Similar to US Treasuries, programmable collateral, and staking yields becoming benchmark interest rates, ETH is emerging as a new hybrid asset, standing out from all other digital assets except BTC.

**Original Title: *Why Ether Stands Out Among Digital Assets***

Author: Lorenzo Valente, Ark Invest Researcher

Translation: 0xjs, Golden Finance

Introduction

As Bitcoin solidifies its position as a reliable digital store of value and the only asset with a rules-based monetary policy, the Ethereum network and its asset Ether (ETH) seem to be gaining momentum with similar potential. In fact, ETH is becoming an institutional-grade asset with yield potential.

As the only truly yield-generating digital asset, ETH appears to have unique and distinct characteristics that make it a "benchmark" within the digital asset space. ETH has already played a key role in both private and public financial markets, influencing the monetary policies of other digital networks and applications, and measuring the health of a broad digital asset ecosystem. With a market capitalization of approximately $315 billion and millions of active users each month, as shown in the figure below, the Ethereum network is realizing meaningful economic value.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data sources, which can be shared upon request. Data as of August 15, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

The staking yield of ETH has already influenced other smart contract ledgers, distinguishing it from other digital assets outside of Bitcoin.

Similarly, US Treasuries play a critical role in the traditional economy, serving multiple functions: setting benchmark interest rates, acting as a safe store of value during uncertain times, and influencing market expectations about future economic conditions. Our research indicates that as an asset, ETH is beginning to develop properties similar to US Treasuries within the digital asset space. The yield-generating potential of ETH—and its widespread use as collateral in digital asset trading—are becoming its two most unique and important qualities.

Investors can earn ETH yield by staking ETH to secure the Ethereum ledger. In other words, technically, this yield is not the native yield of the ETH asset. Liquid staking derivatives such as Lido, Rocket Pool, or Frax provide a way to tokenize staked ETH and its yield. Liquid staking allows users to stake their ETH while maintaining liquidity by receiving derivative tokens that represent their staked ETH. Another method called "Solo Staking" allows for more direct control over staked assets and potentially higher returns, but it locks up ETH.

The goal of this article is to identify and define the unique characteristics of ETH. What makes ETH special? How does it stand out in the broader asset landscape? We aim to answer the following questions:

How does ETH generate yield?

How does miner extractable value (MEV) yield predict economic cycles?

Does ETH have bond-like properties?

Does staking and re-staking enhance ETH's ability as programmable collateral? If so, how?

Will ETH's staking yield become a reference yield in the crypto economy? If so, in what sense?

What are ETH's hybrid attributes in the standard classification of traditional assets?

1. How does ETH generate yield?

"Proof of Stake" (PoS) is a relatively new "consensus algorithm" that is more energy-efficient than "Proof of Work" (PoW). Why? In PoS, the consensus algorithm selects "validators" based on the number of tokens they hold and the amount they are willing to "stake" as collateral—equivalent to "miners" in PoW—to create new blocks and validate transactions. The more staked coins there are, the higher the probability of being selected to build and validate the next block. Therefore, PoS systems do not require massive computational mining power but instead require validators to make significant investments in the network—if they validate fraudulent transactions or violate core protocol rules, they may lose their staked assets. Validator staking can deter fraud, just as the electricity costs paid by Bitcoin miners to participate in the network can deter fraud. Both ensure that each participant acts with economic rationality and integrity.

When the Ethereum network upgraded to Ethereum 2.0, its protocol transitioned from Proof of Work to Proof of Stake. The latest monetary policy upgrade of Ethereum, EIP-1559, introduced a novel fee market structure. These two changes altered the way ETH generates and distributes yield.

ETH yield is based on the following three factors:

Issuance (≈2.8% APR) + Tips (0.5% APR) + MEV (0.5% APR)

Let’s take a closer look at each component of the yield.

