Author: Weilin, PANews

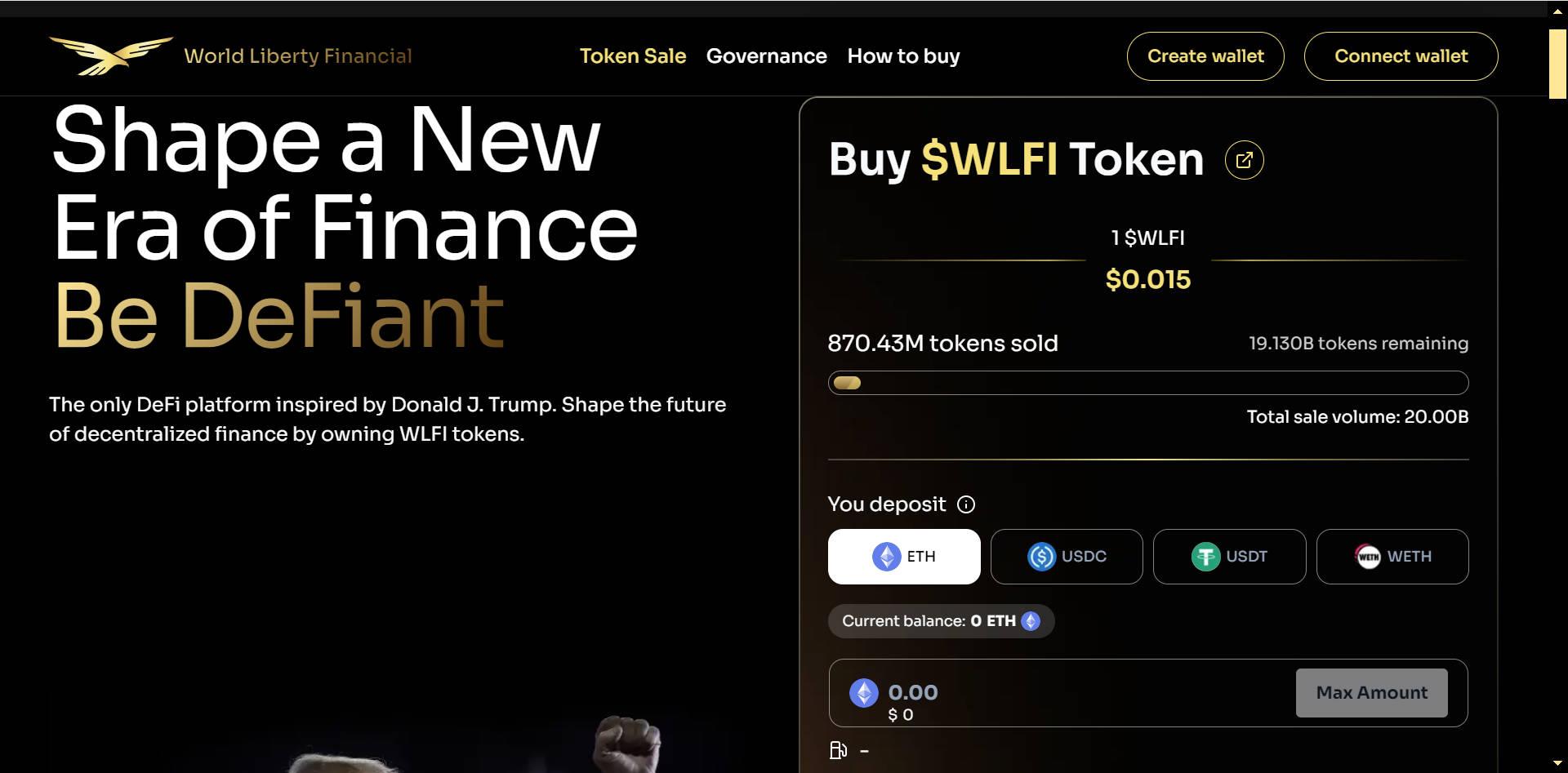

As of 2 PM on October 18, Trump's DeFi project World Liberty Financial's token WLFI has sold approximately 870 million WLFI tokens, amounting to about $13.06 million, far below the expected 20 billion tokens, which would be approximately $300 million based on the presale price.

