Author: Wijdan Khaliq, Coinbureau

Translation: Glendon, Techub News

In the early days of Bitcoin, anyone with a computer could mine blocks independently and receive rewards. However, as Bitcoin's popularity soared, competition intensified. Gradually, mining became a race, and the computational power required to solve cryptographic puzzles increased dramatically. After that, the chances for solo miners to receive continuous rewards became minimal, leading to the rise of mining pools as the rules of the game changed.

This key development allowed miners to pool their resources, thereby improving their chances of mining blocks and receiving rewards. Today, mining pools have become a crucial pillar of the Bitcoin ecosystem, enabling numerous participants to come together and share profits based on their contributions.

So, why have mining pools become a dominant force in the cryptocurrency space? Can miners still mine Bitcoin independently, or is that now a futile endeavor? How do mining pools operate? What factors make one mining pool better than another?

The above questions are just some of the issues miners (especially newcomers) face when dealing with the complexities of modern Bitcoin mining. This article will explore Bitcoin mining pools, delve into how they work, and highlight some of the best Bitcoin mining pools currently available.

01 What is a Bitcoin Mining Pool?

As competition in Bitcoin mining has intensified and resource demands have increased, the concept of mining pools has emerged.

A Bitcoin mining pool is a collective of individual miners who combine their computational resources to increase the chances of successfully mining Bitcoin blocks. Through this collaboration, miners can share rewards based on their contributions, which are measured in hash power—the computational work required to solve cryptographic puzzles for validating transactions and adding new blocks to the Bitcoin blockchain.

As more miners join the Bitcoin network, the difficulty of solving cryptographic puzzles gradually increases. Nowadays, it is nearly impossible for resource-limited individual miners to receive consistent rewards. In contrast, by pooling resources, miners can achieve a more stable income source, as the likelihood of finding blocks significantly increases when many participants contribute hash power together.

Advantages of Joining a Mining Pool:

Stable payouts: Compared to solo mining, miners can receive regular returns, while solo mining rewards can be sporadic and unpredictable.

Lower entry barriers: Pooling resources allows smaller miners to participate without needing substantial hardware or power resources.

Shared expertise: Many mining pools provide support and resources to help inexperienced miners navigate the complexities of mining.

Additionally, mining pools help enhance the overall security of the Bitcoin network. By increasing the number of participants involved in solving blocks, they help maintain decentralization and reduce the risk of any single entity gaining excessive control over the blockchain. Thus, this collective effort also ensures that transactions are processed efficiently and securely.

Solo Mining vs. Pool Mining

The main difference between solo mining and pool mining lies in how miners handle the tasks of validating transactions and earning rewards.

Solo Mining: In this approach, an individual miner works independently to solve cryptographic puzzles. While this method allows miners to own 100% of any mined rewards, it comes with significant risks. The chances of a solo miner successfully mining a block are very low, especially considering that large entities with substantial resources dominate the current Bitcoin mining landscape.

Pool Mining: Pool mining refers to collaborating with other miners to increase collective hash power. This method allows participants to share rewards based on their contributions, resulting in more frequent payouts.

Pros and Cons

There is no doubt that the pros and cons are key factors in determining the success or failure of transactions.

Advantages of Solo Mining:

Complete control over mined rewards.

No fees paid to pool operators.

Disadvantages of Solo Mining:

Income can vary greatly, with long periods without rewards.

Requires significant investment in hardware and electricity.

Advantages of Pool Mining:

More stable income through collective efforts.

Lower initial investment compared to solo mining.

Disadvantages of Pool Mining:

Fees deducted by pool operators may reduce overall income.

Lower autonomy in the mining process, as decisions are often made by the pool operator.

Today, many miners prefer pool mining due to its reliability and lower risk. The competitive environment makes it increasingly difficult for individual miners to earn rewards without collaboration. By joining a pool, miners can ensure regular earnings while still contributing to the security and decentralization of the Bitcoin network.

02 How Do Bitcoin Mining Pools Work?

As mentioned above, Bitcoin mining pools have fundamentally changed how miners operate in the competitive landscape of cryptocurrency, allowing them to pool resources and increase their chances of stable returns while sharing the workload. So, what are the mechanisms behind these pools, and how do they distribute rewards among participants to ensure everyone benefits from the collective effort?