Issuance

As of September 2024, the Ethereum network issues approximately 940,000 new ETH each year, which, based on today's staking ratio, corresponds to an annualized yield (APY) of about 2.8%. The staking ratio will vary over time based on the amount of ETH staked. If more validators stake, the staking ratio increases, thereby lowering the issuance yield, as the issuance yield is averaged among participating validators based on their weighted stakes. Importantly, the Ethereum network guarantees a minimum annual issuance rate of 1.5%, which requires 100% of ETH to be staked and no transactions on the blockchain, which is essentially unlikely. All validators who secure the network through consensus and transaction processing will receive issuance.

Tips

"Tips" are optional fees introduced by the London upgrade and EIP-1559 that users can include in Ethereum transactions. Tips are "priority fees" because they incentivize validators to prioritize processing transactions within blocks.

When users want to send a transaction, they must pay a base fee and can optionally pay a tip. The base fee dynamically adjusts based on network congestion, increasing when the network is busier. If users want to speed up their transaction, priority fees or tips are optional. In practice, priority fees are a cost that varies with network usage and congestion levels.

MEV

In addition to issuance and user tips, validators also earn "miner extractable value" (MEV) rewards, or additional profits gained by including, excluding, or reordering transactions within the blocks they generate.

MEV is akin to "payment for order flow" (PFOF) in traditional markets—additional income paid by high-frequency market makers and traders to validators for prioritizing their transaction flow. Like priority fees, its yield is unstable as it depends on the supply and demand for block space and exploits less-informed traders on the network. Importantly, MEV rewards are only available to validators running MEV clients (e.g., MEV Boost).

Base Fee

Importantly, the base fee (again, the standard cost of sending a transaction) does not impact yield. Instead, it is "burned," providing no direct cash flow to stakers. As part of the EIP 1559 upgrade, the base fee mechanism makes fees more predictable, making the Ethereum network more user-friendly.

Only the base fee and issuance can change the total supply of ETH. The ETH tokens paid as base fees by users will be permanently removed from the total supply. If the base fee is sufficiently high (greater than 23 gwei in today's market) and the "burn" amount exceeds the network's issuance (940,000 ETH per year), the total supply of ETH will decrease over time, leading to a deflationary protocol. Conversely, if the network's issuance exceeds the burned base fees, the network will experience inflation.

These two dynamics support a deflationary trend in ETH supply. First, Ethereum's Proof of Stake (PoS) mechanism allows validators to reduce operating expenses (Opex) and capital expenditures (Capex) associated with running network servers. In other words, the energy and data center costs associated with PoW and ASIC machines do not exist in PoS.

Second, as the premier smart contract platform, the Ethereum network operates with a limit of 14 transactions per second at its core. Thanks to rigorously tested code, Ethereum has attracted the most active developers, the widest range of applications, and the highest settlement value in just nine years of development.

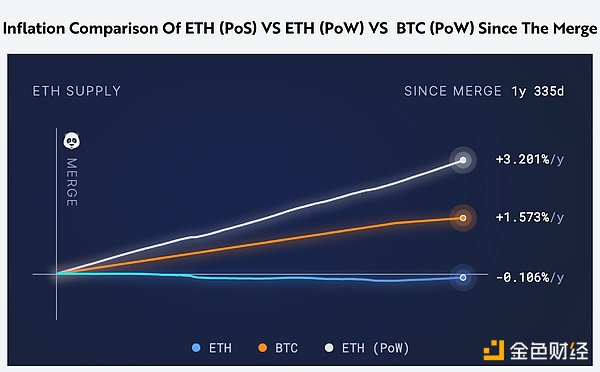

Since transitioning to PoS and implementing EIP 1559 on September 15, 2022, ETH has acted as a net deflationary asset, with an average annual supply reduction of 0.106%. If Ethereum had continued to operate on PoW without transitioning to PoS and without EIP 1559, the network's supply would have inflated by 3.2% annually, as shown below.

Source: Ultra Sound Money. Data access date is August 15, 2024. Comparison of inflation rates of ETH (PoS) vs. ETH (PoW) vs. BTC (PoW) since the merge. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

2. How does miner extractable value (MEV) yield predict economic cycles?

As mentioned above, miner extractable value (MEV) yield is part of ETH staking yield. In this section, we will delve into MEV, focusing on how it is generated and how it predicts economic activity and market cycles.

