Original author: Three Sigma, Blockchain engineering and auditing company

Original compilation: Felix, PANews

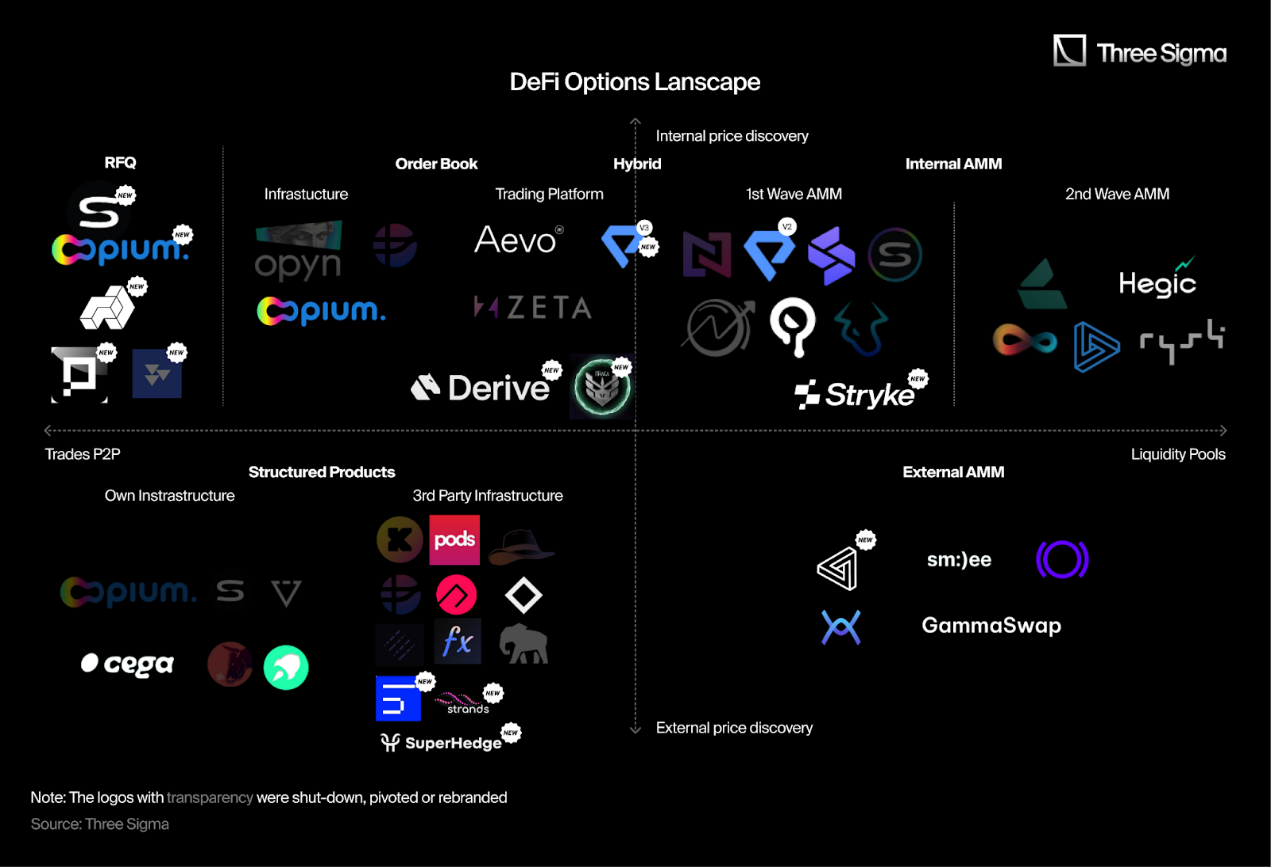

The DeFi space is continuously evolving, and the options market has made significant progress. New protocols, products, and strategies are emerging, reshaping decentralized options trading. It is crucial to reassess this changing landscape and evaluate the trends shaping the future of DeFi options. A year ago, protocols were categorized into four main types:

Order Book

AMM (Internal)

AMM (External)

Structured Products

Since then, protocols in each category have undergone significant changes. Some protocols have actively expanded, while others have shifted to new models or, unfortunately, shut down. The outlook is both challenging and hopeful, and survival in this fast-paced environment is not guaranteed.

As @DanDeFiEd (founder of rysk finance) mentioned in his derivatives talk at the Milan Polytechnic last year, "Some of you are NGMI." (Note from PANews: NGMI stands for Not Gonna Make It, meaning unable to succeed). His words have proven to be prescient. Of the 50% of protocols mentioned in the original report, either they have abandoned their options business or ceased operations. The DeFi ecosystem can be ruthless, and only the most adaptable will survive.

But why such a high elimination rate?

Over the past year, point systems and MEME coins have dominated, raising questions about sustainability and value creation. For many options protocols struggling to find product-market fit (PMF), the preference for leverage in perpetual contracts has been a key challenge.

Additionally, the rise of point trading has shifted attention and liquidity away from more complex structured products like options.

Have the protocols that faced difficulties last year successfully adapted, or has the increasing focus on perpetuals and short-term rewards determined their fate? The answers are as diverse as the projects themselves, but one thing is certain: the road ahead will only become more difficult.