Due to the high qualification threshold for WLFI buyers and the non-transferability of the tokens, the sales volume has fallen short of expectations. This DeFi project has also been criticized for lacking innovation, being described as a "meme disguised as a practical project," drawing complaints from some crypto entrepreneurs and executives.

Nevertheless, with less than three weeks until the U.S. presidential election voting day, Trump's support in prediction markets has seen a significant reversal, reaching a new high of 62.5%. Compared to Harris's recent ambiguity on crypto policy, Trump has seized many opportunities and resources within the crypto community.

High Purchase Threshold for WLFI, Non-Transferable, Sales Volume Far Below Expectations

WLFI tokens began selling on October 15, and just three days later, only 4.3% of the total tokens had been sold. As of 2 PM on October 18, approximately 870 million WLFI tokens had been sold, amounting to about $13.06 million at the presale price of $0.015 per token, with 19.13 billion WLFI tokens still available for sale. The target sales volume was 20 billion tokens, approximately $300 million. The gap between expected and actual sales is primarily due to World Liberty Financial's restrictions on token buyers' qualifications and the non-transferability of the tokens.

Unlike most token sales that are open to everyone and can be purchased anonymously, only qualified investors or non-residents in the U.S. can purchase Trump's DeFi tokens. If users want to buy WLFI, they will be asked whether they reside in the U.S. and meet the "qualified investor" criteria under Regulation D of the 1933 U.S. Securities Act when they first visit the website.

According to Investopedia, U.S. resident investors can only be considered "qualified investors" if they have an annual income exceeding $200,000, a net worth exceeding $1 million, or are general partners, executive officers, or directors of a company issuing unregistered securities.

Users can bypass this KYC requirement by clicking "I reside outside the U.S.," but must then provide proof of residence outside the U.S. to continue. Since many of Trump's supporters are from the U.S. and are not qualified investors, this may be a primary reason for the weak token sales.

Additionally, WLFI tokens cannot currently be transferred between wallets. This means that qualified investors cannot sell the tokens to non-qualified investors, and those residing outside the U.S. cannot sell them to U.S. residents. In fact, holders cannot sell the tokens at all. The only thing they can do is wait for the DeFi protocol to launch, at which point the developers claim that holders will be able to vote on proposals that affect the protocol.

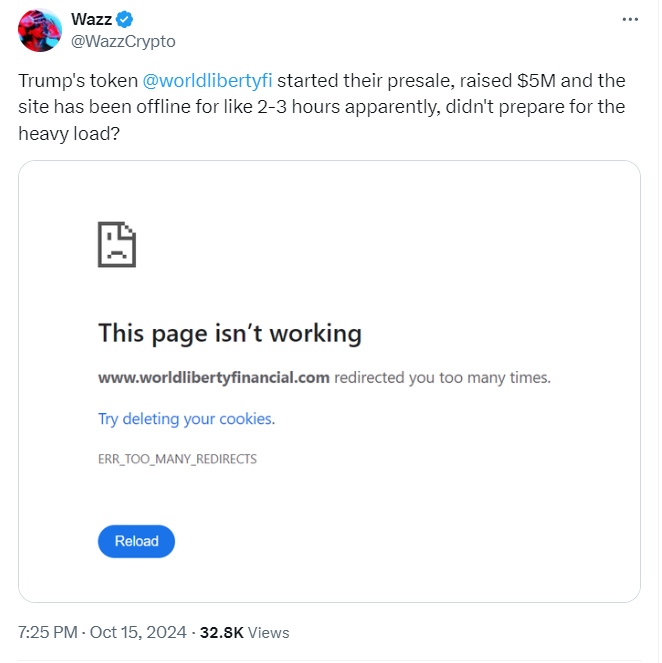

Moreover, website outages have also impacted token sales performance. Despite raising only $13 million, the World Liberty Financial website could not handle the traffic. Some users reported encountering messages stating "this page is not working" when trying to purchase tokens.

