According to Foresight News statistics, from October 12 to October 18, 2024, there were a total of 18 investment and financing events in the cryptocurrency market, including 5 in tools and infrastructure, 4 in the DeFi sector, 4 in asset management, 1 in the blockchain gaming and NFT sector, and 4 in the Web3 sector. The total disclosed investment amount is approximately $900 million.

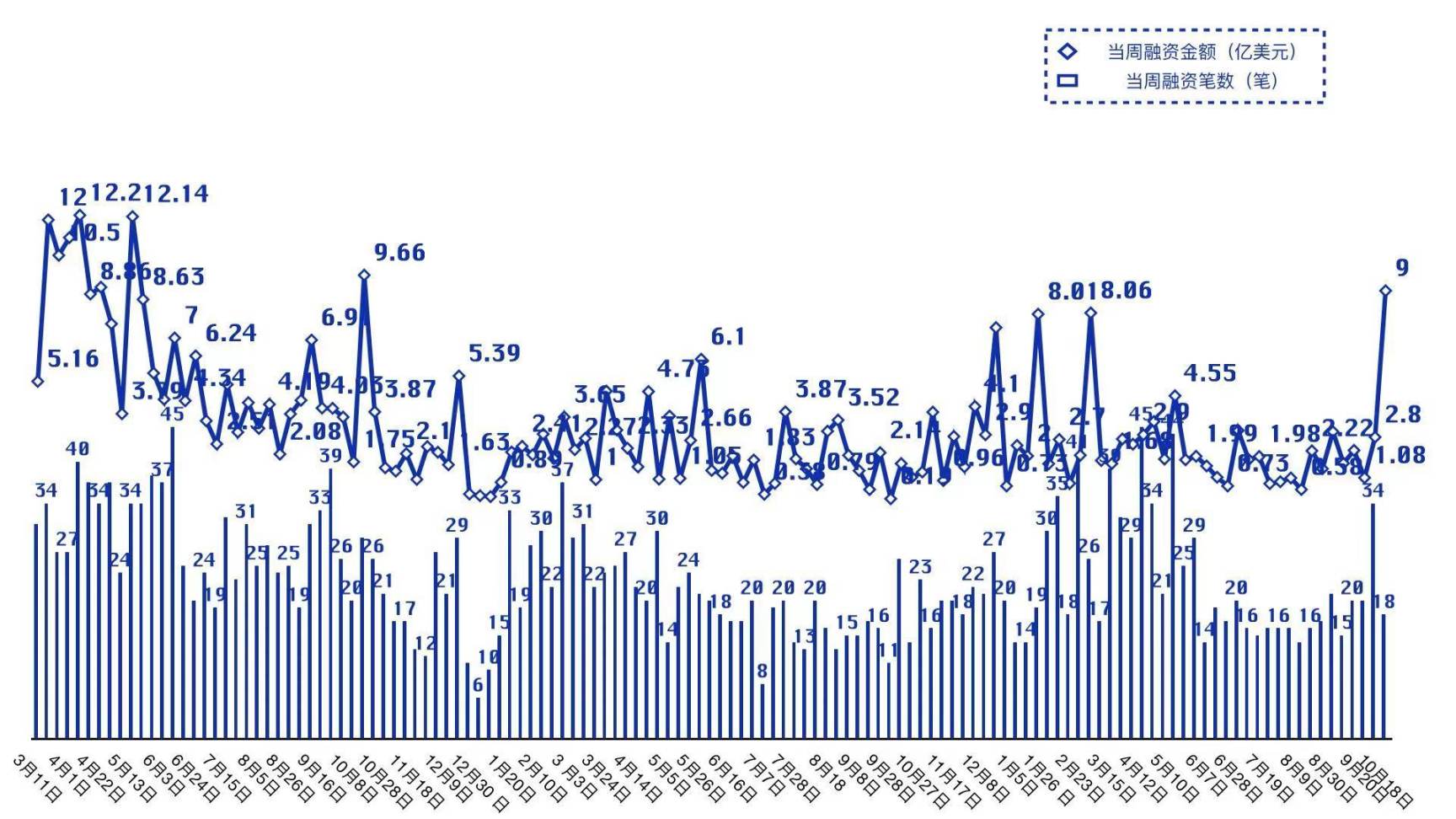

Weekly summary of disclosed financing amounts and number of financing events:

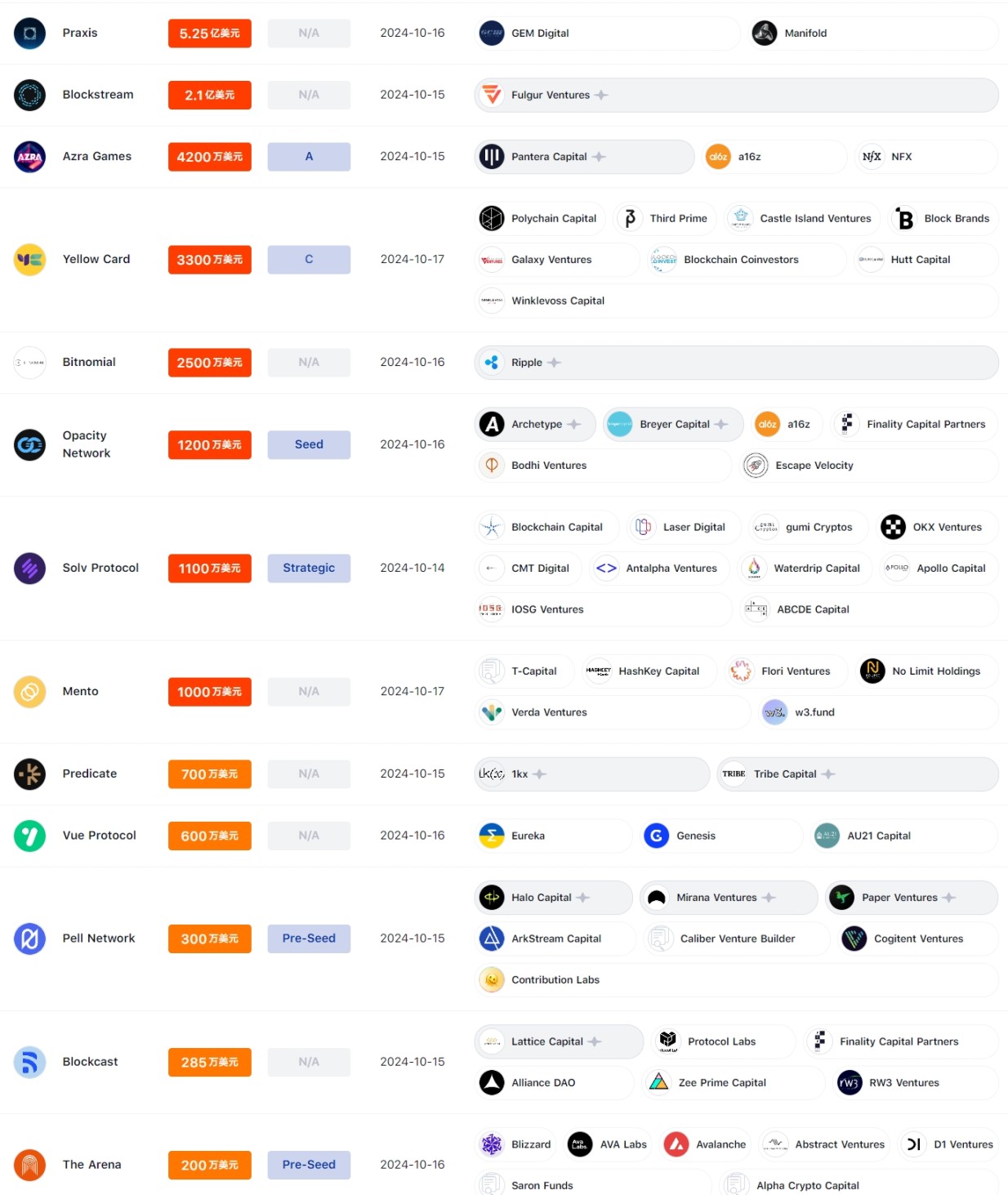

This week's investment and financing projects sorted by financing amount are shown in the following chart:

This week, there were 2 financing events exceeding $100 million: Blockstream completed a $210 million financing round, led by Fulgur Ventures; the network nation project Praxis completed a $525 million financing round. There were 6 financing events in the tens of millions, including zkPass completing a $12.5 million Series A financing round, with a valuation reaching $100 million; Mento, an EVM-compatible stablecoin platform on Celo, completed a $10 million financing round; the African cryptocurrency trading platform Yellow Card completed a $33 million Series C financing round, led by Blockchain Capital; the cryptocurrency derivatives exchange Bitnomial completed a $25 million financing round, led by Ripple Labs; blockchain game developer Azra Games secured $42 million in Series A financing, led by Pantera Capital; and Solv Protocol completed a $11 million strategic financing round, with a total financing amount reaching $25 million.

