Original Author: BitMEX

Abstract: We studied Babylon, a staking project that has attracted nearly 24,000 bitcoins. We compared Babylon with another BTC staking project, CoreDAO, and noted Babylon's unique application of Tapscript. Notably, unlike Ordinals, Babylon does not use Taproot in a trivial manner but aligns more closely with the original intentions of Bitcoin developers. We ultimately conclude that regardless of people's views on Babylon and emerging Bitcoin staking systems, Babylon's practices support the notion that Taproot is a clever and impressive upgrade for Bitcoin. Although some initially had low expectations, Taproot is proving its success.

Overview

Following our August 2024 article on Bitcoin Layer 2s and CoreDAO, this article will focus on another seemingly Bitcoin "L2," Babylon. As of the writing of this article, the funds locked in this Bitcoin staking system exceed CoreDAO, approaching 24,000 bitcoins. This is worth over $1.6 billion. Like CoreDAO, Babylon is not actually a Bitcoin Layer 2 network but should be viewed as a system where people can lock bitcoins using Bitcoin's time-lock feature and earn returns in other alternative tokens.

Babylon Labs

Despite having 24,000 BTC and a TVL of up to $1.6 billion, the Babylon blockchain or staking system does not yet exist and is still under development. Currently, large holders seem to be staking for reward points. The platform is supported by an impressive array of cryptocurrency venture capital and has ties to Binance, which may explain how the platform has been able to attract such significant funding. The platform also aims to position itself as the EigenLayer of Bitcoin. Babylon wants to become the EigenLayer within Bitcoin. Many of the cultures and ideas being developed by Babylon seem to stem from the Ethereum ecosystem. The core concept of EigenLayer is re-staking, which allows the same batch of coins to be staked across multiple systems simultaneously for higher returns.

We will not evaluate the concept of re-staking itself or Babylon's staking protocol or the potential Babylon blockchain; like our CoreDAO article, we will focus on the Bitcoin aspects.

Staking Mechanism and Taproot

Like CoreDAO, to stake in Babylon, you need to create a custom complex transaction, essentially sending your own bitcoins to yourself. You add a custom OP_Return output that provides details about the staking, such as which validator will be used and where the rewards will be sent.

