Source: TI Research

In the third quarter of 2024, the cryptocurrency market experienced significant volatility. The unexpected interest rate hike by the Bank of Japan in early August triggered a collapse in yen carry trades, leading to turmoil in global financial markets and a notable sell-off in the cryptocurrency market. Risk aversion surged in global financial markets, causing asset prices to plummet sharply in a short period, with Bitcoin briefly falling to $49,000. Additionally, large-scale forced liquidations in the market further exacerbated the selling pressure. However, as the Federal Reserve cut interest rates and global liquidity increased, investor sentiment gradually recovered, and the market warmed up towards the end of the quarter, with Bitcoin rebounding to $64,000.

In such a turbulent market, how did the exchanges perform? We are timely bringing you the Q3 2024 exchange report. In this report, we summarize the data performance of the exchange industry and select the top 10 centralized exchanges, hoping to help everyone understand the changes in the exchange market through the data variations.

The total trading volume of the top ten exchanges was $15.1 trillion, a decrease of 6.74% from the previous quarter

In the third quarter, the total trading volume of the top ten exchanges was $15.1 trillion, a decrease of 6.74% from the second quarter. The ongoing downward trend in the market was mainly influenced by global macro factors. However, after the Federal Reserve cut interest rates by 50 basis points, market sentiment began to turn positive. Given the warming sentiment and improving macro environment, trading volume is expected to rebound in the fourth quarter, potentially reaching $20 trillion.

In the third quarter, Bitcoin's price was highly volatile. After breaking below $50,000 in early August, it quickly rebounded and closed the quarter at around $64,000. With improvements in liquidity in the U.S. and China, Bitcoin is expected to rebound above $70,000 in the fourth quarter, with a strong possibility of reaching new all-time highs.

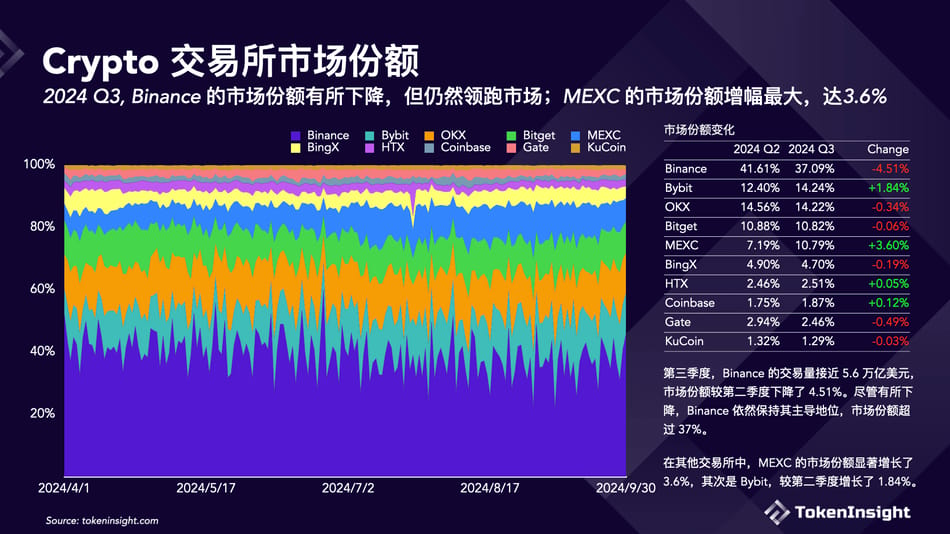

Binance's market share has declined but still leads the market

In the third quarter, Binance's trading volume approached $5.6 trillion, with its market share declining by 4.51% from the second quarter. Despite the decline, Binance still maintains its dominant position, with a market share exceeding 37%.

Among other exchanges, MEXC's market share significantly increased by 3.6%, followed by Bybit, which grew by 1.84% from the second quarter.