Overall Trends

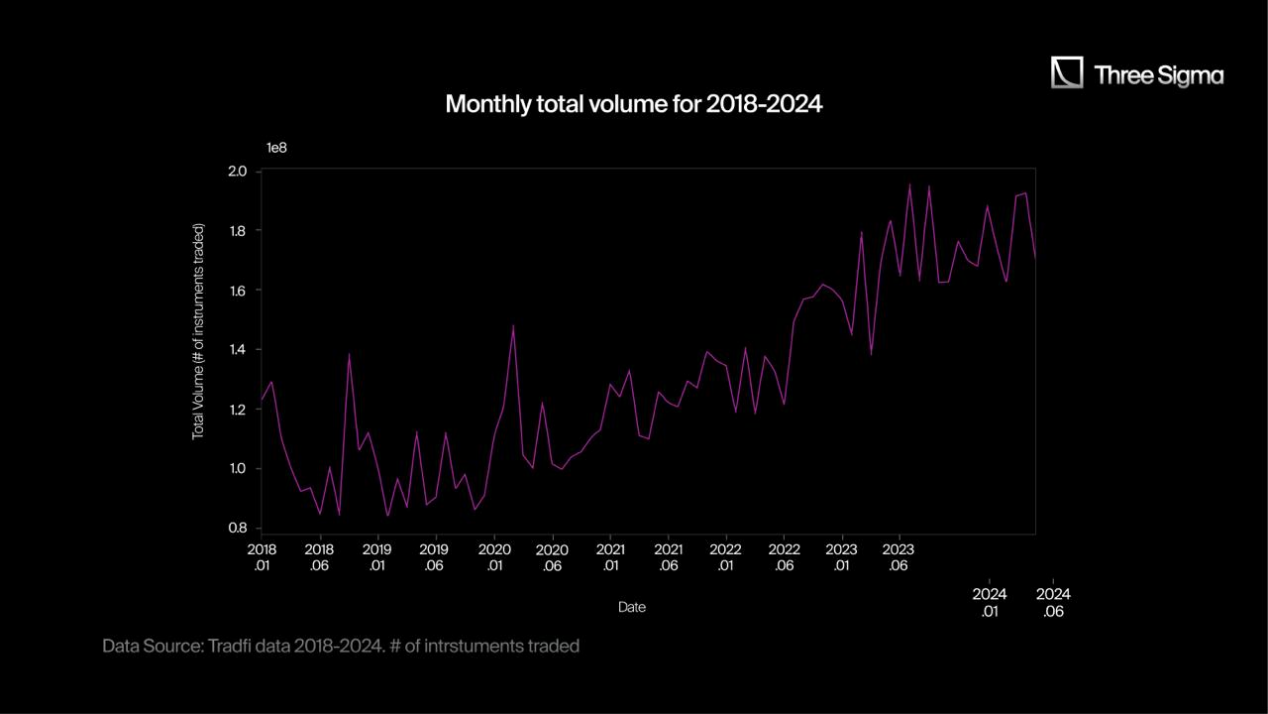

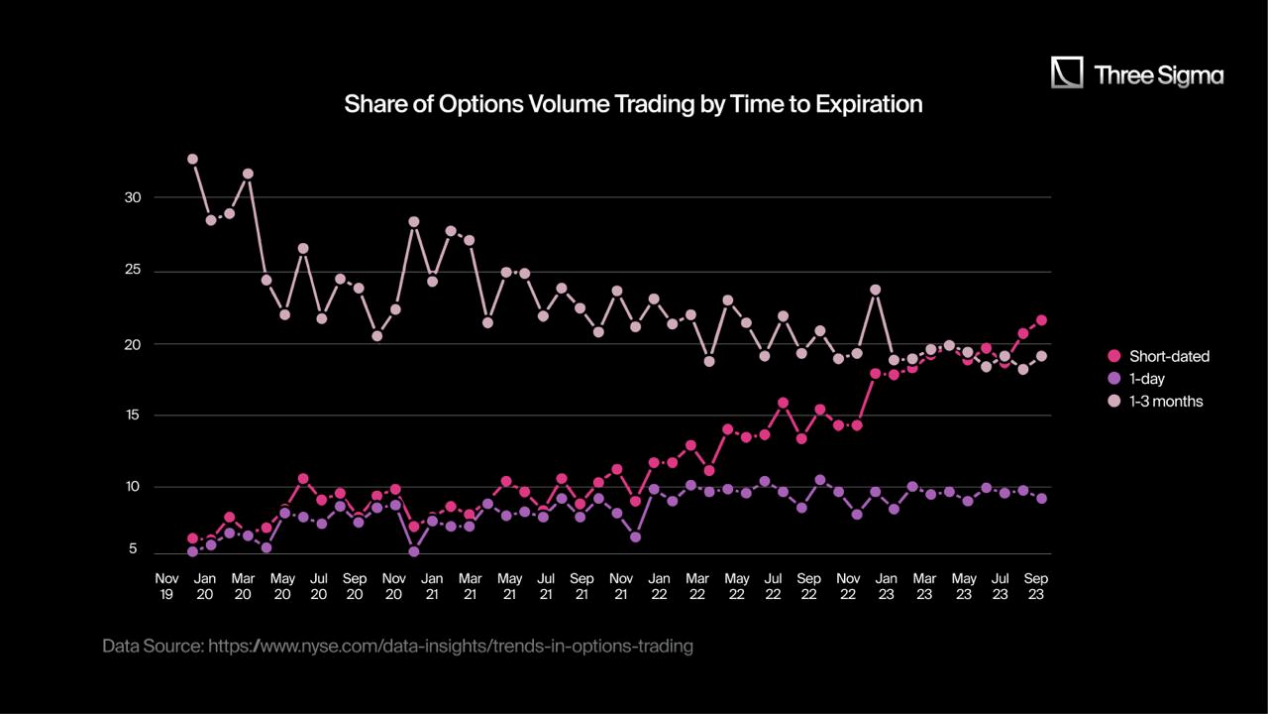

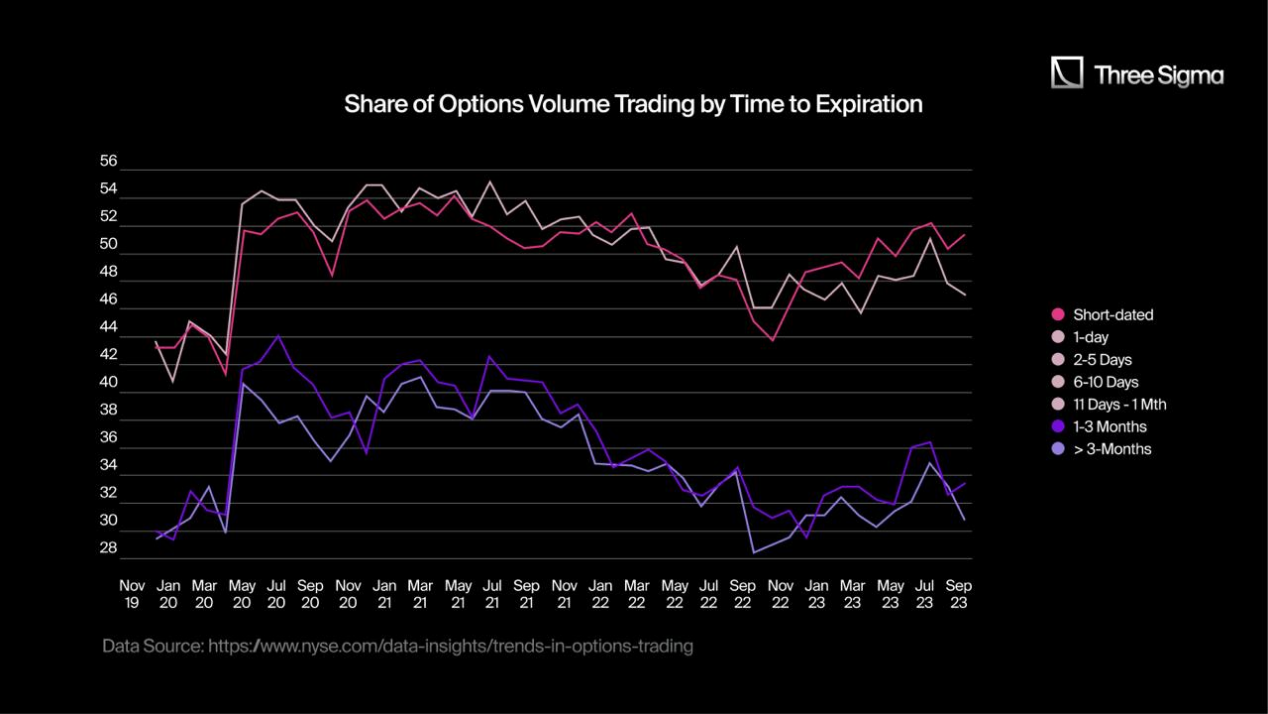

“[…] According to our estimates, the retail share of options trading volume in the U.S. stock market is […] 45%, […]. The growth in the retail share of options was initially driven by the pandemic in 2020, as retail options traders seized short-term options to bet on market direction, and this share has continued to grow. The trading volume share of low-priced options is also increasing, further driving overall options trading volume, especially among retail traders. These trends do not seem to be in danger of reversing.”

New York Stock Exchange — Options Trading Trends, December 2023

In traditional finance (TradFi), retail traders are increasingly interested in high-risk, short-term options. This shift is evident in the data: weekly options trading volume has doubled, rising from about 100 million