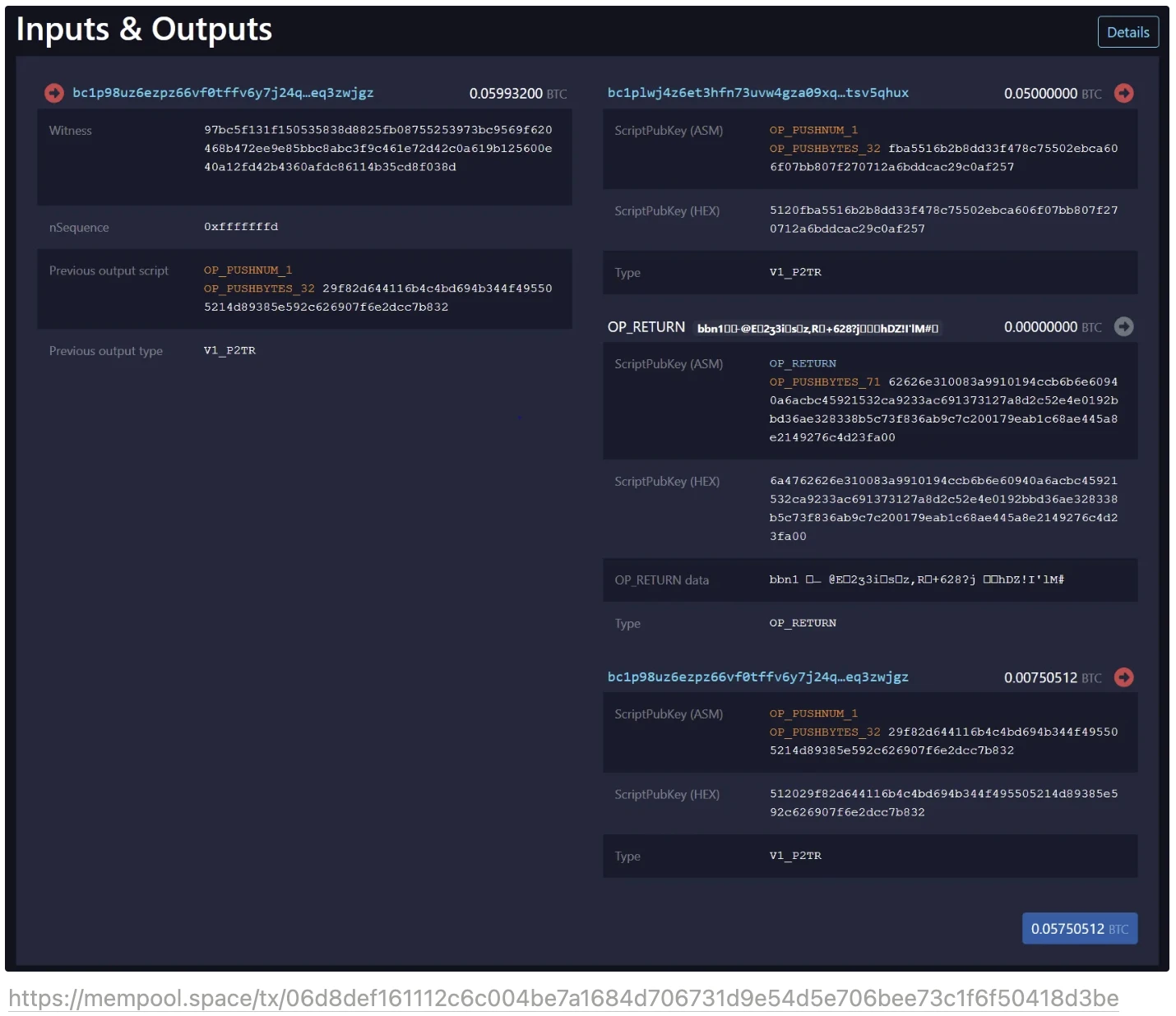

Here is an example of a Babylon staking transaction:

There is nothing particularly special about the contract that initiates the staking itself compared to CoreDAO. The first output of 0.05 BTC is staked, the third output is change, and the middle output is OP_Return. The Babylon team informed us that many exchanges had to upgrade their Bitcoin wallets to allow customers to send bitcoins to P2TR outputs with Bech32m format addresses.