Mining Pool Mechanism

How do Bitcoin mining pools operate? Essentially, these pools are the product of teamwork. When miners join a pool, they combine their computational power to solve the complex mathematical problems involved in validating transactions and adding new blocks to the blockchain. This collaboration significantly increases the chances of successfully mining blocks compared to individual miners working alone.

Share allocation: Each miner in the pool is assigned a certain number of "shares," representing their contribution to the mining effort. These shares are based on the hash rate contributed by each miner—essentially the computational power they bring to the pool. The more shares a miner holds, the greater their potential reward when the pool successfully mines a block.

The role of hash rate: Hash rate is crucial in pool mining, measuring how many calculations a miner can perform per second. A higher hash rate leads to more shares and increases the likelihood of finding blocks. When a miner's hardware solves a puzzle, they submit the solution to the pool operator, who verifies it and broadcasts it to the Bitcoin network.

Understanding Proof of Work (PoW): The underlying mechanism that enables all of this is called Proof of Work (PoW). In short, PoW requires miners to solve complex mathematical problems to prove they have done the necessary work. This process ensures network security and prevents malicious activities like double spending. When pool members successfully mine a block, the block's reward (currently 3.125 BTC) is distributed among all members based on their shares.

Reward Distribution Models

Three common reward distribution models used by major mining pools:

Pay Per Share (PPS): In this model, miners receive a fixed amount for each valid share they submit, regardless of whether the pool finds a block. This provides a stable income source but typically comes with higher fees.

Pay Per Last N Shares (PPLNS): PPLNS rewards miners based on the last N shares submitted before a block is found. This model encourages miners to stay in the pool longer and can lead to higher payouts when luck is on their side, but conversely may result in lower earnings.

Full Pay Per Share (FPPS): Similar to PPS, FPPS includes transaction fees in addition to block rewards, providing miners with a more favorable payment structure.

The main differences between these models lie in how rewards are calculated and distributed. PPS offers stable payouts but at a higher cost; PPLNS can yield higher returns but is less predictable; FPPS combines elements of both, potentially leading to greater earnings.

Which Model Do Different Types of Miners Prefer?

New Miners: New miners may prefer PPS for its reliability.

Experienced Miners: Experienced miners may choose PPLNS, as they can better handle variance and maximize profits over time.

Profit-Oriented Miners: If transaction fees are high, FPPS may be very attractive, as it can maximize earnings through both block rewards and fees.

In short, Bitcoin mining pools simplify the mining process by pooling resources and distributing rewards based on contributions. Understanding how these pools operate and their various reward distribution models can help miners choose the right setup based on their needs, ultimately increasing their chances of consistently earning Bitcoin.

