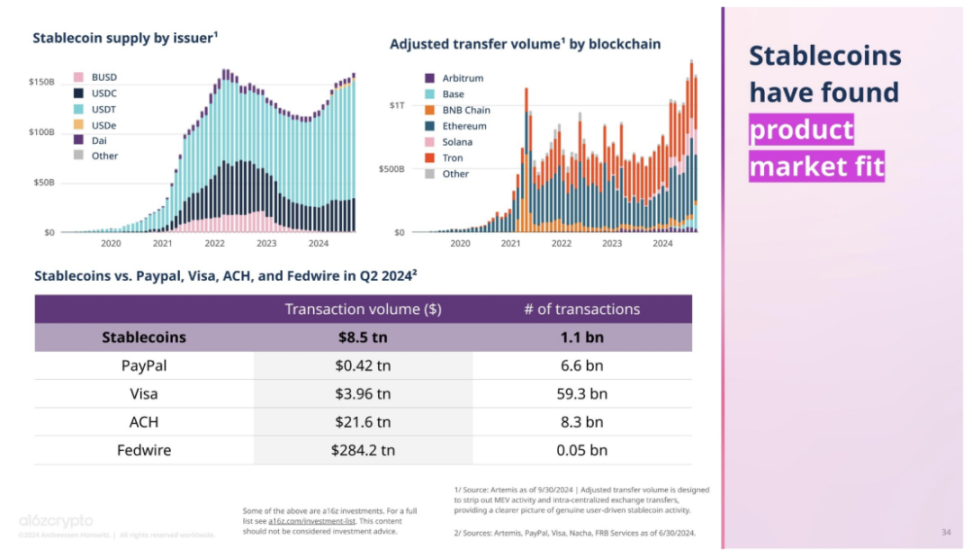

Stablecoins simplify value transfer, with quarterly transaction volumes already more than twice Visa's $3.9 trillion, settling assets worth trillions of dollars annually, fully demonstrating their practicality. Additionally, measured by daily active addresses, stablecoins account for nearly one-third of daily cryptocurrency usage at 32%, second only to decentralized finance (DeFi) at 34%.

(State of Crypto Report 2024: New data on swing states, stablecoins, AI, builder energy, and more)

Furthermore, according to Visa's stablecoin report, the total supply of stablecoins is approximately $170 billion. They settle assets worth trillions of dollars annually. There are about 20 million addresses on-chain conducting stablecoin transactions each month. Over 120 million addresses hold a non-zero stablecoin balance on-chain. These numbers indicate that stablecoins operate as a currency parallel to traditional financial infrastructure—just five years ago, they were starting from nearly zero.

Here are some crazy statistics about stablecoins:

- Stablecoins are now the sixth-largest buyer of U.S. Treasury bonds;

- 30% of cross-border remittances are conducted through stablecoins;

- Major companies like Visa, PayPal, Square, and Mastercard have stablecoin projects;

- SWIFT and some sovereign nations are exploring the utility of stablecoin payments.

- The use of stablecoins for non-crypto purposes is becoming prominent, such as remittances, cross-border payments, payroll, trade settlements, and merchant settlements.

2. What is Bridge

Bridge, founded by entrepreneurs Sean Yu and Zach Abrams, is a stablecoin API engine that provides software tools to help companies accept stablecoin payments. The two founders previously sold their Venmo competitor Evenly to Block in 2013; Abrams is also a former senior employee at Coinbase.

