Original author: starzq (X: @starzqeth)

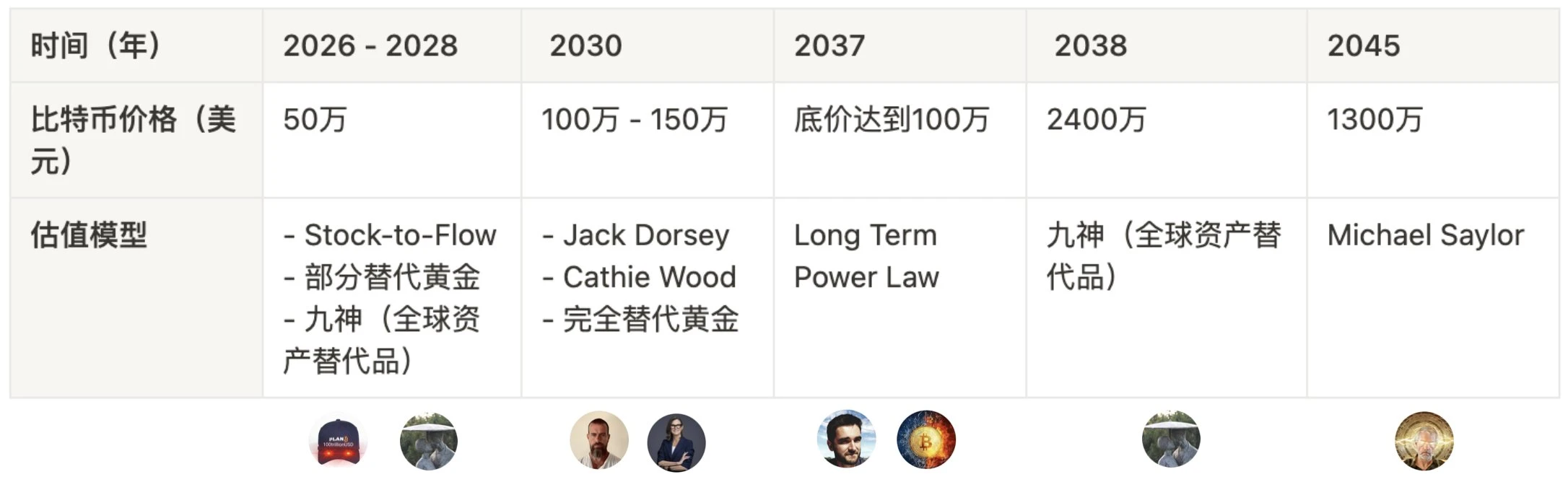

Would you be willing to hold Bitcoin for 4 years until it reaches $500,000? It has increased 90 times in the past 10 years; where will it go in the next 10 or even 20 years?

Recently, the price of Bitcoin has once again reached $69,000. With a series of factors such as the continuous release of favorable crypto news during the U.S. elections and the U.S. economy's monetary easing, breaking the $100,000 barrier next year has become a consensus among more and more people.

https://coinmarketcap.com/currencies/bitcoin/

MicroStrategy CEO Michael Saylor stated in a recent interview that Bitcoin will reach $13 million by 2045, which means an average annual growth rate of 29% over the next 21 years.

As a long-term investor/Hodler, I am more curious about what valuation models exist for Bitcoin. What will the long-term value trend look like? Therefore, I have collected and organized 7 common valuation models, which also provide more theoretical support for the behavior of 'HODL'.

If you are also interested in Bitcoin's valuation models, then enjoy!

Valuation Model 1: Gold Substitute

Valuation Model 2: Global Asset Substitute

Valuation Model 3: Stock to Flow Model

Valuation Model 4: Long Term Power Law Prediction

Valuation Model 5: Celebrity Endorsements

Valuation Model 6: U.S. Dollar Inflation Model

Valuation Model 7: Based on Production Costs

Valuation Model 1: Gold Substitute

This is also the most common method for valuing Bitcoin. With a fixed supply and resistance to inflation, Bitcoin has become a new medium of "value storage," corresponding to gold in the old world.

Gold, as a long-term "value storage" asset, is accepted worldwide and has become a cross-border asset; Bitcoin, as digital gold, has gained some consensus starting from the geek community, among many young people, new money, and wealthy asset systems (the approval of BTC ETFs this year has further strengthened this consensus), replacing part of the "value storage" role previously held by gold.

