The tokenized fund BUIDL represents traditional institutions leveraging public blockchain technology to enhance operational and capital efficiency, signaling a broader adoption of blockchain technology.

Written by: DigiFT

Abstract

- Introduction: On March 20, 2024, renowned asset management company BlackRock issued the tokenized fund BUIDL (BlackRock USD Institutional Digital Liquidity Fund) in collaboration with the U.S. tokenization platform Securitize, further expanding its influence in the Web3 space. This move follows the approval of its Bitcoin spot ETF, marking a significant advancement in mainstream cryptocurrency investment. The tokenized fund BUIDL represents traditional institutions utilizing public blockchain technology to enhance operational and capital efficiency, indicating a wider adoption of blockchain technology.

- Problems addressed by the tokenized fund: Traditional publicly offered funds, such as money market funds, involve operations across multiple institutions, leading to inefficiencies and high costs due to independent databases. As tokens issued on a public blockchain, tokenized funds eliminate the need for centralized registration, reducing costs by providing real-time, traceable transaction records. They enable real-time atomic settlement and secondary market trading, improving capital utilization and offering higher returns. Tokenized funds also support various applications such as staking and lending through smart contracts.

- Large institutions entering public chains: The DeFi space showcases the advantages of blockchain, but transferring traditional financial capital to Web3 faces significant resistance. Fund tokens with KYC and AML compliant whitelist controls demonstrate mainstream institutions' efforts to explore DeFi. Examples include Franklin Templeton's FOBXX and WisdomTree's WTSYX, which initially used blockchain for auxiliary bookkeeping. BlackRock's BUIDL marks a breakthrough by using public blockchain as the primary bookkeeping tool in collaboration with Securitize, acting as a regulated transfer agent.

- Design and performance of BUIDL: BUIDL is issued as an ERC20 token on Ethereum, supporting real-time on-chain transfers within a whitelist. It interacts with smart contracts and offers real-time USDC redemptions through Circle. As of July 9, 2024, BUIDL's assets under management reached $502.8 million, held by 17 addresses, including significant participation from institutions like Ondo Finance. BUIDL facilitates the integration of DeFi, channeling stable real-world returns into the DeFi space.

- Challenges and future outlook: Despite BUIDL's success, it faces significant regulatory and compliance challenges. The tokenization of assets encounters conservative regulations globally, limiting issuance to qualified investors. However, the initiatives by BlackRock and Franklin Templeton are drawing attention to the efficiency of on-chain interactions and driving the development of new laws and standards.

On March 20, 2024, asset management giant BlackRock further positioned itself in Web3 through its collaboration with the U.S.-based tokenization platform Securitize, issuing the tokenized fund BUIDL (BlackRock USD Institutional Digital Liquidity Fund) since the issuance of its Bitcoin spot ETF. If the approval of the Bitcoin spot ETF can incorporate cryptocurrency as a new asset class into the investment realm of compliant funds, it is an acknowledgment of cryptocurrency as an asset class. The greater significance of the tokenized fund lies in traditional institutions attempting to enhance operational and capital efficiency using public blockchain as the underlying new technology, which is a recognition and adoption of blockchain technology.

What problems can tokenized funds solve compared to traditional funds?

The funds that investors commonly encounter are generally public funds, which are subject to strict regulation due to their low thresholds, wide coverage, and large capital volumes. Taking money market funds as an example, these funds involve collaboration among multiple institutions in their operational processes. Each institution is responsible for a part of the fund's operations, improving efficiency through operational specialization and avoiding excessive concentration of power in a single entity, which could lead to misconduct. The entire process roughly includes: fund distribution channels (banks, brokers, financial advisors), fund administration, transfer agency, fund auditing, fund custody, exchanges, etc.

However, inconsistencies in databases among parties in the process lead to significant friction and costs. Generally, each subscription and redemption of a fund involves various institutions along this chain. Orders are communicated through manual or automated means, and funds are settled through a settlement system, often taking several days to complete a fund subscription.

Through fund tokenization, fund shares are issued and traded in the form of tokens on a public chain, with shares directly entering investors' wallets in token form. The shares and net asset values can be publicly viewed on-chain, and all transaction records are accessible and queryable on the blockchain, recorded in real-time and automatically, eliminating the need for centralized registration and avoiding the costs of multiple parties verifying information back and forth.

