Although Ethereum remains the dominant ecosystem, its core developers have slightly decreased due to increased participation in Layer 2 solutions and competition from other L1s. Base has rapidly emerged as a leading Layer 2 platform following the Dencun upgrade.

Author: Luke Nolan

Translation: Blockchain in Plain Language

Ethereum still leads the ecosystem with the most active developers, but the number of core contributors has slightly declined due to increased participation in Layer 2 solutions and competition from other L1s.

The Layer 2 ecosystem is experiencing significant growth, especially after the Dencun upgrade, with Base leading in developer contributions and transaction activity.

Base is showing signs of becoming a leading Layer 2 platform in the future.

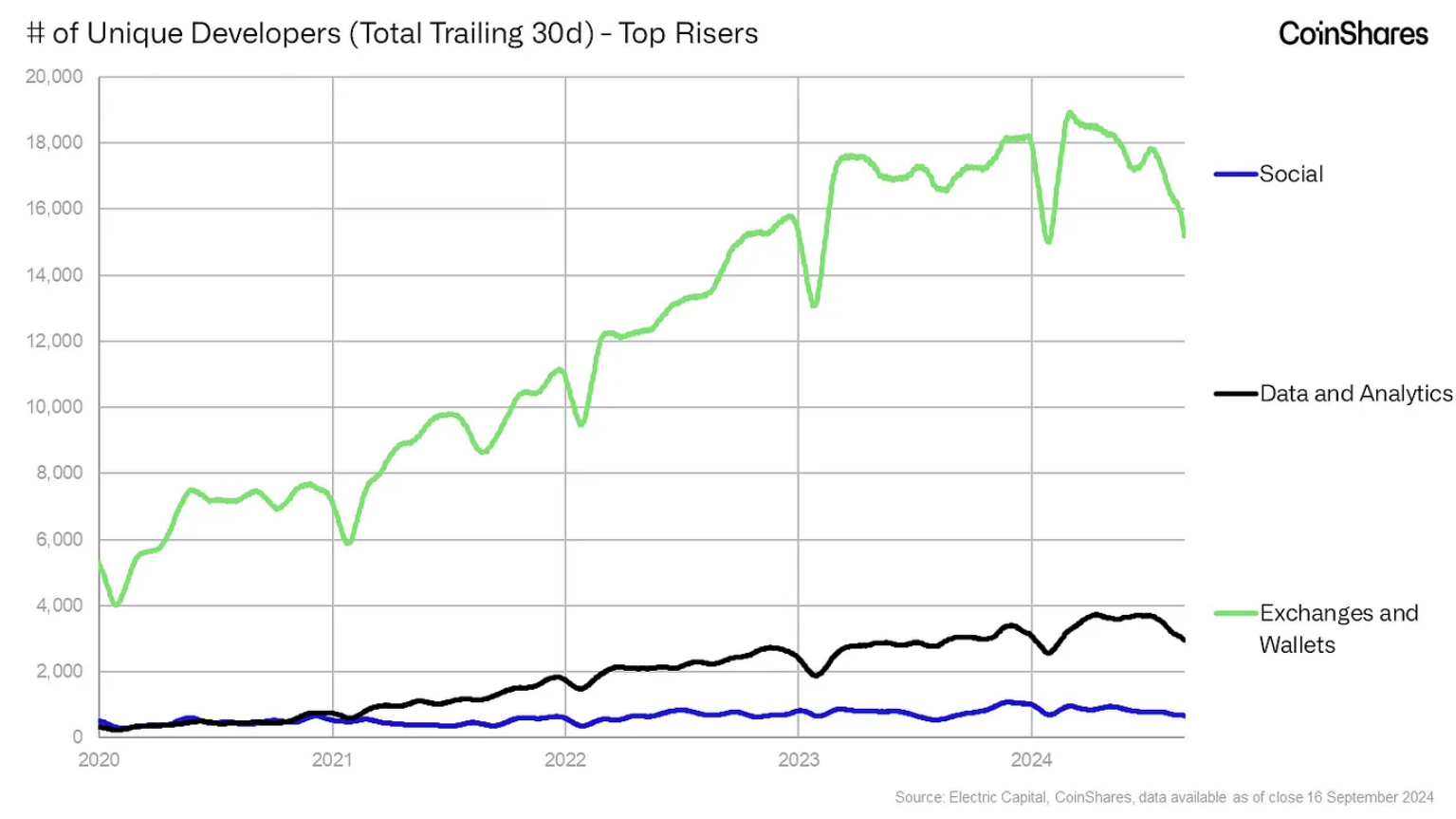

The category of wallets and trading platforms has seen the largest increase in the number of contributors.

