# Introduction

Since August, the SUI ecosystem has experienced remarkable growth, quickly becoming the focus of the blockchain and cryptocurrency fields. The strong performance of its token price and ecosystem development has sparked numerous discussions in the industry, with many believing that Sui is replaying the trajectory of Solana before its significant rise in 2021. Solana, as the most eye-catching Layer 1 public chain in the last market cycle, attracted a large number of developers and capital with its efficient consensus mechanism and highly competitive technology, driving the prosperity of the entire ecosystem. Now, Sui's performance has led the market to speculate: will it become the next Solana? Does this round of Sui's rise signify that it will lead a new breakthrough in the Layer 1 public chain field?

Although Sui's rapid development has generated immense interest in the market, fully understanding its future development prospects requires a comprehensive analysis from multiple angles. This includes not only an in-depth analysis of the fundamentals behind Sui's token price performance but also an exploration of its underlying technological innovations, the progress of ecosystem project construction, and the opportunities and challenges it faces in the global blockchain market. In this article, we will analyze various aspects of the Sui ecosystem in detail, helping readers gain a comprehensive understanding of the rise of this emerging public chain, deeply analyzing why Sui can stand out among numerous Layer 1 public chains, and looking forward to its potential in the next market cycle.

# A Brief History of Sui Ecosystem Development

2.1 Team and Project Background

Sui is a Layer 1 blockchain launched by the Mysten Labs team. Mysten Labs was co-founded in 2021 by core members of the former Meta (Facebook) blockchain projects Diem and Novi. The founding team includes top experts in the technology field, such as Evan Cheng, George Danezis, and Sam Blackshear, who have deep expertise in blockchain consensus mechanisms, programming languages, and distributed systems. The Sui chain aims to address the performance bottlenecks of existing blockchains, providing a more efficient, secure, and scalable infrastructure.

The Sui mainnet went live in May 2023, quickly becoming a rising star in the blockchain field. As a blockchain fully based on the Move language, Sui particularly focuses on parallel execution and low-latency processing, striving to enhance blockchain performance in decentralized applications, especially in high-demand areas such as DeFi, GameFi, and NFTs, through its unique architectural design.

2.2 Financing Situation and Market Attention

From the outset, Sui has received substantial capital support, completing a $36 million Series A financing in December 2021 and a $300 million Series B financing in September 2022, with participation from well-known institutions such as a16z Crypto, Jump Crypto, Binance Labs, and Coinbase Ventures. This financing significantly increased Sui's market visibility and provided a strong financial foundation for its technological development and ecosystem construction.

It is worth mentioning that although FTX Ventures led Sui's Series B financing in 2022, in 2023, following FTX's bankruptcy, Mysten Labs paid $96 million to repurchase shares from FTX. This event marked a further strengthening of the Sui team's control over the project.

After the financing, Sui began to attract increasing attention in the global market, particularly within the crypto community centered in Asia and North America. With the successful launch of the mainnet in May 2023, Sui gradually showcased its technological advantages and attracted a large number of developers into its ecosystem. Meanwhile, the construction of the Sui ecosystem also began to gain momentum, with projects in various fields such as DeFi, NFTs, and meme coins starting to emerge on the Sui network.

On August 7, Grayscale launched the Grayscale Sui Trust. Rayhaneh Sharif-Askary, the product and research lead, stated that Sui is redefining smart contract blockchains. This not only recognizes Sui's technology and market potential but also refocuses global investors' attention on the Sui ecosystem. Grayscale's support further boosted market recognition of Sui, with the SUI token price doubling in a single week, becoming one of the focal points in the crypto market. Meanwhile, the total value locked (TVL) in the Sui ecosystem also maintained rapid growth, with ecosystem projects making significant progress, indicating that the Sui ecosystem is rapidly rising.

2.3 Comparison of Sui and Solana: Competition Among Next-Generation Public Chains

The development trajectory of Sui is quite similar to that of Solana's early development. Solana, as a star public chain in the last bull market, rapidly rose in the market due to its high TPS (transactions per second) and low-latency processing, attracting a large influx of developers and capital, leading to a flourishing ecosystem. Sui, following a similar path, aims to play an important role in the next market cycle through its unique architecture and consensus mechanism.