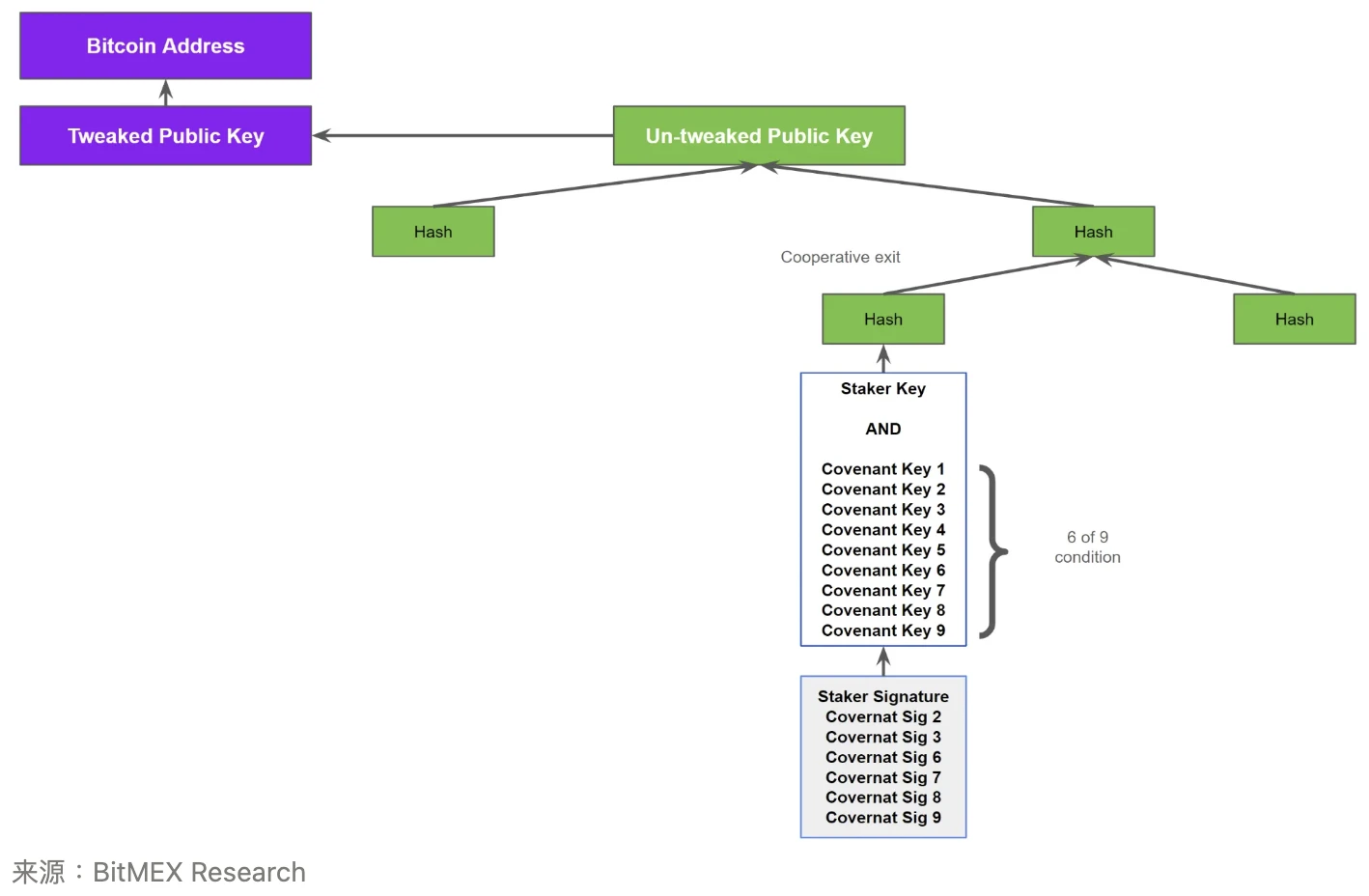

However, when the staked bitcoins need to be redeemed from Babylon, the magic of Taproot begins to show. You can view the redemption transaction from the same address bc1plwj4z6et3hfn73uvw4gza09xqmc8hwq87fc8z2ntmh9v98q27ftsv5qhux here. The redemption process reveals that Babylon utilizes multiple spending paths in the Tapscript and Taproot tree. The following diagram illustrates the information revealed when "cooperatively exiting" from the staking system. It is important to note that to redeem bitcoins from the Taproot tree, the condition of exactly one leaf node must be met, and the path to the Merkle root must be demonstrated through hash values.

Taproot Redemption Demonstration for Babylon Stakers - Visible Parts during Normal Cooperative Exit

In the above redemption case, two transfer paths are hidden, and two additional hash values are required to reach the Merkle root. The selected transfer path requires the staker's signature and a multi-signature from 6 out of 9 members of the Babylon alliance. This spending condition is essentially a combination of 1-of-1 and 6-of-9.

