On the evening of October 21st, Eastern Eight Time, BTC broke upward, officially surpassing the 69,000 mark, reaching a high of 69,500 USD. Throughout the weekend, BTC remained mostly in a sideways trend with low liquidity. Why did a sudden surge occur during Sunday’s U.S. trading hours? Was this surge driven by futures or caused by spot purchases?

Recently, there have been frequent positive developments in altcoins, starting from APE, to DYDX and SUSHI. After the positive news, many altcoins saw increases of over 20%. The bottom altcoins are gradually showing signs of movement. Can the oracle sector, which was the engine of last October's bull market, lead altcoins out of a bull market again this time? Is the bull really back? Let’s take a look at traders' perspectives from various angles.

Technical Analysis Group

From the K-line chart, BTC seems to have broken through a downward trend line that lasted for over half a year, appearing to set new highs daily, but the trading volume accompanying these new highs has significantly shrunk. In contrast, ETH has broken through its previous high but has only reached the real pressure zone around 2800. The increase in ETH yesterday brought about high market sentiment, marking the first time that contract prices exceeded spot prices, leading to the belief that the bullish trend is nearing its end, and the building could collapse at any moment.

From the K-line chart, BTC seems to have broken through a downward trend line that lasted for over half a year, appearing to set new highs daily, but the trading volume accompanying these new highs has significantly shrunk. In contrast, ETH has broken through its previous high but has only reached the real pressure zone around 2800. The increase in ETH yesterday brought about high market sentiment, marking the first time that contract prices exceeded spot prices, leading to the belief that the bullish trend is nearing its end, and the building could collapse at any moment.

Many people are comparing the current market situation to October 2023, noting that both show a weekly MACD golden cross and a weekly K-line bullish breakout. However, I believe the current market sentiment is completely different from that time; back then, the sentiment was consistently bearish, while now it is consistently bullish. I do not think the MACD golden cross here has any practical significance for trading, as a golden cross can quickly turn into a death cross. Who is right or wrong will depend on whether it replicates the bullish trend of October 2023 with new highs this week.

As for when I will stop being bearish, it will likely be after ETH effectively breaks through 2820 following a consolidation. Currently, I do not have any short positions and am looking for opportunities to short on the right side.

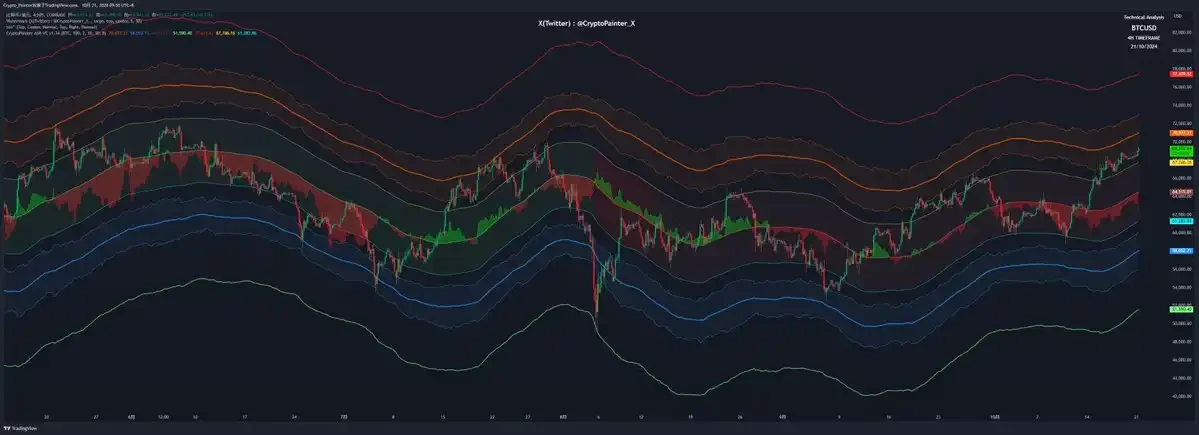

From the ASR-VC4 hourly channel perspective, the current price action is somewhat similar to the pattern at the end of September, continuously operating near the average pressure zone. It could either be building momentum or running out of steam. From the perspective of spot premium, this resembles the market in early June, where a long-term negative premium indicated a bullish trend. The key price level for determining a full bullish trend in the channel is at 71,000. If it strongly breaks through the average pressure zone, the first target could be near the overbought line, currently around 77,500.