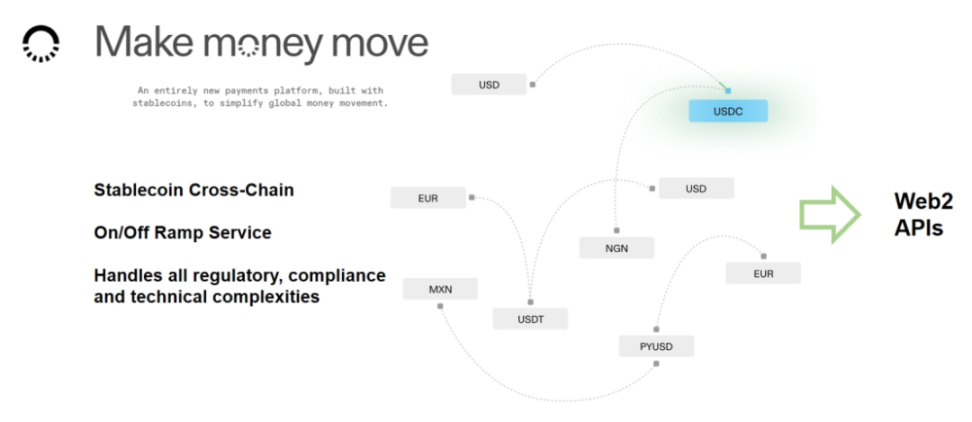

Bridge's Orchestration API integrates stablecoin payments into existing Web2 businesses, handling all compliance, regulatory, and technical complexities.

Bridge's Issuance API helps users issue their own stablecoins and offers a 5% investment option in U.S. Treasury bonds to enhance capital efficiency.

This set of APIs, combined with Bridge's own offerings of 1) cross-chain stablecoin transactions, 2) fiat/crypto deposit and withdrawal acceptance, and 3) virtual bank accounts provided through Leed Bank, enables Web2 users to use stablecoins for payments more conveniently, creating a smoother and seamless user experience.

Bridge claims that using its API allows for global fund transfers in minutes, seamlessly sending stablecoin payments, converting local fiat currency into stablecoins, and providing global consumers and businesses with dollar and euro accounts for saving and spending.

This is not fundamentally innovative; rather, it excels in making Bridge's products more user-friendly for Web2 users.

(https://www.bridge.xyz/#secSolution)

According to Foresight News' article "What Exactly is Bridge, Acquired by Stripe for $1.1 Billion?": Bridge has attracted numerous clients, including SpaceX. According to Fortune magazine, SpaceX uses Bridge to collect payments in different currencies across various jurisdictions and transfers them to its global treasury via stablecoins.

Bridge has also partnered with blockchain networks like Stellar and crypto companies like Strike to provide infrastructure for their own stablecoin payment functionalities. Additionally, Coinbase has adopted Bridge's services to support transfers between Tether on Tron and USDC on Base. It is reported that Bridge has processed annual payments exceeding $5 billion.

According to Forbes, Bridge previously raised $58 million from investors, including $40 million in Series A funding, when the company's valuation was $200 million, with investors including Sequoia Capital, Ribbit Capital, Index Ventures, Haun Ventures, and 1 confirmation. The $1.1 billion acquisition price represents a 5.5x premium, making it Stripe's largest acquisition in history and the largest acquisition deal in the crypto industry to date.

The $1.1 billion acquisition price is not considered crazy compared to the valuations of multi-billion dollar crypto protocols, where the only exit liquidity for crypto protocols is selling worthless governance tokens to the market.

3. Stripe and Bridge Collaboration

The collaboration between Stripe and Bridge is essentially a continuation of the stablecoin rise story, and their integration can further help Stripe's Pay With Crypto strategy. Stripe will be able to handle stablecoins more easily, making transactions more transparent and secure.

(x.com/Stablecoin/status/1848390039975469094)

Let's look at Bridge's latest official announcement:

"Bridge and Stripe will work together to accelerate the adoption and utility of tokenized dollars, making it easier for everyone around the world to transfer, store, and spend currency."

"When we launched the API 18 months ago, the world was very different from now. Many were questioning the utility of the entire digital asset space, and stablecoins were affected. Regulators, banks, and fintech companies were unable or unwilling to engage deeply with this new medium of exchange."

"Since then, some of the largest global financial institutions, such as Visa and SWIFT, have begun to natively support stablecoins. Policymakers around the world are working to provide clarity and support for stablecoin infrastructure, recognizing the strategic importance of this technology to the current financial system."

"Behind the scenes, the adoption and use of stablecoins are accelerating rapidly."

