The launch of Unichain marks Uniswap's shift towards the "Fat Application Theory," which may lead to a decline in Ethereum's dominance while enhancing transaction speed, reducing fees, and minimizing liquidity fragmentation through its own blockchain, thereby redefining the competitive landscape of DeFi.

Author: @arndxt_xo

Translation: Blockchain in Plain Language

1. The Origin of Unichain

The birth of Unichain may signify the beginning of Ethereum's decline in dominance, as mainstream protocols like Uniswap shift value and activity away from Ethereum, ultimately reducing it to a simple settlement layer.

The influence of Uniswap is undeniable.

As the largest decentralized exchange (DEX), Uniswap has millions of users, and a significant amount of liquidity on Ethereum is traded through its protocol.

Today, Uniswap announced the launch of its own blockchain, Unichain, a move that may signify a strategic shift in the blockchain* paradigm*—from the traditional "Fat Protocol Theory" to the upcoming "Fat Application Theory."

As Uniswap aims to solidify its dominance, this development raises critical questions about the future of Ethereum, the value of ETH as an asset, and the potential restructuring of liquidity and user experience in decentralized finance (DeFi).

Here, I have compiled some of my thoughts and findings:

Key Highlights:

Strategic Shift to "Fat Application Theory" Uniswap takes control of its own blockchain through Unichain, capturing more value from transaction fees and infrastructure.

Solving Scalability Issues with Flash Blocks and TEEs Faster transaction speeds (200-250 milliseconds) and reduced gas fees enhance user experience and network performance.

Minimizing MEV Fair gas auctions reduce MEV attacks, potentially saving users up to $1 billion annually.

Liquidity Integration The centralized liquidity hub on Unichain reduces fragmentation and improves Layer 2 cross-layer pricing efficiency.

Impact on Ethereum's Role Supports Ethereum's rollup-centric roadmap, reinforcing ETH's position as a secure settlement layer. (This view is controversial)

Enhancing Security through Unichain Validation Services By allowing UNIToken holders to participate in transaction validation, the integrity and decentralization of the network are improved.

New Competitive Landscape in DeFi Sets an example for other DeFi applications to launch their own chains, promoting vertical integration and infrastructure control.

