Author: 1912212.eth, Foresight News

The market is not as optimistic as many hoped, but it is also not as pessimistic as some feared. No one anticipated that the downward trend in the crypto market, which began in March of this year, would last a full six months. At one point, the decline caused some investors to vent their frustrations, lashing out at the sky, the earth, and exchanges. It dropped to a level where an ancient OG predicted a preparation for an 18-month long battle, and some whales tweeted about abandoning the crypto space, urging more people to invest fully in A-shares.

Will there be a season for altcoins? Every time the market is in doubt, it is precisely at the bottom range of the market. History always responds: there will be.

History is often remarkably similar. In 2023, the market also began to quiet down in the middle of the year, until it took off in October last year. This year is no different. Interestingly, some funds seem to be smart, sensing the opportunity and quickly positioning themselves. As a result, by the end of September, the market welcomed a significant rise ahead of time. After a brief pullback in early October, the self-fulfilling prophecy of "October's rise" was realized again, with the market climbing from a short-term low of $52,000 to $68,000, just about $6,000 away from the historical high. Some previously scorned altcoins have also seen significant gains from their lows, even doubling or tripling in value.

After waiting for half a year, has the bull market arrived?

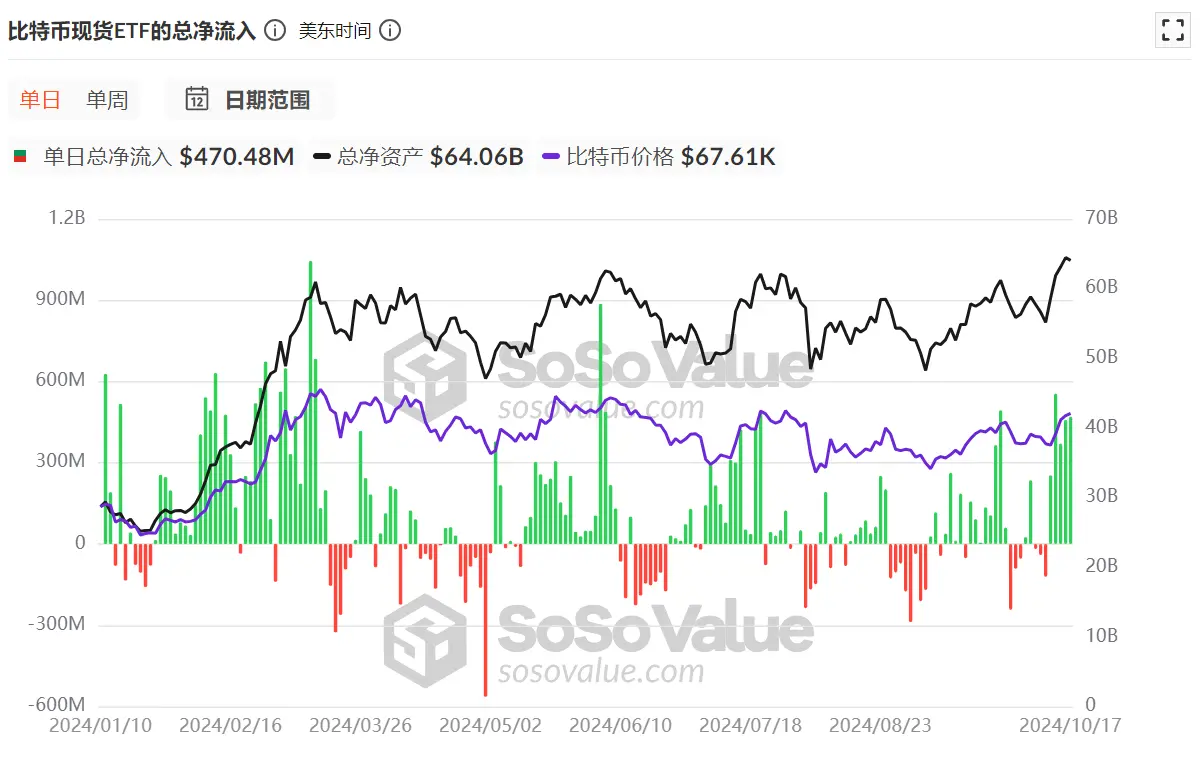

Continuous Large Inflows into Bitcoin Spot ETF

The data from Bitcoin spot ETFs represents the real purchasing power from the over-the-counter market. Unlike personal trading, it indicates that some people are willing to pay fees for others to purchase BTC on their behalf. Historically, when there is a large net inflow, buying pressure increases, often leading to a rise in Bitcoin prices; conversely, a large net outflow typically results in price declines.

