Written by: Xu Xiaohui, Liu Fuqi, Mankun Law Firm

Due to the anonymity and decentralization characteristics of virtual currencies, they are widely used for illegal activities such as money laundering and cross-border fund transfers. As a result, countries and regions around the world often maintain a strong regulatory stance on the buying and selling of virtual currencies. In China's cryptocurrency sector, the criminal risks that Web3 players often face include pyramid schemes, operating casinos, and illegal business operations, with illegal business operations being one of the most common pitfalls for OTC merchants. Previously, Mankun Law Firm published an article titled "Guidelines for Preventing Criminal Risks in Web3 Entrepreneurship (Part 2): Illegal Business Operations Related to Foreign Exchange Trading," which analyzed one of the issues that easily arise in cryptocurrency arbitrage.

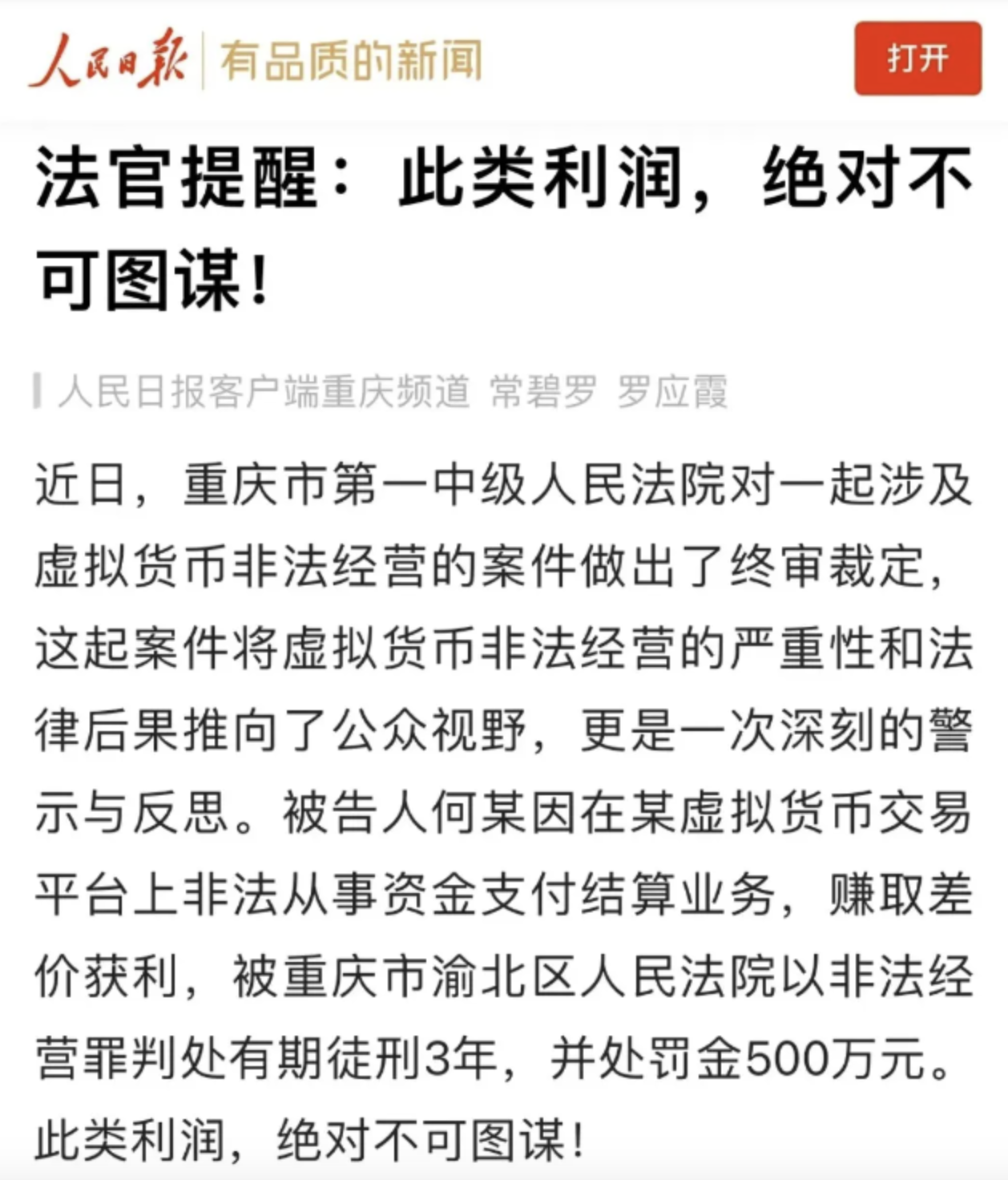

However, illegal business operations are not limited to foreign exchange trading. For example, in a case involving virtual currency and illegal business operations adjudicated by a court in Chongqing, the court found that the parties were suspected of engaging in payment settlement-type illegal business operations. Once the case was disclosed, it sparked heated discussions and left many USDT merchants feeling uneasy. So, does cryptocurrency arbitrage constitute a payment settlement activity? In this article, Mankun lawyers will further discuss the matters related to virtual currency exchange by analyzing payment settlement-type illegal business operations.

