The Chief Investment Officer of Bitwise, Matt Hougan, stated that due to a significant influx of institutional funds into Bitcoin exchange-traded funds (ETFs), instability in the U.S. economy, and the upcoming U.S. presidential election, Bitcoin may reach six figures sooner than expected.

Matt Hougan emphasized the growing support for cryptocurrency among Republicans and how inflation concerns are driving investors towards Bitcoin. With clearer regulations and supply constraints from the Bitcoin halving, he predicts that the price of Bitcoin will surge rapidly.

Chu Yucheng: Bitcoin and ETH Market Analysis and Trading Reference for 10.21

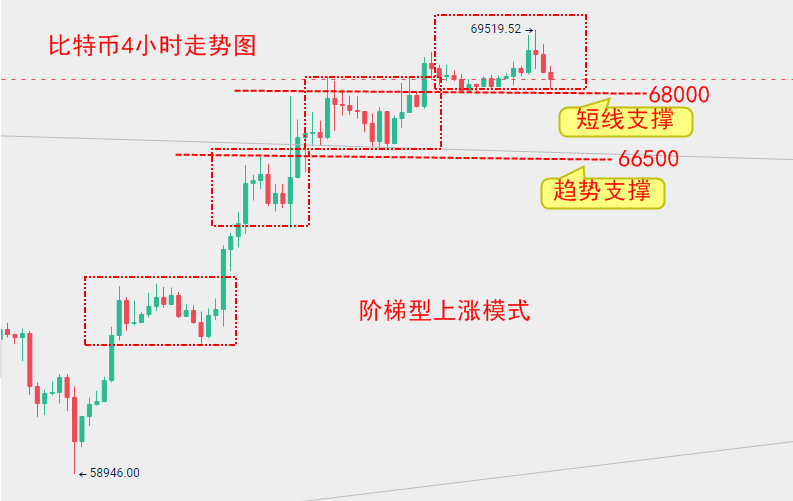

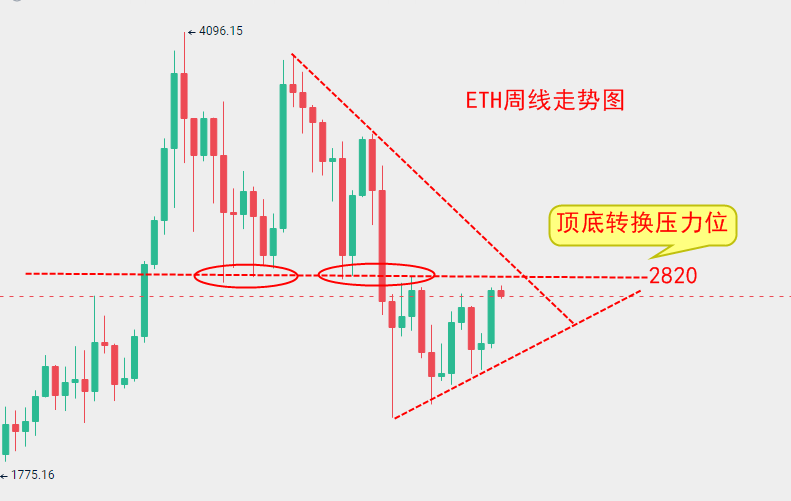

Over the weekend, Bitcoin was basically in a small range of fluctuations until it began to break upwards early Monday morning, reaching a high of around 69,500. From the high point this morning, it has retraced all the way down, currently fluctuating around 68,200, having retraced nearly 1,500 points. ETH reached a high near 2,770 and is currently also retracing, with prices fluctuating around 2,700.

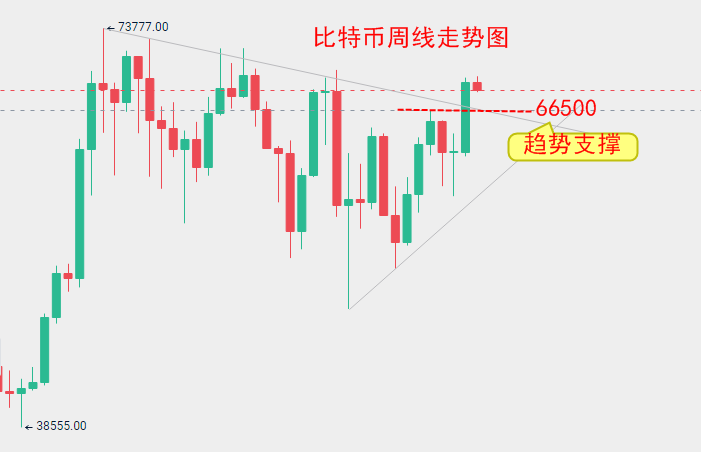

From a technical perspective, Bitcoin has remained above the support level of 66,500 for several days, with minor pullbacks during the fluctuations, maintaining a good stair-step upward pattern. We have been optimistic that Bitcoin could push above 70,000, and the short-term short positions we took were merely for a pullback, as we have been waiting for the 66,800–67,000 range to enter long positions. Unfortunately, the pullbacks have been small each time, not providing an opportunity.

In terms of trend, the effective support for Bitcoin remains at the 66,500 top-bottom conversion level. On the 4-hour chart, short-term support is around 68,000. Short-term contracts can enter long positions at this level, with a stop loss of 500 points and a target of the high point at 69,500. If the stop loss is triggered, continue to enter long positions around 66,800, with a stop loss at 66,000 and a take profit at 68,000.

On the ETH weekly chart, the trend resistance is around 2,820. ETH has not been able to break this level since it fell in July, and we can also see from the weekly chart that the 2,800–2,850 range is a top-bottom conversion area, a dense trading zone. Therefore, when the price reaches this range, there will be back-and-forth tug-of-war between bulls and bears. For intraday contracts, consider entering long positions around 2,700, with a stop loss at 2,650 and a take profit at 2,800. If the stop loss is triggered, continue to enter long positions around 2,580, with a stop loss at 2,500 and a take profit at 2,700.

Specific Operation Suggestions (based on actual market prices)

Enter long positions around 68,000 for Bitcoin, with a stop loss of 500 points and a target of the high point at 69,500. If the stop loss is triggered, continue to enter long positions around 66,800, with a stop loss at 66,000 and a take profit at 68,000.

For ETH, enter long positions around 2,700, with a stop loss at 2,650 and a take profit at 2,800. If the stop loss is triggered, continue to enter long positions around 2,580, with a stop loss at 2,500 and a take profit at 2,700.

Before the market moves, any analysis can be correct and has its reasons, but no trade will be absolutely accurate, and there are risks involved. Therefore, the premise for gains must be proper risk control. The market changes in real-time, and strategy points are for reference only, not as entry criteria. Investment carries risks, and profits and losses are self-responsible.

Many individual investors find it difficult to enter the trading door, often simply due to the lack of a guide. The questions you ponder may be easily resolved with a prompt from an experienced person. Daily real-time market analysis, along with guidance from experience-sharing groups, evening practical guidance groups, and irregular live broadcasts explaining real-time market conditions are available.

For more real-time market analysis, please follow the public account: Chu Yucheng

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。