Starting from the current state of the crypto market, this article explores the essence of the crypto world and its future direction.

Written by: Brook

Translated by: Sissi & Leia, TEDAO

Introduction: The chaos and lack of innovation in the crypto world raise the question: Are we genuinely making substantial progress towards an ideal future? The preface of "The Protocol Revolution and DigiLaw Engineering" examines the essence of the crypto world, the bottlenecks in its development, and the infinite possibilities for future construction from a systematic perspective, providing important insights for understanding the true nature of this new planet.

This article is the first in a series of preface content, starting from the current state of the crypto market to explore the essence of the crypto world and its future direction. More Chinese translated content will be released in succession, so stay tuned.

In September 2023, Matt Huang's article "Casino on Mars" reignited hope that had long been dormant during the crypto bear market. He likened the crypto world to a new planet being settled, reminding everyone that despite the various chaos currently present, it cannot overshadow its vigorous development and the infinite possibilities for future construction. He also rationally analyzed the duality of speculative behavior in the crypto casino, objectively acknowledging the existence of fraud, scams, and other malicious activities on the planet. This article served as a shot of adrenaline during a time of widespread skepticism and frustration, injecting new hope into the crypto world.

In 2024, the crypto world welcomed several significant historical moments: the U.S. Securities and Exchange Commission (SEC) successively approved spot ETFs for BTC and ETH; the U.S. House of Representatives passed the FIT21 bill, officially establishing a regulatory framework for digital assets; BTC experienced its fourth halving; and more. With numerous favorable developments, the crypto world saw a small wave of price increases.

However, during this small bull run, market volatility remained intense, casino speculation continued to flourish, Ponzi schemes and rug pulls persisted, and hacking attacks and scams were still rampant. What are the truly essential innovations? At the very least, the last wave of enthusiasm gave birth to DeFi and NFTs; what about this time? Meme trends? Inscriptions? Why is the sense of value among people diminishing, even leading to "crypto shame"? Are we genuinely making substantial progress towards an ideal future?

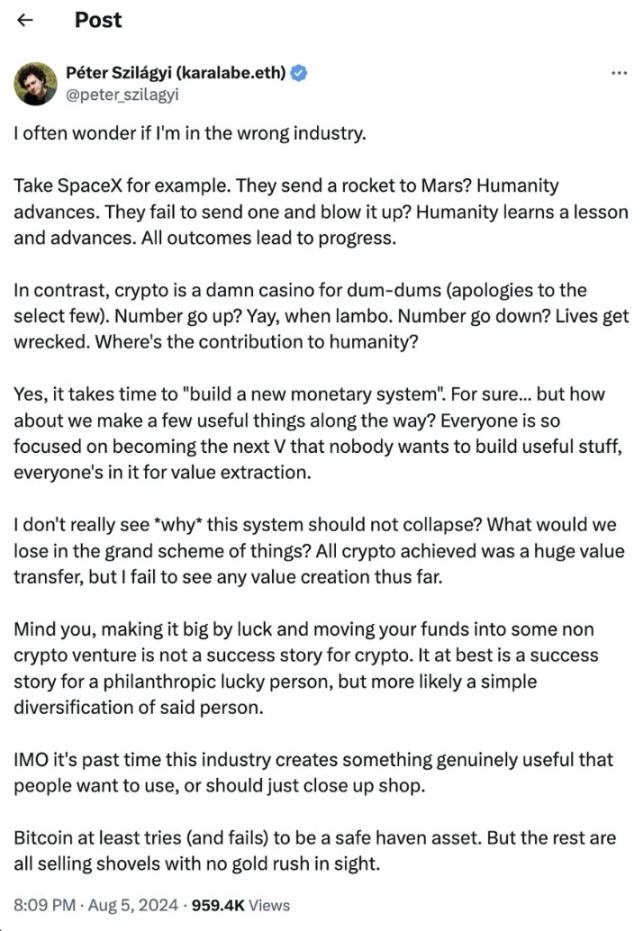

As I write this preface, nearly a year has passed since the publication of "Casino on Mars," and the market seems to have fallen into a similar period of silence once again. A recent tweet by Péter Szilágyi, reflecting on "self-reflection," sparked an industry-wide debate about the meaning of existence in crypto. He bluntly stated, "It's past time this industry creates something genuinely useful that people want to use, or should just close up shop."

While he believes that many great things are being created, the objective fact that cannot be ignored is: looking down on the entire crypto planet, we still have not established a prosperous crypto civilization. If we view blockchain protocols as urban infrastructure and smart contract protocols as city buildings, it must be said that apart from the unexploited wasteland, the cities under construction are largely ruins and half-finished buildings, with the normal operation of the city still relying on established structures like MakerDAO, AAVE, Compound, and Uniswap. It is undeniable that there are many projects that are beautifully packaged and have strong momentum, but how many of them will withstand the test of time, human nature, and market storms to become truly meaningful landmark buildings? Why can't we build skyscrapers? What gives us the right to attract the next billion users? Where are the bottlenecks in development? Or, more fundamentally, what is the true nature of the crypto world we are striving to build?

