Macroeconomic Overview

Market Sentiment Index: 80 (Previous Value) → 85 (Current Value)

Bullish Sentiment:

- The proportion of out-of-the-money call options in the options market has significantly increased.

- Large inflows into ETFs support the upward movement of cryptocurrency prices.

- The tense situation in the Middle East has triggered Bitcoin's safe-haven asset properties.

- Daily moving averages are about to show a bullish arrangement.

Bearish Sentiment:

- A large amount of high leverage is concentrated at 66,000, which has a significant attraction effect on prices.

- The pressure from the U.S. stock market's correction may create resistance for Bitcoin's upward movement.

Interpretation of Macroeconomic Events

1. Federal Reserve Rate Cuts, Neutral Interest Rates, and Market Uncertainty

Since the Federal Reserve's significant rate cut in September 2023, the market's reaction to the U.S. economy has been filled with complexity and uncertainty. Although U.S. Treasury yields have risen, the stock market continues to focus primarily on the resilience of American consumers, the strong performance of the labor market, and the economy's unexpected elasticity. While it seems that the rate cuts have boosted the economy in the short term, many risks remain hidden, especially surrounding the uncertainty of neutral interest rates.

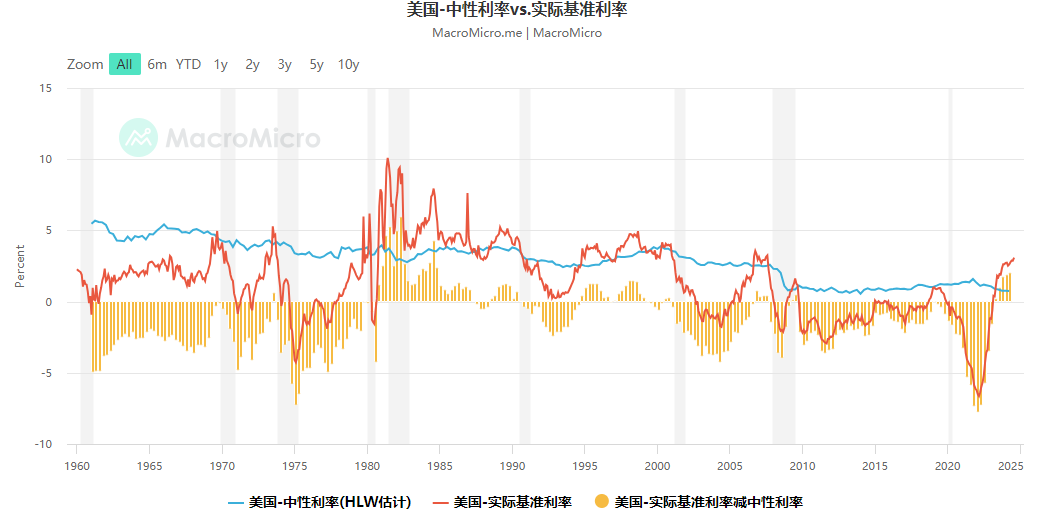

Figure: U.S. - Neutral Interest Rate vs. Actual Benchmark Interest Rate Source: Macromicro @10xWolfDAO

Definition of Neutral Interest Rate and Challenges for the Federal Reserve

The neutral interest rate refers to the ideal interest rate level that can maintain stable economic growth without triggering inflation. The New York Fed considers various data, including real GDP, inflation, and the federal funds rate, when calculating the neutral interest rate. Although the neutral interest rate is a theoretical concept that is difficult to measure precisely, its importance is undeniable—it is a key reference indicator for the Federal Reserve's monetary policy formulation.

However, as economic conditions change rapidly, predicting the neutral interest rate has become increasingly difficult. Factors such as supply chain disruptions caused by the COVID-19 pandemic, new inflation pressures, and the expansion of government deficits have complicated the calculation of the neutral interest rate. Vishal Khanduja, an investment portfolio manager at Morgan Stanley, specifically pointed out that the Federal Reserve may lower rates below the neutral interest rate during the rate-cutting process, which poses a more concerning risk for the market.

The Double-Edged Sword of Rate Cuts: Potential Risks in Bond and Stock Markets

If the Federal Reserve's rate cuts exceed market expectations, leading to excessively low interest rates, the first impact may be felt in the bond market. Overly accommodative monetary policy will suppress bond yields, causing turmoil in the bond market. If inflation resurges, the risks could quickly spread to the stock and foreign exchange markets, resulting in broader market volatility.

