Author: 0xEdwardyw

Introduction

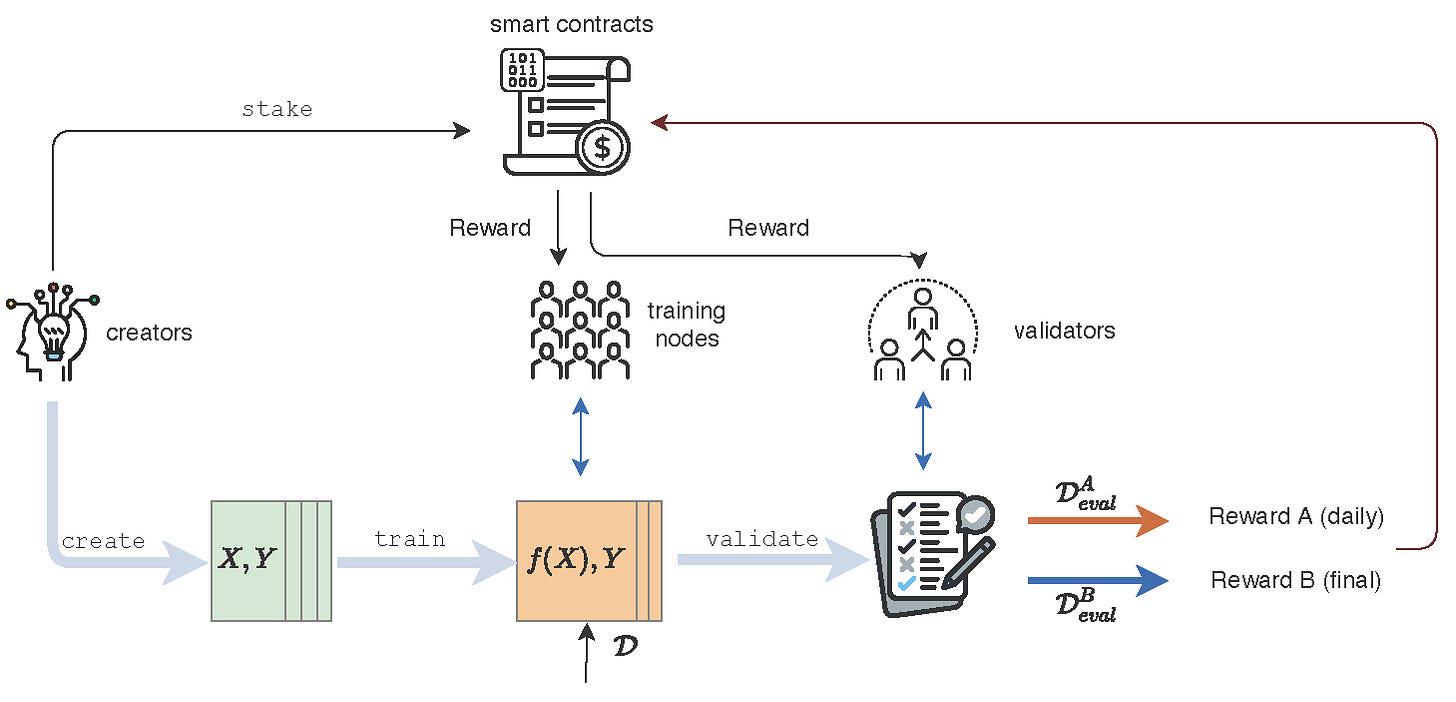

EigenLayer is an innovative protocol built on the Ethereum blockchain that introduces the concept of "Restaking," allowing users to leverage their staked Ethereum (ETH) to provide security for multiple decentralized applications (dApps) simultaneously. Through this mechanism, EigenLayer not only enhances the security and scalability of Ethereum but also enables stakers to earn additional rewards while optimizing capital utilization.

As a middleware solution, EigenLayer facilitates a market where users can restake their ETH or liquid staking tokens (LSTs) across different applications. This mechanism allows various protocols to benefit from Ethereum's robust security infrastructure without having to establish their own validator clusters, significantly reducing the costs and barriers for new projects.

- Restaking Mechanism: Users can choose to restake their staked ETH or LSTs (such as stETH and rETH), thereby extending the security of the crypto-economy to multiple applications on the EigenLayer network. This process is similar to asset remortgaging but still maintains user control over the assets.

