"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and hot news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past seven days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

New Giants on Wall Street: Riding the ETF Wave, Jane Street is Becoming the Most Profitable Trader

Jane Street was founded in 2000 by several traders from Susquehanna and a former IBM developer. It initially traded American Depositary Receipts in a small, windowless office on the now-defunct American Stock Exchange. However, it quickly expanded into options and ETFs, which were promoted by Amex a few years prior. At that time, ETFs were still a niche market, and when Jane Street began trading, the market assets were only about $70 billion.

However, ETFs quickly became its main business, and over time, it became an important "authorized participant," meaning it could create and redeem ETF shares in addition to trading. According to documents shared by the company with lending institutions, last year Jane Street accounted for 14% of U.S. ETF trading and 20% in Europe. In the bond ETF space, Jane Street estimates it accounted for 41% of all creation and redemption transactions. "Technology companies that can price in real-time and respond quickly will earn more profits."

Jane Street does not have a CEO, and in loan documents shared with investors, the company describes itself as "a functional organizational structure composed of various management and risk committees." Each trading desk and business unit is overseen by one of the 40 equity holders, who collectively own $24 billion worth of Jane Street equity. Outside observers believe Granieri is more of a low-key long-haired actor from Silicon Valley than a billionaire trading tycoon, but Jane Street employees say that major decisions are made by a broader collective leadership group, which fosters collaboration and reduces hierarchy.

This is reflected in its compensation structure—Jane Street does not tie compensation to individual trading profits, nor does it link it to the earnings of the trading desk where employees work. The company has long avoided using formal titles, even if this may cause some confusion outside the company.

MicroStrategy Outperforms Bitcoin Fourfold in a Year, Is Leverage Truly Risk-Free?

MSTR's primary investment strategy is to purchase Bitcoin through debt issuance, which has a financial leverage effect: because the cost of debt is fixed while the value of the asset (Bitcoin) grows higher, net profit growth directly enhances stock value. This is why MSTR's stock price has risen more than Bitcoin itself during this period, earning it the nickname "leveraged Bitcoin ETF."

The downside of this decision is: over-reliance on Bitcoin, a single business model, and net losses.

Since MSTR is financed through debt to purchase Bitcoin, it increases financial leverage, which can lead to financial pressure when Bitcoin prices fall, potentially forcing it to sell coins to repay debt. If MSTR starts selling, it may be interpreted by the market as a loss of confidence in Bitcoin's future value, prompting other investors to sell as well, creating negative market sentiment. This negative sentiment could trigger other holders to stop-loss sell or force those with Bitcoin as collateral into margin call situations, further increasing selling pressure, creating a downward spiral, and potentially leading to a systemic crash.

Decline of Points Systems, Where is the Next Token Issuance Hotspot?

A significant change is that the market is returning to the period before the points mechanism emerged: protocols like Eigenlayer are shifting towards "programmatic incentives," indicating a return to liquidity mining.

We are also seeing the rise of so-called private-public sales. Another potentially emerging trend is the "Patron Sales" launched by @infinex_app. Infinex combines the points system with merit-based ICOs, requiring you to earn points to participate in the ICO.

Notably, for the first time in recent years, participating in token sales has become increasingly difficult, marking a shift away from liquidity mining, fair issuance, and points mechanisms.

It seems we have finally realized that simply distributing free tokens does not truly build a community.

Runes on Bitcoin can be issued by just paying transaction fees, and even with (optional) pre-mining features, they maintain transparency. Additionally, we are experimenting with other minting models: Tap-to-earn, community/social tokens, and active validation services.

Airdrop Opportunities and Interaction Guides

Meme

The most important aspect of a meme is its uniqueness. Memes are like short videos, easy to understand and eye-catching.

When selecting targets, feel the community vibe and consider its virality; community virality (continuously stirring things up) is also very important.

Regularly check Twitter and continuously update your follow list.

Meme Cultivation Manual: Rebirth, I Want to Be a Diamond Hand (Part 1) | Produced by Nanzhi

Be sure to set a minimum follow-up amount; trust smart money to chase high prices; do not actively take profits.

New Generation "Meme Godfather" Murad Selects Top Ten Meme Coins

SPX 6900/$SPX (Ethereum), GigaChad/$GIGA (Solana), Mog Coin/$MOG (Ethereum), Apu Apustaja/$APU (Ethereum), Popcat/$POPCAT (Solana), HarryPotterObamaSonic10lnu/$BITCOIN (Ethereum), Retardio/$RETARDIO (Solana), Lock in/$LOCKIN (Solana), Mini/$MINI (Solana), American Coin/$USA (Solana).

Finding the Next Hundredfold Gem: How to Make Money on Pump.fun with ChatGPT

Create a precise trading bot (Sniper Bot); immediately check if the token has a "Rug Pull" scam; use @getmoni_io API to automate social media checks; set conditions for purchasing tokens; decide which tokens the bot will buy; modify the buying and selling process; launch the precise trading bot.

Meme Coin Toolkit: How to Discover Hundredfold Opportunities?

