The cryptocurrency venture capital environment in the third quarter of 2024 shows a cautiously optimistic attitude, with fundraising activities rebounding and increasing interest from institutional investors.

Author: insights4.vc

Translation: Deep Tide TechFlow

Over the past decade, the cryptocurrency industry has undergone significant changes, with venture capital becoming a major force driving innovation and growth. From the ICO boom in 2017 to the rise of decentralized finance (DeFi) in 2020, the industry has experienced a cycle of rapid expansion followed by a period of adjustment. Now, as we enter the third quarter of 2024, the crypto venture capital space is beginning to recover after a challenging period. We have conducted a detailed discussion on the historical context of the venture capital landscape in our paper “The Evolution of Crypto Venture Capital: A 15-Year Review”.

Fundraising Recovery

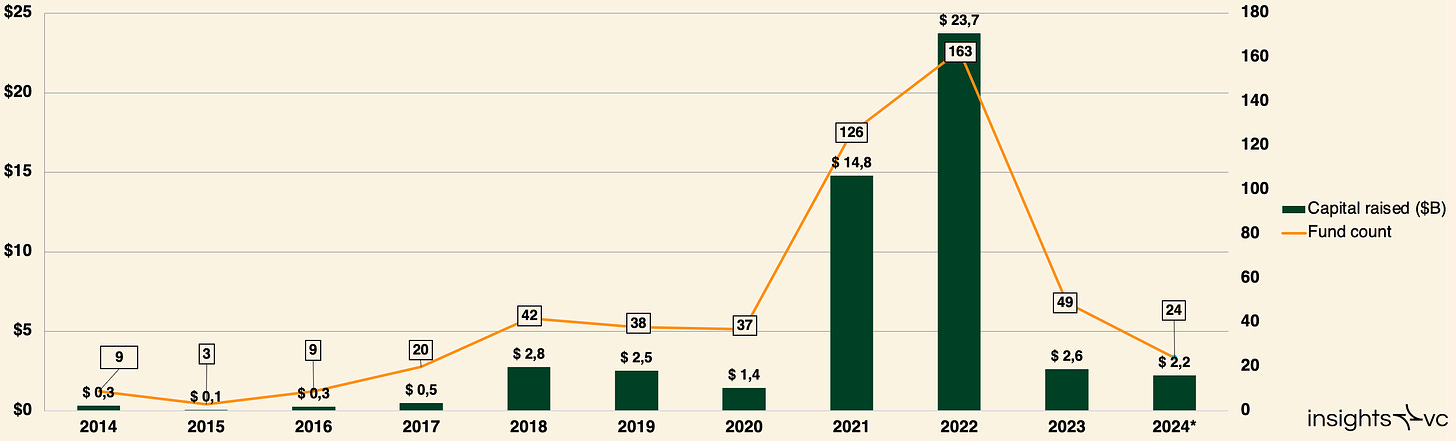

Cryptocurrency venture capital fundraising dynamics (as of August 30, 2024)

As of August 30, 2024, 24 funds have raised a total of $2.2 billion, indicating a potential rebound trend that is expected to exceed the total fundraising amount of 2023. This recovery is primarily attributed to the following factors:

Market Stability: In March 2024, the total market capitalization of cryptocurrencies reached 93% of the previous cycle's peak.

Institutional Participation: Traditional financial institutions such as BlackRock, Fidelity Investments, and Franklin Templeton entering the crypto space have bolstered market confidence.

Project Maturity: Investment projects from the 2020-2022 boom period are gradually maturing, providing attractive investment opportunities.

Investor Sentiment

According to a survey by Coinbase Institutional, 64% of existing institutional investors plan to increase their cryptocurrency investments over the next three years, while 45% of non-investors expect to start investing during the same period. Additionally, nearly 60% of respondents believe that cryptocurrency prices will rise in the next year.