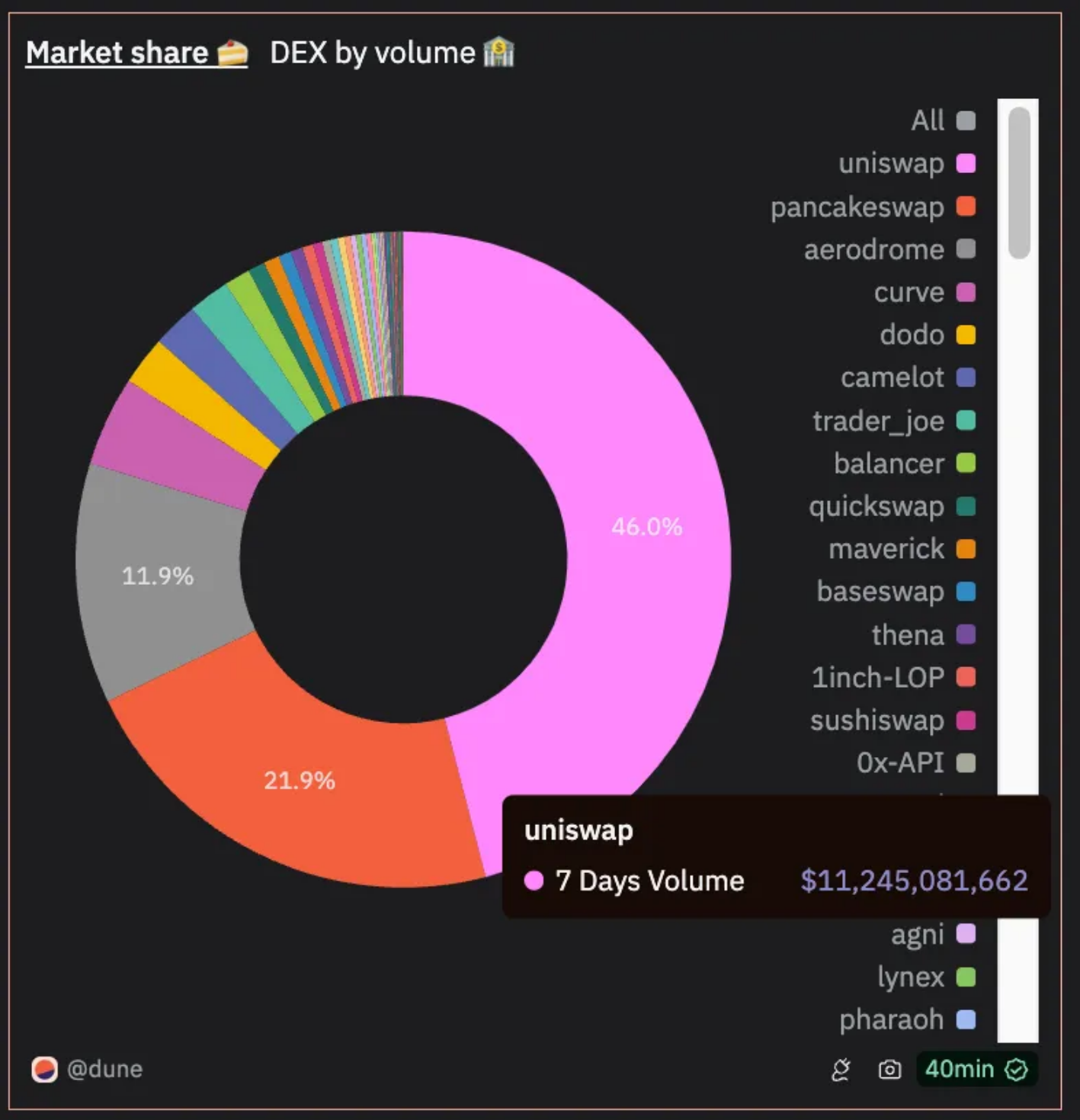

Analyzing Uniswap's Dominance in DeFi through Data Uniswap has been a key pillar in the DeFi space, capturing a significant market share: According to Dune Analytics, Uniswap accounts for about 46% of DEX trading volume on Ethereum.

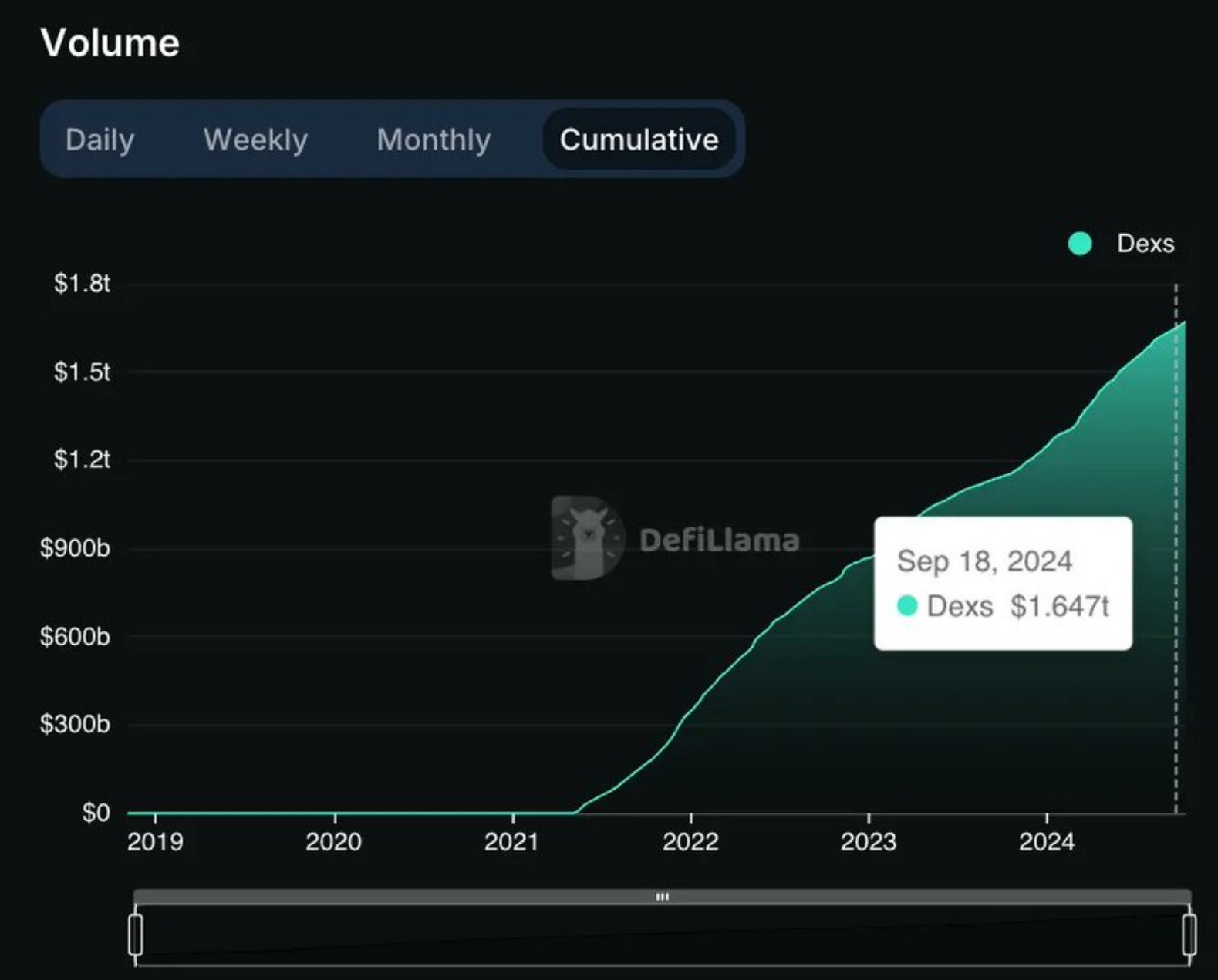

Cumulative Trading Volume: Since its establishment in 2018, Uniswap's cumulative trading volume has surpassed $1.7 trillion.