The SEC's thrilling 3:2 vote outcome, the market's ups and downs, and the fluctuating mindset of participants to some extent confirm my current thoughts:

The crypto world is not a binary opposition of black and white, but rather a superposition of "endless future," "open casino," and "breeding ground for evil." Different people see vastly different crypto worlds from different angles and levels.

In terms of market capitalization, high-value projects represented by Bitcoin and Ethereum contribute over 80% of the crypto market value, indicating that the overall crypto market is healthy. The crypto world has transitioned from being overlooked to once surpassing Apple in market value, and now beginning to gain recognition from mainstream financial markets. Following this development trend, it is very likely to gradually surpass gold and even real estate in the next decade. The rise of decentralized finance (DeFi), the popularity of non-fungible tokens (NFTs), the emergence of digital identity (DID) and decentralized autonomous organizations (DAOs), and the gradual implementation of regulations and recognition of legal status all indicate that the "endless future" of the crypto world is accelerating.

From the perspective of project quantity, among the tens of thousands of cryptocurrencies in the market (including memes, it exceeds hundreds of thousands), only a few hundred projects may ultimately hold value, while the vast majority still focus on "making money." They resemble "open casinos," unrestricted by time and space, where anyone can participate. This new type of casino is "openly evolving," with project teams seizing the greed of speculators, continuously updating casino gameplay through technological upgrades, creating endless and diverse new betting games, and continuously attracting waves of speculators to invest their "chips." The influx of resources further drives innovation in technology and business, and the "casino ecosystem" evolves openly through these repeated cycles.

From the perspective of malicious events, in areas not yet reached by regulation, criminals often use cryptocurrencies for money laundering and other criminal activities, as well as dark web transactions involving drugs and weapons, attempting to evade sanctions. Fraud, scams, and financial misconduct are also rampant in the crypto world; decentralized finance platforms and wallets frequently become targets of hacking attacks. These are objective facts, primarily due to the relatively free and open nature of innovation in the crypto world, where the speed of ecological evolution far exceeds the speed of regulatory implementation. Those "blank areas" not yet touched by regulation naturally become "breeding grounds for evil" for scammers. At the same time, the iteration of crypto technology also requires time; it is challenging to create a "perfect" underlying architecture in the early stages of new developments. "Vulnerabilities" are continuously repaired through trial and error, but this also provides potential opportunities for hackers to attack, inevitably becoming a breeding ground for malicious acts.

The blending of these three states makes it undoubtedly difficult for the majority of people to unravel the true nature of the crypto world. Some only see the "endless future," leading to blind worship; some only see the "breeding ground for evil," leading to fear and avoidance; some only see the "open casino," focusing solely on profit and ceasing to contemplate the true meaning of the crypto world.

Chris Dixon, in his book "Read Write Own," points out that blockchain networks can combine the social benefits of protocol networks with the competitive advantages of enterprise networks, ultimately reshaping the internet into a more open, democratic, and innovative "endless future." This book is concise and easy to understand, making it worthwhile for anyone wanting to better grasp the true potential of blockchain and Web3.

However, possibly due to space limitations, Chris Dixon only briefly acknowledges skeptics in the book without delving deeper. To help more people see the true nature of the crypto world, I believe it is necessary to clarify the following core questions:

First, what is the essential value of the crypto world?

Matt Huang points out in "Casino on Mars" that the crypto world is a new planet worth building because it offers a blank slate, giving us the opportunity to establish a new property rights system and construct an upgraded financial system and internet platform. This is an analysis from a relatively macro perspective. If we approach it from a more micro and first-principles perspective, what is the essential value of the crypto world? What is its most fundamental difference from the existing world system? What are the unchanging foundations and driving forces behind its vigorous development?

Second, why, after 16 years, is our understanding of the crypto world still in a fragmented state?

The emergence of new technologies often comes with significant skepticism and uncertainty, not only because it reshapes our way of life but also challenges our cognition and values. However, the fragmented understanding of the iPhone and Tesla quickly reached a consensus. Yet today, the crypto industry, led by Bitcoin, has made considerable progress; why is there still a large amount of positive and negative controversy intertwined? Why does the public's understanding of the crypto world remain filled with confusion and conflict, and why do many still fail to see the bright future of the crypto world?

Third, why is the prevalence and persistence of malice in the crypto world so rampant?