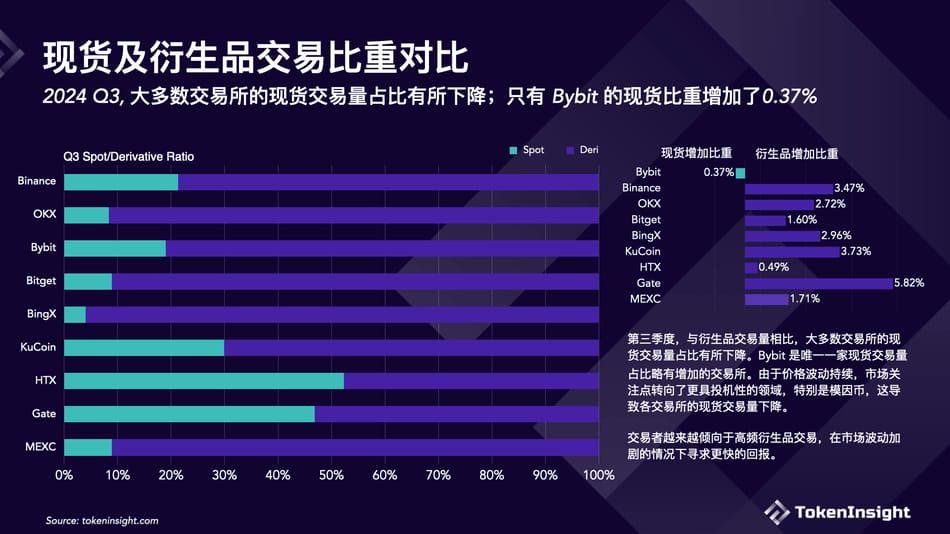

The proportion of spot trading volume has decreased for most exchanges; only Bybit saw an increase

In the third quarter, compared to derivative trading volume, the proportion of spot trading volume decreased for most exchanges. Bybit was the only exchange that saw a slight increase in its spot trading volume proportion. Due to ongoing price volatility, market attention shifted towards more speculative areas, particularly meme coins, leading to a decline in spot trading volume across exchanges.

Traders are increasingly inclined towards high-frequency derivative trading, seeking faster returns amid heightened market volatility.

The total spot trading volume of the top ten exchanges was $2.7 trillion, a decrease of 21% from the previous quarter

In the third quarter of 2024, the spot market continued the downward trend from the second quarter, with average daily trading activity dropping from $37 billion in the second quarter to $29 billion in the third quarter. The total spot trading volume across exchanges in the third quarter was approximately $2.7 trillion, a decrease of 21% from $3.4 trillion in the second quarter.

However, with improvements in market sentiment and increased global liquidity, spot trading volume is expected to rebound in the fourth quarter, potentially reaching a range of $3.5 trillion to $4 trillion.

Derivative trading volume continues to decline, with average daily trading volume below $150 billion

In the third quarter, the total derivative trading volume was $12.8 trillion, a decrease of about 2.3% from the previous quarter's $13.1 trillion. The downward trend that began in the second quarter reflects the ongoing consolidation in the cryptocurrency market.

Aside from a brief surge in early August due to macroeconomic fluctuations, the average daily trading volume remained below $150 billion, consistent with the levels seen in the second quarter.