contracts per week in 2018 to 200 million contracts in 2024. This means a significant increase in the number of positions opened and closed each week.

As retail traders outside the crypto space heavily lean towards short-term, high-leverage opportunities, the question arises: Can DeFi options capitalize on the same momentum? Or will perpetual options continue to dominate the crypto leverage narrative?

Development of DeFi Options

“We found PMF” — a founder told an unsuspecting VC

“Huuugeee TAM (Note: Total Addressable Market)” — the same founder told the same unsuspecting VC

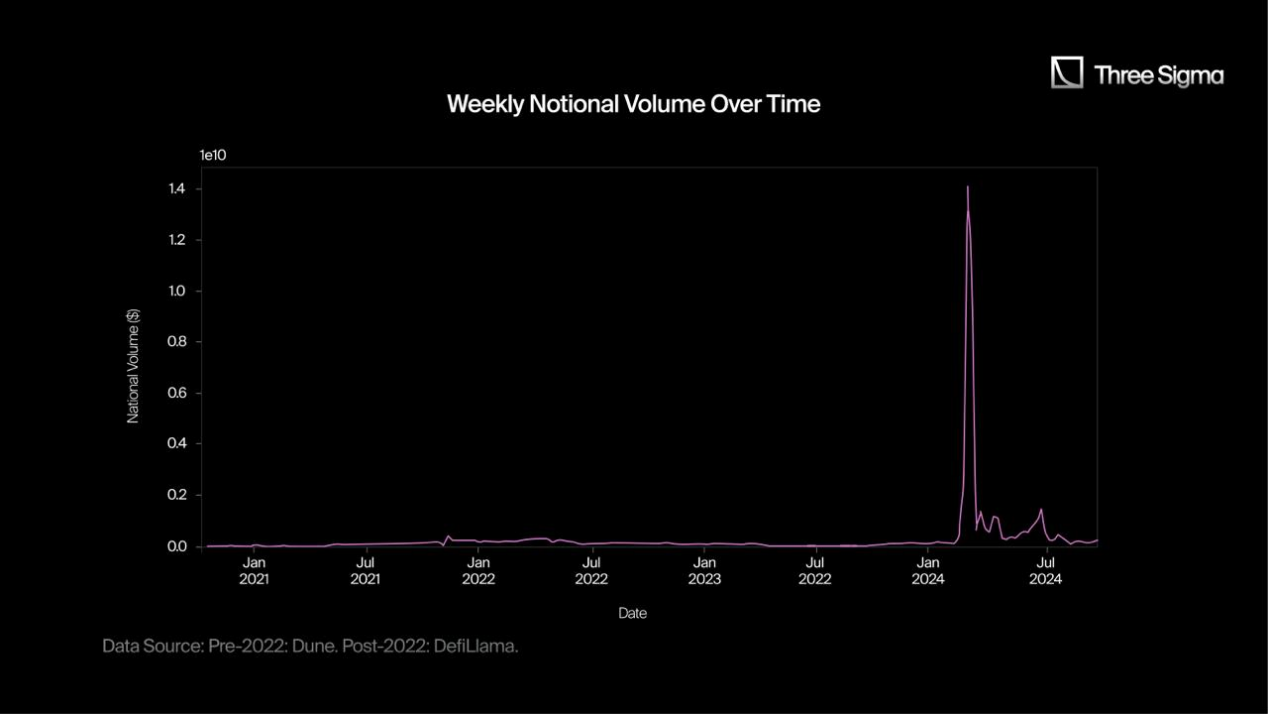

Throughout 2022, options vaults like Ribbon gained popularity, capturing the interest of the DeFi community. However, as the initial excitement faded, nominal trading volume began to steadily decline from the end of 2022 to 2023. This downturn reflects the broader challenges faced by DeFi options protocols in maintaining momentum.