03 Best Bitcoin Mining Pools

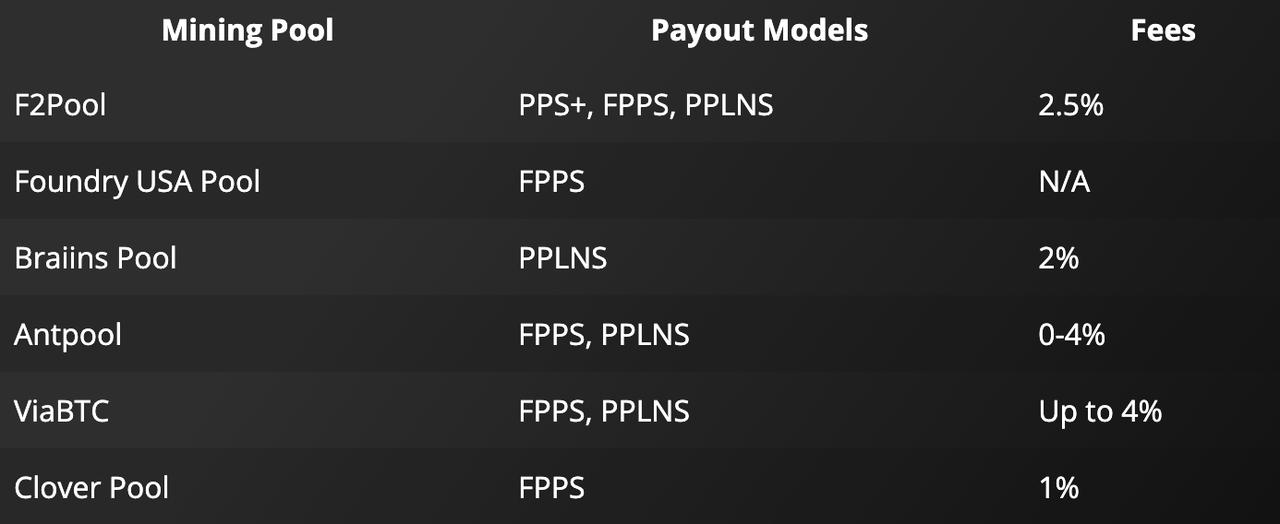

1. F2Pool

F2Pool charges a 2.5% mining reward fee; image from F2Pool

F2Pool, also known as "Fish Pool," is one of the largest Bitcoin mining pools in the world, controlling about 20% of the network hash rate. Founded in 2013, it allows miners to mine various cryptocurrencies, including Bitcoin.

Payment Methods

F2Pool offers three payment models for Bitcoin mining:

PPS+ (Pay Per Share+): Miners receive a fixed amount for each valid share submitted, regardless of whether the pool finds a block.

FPPS (Full Pay Per Share): This method includes both block rewards and transaction fees.

PPLNS (Pay Per Last N Shares): Rewards are based on the last N shares submitted, allowing loyal miners to benefit over time.

Fees: F2Pool charges a 2.5% fee on mining rewards, with a minimum withdrawal threshold set at 0.005 BTC to ensure miners can access their earnings promptly.

Multi-Currency Support: In addition to Bitcoin, F2Pool allows mining of various cryptocurrencies such as Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

Advantages:

Stable and consistent income: Various payment models ensure that miners can choose the option that best suits their needs.

Multi-currency support: In addition to Bitcoin, F2Pool also allows mining of various cryptocurrencies, providing flexibility for miners.

Transparent operations: The pool regularly publishes information about its hash rate and mining income, promoting transparency within the community.

Cons:

- Centralization issues: As one of the largest pools, F2Pool has faced controversy for promoting the centralization of Bitcoin mining, which could pose risks to the Bitcoin network.

2. Foundry USA Pool

Foundry USA Pool is a Bitcoin mining pool launched by Digital Currency Group in 2020, quickly becoming a significant player in the Bitcoin mining space.

Key Features

Market share: Foundry USA Pool currently controls about 30% of the Bitcoin network hash rate, making it one of the largest pools in the world.

Payment model: The pool primarily uses the FPPS model, which ensures stable and consistent payments, including block rewards and transaction fees.

Security and compliance: Foundry has features like KYC (Know Your Customer) compliance and SOC (Service Organization Control) certification. This focus on security helps build trust among miners.

Analytical tools: The platform provides advanced analytics and performance tracking tools, allowing miners to effectively monitor their operations.

Pros

Stable income: The FPPS model provides stable earnings.

Security measures: With security protocols and compliance standards, Foundry USA Pool prioritizes the safety of user funds.

Cons

Centralization issues: Concerns arise regarding the centralization of the Bitcoin network due to Foundry controlling a significant portion of the hash rate, which could lead to risks associated with a 51% attack.

Limited cryptocurrency support: Foundry focuses on Bitcoin mining and does not offer many options for miners interested in transitioning to other cryptocurrencies.