From a weekly perspective, the upward trend continues. Currently, bsl is waiting to be raided. This upward trend must set new highs, with my personal target looking at the 90,000 range. It still belongs to the range (within the oscillation range, fvg gaps generally get filled). Pay attention to whether there are wfvg opportunities, around 64,500 USD.

From the daily perspective, it continues to oscillate upward, mainly waiting for bsl to be raided. If there is a pullback opportunity for BTC, it will likely be around 645, and it is essential to buy. If BTC does not have many trading opportunities, look for trading opportunities in altcoins.

From the hourly perspective, it is oscillating upward, continuously creating new highs. If it retraces without breaking the ob, short-term longs can be taken during the day. If it breaks the ob, one can expect a buying opportunity on the retracement.

Firstly, I believe that the downward trend line of this large cycle has been broken and successfully retested. A bearish rising wedge has formed on a smaller scale, indicating a potential short-term weakness, with a pullback expected to the large cycle's downward trend line and the 0.236 Fibonacci retracement level from this round of market battles, roughly around 67,000 USD, forming a large-scale rising wedge. The first target of this upward movement remains around 72,000 USD.

Firstly, I believe that the downward trend line of this large cycle has been broken and successfully retested. A bearish rising wedge has formed on a smaller scale, indicating a potential short-term weakness, with a pullback expected to the large cycle's downward trend line and the 0.236 Fibonacci retracement level from this round of market battles, roughly around 67,000 USD, forming a large-scale rising wedge. The first target of this upward movement remains around 72,000 USD.