MEV is akin to payment for order flow (PFOF) in traditional finance, occurring when market makers and high-frequency trading firms pay additional fees to validators to bypass the standard Ethereum "Mempool" queue, thereby prioritizing their transaction bundles. Similarly, in traditional finance, companies like Citadel Securities pay platforms such as Robinhood, TD Ameritrade, Charles Schwab, and Fidelity to direct customer order flow to them. In fact, MEV originated during the 2017 ETH ICO boom as a basic form of priority "bribery." During the ICO era, participants and investors purchasing tokens for certain projects had to deposit ETH into smart contracts in exchange for the project's native tokens. As they became increasingly popular, token offerings became oversubscribed and operated on a first-come, first-served basis. To be among the first to deposit ETH into these smart contracts, participants would "bribe" validators off-chain.

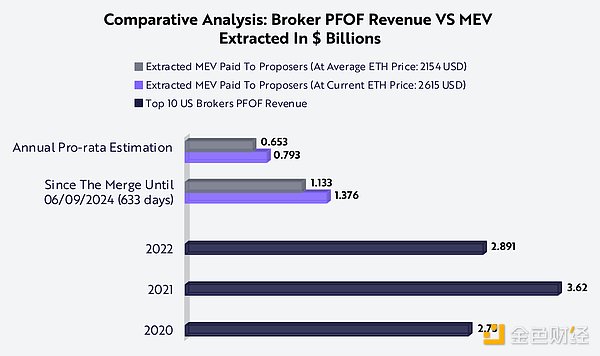

Like PFOF, MEV often reflects retail trading activity, as market makers are willing to pay higher prices for less informed orders than for informed ones. Just as PFOF payments are indicators of overspending and risk appetite in the retail stock space, MEV plays a similar role in predicting downturns in the Ethereum ecosystem and economic cycles, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from Daytradingz.com and MEV-Explore v1 as of June 9, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

While MEV on Ethereum generates revenue comparable to that from PFOF in the stock market, the percentage of MEV relative to the total market capitalization of ETH and ERC-20 tokens is significantly higher than that in the US stock market. Since the merge, the proportionate extraction of $790 million in revenue accounts for 0.20% of ETH's $315 billion market cap. The total market cap of ETH and ERC-20 tokens is approximately $500 billion, with the extracted revenue percentage dropping to 0.15%, still 27 times higher than the $2.891 billion in PFOF revenue, which accounts for 0.0056% of the $50 trillion US stock market. In the early development phase, Ethereum's order routing mechanism was more expensive than traditional financial order routing mechanisms, but it is worth noting that Ethereum supports a wider variety of order types through smart contracts—such as flash loans, staking, and swaps—along with other interactions with decentralized applications.

Additionally, in traditional finance, other fees and profit centers (brokerage fees, exchange fees, and hedge fund profits) are primary sources of PFOF revenue. These costs are not transparent but are crucial to the overall cost structure of traditional financial transactions.

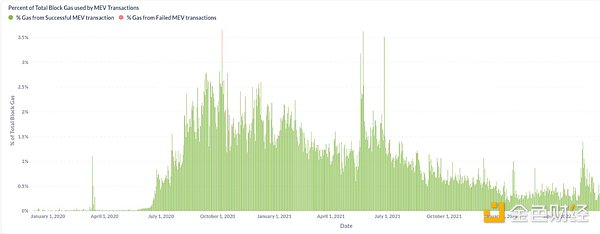

According to historical PFOF patterns in traditional finance, an increase in PFOF revenue is associated with a rise in retail activity involving less informed traders, while a decrease in PFOF indicates the opposite. For example, during the period from 2021 to 2022, as interest rates rose 16 times, Robinhood's PFOF revenue fell by 40% from $974 million to $587 million, signaling the onset of a bear market. The same is true for MEV; from July 2021 to October 2021, the block space used by high-frequency trading firms and MEV bots decreased fivefold before the severe cryptocurrency bear market in 2022, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from Explore.flashbots.net as of August 15, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

Our research indicates that a significant portion of MEV may be extracted and redistributed on Layer 2 in the coming year. Layer 2 refers to secondary protocols built on top of Ethereum. They enhance scalability and efficiency by processing transactions off the main chain while leveraging its security, reducing transaction times, and significantly lowering transaction costs. We expect that over 90% of total transactions will occur on Layer 2 within the next two years. To cater to price-sensitive retail investors, Layer 2 is likely to dominate ETH trading activity, disproportionately benefiting from MEV as sorters (or Layer 2 validators) become further decentralized.

