Original | Odaily Planet Daily (@OdailyChina_)

_

DeFi and stablecoins have always been regarded as the two pillars of long-term growth for the BNB Chain ecosystem, with DeFi used to build the on-chain economy, while stablecoins aim for mass adoption and to attract the next billion Web3 users.

This article will analyze the strategic measures behind BNB Chain's recent achievements in stablecoin gas-free transfers and TVL incentive programs, as well as the strong growth potential inherent in BNB Chain's DeFi ecosystem.

Achievements

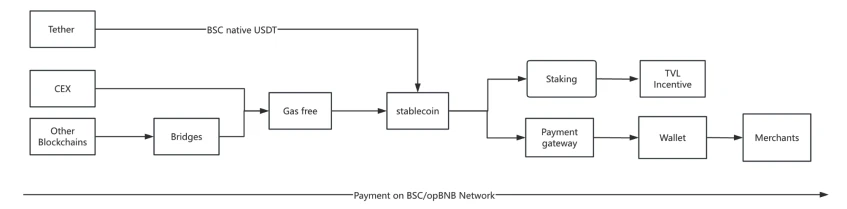

Recently, BNB Chain has conducted gas-free transfer activities and TVL incentive programs in the stablecoin and DeFi fields. During the event, users could transfer stablecoins from CEX or other chains to BNB Chain or opBNB for free. Additionally, to enhance the retention of stablecoins on its network, a TVL incentive program was held to accelerate the growth of the DeFi ecosystem on BNB Chain.

The activities have also achieved good results:

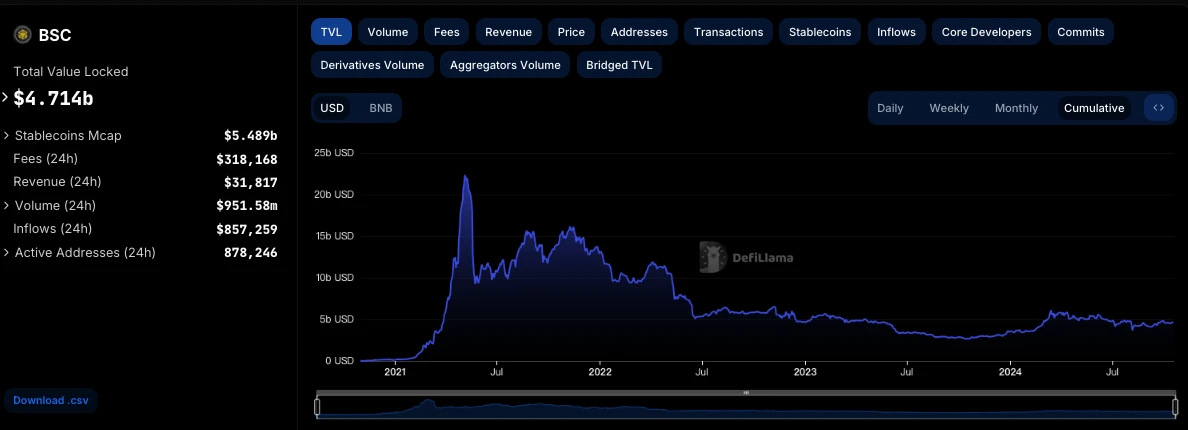

According to DefiLlama data, as of October 18, the market capitalization of BNB Chain stablecoins was $5.489 billion, an increase of $491 million compared to the market capitalization before the gas-free transfer activity began (which was $4.998 billion on September 19).

At the same time, since the start of the TVL incentive program (from September 12 to now), BNB Chain's TVL has grown from $4.408 billion to $4.714 billion, with a cumulative increase of over $300 million, and it is still on an upward trend.