In this context, Khanduja noted that the U.S. federal government's massive budget deficit has increased the difficulty of modeling the neutral interest rate, making the Federal Reserve's monetary policy decisions increasingly challenging. He warned investors to remain highly vigilant about future policy directions, as the market may soon experience significant volatility.

Internal Conflicts and Policy Uncertainty within the Federal Reserve

There are clear divisions within the Federal Reserve regarding the neutral interest rate and its response policies. For example, in the latest Federal Reserve meeting minutes, Governor Bowman opposed rate cuts, becoming one of the few officials in recent years to publicly disagree with policy opinions. Atlanta Fed President Bostic also indicated that he prefers to keep rates unchanged in the remaining two policy meetings of the year.

These divisions not only reflect differing views within the Federal Reserve on the economic outlook but also illustrate the market's divergence regarding future policy directions. The volatility of economic data and the disagreements among policymakers pose significant challenges for the Federal Reserve in assessing the neutral interest rate. As Federal Reserve Chairman Powell stated, the Fed is "navigating by the stars under a cloudy sky," indicating the uncertainty in the policy-making process.

Impact of Neutral Interest Rates on Future Economy

While the exact level of the neutral interest rate cannot be precisely determined, its impact on the market and policy cannot be ignored. Recent economic data shows that the U.S. labor market remains strong, with a declining unemployment rate and a slight increase in wage growth. This data has raised concerns among some economists about whether the Federal Reserve is overdoing the rate cuts, especially in the context of an economic recovery that exceeds expectations. If the Federal Reserve becomes overly accommodative, it could lead to a resurgence of inflation.