This article compiles some practical tools for playing with memes, covering on-chain monitoring and trading, including: discovering meme coins, tracking smart money, data dashboards, trading tools, and security tools.

Bitcoin Ecosystem

Rune Craze Returns, Is the Bitcoin Ecosystem on the Verge of a Full Explosion?

Important assets in the Bitcoin ecosystem have all seen an increase. Several leading assets in the rune market have also experienced significant rises. If OPCAT can successfully revive in this bull market, the technical narrative on the Bitcoin ecosystem will almost certainly be led by OPCAT. Currently, the targets attempting to go long on OP_CAT's revival are Quantum Cats and the CAT 20 protocol on Fractal. If it cannot, then runes should continue to hold the position of the most influential FT protocol in the Bitcoin ecosystem.

Some directions that have not yet become market hotspots, such as the Lightning Network (Taro, RGB, CKB), BitVM, etc., may gain more attention if OP_CAT fails to revive.

Ethereum and Scalability

Ark Invest Research Report: Staking Ethereum = "U.S. Treasury Bonds" in the Crypto Economy

The staking yield of ETH has already influenced other smart contract ledgers, distinguishing it from other digital assets outside of Bitcoin. Similarly, U.S. Treasury bonds play a key role in the traditional economy, serving multiple functions: setting benchmark interest rates, acting as a premium value storage method during uncertain times, and influencing market expectations for future economic conditions. As an asset, ETH is beginning to develop attributes similar to U.S. Treasury bonds in the digital asset space.

The potential for ETH to generate yield—and its widespread use as collateral in digital asset trading—are becoming its two most unique and important qualities.

What Does Uniswap's Launch of Unichain Mean for Ethereum?

Unichain aims to enhance competitiveness in three key areas: cost, speed, and interoperability. Since Uniswap generates the highest revenue for Ethereum and is one of the largest user bases on the Ethereum L1 chain, some commentators in the crypto community believe that the launch of a native L2 chain by Uniswap could impact the Ethereum mainnet. Once Uniswap transitions to its own chain, it will be able to capture trading fees and MEV fees. Although the exact share of business moving from Ethereum to the new blockchain remains to be seen, both revenue sources are certainly substantial.

However, this could lead to a decline in relevant network activity on Ethereum L1, which in turn would affect the rate of ETH burn. The increasing number of protocols migrating from Ethereum's L1 may continue to weaken the narrative of ETH as a "super sound currency" (an asset that defaults to deflationary after EIP-1559 activation).

The true catalysts for Ethereum's growth: innovation, users, large tech companies, and dApps.

Cross-Chain

The killer application of cryptocurrency has emerged in the form of stablecoins.

As long as transaction fees remain prohibitively high, we may not see users turning to L1s like Ethereum or Bitcoin. Users may be directly introduced to L2s (like Base), while developers may choose to absorb the gas fees. Alternatively, users may switch only between low-cost networks.

Cross-chain bridges have several key profit points: TVL, relayer fees, liquidity provider fees, and minting costs. Funding routers like cross-chain bridges may be one of the few product categories in cryptocurrency that can generate significant economic value.