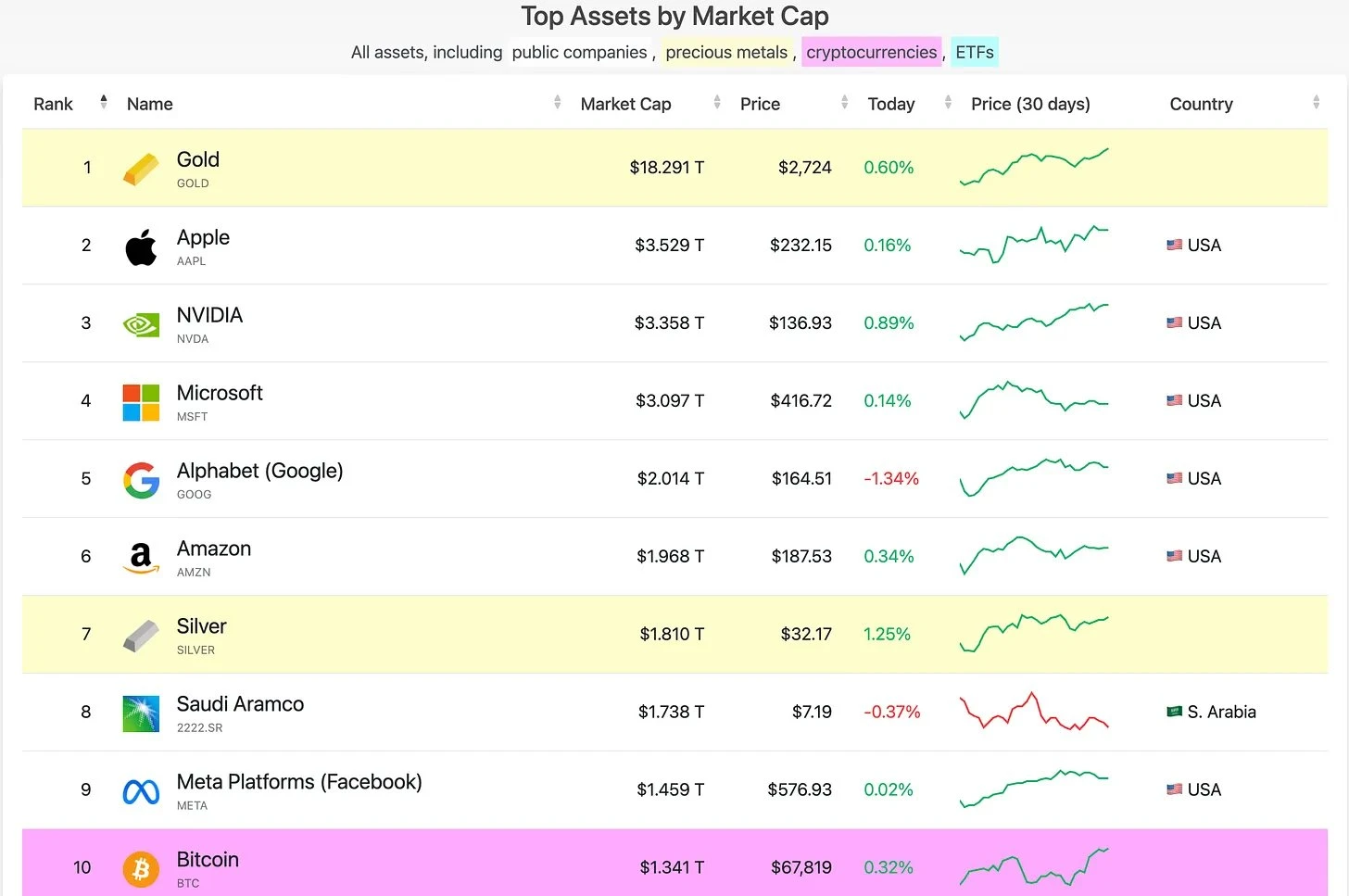

https://companiesmarketcap.com/assets-by-market-cap/

As of now (October 18, 2024), the market value of gold is $18.3 trillion, while Bitcoin's price is $67,819, with a market value of $1.34 trillion (the current mined amount is 19.76 million, very close to the total supply of 21 million), ranking as the tenth largest asset globally, accounting for 7.3% of gold. Below, I have listed the corresponding Bitcoin prices as this ratio increases:

10%: $92,523

15%: $138,784

33%: $305,325

100%: $925,226 (fully reaching the same market value as gold)

10% is the historical peak of the [Bitcoin/Gold] market value ratio; if the penetration rate further increases, it could reach 15%, meaning this cycle's peak might be around $140,000.

