Stablecoins are targeting multiple trillion-dollar industries.

Written by: Juan Leon, Ari Bookman, Bitwise

Translated by: Luffy, Foresight News

The Bitwise research team releases the "Crypto Market Review" every quarter, analyzing the most important fundamentals and trends affecting the crypto market based on data. The market review for the third quarter is particularly exciting.

On one hand, cryptocurrency prices have shown no signs of improvement, and the market has been consolidating sideways for most of the past six months.

On the other hand, as Bitwise Chief Investment Officer Matt Hougan stated, "The calm on the surface conceals significant progress beneath."

We aim to reveal one aspect of this progress: stablecoins have become the dominant application of crypto technology.

Why should investors pay attention to stablecoins?

Stablecoins are no longer niche; we have been discussing them for many years. Traditional giants like PayPal are launching their own stablecoins. High-level discussions about stablecoins are taking place in the U.S. House of Representatives and Senate. Last week, payment processing giant Stripe announced plans to acquire the stablecoin issuance platform Bridge for $1 billion, marking its largest acquisition in the cryptocurrency space to date.

So, what makes stablecoins so valuable? Why should investors care about them?

Unlike other crypto assets, stablecoins are designed to maintain a stable value relative to a certain asset (usually the U.S. dollar). If you see price fluctuations in stablecoins, something must be wrong. This reduces their attractiveness as investment targets, making them more of a medium of exchange. More importantly, this role makes stablecoins a bridge between traditional finance and the crypto economy.

Moreover, they are fast, efficient, and programmable. You can send $10,000 to anyone in the world in seconds without worrying about bank hours or lengthy settlement times. As digital assets, stablecoins can be programmed to execute smart contracts, enabling automatic payments, custodial services, and various decentralized finance (DeFi) applications.

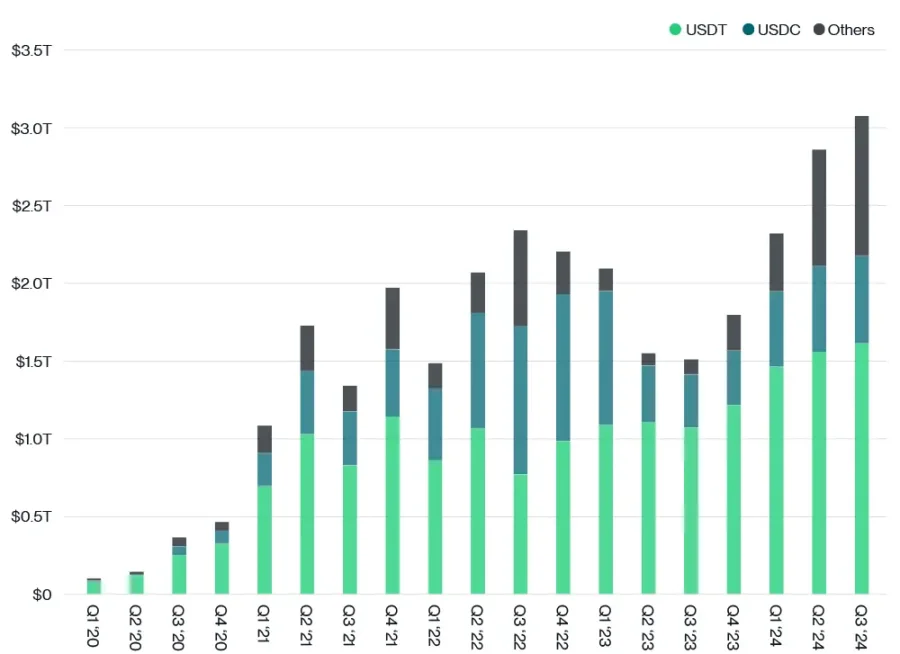

This is why the usage of stablecoins has surged to record levels. In the first half of this year, over $5.1 trillion in transactions were conducted using stablecoins, which is not far off from Visa's $6.5 trillion.

Stablecoin transactions, source: Bitwise Asset Management, Coin Metrics. Data ranges from Q1 2020 to Q3 2024. Note: "Others" includes BUSD, DAI, FDUSD, GUSD, HUSD, LUSD, PYUSD, TUSD, USDK, and USDP.

How did stablecoins take off?

Why is traditional payment giant PayPal launching a stablecoin? The answer is that the business model is too good.

Issuers take in dollars (or other fiat currencies) and issue an equivalent amount of stablecoins. They then use these fiat currencies to purchase U.S. Treasury bonds and other income-generating assets. Finally, they pocket the interest income.