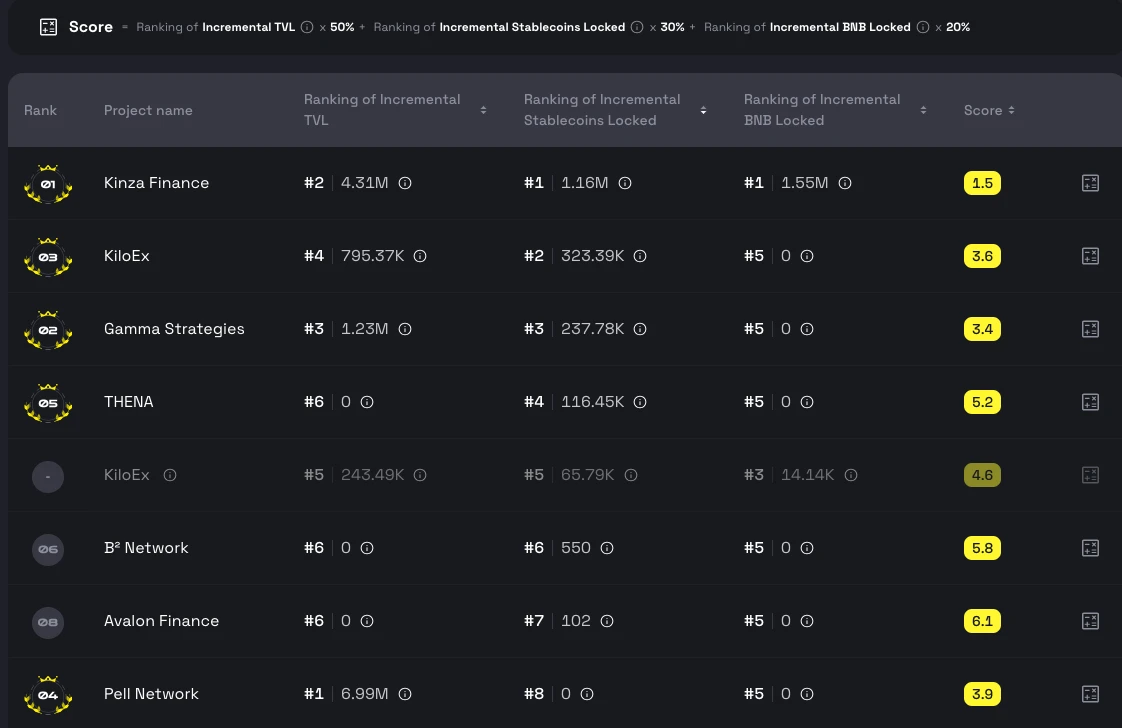

The TVL incentive program has also attracted a significant amount of incremental funds to DeFi applications within the ecosystem. According to the official updated leaderboard, as of October 11, the TVL challenge program attracted over $1.904 million in incremental stablecoins to the ecosystem.

Strategic Measures of BNB Chain in the DeFi Ecosystem

Any activity is temporary and full of changes; understanding the strategic intentions behind multiple activities is what truly matters. So, what strategic intentions can we see behind these activities of BNB Chain? The answer is a strong emphasis on building DeFi.

To understand how BNB Chain is building its DeFi ecosystem, we must first look at the current industry environment.

According to DefiLlama data, BNB Chain's ecosystem ranks fourth in TVL across the entire network, while the top three are Ethereum, Tron, and Solana; however, in terms of stablecoin market capitalization, BNB Chain ranks third, with Ethereum and Tron in the top two positions.

From the above data, it can be seen that while BNB Chain ranks among the top in the industry, there are still some gaps compared to Ethereum and Tron.

Ethereum, as the origin of DeFi, firmly holds the first position in TVL, which is not surprising. But why has Tron been able to surpass Solana and BNB Chain to take the second position? In fact, this is related to its excellent performance in stablecoin transfers in the early stages.

In a sense, stablecoins are also one of the "killer applications" of blockchain. Tron has gradually grown into a payment public chain due to its lower stablecoin transfer fees (at one point, exchange withdrawal fees were below 1 USDT) and faster block times, with stablecoin transfer transactions accounting for over 90% of on-chain activities, while also accumulating a large user base. Based on the unique advantages of stablecoins, the subsequent DeFi ecosystem of Tron has also shown a rich and diverse appearance.

BNB Chain's strategy for building its DeFi ecosystem is somewhat similar; it first incentivizes users to transfer stablecoins from off-chain exchanges and other chains to the BNB Chain ecosystem, aiming to attract users to move stablecoins from exchanges and other chains to BNB Chain, thereby providing a financial foundation for the development of the on-chain DeFi ecosystem.

Once users transfer stablecoins to BNB Chain, they are then incentivized to develop DeFi applications within the ecosystem through rewards. High-quality and powerful applications, along with generous rewards, can not only attract the retention of new funds but are also key to long-term user attraction on-chain.

DeFi is More Than Just On-Chain Retention

The competition among major public chains has long gone beyond transaction speed and throughput capacity, focusing instead on ecosystem building and differentiation. In the competition for users, it is the differentiated and rich unique ecosystems that truly serve as the "moat" for public chains.