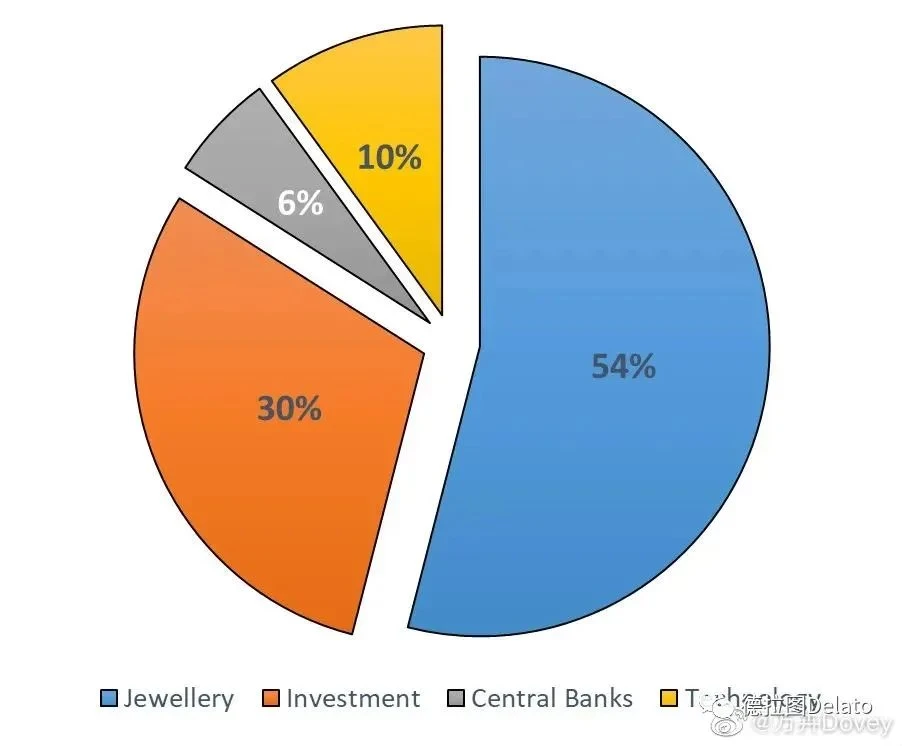

Why mention the 33% ratio? Because gold's value is not entirely "value storage"; in fact, over half is for decorative purposes, 10% is for industrial use, and only 1/3 is for investment and reserves. Since Bitcoin has no decorative or industrial use, under normal circumstances, 33% might be the maximum ratio, at which Bitcoin could reach around $300,000.

If one day Bitcoin reaches the same market value as gold, the price will approach nearly $1 million.

Source: The Golden Age of Bitcoin

Valuation Model 2: Global Asset Substitute

Is $1 million the endpoint for Bitcoin?

The answer is certainly No.

Besides gold, we also use currencies and real estate as forms of value storage. The following estimates come from the renowned Jiu Shen's "Hoarding Bitcoin" (the estimation point was in 2018, available for download here):

