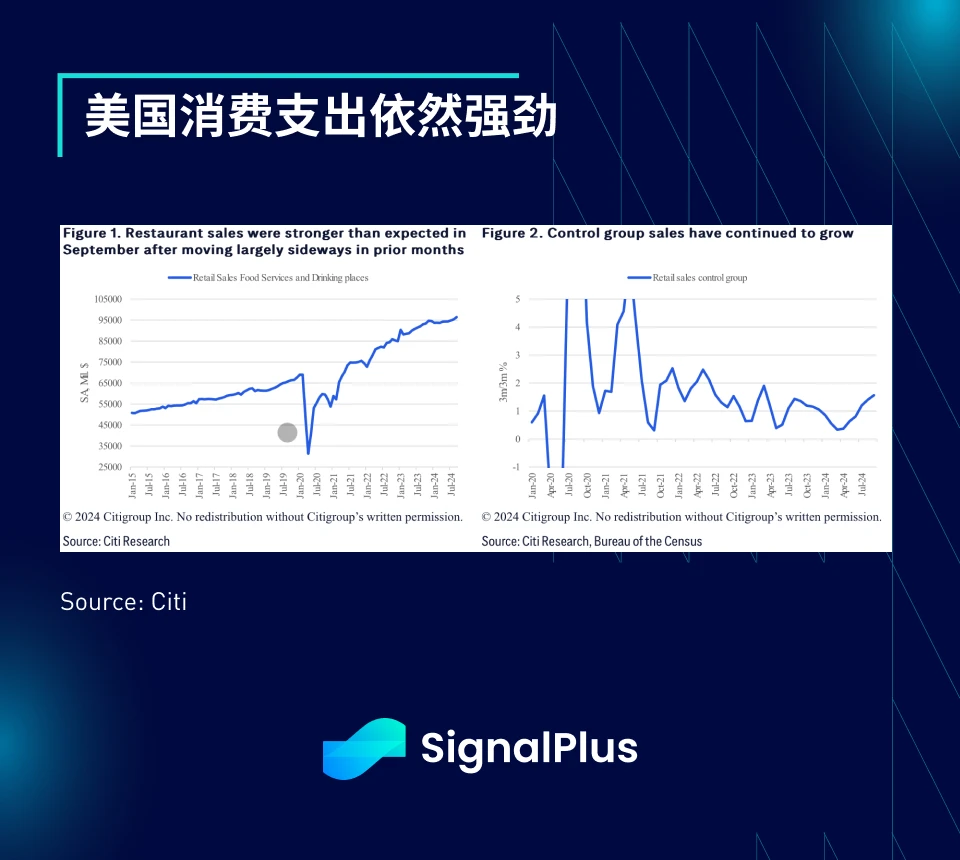

The market was relatively calm last week, with risk appetite continuing. The U.S. stock market, U.S. Treasury yields, the dollar exchange rate, gold, and BTC prices all approached mid-term or yearly highs. U.S. economic data performed strongly, with retail sales exceeding expectations (actual monthly increase of 0.6%, control group monthly increase of 0.7%), and the number of unemployment claims remained stable, continuously supporting the narrative of a soft landing.