Shift in Investment Focus to Mid-Sized Funds

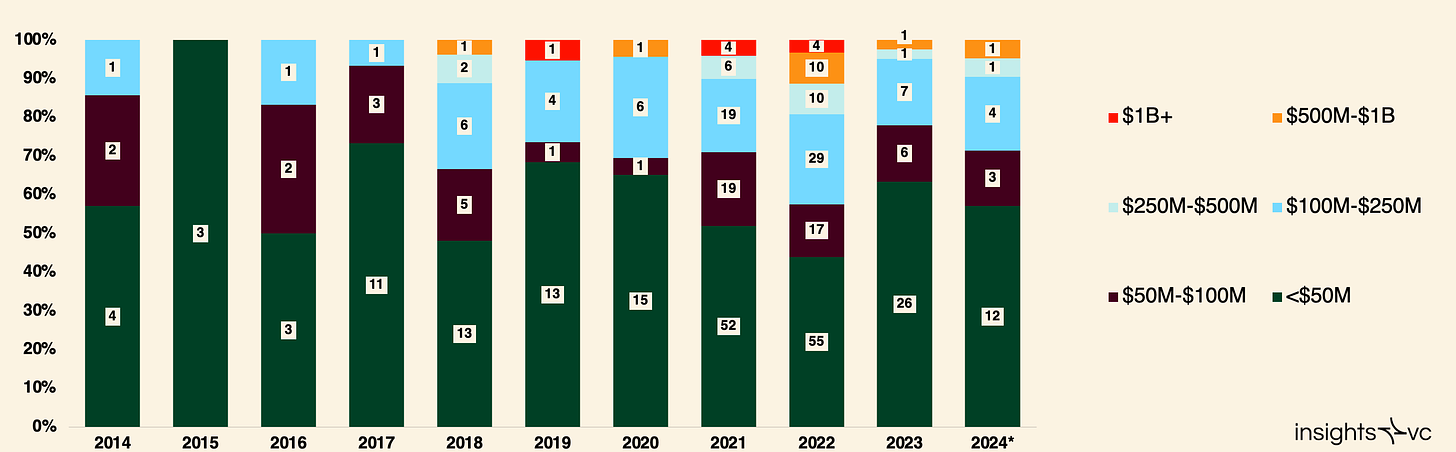

Number of cryptocurrency venture capital funds by size (as of August 30, 2024)

In the past, the cryptocurrency venture capital space was primarily dominated by smaller funds (valued at $100 million or less), reflecting the early development stage of the industry. However, since 2018, capital has gradually shifted towards mid-sized funds ($100 million to $500 million). The median size of funds has increased by 76.0% from $25 million in 2023 to $41.3 million in 2024.

Large funds (valued at $1 billion or more) saw significant growth from 2019 to 2022, but have not shown notable activity in 2023 and 2024. Major challenges include:

Difficulty in Capital Deployment: Large funds find it challenging to locate startups that require substantial capital.

Valuation Pressure: The demand for large investments has driven up valuations, increasing investment risks. Nevertheless, funds like Pantera Capital (targeting $1 billion) and Standard Crypto (targeting $500 million) remain active in the market. These funds are expanding their investment scope beyond cryptocurrencies to include areas like artificial intelligence (AI) to deploy capital more effectively.

Emerging Managers' Dominance

In terms of the number of funds, emerging managers continue to dominate, raising 77% to 87% of funds annually over the past five years. This trend is attributed to the following reasons:

Specialized Technical Expertise: The crypto space requires deep technical knowledge and skills, which emerging managers often possess.

Market Focus: Due to the specialization of the crypto industry, general venture capital firms have launched fewer new crypto funds.

The proportion of first-time funds has decreased from about 58% in 2020 to 45.8% in 2024. However, as the market recovers, we expect to see a "barbell effect," where first-time managers and mature crypto-native fund managers achieve significant success in fundraising.