- Active Validator Services (AVS): EigenLayer supports AVS, which utilize the shared security provided by restakers to create a dynamic environment. Various protocols can decide how much yield to offer, while validators can choose which services to support based on risk and reward.

Token Model

Intersubjective Staking

The EIGEN token introduced by EigenLayer serves as a universal "subjective work token," aimed at enhancing the security and functionality of decentralized applications (dApps) within the Ethereum ecosystem. The EIGEN token introduces a novel mechanism called "Intersubjective Staking," which allows for penalties (or "slashing") to be imposed when subjective misconduct occurs that cannot be easily identified on-chain. This mechanism helps maintain the integrity of the network by providing subjective error detection without requiring a fork of Ethereum itself.

In simple terms, "intersubjectivity" refers to something that a group of people collectively agrees upon or understands, rather than something that can be objectively measured by machines or code. It is akin to when two or more people reach a consensus on what is fair or true, even without strict rules or formulas to prove it.

In the context of EigenLayer, "subjective errors" refer to actions that are not explicitly captured by blockchain rules but are still evidently wrong or harmful to the system. When these errors occur, a group of participants (validators or community members) can reach a consensus that action should be taken, such as punishing the wrongdoers. In this way, human consensus can help make decisions that algorithms cannot accomplish alone.

Subjective Error Resolution Mechanism: EIGEN resolves disputes through community consensus, employing a forking mechanism to punish malicious actors by slashing their stakes. This process is known as "slashing-by-forking," and a fork is created when the majority of stakers behave maliciously, allowing users to choose which version of the token to support.

Dual Token Model: EIGEN operates with two different tokens:

- EIGEN: This is the primary token used for DeFi applications, which is independent of forks and remains unaffected in long-term holdings.

- bEIGEN: This is the token used for staking, which may involve forks. It manages the normative state of EigenLayer and is responsible for handling dispute resolution across various active validator services (AVS).

Staking Mechanism

EIGEN tokens can be staked to secure various active validator services (AVS), providing crypto-economic security by punishing operators who commit subjective errors. This staking mechanism complements the ETH restaking primarily aimed at objective errors.

AVS Secured by Restaked ETH and Staked EIGEN

EigenLayer's AVS can be secured by both restaked ETH and staked EIGEN tokens. EigenLayer introduces a dual staking model, where AVS like EigenDA (data availability layer) can leverage Ethereum's native security (through restaked ETH) as well as additional security provided by staked EIGEN tokens.

Restaked ETH comes from Ethereum validators who "reuse" their staked ETH to not only secure Ethereum but also protect other protocols on EigenLayer. This shared security model enhances the security of AVS through Ethereum's robust validator network. Additionally, the EIGEN token adds a layer of governance and fault tolerance through subjective staking, allowing for penalties against misconduct that is difficult to detect by code.

In summary, by utilizing restaked ETH and EIGEN tokens, AVS gains a more comprehensive security mechanism that combines Ethereum's objective slashing with EigenLayer's more nuanced governance and error resolution system.

Token Distribution, Unlocking Plan, and Inflation Mechanism

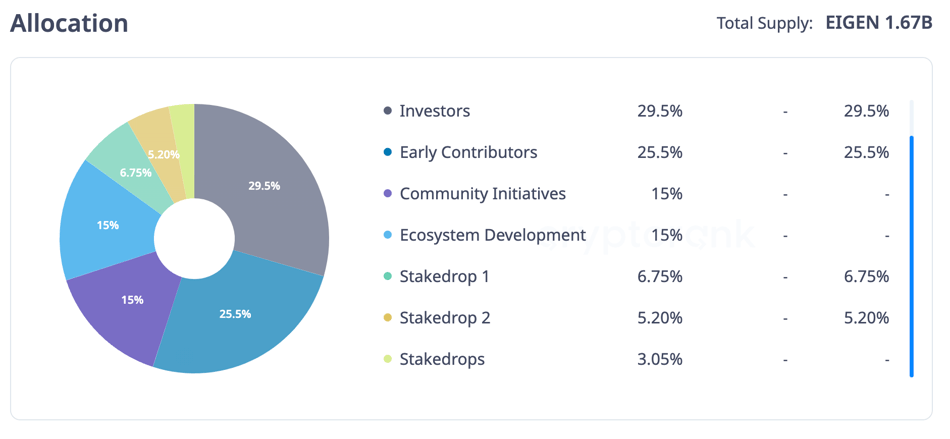

The initial total supply of EIGEN tokens is 1.67 billion. However, EIGEN is an inflationary token, meaning this number is not its maximum supply. While the exact inflation rate has yet to be determined, it is expected to remain in the low single digits.