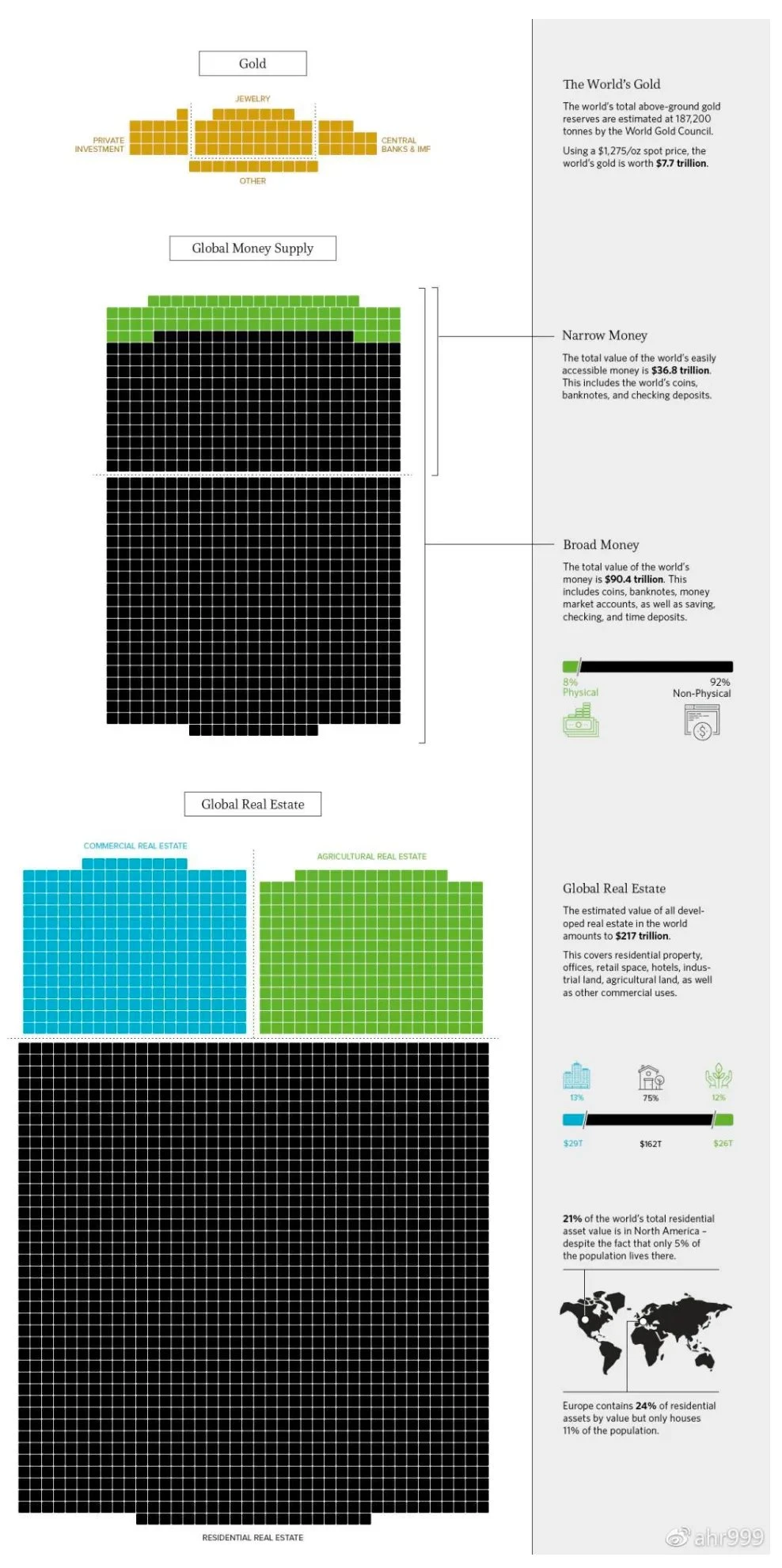

The total market value of global gold is $7.7 trillion, the total amount of broad money is $90.4 trillion, and real estate is $217 trillion.

Broad money includes cash, demand and time deposits, and client margin at securities firms. Except for cash (which accounts for 8%) used for circulation, the rest is for value storage.

The primary use of real estate should still be for living and use, but there is certainly a considerable proportion used for value storage. If it weren't for Bitcoin, I would likely have allocated most of my funds to buying property. Since there is no ratio to check, we temporarily assume that 20% of real estate is used for value storage (this ratio does not affect the final result's magnitude).

So, how large is the global total value storage market? 7.7 + 90.4 × 92% + 217 × 20% = $134 trillion.

Total amounts of world gold, currency, and real estate (modified from http://money.visualcapitalist.com/)

Bitcoin's total supply is only 21 million, with about 3 million permanently lost. Considering Bitcoin's absolute advantage in value storage compared to gold, currency, and real estate, each Bitcoin could rise to $7.5 million.

$134 trillion / 18 million = $7.5 million

Is that all? Of course not.

The total wealth in the world is growing at a rate of 6% per year, meaning in 10 years, the total will be 1.8 times what it is now, and in 20 years, it will be 3.2 times what it is now. Therefore, assuming that by 20 years later (2038), Bitcoin's value storage function is widely recognized, its price should be $24 million, or 160 million RMB.

Of course, this is under the condition that Bitcoin occupies 100% of the global total value storage market; if it reaches a 10% market share, Bitcoin's price in 2038 would be $2.4 million, or 16 million RMB.

For the most aggressive version of [160 million RMB], Jiu Shen also created linear and exponential price models:

"Linear Growth" (which is not actually linear mathematically): the growth multiple is the same for each cycle;

"Exponential Decay": the growth multiple is high at first, then decreases later.

Predictions for Bitcoin prices under the two growth models, in RMB

The above predictions were made in 2018, and indeed, by the end of 2021, Bitcoin's price reached $64,863, approximately 450,000 RMB, which is quite close to Jiu Shen's prediction. Will this cycle reach the figures in the table of 3.4 million RMB / $500,000?

By the way, another significant contribution from Jiu Shen is the invention of the famous Jiu Shen Hoarding Index, which guides dollar-cost averaging and bottom-fishing (I personally use this indicator):

ahr999 = (Bitcoin price / 200-day dollar-cost average) * (Bitcoin price / index growth valuation)

• Index growth valuation = 10^[5.84 * log(age of coin) - 17.01]

• Age of coin = the number of days from the Bitcoin genesis block (January 3, 2009)

Based on the index backtesting:

When the ahr999 index data is below 0.45, it may be suitable for bottom-fishing;

Between 0.45 and 1.2, it may be suitable for dollar-cost averaging BTC;

Above this range indicates that it may not be a good time for dollar-cost averaging.

Valuation Model 3: Stock to Flow Model

In 2019, Twitter user PlanB expanded on the concept of "scarcity" based on the "gold substitute" idea and proposed the Stock to Flow Model.

We will explain this model in three parts:

Only goods with scarcity can better serve as a store of value and fulfill the role of currency;

Scarcity can be quantified through the Stock-to-Flow Ratio;

Final modeling

1. Only goods with scarcity can better serve as a store of value and fulfill the role of currency

This point should not require much explanation; we can directly quote the words of cypherpunk pioneer Nick Szabo:

What do antiques, time, and gold have in common? They are all expensive, either because of their original cost or because their history is unpredictable, making it difficult to counterfeit such expense. Precious metals and collectibles have an unforgeable scarcity due to their high production costs.

This has historically provided value for currency, with its value largely independent of any trusted third party. Therefore, if there were a protocol that could create unforgeable expensive bits online, relying minimally on trusted third parties, and then securely store, transfer, and verify with similar minimal trust, that would be very good. Bitcoin is like gold.

By the way, Nick Szabo has been suspected of being Satoshi Nakamoto due to his professional background and writing style, but he has repeatedly denied it.