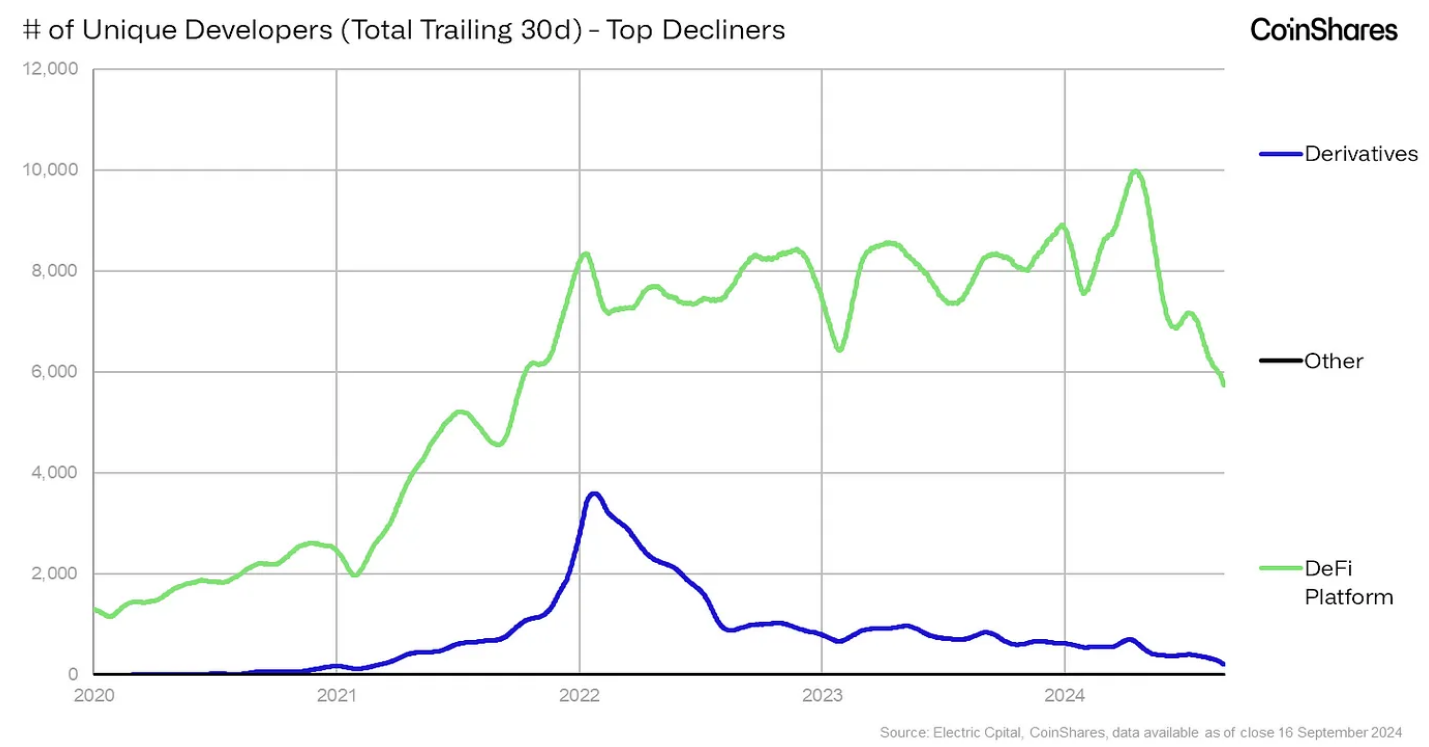

Conversely, the number of contributors to pure derivatives platforms has seen the largest decline.

The value of a blockchain or its underlying token derives from various variables and perspectives. Typically, this may involve speculative capital investing in an idea, whether it’s a technological advantage over existing competitors, a new application or service that seems capable of attracting hundreds of thousands of users in the future, or a protocol that has found some product-market fit and generated actual cash flow as a revenue-generating asset.

It is evident that there is no one-size-fits-all approach. In the stock market, relative valuation or objective discounted cash flow models may work well, but in the world of crypto tokens, it is challenging to find a method to help you evaluate any specific token or protocol.

When we consider developer activity, we believe it can be both a* lagging indicator* and a leading indicator. Blockchains or protocols that outperform their peers often attract a large number of top developer talent, while those with many developers working from the start tend to perform better than their peers without the same network effects. The numbers explored in this article largely support this view. Therefore, while it is important to assess the value of token-based protocols from a broad perspective, this article will focus on the changes in developer activity over time, including the areas with the most recent growth and the ecosystems with the largest decline in developer activity.

We will also pay special attention to the top five ecosystems by market capitalization and the changes in the Ethereum Layer 2 developer ecosystem since the Dencun upgrade in March of this year.

Data collection is an ongoing process and will be regularly improved, so we will strive to keep updates frequent to stay informed about developments.

1. Methodology

Electric Capital has done an excellent job in crypto developer statistics. They not only maintain an open-source GitHub taxonomy (which we will use), but also publish a comprehensive report every few months detailing how they collect and classify data, which distinguishes this article from future analyses.

As this taxonomy is continuously updated, new ecosystems and sub-ecosystems are constantly being added, creating a dynamic dataset that may alter past data. For example, new repositories created and added to the Base ecosystem last year will modify past numbers. While having a dataset that showcases a "dynamic" situation is very valuable, this article intentionally maintains it as a static snapshot to provide control for future iterations. We are still exploring a separate dynamic progress and the best way to implement it.

With this clarification, our methodology for this analysis can be described as:

Scraping all ecosystems based on the aforementioned taxonomy

Data is frozen to ignore newly added repositories in future scrapes

Collecting the total number of commits and the total number of unique developers for each repository in each ecosystem and sub-ecosystem

Only including ecosystems with at least 50 active developers in the past 30 days

Developers are considered active if they contributed at least 10 times in the past 3 months

This is done to reduce the so-called "crypto tourist effect," where people are attracted to participate in projects for a short time due to airdrops or other incentives

Although this results in lower numbers, it more reasonably reflects the overall trend of those who contribute significantly to the ecosystem

This methodology has undergone multiple iterations; while we do not consider it perfect, it has produced very interesting results, and we will continue to optimize it as necessary in the future.

