Chain Abstraction is one of the most discussed narratives in the current cryptocurrency space. This narrative aims to abstract complex blockchain concepts into a unified model or interface, allowing developers and users to create applications or interact more easily without dealing with the underlying technical complexities.

In other words, chain abstraction means hiding complex technologies behind the scenes, allowing users to interact without being aware of the blockchain's existence—just as internet users do not need to know which cloud service provider they are interacting with, blockchain users also do not need to know which chain they are interacting with.

Limitations of Chain Abstraction

However, the narrative of chain abstraction is facing an objective limitation in its implementation: under the concept of chain abstraction, the liquidity of various underlying blockchains should be freely and efficiently accessible, but the reality is not so.

Currently, the interoperability of liquidity between multiple chains mainly relies on bridging protocols like LayerZero and Wormhole. However, since the usage needs of each blockchain vary, the overall available liquidity on bridging protocols tends to gradually flow towards chains with higher usage demands, leading to an imbalance in available liquidity between chains. To ensure the sustainability of cross-chain functionality, liquidity rebalancing is necessary. Currently, the entities executing the rebalancing tasks behind bridging protocols are mostly the protocols themselves or other large liquidity providers (also known as Solvers, which may include exchanges, market makers, or other roles), who actively coordinate inter-chain liquidity based on actual supply and demand conditions.

The key issue is that this active coordination mechanism has several drawbacks: first, it is inefficient, which may indirectly limit the liquidity availability of certain blockchains; second, it has low economic efficiency, as high costs can lead to significant unnecessary wear and tear. More importantly, the lack of economic benefits can limit the motivation for bridging services to expand to new chains or new tokens, which is detrimental to the expansion of the multi-chain ecosystem. In summary, the concept of chain abstraction is currently constrained by objective liquidity conditions, making it difficult to realize its imagined utility, which directly undermines the narrative's core claim of "lowering barriers and improving experiences," thereby restricting its real-world implementation.

Everclear's Solution

The entities most acutely aware of the above issues are the major bridging protocols operating at the forefront of cross-chain interactions.

In June of this year, Connext, which was previously positioned as a bridging protocol, announced a strategic upgrade and rebranded itself as Everclear. Everclear's new positioning is to serve as a settlement layer to coordinate the settlement and balance of inter-chain liquidity, addressing the issue of liquidity not being freely and efficiently accessible.

Along with the rebranding, Everclear also announced a $5 million funding round through the sale of NEXT tokens to Pantera Capital.

In Everclear's view, the blockchain industry is no longer lacking in bridging protocols; in fact, there are countless bridging protocols in the market clustered around different ecosystems, and liquidity rebalancing has become a common challenge faced by all bridging protocols. To this end, Everclear aims to build an effective liquidity coordination mechanism that breaks the current isolated, active liquidity rebalancing model, providing a unified, efficient, and low-cost solution for all bridging protocols.