2. Scarcity can be quantified through the Stock-to-Flow Ratio

Bitcoin scholar Saifedean Ammous further introduced the concept of the Stock-to-Flow Ratio to quantify scarcity:

For any consumable, doubling the output will make the existing stock look insignificant, causing prices to plummet and harming holders.

For gold, a price surge leading to a doubling of annual output is also trivial, only increasing reserves by 3%.

It is precisely the low supply rate of gold that has allowed it to maintain its role as currency throughout human history.

Gold's high [Stock-to-Flow Ratio] makes it the commodity with the lowest supply elasticity.

In 2017, Bitcoin's existing reserve was about 25 times the new Bitcoin produced that year. This was still less than half of gold's ratio, but by around 2022, Bitcoin's [Stock-to-Flow Ratio] will exceed that of gold.

Stock-to-Flow Ratio (abbreviated as SF) = stock / flow

Stock refers to the total amount of the current commodity

Flow refers to the annual supply of the current commodity

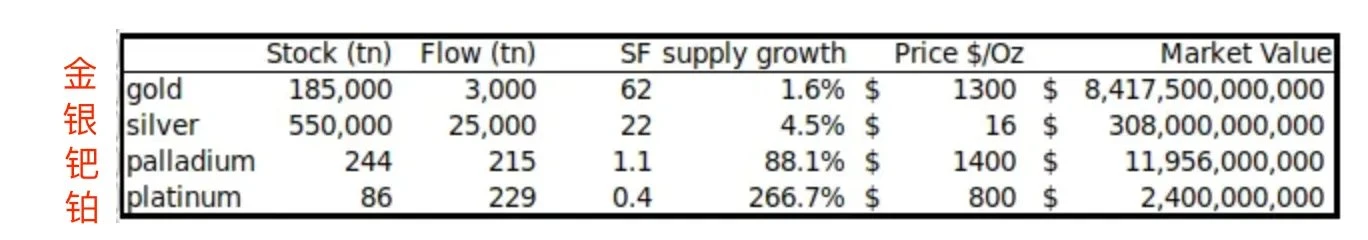

The author provided the Stock-to-Flow Ratios of several commodities as of March 23, 2019:

Gold has the highest SF of 62, requiring 62 years of production to achieve the current gold reserves. Silver ranks second with an SF of 22. This high SF makes them monetary commodities.

Palladium, platinum, and all other commodities have SFs of nearly 1. Existing stocks are usually equal to or less than annual production, making production a very important factor.

It is difficult for commodities to achieve a higher SF because once someone hoards them, prices will rise, production will increase, and prices will fall again. It is hard to escape this trap.

Bitcoin currently has a stock of 17.5 million coins, with an annual supply of 700,000 coins = SF 25. This places Bitcoin in the category of monetary commodities, like silver and gold. The market value of Bitcoin at the current price ($4,000) is $70 billion.

From the table above, it can also be seen that SF is proportional to the value of such commodities, and Bitcoin halving will lead to a continuous increase in Bitcoin's SF, thereby enhancing its value.

Indeed, according to Biteye's statistics,

Bitcoin's Stock-to-Flow Ratio is: 19,750,000 / 164,359 ≈ 120.1 (August 2024)

Gold's Stock-to-Flow Ratio is: 209,000 / 3,500 ≈ 59.7 (2023)

Gold's Stock-to-Flow Ratio is not much different from 2019, but Bitcoin has increased more than threefold and is currently twice that of gold! This means Bitcoin's scarcity is about twice that of gold. How will this be reflected in Bitcoin's value predictions?