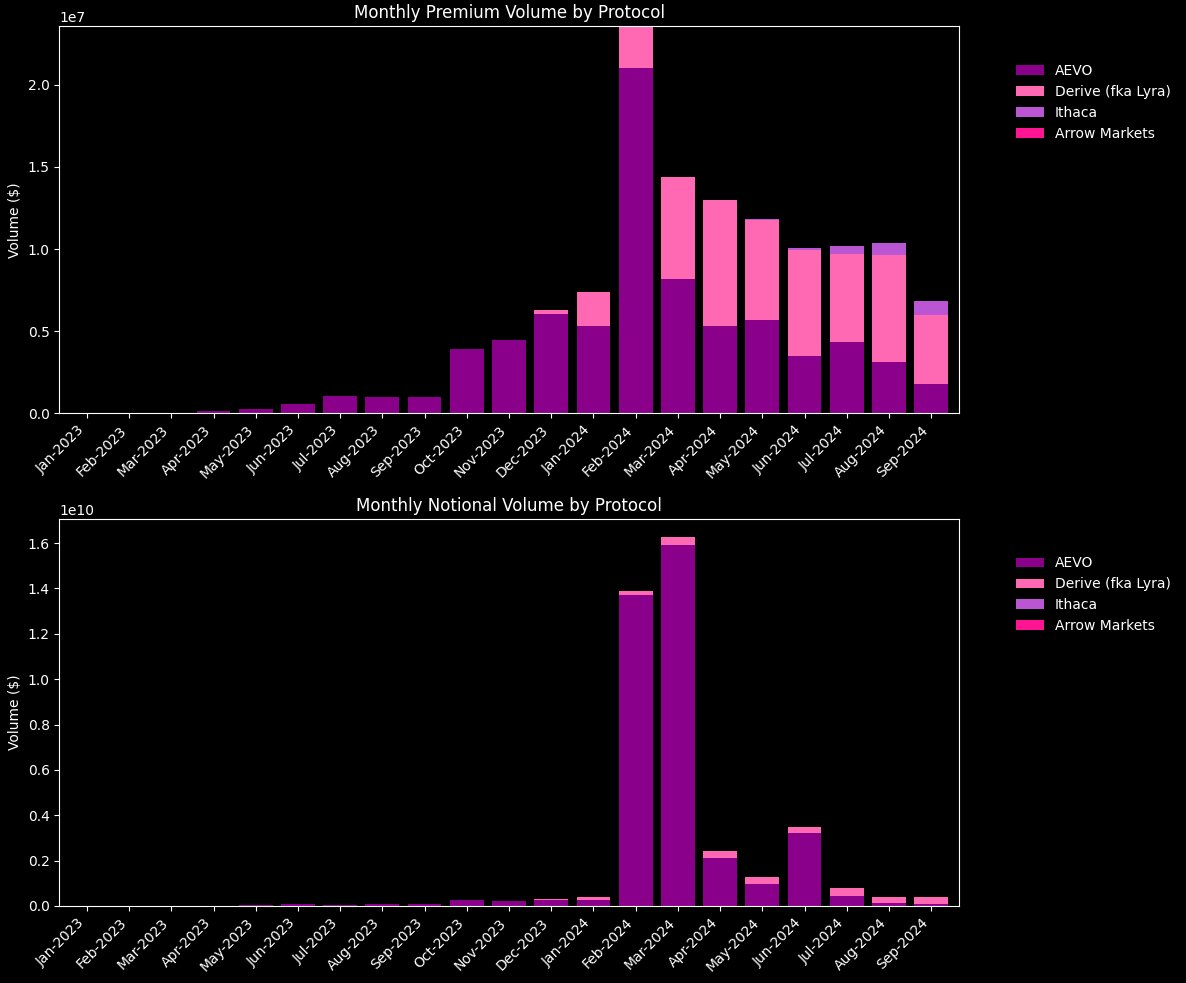

However, by 2024, the situation began to change. The introduction of new exchanges and products, such as AEVO, Derive (Lyra's application chain), and Stryke, helped rekindle interest in the space, gradually reclaiming market share. The following are nominal trading volume data:

September 2021: $392 million

September 2022: $411 million (year-on-year growth of 1.05 times)

September 2023: $78 million (year-on-year decline of 0.19 times, trading volume down 81%)

September 2024: $866 million (year-on-year growth of 10.99%)