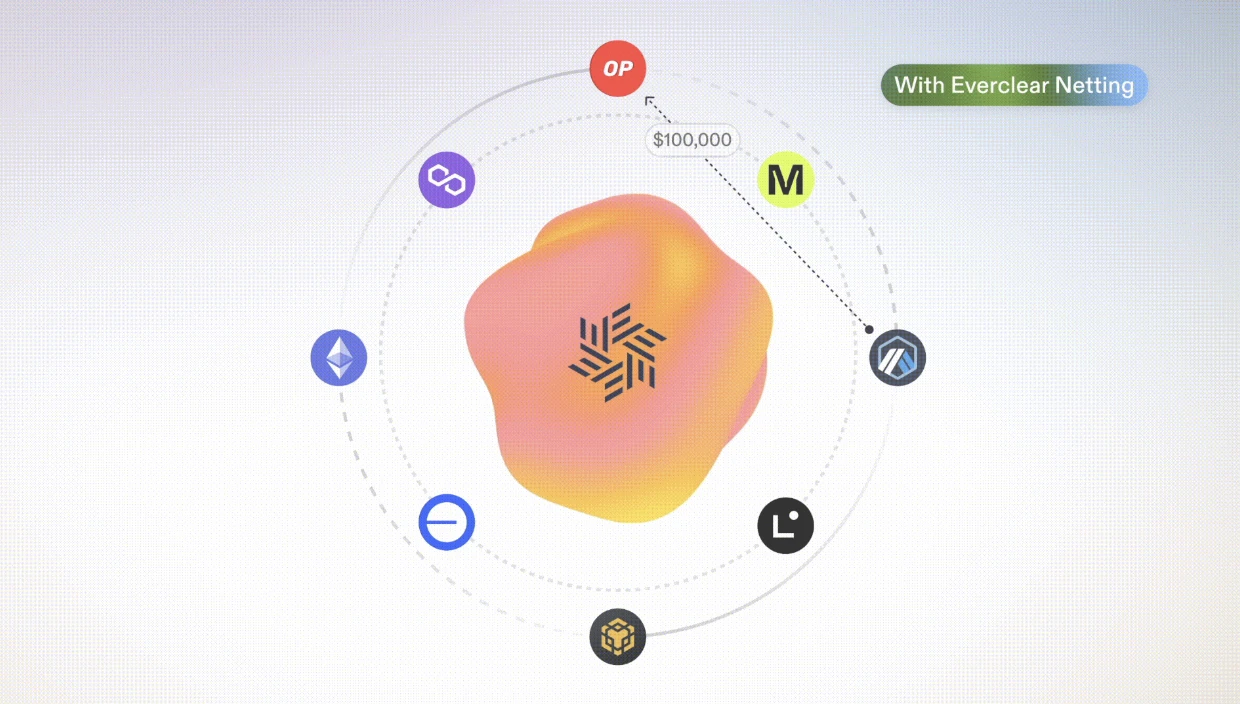

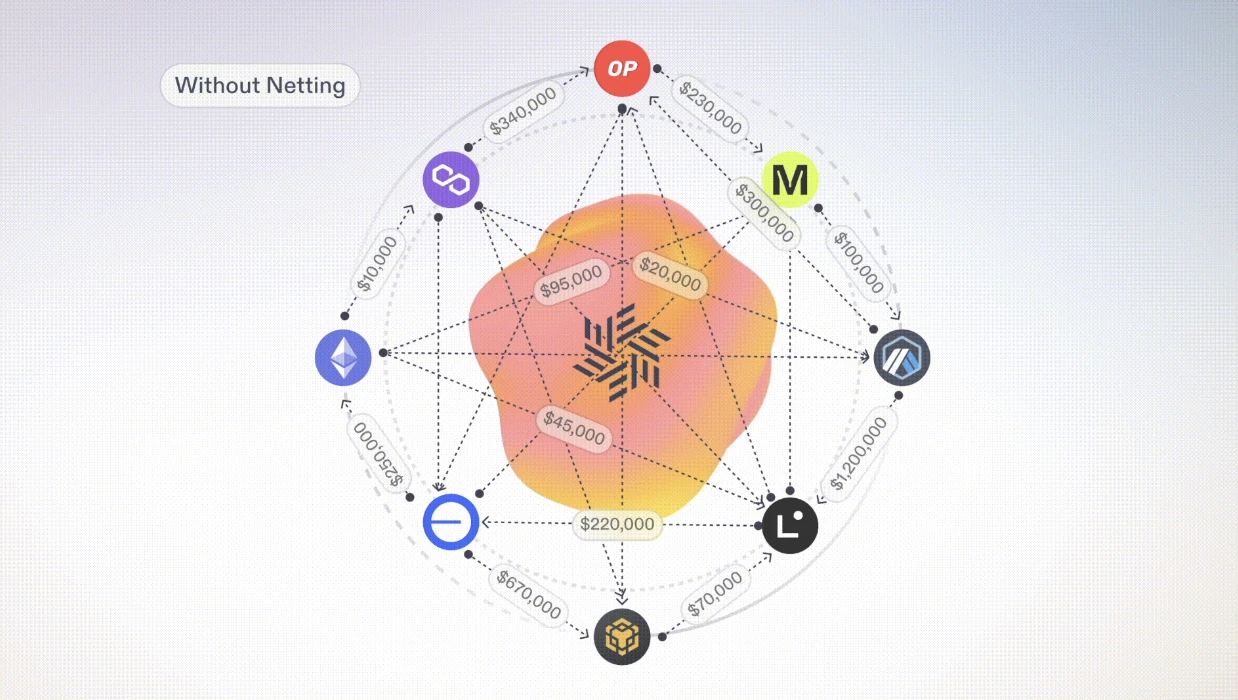

How does Everclear achieve this? In short, Everclear's system monitors the liquidity balance status between all chains across the network, aggregates and organizes each isolated liquidity rebalancing demand, and then finds the best settlement path based on overall demand, significantly improving execution efficiency and reducing operational costs.

To put it more intuitively, suppose there are currently two bridging protocols: one has liquidity skewed towards Chain A and needs to rebalance towards Chain B, while the other has liquidity skewed towards Chain B and needs to rebalance towards Chain A. In the traditional model, these two bridging protocols must each execute a rebalancing operation actively. However, with Everclear acting as the settlement layer, these two demands can offset each other, thereby minimizing the actual amount of liquidity that needs to be rebalanced.

This is akin to the settlement mechanism in cross-border payments. For instance, if a payment institution has an inflow of $100 and an outflow of $80 in a single day, the bank does not need to first transfer out $100 and then transfer in $80; instead, it can simply account for the inflow and outflow, ultimately executing a net inflow of only $20.

In Everclear's perspective, while the entities currently responsible for executing rebalancing can optimize their team capabilities to improve efficiency (for example, CEXs typically have teams of over 30 people using bridging protocols to maintain liquidity balance within their platforms), a more fundamental solution to the aforementioned dilemma lies in an open, decentralized global coordination mechanism. In the long run, as more blockchains and bridging protocols emerge, Everclear's performance will become increasingly prominent.

With the upgrade in positioning, Everclear's clients will transition from ordinary cross-chain clients to bridging protocols. To achieve this, Everclear must integrate with more cross-chain protocols, gradually expanding its services and ultimately evolving into the settlement layer for cross-chain transfers in the entire crypto world.