Currently, the dominant Layer 2 networks, Arbitrum and Optimism, operate using a single sorter, meaning that block space is not auctioned to the highest bidder. Instead, transactions are sorted on a first-come, first-served basis, and block seekers or builders cannot reorder them.

As a result, certain forms of MEV (maximum extractable value) are impossible, indicating that MEV is significantly lower than it would be in a more advanced state with multiple decentralized sorters and more mature MEV infrastructure.

MEV yield is a subset of the overall yield of ETH, and it is becoming a reliable indicator of activity and economic cycles on the Ethereum blockchain. Compared to traditional finance, MEV is predominantly driven by retail trading, with a higher proportion of less informed capital flows. MEV serves as a measure of activity and economic health, influencing ETH's yield in cycles and providing a framework for assessing Layer 1 ledgers.

3. Does ETH have bond-like properties?

Fixed income assets (especially bonds) have existed for centuries and are one of the most important financial drivers of the economy. Bonds represent loans made by investors to borrowers (typically companies or governments). Our research indicates that while not equivalent to sovereign bonds, staked ETH (stETH) possesses characteristics similar to those of sovereign bonds, and these similarities are worth exploring.

The most important similarities and differences between staked ETH and sovereign bonds are as follows:

Note: Regarding the maturity portion, staked ETH can be unstaked at any time, after which the initially staked amount (referred to as "principal") can be recovered along with any earnings accrued during that period. Source: ARK Investment Management LLC, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

When we discuss the comparison between staked ETH and sovereign bonds below, we emphasize that their differences are as important as their similarities. We believe that their risk profiles represent the most significant differences between staked ETH and sovereign bonds.

Credit Risk

- Sovereign Bonds: When a government issues debt denominated in local currency, there is a possibility of default, although this risk is lower for stable economies.

- Staked ETH: The Ethereum network cannot default on staked ETH because, technically, it is not a debt. Staking rewards are derived programmatically from on-chain activity and network issuance, meaning that yields will fluctuate based on network performance, activity levels, and staking rates.

Inflation Risk

- Sovereign Bonds: Inflation of the local currency erodes the value of bond returns, reducing purchasing power.

- Staked ETH: There is inflation risk if the issuance rate of new ETH significantly exceeds the burn rate of base fees, leading to an increase in supply and thereby reducing net returns and diluting the value of interest payments.

Interest Rate Risk

- Sovereign Bonds: Changes in interest rates affect bond prices, with rising rates typically leading to falling bond prices.

- Staked ETH: While Ethereum itself does not issue multiple bonds (with varying maturities and staking yields), changes in yield expectations from other Layer 1 smart contract platforms may affect the perceived value and attractiveness of staked ETH.

Currency Depreciation Risk

- Sovereign Bonds: Depreciation of the local currency relative to other currencies can significantly reduce the value of interest payments and principal when converted to other currencies.

- Staked ETH: The value of ETH relative to other major cryptocurrencies and fiat currencies may fluctuate, affecting the actual value of staking yields and principal relative to other assets.

Political and Legal Risk

- Sovereign Bonds: Changes in government or regulatory regimes may affect bond repayment and could lead to changes in fiscal policy and/or debt restructuring.

- Staked ETH: This analogy is less direct. Staked ETH carries additional risks related to network security and governance. If validators act maliciously or collude, staked ETH may be slashed as a penalty, leading to potential losses of principal. Regulatory changes affecting the broader cryptocurrency market may also impact the value and security of staked ETH.

Volatility Risk

- Sovereign Bonds: Sovereign bonds are generally viewed as low-risk, low-volatility investments. However, during periods of economic instability or political turmoil, the volatility of bonds may increase significantly.