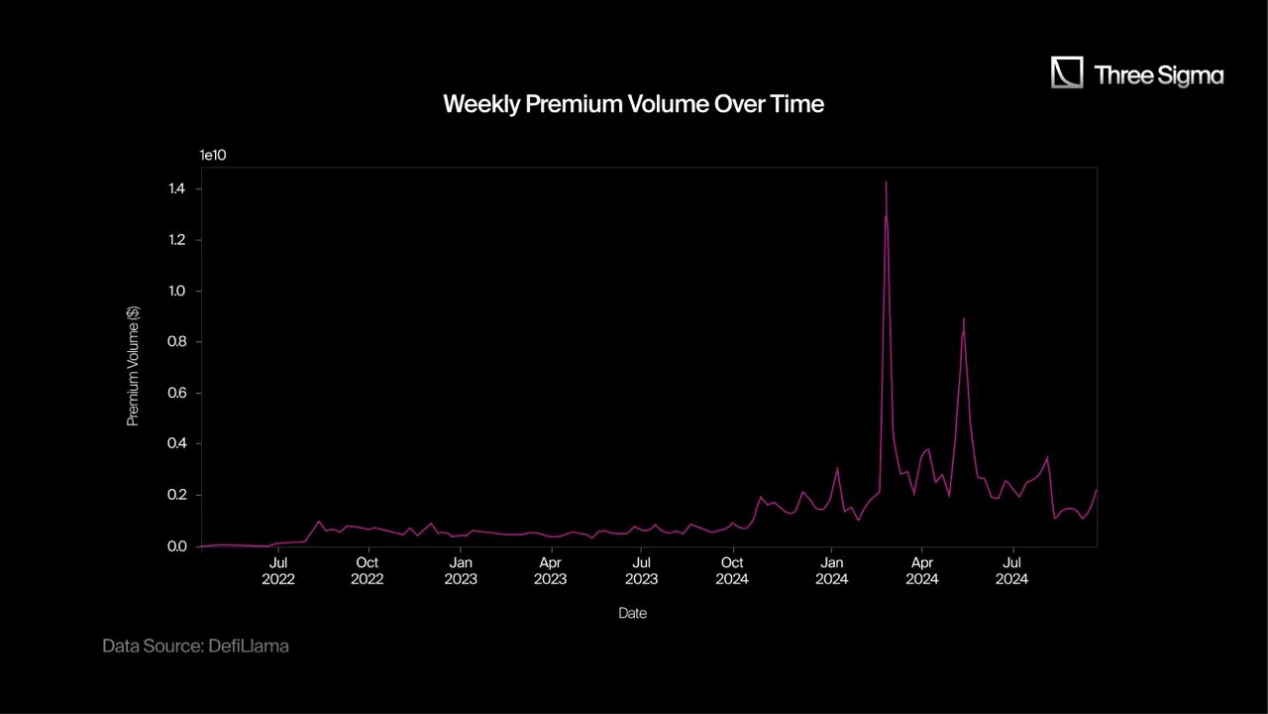

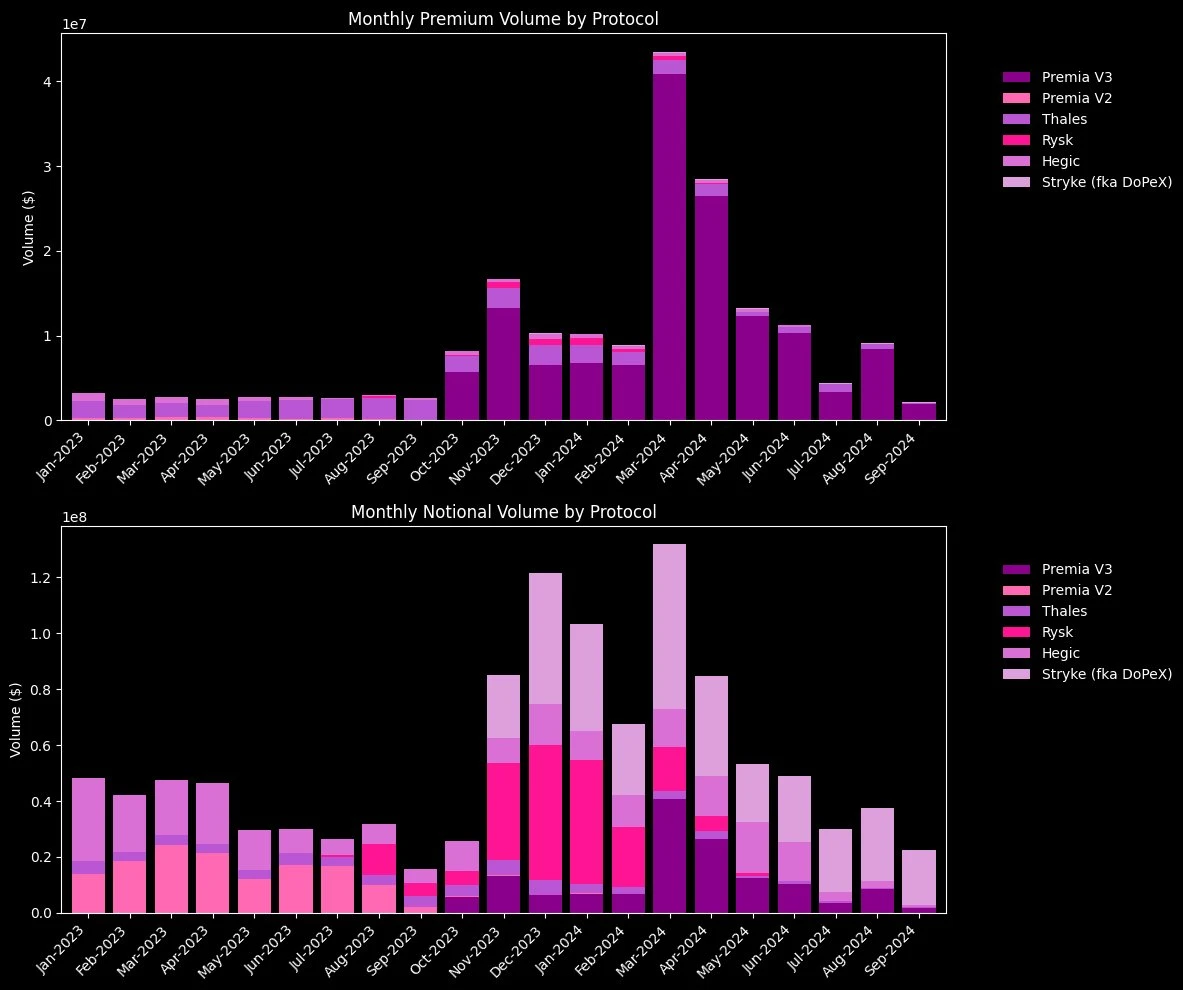

In addition to the surge in nominal trading volume, another key indicator of market health is premium trading volume — the amount buyers pay sellers for options. Strong recovery data from 2022 to 2024:

September 2022: $3.8 million

September 2023: $3.3 million (year-on-year change: 0.87 times)

September 2024: $10.3 million (year-on-year change: 3.11 times)

The growth in premium trading volume highlights new demand for DeFi options, as buyers are willing to pay significantly higher premiums in 2024 than in previous years. This reflects a market shift, with new products and more complex strategies driving increased participation and confidence in the options space.

While nominal trading volume skyrocketed 18 times from 2023 to 2024, the premium for liquidity providers (LPs) only grew 3.7 times. This discrepancy indicates that while trading activity surged, a significant portion of it was driven by cheap options, likely out-of-the-money (OTM) options. High trading volume may be impressive, but the lower premium growth suggests that the market is still dominated by low-cost, high-risk options.

Options vs. Perpetual Contracts: The Battle for Dominance

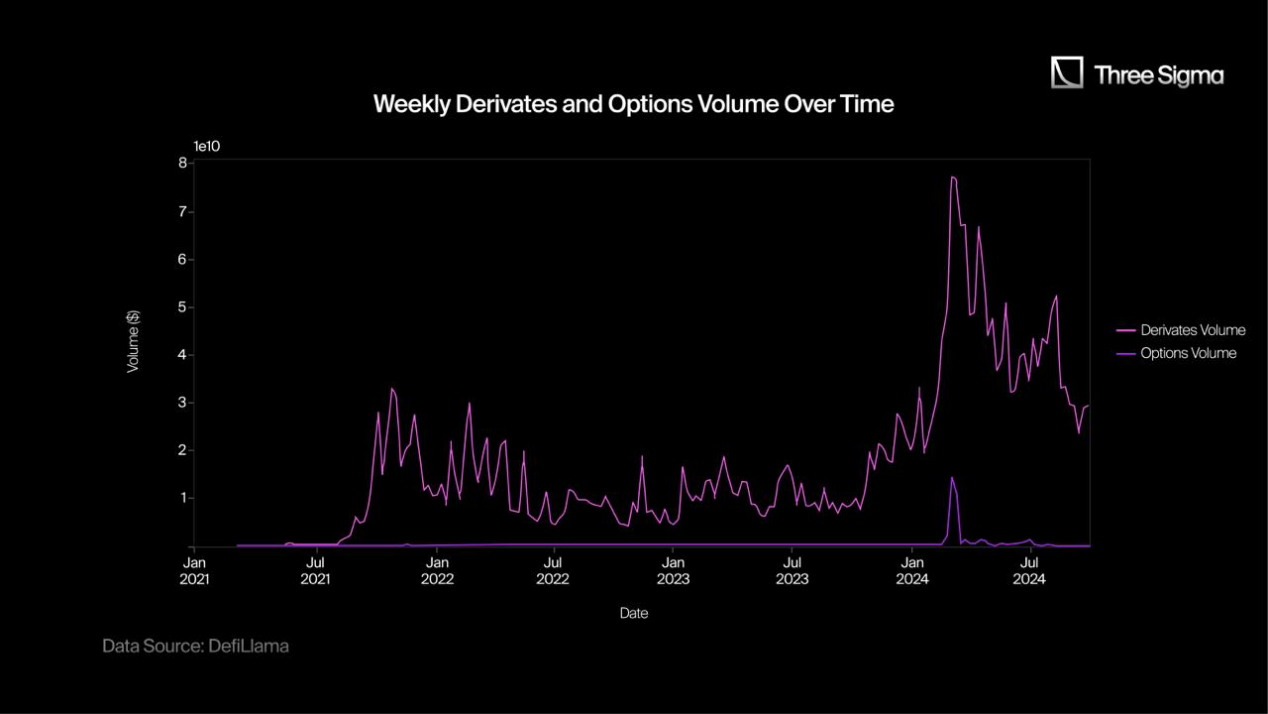

Despite the rapid growth of DeFi options, perpetual contracts still dominate.