At launch, tokens from Statedrop 1 (6.75%) and Statedrop 2 (5.2%) were unlocked, bringing the initial circulating supply to 200 million EIGEN tokens, approximately 11.95% of the total supply. An additional 3.05% of staking reward tokens will be distributed in the near future.

Source: Cryptorank

Community Distribution (Total 45%)

- Staking Rewards (15%): This portion is used to reward users who stake Ethereum (ETH) on EigenLayer.

- Community Initiatives (15%): Reserved for various community-driven projects and initiatives.

- Ecosystem Development (15%): Used to support the development of the ecosystem surrounding EigenLayer.

Contributors and Investors (Total 55%)

- Early Contributors (25.5%): Includes developers of the protocol and early supporters.

- Investors (29.5%): Allocated to investors who provided funding for the project.

Unlocking Plan

The total allocation for ecosystem development is 15% of the total supply of EIGEN tokens. However, EigenLayer has not disclosed detailed unlocking plans for this category.

Community initiatives receive a 15% allocation of the total supply of EIGEN tokens. Of this, 4% is designated for "Programmatic Incentives v1," which will unlock linearly over one year. The unlocking plan for the remaining 11% has not been announced.

All tokens allocated to investors and core contributors will be fully locked for one year after the tokens are first transferable to the community. After this date, EIGEN allocated to investors and core contributors will unlock at a rate of 4% per month. This means that the EIGEN held by investors and core contributors will not be fully unlocked until three years after the first transferable date.

Future Inflation

EigenLayer is designed similarly to Ethereum, with a dynamic token supply expected to experience an inflation phase in the early stages. The specific issuance plan has yet to be determined. According to the project's design, inflation aims to prioritize the balance of the ecosystem, distributing EIGEN tokens to various participants such as operators, ETH restakers, and developers. This differs from typical proof-of-stake systems, where rewards are usually skewed towards existing token holders.

Price and Valuation Analysis

Venture Capital Cost

EigenLayer has garnered significant attention in the venture capital space, raising a total of $164.5 million through three funding rounds. According to the disclosed data from the Series A funding, EigenLayer's valuation stands at $5 billion, and it may be higher after the Series B investment. The cost of Series A funding was approximately $0.3 per EIGEN token. Series A investors typically expect a return of 10 to 15 times.

Series B Funding: a16z $100 Million Investment

- Announced on February 22, 2024, this $100 million investment is part of EigenLayer's Series B funding, exclusively invested by Andreessen Horowitz (a16z), with the financing valuation not disclosed.

Series A Funding: $50 Million

- Prior to Series B funding, EigenLayer raised $50 million in March 2023, led by Blockchain Capital. This round of funding helped EigenLayer establish a valuation of $5 billion at that time.

Current Valuation

After launching on October 1, 2024, EigenLayer's EIGEN token experienced significant market volatility, starting at a price of $3.90, with a fully diluted valuation (FDV) of $6.5 billion. The token price quickly surged, reaching a high of $4.47 within the first few hours of trading.

In the days following the launch, EIGEN's price fluctuated significantly, primarily due to actions by some large holders, such as Tron founder Justin Sun selling a large amount of airdropped EIGEN tokens. Despite these fluctuations, EIGEN's current price stabilizes around $3.5, giving it an FDV of over $6 billion. The current price is approximately 10 times the cost of Series A venture capital.

EIGEN is a token with low circulation and high FDV. Due to the large allocation for investors (29.5%) and core contributors (25.5%), this means that after the one-year lock-up period ends, the token may face significant selling pressure.

The low circulation and high FDV model has several implications for the market. Initially, the limited supply available for trading may lead to rapid price increases. However, as more tokens unlock and enter the circulating market, there may be substantial selling pressure. This dynamic raises concerns about the long-term sustainability of such tokens and their potential impact on retail investors. Critics argue that this structure leaves little room for price appreciation for investors after the token generation event (TGE), as most of the potential value has already been captured by early private investors and venture capitalists.

The future potential of the EIGEN token lies in its demand within the EigenLayer ecosystem. As the circulating supply increases after the one-year lock-up period, more active validator services (AVS) will come online, and EIGEN tokens will be used for staking to enhance the security of these services. These factors are expected to maintain healthy demand for the token and help mitigate selling pressure after the tokens are unlocked.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。