3. Final Modeling

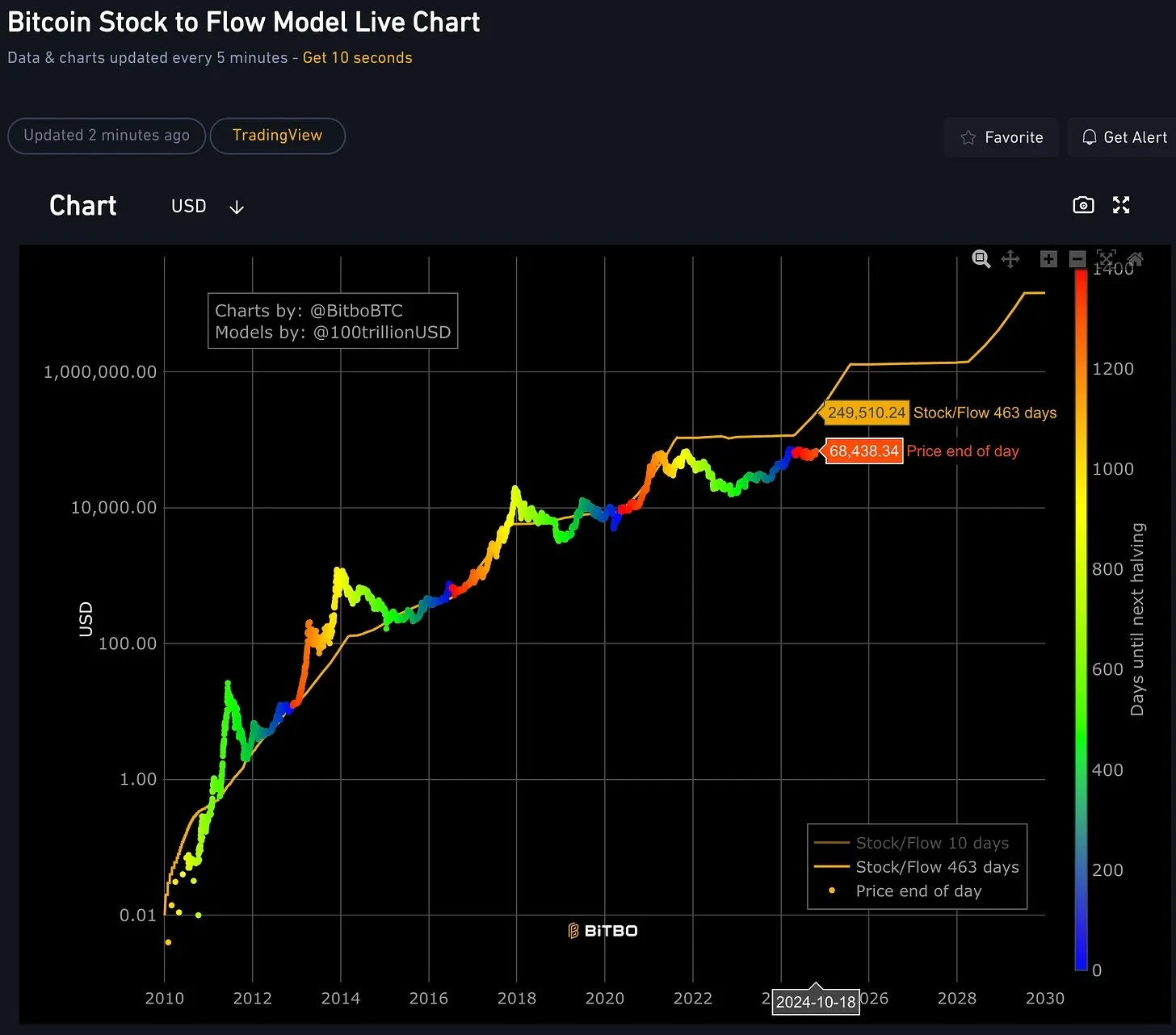

PlanB's model assumes that scarcity represented by SF directly drives Bitcoin's value.

Skipping the intermediate derivation process, the final formula is: market value = exp(14.6) * SF ^ 3.3 (a power law distribution)

https://charts.bitbo.io/stock-to-flow/

It can be seen that this Stock-to-Flow model has been quite accurate in its predictions from March 23, 2019, to May 2021, but then the predicted prices far exceeded the actual prices.

According to this model, the current predicted price is $250,000 😂

However, the author did predict that after the halving in May 2020, the price would reach $55,000 within one to two years, and Bitcoin's market value would exceed $1 trillion (March 9, 2021), which also made PlanB famous on Twitter.

Moreover, he also predicted where all the funds needed for a $1 trillion Bitcoin market value would come from:

My answer: silver, gold, countries with negative interest rates (Europe, Japan, the U.S. soon), predatory governments (Venezuela, China, Iran, Turkey, etc.), billionaires and millionaires hedging against quantitative easing (QE), and institutional investors discovering the best-performing asset of the past decade.

PlanB himself still insists on his prediction:

After the halving in 2024, Bitcoin will reach $500,000 by 2028, and its market value will exceed $1 trillion.

Will it happen? Let's wait and see.