After tokenization, distribution platforms can achieve real-time atomic settlement between fund share tokens and payment tokens (such as various stablecoins) through smart contracts, reducing the waiting time for investors. If fund tokens achieve a secondary market on-chain, investors can enter and exit the secondary market in real-time, reducing the redundant capital reserves that funds need to maintain for redemptions, thereby improving the efficiency of fund capital utilization and generating higher returns. Investors can enjoy an efficient trading experience through real-time settlement in the secondary market, avoiding the waiting periods for subscriptions and redemptions.

Additionally, tokenized funds can integrate more application scenarios, such as supporting staking, lending, and other business scenarios through smart contracts, thereby meeting a richer set of user needs.

Institutional attempts to enter public chains — from auxiliary tools to primary ledgers

The DeFi scenario fully showcases the advantages of blockchain, but transferring vast traditional financial capital from a complete Web2 system to a new system based on Web3 technology faces significant resistance and requires gradual advancement and overcoming challenges, as well as exploring new practical solutions.

Due to compliance requirements, especially KYC and AML, unlike the cryptocurrencies we commonly see, fund tokens typically implement a whitelist mechanism, where each whitelisted address corresponds to a user who has passed KYC through the fund platform, and transactions from non-whitelisted addresses cannot be executed. Issues such as transfer risks, fund loss risks, and transaction monitoring arising from the ability to freely transfer between addresses will be difficult limitations to overcome before risk control solutions are in place.

However, we note that mainstream asset management institutions are also exploring the DeFi space, attempting to transform their products by integrating the characteristics of blockchain technology, and we can see the trajectory of evolution in their product designs.

In 2021, U.S. asset management giant Franklin Templeton issued the tokenized fund Franklin Onchain U.S. Government Money Fund — FOBXX. In the initial design, the tokens were actually maintained by a transfer agent in a private database system, with secondary records on Stella and Polygon. If conflicts arose between centralized bookkeeping and public chain records, centralized bookkeeping would take precedence. Investors traded fund share tokens through Franklin's app, with each user assigned an on-chain address, but investors could not transfer the tokens in their wallets. In 2022, WisdomTree also issued a similarly designed tokenized fund WTSYX investing in short-term U.S. Treasury bonds on the Stella blockchain.

The designs of FOBXX and WTSYX essentially only used blockchain as an auxiliary bookkeeping tool, making share records public without gaining actual benefits.

In March 2024, BlackRock's issuance of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) through the tokenization platform Securitize marked a significant breakthrough, partly because Securitize, as a regulatory-approved transfer agent, can use the public chain as the primary bookkeeping tool to record ownership and change records of issued assets.

In-depth design of BUIDL — obstacles and improvements

According to the BUIDL issuance documents, the basic information of the issuance is as follows:

- Issuer: BlackRock USD Institutional Digital Liquidity Fund Ltd. (BlackRock's BVI entity, established in 2023)

- Registration exemption: SEC Reg D Rule 506(c), Section 3(c)(7) (Reg D is an exemption clause for securities issuance that allows fundraising from qualified investors, with no limit on the number of investors or fundraising scale)

- Type of registered securities: pooled investment fund

- Investment threshold: Qualified Purchaser.

- Minimum investment amount: $5 million for individual investors; $25 million for institutional investors

- Issuance scale and investor scale: no upper limit

At the time of issuance, the only distribution channel was Securitize Markets, LLC, a SEC-registered securities broker. Additionally, Securitize's related entity, Securitize, LLC, is a SEC-registered transfer agent capable of registering and recording ownership of securities on the blockchain.

It is noteworthy that the fund's issuance used a newly registered BVI entity by BlackRock, rather than its usual fund issuance entity, which may be a risk consideration to minimize the impact on compliant entities. Furthermore, the four related personnel mentioned in the SEC registration documents are Ian Pilgrim in Bermuda, Jennifer Collins in the Cayman Islands, W. William Woods in Canada, and Noëlle L’Heureux in California, USA. Only Noëlle L’Heureux is a Managing Director at BlackRock, having worked there for 32 years. The other three are likely from third-party institutions.

BUIDL product design

- Trading currencies: USD and USDC

- Subscription and redemption: Daily subscription and redemption

- Strategy: Primarily investing in short-term government bonds

- Share net value: 1 BUIDL = 1 USD

- Token standard: Specially designed ERC20, with a whitelist mechanism; tokens can only circulate among whitelisted addresses, and transfers and trades to addresses outside the whitelist will fail

- Earnings calculation: Earnings are recorded based on the shares held at 3:00 PM Eastern Time on each business day, and earnings are distributed on the first business day of each month by issuing additional BUIDL tokens and airdropping them.