2. Ecosystem Summary

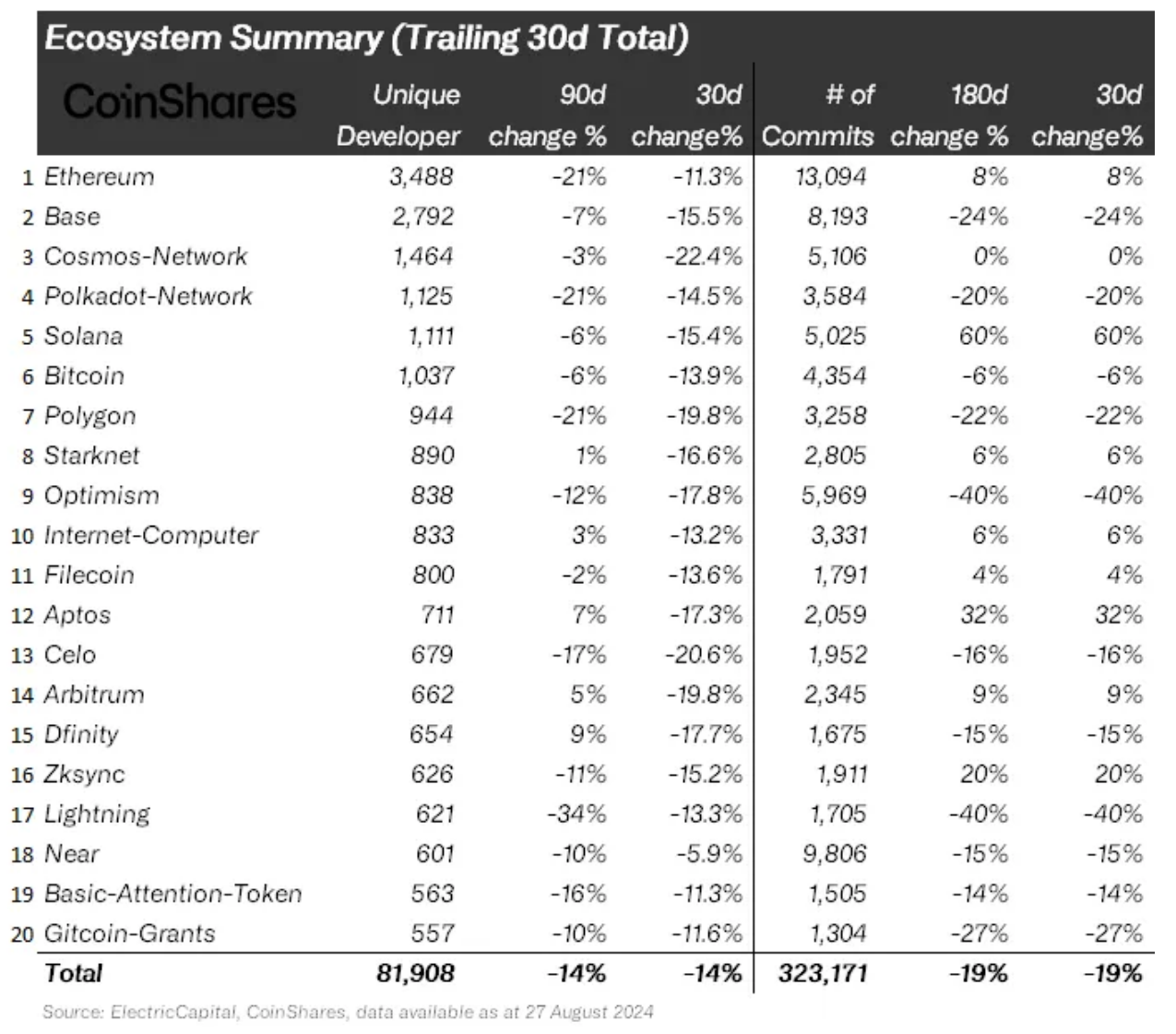

Above, we can see the ecosystem summary, showcasing the top ecosystems with the most unique developers in the past 30 days. Unsurprisingly, Ethereum ranks first with approximately 3,500 unique developers. In fact, most of the ecosystems on the list are expected to be at the forefront.

Considering that the Cosmos network is essentially "the blockchain of blockchains," it is reasonable that a large number of developers are working within this ecosystem, as it contains a significant number of sub-repositories. Notably, there are six Ethereum Layer 2s in the top 20, with their activity growth closely related to the surge in activity following the Dencun upgrade, which will be analyzed in more detail later.

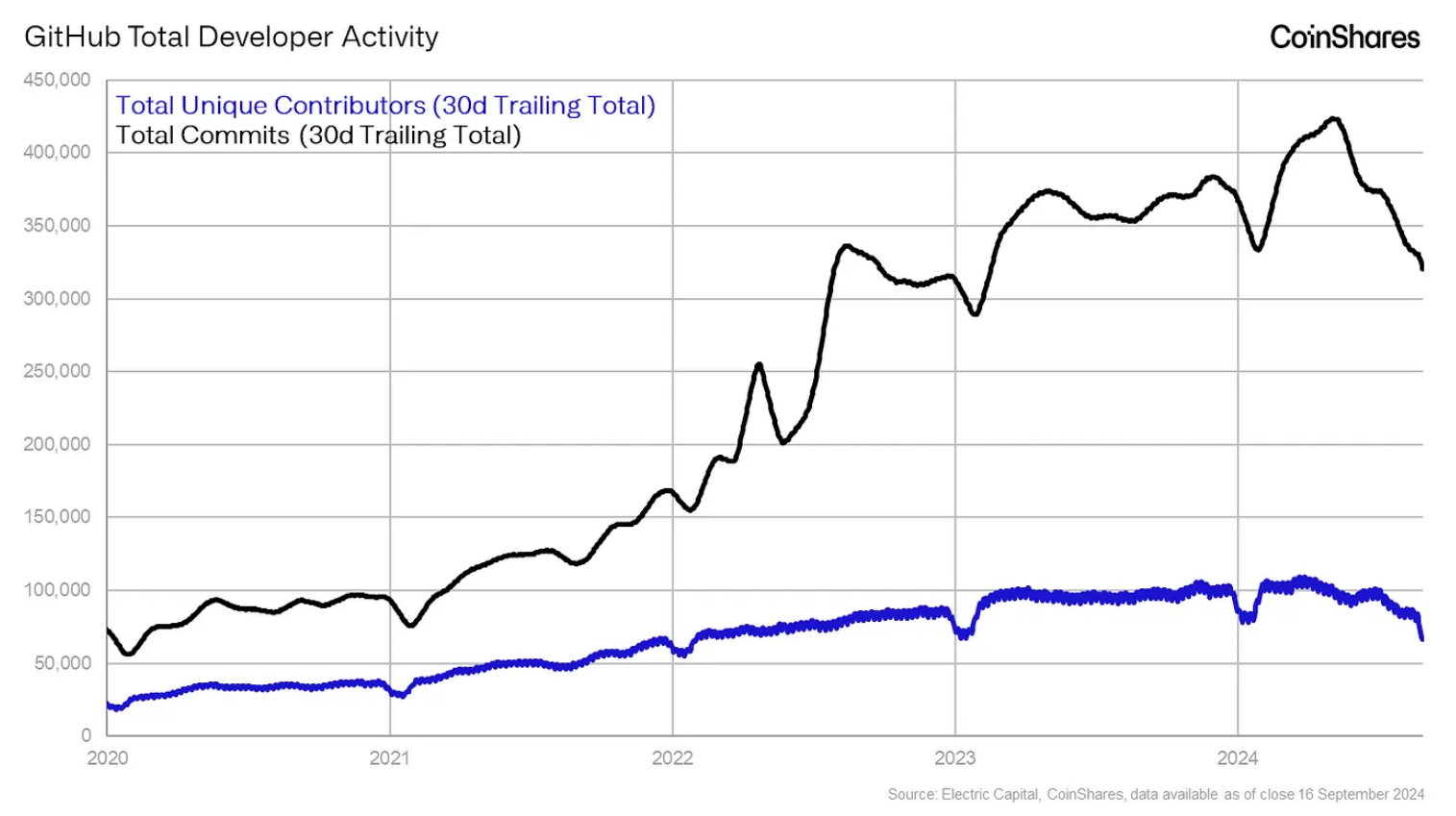

The chart below the table shows the total number of commits and the total number of unique developers in the past 30 days. Of course, it should be noted that this total only includes ecosystems that meet the criteria outlined in the methodology section. While the total number of commits shows a clear long-term upward trend, the number of developers has stagnated or declined since the beginning of 2023, indicating that there are not many new developers entering the crypto space and frequently contributing to the ecosystem.