Valuation Model 4: Long Term Power Law Prediction

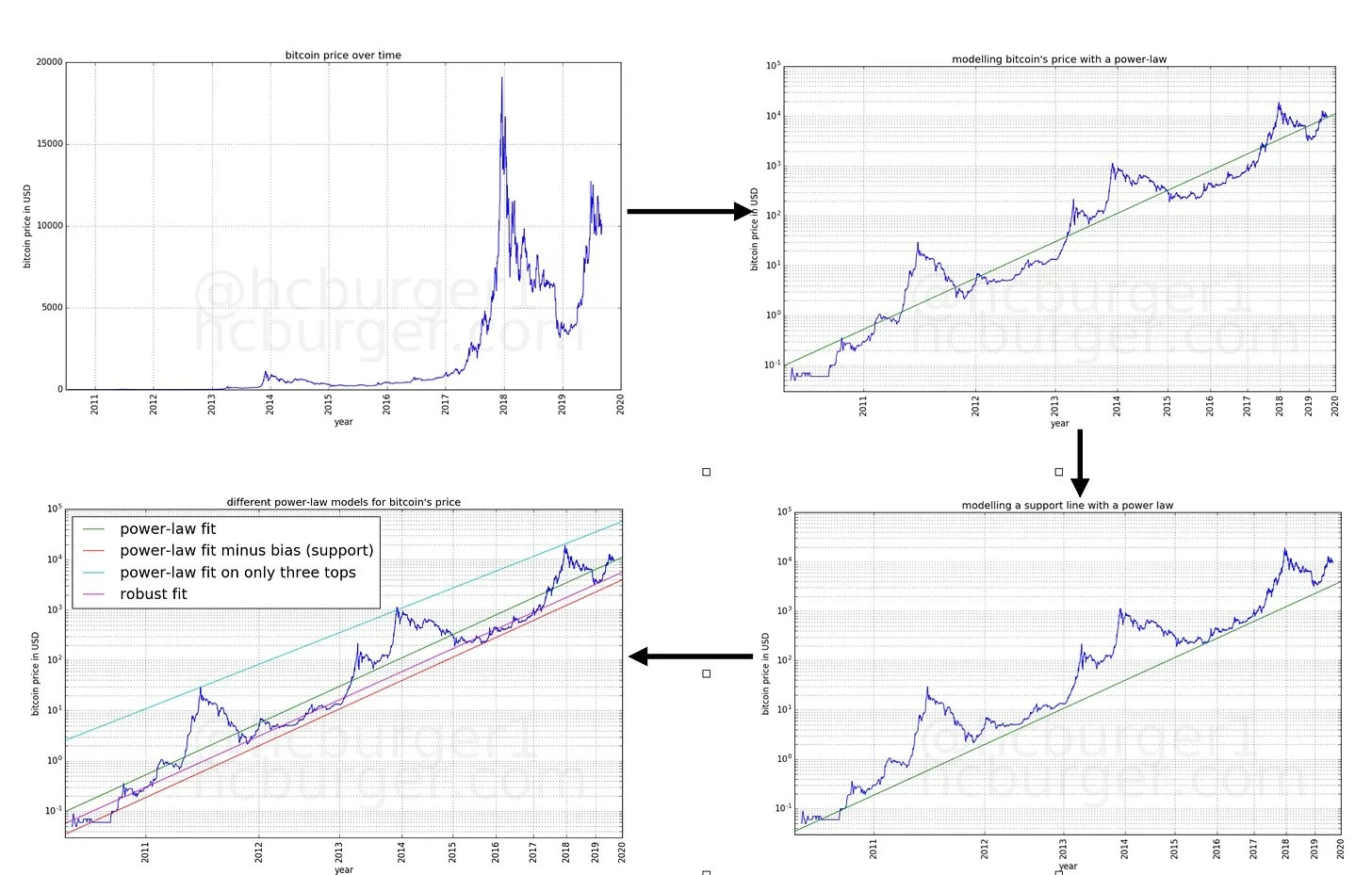

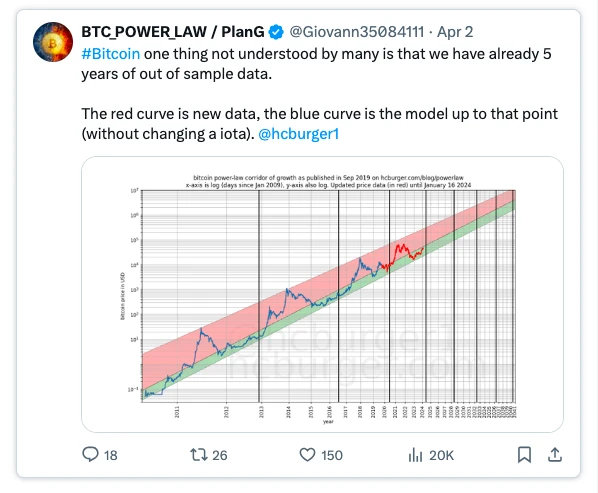

After PlanB proposed the Stock-to-Flow model in 2019, many others also noticed the time power law distribution of Bitcoin prices, one of whom is Harold Christopher Burger. He pursued his PhD at the Max Planck Institute and is now an AI expert.

On September 3, 2019, he published an article titled “Bitcoin’s natural long-term power-law corridor of growth” predicting the long-term market tops and bottoms of Bitcoin prices:

Bitcoin prices will reach $100,000 per Bitcoin between 2021 and 2028, and after 2028, prices will never fall below $100,000.

Bitcoin prices will reach $1 million per Bitcoin between 2028 and 2037, and after 2037, prices will never fall below $1 million.

This model is very easy to understand:

By taking the logarithm of both the y-axis (price) and x-axis (time) for the [price-time] distribution of Bitcoin, it can surprisingly be fitted with linear regression;

By slightly moving the fitted line down (without changing the slope), we obtain a support line for Bitcoin prices;

By performing linear regression on the three highest points obtained in 2011, 2013, and 2017, we get a power law line for market tops;

Bitcoin prices fluctuate between the two power law lines: the lower support line and the upper line defined by the three market highs.

https://hcburger.com/blog/powerlaw/

The strength of this model lies in the fact that the data from the five years following its proposal (September 2019 to September 2024) still falls within its predicted range, suggesting that the $100,000 mark should not be far off.

Valuation Model 5: Celebrity Endorsements

I must admit that this part is quite entertaining and serves more as a record of the times. Here are three representative examples:

ARK Invest CEO Cathie Wood predicted in January 2024 that Bitcoin will grow to 1.5 million dollars by 2030.