- Redemption rules: Daily redemption, with redemptions based solely on the number of BUIDL tokens held at a rate of 1 BUIDL = 1 USD; direct redemptions through Securitize require sending tokens to a designated address, after which BUIDL will be destroyed at 3:00 PM on each business day, completing the off-chain USD redemption operation, generally redeeming on a T+0 basis. Accumulated earnings between the last distribution and the current redemption require initiating a "full redemption" operation, which will be completed 2-3 business days after the interest distribution (on the first business day of each month).

BUIDL is an ERC20 token issued on the Ethereum blockchain, allowing free circulation within the whitelist and the ability to enter smart contracts within the whitelist, while interactions with addresses outside the whitelist will fail. For DeFi users, this simple step represents a significant breakthrough for traditional finance, indicating that large institutions are beginning to recognize public chains as tools for recording the transfer and change of asset ownership, with a series of rights based on ownership also recorded on the public chain ledger, enjoying its characteristics of openness, transparency, efficiency, and traceability.

By enabling open transfer functionality, BUIDL enjoys the advantages of a blockchain settlement system to some extent. One use case is provided by Circle, which, after the release of BUIDL, launched a contract allowing real-time BUIDL exchanges for USDC and prepared a redemption reserve of 100 million USDC to enable BUIDL holders to redeem in real-time at a rate of 1 BUIDL = 1 USDC.

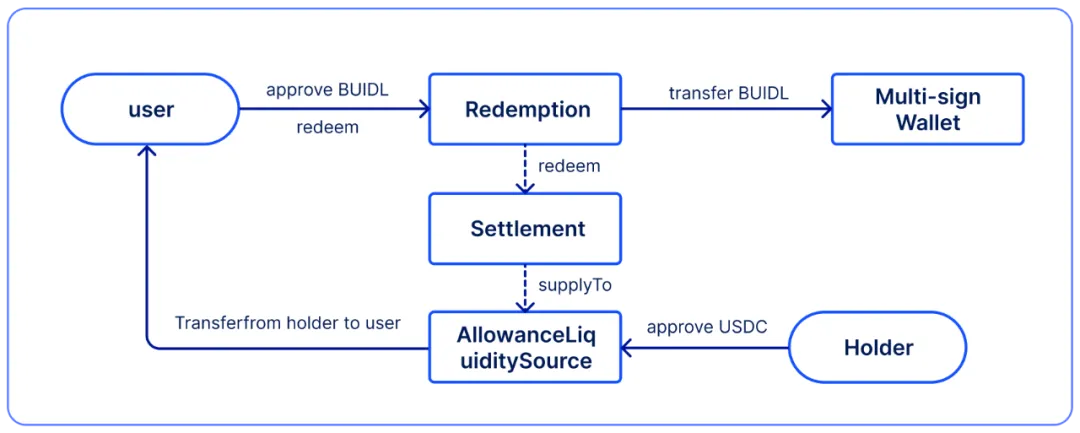

This redemption option is provided by Circle and is essentially an OTC transaction: Circle provides the exchange contract (Redemption address in the image below), and users transfer funds into the exchange contract, triggering the contract to transfer USDC from another EOA account (holder address in the image below) to the user's address. All these steps are on-chain transactions with atomic settlement.

Figure 1: Flowchart of the USDC redemption contract provided by Circle for BUIDL

At the establishment of this EOA account, there was a balance of 100 million USDC. Here, since the daily interest of BUIDL tokens is realized through centralized bookkeeping, if USDC is exchanged through Circle's contract, from the issuer BlackRock's perspective, it is a transfer. Therefore, the interest recorded daily between the last distribution and the transfer will still be distributed at the next distribution time. After BUIDL is exchanged, Circle will hold BUIDL, and subsequent operations will be decided by Circle. From the current on-chain information, Circle will periodically redeem BUIDL for USD through Securitize, then mint USDC and replenish the fund pool.

What is the status of BUIDL three months after issuance?

As of May 15, 2024, BUIDL's AUM (Assets Under Management) exceeded Franklin Templeton's tokenized government bond fund FOBXX, becoming the largest tokenized fund project. As of October 17, 2024, the total AUM reached 557 million USD. However, compared to the trillion-dollar scale of the traditional market, the overall scale of tokenized government bond products is only 2.35 billion USD, indicating significant growth potential. (Data source: RWA.XYZ, October 17, 2024)