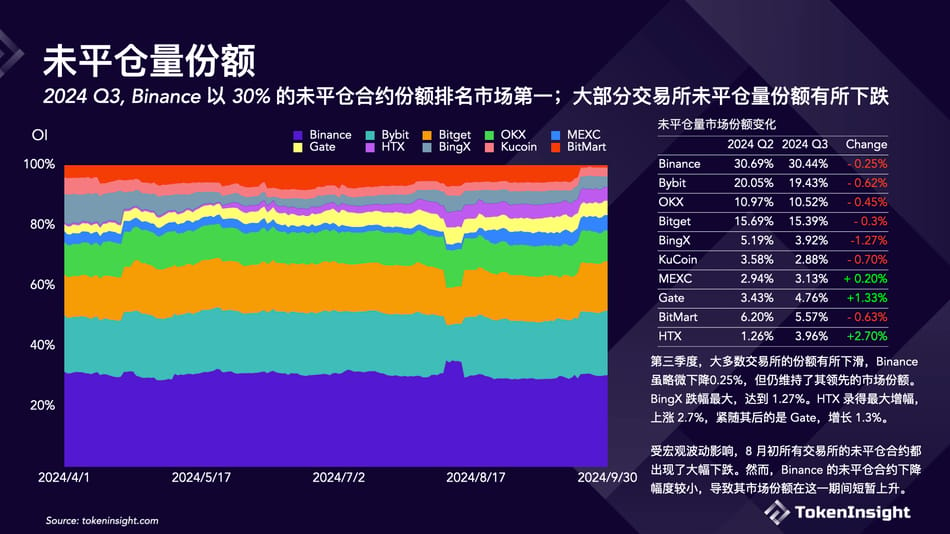

Binance ranks first in the market with a 30% share of open contracts

In the third quarter, most exchanges saw a decline in their shares, with Binance experiencing a slight decrease of 0.25% but still maintaining its leading market share. BingX saw the largest drop at 1.27%. HTX recorded the largest increase, rising by 2.7%, followed closely by Gate, which grew by 1.3%.

Affected by macro fluctuations, all exchanges experienced a significant drop in open contracts in early August. However, Binance's decline in open contracts was relatively small, leading to a temporary increase in its market share during this period.

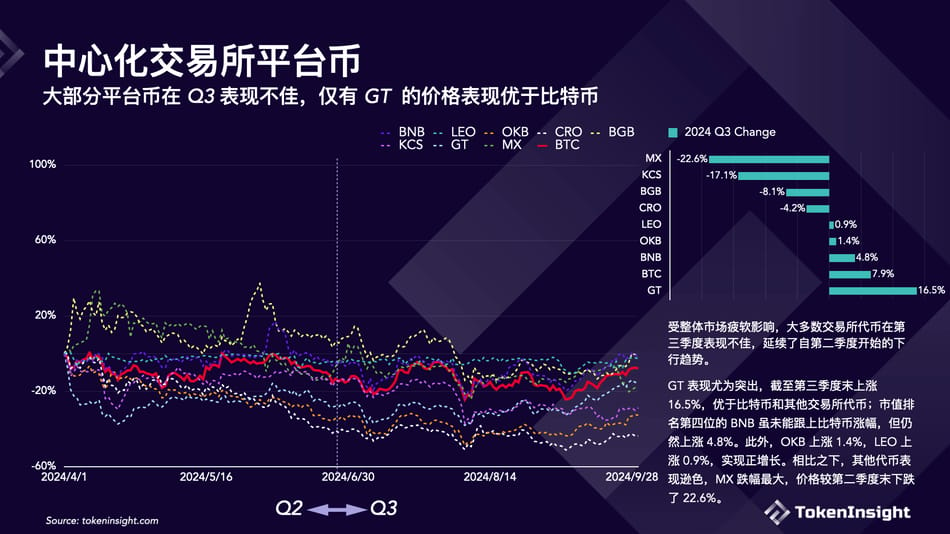

Most platform tokens performed poorly in Q3, with only GT outperforming Bitcoin

Due to the overall market weakness, most exchange tokens performed poorly in the third quarter, continuing the downward trend that began in the second quarter.

GT stood out, rising 16.5% by the end of the third quarter, outperforming Bitcoin and other exchange tokens; BNB, ranked fourth by market capitalization, did not keep pace with Bitcoin's gains but still rose by 4.8%. Additionally, OKB increased by 1.4%, and LEO rose by 0.9%, achieving positive growth. In contrast, other tokens performed poorly, with MX experiencing the largest drop, down 22.6% compared to the end of the second quarter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。