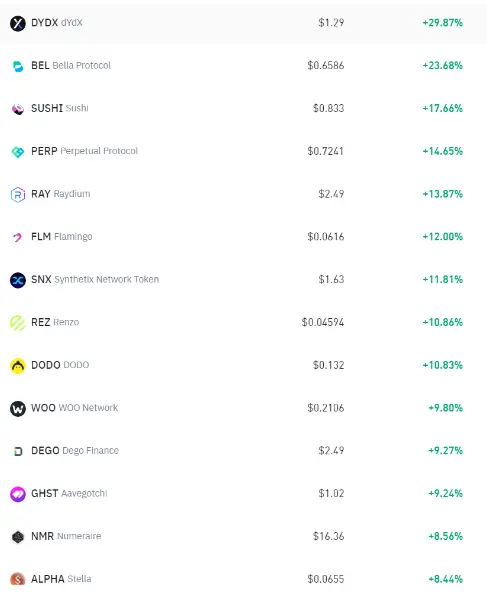

In this round of the bull market, the long-awaited "altcoin season" seems to have stirred recently. Starting from APE to DYDX and SUSHI, many altcoins have seen significant increases. Is this a genuine return of the bull market, or are altcoins taking the opportunity to release good news and then offload? Why has the "altcoin season" phenomenon, which was once inevitable in the crypto market, failed to materialize this year?

How Did Previous Altcoin Seasons Come About?

In past bull markets, the arrival of altcoin seasons seemed to be a natural phenomenon. When the prices of Bitcoin and Ethereum rose, investors would gain sufficient profits from mainstream coins, and funds would gradually overflow into the altcoin market, which is more volatile but potentially offers higher returns. Thus, under this capital push, altcoins would start to rise in succession, forming a unique "altcoin season" trend.

However, in 2024, this pattern seems to have broken down. Bitcoin's price soared from $26,000 to a high of $70,000 due to the halving event and ETF catalysts, and mainstream funds have already reaped substantial profits. Logically, this should be the time for altcoins to shine, but the reality is disappointing. Many investors who anticipated a repeat of historical trends found themselves deeply trapped, suffering heavy losses. This year, very few altcoins have outperformed Bitcoin, and selecting the right altcoin feels like searching for a needle in a haystack.

Why Is There No Altcoin Season in 2024?

While altcoin seasons were previously a "natural phenomenon," why are they absent this year? This is the result of multiple intertwined factors.

First is the lack of new narratives. Behind every bull market, there is a strong narrative driving it. For example, 2017 was marked by the initial coin offering boom, while 2021 was supported by emerging concepts like DeFi, NFTs, and GameFi. This year, although there are many new projects in the crypto space, they are mostly old wine in new bottles, repeating past ideas without enough compelling new narratives to attract funds and drive significant market movements.

Secondly, there is token dilution. A large number of high-market-cap, low-circulation tokens have launched this round, with data showing that the average circulation rate of these projects is only 14%, and about $90 billion worth of tokens are waiting to be unlocked. When project saturation combines with an oversupply of tokens, it becomes difficult for an altcoin season to sustain itself.

Another important factor is that the emergence of Bitcoin spot ETFs has changed the flow of funds. Previously, investors mostly accessed Bitcoin through centralized exchanges (CEX), and these investors often tried altcoins, which helped boost the altcoin market. However, the approval of ETFs has attracted a large amount of institutional capital, which is only interested in Bitcoin. This structural change in institutional funding has weakened the market demand for altcoins, breaking the traditional flow of capital.

Additionally, the uncertainty in the macroeconomic environment has intensified the market's conservative sentiment. The global economic outlook is concerning, and investors are more cautious in such an environment. Altcoins, due to their higher volatility and risk, appear particularly weak in this risk-averse atmosphere.

What Should Be the Next Steps?

The direction of the crypto market is filled with uncertainty. If interest rate cuts stabilize the economy, investors' risk appetite may rebound, and Bitcoin's market dominance could be challenged, allowing funds to flow more freely into other quality assets, including some promising altcoins. However, if recession fears continue to escalate, Bitcoin's status as a safe-haven asset will further solidify, maintaining its high market dominance.

Regardless of the scenario, one undeniable fact is that the differentiation among altcoins will increasingly intensify. Quality projects will stand out due to their unique technological advantages, application scenarios, and market potential, while inferior projects may struggle and gradually be eliminated from the market.

In such a complex and volatile market environment, blind operations will undoubtedly increase investment risks significantly. For ordinary investors, it is unnecessary to limit opportunities to altcoins; it may be wise to consider more stable products, seeking certainty amid uncertainty. For instance, 4E Wealth Management offers financial products with an annualized yield of up to 5.5% on USDT, allowing for flexible combinations of demand and fixed-term deposits, ensuring funds are not idle while waiting for market changes.

Of course, diversifying asset allocation helps to mitigate the volatility risks of a single market and allows for a focus on investment opportunities in other areas during this period of uncertainty. For example, 4E also supports asset classes in traditional financial markets such as stocks, indices, foreign exchange, and gold, providing a one-stop trading experience in USDT and offering more stable growth opportunities.

In summary, whether the altcoin season of 2024 will arrive remains unknown. In the context of the continuously evolving crypto market, market rules are no longer as reliable as in the past. Facing a complex and changing market, investors should remain cautious, reasonably diversify risks, and not rely solely on past experiences, seeking stable growth opportunities in diversified investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。