However, Sui is not a simple copy of Solana. While both emphasize high performance and low fees, Sui has significant differences in technical design. For example, Sui's parallel execution architecture allows it to process multiple independent transactions simultaneously, while Solana relies on sequential execution, giving Sui higher efficiency in certain application scenarios. Additionally, the Move language used by Sui offers unique advantages in security and flexibility, enabling developers to write complex smart contracts more efficiently.

# Characteristics of Sui's Underlying Technology

Sui's underlying technological architecture allows it to stand out among numerous blockchain projects. As a Layer 1 blockchain, Sui not only leads in performance compared to other public chains but also introduces several unique technological innovations that make it more suitable for scenarios such as DeFi, decentralized dApps, gaming, and NFTs.

3.1 Consensus Mechanism and Performance Advantages

The consensus mechanism determines the network's security, degree of decentralization, and transaction processing efficiency. Sui has boldly innovated in this area by adopting a parallel consensus engine based on the Narwhal and Bullshark protocols, and recently introduced a new consensus protocol—Mysticeti.

Narwhal-Bullshark Consensus: The Narwhal and Bullshark consensus engine initially used by Sui is an innovative consensus protocol based on graph theory and voting mechanisms. It significantly improves blockchain throughput by separating the transaction transmission layer from the consensus layer. Narwhal ensures data persistence before transactions enter blocks, while Bullshark achieves transaction confirmation through a fast consensus algorithm. This architectural design allows Sui to maintain efficient operation even under complex market conditions, ensuring that transactions can be processed and confirmed quickly.

Mysticeti Consensus: To further enhance network performance, Sui introduced the Mysticeti consensus protocol, a high-performance consensus protocol specifically tailored for Sui. By simplifying the consensus process, Mysticeti can achieve approximately 390 milliseconds of consensus latency and 640 milliseconds of settlement finality, reducing latency by 80% compared to Narwhal-Bullshark. This extremely low latency ensures that even under high transaction volumes, Sui can guarantee rapid transaction confirmation, providing users with a smooth experience. In financial dApps and gaming applications, low latency means users can complete critical operations in a very short time, avoiding transaction failures or high costs due to blockchain delays.

Additionally, Sui's consensus mechanism features high scalability and flexibility. Its parallel execution design allows transactions in the network to be processed without linear ordering, significantly enhancing throughput, with the capability to handle up to 297,000 transactions per second (TPS). This data places Sui among the top public chains.

3.2 Parallel Architecture: Achieving Ultimate Efficiency

Sui's parallel architecture is one of its greatest advantages over other public chains. Traditional blockchains, such as Ethereum and Bitcoin, typically adopt a serial transaction execution model, meaning all transactions must be processed and confirmed sequentially. While this model ensures network security, it severely limits blockchain throughput, especially in high-concurrency scenarios where the network can easily become congested, leading to increased transaction costs and extended processing times.

Parallel Execution Design: Sui's parallel architecture allows multiple independent transactions to be executed simultaneously in different threads. This parallel processing mechanism breaks the performance bottleneck of traditional blockchains. In this architecture, unrelated transactions can be executed in parallel, greatly enhancing the network's processing capacity. This is particularly important for complex application scenarios such as decentralized finance, NFT markets, and gaming. For example, in the DeFi field, different user transactions often involve different asset pools and contracts. If a serial execution model is used, transactions may end up waiting on each other. Sui's parallel architecture ensures that these transactions can be executed simultaneously without interference, significantly improving transaction processing efficiency and user experience.

Scalability and User Experience: The parallel architecture not only enhances transaction processing speed but also improves network scalability. As more applications enter the ecosystem, traditional blockchains often face scalability bottlenecks, while Sui avoids this issue through parallel execution, laying the foundation for large-scale applications in the future. Furthermore, Sui's transaction fees are almost negligible, allowing users to explore applications on the network without worrying about high gas fees. For developers, low transaction costs mean they can design and deploy complex smart contracts on Sui more freely without being overly concerned about additional costs due to network load.

3.3 Move Language: Building Secure and Flexible Smart Contracts

The Sui network uses Move as its smart contract programming language. Move was originally developed by Facebook (Meta) for the Diem project and is a programming language specifically designed for blockchains and smart contracts. Compared to traditional blockchain languages (such as Solidity), Move offers higher security, verifiability, and flexibility.