Data Analysis Group

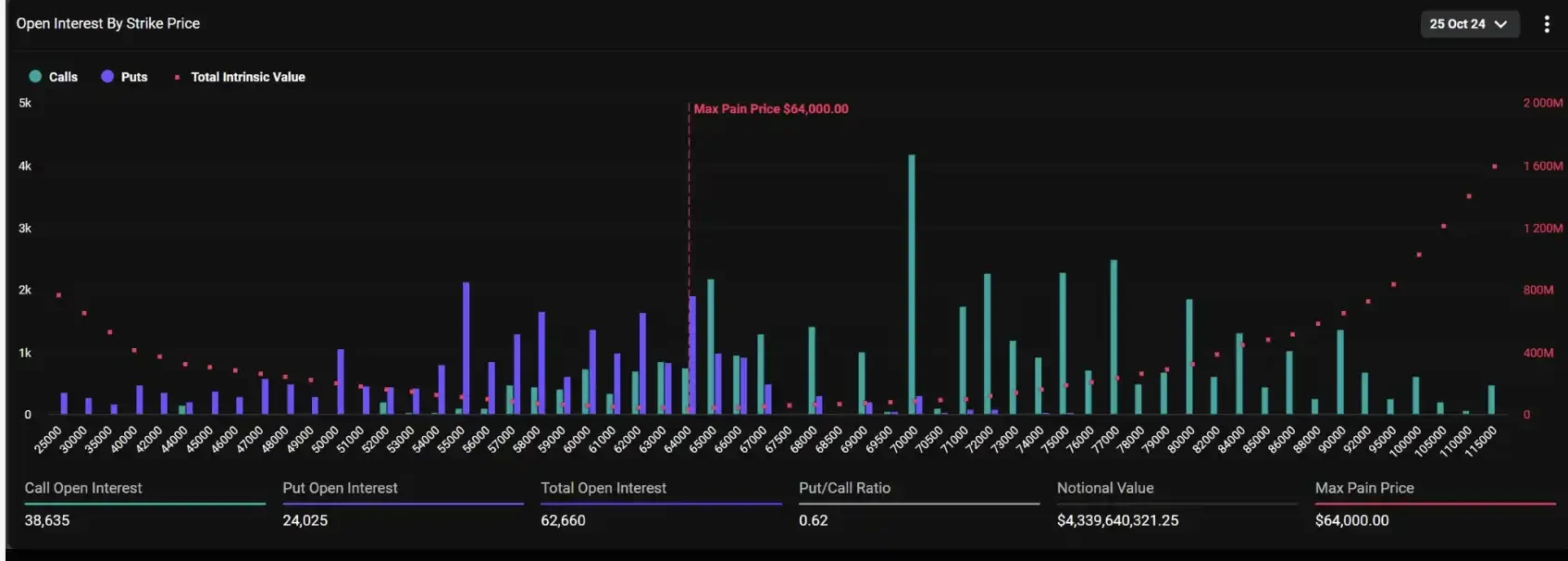

Based on the value area of BTC's wide oscillation over the past six months, yesterday's upward breakout did not surpass the half-year VAH, and the thickest distribution area, which is the largest supply zone, is at 70,900. If it can continue to rise without showing upward auction rejection, the next target for the rise would be 70,900.

Based on the value area of BTC's wide oscillation over the past six months, yesterday's upward breakout did not surpass the half-year VAH, and the thickest distribution area, which is the largest supply zone, is at 70,900. If it can continue to rise without showing upward auction rejection, the next target for the rise would be 70,900.

From the perspective of the annual VWAP, it has gone through a buildup and breakout without showing a significant downward drive but has retraced without breaking. Therefore, in the short term, I believe there will be continued upward breakouts. Based on the buyer liquidity depth chart and liquidation heat map, a key position for a downward pullback is around 65,000 USD to 67,000 USD.

Observing the auction format during the day, it is clearly an upward auction structure. This aligns with the view of continued upward breakouts, so one can remain bullish.

@LinChen91162689

From a data perspective, in the spot market: aggregated spot maintained slight selling on Sunday evening but began to increase volume on Monday morning, with the surge occurring in two phases; in the futures market: aggregated futures saw continuous small sales from Sunday evening to Monday morning, maintaining long positions and shorting during the first surge in the spot market, but after the second complete breakthrough of 69,000, it fully turned bullish. It appears that the bears initially entered based on the potential false breakout at 69,000, only to be stopped out by strong buying in the spot market. Notably, Coinbase changed its previous continuous selling state starting Sunday and began to consistently buy small amounts, which is a significant change; however, Binance futures, aside from three notable buying surges, spent the rest of the time in small long/short positions. In summary, buying pressure in the spot market has begun to appear! Although the volume is not very large, if it can absorb the selling pressure from futures profit-taking, the price can stabilize above 69,000;

From the perspective of USDT market share, the weekly USDT market share has slightly broken below the upward trend line of the past six months. If this truly confirms a breakout, it represents the entry of idle funds, and a likely outcome is that BTC's dominance may temporarily peak, while altcoins and small-cap projects will gain comprehensive liquidity in the next 2-3 weeks.

From the perspective of total futures positions, the total futures positions for BTC across the network have remained above the 40 billion USD mark for three consecutive days. While the positions remain high, the price has increased by 1,500 USD, indicating a small influx of spot funds. However, compared to the previous range of 68,000 to 69,000 USD, the current total positions have increased by 2.5 billion USD. For spot bulls, although sentiment is strong, there has not been significant selling pressure. Therefore, for the current market, spot does not pose a potential risk; rather, the additional 2.5 billion in positions could be the source of the next "long squeeze," leading to a large liquidation of high-positioned longs. In a true bull market, each liquidation of a large number of leveraged longs is a necessary condition for the next upward movement. In a market with high futures weight, shorts are the source of upward funds, while longs become a burden.