User Base and Adoption

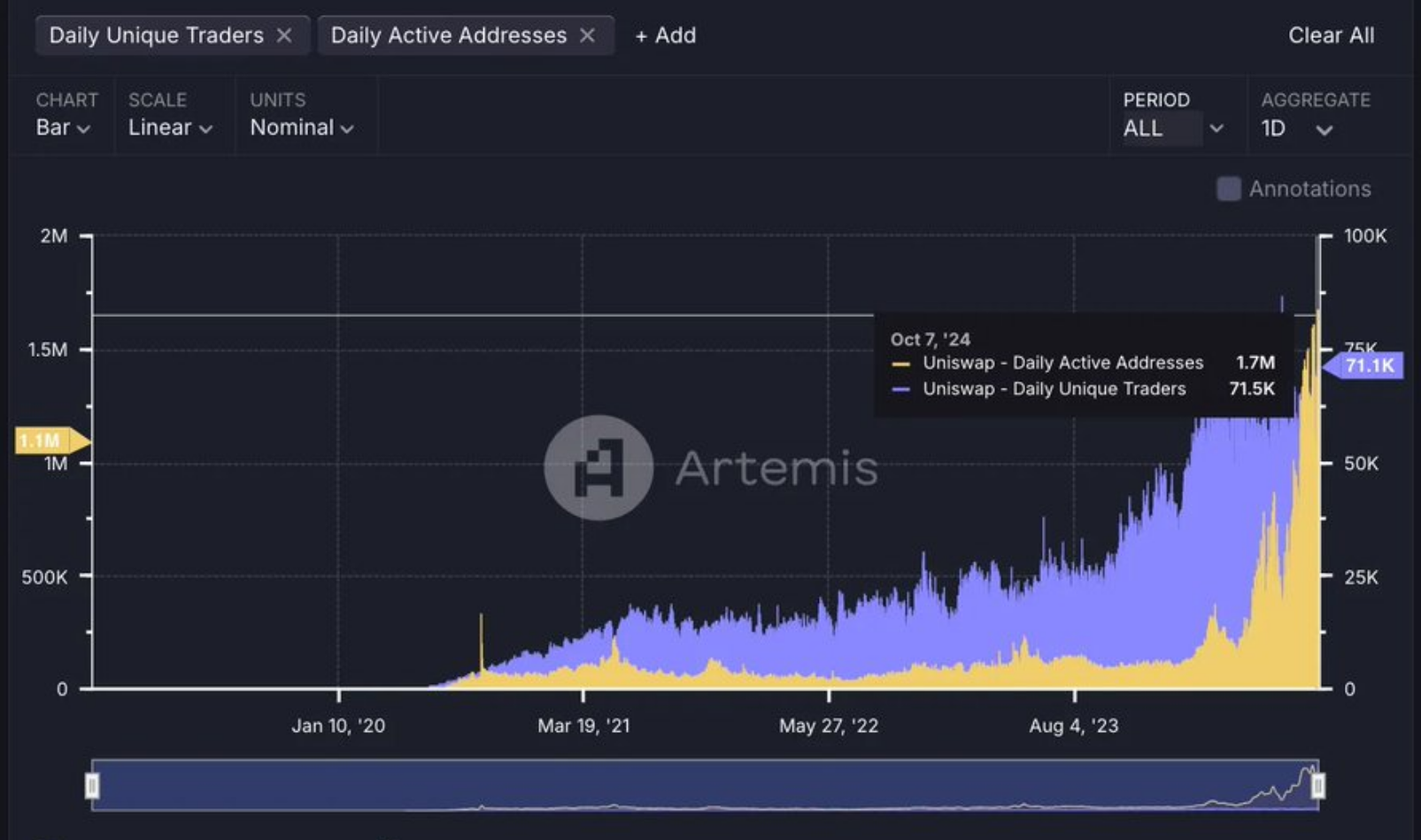

Independent Trading Users: Over 71,500 independent trading users have interacted with Uniswap's smart contracts.

Daily Active Users: Uniswap currently has about 1.2 million daily active users, showcasing its widespread adoption.