Balancing Security and Flexibility: The design of the Move language aims to enhance the security of smart contracts, avoiding common blockchain vulnerabilities such as reentrancy attacks and memory overflows. In Move, assets are treated as "first-class" objects, meaning every token, NFT, or other blockchain asset is a native object in Move, and developers must follow strict rules when handling these objects. This object model makes asset operations more intuitive and secure, reducing the likelihood of errors when developers write complex contracts. Additionally, Move supports formal verification, allowing developers to use mathematical tools to verify the correctness of contracts before deployment, ensuring that they do not contain logical errors or security vulnerabilities.

Developer-Friendly Design: Compared to other blockchain programming languages, Move is very developer-friendly. Its modular design allows developers to easily reuse code, improving development efficiency. Additionally, Move has inherent advantages in resource management and concurrent operations, making it particularly suitable for building complex financial applications and high-frequency trading scenarios. The application potential of Move on the Sui network has been widely recognized by the developer community, with an increasing number of projects choosing to develop and deploy smart contracts on Sui, further driving the development of the Sui ecosystem.

3.4 Developer Tools and Ecosystem Support

Sui provides developers with a complete toolchain, significantly lowering the barrier to developing decentralized applications. Sui's development tools include SDKs, APIs, documentation, and various development frameworks, which help developers quickly get started and efficiently build and deploy applications.

The Sui team places great importance on building the developer ecosystem. In addition to providing comprehensive development tools, Sui also attracts global developers to join the ecosystem through hackathons, developer competitions, and community rewards. Through these activities, Sui not only enhances its visibility in the global blockchain developer community but also fosters the birth of numerous innovative projects. The vibrancy of this developer community lays a solid foundation for Sui's continued development in the future.

3.5 Low Transaction Fees and User Experience

The Sui network also has significant advantages in transaction fees. Traditional Layer 1 public chains, such as Ethereum, often experience extremely high transaction fees during peak load periods, greatly affecting user experience. Sui, through its efficient consensus mechanism and parallel execution architecture, keeps transaction fees at an extremely low level, almost negligible.

This low-fee design not only lowers the barrier for users to use dApps but also provides more opportunities for new project development. Developers can focus on improving product and user experience without worrying too much about the limitations imposed by high network fees.

# Current Status of Sui Ecosystem Project Construction and Development

Since the launch of the Sui mainnet, significant progress has been made in the construction and development of the Sui ecosystem. Similar to other Layer 1 public chains, Sui has attracted a large number of projects in DeFi, dApps, NFTs, and meme coins through its efficient underlying technology, low transaction costs, and developer-friendly support.

4.1 Overview of the Sui Ecosystem

The Sui ecosystem currently covers multiple fields, including decentralized exchanges, lending protocols, liquid staking, NFTs, meme coins, and GameFi. The emergence of these projects has not only led to a rapid increase in the number of users in the Sui ecosystem but also driven the continuous rise of the ecosystem's total value locked (TVL).

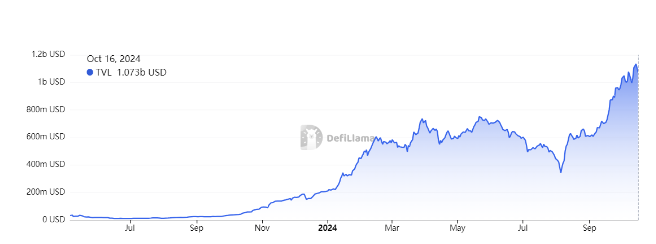

According to DefiLlama data, as of October 16, 2024, the TVL of the Sui ecosystem has exceeded $1 billion, maintaining impressive growth. This indicates that Sui still possesses strong growth momentum during the overall market downturn, and the expansion speed of ecosystem projects is remarkable.

4.2 Rapid Expansion of the DeFi Ecosystem

DeFi projects are one of the most active areas in the Sui ecosystem, providing services such as lending, liquidity pools, and decentralized exchanges, becoming an important pillar of the Sui ecosystem. Here are some representative projects in the Sui DeFi ecosystem:

NAVI Protocol: NAVI is one of the largest lending protocols on Sui, with a locked value of $350 million, making it a leader in the Sui DeFi ecosystem. NAVI offers lending services for various assets, including stablecoins (such as USDC and USDT) and the native Sui token SUI. NAVI users can also earn additional liquidity incentives through deposits, attracting a large number of users to participate in deposit and lending activities.

Cetus: Cetus is a decentralized exchange in the Sui ecosystem that uses an automated market maker (AMM) model, becoming one of the largest DEXs by trading volume on Sui. Cetus has an average daily trading volume exceeding $118 million and offers the best liquidity for trading pairs involving mainstream tokens like SUI and USDC. Cetus has also introduced a concentrated liquidity market maker (CLMM) model, allowing liquidity providers to offer liquidity within smaller price ranges, further improving capital utilization efficiency.