- Staked ETH: Staked ETH is more volatile as it is still in its nascent stage. Volatility can affect staking yields and the value of principal.

Modeling staked ETH as sovereign bonds requires an understanding of the differences in their respective risk profiles. While both are affected by inflation, interest rate changes, and currency depreciation, the nature of these risks and their impacts may vary significantly. Additionally, staking ETH introduces unique risks related to network security, validator behavior, and smart contract errors, which do not have direct counterparts in traditional sovereign bonds.

Similar to calculating the present value of sovereign bonds, one can attempt to simulate the present value of so-called "staked ETH bonds." This formula would add the present value of each reinvested coupon to the present value of the face value at the bond's maturity. Then, by modeling the coupon interest against the staking yield of ETH and discounting the rate against the risk-free rate of US Treasuries, one can derive the present price of staked ETH bonds.

Nevertheless, one of the most significant differences between sovereign bonds and "staked ETH bonds" is that the yield on staked ETH changes daily. Therefore, modeling "staked ETH bonds" requires calculating the average yield over the maturity period. Furthermore, unlike traditional sovereign bonds, staked ETH can be unstaked or "redeemed" at any time, allowing for the principal to be redeemed at any moment.

Currently, ETH does not have a yield curve, meaning there is no relationship between staking yields and the maturity of the staked assets. However, according to our research, the ETH yield curve may change in the coming years, increasing its similarity to sovereign bonds, with varying terms and maturities for staked ETH.

4. Will staking and re-staking enhance ETH's position as programmable collateral?

Liquid Staking Derivatives (LSD) are protocols designed to simplify the staking process for users lacking technical expertise. LSD collaborates with trusted node operators to manage staking operations on behalf of users. Users staking ETH through leading LSD provider Lido receive stETH. stETH is a synthetic version of their staked ETH, functioning similarly to tokenized proof of deposit. The stETH token automatically readjusts to reflect staking rewards (3.2% APY) and can be converted to ETH on centralized and decentralized exchanges. The token or proof of deposit can then be used for lending, obtaining leverage, re-staking, and many other financial activities within the digital asset space, especially in Ethereum-based applications/protocols.

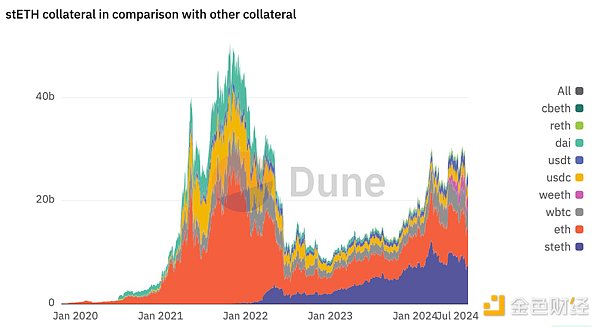

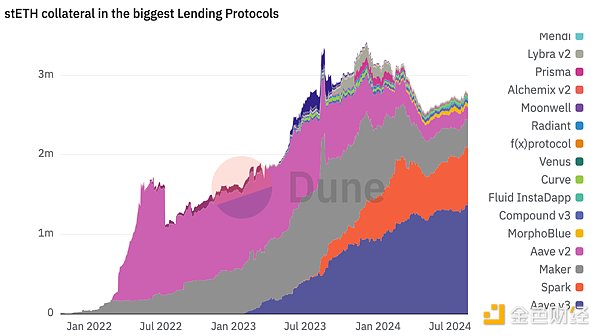

stETH is a yield-bearing version of ETH. Due to its programmability and liquidity, stETH is beginning to replace ETH in many DeFi protocols and applications. In fact, stETH has been replacing ETH as the premium collateral in the Ethereum economy. Today, the total supply of stETH used as DeFi collateral is approximately 2.7 million, accounting for about 31% of the total stETH supply, as shown below.