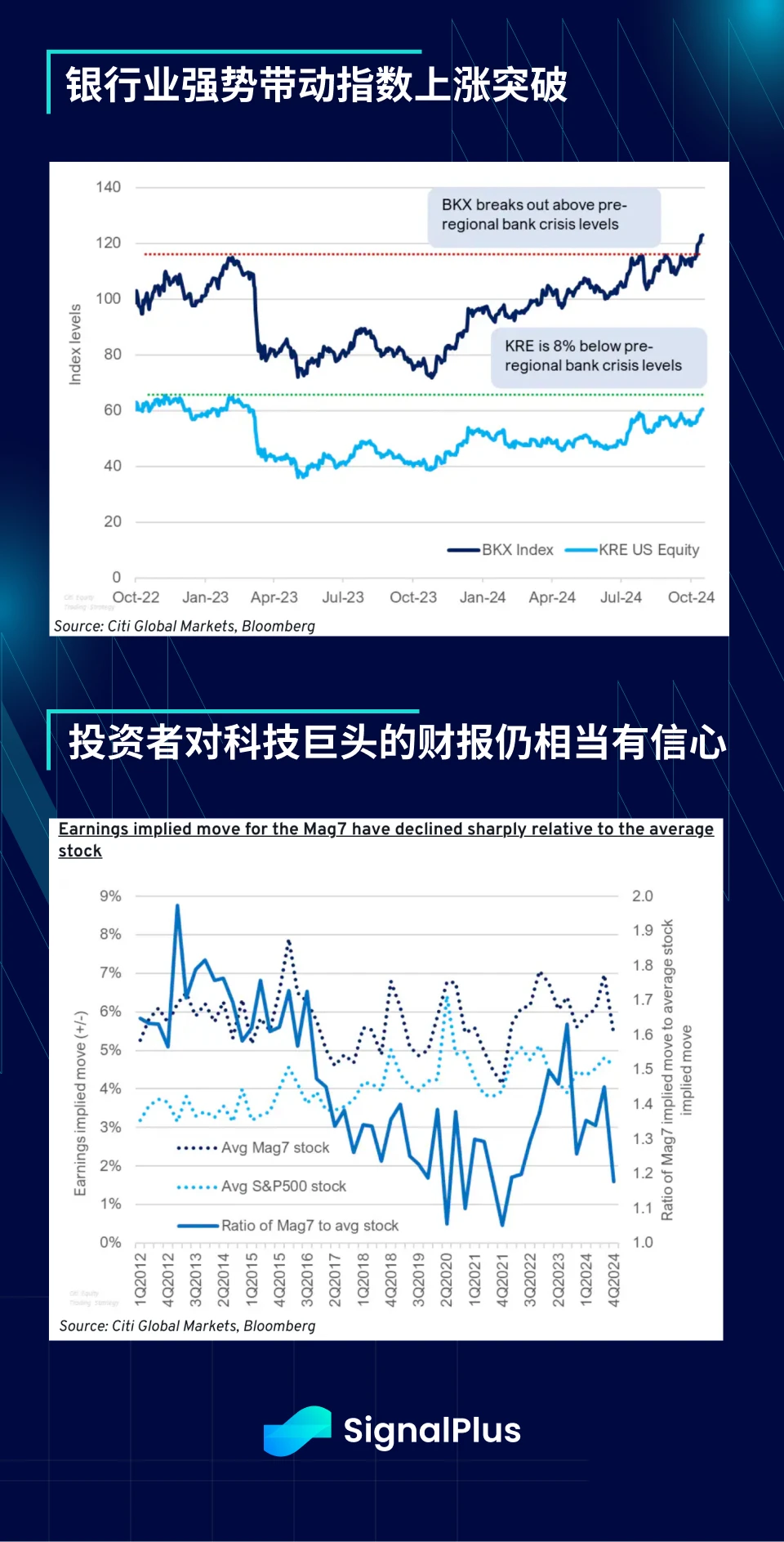

The performance of the earnings season has also been favorable for the market, with the U.S. banking sector, Netflix, and TSMC (up 9.8%) all exceeding expectations. The SPX index has risen for six consecutive weeks, setting the best consecutive increase record of the year, while investors remain confident in the market and corporate profits, with options implied volatility on earnings days about 5% lower than the recent average.

