On October 21, the open interest in BTC futures reached an all-time high, while the Fear and Greed Index signaled positive sentiment. The simultaneous occurrence of these two indicators may suggest a new turning point for BTC.

BTC Open Interest Hits New High

In the BTC market, a surge in open interest is often seen as an important signal of potential market volatility. Recent market data shows that the open interest (OI) for Bitcoin perpetual contracts and futures has soared to over $40 billion, marking a historic high and reflecting an increase in speculative activity since October.

An increase in OI is typically viewed as a sign of heightened market activity, generally conveying an optimistic outlook among investors regarding the future of the Bitcoin market. However, some investors are concerned that the rise in OI, coupled with a decrease in Bitcoin's peak prices, indicates that the current price fluctuations are driven more by leveraged futures positions rather than spot market demand.

The Bitfinex Alpha report stated, "This time is different, as the funding rate remains neutral, indicating that the long positions in perpetual contracts are not excessively imbalanced." This suggests that the record high in open interest indeed reflects an increase in the activity of the Bitcoin market.

Fear and Greed Index Signals Positive Sentiment, Macroeconomic Factors Continue to Boost BTC

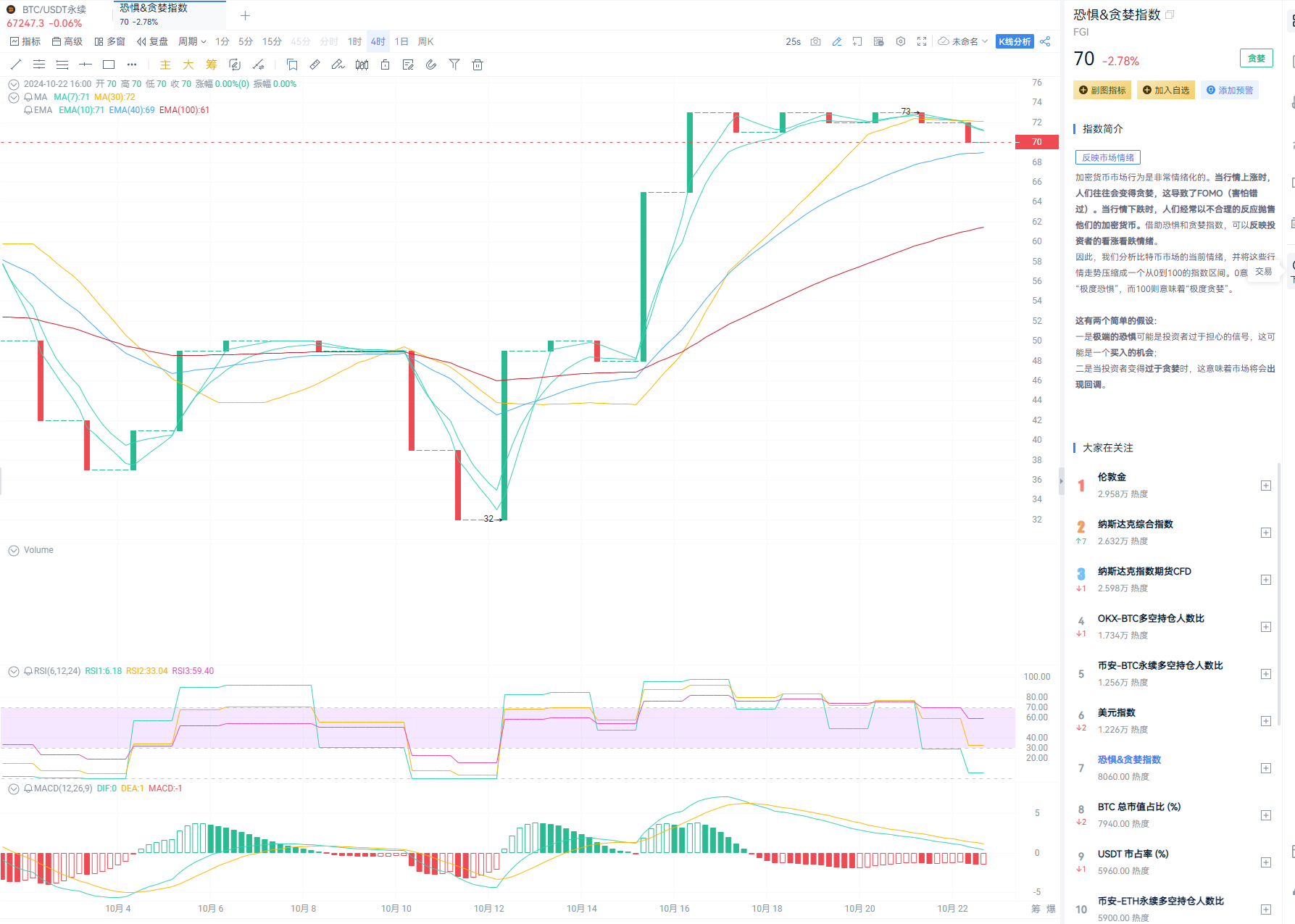

Recent data shows that today's Bitcoin Fear and Greed Index is at 70, which is considered a positive signal. This indicates that market participants generally hold an optimistic view of Bitcoin's future price, believing that it will continue to rise. Such sentiment may lead to overbuying in the market, thereby increasing the likelihood of price corrections.

Image Source: AICoin

Zhao Wei, a senior researcher at OKX Research Institute, stated that there are many factors driving the recent rise in the crypto market, with the macroeconomic environment being particularly crucial.

During the recent U.S. election period, Trump publicly expressed support for the cryptocurrency market, which undoubtedly propelled the development of the crypto market. The market generally anticipates that Trump may win the election, further boosting the rise of the cryptocurrency market.

Maria Carola, CEO of StealthEX, also noted, "The probability of Trump winning the election has recently increased, which has positively impacted Bitcoin's price. It is expected that by Friday (October 25), Bitcoin will break through the important psychological threshold of $70,000."

In addition, global policy changes have also brought favorable news for the Bitcoin market. Today, the leader of the Japanese Democratic Party promised to reduce the tax on Bitcoin and cryptocurrencies from 55% to 20% if elected, which is also good news for Bitcoin.

Image Source: x

Conclusion

The explosion of open interest, the surge in market sentiment, and the boost from macro policies are interwoven factors that present both unknown challenges and opportunities for the market. The coming days will be a crucial observation period for Bitcoin and the entire cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。