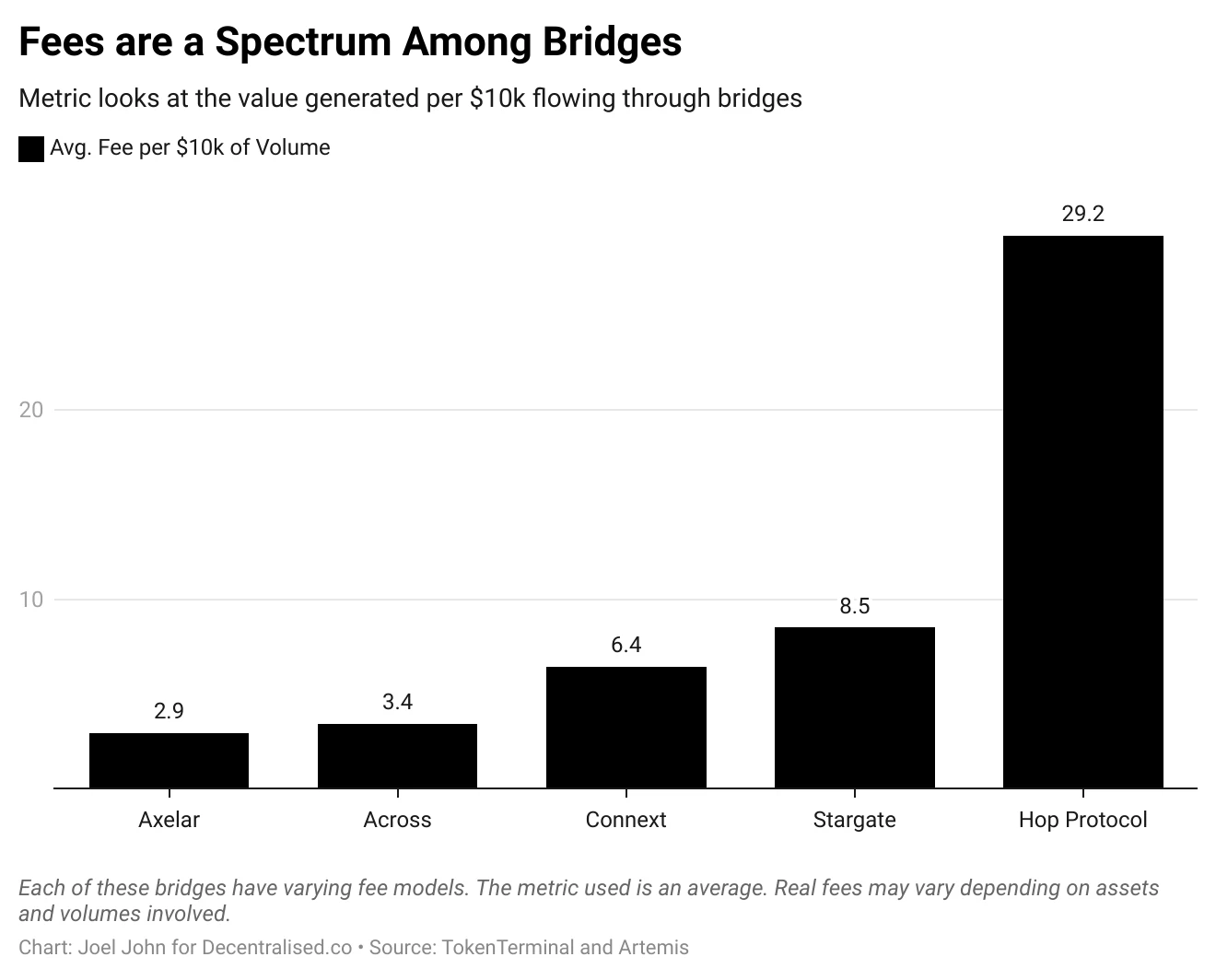

Data on fees generated from transferring $10,000 through cross-chain bridges (the value created across the value chain, such as liquidity providers, relayers, etc.)

Another way to compare the economic value of cross-chain bridges is to contrast them with decentralized exchanges. Both serve similar functions, enabling token conversions. Exchanges allow conversions between assets, while cross-chain bridges facilitate token conversions between blockchains.

The phenomena we observe on cross-chain bridges are similar to the development of the physical infrastructure for internet data routing.

DeFi

Opinion: Could It Reclaim $1? Why Ethena is Worth Watching?

Ethena is the fastest-growing DeFi product in history. Within just a few months, its yield-bearing stablecoin has reached a scale of $3 billion. sUSDe, the stablecoin issued by Ethena, has attracted a large number of users by offering high yields, leading to rapid growth.

It is clear that sUSDe is the undisputed king of high yields in the cryptocurrency space. With support from Bybit, USDe has become the second-largest stablecoin available to users on centralized exchanges, and the platform has embedded automatic yield generation features. This allows users to obtain a higher quality stablecoin collateral without adding extra friction.

Security

Security Investment Starts Here: A Guide to Identifying On-Chain Transaction Fake Address Scams

Do not match wallet addresses solely from memory; use whitelist features; purchase ENS addresses.

Weekly Hot Topics Recap

In the past week, Trump announced the launch of World Liberty Financial; BTC briefly broke through 68,000 USDT;

Additionally, in terms of policy and macro markets, Harris proposed a loan plan and supported a crypto regulatory framework to win over Black male voters; Elon Musk donated $75 million to a political action committee supporting Trump;

In terms of opinions and voices, Michael Saylor stated that MicroStrategy's ultimate goal is to become a Bitcoin bank; Andre Cronje claimed that Layer 2 is useless and is just a waste of money doing redundant things; Arthur Hayes has significantly reduced his holdings in Meme tokens after the escalation of the situation in the Middle East, with SCF being the only Meme token he currently holds; Vitalik published an article discussing the future development of the Ethereum protocol, The Surge, with key goals including achieving maximum interoperability for L2; the Sui Foundation refuted rumors of "insiders selling $400 million SUI": the wallet owner may be an infrastructure partner;

Regarding institutions, large companies, and leading projects, the Ethena community initiated a proposal to include SOL as collateral for USDe; Sonic released a Litepaper: the circulating supply of S is approximately 2.88 billion, with airdrops accounting for 6% of the initial supply; Gotbit officially confirmed that its CEO has been arrested in Portugal, stating that they will "fully cooperate with the investigation to clear up misunderstandings";

In terms of data, on October 13, Solana's TVL rose to 40.9 million SOL, reaching a two-year high, with a 26% increase over the past two months; on October 14, the total market cap of runes surpassed $1.5 billion, with a 24H trading volume of $5.04 million; GOAT saw a thousandfold increase in a week; Wintermute reported that Solana's weekly on-chain trading volume surpassed Ethereum, with 40% of its on-chain trading volume coming from Memecoins; deBridge's governance token DBR has now launched and airdropped to 491,000 wallets; PUFFER is open for claims; the Worldcoin brand has been rebranded as World Network and announced that World Chain has launched its mainnet…… Well, it has been another eventful week.

Attached is the portal to the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。