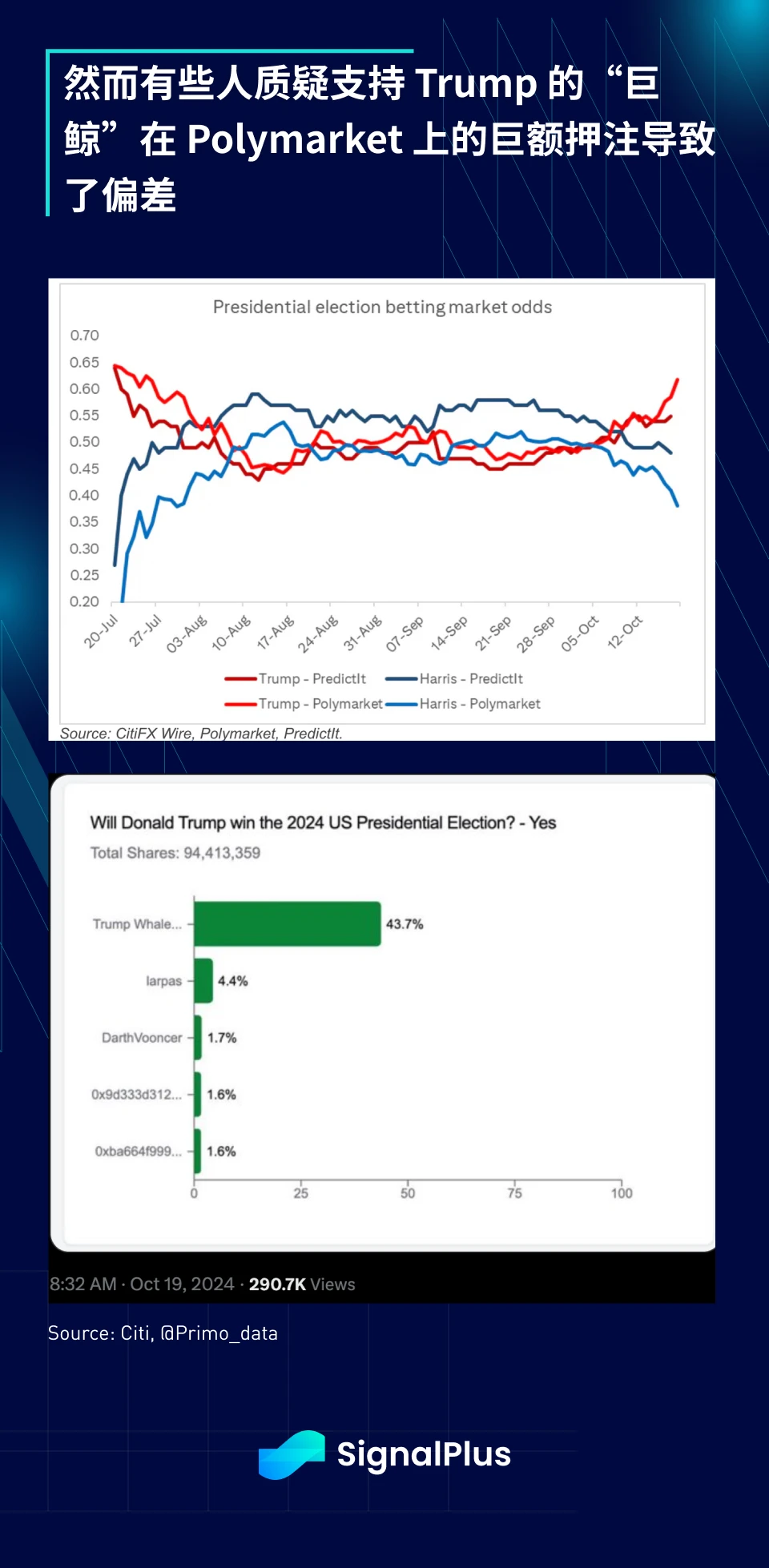

Recent focus has naturally shifted to the U.S. elections, with much discussion about the divergence between predictions from Polymarket (Trump's winning probability at 60%) and traditional forecasts (still close to 50/50). Regardless of the details, macro asset trading may lean towards a Trump victory as we approach November, with bond traders generally expecting Trump to push for more aggressive fiscal spending in a second term. Recently, the trend in U.S. Treasury yields has shown a very high correlation with the probability of a Trump victory.

BTC seems to be waking up from a long slumber, breaking out of its downward channel and seeking to challenge historical highs before the election. The price recently broke through $68,000, while ETFs saw about $2.4 billion in inflows over the past six trading days, and BTC futures open interest has surged accordingly, which may indicate that the market is establishing new long positions.

Excitingly, the increase in BTC inflows coincides with a significant rise in trading activity in CME derivatives, with CME futures open interest exceeding $11.5 billion, reaching a historical high. Additionally, according to research from K33, the growth in CME open interest is driven by "direct participants" rather than leveraged inflows, presenting a healthier bullish structure and a more positive buying inclination. Furthermore, considering that traditional financial (TradFi) participants are largely restricted in trading on centralized exchanges, the surge in CME trading activity also indicates the entry of more mainstream and TradFi participants.

The current market focus is on the U.S. elections. For cryptocurrencies, the most favorable outcome would be a Trump victory and a Republican sweep of both houses, allowing the Trump/Vance-supported digital asset reform plan a chance to pass through Congress. The second scenario is a Trump victory but a divided Congress, where the reform plan may face some resistance from the House Financial Services Subcommittee. However, incumbent senior senator Maxine Waters has previously urged for stablecoin legislation to be included in the defense bill.

On the other hand, if Harris is elected but Congress is divided or controlled by Republicans (the probability of a Democratic sweep is low), it would bring more uncertainty. Harris has yet to detail any cryptocurrency-related policy goals, only stating the need to "encourage innovative technologies such as AI and digital assets." Let's keep an eye on this!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。