3. Fastest Growing Ecosystems

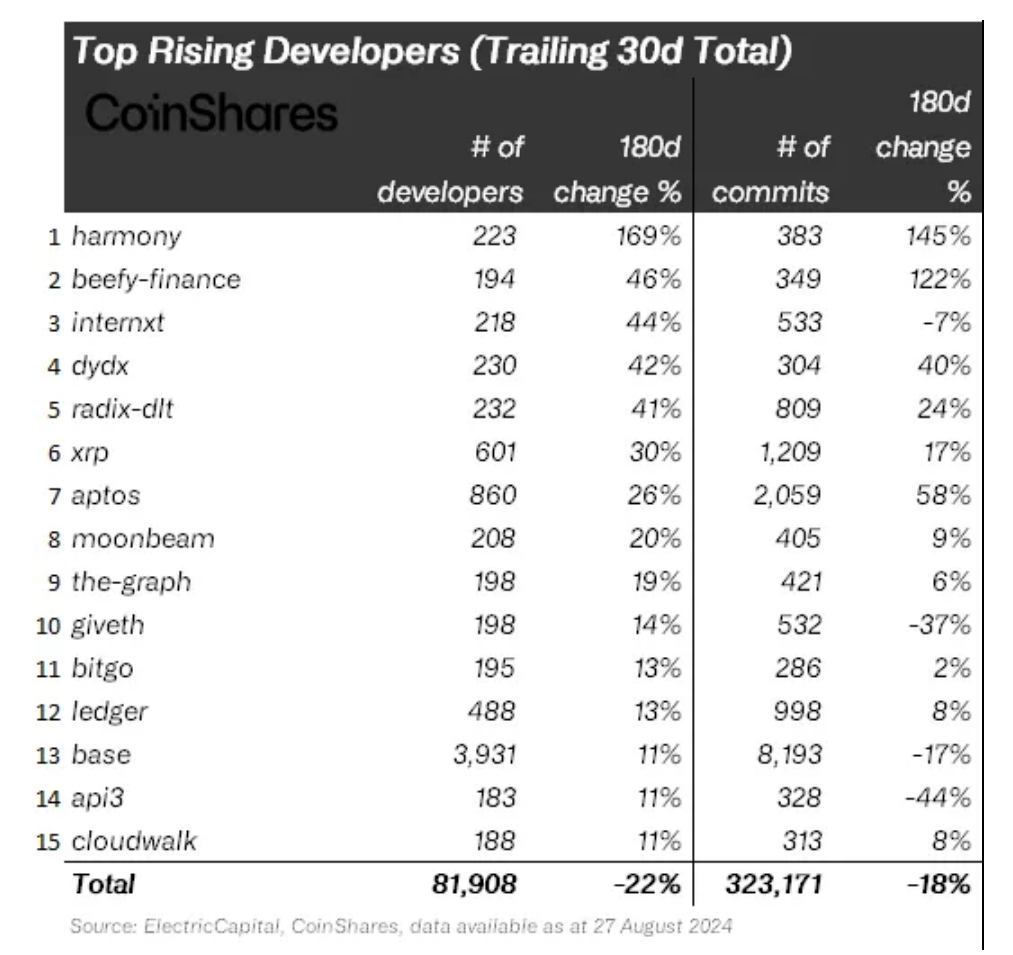

The fastest-growing ecosystems are typically those that start small and generate upward momentum, often stemming from** new product development**, or larger ecosystems that have undergone significant network upgrades (for example, Base has grown due to Ethereum's Dencun upgrade in March).

Notable fast-growing projects include dYdX (a popular decentralized derivatives trading platform), Aptos (which gained significant attention earlier this year due to a notable surge), and popular ecosystems like XRP and Ledger (hardware wallets).

In the category with the largest increase in contributors, trading platforms and wallets lead the way. The rise of multiple trading platforms on Solana, along with fierce competition in the Ethereum space, has driven developer activity to compete for capital and market share from increasingly fee-sensitive users while chasing volume-based token incentives (such as Hyperliquid and Jupiter).

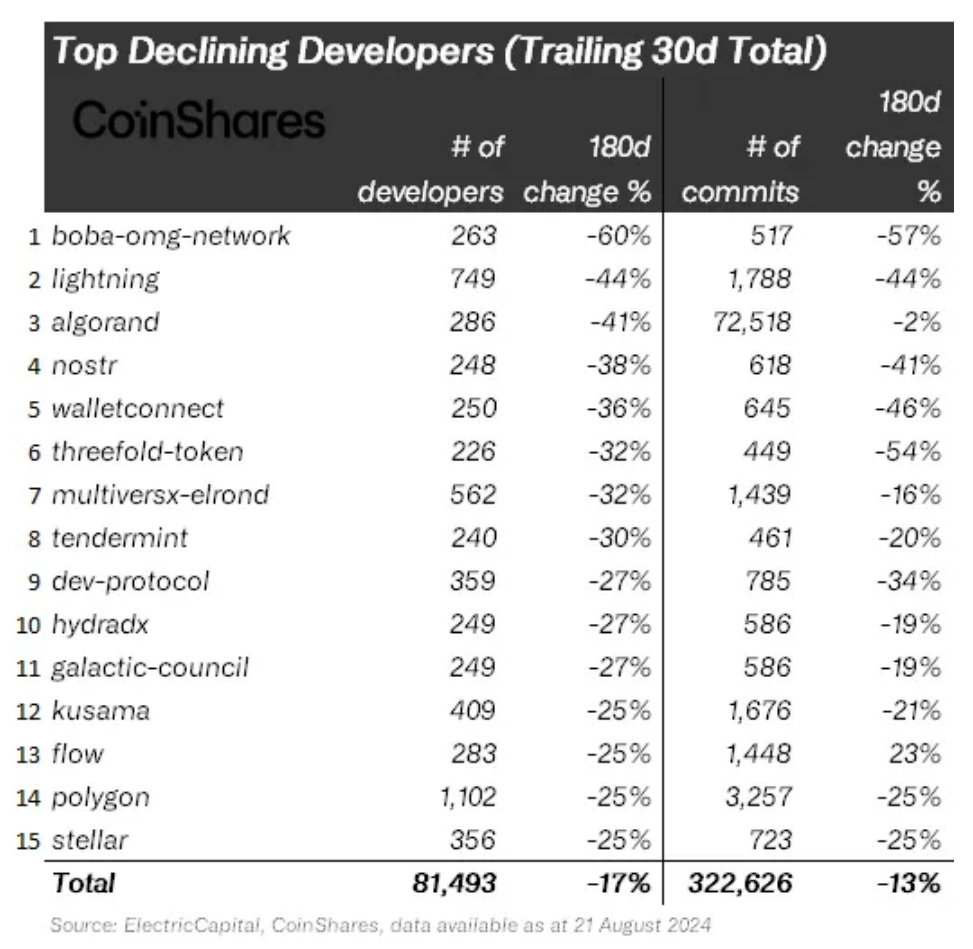

4. Fastest Declining Ecosystems

When observing the fastest declining ecosystems, if we ignore lesser-known ecosystems and focus on some familiar names, we can see some interesting data. First, the decline of Lightning is particularly notable in the face of fierce competition from emerging Bitcoin Layer 2 solutions. While Lightning is undoubtedly a well-tested protocol, it has failed to generate significant appeal over time, leading to renewed user attention on protocols like Stacks, Babylon, and CoreDAO as potential profit opportunities in Bitcoin emerge.

Interestingly, the number of contributors to the decentralized social network Nostr has declined, which may be related to the rise of Farcaster (with approximately 50,000 daily active users). The declines in Algorand, Polygon, and Tendermint are also quite evident.

In the declining categories, the number of contributors to DeFi platforms has noticeably decreased, and the number of contributors to derivatives platforms has also declined. The latter may be a limitation of our classification method, as only pure derivatives platforms are considered; platforms offering spot trading are classified as "trading platforms and wallets," which, as mentioned earlier, has been one of the fastest-growing categories.