Currently, mainstream public chains each have their strengths. Due to its long development history and the largest number of users and developers, Ethereum is the most comprehensive and rich smart contract chain; Tron has risen as a "payment public chain" due to low fees for stablecoin transfers; the unique and prosperous Meme ecosystem and DEPIN ecosystem make Solana stand out; the TON chain is deeply integrated with Telegram, continuously growing through mini-program applications…

For BNB Chain, DeFi has always been regarded as the cornerstone of ecosystem development. Building DeFi is not just about on-chain retention; although there are similarities in activity strategies with Tron, BNB Chain's ambition is not to develop into another "payment public chain," but to establish a strong ecosystem based on DeFi. This includes not only attracting stablecoins through interactions with CeFi and other chains but also integrating on-chain yields (staking) and stablecoin off-chain payments.

- On-Chain Excess Returns

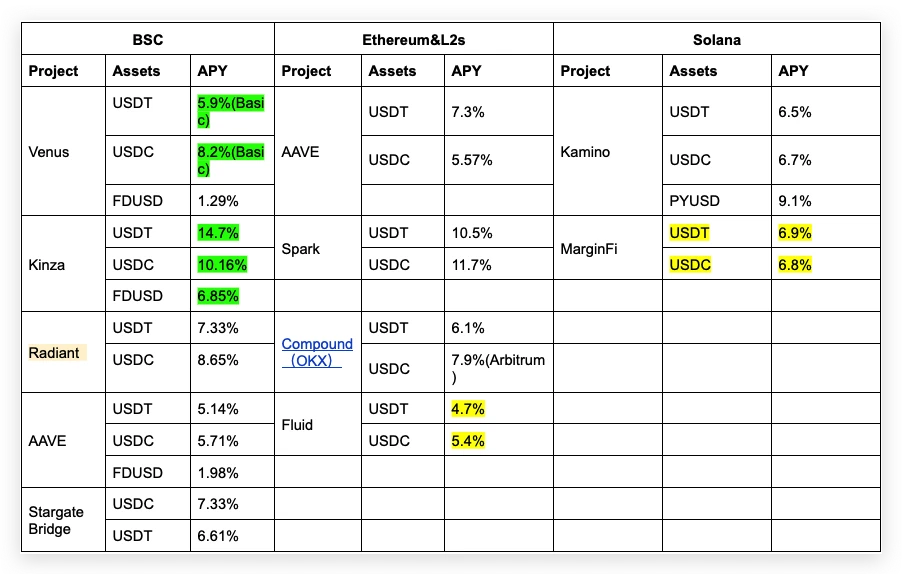

In terms of on-chain yields, users can stake stablecoins on platforms like Venus and PancakeSwap, which offer more attractive returns than Solana. As shown in the figure below, the annualized return for staking USDT on Kinza in the BNB Chain ecosystem reaches 14.7%, far exceeding that of Ethereum and Solana (data as of 10/17).

At the same time, compared to local fiat currencies, choosing to hold stablecoins is also a good asset preservation and investment choice. For example, from December last year to September this year, Argentina's inflation rate reached 153%, while the increase in various unofficial dollar exchange rates was less than 20%. The dollar exchange rate has fallen below 1200 pesos, finding support between 900 and 1050 pesos.

A similar situation exists in Turkey, where the inflation rate has exceeded 80%, and the exchange rate of the national currency lira against the dollar has hit a historical low of 18.41 lira. The exchange rate has dropped nearly 30% this year alone and has cumulatively fallen about 70% over the past three years.

In summary, for countries with unstable economic foundations and severe inflation, it is better for citizens to hold stablecoins on-chain to earn relatively more stable and preserved returns.

- Integration of Stablecoin Off-Chain Payments

In terms of off-chain payments, BNB Chain has also partnered with Alchemy Pay, Oobit, Lunu, MugglePay, Now Payment, Depay, Xion, Portal Pay, and Slash Vision payment gateways, enabling users to use stablecoins for shopping in real life, breaking the on-chain boundaries of decentralized finance and providing users with a new payment alternative beyond traditional payment methods.

In addition, BNB Chain is also exploring the integration of stablecoin payments with AI Agents. Imagine that in the future, as AI technology matures, AI Agents can assist humans in more areas such as life management and intelligent decision-making, while blockchain technology and stablecoin payments can help AI achieve more complex payment scenarios and automated transactions, realizing a truly intelligent economy.

In conclusion, BNB Chain maintains differentiation and unique advantages in multi-chain competition through low gas fees and high TPS on the hardware side, and through high daily active users and a mature, dual development of on-chain and off-chain DeFi systems on the ecosystem side.

Summary

BNB Chain's mission and vision are to attract the next billion users into Web3. Whether it is increasing the adoption of stablecoins on-chain and off-chain or providing more attractive DeFi yield strategies, all are moving closer to BNB Chain's original intention and mission.

As for users, standing with the BNB Chain ecosystem, actively participating in early activities, and integrating into the development process of BNB Chain will surely yield rich ecological returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。