Note: The left Y-axis of this third-party chart is measured in dollars (billions). Each abbreviation shown on the right side of the chart represents a different asset that can be used as collateral, as follows: cbeth (Coinbase Staked ETH), reth (Rocket Pool ETH), dai (MakerDao Stablecoin), usdt (Tether Stablecoin), usdc (Circle Stablecoin), weeth (Ether.fi ETH), wbtc (Wrapped Bitcoin), eth (ETH), steth (Lido Staked ETH). Source: Dune (https://dune.com/lido/steth-collateral-compare-to-others) as of August 15, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

There are over 80,000 stETH in liquidity pools on leading DEXs such as Curve, Uniswap, Balancer, Aerodrome, and others. stETH is a yield asset, and due to the capital efficiency it provides to users, liquidity providers, and market makers, it is becoming the preferred collateral. Currently, the preferred collateral on Aave V3, Spark, and MakerDao is 1.3 million stETH, 598,000 stETH, and 420,000 stETH, respectively, locked in these protocols and used as collateral for issuing loans or cryptocurrency-backed stablecoins, as shown below. Our research indicates that stETH and other liquid staking derivatives are becoming the preferred premium collateral for financial activities within the Ethereum ecosystem.

Note: The left Y-axis of this third-party chart measures the number of stETH rather than the dollar amount of stETH. Source: Dune (https://dune.com/lido/steth-collateral-compare-to-others) as of August 15, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency. Note: Each legend label shown on the right side of the chart is the name of a specific protocol.

But what if users want to earn higher yields from their staked ETH while providing more utility as collateral?

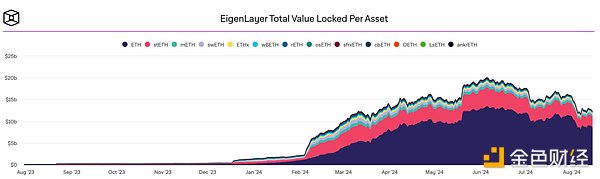

This is precisely what Eigenlayer (a re-staking protocol) can achieve. To date, Eigenlayer has accumulated $13 billion in tokenized deposits of ETH, accounting for 50% of Lido's TVL and approximately 4% of the total ETH supply, as shown below. Liquid staking derivative tokens representing staked ETH on the Ethereum network can be re-staked on the Eigenlayer platform, allowing other protocols to enhance their network security for a specified period, similar to leasing security services.

Certain protocols may have token volatility too high to provide reliable network security, potentially facing liquidity shortages and/or needing to enhance their security, both of which can be addressed through dual-token staking or renting out their entire security with more stable collateral like ETH. For their security services, re-staking protocols like EigenLayer reward re-stakers just as the Ethereum network pays validators.

We believe the emergence of re-staking enables investors to better control their risk and return profiles, thereby enhancing the utility and efficiency of ETH as collateral in DeFi.

Note: Each abbreviation shown at the top of the chart refers to the protocol associated with different ETH liquid staking tokens, as follows: Steth (Lido), rETH (Rocketpool), sfrxETH (Frax), cbETH (Coinbase), ankrETH (Ankr), LsETH (Liquid Collective), oETH (Origin Protocol), mETH (Mantle), SwETH (Swell), wBETH (Binance). Source: The Block as of August 15, 2024. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

The success of EigenLayer indicates a strong interest from users and institutions in utilizing their held ETH in more complex ways. By introducing new use cases, EigenLayer allows participants to retain their held ETH while generating additional yields. As they emerge from EigenLayer's launch—just as stETH emerged from native staking—liquid re-staking tokens are likely to serve as collateral across various platforms.

Whether in liquidity pools, lending platforms, structured products, or crypto-backed stablecoins, various forms of yield-bearing ETH have the potential to become the preferred programmable collateral for leading applications and products in DeFi—whether deployed on Ethereum Layer 1 or any currently available Layer 2.

5. Will the staking yield of ETH become an endogenous benchmark for the crypto economy?

So far, we have described staked ETH in some ways as an asset similar to sovereign bonds and characterized ETH and its liquid staking derivatives as premium liquid collateral in DeFi, supporting many widely used applications. In this section of the article, we focus on another unique feature of ETH staking yields: their impact on investments in the crypto economy, which our research suggests can be comparable to the roles of government bonds and federal funds rates in the traditional economy.