Review of the Chongqing Case

In early 2018, He was invited by Zheng to register as a "merchant" on a well-known virtual currency trading platform, starting to engage in the exchange of virtual currency "USDT" for RMB, earning a profit from the price difference. To expand his business, He rented a venue, recruited employees, and registered multiple accounts and opened bank accounts in the names of friends and family to conduct a large number of virtual currency and RMB exchange transactions.

By May 2019, the total transaction volume of the bank accounts controlled by He had exceeded 14 billion yuan, with personal profits reaching 4.77 million yuan.

The People's Court of Yubei District, Chongqing, sentenced him to three years in prison for illegal business operations and imposed a fine of five million yuan. He later appealed, arguing that the exchange business he engaged in between virtual currency and RMB did not constitute a payment settlement activity, but the Chongqing First Intermediate Court did not support this claim, ultimately ruling to dismiss the appeal and uphold the original judgment.

What is Payment Settlement?

The business of earning a profit from price differences, as He did, is a common practice among U merchants: buying low and selling high on exchanges to gain a profit from the price difference. To clarify the issue of arbitrage and illegal business operations, it is essential to understand what payment settlement is and how it is defined in the context of criminal law.

Payment settlement business is a common intermediary service in banks, where intermediaries use credit cards, remittances, and collection services to facilitate currency payments and fund clearing for clients.

According to relevant regulations, the object of "payment settlement" is legal tender, and the essence of the activity lies in the transfer and settlement of funds. Engaging in payment settlement business requires approval from the People's Bank of China and obtaining a "Payment Business License"; those who engage in this business without permission, using fictitious transactions, false pricing, transaction refunds, and other illegal methods, may be held criminally liable for illegal business operations if the circumstances are severe.

Can Payment Settlement Be Determined?

Mankun lawyers previously mentioned in "Guidelines for Preventing Criminal Risks in Web3 Entrepreneurship (Part 2): Illegal Business Operations Related to Foreign Exchange Trading" that if other foreign currencies are involved in the entire transaction chain, it may be recognized as using virtual currency as a medium for foreign exchange, achieving cross-border conversion between domestic and foreign currencies, thus constituting illegal foreign exchange trading and potentially involving illegal business operations related to foreign exchange trading.

However, in He's case, although the transactions did not involve foreign currencies and did not constitute foreign exchange trading, the court still found He suspected of illegal business operations. The court held that He controlled multiple trading accounts and bank accounts, accepted investments from others to form a capital pool, and acted as a central counterparty, indirectly providing large-scale RMB and virtual currency recharge and exchange services for the involved platform. The essence of this behavior is the provision of currency fund transfer services based on capital aggregation, which falls under the category of engaging in payment settlement business.

So, does this mean that all virtual currency arbitrage activities could be deemed as engaging in payment settlement business, like He's case, regardless of whether they involve foreign currency transactions, thus potentially constituting illegal business operations?

Not necessarily. Based on relevant regulations and judicial practices, whether virtual currency arbitrage constitutes payment settlement-type illegal business operations should be considered from the following factors:

The term "illegal" in illegal business operations typically refers to violations of prohibitive or restrictive norms in national laws and regulations. However, the current regulatory policies on virtual currencies in China are mostly notifications and announcements, such as the 924 notice issued by ten ministries, and do not constitute the "laws and administrative regulations" referred to in illegal business operations.

"Payment settlement business" is fundamentally about the transfer and settlement of currency funds. The U merchant business model involves buying and selling virtual currencies and transferring RMB through bank accounts to earn a profit from the price difference. However, virtual currency is not legal tender and does not have the characteristics of legal compensation; therefore, U merchants do not directly handle or transfer funds. At the same time, U merchants act as both buyers and sellers in the "buy U" and "sell U" roles, directly participating in the transactions, which fundamentally differs from the role of intermediaries like banks that are independent of the payers and payees. Therefore, in virtual currency arbitrage, U merchants do not directly engage in fund transfer and settlement activities.

Additionally, in common U merchant arbitrage models, apart from He's extensive trading as a registered merchant on exchanges, there are also more cautious U merchants in the industry who only trade with a few trusted "old customers." Mankun lawyers believe that for these U merchants, they often only conduct sporadic transactions with specific individuals, without establishing dedicated payment settlement channels or engaging in widespread, regular, and continuous business aimed at unspecified parties, thus not meeting the "independent operation" characteristics in illegal business operations.

In summary, the reason why engaging in payment settlement business is classified as illegal business operations is that such behavior inherently possesses independent operational characteristics, providing currency payments and conducting fund clearing, leading to false trading prosperity and disrupting normal trading order. Therefore, taking He's case as an example, whether ordinary virtual currency arbitrage can constitute payment settlement-type illegal business operations remains questionable.

Conclusion by Mankun Lawyers

With the rise of cybercrime cases, criminals are using virtual currencies for illegal payment settlements to transfer funds related to cybercrime, making virtual currencies a focal point of judicial practice. It should be noted that although there are doubts about whether the buying and selling of virtual currencies constitute payment settlement-type illegal business operations, He's case cannot serve as a guiding conclusion. However, in common cases in judicial practice, U merchant transactions may also involve charges such as aiding information crime activities, concealing and disguising criminal proceeds, money laundering, and obstructing credit card management.

Therefore, for ordinary Web3 users, it is still essential to participate cautiously in virtual currency trading activities, ensuring thorough examination and verification of trading counterparties and transaction funds to avoid involvement in illegal fund transfers and other unlawful activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。