"Shortly after launch, several cross-border payment companies integrated our API, proving that stablecoins can be used to make global fund flows faster and cheaper. We then partnered with government agencies to distribute aid payments, supporting thousands of frontline workers in Latin America. Subsequently, we established virtual accounts, enabling fintech companies like Dolar App and Chipper Cash to allow global consumers and businesses to hold and spend dollars."

"Through each use case, we have demonstrated to ourselves and to those outside the company that stablecoins can become a core global fund flow infrastructure, representing a new payment platform. This is not because consumers or businesses inherently want 'cryptocurrency,' but because stablecoins solve critical financial problems. They make funds easier to move, cheaper to hold, and less expensive to remit."

"Stripe and Bridge share a common vision that our increasingly globalized world needs better currency. We need currency that can flow across borders; that anyone in any country or region can use freely; and that can be remitted almost for free."

"And crucially, we both believe that significant changes in financial services do not happen overnight. Change requires years of accumulation. Continuous improvement of products and platforms, along with ongoing trust with customers, regulators, and partners."

4. Stripe's Crypto Layout

Previously, on October 10, Stripe announced the reintroduction of its crypto payment gateway (Pay With Crypto) for U.S. businesses, allowing them to:

Accept USDC and USDP (Crypto Payin) from over 150 countries via Ethereum, Solana, and Polygon;

Businesses can receive payments in dollars (Crypto payouts);

Integrate for checkout acquiring, element payment components, and payment intent APIs, which will soon be applicable to the company's subscription features.

Stripe was the first major payment company to offer Bitcoin payments in 2014. However, due to long confirmation times, high fees, and price volatility leading to decreased demand, this feature was gradually reduced in 2018.

However, this is not the first time Stripe has integrated crypto services in recent months. In July of this year, Stripe's EU company allowed users to purchase cryptocurrencies such as BTC, ETH, and SOL.

In June, Stripe also signed a partnership agreement with Coinbase, incorporating Coinbase's Base Layer 2 into its cryptocurrency payment products, while Coinbase allowed users to use Stripe's fiat-to-crypto onramp to purchase cryptocurrencies in their Coinbase wallets.

(docs.stripe.com/crypto/pay-with-crypto)

The essence of these Stripe services (whether acquiring or transferring) is: 1) On/Off Ramp; 2) Cross-chain settlement of crypto/stablecoins.

Therefore, regarding the acquisition of Bridge,

- It can quickly fill the functional needs of this business;

- Better serve existing customers within the Stripe ecosystem;

- Expand beyond the Stripe ecosystem. Bridge's star client is the U.S. government. Yes, you read that right. Uncle Sam has also joined the stablecoin feast.

5. Response to PayPal PYUSD

When I wrote the article "Web3 Payment Research Report: Industry Giants' Full-Scale Attack, Expected to Change the Existing Crypto Market Landscape" last October, I was still considering the specific utility and adoption of stablecoin payments. Now, several payment giants have already entered the fray.

Since PayPal first issued its stablecoin PYUSD on Ethereum last August, it launched PYUSD on Solana in June of this year. Beyond its own ecosystem, it is also actively promoting the developer ecosystem for PYUSD.

According to DeFilama data, in August of this year, PYUSD on Solana accounted for 64% of the market share, while Ethereum only accounted for 36%. PYUSD's overall market cap reached $1 billion in August.

PayPal previously published an article outlining the evolution of stablecoin payments towards mass adoption:

- Awareness through Introduction

- Utility through Integration

- Ubiquity through Assimilation

Clearly, it is currently in the second stage and is moving towards the third stage.

(Analyzing the Internal Logic of PayPal's Stablecoin Payments and the Evolution Towards Mass Adoption)

(Analyzing the Internal Logic of PayPal's Stablecoin Payments and the Evolution Towards Mass Adoption)

Another payment giant, Block (formerly Square), led by Jack Dorsey, is also a staunch supporter of Bitcoin, holding 8,027 bitcoins and making various moves in the crypto space.

6. Final Thoughts

As Anna @gizmothegizzer said, in the land of the blind, the one-eyed man is king. In the crypto space, the company with the most obscure APIs and the best connections may be the emperor. My first reaction is Tether; Bridge may also be one of them.

We are just getting started.

Future M&A deals will be even crazier.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。