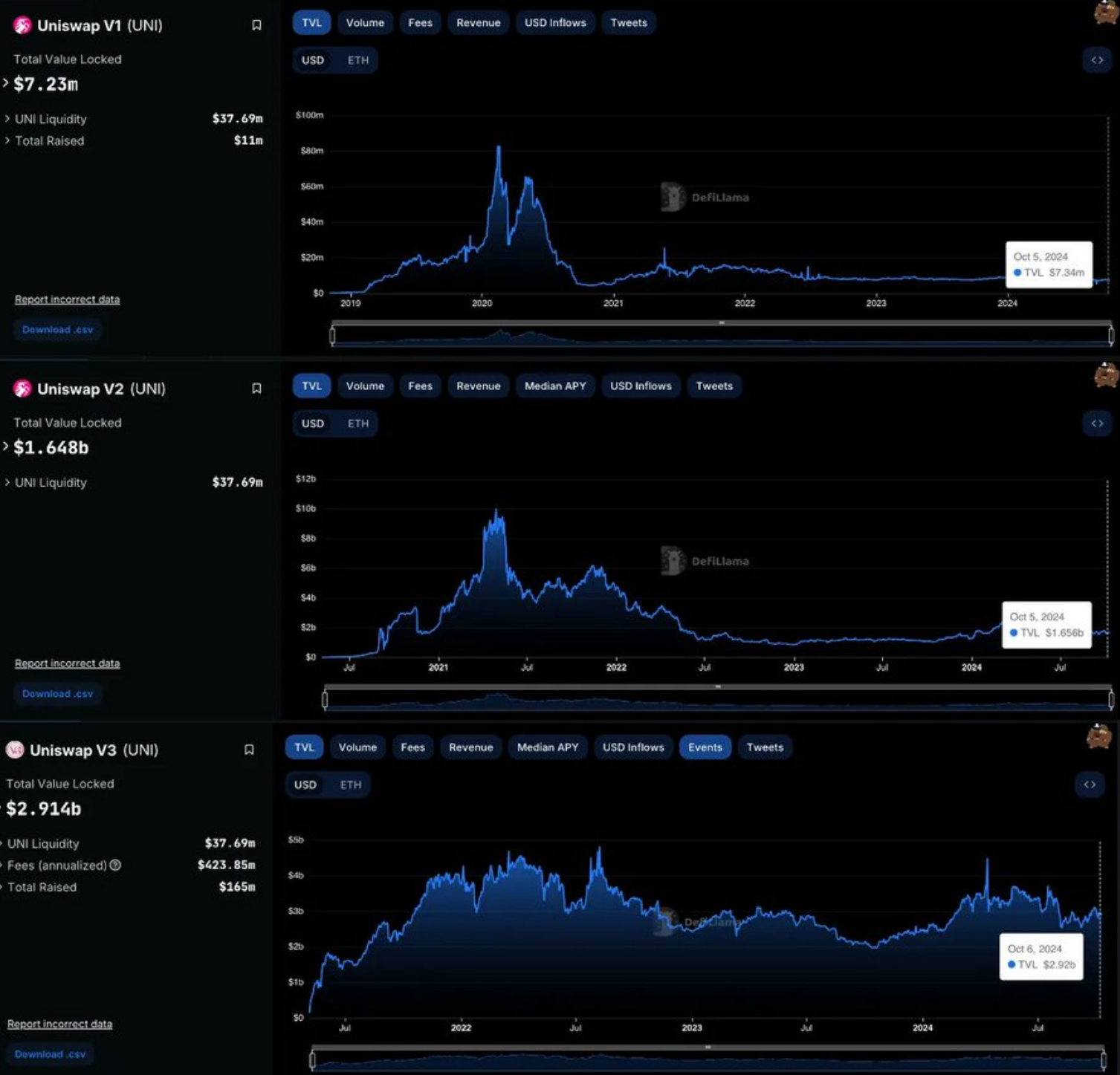

2. Total Locked Value (TVL)

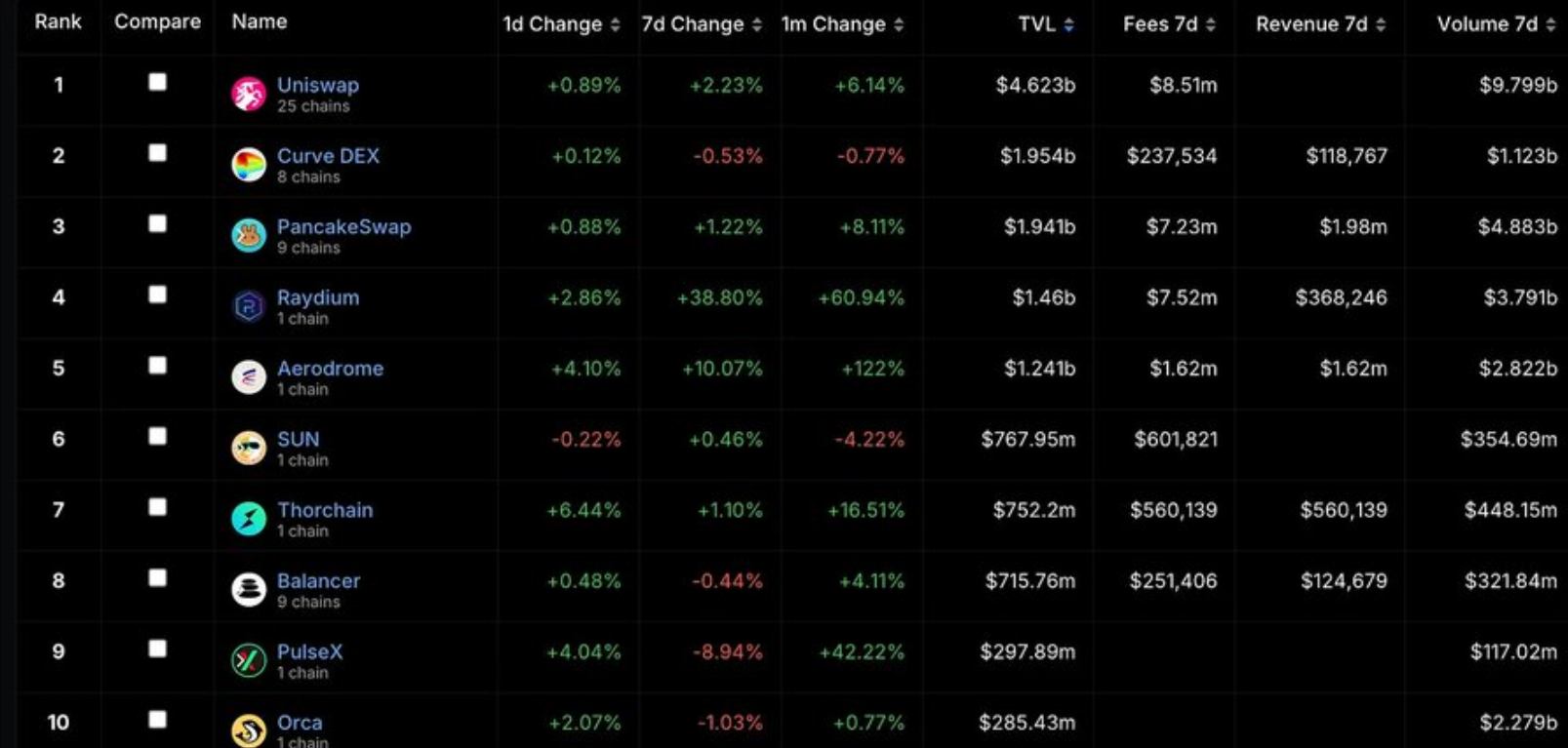

TVL: Uniswap's total locked value is approximately $6 billion, making it one of the most liquid DeFi protocols. The birth of Unichain may signify the beginning of Ethereum's decline in dominance, as mainstream protocols like Uniswap shift value and activity away, reducing Ethereum to a simple settlement layer.

3. Why Uniswap is Building Unichain

Motivation: Solving Scalability Issues with Layer 2 Solutions

The scalability issues of Ethereum are well-known.

High gas fees and slow transaction speeds have been hindering user experience and limiting the network's ability to cope with a growing user base.

Ethereum has adopted a rollup-centric roadmap aimed at alleviating these issues by shifting most transactions from the main chain (Layer 1) to Layer 2 (L2) solutions, which can handle transactions more efficiently.

Unichain is built using the open-source framework OP Stack developed by Optimism, designed to operate within a Superchain—a network of interoperable blockchains sharing common standards.

By leveraging this technology, Unichain aims to address the following issues:

1) Addressing Scalability and Performance Issues

Congestion and high gas fees on the Ethereum network have been ongoing obstacles. Uniswap's goal in transitioning to Unichain is to:

Enhance Transaction Speed: Target block time of 200-250 milliseconds, significantly faster than Ethereum's average of 12-15 seconds.

Reduce Transaction Costs: Lower fees make DeFi more attractive to a broader user base.

2) Control Infrastructure and Customization

Operating on its own dedicated blockchain allows Uniswap to:

Implement Protocol-Level Optimizations: Customize the blockchain according to Uniswap's specific needs, such as custom transaction ordering.

Introduce Advanced Features: Implement innovations like Flash Blocks and MEV minimization strategies.

3) Reduce Liquidity Fragmentation

By creating a centralized liquidity hub, Uniswap users will benefit from:

Consolidating Liquidity Pools: Unichain aims to aggregate liquidity currently scattered across multiple Layer 2 solutions and sidechains.

Improve Pricing and Slippage: Deeper liquidity will provide traders with better pricing and lower slippage.