5. Top Five by Market Capitalization

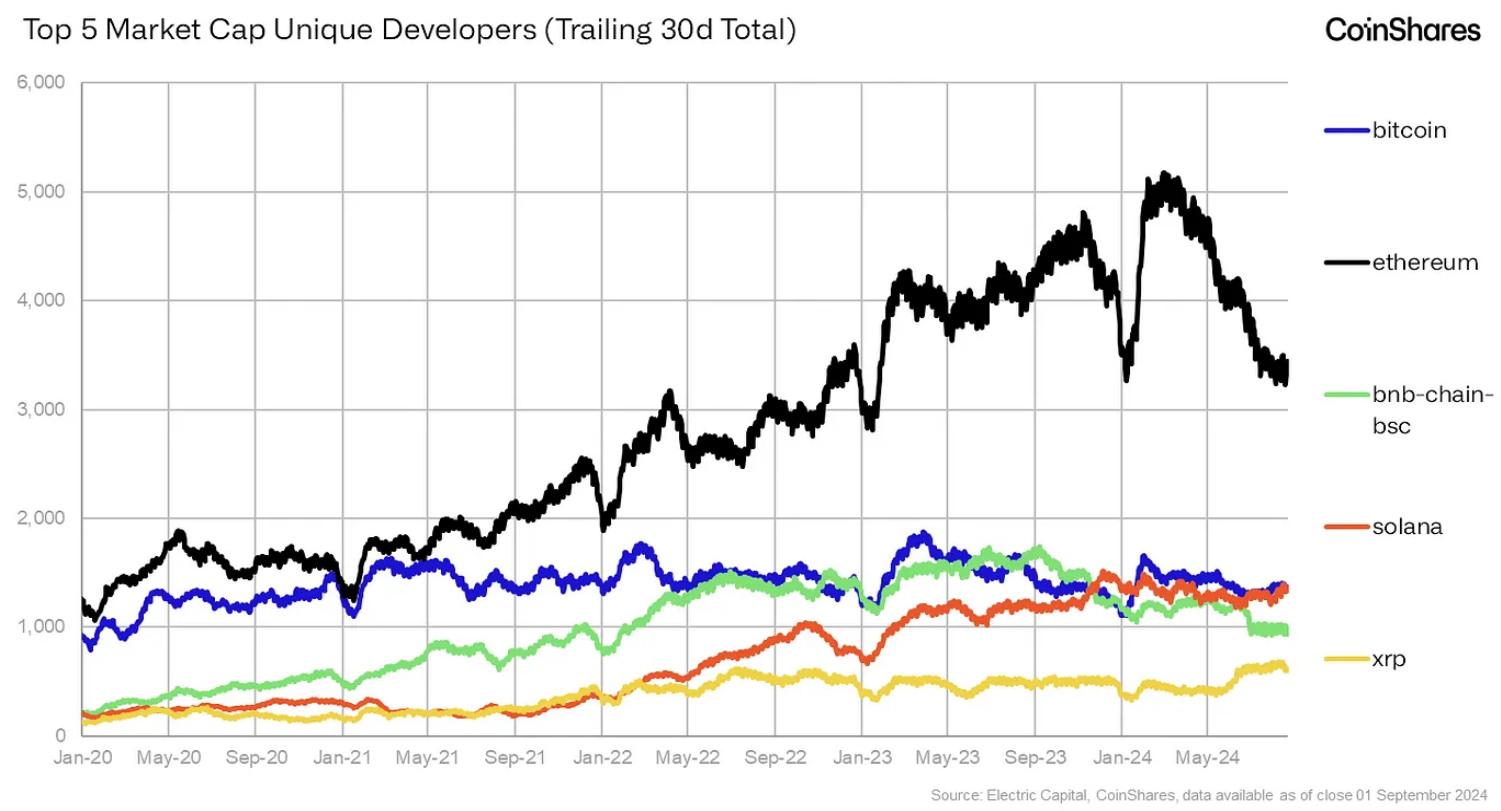

In the ecosystems with the largest market capitalization, it is not surprising that Ethereum ranks first, as it has historically maintained the most active development environment and has been the birthplace of DeFi. The rise of Solana is clearly visible in the chart, contrasting with the trend of other ecosystems that have seen stagnation or decline in developer contributions over the past few years. Interestingly, there is a seasonal variation in all developer statistics; activity levels tend to drop significantly at the end of each year as developers may take vacations or breaks.

In the top five by market capitalization, Ethereum and BNB Smart Chain are the two ecosystems with the most noticeable decline in activity. For BNB, this is somewhat reasonable given CZ's arrest and the general decline in network enthusiasm as indicated by usage metrics. For Ethereum, despite peaking at nearly 5,000, the number of core contributors has sharply declined due to competition from other L1s and the rise of Ethereum Layer 2.