In the segmented investment and financing tracks, both the DeFi and asset management sectors were relatively active this week, while the NFT and blockchain gaming sectors were somewhat sluggish.

On the institutional side, active institutions this week included Fulgur Ventures, Pantera Capital, and GEM Digital, primarily focusing on the DeFi and asset management sectors.

Tools and Infrastructure

zkPass completed $12.5 million Series A financing

zkPass is a privacy-preserving data verification protocol.

Bitcoin protocol layer Surge completed $1.8 million Pre-Seed financing

Surge claims to plan to launch its testnet soon.

Hyve completed $1.85 million seed financing

Hyve is an on-chain DA project.

Blockstream completed $210 million financing

Blockstream is a Bitcoin infrastructure development company.

Pell Network completed $3 million Pre-Seed financing

Pell Network is a fully decentralized verification service (DVS) network.

DeFi

Drop Protocol completed $4 million seed financing

Drop Protocol is a liquid staking protocol.

USDh issuer Hermetica completed $1.7 million financing

Hermetica developed the yield-bearing synthetic dollar USDh, issued on the Bitcoin network. The company intends to use this funding to support the USDh ecosystem, such as through custodial partnerships and enhancing liquidity. Hermetica plans to expand to other Bitcoin L2s, such as Arch Network and Bitlayer, in the coming months.

Solv Protocol completed $11 million strategic financing

Solv Protocol has established partnerships with several protocols, including Babylon Chain, Pendle, Ethena, and CoreDAO, to explore new use cases and yield opportunities for Bitcoin.

On-chain venture capital platform Fission Labs completed $1.6 million Pre-Seed financing

Fission Labs brings venture capital to on-chain DeFi applications, and its platform has launched a testnet on Ethereum to support both cryptocurrency-native users and traditional financial participants to invest in and trade private equity-backed tokens.

Asset Management

Predicate completed $7 million financing

Predicate is a blockchain financial services application.

Yellow Card completed $33 million Series C financing

Yellow Card is an African cryptocurrency trading platform, and it is developing innovative new products for the African continent, strengthening its team and systems.

EVM-compatible stablecoin platform Mento on Celo completed $10 million financing

Mento also released a stablecoin roadmap outlining the addition of local currency stablecoins PUSO (Philippines), cCOP (Colombia), and cGHS (Ghana) to its decentralized stablecoin list.

Cryptocurrency derivatives exchange Bitnomial completed $25 million financing

Ripple CEO Brad Garlinghouse will join the Bitnomial board. Meanwhile, Bitnomial announced the upcoming launch of its new U.S. perpetual futures trading platform, Botanical (currently in closed testing).

NFT and Blockchain Gaming

Azra Games secured $42 million Series A financing

Azra Games is a blockchain game developer.

Web3

Social protocol The Arena completed $2 million Pre-Seed financing

Arena is a SocialFi application aimed at redefining creator interaction relationships and content incentive models. Additionally, The Arena plans to expand its login options beyond X, including Instagram, TikTok, and Reddit.

Web3 social Layer2 solution Vue Protocol completed $6 million financing

Vue Protocol is a decentralized platform that seamlessly maps multi-chain relationships, aiming to connect Web3 native developers and empower users with ownership of their data, allowing community participation and collaboration.

Network nation project Praxis completed $525 million financing

Praxis claims to be the world's first network nation, an internet-native alliance aimed at accelerating technological progress and revitalizing Western civilization. Over 14,000 Praxians reside in 82 countries/regions.

Open content delivery network Blockcast completed $2.85 million financing

Blockcast is an open content delivery network built on a unique caching architecture.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。