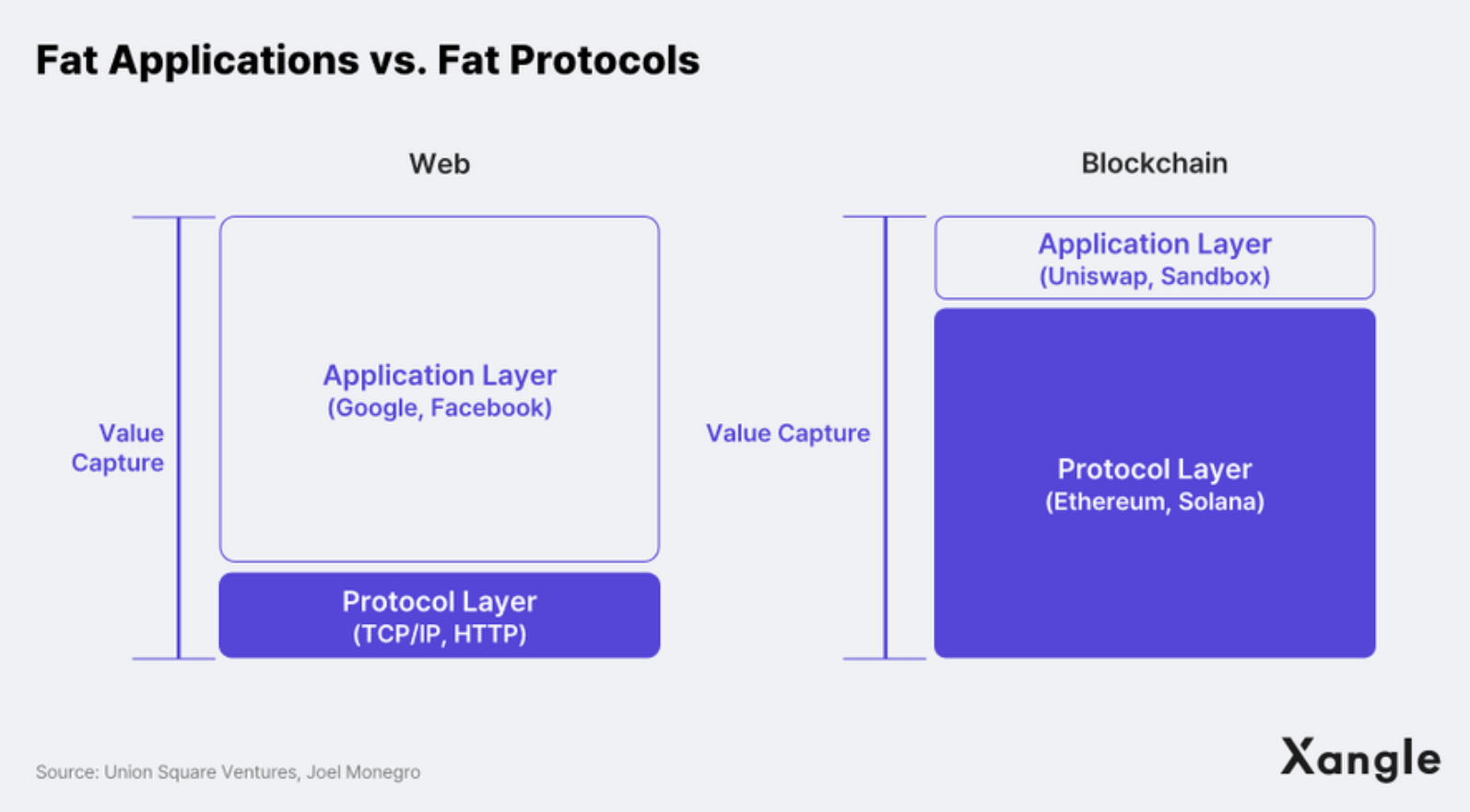

4. Transition from "Fat Protocol" to "Fat Application" Theory

1) Brief Overview

Fat Protocol Theory: Argues that in the blockchain ecosystem, the protocol layer (like Ethereum) captures the most value because it supports all applications. Fat Application Theory: Suggests that leading applications can capture more value by controlling more of the tech stack.

A. Fat Protocol Theory

Fat Protocol Theory was first proposed by Joel Monegro in 2016. It posits that in the blockchain ecosystem, most value accumulates at the protocol layer rather than the application layer. This contrasts with the traditional internet model, where the application layer (like Facebook, Google) captures most of the value, while the underlying protocols (like TCP/IP, HTTP) are relatively "thin" in value capture. Key Points of Fat Protocol Theory:

Value Accumulation: Protocol tokens (like Ethereum's ETH) appreciate in value as they play a core role in network operations, with their scarcity and network effects driving demand.

Network Effects: As more applications and users build on a protocol, the protocol itself becomes more valuable, solidifying its dominance.

Composability: Applications built on these protocols benefit from the security and decentralization of the protocol, but individual applications capture relatively little value.

B. Fat Application Theory

Fat Application Theory challenges this view, arguing that leading applications can capture significant value by controlling more of the tech stack, effectively "moving down" the tech stack. This theory is based on the idea that applications can differentiate themselves through proprietary features, user experience optimization, and control over infrastructure. Key Points of Fat Application Theory:

Value Capture at the Application Layer: Applications can capture more value through vertical integration, owning not just the user interface but also parts of the underlying infrastructure.

Differentiation: By controlling more of the tech stack, applications can offer unique features and optimizations that competitors cannot access.

User Experience: Focusing on seamless, efficient, and user-friendly experiences can drive user adoption and loyalty, further increasing the application's value.

2) Uniswap's Strategic Shift

By launching Unichain, Uniswap is:

Moving Downstream in the Tech Stack: Taking control of the underlying protocol to capture more value.

Enhancing Value Capture: Potentially increasing revenue through transaction fees and other mechanisms.

Strengthening Ecosystem Control: Guiding development and innovation within its ecosystem.

3) How the Shift to "Fat Application" Theory Will Unfold

A. Intensified Competition Among Applications

With Uniswap launching Unichain, the shift towards "Fat Application" theory will significantly reshape the blockchain ecosystem. This change may lead to:

Applications competing more fiercely, as other successful DeFi platforms may follow Uniswap's lead and launch their own chains.

This vertical integration allows applications to control their infrastructure, not just limited to improvements in user interfaces, but also providing more robust performance and features.

This will create a new competitive landscape where applications differentiate themselves not only through functional differentiation but also through the efficiency and scalability of their underlying infrastructure.

B. Fragmentation and Integration of the Ecosystem

However, this shift also brings both risks and opportunities of fragmentation and integration within the ecosystem.

On one hand, the surge of application-specific chains may lead to fragmentation, increasing interoperability challenges, which could affect the overall user experience that is crucial for mass adoption.

- On the other hand, dominant applications may attract smaller projects to build within their ecosystems, creating new active hubs and potentially facilitating the integration of resources and user bases.

This evolution will impact the value dynamics between the protocol layer and the application layer. If applications begin to capture more value, the dominance of the underlying protocols may relatively decline, and network effects will tilt towards these application ecosystems as users and liquidity concentrate around them.

C. Impact on Protocol Layer Value

The shift to "Fat Application" theory poses a challenge to the traditional dominance of the protocol layer.

As applications like Uniswap launch their own chains, they begin to capture more value, reducing their reliance on the underlying protocols, especially in terms of transaction fees and infrastructure.

This may lead to a shift in network effects, with users and liquidity concentrating more on these application-specific ecosystems rather than the broader protocol layer.

Consequently, protocols like Ethereum may see a relative decline in value capture, while dominant applications will become new active and influential centers within the blockchain ecosystem.

5. Impact on Ethereum and ETH as an Asset

The launch of Unichain has sparked discussions about the future role of the Ethereum mainnet and the value accumulation of ETH as an asset. Some argue that migrating DeFi activity to Layer 2 solutions may weaken the importance of the mainnet and negatively impact the value of ETH. Another perspective worth considering is here: https://x.com/arndxt_xo/status/1843769349620019586

However, supporters argue that this evolution aligns with Ethereum's long-term vision. By serving as a secure, decentralized settlement layer, the Ethereum mainnet can focus on providing data availability and finality, while Layer 2 solutions handle scalability and user-facing applications. This symbiotic relationship may actually enhance ETH's value proposition as it becomes the foundational asset supporting a wide range of Layer 2 networks.