Suilend: As the second-largest lending protocol on Sui, Suilend has innovated in liquid staking. Suilend has a locked value of $190 million and primarily provides lending services for assets such as SUI, USDC, and ETH. Additionally, Suilend attracts a large amount of liquidity to the platform by offering extra SUI rewards, becoming an important liquidity center in the Sui ecosystem.

Scallop: Scallop is another important lending protocol on Sui, with a TVL of $160 million. Compared to NAVI, Scallop offers more incentive mechanisms, including weekly veSCA token rewards and liquidity mining rewards. Users on the Scallop platform can not only borrow mainstream assets like SUI and USDC but also participate in other decentralized financial products offered by the platform.

Aftermath: Aftermath Finance is a decentralized exchange based on Sui. The platform aims to provide users with a CEX-like experience while increasing the security of self-custody. Aftermath also supports liquid staking of SUI (afSUI), allowing users to earn additional returns by providing liquidity. Aftermath's TVL exceeds $100 million, making it an important DeFi hub within the Sui ecosystem.

Haedal: Haedal is one of the first liquid staking protocols on Sui, focusing on providing liquid staking services for SUI tokens. Haedal supports not only traditional staking but also allows users to participate in governance and earn additional rewards through a decentralized approach. Its flexible staking mechanism has attracted a large number of users.

DeepBook: DeepBook is a shared decentralized central limit order book exchange built for the Sui ecosystem, focusing on efficient order book trading. It provides support for high-frequency trading and complex order types through advanced matching mechanisms. On October 14, DeepBook announced the launch of its native token DEEP and DeepBook V3 on the Sui mainnet.

These DeFi projects not only drive the growth of Sui's locked value but also increase the network's activity and usage. With the introduction of more DeFi projects and innovative products, Sui is expected to become an important player in the decentralized finance sector.

4.3 Rising Popularity of Meme Coins

In the Sui ecosystem, meme coins are another standout area. Since September 2024, the trading volume of meme coins on Sui has rapidly climbed, becoming one of the key factors driving on-chain trading activity.

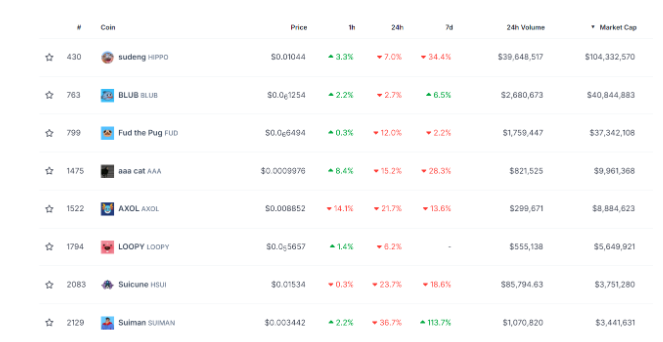

HIPPO: HIPPO is a popular meme coin on the SUI chain, aimed at celebrating the world's cutest hippo, sudeng. Under new community-driven management, the team will donate a portion of the profits to wildlife in need around the world, starting with support for the Khao Kheow Zoo, which raises "Moo Deng." Currently, HIPPO's market capitalization has reached $100 million.

BLUB: BLUB is another major meme coin in the Sui ecosystem, featuring a distinctive "dirty fish" character that incorporates elements of popular culture like Pepe. BLUB's market capitalization has reached $40 million, attracting a large number of community users to participate in its liquidity pool.

FUD: FUD conducted a free airdrop to the Sui community in December 2023, quickly accumulating a large user base. FUD has a total supply of 1 trillion, with part of it allocated for liquidity provision and another part for community rewards. Currently, FUD's market capitalization has reached $37 million, with over 48,000 on-chain holders.

AAA: AAA Cat is a dark horse meme project that has performed impressively on Sui. Inspired by the black cat emoji released by the Sui Name Service, AAA Cat has increased over 14 times in just two weeks. The community around AAA Cat is highly active, making it an undeniable force within the Sui ecosystem.

The meme coin craze on Sui has not only boosted on-chain activity but also made significant contributions to its trading volume, greatly enhancing the network's daily active user count. The rise of meme coins in the Sui ecosystem demonstrates their effectiveness as a community-driven economic form that can attract new users and increase user engagement.