Macroeconomic Analysis Group

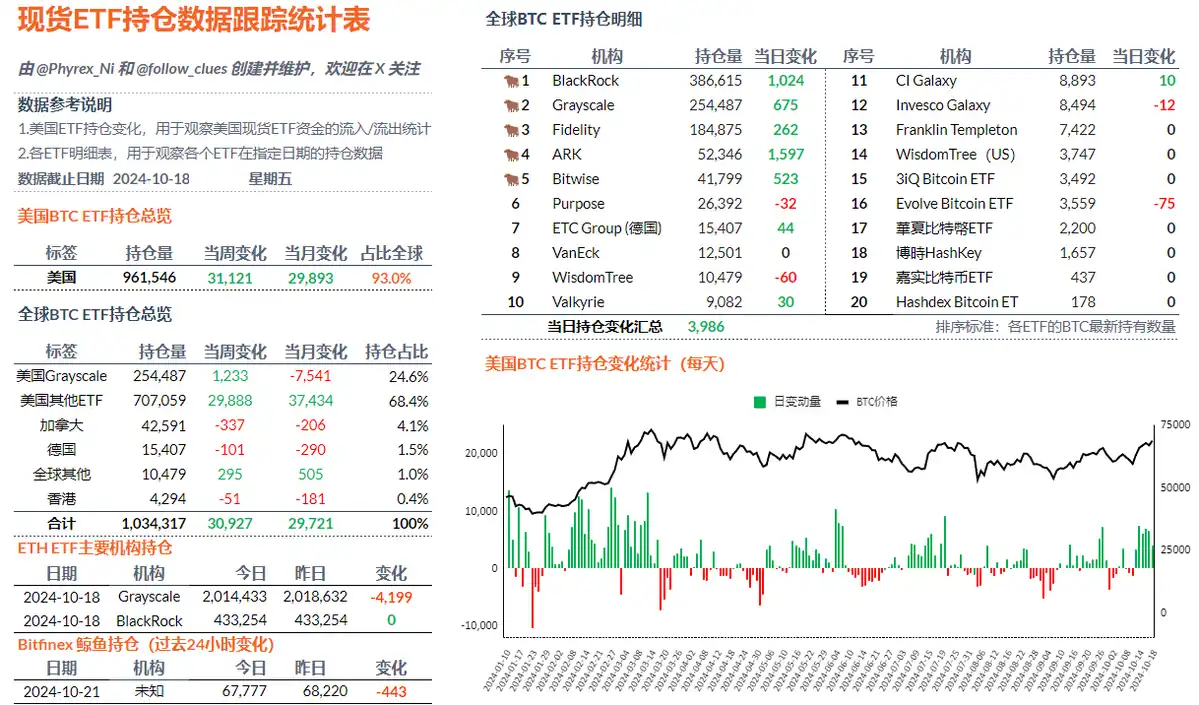

Last Friday, the data for BTC spot ETFs still performed well. Although there is a trend of decreasing purchasing power similar to ETH, a significant amount of funds are still concentrated in BTC. On Friday, the net inflow for spot ETFs was 4,099 BTC, which, although the lowest for the week, is still strong compared to the past.

BlackRock has seen a net increase for five consecutive working days during the week, accumulating a total of 16,975 BTC. Such weekly accumulation data has not been seen since March. Fidelity ranked second with a net increase of 4,807 BTC, followed by ARK with 4,538 BTC and Bitwise with 2,244 BTC in fourth place.

It is worth mentioning that Grayscale's GBTC saw a net increase of 963 BTC over the past week, not including the amount added by Mini ETFs, which stands in stark contrast to ETH. Even during times of very tight liquidity, investors' limited funds are still concentrated primarily in BTC.

In the past week, the net purchasing power of twelve U.S. ETFs was 31,119.43 BTC, an increase of 685.34% compared to the previous week. This data also far exceeds that of ETH. Grayscale's net selling has transformed from a net sale of 1,103.36 BTC two weeks ago to a net inflow of 1,232.71 BTC, indicating that Grayscale is no longer synonymous with BTC selling.

Other Cryptocurrencies

Altcoins did show some improvement over the weekend. Meme coins experienced a pullback, but optimism should still be tempered with caution. The oracle sector is rising, with API3 and DIA indicating increased on-chain activity, which can be seen as a positive signal for altcoins. APE surged after a pump announcement on October 20th, reaching a peak increase of over 100%, leading a joint rise in the metaverse and NFT sectors. Overall, the current market narrative does not seem to focus on the metaverse and NFT-related hotspots, so caution is warranted. These hotspots may be opportunities for altcoins to become active before selling off, as the metaverse and NFT sectors have the lowest heat in this cycle. However, the activity in the oracle sector remains optimistic, as last year's altcoin rally also began with the oracle sector, hoping to once again boost market activity.

He believes the market operates in a mysterious way, and we all have the opportunity to find some currencies that may bring excess returns or head towards zero after being promoted by other KOLs. For him, he would choose $GOAT and $GNON, and he has already bottomed out on GOAT. He believes that GOAT and GNON will become key positions in the long-term trend in the future. If he is wrong, he will become the exit liquidity for others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。