How effective is this model? The largest stablecoin issuer, Tether, made more profit last year than BlackRock.

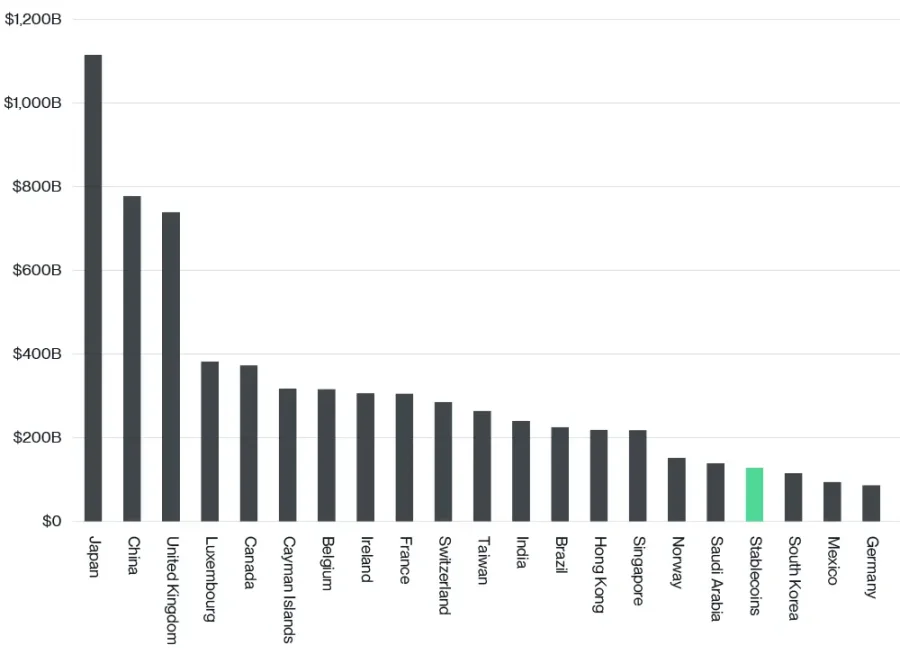

These issuers are becoming major players. As shown in the chart below, the top five stablecoins hold more U.S. Treasuries than some G20 countries like South Korea and Germany. Therefore, the growth of stablecoins provides a new source of demand for U.S. debt and helps provide liquidity to the U.S. Treasury market, benefiting the broader financial system.

Investors are eager to get involved. Tether's biggest competitor, Circle, is more than willing to assist investors, as the company quietly filed for an IPO this year. Additionally, publicly traded companies like Visa are already planning to integrate stablecoins into their businesses.

Stablecoins and major foreign holders of U.S. Treasuries, data from the U.S. Treasury and company reports. Data as of June 30, 2024.

What opportunities should investors seize?

So how can investors seize this opportunity?

Keep in mind: stablecoins do not appreciate; they will face the same inflation pressures (and currency exchange risks) as the assets they are pegged to.

So, what opportunities should investors look for? What risks should they be aware of?

1) Public Companies

Some multinational companies are integrating stablecoins into their businesses for a competitive edge. These companies are reflected in cryptocurrency stock indices, such as the Bitwise Crypto Innovators 30 Index. Since stablecoins offer lower transaction costs and faster settlement times than traditional trading intermediaries, we expect that companies like Visa and PayPal will not be the last to enter the stablecoin space, with more banks and payment processors expected to follow.

2) Potential Alternatives to Money Market Accounts

For most stablecoin holders today, the stablecoins they hold are similar to cash in a checking account: they earn no interest. But what if issuers could offer some of the profits they earn from Treasury reserves as interest?

If this pathway opens up, stablecoins could become an attractive alternative to money market funds (a $6.3 trillion industry). For advisors with cash on hand for clients, stablecoins could become a useful tool in their portfolios. Given that stablecoin regulation is a hot topic in Congress, this is worth watching.

3) Value Accumulation of Underlying Blockchains

Most stablecoin activity occurs on Ethereum. The growth of stablecoins directly promotes the growth of the network and indirectly drives the price of ETH. Of course, the reverse is also true: if stablecoins fail, it could put pressure on network activity.

Final Thoughts

How large can the scale of stablecoins become? Consider this:

The total amount of liquid deposits in the U.S. is about $18 trillion. Currently, stablecoins only account for 1% of that market size. If we see the approval of interest-bearing stablecoins on a large scale or clearer regulatory frameworks emerge, what changes might occur in relative market share?

For investors, the signal is clear: now is the time to pay attention to stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。