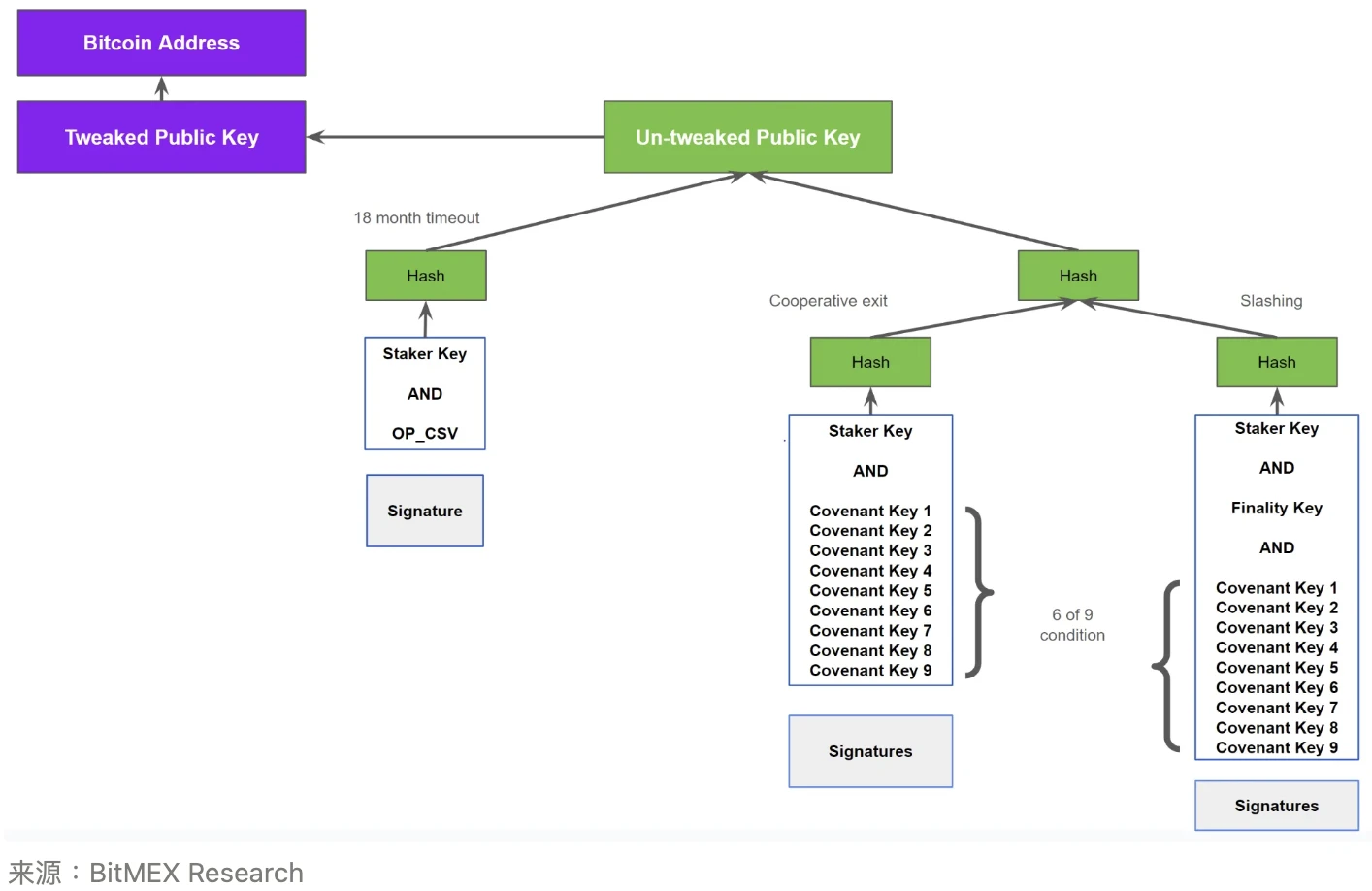

By studying Babylon's protocol specifications and analyzing other transactions, we were able to map out the complete Taproot tree diagram, including all spending paths. The tree diagram below illustrates three redemption scenarios.

Complete Taproot Redemption Tree Diagram for Babylon Stakers

1. Time Lock - This scenario requires the staker's signature and the OPCHECKSEQUENCEVERIFY (OPCSV) opcode. The time lock period is 15 months. This allows the staker to retrieve funds without relying on the alliance. This path is located on a higher branch in the tree, allowing for more efficient redemption.