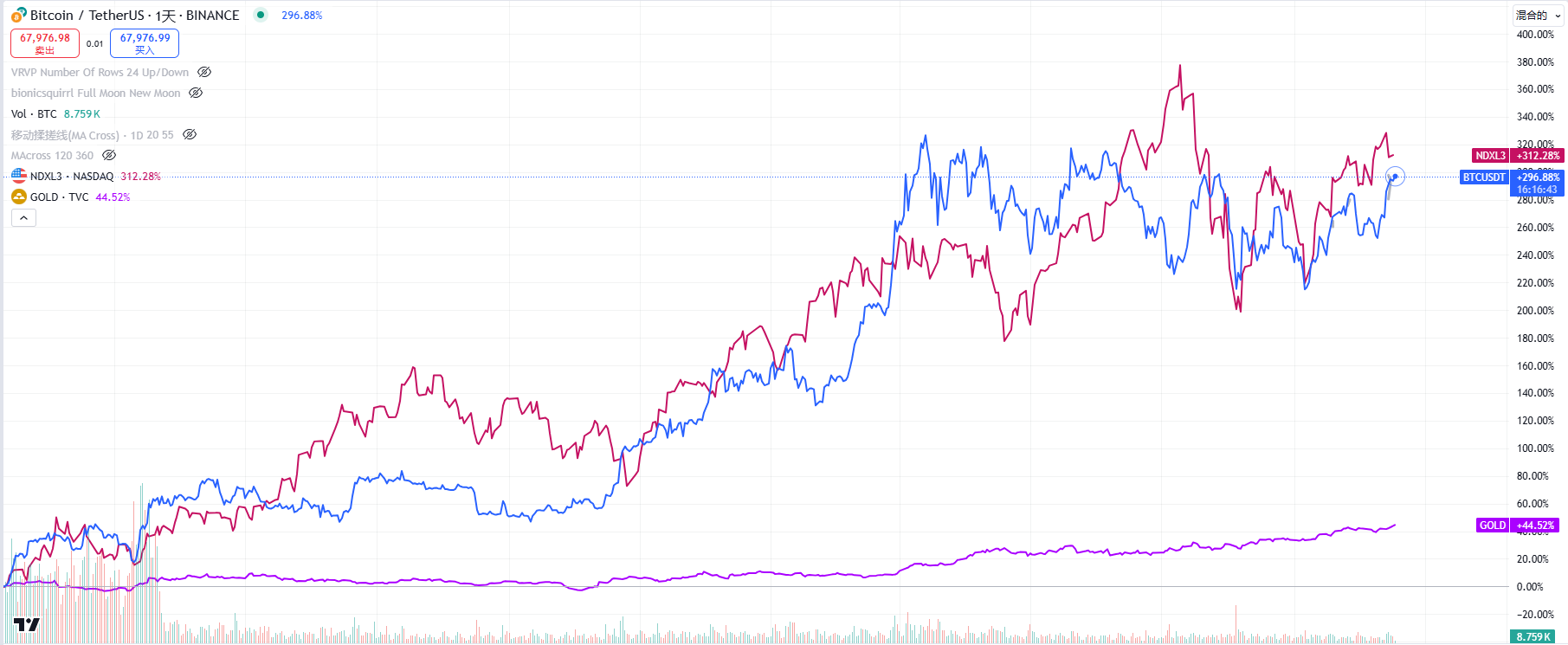

2. BTC/U.S. Stocks and Gold Market Trends

Bitcoin has recently maintained a significant correlation with the Nasdaq market, so the recent correction in U.S. stocks has also put considerable pressure on Bitcoin's upward trend. The turmoil in the Middle East has once again endowed Bitcoin with safe-haven asset properties, and the support from intrinsic momentum combined with the rise in U.S. stocks is expected to break through previous highs, disrupting the consolidation trend of the past six months.

Figure: Comparison of BTC/Nasdaq and Gold Price Fluctuations Source: Tradingview @10xWolfDAO

3. Situation in the Middle East

Figure: Representative Figures of the Middle East Situation Source: Internet @10xWolfDAO

The Death of Yahya Sinwar and the Future Direction of the Gaza War

Israel's successful assassination of Hamas leader Yahya Sinwar marks a significant victory for Israel in the Gaza War. However, the future direction of the war is fraught with uncertainty, especially as Netanyahu's decisions will have far-reaching implications for the entire Middle East situation. Here are two possible development paths:

1. Declare Victory and Seek a Ceasefire

Sinwar's death provides Israel with a potential turning point. U.S. President Biden and senior officials believe this event creates an opportunity to release Israeli hostages and end the war. Biden hopes to use this moment to push for a political solution, improve the humanitarian situation in Gaza, and achieve a ceasefire through international mediation. Many in the Israeli military and intelligence community also believe that a ceasefire is the only way to save the remaining hostages.

Sinwar's extreme position within Hamas made him the biggest obstacle to a ceasefire agreement, so his death may provide an opportunity for a more pragmatic political leadership within Hamas, especially for those leaders in exile in Qatar. Reducing military pressure in Gaza will help accelerate ceasefire negotiations while alleviating diplomatic pressure from the international community, particularly the U.S.

2. Continue Fighting and Targeting Remaining Hamas Forces

However, many supporters within Netanyahu's right-wing coalition oppose any form of ceasefire agreement with Hamas, especially those who wish to completely eradicate Hamas's influence. While Sinwar's death is symbolic, it has not entirely weakened Hamas's combat capabilities. The Israeli military continues to believe that Hamas still possesses sufficient military strength in Gaza to threaten the establishment of any alternative government.

Netanyahu may choose to continue military operations to further weaken Hamas, especially as his public support rises. The continuation of fighting would indicate Israel's commitment to diminishing Hamas's military power, rendering it incapable of posing a threat again. This suggests that the Gaza War may not end soon, and Israel may continue to exert greater military pressure on Hamas, potentially lasting more than a year.

The future direction of the Gaza War depends on Netanyahu's decisions. If he chooses to negotiate with Hamas and push for a ceasefire under international pressure, the war may gradually de-escalate after the release of hostages; if Netanyahu insists on continuing to strike Hamas, the war may prolong, accompanied by larger military actions against Iran and its proxy Hezbollah. Regardless, Sinwar's death marks a critical turning point in the war, but not its conclusion.

4. Macroeconomic Radiation Trends

Figure: BTC Daily Price Trend Source: Tradingview @10xWolfDAO

Bitcoin reached the support-resistance exchange level of 68,000 on Friday, and the moving averages are about to form a bullish arrangement. It is crucial to monitor whether it can hold above 68,000; if it tests and falls below for the second time, it may decline back to 65,000. If it stabilizes above 68,000 within this week, the probability of a rapid rise to 72,000 is relatively high.

(WolfDAO reminds: Market analysis is for cryptocurrency market research only and does not constitute direct investment advice)

Special Thanks

Creating this content is not easy. If you need to reprint or quote, please contact the author for authorization or indicate the source. Thank you again for the support of our readers.

Written by: Sylvia / Mat / WolfDAO

Edited by: Punko

Thanks to the above contributors for their outstanding contributions to this macroeconomic report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。