Some of my thoughts on this are also here: https://x.com/arndxt_xo/status/1844432389784940754

Potential Negative Impacts on ETH

Reduced Demand for ETH: If Unichain uses a different native token as a payment tool for transaction fees, the demand for ETH may decline.

Reduced Ethereum Transaction Fees: The migration of activity to Unichain may lead to lower fees charged by Ethereum validators.

Liquidity Drain: The concentration of liquidity on Unichain may reduce liquidity on the Ethereum mainnet and other Layer 2s.

@0xmughal also shared his findings and thoughts here: https://x.com/0xMughal/status/1844419182877868182

Counterarguments: Potential Upsides for Ethereum

Alignment with Ethereum's Rollup-Centric Roadmap: Unichain still relies on Ethereum for security and data availability.

ETH as a Settlement Layer: Ethereum can strengthen its position as the foundational settlement layer for multiple Layer 2s.

Potential Increase in Ethereum Usage: Enhanced scalability may attract more users into the entire ecosystem.

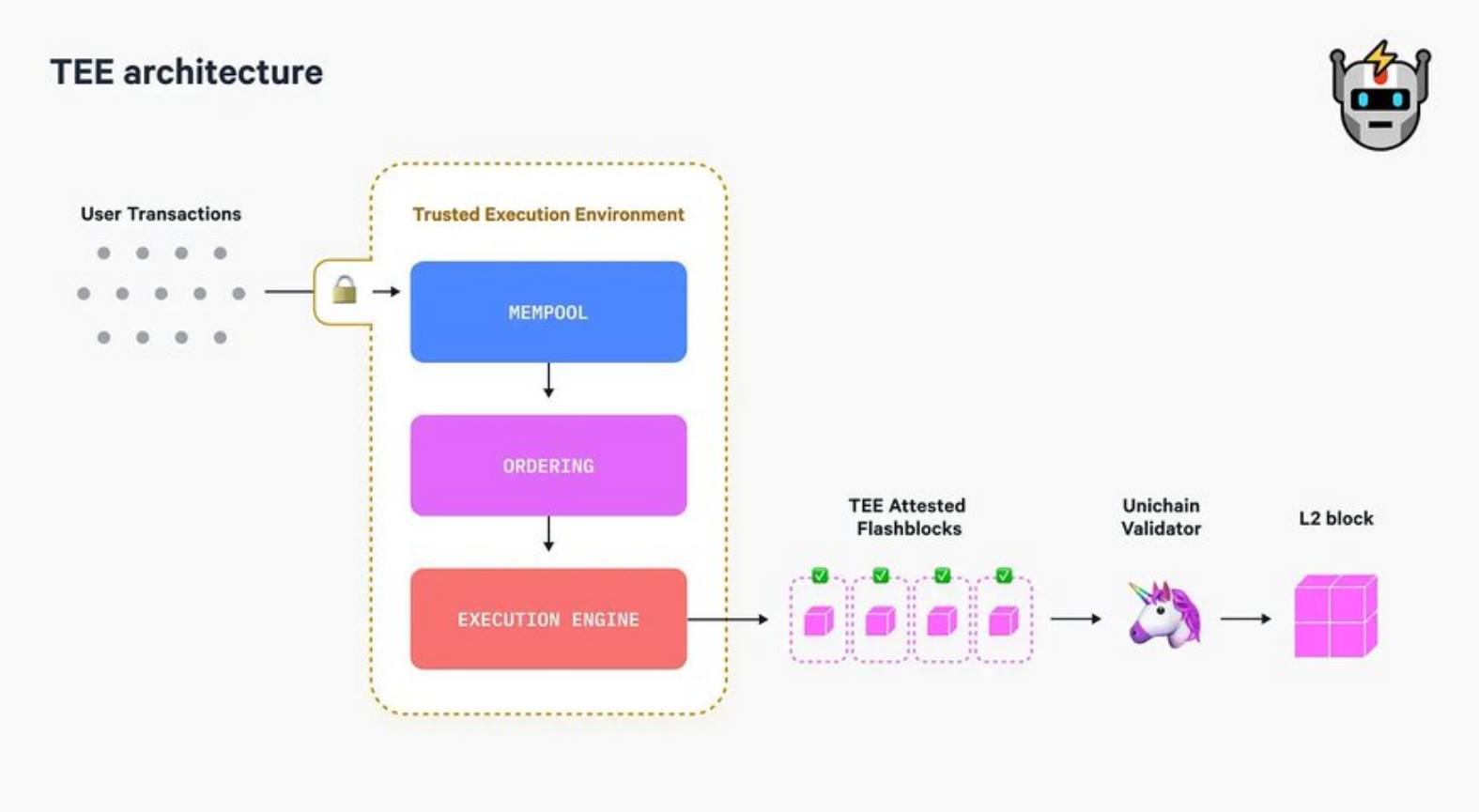

6. Technological Innovations of Unichain

Unichain introduces a series of technological innovations aimed at enhancing speed and security. These advancements include Flash Blocks and Trusted Execution Environments (TEE), which serve to:

Achieve sub-second transaction finality.

Reduce manipulation risks, ensuring faster and safer transactions for users.