2. On-Demand Unlock - This is considered a normal or cooperative redemption scenario, requiring the staker's signature and the alliance's approval. This is similar to cooperative exits in the Lightning Network.

3. Forfeiture - This is the final scenario, similar to the unbinding situation but requires an additional signature from the "finality provider." We will discuss this in detail in the next section.

Forfeiture Mechanism

We criticize CoreDAO for lacking a forfeiture mechanism, thus labeling CoreDAO as "fake staking." However, Babylon, with its EigenLayer and Ethereum staking technical background, believes that a forfeiture mechanism can be implemented in Bitcoin.

To some extent, we believe that Babylon has chosen a more difficult path, as only by implementing forfeiture can a more sustainable protocol be built, making its returns and network security "less fake." However, as we explained, Babylon's yield generation system does not actually exist yet, so there is currently no forfeiture, but there is still a redemption path in the Taproot tree. Therefore, the third redemption path in the Taproot tree has not yet been implemented, as there is no blockchain or finality agent. Babylon envisions that once the system is online, stakers will need to pre-sign the forfeiture redemption path, meaning that bitcoins will be transferred to a bitcoin address controlled by others or possibly destroyed. Who these funds might be sent to has not yet been determined by Babylon Labs. If the staker has pre-signed the third path, then there is real counterparty risk. But while it remains unsigned, bitcoin stakers can consider Babylon to be "risk-free."

Once the forfeiture mechanism is online, if the third path has not been pre-signed by the staker, then the stake will not be considered valid and will not earn any rewards. We see this as a minor flaw, as observers of the Bitcoin blockchain cannot determine whether it is a valid staking deposit. However, since this is not yet online, such pre-signing is not required. Therefore, currently, staking with Babylon is, like CoreDAO, free of counterparty risk. You can always retrieve your bitcoins without relying on anyone (though the lock-up time is longer). Thus, at present, this may be a good place to stake bitcoins before the system goes live, although how many Babylon token rewards you can earn from it is uncertain.

Criticism of Bitcoin Core Developers

Bitcoin core developers and protocol engineers have faced criticism in recent years, primarily for not implementing new protocol upgrades or adding enough new features to Bitcoin. Additionally, some critics claim that Bitcoin developers are out of touch with the crypto industry, and even if Bitcoin adds new features, no one cares or uses them.