Extended Fundraising Cycles

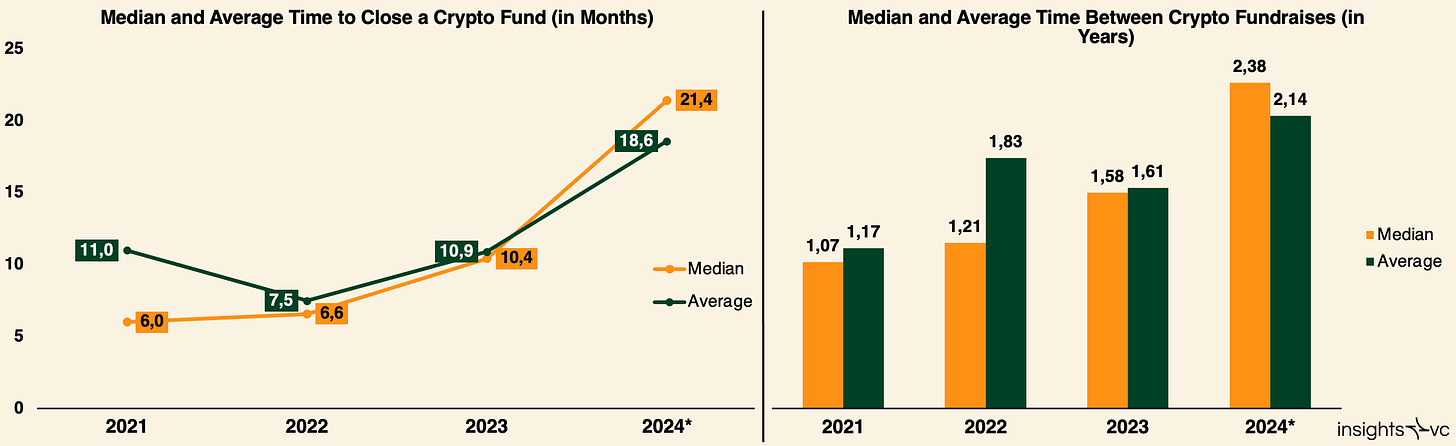

Note: Data as of August 30, 2024

From 2021 to 2024, the median interval for fund fundraising increased from 1.1 years to 2.4 years, while the median time to close funds extended from 6 months to 21.4 months. The reasons for this trend include:

Increased Caution Among Investors: Limited partners (LPs) have become more selective and require detailed evaluations.

Market Conditions: During bear markets, fund managers have slowed down the pace of capital deployment. Due to a lack of substantial returns distributed to LPs, savvy cryptocurrency investors may continue to exercise caution. Fund managers holding tokens may begin to liquidate positions, even at a loss, to demonstrate some returns.

Venture Capital in Q3 2024

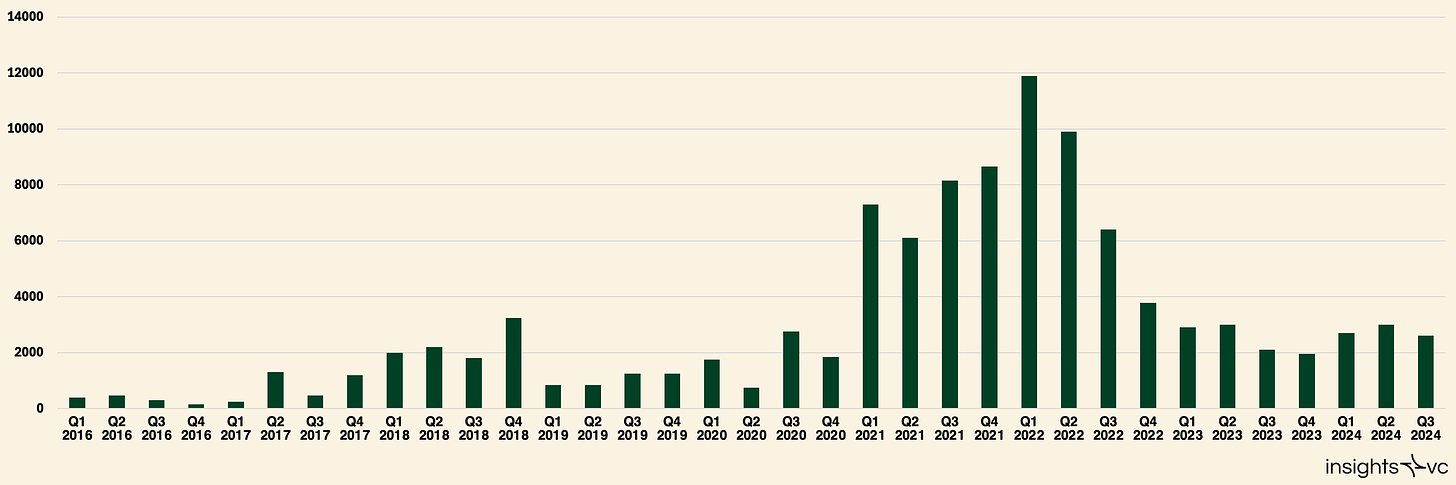

Cryptocurrency venture capital by quarter (2016–2024)