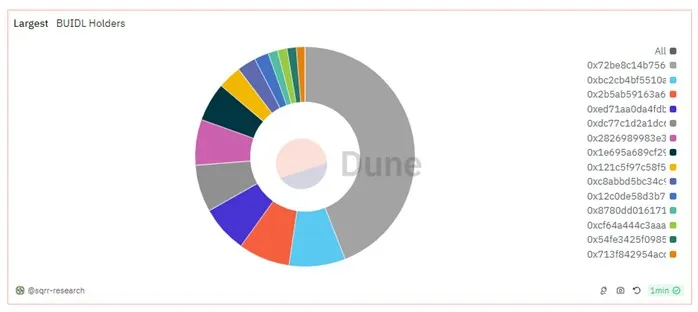

Currently, BUIDL is held by a total of 27 addresses, with the following distribution:

Figure 2: Distribution of BlackRock BUIDL token holdings (data as of October 17, 2024)

Securitize allows each client to bind up to 10 on-chain whitelisted addresses. Among the 27 addresses mentioned above, 2 belong to Ondo Finance, making it the largest holder with 216 million BUIDL, valued at 216 million USD. The two addresses are 0x72, holding approximately 164 million BUIDL, and 0x28, holding 51 million BUIDL, serving as the underlying assets for its tokenized government bond fund product OUSG (AUM of 216 million USD). Previously, the underlying assets were BlackRock iShares' short-term government bond ETF, which was fully converted to BUIDL after its issuance. Currently, the redemption operations for OUSG are realized through Circle's redemption contract for real-time USDC redemption.

Additionally, due to BUIDL's collaboration with several crypto custody institutions, multiple on-chain addresses appear as EOA addresses with no historical transaction records, or they are accounts of traditional institutions invited by BlackRock and Securitize to attempt the purchase and custody of tokenized funds.

The USDC redemption pool provided by Circle currently has a balance of 80.03 million USDC, with Ondo Finance being the main redemption party. Circle's address (0xcf) also holds approximately 19.96 million BUIDL.

Figure 3: Amount of USDC held by the BUIDL USDC redemption contract, data as of October 17, 2024.

The path of financial institutions towards DeFi

Due to the investment threshold set by BUIDL, ordinary users find it difficult to access BUIDL directly. However, BlackRock's issuance of a stable, secure money market fund on-chain allows other institutions to introduce real-world stable returns into the DeFi world by using BUIDL as an underlying material.

A typical example here is Ondo Finance. As mentioned earlier, Ondo is the largest holder of BUIDL. Through BUIDL and the redemption contract provided by Circle, Ondo Finance has achieved rapid subscription and redemption of its money market fund product OUSG via USDC, while lowering the user entry threshold from 5 million USD to 5,000 USD. At the same time, Ondo can collaborate with other DeFi protocols to further transmit returns into the DeFi world, such as through DeFi lending platforms like Flux Finance, allowing anonymous DeFi users to also obtain real-world returns. This layered structure can direct the real-world returns provided by large traditional institutions into the DeFi world.

Are institutions fully entering the market? Facing numerous obstacles

Products like BUIDL improve the liquidity management efficiency of money market funds through a combination of on-chain and off-chain designs, providing on-chain investors with channels to obtain real-world returns. BlackRock, through fund tokenization, in collaboration with Securitize, Circle, Ondo Finance, and other related Web3 institutions, enables Web3 institutions to obtain real-world returns in the form of tokens on public chains, avoiding complex deposit and withdrawal processes, and increasing application scenarios and improving capital utilization through smart contracts.

In fact, what BUIDL is doing here is allowing tokens to achieve on-chain transfers directly without the operation of centralized institutions. The simple transfer functionality hides very high compliance and legal costs. It is challenging to achieve transfers between different accounts on traditional financial platforms, and even transfers between accounts with the same name are very difficult; generally, financial institutions only allow transactions, subscriptions, and redemptions on the platform. After BlackRock implemented the transfer functionality, within a month, Franklin Templeton's FOBXX also achieved this functionality, indicating institutional recognition of public chains as ledgers, representing a breakthrough at the product level. (In contrast, FOBXX holders do not have control over the address private keys, so they can only perform transfer operations within the platform and cannot truly operate on-chain).

From the perspective of asset tokenization regulations in various countries and regions, the current regulatory stance is conservative: the U.S. has no clear legislation, so asset issuers only rely on various exemption clauses. BlackRock also avoids impacting its compliant entities by issuing through a BVI SPV. In other regions, such as Singapore, asset tokens have whitelist restrictions and can only be offered to qualified investors. These various restrictions and uncertainties hinder users and institutions from further entering the Web3 space.

Optimistically, the exploration of tokenization by institutions like BlackRock and Franklin Templeton has greatly attracted attention in the financial sector, showcasing the high efficiency of on-chain interactions through real cases, while also promoting regulation to advance the development of new laws and standards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。