3. Braiins Pool (formerly Slush Pool)

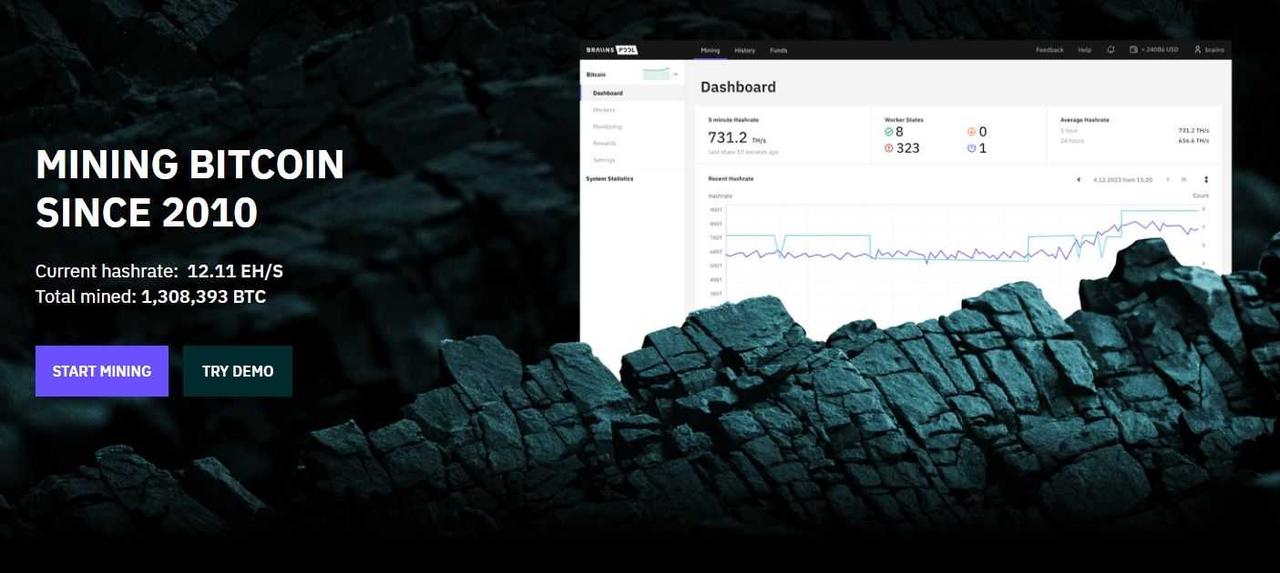

Braiins Pool has mined over 1.3 million BTC. Image from Braiins Pool

Braiins Pool (formerly Slush Pool) is recognized as the first Bitcoin mining pool, launched in 2010, and as of the time of writing, it has mined over 1.3 million BTC.

Key Features

Payment model: Uses the Pay Per Last N Shares (PPLNS) model to reward miners based on recent contributions.

Fees: Charges a 2% fee, with a minimum withdrawal threshold of 0.001 BTC.

Transparency: Provides detailed statistics and real-time monitoring tools.

Pros

Innovative payment structure: As a pioneer of the PPLNS model, Braiins Pool has developed various mechanisms to minimize pool hopping risks, ensuring miners receive more stable earnings.

Detailed analytics: Comprehensive statistics help miners effectively track performance.

Cons

Variable payouts: PPLNS can lead to earnings fluctuations.

Higher fees compared to some pools: The 2% fee may deter smaller miners.

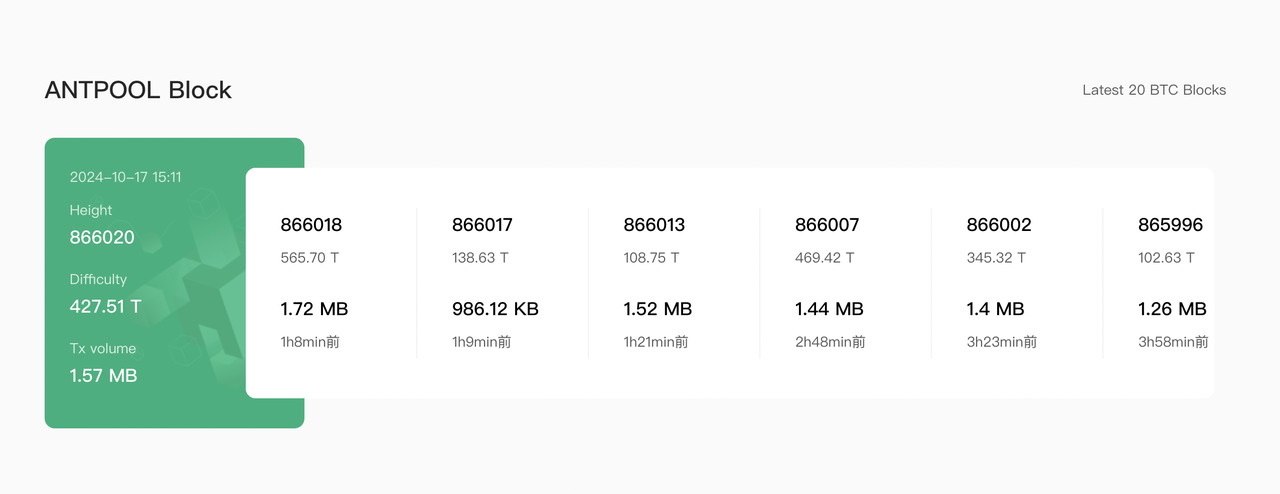

4. Antpool

The Solo Option allows miners to independently earn the entire block reward. Image from Antpool