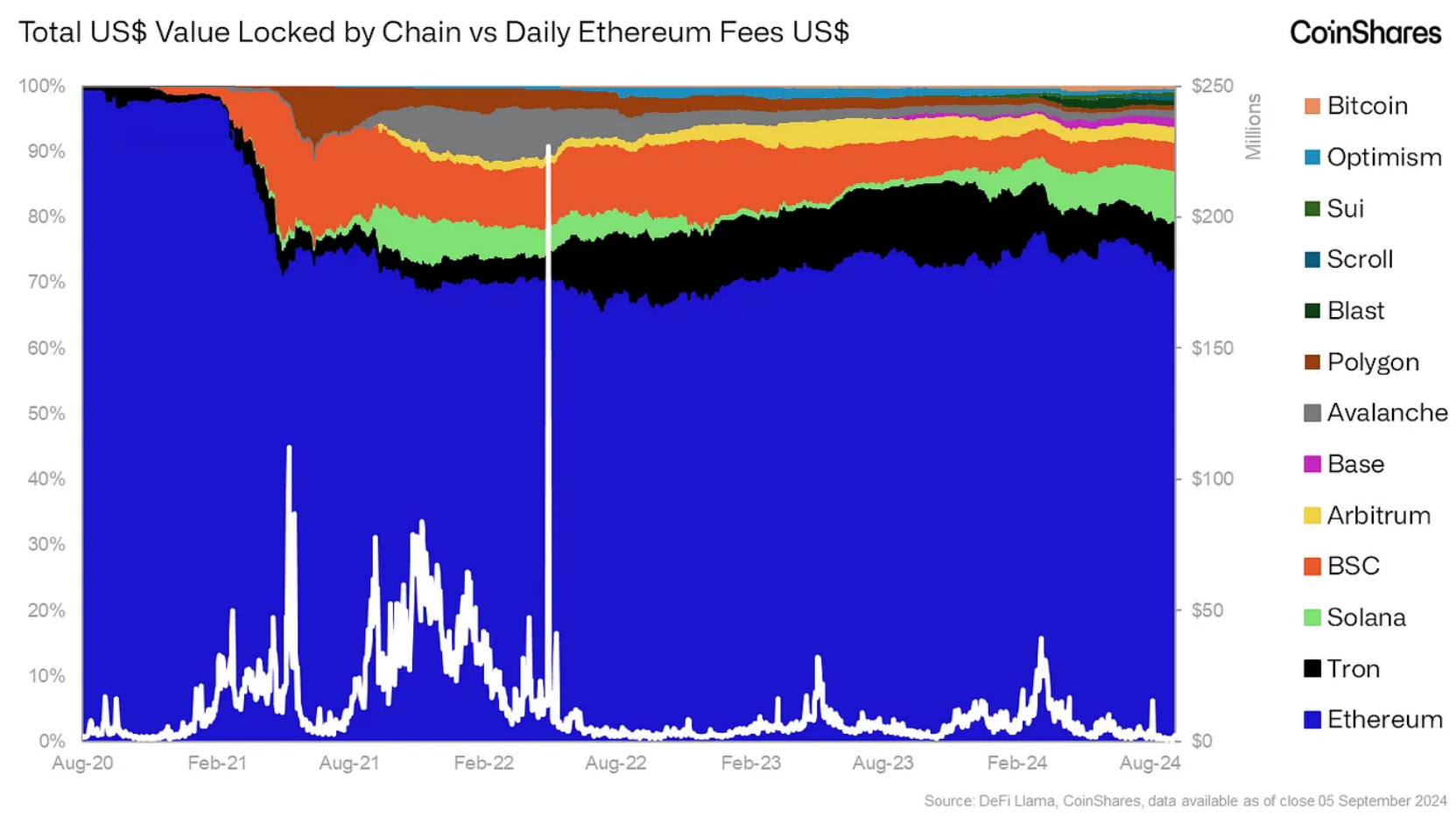

6. Ethereum Layer 2

The Dencun upgrade on March 13 propelled Layer 2 activity to new heights. With fees typically below one cent, users who previously exited Layer 1 Ethereum due to high fees have returned through Layer 2. The following year-over-year change metrics clearly illustrate this:

All Layer 2s'* TPS* (transactions per second): 45 → 340

All Layer 2s' daily transaction volume: 3.4 million → 15.2 million

All Layer 2s' daily active addresses: 780,000 → 1.82 million

It is widely believed that average crypto users are extremely sensitive to fees. During the frenzy of 2021, users paid over $200 for a single token swap², while many users trading small amounts flocked to other chains.

We expect that due to higher security assurances, higher-value users will continue to stay on Layer 1 after the Dencun upgrade, while those sensitive to fees will at least partially return, but this time using the various available Layer 2s.

Taking Uniswap as an example, we can see some relevant evidence by examining two metrics of usage across chains:

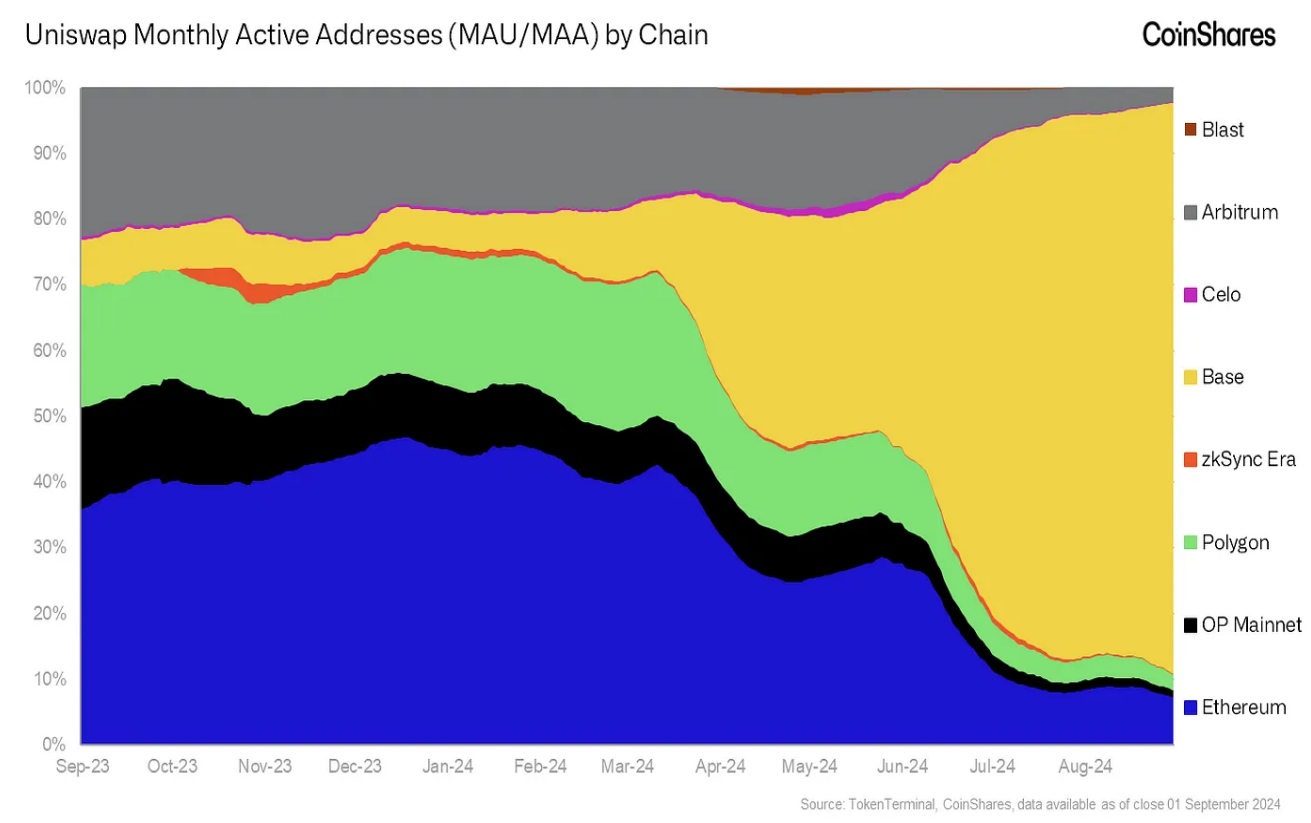

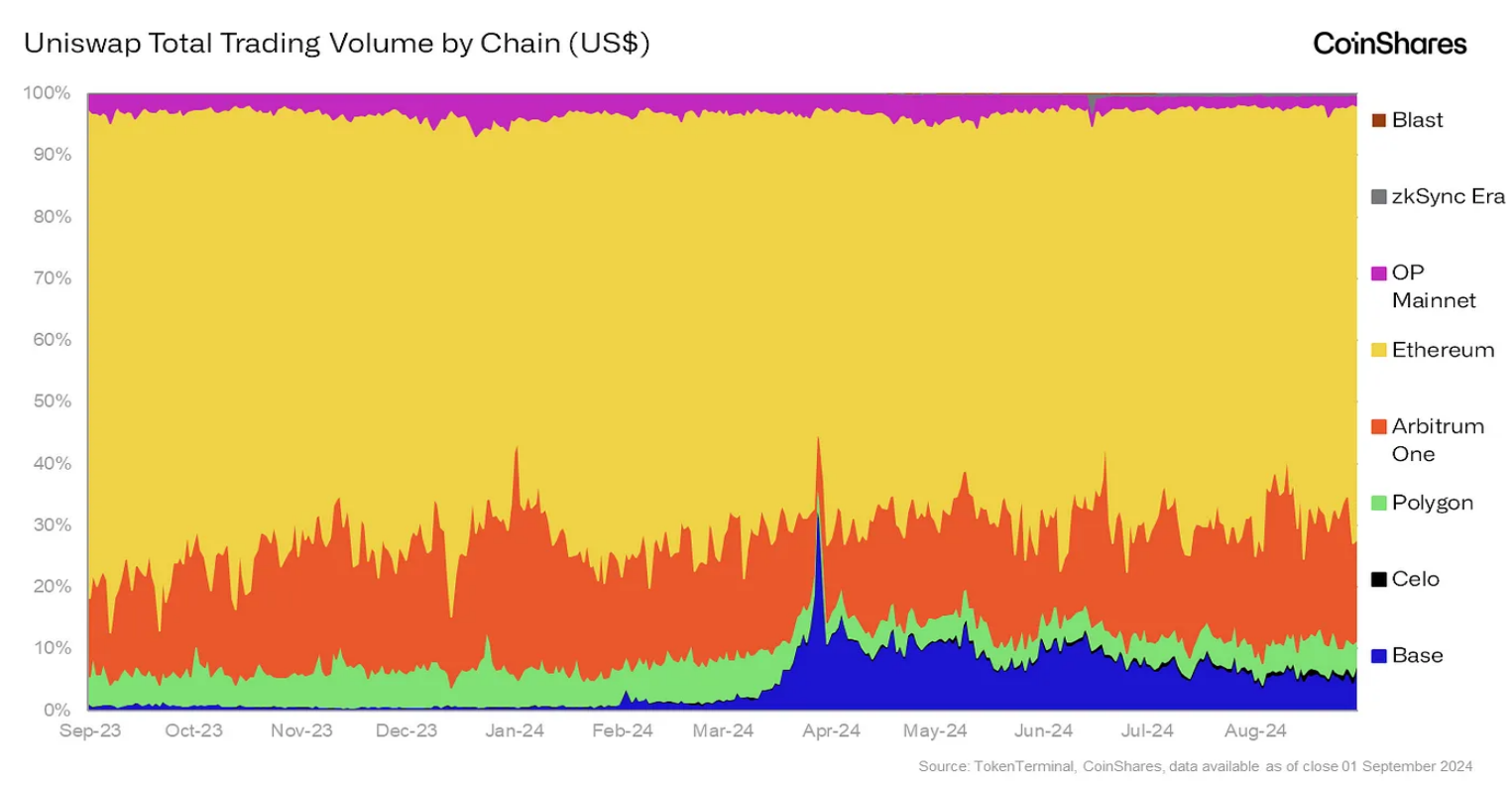

After the Dencun upgrade, the number of Uniswap addresses using Layer 2 (especially Base) has significantly increased. In fact, Base accounts for about 83% of the market share in monthly active addresses. However, it should be reiterated that this may be more indicative of fee-sensitive users who trade lower nominal amounts (in addition, many of these addresses may have balances below $10—clearing wallets in good faith is very low-cost compared to L1 Ethereum). The following chart illustrates the exact situation of this phenomenon:

As shown, Ethereum still dominates the market share of Uniswap trading volume, even though the proportion of monthly active addresses is only about 10% when broken down by chain. This seems to indicate that "whales" holding high nominal value wallets remain on Layer 1, as they are not sensitive to fees. If you are trading hundreds of thousands or even millions of dollars, even if gas prices soar and transaction costs reach hundreds of dollars, this is still only a very small portion of your position size.