Why, after more than a decade of development, does the crypto world still face frequent chaos and disorder? Many often attribute this to "the emergence of any new financial market will be accompanied by various problems." However, there is a very contradictory point, which I call the "crypto paradox": the original intention of the crypto world was to build a new system from "do not do evil" to "cannot do evil" using blockchain technology and decentralized concepts, yet it has now fallen into the absurd predicament of "widespread malice." This inevitably raises the question of whether the malice in today's crypto world possesses some form of specificity.

Fourth, how can we realize the original intention of the crypto world and maintain a safe and ethical development environment?

The crypto world is still in its early stages of development, with many orders gradually being established. New entrants who rashly venture in can easily end up with "nothing to show for their efforts." When existing infrastructure cannot adequately support the original intention of decentralization in the crypto world, can we collaborate with traditional regulatory agencies and the community to establish a mechanism that can spontaneously monitor and compress the space for malice, building an "immune system" for the crypto world to comprehensively purify its development environment? At the same time, can we also provide ordinary people caught in the midst of it all with a broader perspective to better understand the overall development of the crypto world?

However, these questions cannot be clarified through just a few articles.

Since I first encountered Bitcoin and Ethereum in 2016, I have personally experienced two massive bull-bear cycles in the crypto market, witnessing the rise and fall of hundreds of crypto projects. Some projects have managed to transcend cycles and continue to thrive today; others have dominated during bull markets but collapsed in an instant during bear markets; some projects have simply used the guise of Web3 and decentralization to engage in Ponzi schemes and scams. When we strip away the halo of "crypto" and "decentralization," turn off the beautification, and remove the filters, what is the true nature of each project? Crypto entrepreneurship? Crypto business? Or just crypto money-making? My past experiences have deeply made me aware of the dangerous yet alluring complexity and chaos of the crypto world, as well as the importance and urgency of deeply understanding and collaboratively addressing these challenges at this stage.

I have always wanted to write a book that gathers rational and profound cutting-edge insights that have been overwhelmed by a flood of information, exploring the underlying laws behind common issues, and attempting to string together existing wisdom using a relatively scientific and rigorous logical framework. I plan to name this book "The Protocol Revolution and DigiLaw Engineering," not only to understand the aforementioned issues from a more first-principles perspective but also to outline a systematic and comprehensive practical methodology, hoping to reduce participants' blind and chaotic exploration and lower unnecessary trial-and-error costs.

The desire to write this book does not imply that my answers are correct and profound; rather, in the still chaotic early development of the crypto world, there is indeed a need for effective sorting and summarization. Therefore, the 1.0 version of this book will be completed by a centralized small team led by me. But this is merely a beginning; I hope it can become an open community for discussion in the future, where everyone can engage in open dialogue, collide ideas, and co-create the 2.0 version of this book.

It should be noted that when describing this field, I prefer to use the term "Crypto." As the industry develops, the possibilities built on blockchain in the coming decades will far exceed the current imagination, and buzzwords like "Web3" and "metaverse" are likely to be replaced by emerging concepts that will continue to appear. The "crypto world" commonly understood today specifically refers to the new digital ecosystem built on decentralized public chain technology following the emergence of Bitcoin and blockchain. It also encompasses the infinite possibilities generated by the combination of some new cryptographic technologies (such as zk and homomorphic encryption) with blockchain technology. At least at this stage, I believe that naming it the "crypto world" is still relatively appropriate.

This book will focus more on exploring and solidifying the universal laws that have been validated by the market, which can help participants navigate through bull and bear cycles to address longer-term issues and challenges. It does not intend to discuss the current phenomenon-level cutting-edge hotspots in depth, as they may not withstand the test of time. This article will serve as the preface to "The Protocol Revolution and DigiLaw Engineering," briefly outlining my thoughts on the four questions mentioned above, as well as the vision and content overview of the book.

The content of this book strives to be accessible and easy to understand, suitable for a wide audience wanting to gain a deeper understanding of the crypto world.

For bystanders and newcomers, this book will introduce the complex concepts, technologies, and developments of the crypto world through rich case studies, allowing you to quickly gain a relatively objective and rational understanding of the crypto world at minimal cost.

For active participants, this book will summarize the historical development patterns of the industry and the characteristics of quality projects that have successfully navigated bull and bear markets, providing a perspective of "trust economy" to help rationally analyze and filter out truly valuable crypto projects, rather than relying entirely on "luck" and "industry dividends."

For innovative builders, this book will focus on discussions of business models, rapid industry scanning, and sharing a theoretical framework and engineered smart solutions designed for the DigiLaw ecosystem, which are essential courses for every builder's growth journey.

For regulators and policymakers, this book aims to provide a new understanding of the complexity of the crypto world and its rapidly evolving ecosystem mechanisms. By analyzing the DigiLaw ecosystem, it hopes to help you find the boundaries of regulatory scope, thereby formulating more comprehensive and long-term effective policies to jointly create a healthy, fair, transparent, and innovative digital natural environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。