Since the official launch of the spot ETF, the total net inflow has reached $20.66 billion. Notably, from October 1 to now, there have been 6 days of net outflows, but 7 days of net inflows, with the net inflow amounts being quite substantial. On October 14, the net inflow exceeded $555 million, and on October 16 and 17, the net inflows were both over $450 million, with October 15 seeing a net inflow of over $370 million.

Although the number of days with net inflows and outflows is roughly equal, the amount of net outflows is small, while the net inflows are often several times greater than the outflows.

Even the less favored Ethereum spot ETF has seen a rare single-day net inflow of $48.41 million since October.

The purchasing power from the over-the-counter market remains quite strong.

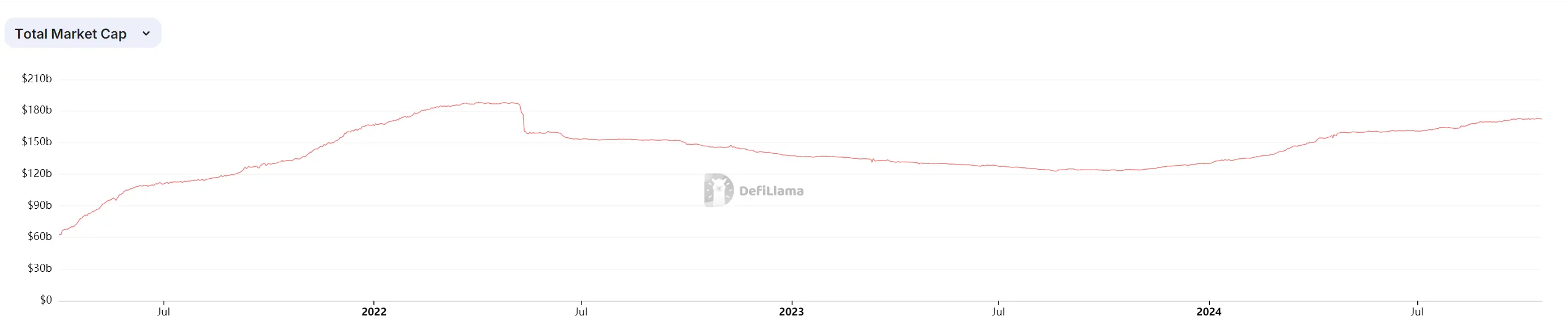

Stablecoin Market Cap Approaching Historical Highs

The changes in the total market cap of stablecoins represent the size of capital inflows. Although the market has fluctuated over the past few years, when we broaden our perspective, it is hard to be pessimistic.

The total market cap of stablecoins reached a historical high of $186.3 billion in mid-2022, then continuously declined, but overall remained above $120 billion. Fast forward to October 2023, capital inflows have accelerated, and the total market cap of stablecoins has now exceeded $172.3 billion, nearing the historical high.