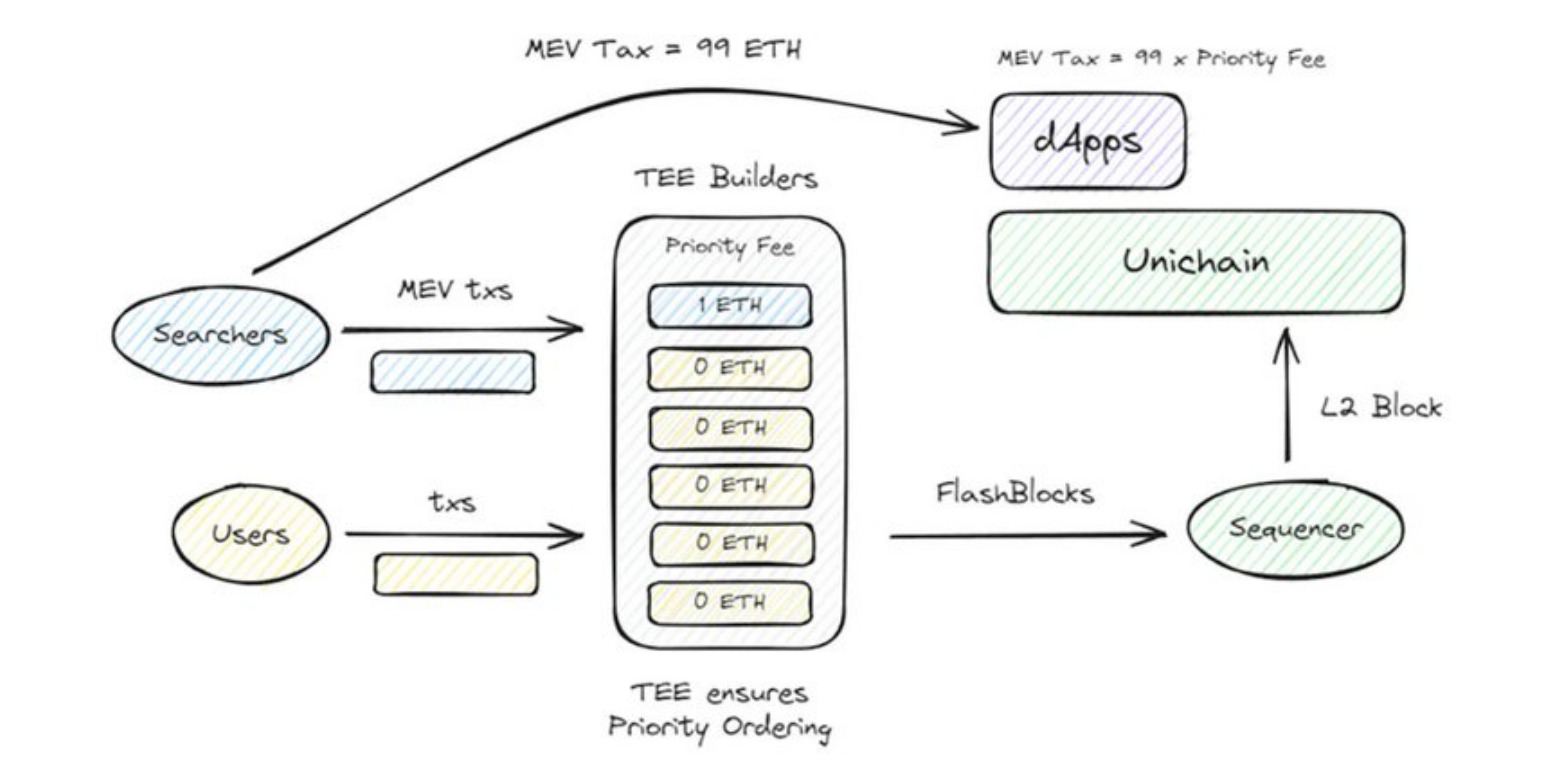

Another key innovation is Unichain's approach to minimizing Maximum Extractable Value (MEV).

Through a fair priority gas auction system, Unichain ensures transparency and fairness in transaction ordering, thereby reducing harmful MEV attacks, such as sandwich attacks. This system is expected to save users up to $1 billion annually, curbing exploitative behaviors that often lead to increased transaction costs.

To further enhance security and decentralization, Unichain introduces validation services, where a group of validators continuously verifies the operations of the sequencer responsible for transaction ordering. This additional layer of security not only ensures the integrity of the network but also encourages community participation, allowing UNIToken holders to engage in network validation, creating a more decentralized and robust ecosystem.

7. Conclusion

Unichain is a bold move by Uniswap, solidifying its position as a leader in DeFi and redefining how decentralized applications operate. By directly addressing scalability issues, minimizing MEV losses, and centralizing liquidity, Uniswap is taking control of its future in a way that few other projects have dared to. This strategic shift challenges Ethereum's traditional role but aligns perfectly with its rollup-centric vision.

I see this as a pivotal moment for DeFi. Uniswap's decision to control more of the tech stack feels like the evolution we've long awaited in this space. I anticipate that other DeFi projects will follow suit, reimagining how value is created and captured. Unichain represents the next wave of decentralized finance, and I believe this is just the beginning of the DeFi journey we are witnessing.

Article link: https://www.hellobtc.com/kp/du/10/5488.html

Source: https://x.com/arndxt_xo/status/1844764163094286523

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。