Antpool is operated by Bitmain Technologies and was launched in 2014, making it one of the largest pools in the world.

Key Features

Payment model: Offers flexible payment options, including FPPS (Full Pay Per Share) and PPLNS (Pay Per Last N Shares).

Fees: Variable fees range from 0% for PPLNS to 4% for FPPS.

Solo mining option: Provides miners with the option to attempt to earn the entire block reward independently.

Pros

Flexible payment structure: Miners can choose from various payment models.

Multi-currency support: Supports various cryptocurrencies, such as Litecoin and Ethereum.

Cons

Poor user experience: Some users may find the platform's interface not intuitive enough.

Different fees impact profitability: Higher fees based on the chosen payment model may affect earnings.

5. ViaBTC

ViaBTC supports multiple cryptocurrencies and offers cloud mining services. Image from ViaBTC

ViaBTC is a well-known cryptocurrency mining pool established in 2016, controlling about 11% of the Bitcoin network hash rate. It supports various cryptocurrencies and provides cloud mining services.

Key Features

Payment model: Offers FPPS and PPLNS payment options, with FPPS ensuring consistent payments, including transaction fees.

Multi-currency support: ViaBTC supports mining of various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, allowing miners to diversify their operations.

Cloud mining services: Allows users to rent hash power without maintaining physical equipment.

Pros

Diverse mining options: Broad support for various cryptocurrencies.

User-friendly interface: Intuitive platform with real-time statistics and performance tracking tools.

Cons

Cloud mining risks: There are risks associated with scams and market volatility.

Higher fees for certain models: Fees can vary significantly based on the payment method, with FPPS fees reaching up to 4%, potentially impacting overall profitability.

6. Clover Pool (formerly BTC.com)

Clover Pool charges a fee of only 1%, making it competitive among major pools. Image from Clover Pool

Clover Pool, formerly BTC.com, is a major player in the Bitcoin mining pool space, launched by Bitmain in 2016, known for its user-friendly platform and advanced analytical capabilities.

Key Features

Payment model: Primarily uses FPPS to achieve stable income, including block rewards and transaction fees.

Fees: Charges a 1% fee.

Multi-currency support: Clover Pool supports mining of various cryptocurrencies, including Bitcoin, Bitcoin Cash, Litecoin, and Ethereum.

Analytical tools: Provides comprehensive analytics, enabling users to effectively track performance metrics.

Pros

Low fees: Clover Pool's fee of only 1% is competitive among major pools.

Real-time data tracking: Advanced analytics help optimize operations and closely monitor earnings.

Diverse cryptocurrency support: The ability to mine multiple cryptocurrencies enhances miners' flexibility in maximizing profitability.

Cons

- Potential minimum withdrawal threshold: Smaller miners may face challenges in quickly accessing their earnings.

04 Key Factors to Consider When Choosing a Mining Pool

Choosing the right Bitcoin mining pool can significantly impact a miner's success rate and profitability. With so many options available, several key factors must be considered before making a decision, including pool fees, pool hash rate and size, as well as security and reputation.

Pool Fees

For mining pools, fees are a significant concern. Different pools charge different types of fees, and if miners are not careful, these fees can erode their profits.

Commission fees: Most mining pools take a certain percentage from miners' earnings as a commission for their services. This typically ranges from 1% to 3%, but specific pools can vary significantly.

Maintenance fees: While some pools may charge maintenance fees to cover operational costs, many pools primarily deduct fees from earnings rather than impose a fixed maintenance fee.

Understanding how these fees impact miners' overall profitability is crucial. For example, if a pool charges a 2% commission but offers higher returns due to its hash rate, it may still be worth joining.