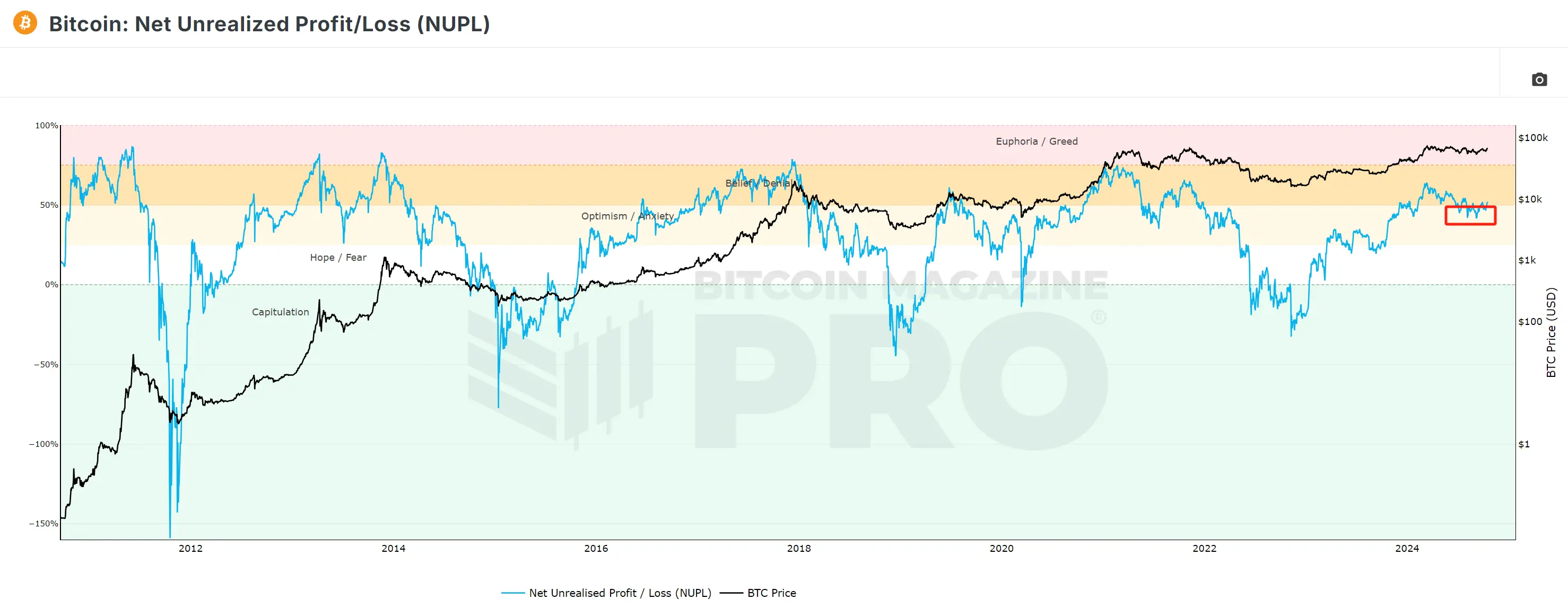

BTC Unrealized Net Profit Shows Most Players Are in Profit

The unrealized net profit/loss of Bitcoin is an indicator used to measure the profit/loss situation of on-chain Bitcoin players. We can see that the colors of the chart range from red, orange, light yellow, gray-white, to light blue from top to bottom. The bottom blue represents most people losing money, while the top red indicates that most players are in profit.

When the line chart is in the light blue area, it often indicates the bottom range of BTC prices, as those who are losing money are continuously exiting the market, forming a bottom. Conversely, when the line chart is in the yellow or red area, it often indicates the top range of BTC prices, where many people take profits after being in the green, leading to a peak in the cycle. This cycle repeats.

From the line chart, the market is currently climbing from the light area back into the yellow area. According to data disclosed by IntoTheBlock, 95% of BTC addresses are now in profit, indicating a clear recovery in market sentiment.

Historically, such levels often signal a strong bullish momentum, but they may also represent potential overextension.