Although the gap between the two remains large, it is gradually narrowing. In 2022 and 2023, the weekly on-chain trading volume of perpetual contracts ranged between $10 billion and $12 billion, growing to $41 billion by 2024. Meanwhile, options trading volume remains about 1/100th that of perpetual contracts.

September 2022: The trading volume of perpetual contracts was 85 times that of options

September 2023: This gap widened to 400 times

September 2024: It has narrowed to 160 times

Although the DeFi options space has struggled to match the scale of perpetual contracts, there is still hope for development. When reviewing research from a year ago, it is clear that the industry is growing, despite uneven development. Most users still prefer perpetual contracts due to their simplicity and strong liquidity, placing options protocols in a more challenging position.

The options space is heavily overshadowed, with many projects continuing to struggle for PMF in a market still dominated by perpetual contracts.

The key question remains: Where will future demand for DeFi options come from? As traders seek more complex strategies, can DeFi options carve out their own niche market, or will perpetual contracts continue to dominate the on-chain derivatives space?

New Faces

As DeFi options continue to evolve, several new protocols have emerged. Here is a brief analysis of these new entrants:

Order Book/Request for Quote (RFQ)

Arrow Markets — Launched on Avalanche using an RFQ system

Ithaca — Features an off-chain order book with on-chain settlement capabilities

Predy V6 — Expected to launch soon with intent-based options

Valorem — Utilizing an off-chain streaming RFQ system. Unfortunately, it has become outdated.

External AMM

- Limitless — A platform without oracles and liquidation, where Uniswap LPs can earn by lending their liquidity positions to traders/borrowers even when out of range.

Structured Products

3Jane — A Ribbon fork that allows early depositors to earn more.

Strands — Structured products based on Lyra and CME, allowing traders to tokenize their covered call options.

SuperHedge — Allows users to deploy assets on platforms like AAVE or Ethena, stake yield tokens on Pendle, and use part of the yield to purchase options.

Other Protocols

ClearDAO — Provides an options SDK.

Jasper Vault — Offers 0DTE and 2-hour options with permissioned liquidity and internal pricing oracles.

Sharwa (Dedelend) — Originally an aggregator for Ryks, Hegic, Premia, etc., the upcoming version will introduce 10x leverage, using WBTC, WETH, and USDC as collateral, supported by Hegic.

tealfinance — An aggregator that compares prices across different platforms (e.g., bitbit).

Umoja — Creates synthetic options by adjusting positions in token and perpetual contract portfolios based on market trends.

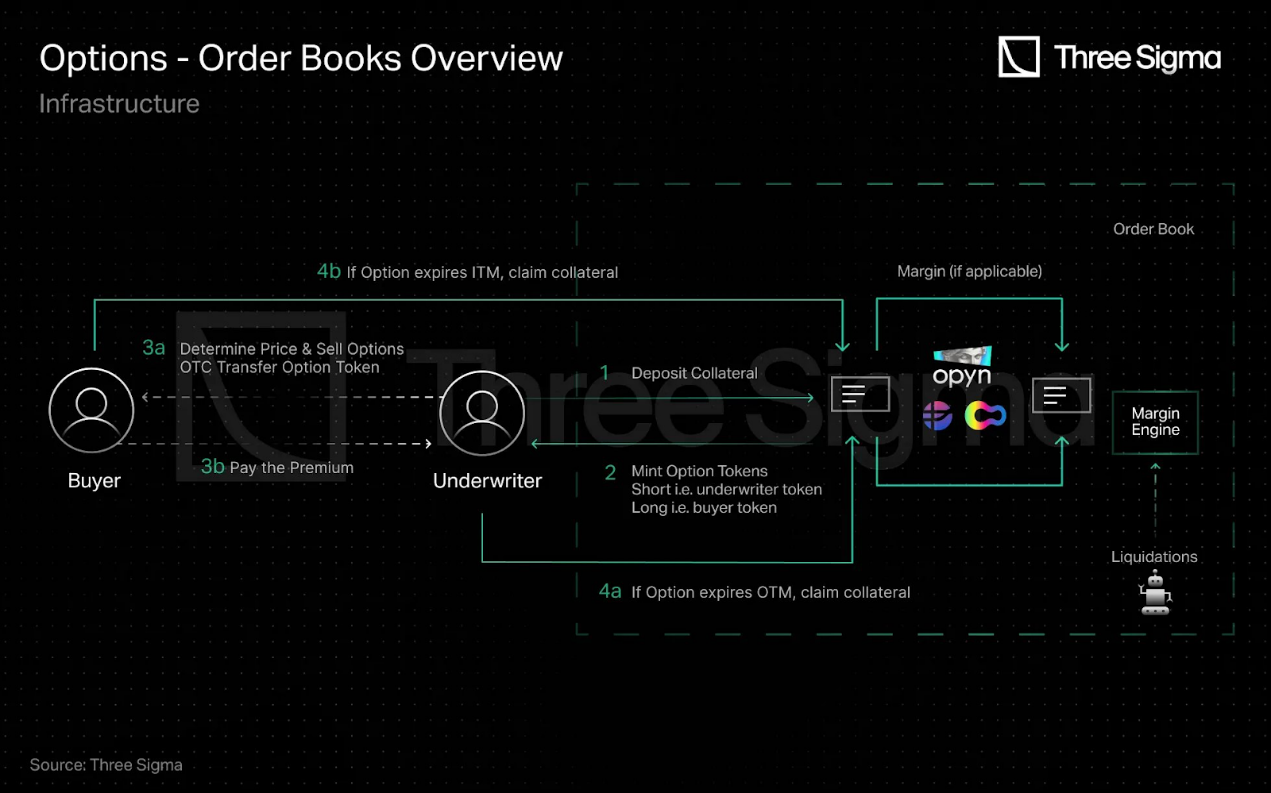

Order Book

The order book landscape within the DeFi options space can be divided into two main categories: protocols that provide order books for others to build infrastructure and protocols that serve as trading platforms. The reality is harsh, with 3 out of 6 having exited. Here’s a deeper look at what has happened:

Still Developing:

AEVO — As a top competitor in the on-chain options market, AEVO's rise is simple: token mining. AEVO allows traders to take 10x long positions on a single Bitcoin under appropriate collateral or to purchase ultra-low-priced out-of-the-money (OTM) options. For example, an option with a nominal value of $40,000 can be bought for just a few cents if the seller is willing to underwrite it.