In the third quarter of 2024, venture capitalists invested approximately $2.7 billion in crypto and blockchain startups, a 10% decrease from $3 billion in the second quarter of 2024. This downward trend reflects a more cautious investment strategy among investors in the face of ongoing market uncertainty.

Despite the quarterly decline in investment, the total venture capital amount for 2024 is still expected to reach or slightly exceed the levels of 2023. This indicates that, despite short-term fluctuations, overall interest in crypto and blockchain venture capital remains stable on an annual basis.

Most Active Investors

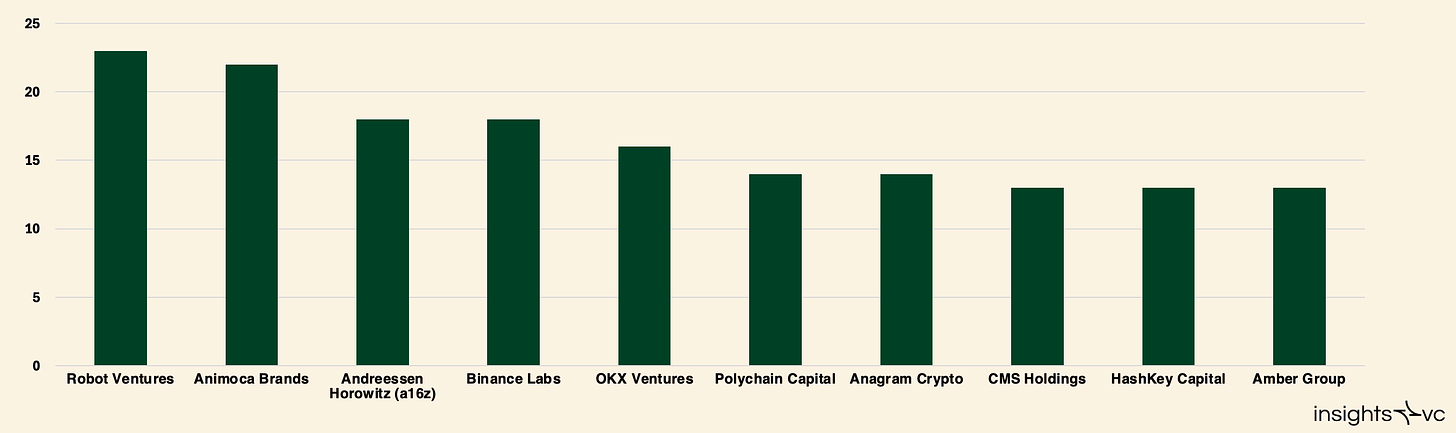

Most active investors (July 1, 2024, to October 15, 2024)

From July 1, 2024, to October 15, 2024, the most active investors in the cryptocurrency space demonstrated a continued commitment to fostering innovation, particularly in early-stage companies. Leading the way is Robot Ventures, which completed 23 investments during this period. Animoca Brands closely followed with 22 investments, while Andreessen Horowitz (a16z) and Binance Labs each made 18 investments. OKX Ventures secured 16 deals, and both Polychain Capital and Anagram Crypto participated in 14 investments. CMS Holdings, HashKey Capital, and Amber Group each made 13 investments, becoming top players in the cryptocurrency investment space.

