Do not trade out of revenge or urgent need for money. The market does not understand your situation; it is just a vast space connected by the actions of all other traders. It will not reward you just because you need a return. You are the one in control. Earning money from the market or losing to other market participants depends on your abilities.

One of the best ways to improve trading skills is to correct past mistakes. Books can easily tell a trader how to trade correctly, teaching them how to pick opportunities with the lowest risk and the highest odds. However, these books cannot tell you the right mindset to handle losses, nor can they effectively teach you how to control the emotions that may arise during trading. Only by putting real money on the line will you feel the pain, leading to some abnormal behaviors.

Generally speaking, trading opportunities should align with the main trend of the market. If the market is in an uptrend, traders should wait for a pullback and successfully test the lower support before entering long positions. Shorting during a pullback in an uptrend can also be profitable, but it is a lower probability opportunity and should be avoided as much as possible. High-probability traders know when to cut losses and when to continue holding profitable positions. This kind of skill takes time and experience to develop, so—be patient.

Chu Yuechen: 10.18 Bitcoin and ETH Market Analysis and Trading Reference

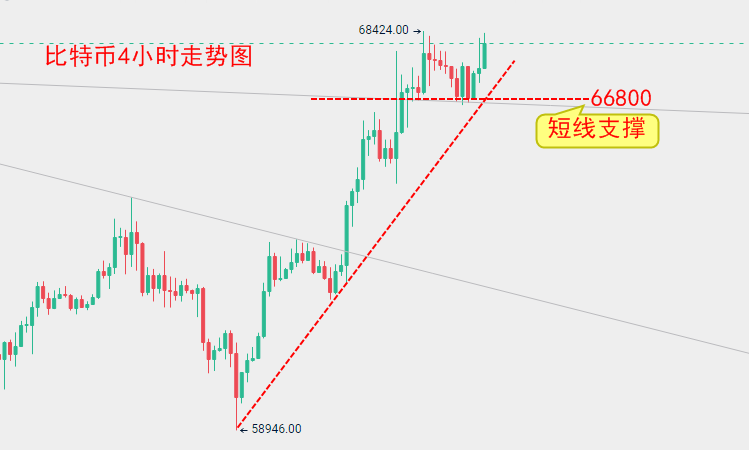

First, let's review what was provided yesterday evening. The current price order for Bitcoin was a long position at 66800, with a target of 68000 successfully taking profit. The ETH position was also a long order at 2590, with a take profit at 2650. Anyone who followed yesterday's advice definitely saw good returns. These two trades from yesterday can be considered quite perfect, with no hindsight trading, as they were both current price orders.

As of now, Bitcoin is fluctuating around 68100, and ETH is around 2630. We analyzed the trend of Bitcoin from the daily chart yesterday, which may not have been very clear. Today, let's take a look at the weekly chart for a better view of the trend. We can see more clearly that the trend resistance line formed from the historical high of 73777 has broken upward. Currently, around 66500, it serves as both a support level for the top-bottom conversion and a breakout point for the downward trend resistance. Therefore, we mentioned yesterday that we are optimistic about reaching above 70000.

On the short-term 4-hour chart, there is also a step-like upward movement. The short-term support below is what we mentioned yesterday at 66800, which was the position I provided for the current price order last night. There is still pressure around 68500 above, so it is normal to see a short-term pullback at this level. We explained yesterday that while we are bullish on the trend, we still need to pay attention to entry points for short-term contracts. If the entry point is set too high, it becomes difficult to set stop losses, and even in a bullish upward trend, it does not rise in a straight line. When it reaches pressure or support levels, which we call dense trading zones—areas where the market has consensus—there will be battles between bulls and bears, leading to repeated tug-of-war. Therefore, Bitcoin may continue to oscillate for a while.

For intraday short-term contracts, currently, we can take a short position around 68200, with a stop loss at 69000 and a take profit at 67000. Of course, when it drops to around 66800, we will enter a long position again, with a stop loss at 66000 and a take profit at 68000.

For ETH, the same principle applies. Currently, around 2650, we can also take a short position for a pullback, with a stop loss at 2700 and a take profit at 2590.

Specific Operation Suggestions (based on actual market price orders)

For Bitcoin, take a short position around 68200 for intraday short-term contracts, with a stop loss at 69000 and a take profit at 67000. Of course, when it drops to around 66800, we will enter a long position again, with a stop loss at 66000 and a take profit at 68000.

For ETH, take a short position for a pullback around 2650, with a stop loss at 2700 and a take profit at 2580.

Before the market moves, any analysis can be correct and has its reasons, but no single trade will be absolutely accurate; there are risks involved. Therefore, the premise for making money is to manage risk well. The market changes in real-time, and strategy points are for reference only and should not be used as entry criteria. Investment carries risks, and profits and losses are borne by the investor.

Many individual investors find themselves unable to enter the trading door, often simply because they lack a guide. The questions you ponder may be easily resolved with a single pointer from an experienced person. Daily real-time market analysis, along with guidance from experience-sharing groups, and evening practical guidance groups are available for real-time support. Evening live broadcasts will explain real-time market conditions.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。