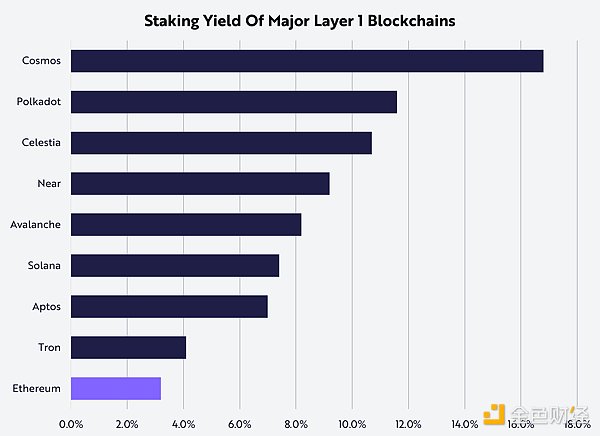

Today, staking yields influence public and private investments in the digital asset space, much like the role of High-Quality Liquid Assets (HQLA) in traditional finance. First, ETH yields seem to exert significant pressure on the native yields of competing Layer 1 smart contracts, forcing other blockchains to offer higher rewards to validators to recognize their security and long-term commitment, as shown below. If the return on investment is unlikely to be higher, why would investors/validators hold and stake riskier, more volatile assets? Importantly, unlike ETH, the yields of other assets often dilute cash flows. In other words, if investors hold and do not stake any other Layer 1 tokens, network inflation will dilute them.

Source: ARK Investment Management LLC, 2024, based on data from The Staking Explorer as of August 15, 2024. (https://www.stakingrewards.com) For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

The staking yield of ETH also raises the opportunity cost of holding and borrowing stablecoins. As its native yield rises and becomes a benchmark, the activity, MEV fees, and overall demand for ETH put pressure on multiple DeFi protocols. MakerDAO, Aave, and Compound are three such protocols.

MakerDAO is a protocol for managing the issuance and management of the DAI stablecoin. DAI is issued through Collateralized Debt Positions (CDPs) as users lock up collateral such as ETH or other whitelisted assets to mint DAI. One of the core functions of the MakerDAO protocol is the DAI Savings Rate (DSR), which allows DAI holders to earn interest by locking their DAI in special smart contracts. After DAI faced significant selling pressure and a reduction in circulating supply, MakerDAO governance decided to raise the DSR rate from 5% to 15%.

In money markets like Aave or Compound, where conditions are determined by supply and demand, the returns for supplying/borrowing stablecoins have significantly increased. The APY for fiat-backed stablecoin supply ranges from 5% to over 15%, depending on market conditions. This interest rate reflects investors' willingness to borrow stablecoins while providing ETH or stETH as collateral without needing to sell.

Additionally, protocols like Ethena Labs (which offers a stablecoin backed by spot stETH positions and perpetual futures short positions for arbitrage trading) have attracted many stETH holders. Why? The yield provided by Ethena's stablecoin is significantly higher than that of DeFi alternatives, not to mention the typical staking yield of ETH.

The yields from ETH staking also affect yield farming opportunities. Teams looking to launch new products or features and attract ETH-denominated capital into their pools must align their incentives with current market conditions. For many teams and protocols, higher staking yields often mean higher user acquisition costs, as potential investors and liquidity providers are more likely to stake ETH for more stable returns rather than take on the higher risk-return profile associated with new or less mature yield farming opportunities.

Investors allocating funds to early digital assets are all asking the same question: based on risk and liquidity adjustments, will this project provide better investment returns than staking ETH? We can explore this question with a hypothetical example. How much better must a typical closed-end fund, with an investment horizon of 7 years (the average harvest period for tech startups), perform after compounding to break even compared to ETH? If the ETH yield is 4% after 7 years of compounding, then the closed-end fund must outperform ETH by over 31%, even without considering price appreciation. In other words, early investors in the digital asset space often consider this: based on risk and liquidity adjustments, do the projects they are evaluating offer higher returns than simply holding and staking ETH during the investment period? For example, consider a typical 7-year fund, often referred to as a harvest period, during which investments are expected to mature and provide liquidity. If the same funds were invested in ETH and staked, with an average staking yield of 4%, the project's performance would need to exceed ETH by at least 31% to compensate for the compounding yield effect. In a bull market characterized by oversubscription in private rounds, declining valuation attractiveness, and unfavorable vesting conditions, competition from staked ETH will become even more intense.