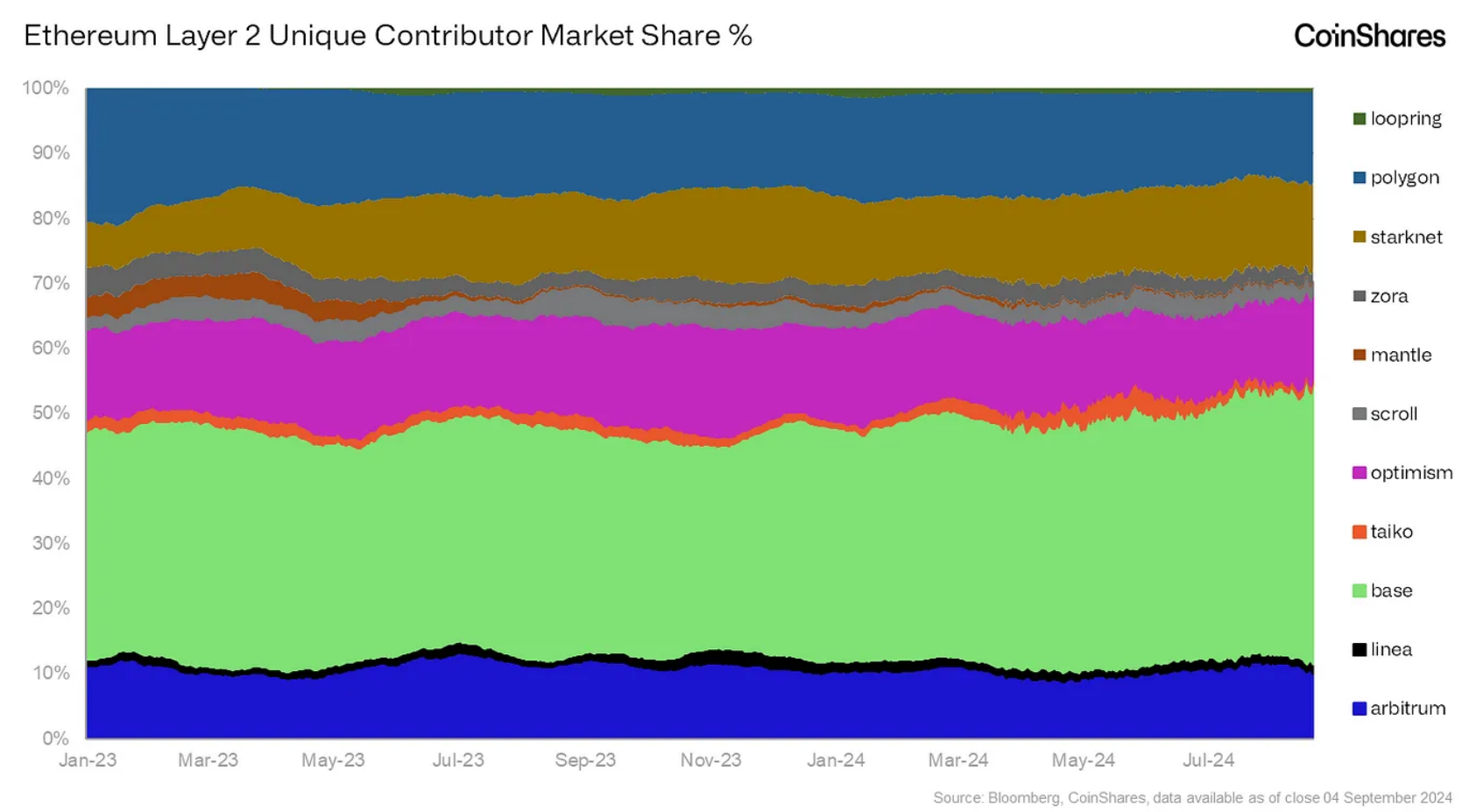

Now looking at the overall Layer 2 developer market share by protocol, we can see that Base has long established itself as a leading contributor ecosystem:

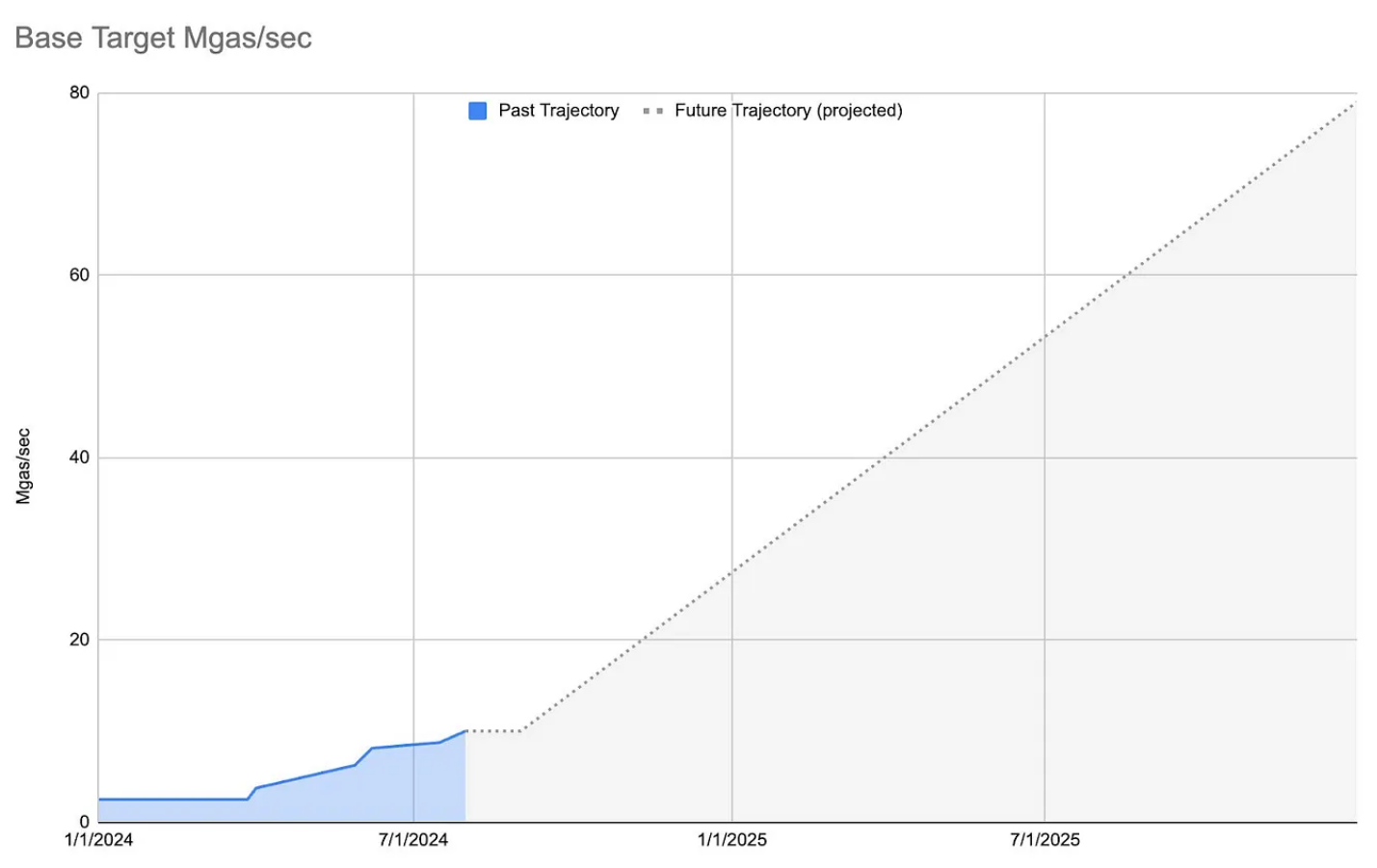

Currently, Base has the highest TPS among all major Layer 2 solutions, reaching 46, while Arbitrum is at 16³. Additionally, Base has clear plans to continue upgrading the network, with a target of 80 Mgas/sec by the end of 2025. These ambitious plans may continue to attract developers to build consumer applications and infrastructure on the network.

Given the backing of Coinbase behind Base, we expect it to continue being the Layer 2 solution with the most developers and, over time, become the ecosystem with the largest TVL and stablecoin supply (although this may take a while considering Arbitrum's current lead).

7. Conclusion

Overall, we have analyzed the focus areas of developers and their changes over time. Specifically, we observed the ecosystems and categories with the most significant increases and decreases in developer activity over the past year, and delved deeper into the top five ecosystems by market capitalization as well as the Layer 2 landscape of Ethereum.

The purpose of observing ecosystems through developer statistics is not to predict the future value of a specific token or protocol, but to attempt to assess areas of potential value creation; a concentration of human capital is more likely to lead to complex DeFi platforms, consumer applications, or revenue-generating enterprises. Overall, monitoring developer dynamics and activity provides valuable insights into where innovation may emerge. Understanding the long-term trends of ecosystems that were once popular with developers but are now gradually fading from view, as well as those that are regaining attention, is equally important.

As mentioned earlier, the methodology used in this analysis will be reviewed and revised regularly to find the right balance between accuracy and insight over time. In the future, we will also focus on analyzing ecosystems with only foundational tokens to better assess their relative valuation comparisons.

Article link: https://www.hellobtc.com/kp/du/10/5485.html

Source: https://blog.coinshares.com/analysing-developer-trends-across-the-crypto-ecosystem-67f470d77b17

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。