(Note from PANews: Out-of-the-money options refer to options whose strike price renders them worthless. For call options, the strike price is above the current market price; for put options, the strike price is below the market price.)

This has led to AEVO achieving monthly trading volumes in the billions, setting historical highs for the protocol and the entire on-chain options market.

Although nominal trading volume surged, premiums remain low due to the large number of forward OTM options. Considering that March's trading volume was $16 billion and April's was $2 billion — despite an 8-fold increase in trading volume, premiums only rose by 50% ($8.2 million vs. $5.3 million). Even without implementing the token mining program, AEVO remains one of the protocols with the highest nominal trading volume.

Derive (fka Lyra) — After transitioning from the Synthetix ecosystem, Derive now operates its application chain, Derive Chain, on the Optimism (OP) Stack. By shifting to an order book model, Derive provides a more efficient trading experience, with monthly settlement volumes between $200 million and $300 million.

Opium — Once a foundational infrastructure provider, it has now shifted focus to zero-day-to-expiration (0DTE) options, reflecting the growing interest of retail markets in short-term tools in TradFi.

Exiting the Options Business or Failing

Opyn — Despite early success with its options suite, Opyn never generated any revenue through it. The team has since shifted to perpetual contracts.

Psyoptions — Has ceased operations with no clear development direction.

Zeta — Has abandoned options and is now fully committed to perpetual contracts, which have proven to be more sustainable for them.

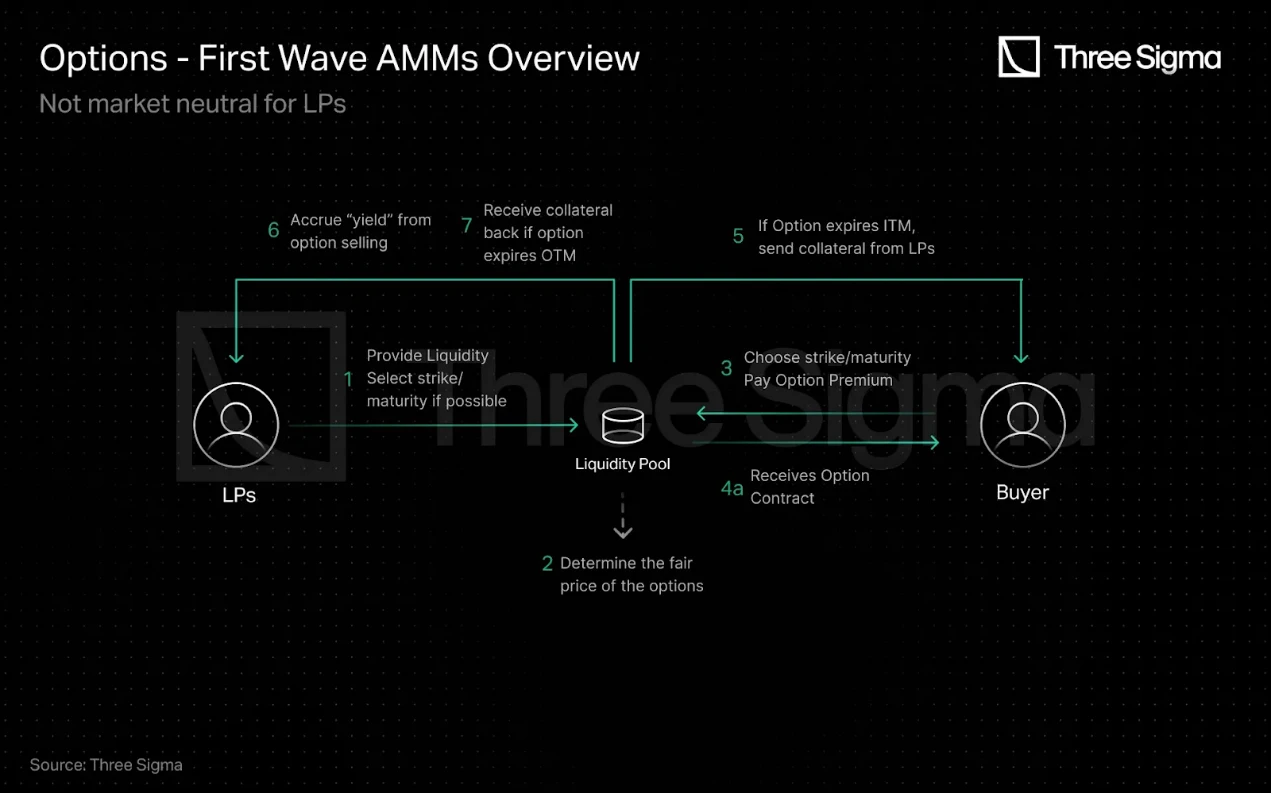

AMM (Internal)

Protocols that use internal AMMs for options pricing. Some protocols adopt complex liquidity provision strategies, while others are simpler and rely more on the risk of their LPs. Today, 3 out of 10 protocols have either transformed or shut down.

Still Developing:

Deri — With the launch of the V4 protocol, Deri has attracted significant funding on Linea and now offers perpetual contracts and perpetual derivatives, with its liquidity pool acting as the counterparty for all trades.

Hegic — Launched 0DTE options in the summer of 2024, but its core product, one-click strategies, has remained unchanged for years.

IVX — Offers 0DTE on Berachain.

Premia — V3 adopts a hybrid model, combining CLAMM on Arbitrum One with an on-chain order book on Arbitrum Nova. Monthly trading volume ranges from $6 million to $15 million, and the team plans to launch premium V4 to improve collateral and introduce perpetual contracts.

Rysk — After the success of V1, Rysk is now focused on building Rysk V2, which will create vaults for a decentralized order book DEX, allowing market makers to sign orders from these vaults.

Stryke (fka DoPeX) — Successfully transformed their AMM by introducing CLAMM and managed to turn the situation around. Over the past year, monthly trading volumes have reached $20 million to $50 million. During the rebranding process, Stryke also migrated from their dual-token model (DPX / rDPX) to SYK, phasing out the rDPX token. Now, xSYK represents the staked version of the SYK token.

Thales — Supports trading of binary options and on-chain derivatives on the Ethereum network. Although the protocol belongs to a niche market, monthly trading volume has consistently remained around $5 million. However, by the second half of 2024, trading volume has dropped to $1 million per month, down from higher levels earlier this year.

Exiting the Options Business or Failing:

Ntropika — They seem to have never successfully launched. Despite raising $3.2 million from a tier-one venture capital firm in August 2020 and another $12 million from NFT sales in 2022, there has been little activity since. Rug pull? Development issues? The community knows nothing.

Oddz — Originally an options-AMM protocol, Oddz later shifted to become a perpetual options aggregator.