Current Status: Mainnet Launch & Token Upgrade

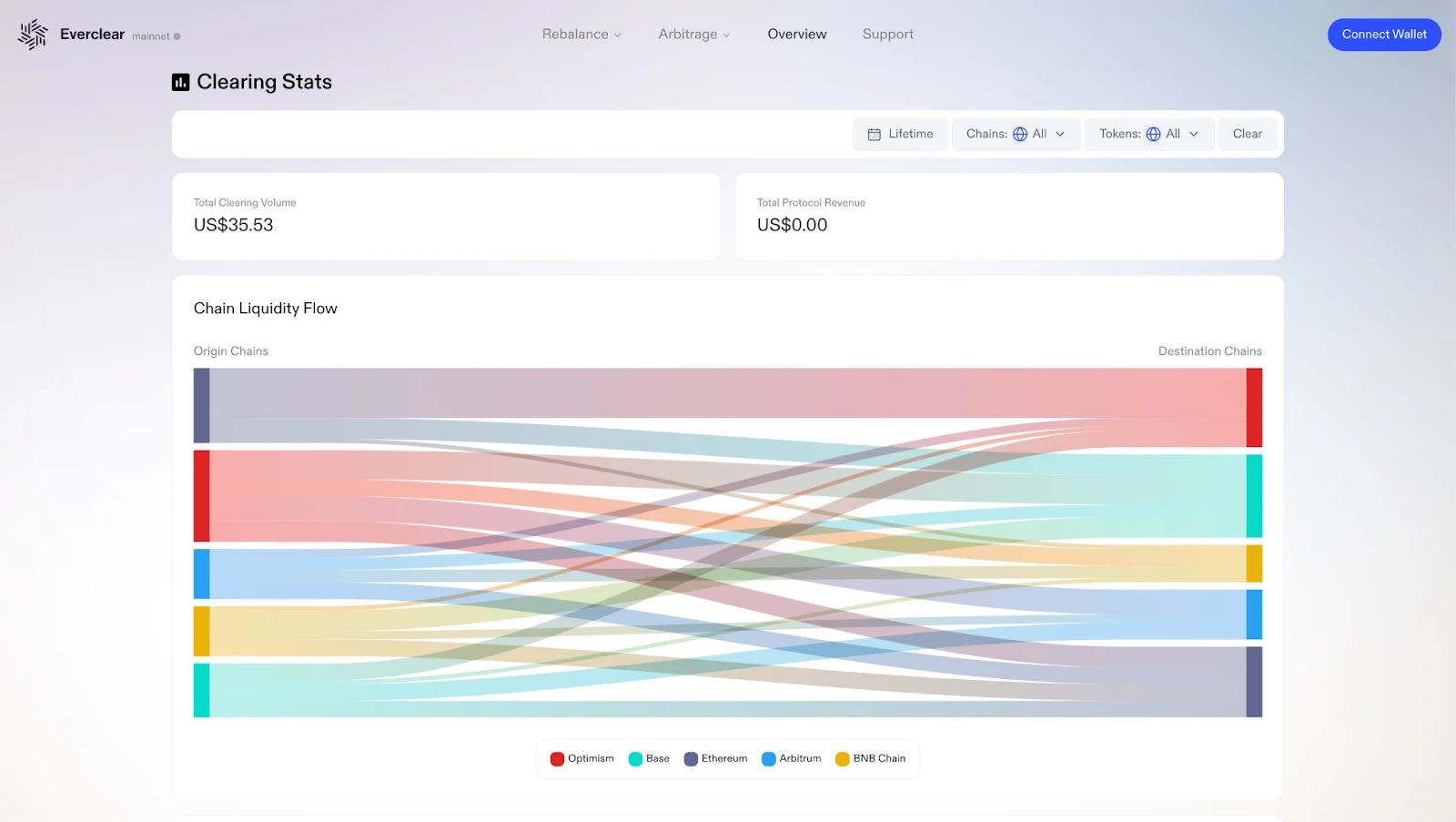

In mid-September, Everclear announced the launch of its mainnet Beta version. Under this version, Everclear temporarily covers five networks: Ethereum, Optimism, Base, Arbitrum, and BNB Chain, integrating bridging protocols such as LiFi Protocol, Router Protocol, Symbiosis, and Synapse.

Everclear stated that the significance of the Beta phase lies in providing more real and accurate data for the system's operation. Once all functions have been thoroughly tested, Everclear will transition from the Beta phase to the official phase and expand to more networks, integrating more cross-chain protocols.

Compared to the progress on the product level, the market may be more concerned about the utility upgrade of Everclear's protocol token, NEXT.

According to Everclear's latest announcement, NEXT will adopt a vb governance model in the future, allowing token holders to stake NEXT as vbNEXT. The latter can not only participate in the distribution of Everclear's protocol revenue but also guide the inter-chain transfer of liquidity through governance.

Everclear revealed that the vb governance model is designed based on Curve Finance's ve governance model, but focuses on the new scenario of liquidity settlement. Specifically, vbNEXT can direct token incentives towards specific chains or paths through voting, thereby utilizing higher yields to adjust the demand for liquidity transfer between chains—this easily brings to mind the Curve War period when various stablecoins competed to accumulate CRV to attract higher liquidity. Perhaps in the future, we will also see various networks or bridging protocols accumulating NEXT to attract higher liquidity…

Protocol + Token, Unlocking Imagination

In summary, Everclear's rebranding may be one of the most thorough positioning upgrades in the history of cryptocurrency.

On the protocol level, Everclear has stepped out of the fiercely competitive bridging protocol arena and positioned itself as the unique settlement layer in the current crypto world. By capturing the core pain points it faced as a bridging protocol, Everclear is expected to rapidly expand its services to more networks and more cross-chain protocols, transforming from an independent protocol into a large and closely linked ecosystem.

On the token level, the utility of NEXT has received a qualitative upgrade under Everclear's new narrative, making it a key medium for influencing liquidity balance between chains. This is expected to amplify the real demand for NEXT, providing a more solid value support for the token.

Looking ahead, as the concept of chain abstraction becomes increasingly popular, the necessity of Everclear as a settlement layer will become more pronounced, and that may mark the true value discovery period for it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。