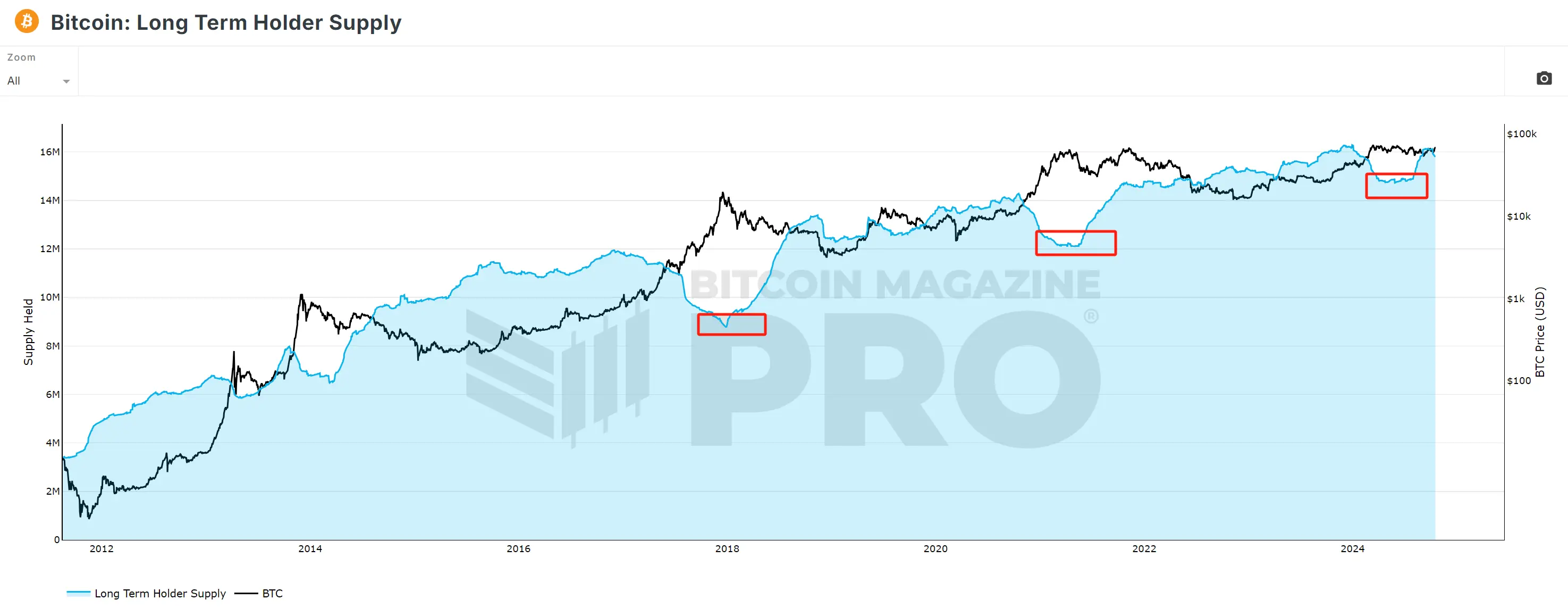

Bitcoin Long-term Holders Are Continuously Buying

The amount of long-term holders primarily shows the total supply of BTC held by long-term holders. Here, long-term holders refer to addresses that have held BTC for over 155 days.

The chart shows that whenever BTC prices peak, the number of addresses held by long-term holders decreases. This is because smart money tends to take profits at price peaks. After a decline, they accumulate BTC again until prices rise to a high point, at which point they sell again, and this cycle continues.

The chart indicates that since the end of July this year, this group of long-term holders has resumed their buying spree, with the right-side line chart appearing quite steep. Clearly, these smart funds are optimistic about future market conditions.