Siren — Once based on AMM, it has now transitioned to an oracle/RFQ system, with off-chain pricing managed by a select group of whitelisted providers known as Siren Guardians.

AMM (External)

What does external AMM mean? These protocols utilize third-party spot AMMs (like Uniswap or Balancer) as a foundational layer, enabling others to trade options seamlessly. Currently, all 3 are operational.

GammaSwap — Launched on Arbitrum, GammaSwap offers over 20 assets. A key development is that they now use an internal spot AMM (Delta Swap) to support the platform instead of Balancer or Uniswap. Since its launch in January 2024, the protocol has facilitated approximately $130 million in nominal trading volume, averaging $13 million per month.

Panoptic — After several alpha tests on L2s and alt-L1s, it is preparing for its mainnet launch, expected to go live before the end of 2024.

Smilee — Launched on Arbitrum, Smilee offers wETH, wBTC, GMX, and ARB options. Since its launch in March 2024, the protocol has achieved approximately $71 million in nominal trading volume, averaging $10 million per month.

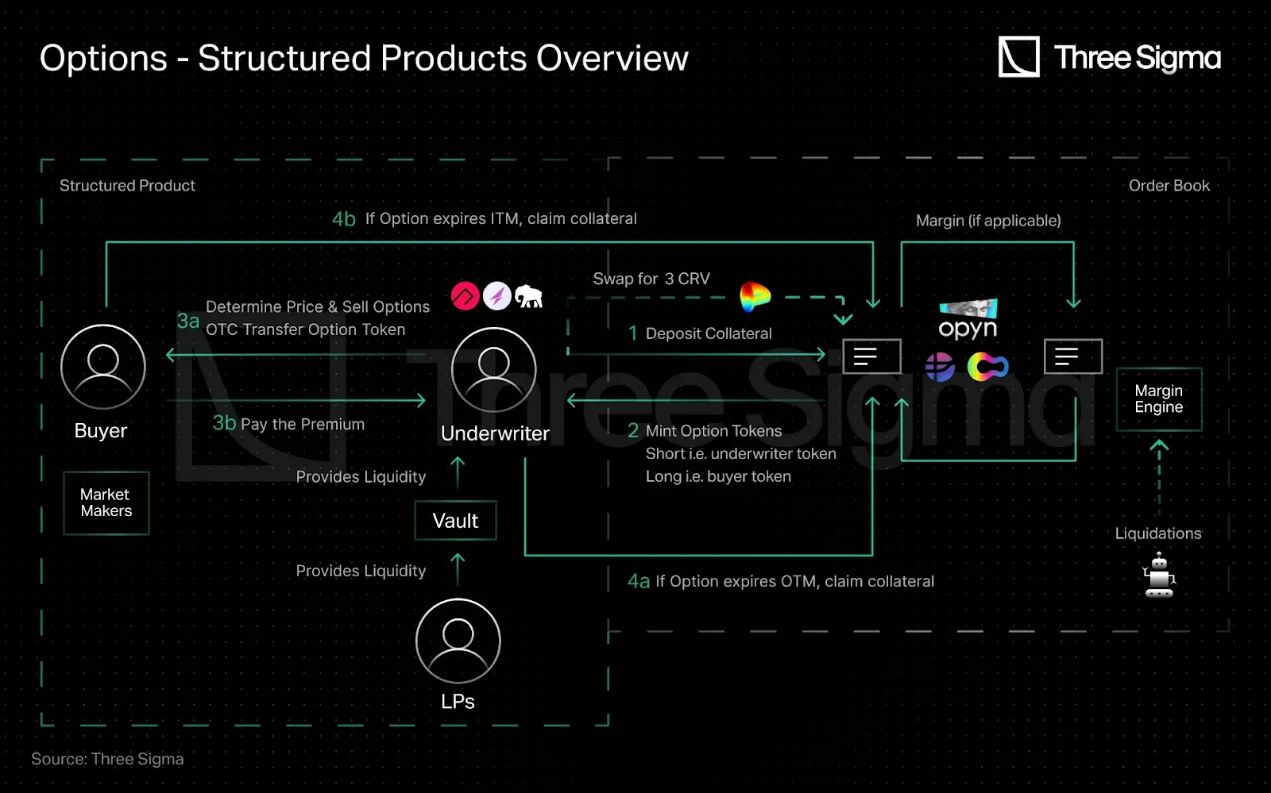

Structured Products

This sector once held the largest share of DeFi options TVL, but its luster has clearly dimmed — 9 out of 13 protocols have adjusted or discontinued their products.

Still Developing:

Cega — Continues to offer knock-in and knock-out vaults, expanding beyond Solana and integrating Pendle YT tokens for additional yield.

PODS — Still active, using yield-bearing assets (stETH, aUSDC) to purchase options, providing a unique approach compared to other structured products.

Ribbon — Although TVL has decreased and the team's focus has shifted to AEVO, Ribbon is still operational.

Thetanuts — Continues to operate, with recent vaults focusing on Pendle's PT tokens.

Exiting the Options Business or Failing:

Cally and Putty Finance — Both protocols are struggling to find market-fit products as the NFT market cools down.

JonesDAO — Has abandoned its options vault, marking its exit from the options space.

Katana — Acquired by PsyFi through a merger on April 4, 2023.

Knox Vaults — Integrated into Premia's V3 ecosystem as part of a broader strategic shift.

Polynomial — Transitioned to become a derivatives L2, now focusing on perpetual contracts.

Polysynth (now Olive) — Closed its options vault and shifted to become a universal aggregation liquidity layer across L1 and L2.

Primitive — Has not gained significant traction. The team is currently focused on building Pluto (Pluto Labs).

PsyOptions — Despite acquiring Katana, PsyOptions closed its vault and other products in June 2024.

StakeDAO — No longer offers an options vault.

Will History Repeat Itself?

The revival of on-chain options trading volume led by order books like AEVO and Derive signals a positive trend, but it raises important questions about decentralization. Just like the perpetual market, complete on-chain and decentralized solutions may no longer be as attractive as before. Instead, protocols are shifting towards centralized L2s or application chains to better control the key parameters needed to build efficient order books.

New protocols like GammaSwap and Smilee offer hope for attracting new users to options trading, but the market remains brutally unforgiving. As the saying goes, history does not repeat itself, but it often rhymes. It is quite possible that within a year, several of the protocols listed here will no longer be operational, proving the ruthless and rapidly evolving nature of the DeFi market.

However, despite the challenges, the increase in options trading activity is undeniable. With the perpetual contract market still approximately 100 times larger than the options market, the challenge for options protocols is to make their products accessible to inexperienced users.

Related Reading: All set, just waiting for the right moment: Exploring decentralized options

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。