6. What are the hybrid attributes of ETH?

The success of spot Bitcoin ETFs may be attributed to Bitcoin's appreciation potential and relative stability compared to other stores of value, particularly fiat currencies. The arbitrary decisions made by monetary authorities (often capricious and inconsistent) have played a significant role in the long-term depreciation of fiat currencies. In contrast, Bitcoin is "rule-based," with its supply mathematically capped at 21 million coins. Thus, Bitcoin is becoming a strong alternative to fiat currencies, representing a digital asset class akin to digital gold.

As a younger asset, ETH has undergone multiple monetary and technological upgrades over the years. Furthermore, its Turing completeness and yield cash flows make it difficult to describe, define, and frame within the boundaries of traditional asset classes.

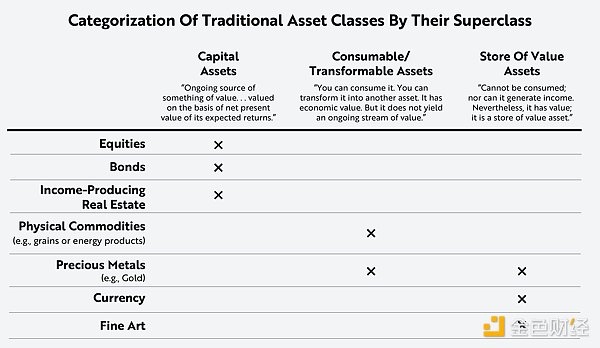

Robert Greer categorizes assets into three types in his paper "What is an Asset Class, Anyway":

- Capital Assets: Assets that are productive and add value to the holder in the form of cash flow, such as stocks, bonds, or real estate.

- Consumable Assets: Assets that can be consumed or converted into other assets or commodities, such as commodities.

- Store of Value: Assets that cannot be consumed or converted into other assets or commodities but can maintain value over a long period.

Source: Greer 1997. For reference only and should not be considered investment advice or a recommendation to buy, sell, or hold any specific security or cryptocurrency.

In this article, we have illustrated the similarities between ETH yields and the yields of bond-like instruments, particularly sovereign bonds. We have demonstrated that ETH staking yields serve as a benchmark for smart contract activity and economic cycles in the digital asset space, much like the federal funds rate in traditional finance. Additionally, like any other Layer 1 asset, ETH is a consumable asset used to pay for transactions that are to be recorded on the Ethereum network. This process involves exchanging assets to pay for the costs incurred by validators for storing and computing data. We have also highlighted the ability of staked ETH to serve as a high-quality liquid asset in DeFi, supporting the most popular applications and stablecoins like DAI and USDe.

So, what is the best way to classify and define ETH as an asset?

While the Bankless team considers ETH to be a "tri-phase asset," reflecting characteristics of three different asset classes according to Robert Greer's classification, we believe that Bitcoin has already become and will continue to be a very reliable store of value. That said, we also believe that ETH is paving the way for a new hybrid asset. While ETH exhibits store of value properties in the smart contract economy, what distinguishes ETH from any other digital asset is that it is a programmable asset capable of generating cash flow, serving as high-quality collateral in financial applications.

ETH and staked ETH are highly liquid and widely traded across many exchanges. Their liquidity ensures that they can be easily liquidated and converted into other assets and/or used in various DeFi protocols. Although ETH is more volatile than government bonds or real estate, it is one of the most mature, valuable, and widely used cryptocurrencies in the world. With the launch of spot ETH ETFs, the acceptance of ETH may increase, potentially reducing its volatility.

Currently, ETH and its liquid staking derivatives are used as collateral in various DeFi protocols, not only for securing loans but also for participating in liquidity pools, generating yields, and issuing stablecoins. While ETH may not fit neatly into a single asset class, its multifaceted attributes highlight the appeal of its unique asset profile, making it highly attractive for those looking to participate in the rapidly growing global smart contract economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。