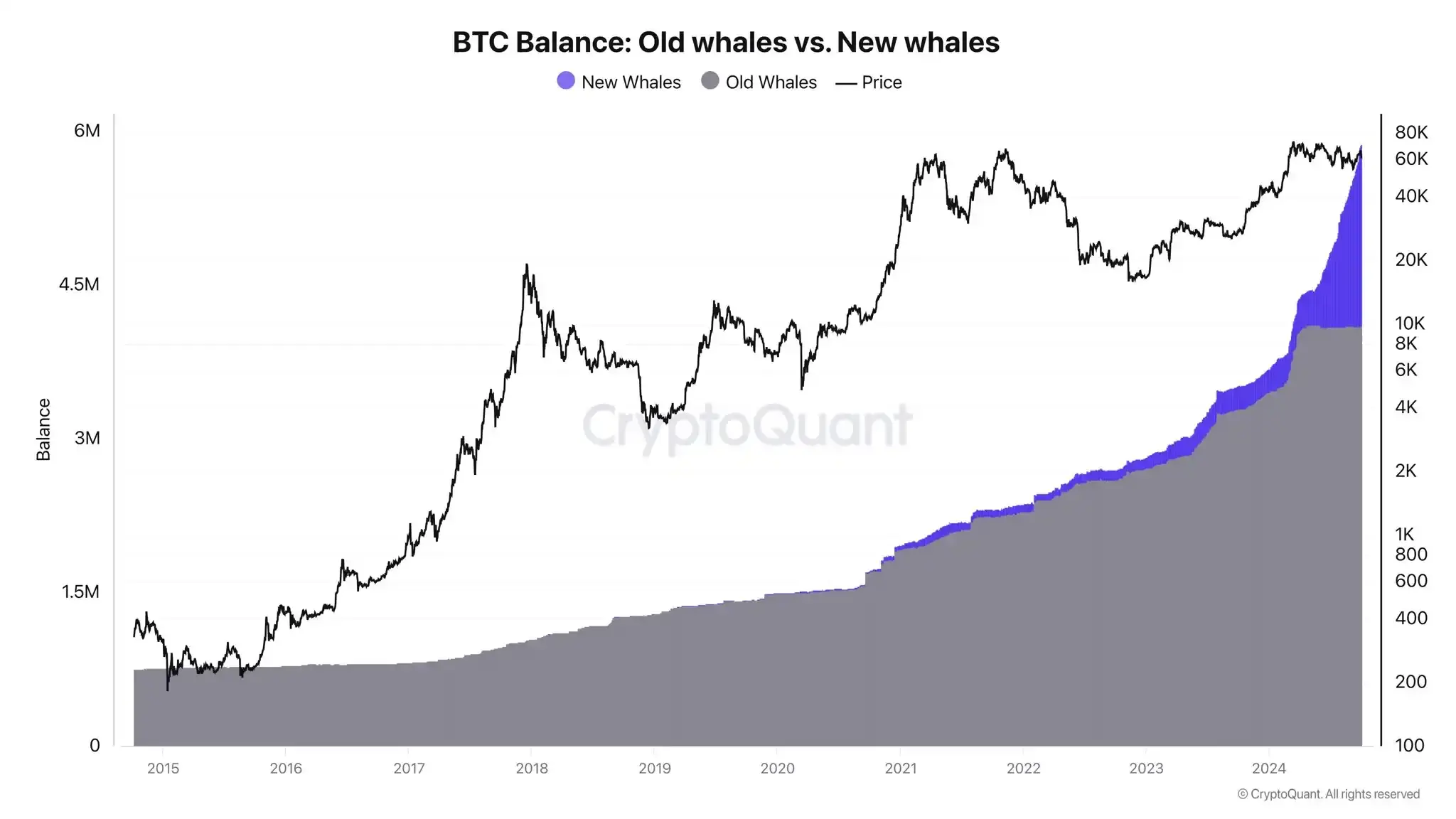

It is worth mentioning that according to CryptoQuant data, new whale addresses are almost frantically accumulating BTC. Founder Ki Young Ju stated that the BTC market has never seen such accumulation behavior. Some believe the new whales are primarily due to ETF inflows, but recent accumulation behavior suggests that these new whale addresses have little correlation with ETFs.

The Total Open Interest in Bitcoin Contracts Has Reached a Historical High

Today, according to Coinglass data, the total open interest in Bitcoin contracts across the network has risen above $39.7 billion, setting a new historical high.

Contract data often represents the market's view on future price movements. It typically lags behind the performance of Bitcoin spot prices, and because of this, when the market becomes overly optimistic about short-term trends, it is also prone to corrections that clear out positions and leverage.

It is noteworthy that over the past six months, the open interest in Bitcoin contracts has remained at a relatively high level. This latest data marks a historical high, breaking the previous record of over $38 billion set earlier this year. Market optimism has clearly increased.

Summary

On a macro level, the Federal Reserve is expected to cut interest rates in November and December, with some liquidity from around the world continuously flowing into risk assets, making liquidity in the crypto market more abundant. A series of on-chain indicators show that the market is continuously warming up, with capital inflows.

"Market trends are born in despair, grow in doubt, mature in anticipation, and perish in hope."

Perhaps, after nearly half a year of waiting, a new round of the crypto market bull run is ready to launch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。