Project Criticized by Crypto Community, but Trump's Support Has Seen a "Major Reversal"

On October 18, World Liberty Financial released a 13-page document outlining its mission and how the tokens would be distributed, noting that Trump and his family could receive 75% of the net income, meaning the Trump family would receive 22.5 billion WLFI tokens, valued at $337.5 million based on the issuance price of 1.5 cents per token.

The document indicates that Trump and his family bear no responsibility and are not directors, employees, managers, or operators of WLF or its affiliates, stating that the project and tokens "are not political and are not affiliated with any political activities."

The document shows that a company named DT Marks DEFI LLC will receive 75% of the net income from the agreement, which is located in Delaware and has ties to Trump. The remaining 25% of the net income from the agreement will be allocated to Axiom Management Group (AMG), a limited liability company based in Puerto Rico, wholly owned by World Liberty Financial's two co-founders, Chase Herro and Zachary Folkman.

Due to the high proportion of income from the agreement and the lack of innovation, Trump's project has sparked criticism within the crypto community. "This presidential candidate supports this project, which is actually the only difference between it and about a dozen similar DeFi lending protocols," said Tezos CEO Kathleen Breitman in an interview with CNBC.

dYdX Trading policy head Rashan Colbert stated that whether connected to truly unique projects, through useful technical features, or purely for entertainment, there must be something of value to spark interest. However, many cryptocurrency supporters have developed some aversion to the ongoing politicization of the community, failing to find value in uninteresting profit-making activities.

This view was echoed by Two Prime CEO Alexander Blume, who said, "Aside from having the Trump brand, I don't see anything interesting or unique about it, which is not enough for most people." He added, "I think the crypto community was already quite skeptical of this project before its launch. It looks purely speculative, especially since it doesn't do anything novel."

Rumi Morales, a partner and board member at Outlier Ventures, pointed out that the project's white paper "looks rushed and full of errors." Morales stated that in today's market, even when facing challenges, super active individuals are experienced and insightful. They know how to distinguish between opportunities and games; they are not cheerleaders or novices. The launch of WLF might have had a chance during the less discerning days of the 2017 ICO boom or even in the DeFi summer of 2020, but we have moved past those years. The WLF team seems unaware of how sharp and complex the community is—we have our own ideas.

Bitwise Chief Investment Officer Matt Hougan stated that a personality-driven DeFi project is not viable. In DeFi, practicality is crucial. "WLF gives me the impression of a meme disguised as a practical project. I think people have realized this, which is why it hasn't succeeded. DeFi cannot be personality-driven; that's the essence of 'De.' Therefore, a personality-driven DeFi project is like oil and water."

Nevertheless, on October 17, according to prediction site Polymarket, the probability of Trump winning the U.S. presidential election rose to 62.5%, a historic high, while Vice President Harris's probability of election was 37.5%. The latest poll results from NBC indicate that by the November 5 voting day, Harris and Trump are expected to have equal support nationwide, both at 48%. In the same survey last month, Harris had a 5-point lead.

On October 16, CNBC reported that according to documents submitted to the Federal Election Commission, Trump's political action committee "Trump 47 Committee" has raised approximately $7.5 million through cryptocurrency, with donors contributing BTC, ETH, and XRP, as well as USDT and USDC to Trump's campaign. Trump has demonstrated his fundraising "cryptocurrency" prowess, partly due to Harris's underwhelming performance.

Recently, Harris announced a series of economic security plans targeting Black male voters during her campaign rallies, including a commitment to support a crypto regulatory framework to protect Black men's cryptocurrency investments. After the plan was announced, Harris was criticized by the crypto community for "lack of sincerity," further weakening her influence within the crypto community.

It now appears that despite various parties launching crypto policies to attract voters to varying degrees, Trump has seized the initiative. His strategy has energized some supporters, winning crucial time and resources. Harris needs to gain a deeper understanding of the crypto market's demands to reverse the situation in the upcoming election and reshape her influence within the crypto community. As the election voting day approaches, the outcome of this showdown will have profound implications for future crypto regulatory policies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。