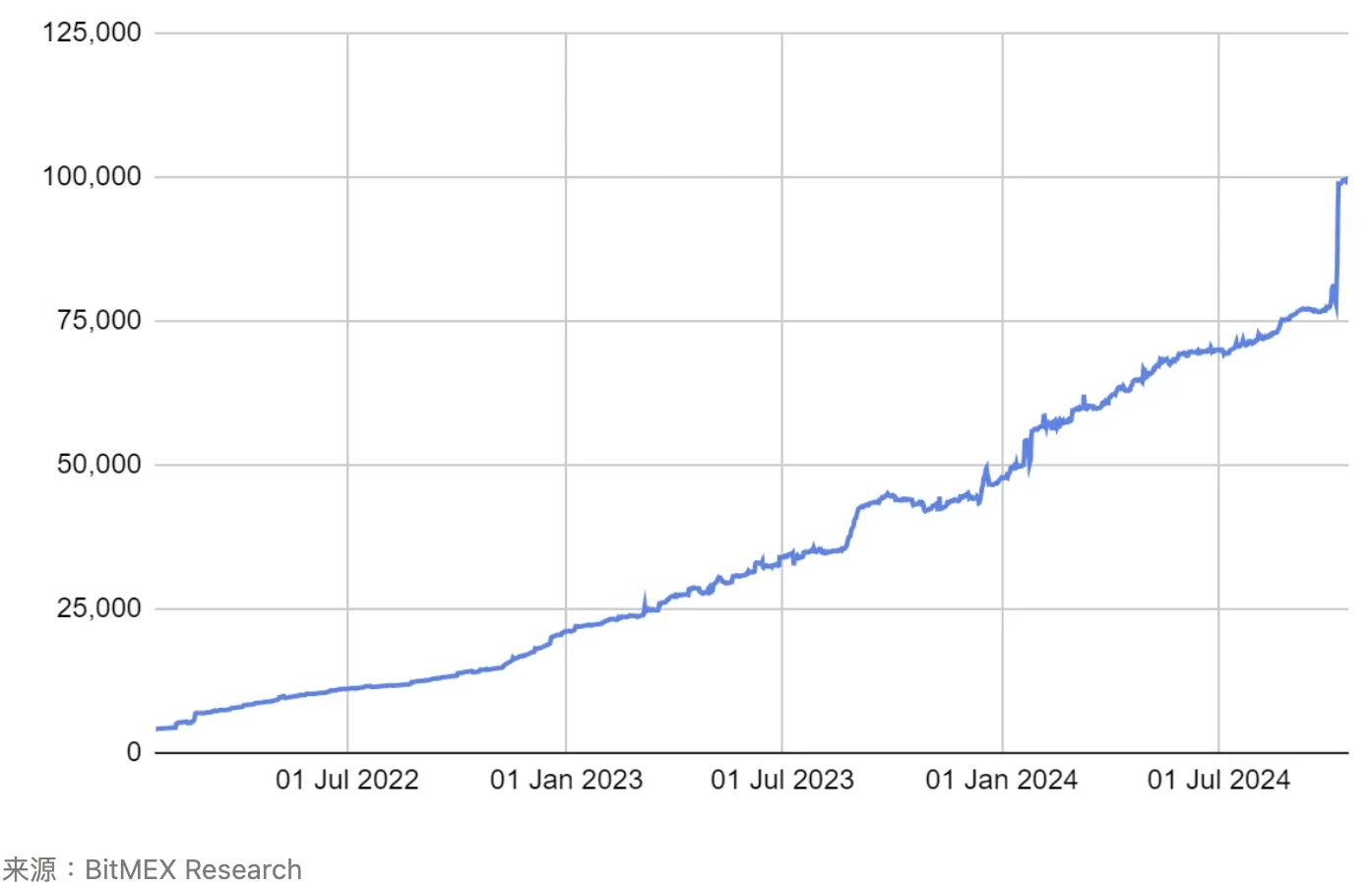

We believe that Babylon's use of Taproot is strong evidence against the aforementioned criticisms. In our view, Taproot is actually a rather clever upgrade that enables many new custom spending conditions without increasing downside risk. The hidden unused parts of the tree help enhance privacy and scalability. Furthermore, the adoption metrics for Taproot are very strong, much stronger than we anticipated a few years ago. As of today, nearly 100,000 bitcoins are stored in Taproot outputs.

Bitcoins stored in Taproot

Conclusion - Taproot is Successful

Who would have thought that the idea of a Merkleized Abstract Syntax Tree, initially proposed by Bitcoin engineer Johnson Lau on the BitcoinTalk forum in 2013 and formalized in 2016, would actually be introduced into Bitcoin and achieve success?

Babylon alone has attracted $1.6 billion in TVL by leveraging the capabilities of Taproot. Moreover, its usage is not trivial; unlike the storage of images related to Ordinals, which some consider somewhat foolish, these script paths are actually being utilized and involve significant amounts of funds.

On the other hand, many readers may question the fundamental efficacy of Proof of Stake (PoS), and re-staking is even harder to understand. In fact, liquid staking and re-staking may reflect the fundamental issues of the Proof of Stake system. Some readers might also view Babylon as somewhat like a altcoin, as Bitcoin stakers are incentivized to earn token rewards that do not yet exist. However, the adoption of Taproot must start somewhere. Capital needs to be invested to build the Taproot script system, and examples of Taproot script usage are needed for others to emulate. Perhaps one day, projects that do not rely on token rewards or building PoS can also follow suit.

However, regardless of people's views on Babylon, Taproot is being used and undoubtedly proves to be a clever idea and a success. Considering the various constraints faced by Bitcoin developers, their ability to achieve this is truly admirable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。