4.4 Infrastructure and Cross-Chain Support

The success of the Sui ecosystem is inseparable from its strong infrastructure support. Infrastructure projects such as cross-chain bridges, oracles, and stablecoins provide a solid technical foundation for Sui's DeFi and dApps, further enhancing Sui's competitiveness among Layer 1 public chains.

Wormhole Cross-Chain Bridge: Wormhole is one of the most important cross-chain bridges on Sui. Through Wormhole, users can transfer assets from other blockchains (such as Ethereum, Solana, etc.) to Sui for trading and use. The Portal Bridge (a feature of Wormhole) has transferred over $55 million in assets to Sui.

Pyth Network Oracle: Pyth Network is the largest oracle protocol on Sui, guaranteeing a value of up to $939 million. Several top protocols within the Sui ecosystem, such as NAVI, Scallop, and Suilend, rely on the price data services provided by Pyth. This provides reliable on-chain data support for decentralized financial applications in the Sui ecosystem.

Stablecoin Support: The stablecoins in the Sui ecosystem mainly include USDC and USDT, and it also supports cross-chain wrapped stablecoins from other chains. AUSD, launched by Agora, is the first stablecoin on Sui backed by RWA (real-world assets), further enriching Sui's native asset ecosystem. With the introduction of more cross-chain bridges and stablecoins, Sui's financial infrastructure will become even more robust.

# Opportunities and Challenges in the Development of the Sui Ecosystem

Since the launch of the Sui mainnet, it has attracted widespread attention from global blockchain developers and investors due to its unique technological advantages and rapidly developing ecosystem. However, in the fiercely competitive environment of Layer 1 public chains, Sui faces both significant development opportunities and challenges that cannot be ignored.

5.1 Opportunities for the Sui Ecosystem

- High Performance and Low-Cost Technological Advantages

Sui's underlying technology, particularly its parallel execution architecture and efficient consensus mechanism, provides significant advantages in performance and cost. Compared to other Layer 1 public chains, such as Ethereum and Solana, Sui offers faster transaction speeds and lower transaction costs, making it particularly suitable for high-frequency trading and applications that require real-time responses. The Mysticeti consensus engine used by Sui greatly shortens transaction confirmation times while enhancing the overall throughput of the network by processing multiple transactions in parallel.

- Attractiveness of the Move Language for Developers

The Sui network uses the Move language as a tool for writing smart contracts, which offers high security and flexibility, providing developers with a more intuitive and secure development environment. The modular design and efficient resource management capabilities of the Move language enable developers to build complex applications with less code while reducing security vulnerabilities. The advantages of the Move language are particularly evident in the DeFi and gaming sectors, allowing developers to create safer and more flexible smart contracts, which enhances Sui's appeal to developers.

- Explosive Growth of the DeFi Ecosystem

The DeFi ecosystem on Sui is expanding at an astonishing rate, with the rapid rise of numerous DeFi projects providing a continuous flow of liquidity support for the Sui network. Projects such as NAVI, Scallop, and Cetus have become core drivers within the Sui ecosystem. As the DeFi market continues to expand, Sui has the opportunity to attract global users through more innovative financial products and further increase its total locked value (TVL).

- Support from Meme Culture Popularity

Meme projects within the Sui ecosystem have also shown strong growth momentum. Similar to the rise of meme culture in the Solana ecosystem, meme coin projects like FUD, BLUB, and AAA Cat in the Sui ecosystem have brought significant on-chain trading volume and user activity to Sui. The explosion of meme projects has not only contributed a significant share to the trading volume on the Sui chain but has also attracted many new users.

- Support from Global Capital and Investment Institutions

The funding situation for Sui is one of the important driving forces behind its rapid rise. Support from well-known investment institutions such as FTX Ventures, a16z Crypto, Jump Crypto, and Coinbase Ventures has not only provided ample financial backing for Sui but also offered strong support for the construction of its ecosystem. The launch of Grayscale's trust product focused on Sui has also enhanced investor confidence in its long-term development.

5.2 Challenges for the Sui Ecosystem

- Intense Competition with Other Layer 1 Public Chains

Despite Sui's numerous technological advantages, the competition in the Layer 1 public chain market is exceptionally fierce. Ethereum, as the public chain with the highest market share, remains the first choice for developers and users, while emerging public chains like Solana, Avalanche, Aptos, and Base are also accelerating their ecosystem layouts. Although Sui possesses high technical competitiveness, it still needs to face the ecological barriers and market foundations of other public chains.