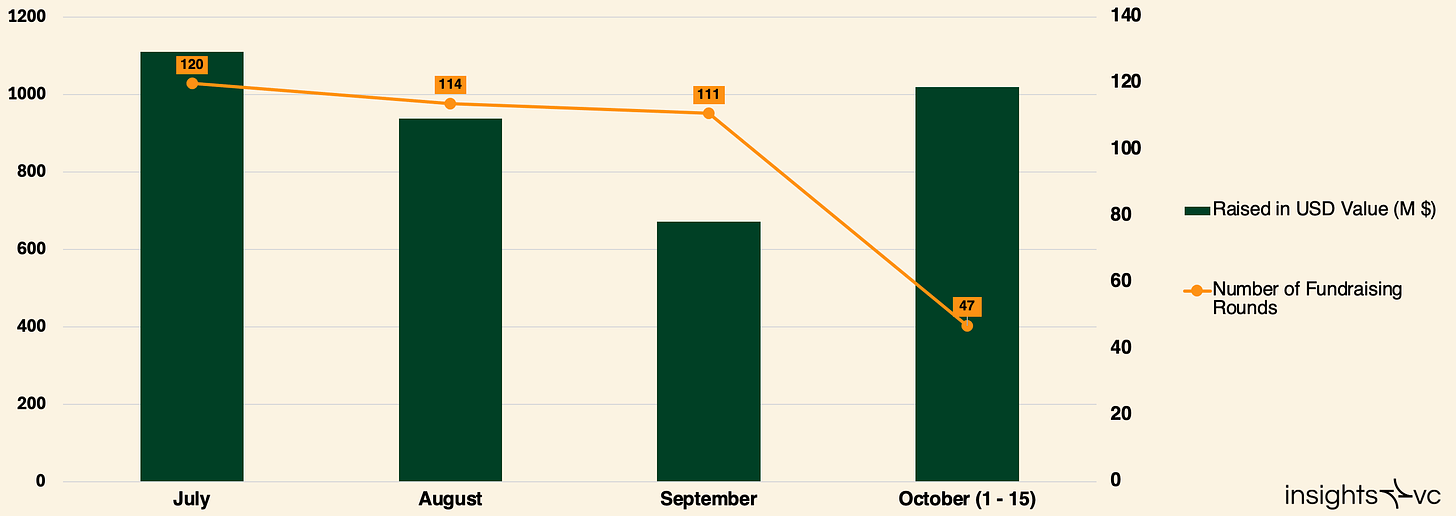

Fundraising Rounds from July 1, 2024, to October 15, 2024

Total fundraising amounts and rounds (July 1, 2024, to October 15, 2024)

During the period from July 1, 2024, to October 15, 2024, despite an overall decline in venture capital, several significant funding rounds still indicate ongoing interest in high-potential projects. Praxis Society stood out by raising $525 million, with specific stages undisclosed, supported by notable figures such as Dan Romero, Fred Ehrsam, Brian Armstrong, and Erik Voorhees.

In the third quarter of 2024, Celestia raised $100 million for its modular data availability network, topping the fundraising chart. Following closely was Sentient, which raised $85 million for its open-source AI development platform. Story Protocol secured $80 million for blockchain-based intellectual property management, while Infinex raised $65.2 million for its decentralized exchange. Chaos Labs, focusing on crypto protocol security, raised $55 million, and Sahara AI secured $37 million for its decentralized AI network. Other notable fundings include Drift Protocol ($25 million), Helius ($21.7 million), B3 Fun ($21 million), and Caldera ($15 million) for modular blockchain development.

