Original | Odaily Planet Daily (@OdailyChina)

Author | Fu Ruo (@vincent31515173)

In the global payment field, Stripe is a well-known name. Recently, the company announced the acquisition of the Web3 payment platform Bridge for $1.1 billion, making it the largest acquisition in the history of Web3 and attracting widespread attention. This is not only an important step for Stripe to expand its payment solutions but also a landmark moment for Web3 technology to emerge in the traditional financial system.

Odaily Planet Daily will delve into the parties involved in this acquisition and the motivations behind it.

Basic Introduction of Stripe and Bridge

Stripe was founded in 2010 and is headquartered in San Francisco. It is a fintech company focused on online payment solutions. Founded by brothers Patrick Collison and John Collison, Stripe is known for its user-friendly APIs and powerful developer tools, quickly becoming the preferred payment processing platform for millions of businesses worldwide.

Main Products and Services:

Payment Processing: Stripe offers various payment methods, including credit cards, debit cards, and digital wallets, helping merchants easily accept online payments.

Subscription Management: Stripe's subscription management tools enable SaaS companies and other businesses to handle recurring payments effortlessly.

Fraud Detection: Stripe Radar uses machine learning technology to monitor transactions in real-time to identify and prevent fraudulent activities.

Global Support: By supporting multiple currencies and local payment methods, Stripe helps merchants expand into international markets.

Developer-Friendly: Stripe has comprehensive documentation and robust APIs, significantly lowering the technical barrier.

Stripe has not only earned the trust of numerous startups and large enterprises (such as Amazon and Uber) but also reached a valuation of $95 billion in 2021, becoming one of Silicon Valley's most valuable startups.

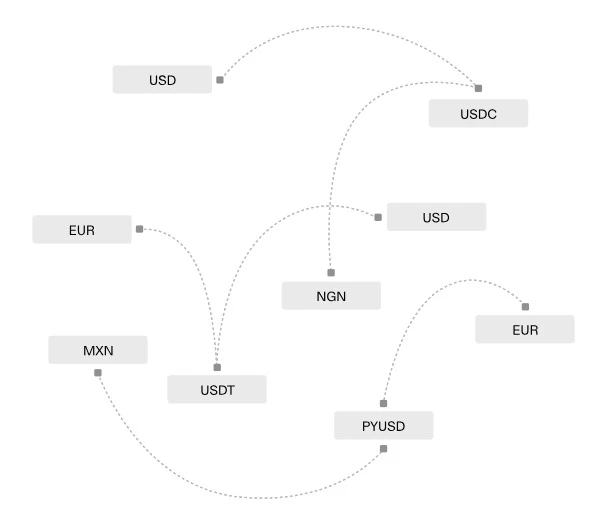

Bridge is a stablecoin-based payment platform that challenges traditional payment systems like SWIFT and credit cards through innovative global fund flows. The core value of Bridge lies in its ability to allow developers to seamlessly convert between fiat and stablecoins and transfer across different blockchains.

Main Features and Services:

Stablecoin API: Bridge focuses on providing developers with stablecoin-related APIs, enabling them to easily implement seamless conversions between fiat and stablecoins.

Cross-Border Payments: Bridge offers cross-border payment and currency exchange services, allowing users to quickly transfer funds using its Orchestration APIs.

Fund Reserves: Bridge invests its reserve funds in U.S. Treasury bonds, yielding over 5% annually, ensuring the safety and stability of funds.

Compliance: Bridge has obtained licenses in 48 states and holds a VASP license from Poland, ensuring its compliant operations.

Fast and Efficient: The entire fund transfer process typically takes only a few minutes, with fees of just a few cents, making it a strong competitor to traditional payment systems.

Notably, on August 30 of this year, Bridge announced it had secured $58 million in funding from Sequoia Capital, Ribbit Capital, Index Ventures, Haun Ventures, 1confirmation, and BEDROCK. Just two months later, Stripe announced its acquisition of Bridge for $1.1 billion.

Additionally, according to official news, since its launch 18 months ago, Bridge has processed over $5 billion in annual payment volume and has partnered with several fintech companies, including well-known firms like Coinbase, Bitso, and SpaceX.

Analysis of the Reasons Behind Stripe's Acquisition of Bridge

Stablecoin payments, especially cross-border payments, are gradually developing in various countries and regions. I previously interviewed one of the companies selected for Hong Kong's stablecoin sandbox, Yuan Coin Technology. The CEO, Rita, emphasized the role and future development of the Hong Kong dollar stablecoin, particularly in the direction of stablecoin cross-border payments. For details, see the article “Exclusive Interview with Yuan Coin Technology CEO Rita: How Will the Hong Kong Dollar Stablecoin Shine in Web3?”

Stablecoin payment solutions are one of the trends of the future, and as a payment giant, Stripe's specific reasons for acquiring Bridge are as follows:

Expanding Market Share: The primary reason for Stripe's acquisition of Bridge is to further expand its market share, especially in the Web3 and stablecoin sectors. With the development of blockchain technology, more and more merchants and consumers are beginning to accept digital currencies. By acquiring Bridge, Stripe can quickly enter this emerging market and provide more comprehensive payment solutions.

Technological Integration and Innovation: Bridge's technological foundation and innovative capabilities align well with Stripe's core business. By integrating Bridge's stablecoin API and cross-border payment capabilities, Stripe can enhance its existing payment products, improving transaction speed and efficiency. This technological integration not only enhances user experience but also provides more possibilities for future product innovation.

Competitive Advantage: The fintech industry is becoming increasingly competitive. Stripe faces pressure from companies like PayPal and Square, as well as emerging competitors in the Web3 space. Acquiring Bridge will give Stripe a competitive advantage in both technology and market, especially in providing blockchain-based payment solutions.

Attracting Developers and Businesses: Bridge is known for its developer-friendly APIs, which aligns closely with Stripe's strategic goals. By acquiring Bridge, Stripe can further attract developers and businesses, providing richer tools and resources to help them build and expand their operations in the Web3 environment.

Strengthening Compliance Capabilities: Compliance in stablecoin payments is crucial in the fintech industry. Bridge has obtained compliance licenses in multiple regions, providing the necessary compliance foundation for Stripe's global expansion. Acquiring Bridge will enable Stripe to better address regulatory requirements in different countries and regions, reducing compliance risks.

This acquisition is not only a collaboration between Stripe and Bridge but also a milestone for the entire Web3 industry. As traditional fintech giants pay more attention to Web3 technology, more funds and resources will flow into this field, driving its development. In the future, Web3 may further integrate with traditional payment systems, creating more innovative payment solutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。