Additionally, Layer 2 scaling solutions (such as Optimism and Arbitrum) are gradually maturing. These Layer 2 networks are providing scalability solutions for public chains like Ethereum, gradually addressing Ethereum's bottlenecks in fees and scalability, which weakens the competitiveness of new Layer 1 public chains. Sui needs to further establish its unique positioning in the public chain market through more differentiated application scenarios and user experiences based on its technological advantages.

- Diversity of Ecological Projects and User Growth

Currently, Sui's ecological projects are still concentrated in the meme sector. Although these areas are experiencing rapid growth, Sui still lacks "killer applications" with a broad user base. Compared to iconic DApps like Raydium and Magic Eden in Solana during the last bull market, Sui's ecological projects remain relatively limited in influence and user numbers.

Furthermore, while Sui's technological innovations can attract developers, converting this into large-scale user growth remains a challenge. Sui needs more innovative applications and strong user experiences to attract mainstream users, especially in areas like gaming, NFTs, and SocialFi, where a lack of a large user base will impact the long-term development of the Sui ecosystem.

- Market Volatility and Ecological Stability

Sui's market performance in the early stages has exhibited a certain degree of volatility. This volatility has led some investors and users to adopt a wait-and-see attitude towards Sui's market performance, especially in cases of severe fluctuations in token prices, where market confidence can easily be affected.

Sui needs to further enhance the stability of the network and the sustainability of on-chain activities in its ecological development to avoid significant pullbacks after short-term surges. Additionally, as the token unlock date approaches, how to address the selling pressure and market risks brought about by token unlocks will be an important issue that Sui needs to confront.

- Matching Project Development with Market Demand

Sui's technological innovations provide a good market starting point, but in reality, the development of ecological projects needs to align with market demand. On one hand, while Sui's developer ecosystem is gradually growing, it still faces challenges in attracting larger-scale application development, especially in the fiercely competitive Layer 1 public chain market. How Sui can leverage its technological advantages to capture market demand and promote more high-quality projects to go live will be key to its long-term development.

On the other hand, the diversification of user demands also means that Sui's ecological projects need to innovate more across different fields. In addition to the current DeFi and NFT sectors, Sui needs to strengthen its layout in emerging areas such as GameFi, SocialFi, and DePIN to promote the diversity of ecological projects and better meet the diverse needs of the market.

### Outlook for the Development of the Sui Ecosystem

The Sui ecosystem, with its outstanding technical architecture, rapidly expanding project ecosystem, and strong market performance, has attracted widespread attention both within and outside the cryptocurrency industry. Looking ahead, whether Sui can establish a foothold in the fiercely competitive blockchain market and become a leader among the next generation of Layer 1 public chains will depend on its development in multiple areas.

Continuous Optimization and Innovation of Technology: Sui will continue to push the frontiers of technological innovation by introducing more efficient consensus mechanisms, cross-chain solutions, and privacy technologies to enhance the resilience and scalability of its network.

Strengthening Developer Ecosystem Construction: Sui can attract more developers to its ecosystem through more hackathons, developer incentive programs, and global developer conferences. Particularly within the global developer community, Sui can leverage its technological advantages to attract more high-quality projects to go live through collaboration and resource support.

Promoting Diversity of Ecological Projects: In addition to the current DeFi and NFT sectors, Sui needs to further promote the construction of more innovative projects in other fields, especially in AI, RWA, gaming, and social directions, to explore new application scenarios.

Enhancing User Experience and Education: Sui needs to provide ordinary users with a more convenient and intuitive user experience while helping users better understand the performance and cost advantages of the Sui ecosystem through education and community activities. This will help attract more non-technical users into the Sui ecosystem and drive its user growth.

The development prospects of Sui are filled with opportunities and challenges. With the continuous evolution of technology and the ongoing expansion of the ecosystem, Sui is expected to occupy an important position in the future blockchain market and become part of the global blockchain ecosystem. By continuously innovating, optimizing user experiences, and seizing opportunities in the global market, Sui has the chance to become a pioneering force leading the next wave of blockchain technology revolution.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed analyses of potential projects, and real-time market observations. Whether you are a newcomer exploring the cryptocurrency field for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

[Mail: labs@hotcoin.com](mailto:Mail: labs@hotcoin.com)

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。