Former Twitter CEO Jack Dorsey predicted in May 2024 that Bitcoin will surpass the $1 million mark by the end of 2030.

MicroStrategy's Michael Saylor stated in a recent interview that Bitcoin will reach $13 million by 2045, which means an average annual growth rate of 29% over the next 21 years.

Although this is entertaining, the crypto market still has strong reflexivity, and celebrity endorsements can indeed influence local prices at certain times.

Valuation Model 6: Dollar Inflation Model

Source: https://www.tastycrypto.com/blog/bitcoin-price-predictions/

When making price predictions over a 10-year period, we must consider the impact of dollar inflation, which leads to a significant increase in asset prices.

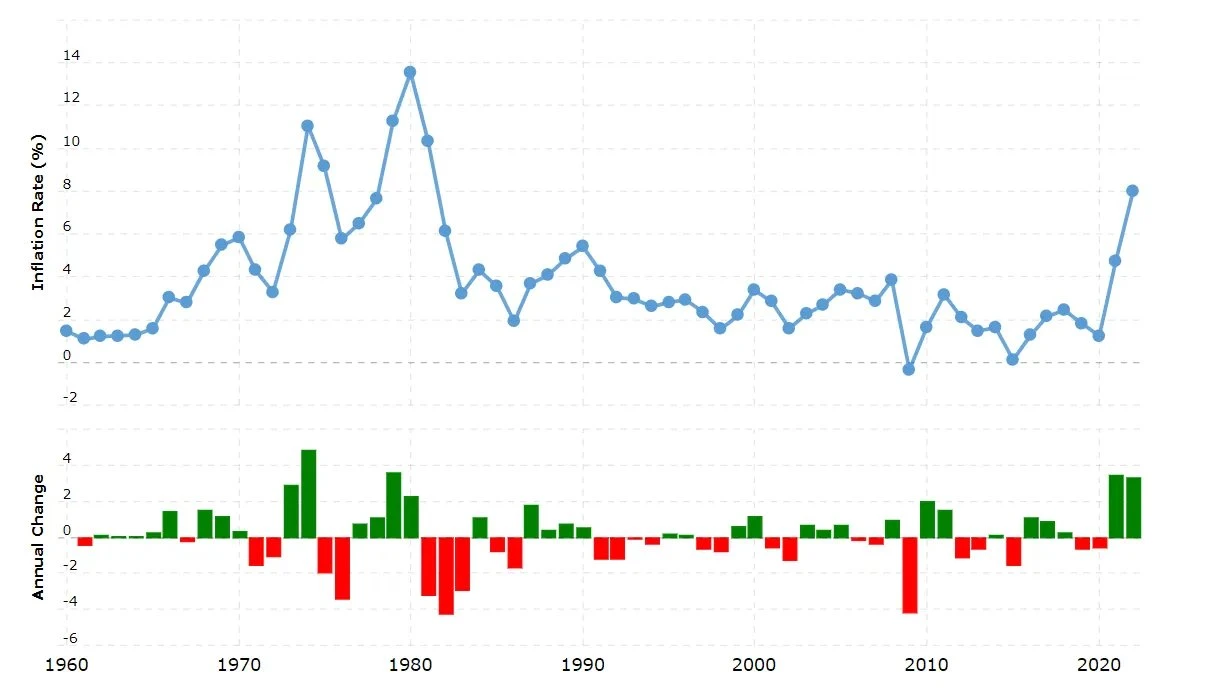

Unlike Bitcoin, the dollar is an inflationary asset, with the Federal Reserve's inflation target set at 2%. However, we are not robots, and completely controlling the economy is challenging. Central banks often print more money by lowering interest rates to stimulate economic growth, especially during difficult times like a pandemic. This is why we have seen a surge in inflation, with an annual rate reaching 8%, the highest in about 40 years.

https://www.macrotrends.net/global-metrics/countries/USA/united-states/inflation-rate-cpi

Due to rising inflation, the purchasing power of the dollar is weakening. For example, $100 in 1984 is worth over $300 today.

Considering this factor alone, Bitcoin's current price of $69,400 (April 2024) could reach around $200,000 by 2050, not accounting for other fundamental factors.

(I believe many celebrity predictions also take inflation into account.)

In fact, if the dollar loses its status as the world's reserve currency, possibly due to current structural geopolitical changes, this could lead to hyperinflation (though the likelihood is very low), pricing Bitcoin at astronomical figures.

Valuation Model 7: Based on Production Costs

This is also easy to understand; for miners, Bitcoin is a business that generates cash flow and profits. The shutdown price of mining machines often marks a bottom price for a period, which can be used to guide bottom-fishing (though it is difficult to use for guiding price increases).

Well, that concludes the seven valuation models for Bitcoin. For those interested in the details, I have included links in each section for further exploration. If I have missed any other important valuation methods that you know of, feel free to leave a comment.

I hope these valuation models can help you better understand, invest in, and hold Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。