Typical Fee Structure

Popular mining pools often have transparent fee structures. For example:

F2Pool: FPPS fee of 2.5%

Braiins Pool: PPLNS fee of 2%

Antpool: FPPS of 2.5%, PPLNS of 1.5%

Hash Rate and Pool Size

The hash rate of a pool is another key factor to consider. A higher hash rate means the pool can mine blocks faster, leading to more frequent payouts. Joining a pool with a high hash rate increases miners' chances of receiving rewards consistently. Simply put, the larger the pool's hash power, the greater the chance of finding blocks.

Large Pools vs. Small Pools

Large pools: Due to their strong hash power, they typically offer more stable and consistent payouts. However, the downside is that rewards may be divided among many miners, resulting in lower individual earnings.

Small pools: With fewer miners sharing the rewards, these pools often provide higher payouts per block. However, due to their overall lower hash rate, their earnings may be less stable.

Current Hash Rate Data

Here is a breakdown of some top mining pools and their hash rates for a more intuitive presentation:

Foundry: Approximately 30% of the Bitcoin network's total mining power.

Antpool: Accounts for about 20% of the network's hash rate.

ViaBTC: Contributes around 10% to the overall hash rate.

F2Pool: This pool's share is about 8%.

Security and Reputation

Security is crucial when choosing a mining pool.

Factors affecting pool security: Look for pools that can effectively defend against DDoS attacks and maintain server stability. Stable servers mean less downtime and more mining opportunities.

Assessing the pool's reputation: Check user reviews, community feedback, and any history of security breaches. A reputable pool will have transparent operations and good customer support.

Security Breaches

Unfortunately, some pools have faced serious security issues in the past:

In 2014, Ghash.io temporarily controlled over 51% of the Bitcoin hash rate, raising concerns about centralization.

In 2020, Poolin suffered a DDoS attack, causing temporary service disruption.

Recently, F2Pool received attention for filtering transactions from OFAC-approved addresses, raising concerns about internal censorship in mining operations. Link

05 Risks of Bitcoin Mining Pools

While Bitcoin mining pools offer numerous advantages, they also come with inherent risks that miners should be aware of. Understanding these risks can help miners make informed decisions about where to invest their time and resources.

Centralization Risk

One of the biggest issues with mining pools is centralization. Large pools can control the entire network, leading to a concentration of power that contradicts the decentralized spirit of Bitcoin. When a few pools control a significant portion of the hash rate, they may initiate a 51% attack, allowing them to manipulate transactions, censor blocks, or double-spend. This centralization not only threatens the integrity of the Bitcoin network but also undermines trust among users.

To mitigate this risk, diversifying mining efforts across multiple pools can help maintain decentralization. By spreading hash power across different pools, miners can reduce the likelihood of any single entity gaining excessive control over the network.

Pool Operator Risk

Another key risk involves the pool operator itself. If a pool operator is poorly managed or dishonest, it can lead to significant financial losses for miners. Issues such as low transparency, lack of communication, or outright fraud can jeopardize miners' earnings.

Therefore, it is crucial to find a reliable pool operator, looking for those with a good track record and positive community feedback. Research their history and check for any past incidents of fraud or mismanagement. For example, some pools have been scrutinized for failing to distribute rewards fairly or engaging in questionable practices. Some cases have already been shared above.

While pools provide opportunities for stable profits, they also come with risks related to centralization and operator integrity. By staying informed and vigilant, miners can effectively navigate these challenges.

Conclusion

Bitcoin mining pools have become an indispensable part of the mining landscape, especially as mining difficulty continues to rise. While solo mining may appeal to those seeking complete control over their operations, for most miners, the risks and inconsistencies often outweigh the potential rewards. On the other hand, pools offer a more convenient and reliable way to participate in Bitcoin mining, particularly for those unable to utilize large hardware or significant financial resources.

However, choosing the right pool requires careful consideration. Factors such as fees, payment models, hash rates, and security measures play a crucial role in influencing miners' overall profitability. It is essential to weigh the pros and cons of different pools based on individual needs and resources, as larger pools may offer stability while smaller pools may provide higher returns at the cost of greater variability. The key lies in how miners align their goals with pools that offer the best security, rewards, and operational transparency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。