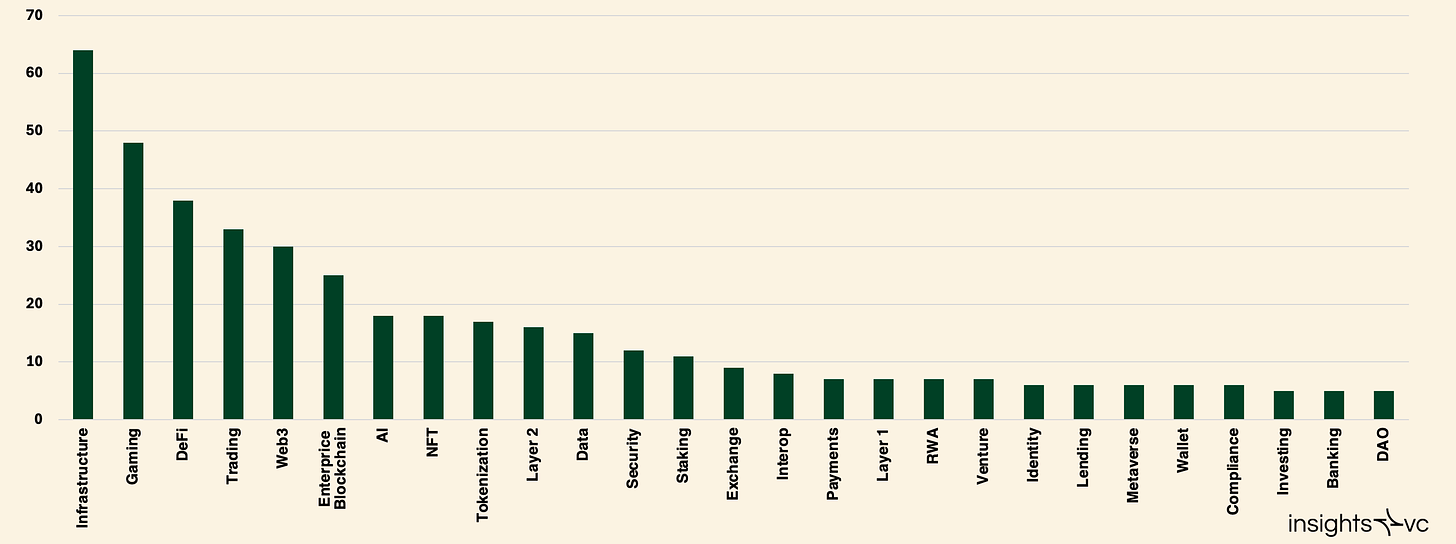

Overview of cryptocurrency venture capital transactions in Q3 2024

Analysis shows that in terms of transaction volume, crypto infrastructure projects led with 64 transactions, followed by gaming projects with 48 and DeFi projects with 38. This indicates a market emphasis on infrastructure and blockchain development, while interest in gaming and decentralized finance is also increasing.

Capital Investment and Bitcoin Prices

Historically, there has been a strong correlation between Bitcoin prices and the investment amounts in crypto startups. However, since January 2023, this relationship has significantly weakened. Despite Bitcoin reaching an all-time high, venture capital activity has not seen a corresponding increase.

Possible reasons include:

Decreased Investor Interest: Institutional investors may have become cautious due to regulatory uncertainty and market volatility.

Shift in Market Focus: The current market's greater focus on Bitcoin may have led to other crypto investment opportunities being overlooked.

Venture Capital Market Environment: The overall downturn in the venture capital market has also impacted crypto investments.

Investment Trends

In the third quarter of 2024, 85% of venture capital flowed to early-stage companies, with only 15% directed towards late-stage companies. This indicates that investors are more focused on startups with high growth potential, likely due to their lower valuations and higher return potential. Although there was a slight decline in pre-seed stage transaction activity, it remains strong compared to previous cycles, showing continued interest in early-stage companies.

Venture-backed crypto companies reached their lowest valuations at the end of 2023 but began to rebound in the second quarter of 2024 as Bitcoin hit new highs. In the third quarter of 2024, the estimated median valuation of companies was $23 million, with an average deal size of $3.5 million.

In terms of capital allocation by stage, most investments in Layer 1, enterprise blockchain, and DeFi were concentrated in early-stage companies, reflecting a focus on innovation. Mining companies attracted more funding in the late stage, likely due to their resource-intensive business needs.

Industry maturity analysis shows that early-stage companies still dominate in most categories, indicating a continued market emphasis on new entrants and innovative firms. Late-stage investments are more concentrated in areas like mining and infrastructure, where mature companies require substantial capital for growth.

The proportion of early-stage transactions across categories remains high, consistent with trends from the second quarter of 2024. The number of late-stage transactions has remained stable compared to the previous quarter, indicating sustained investment in mature companies.

Emerging Trends in Q3 2024

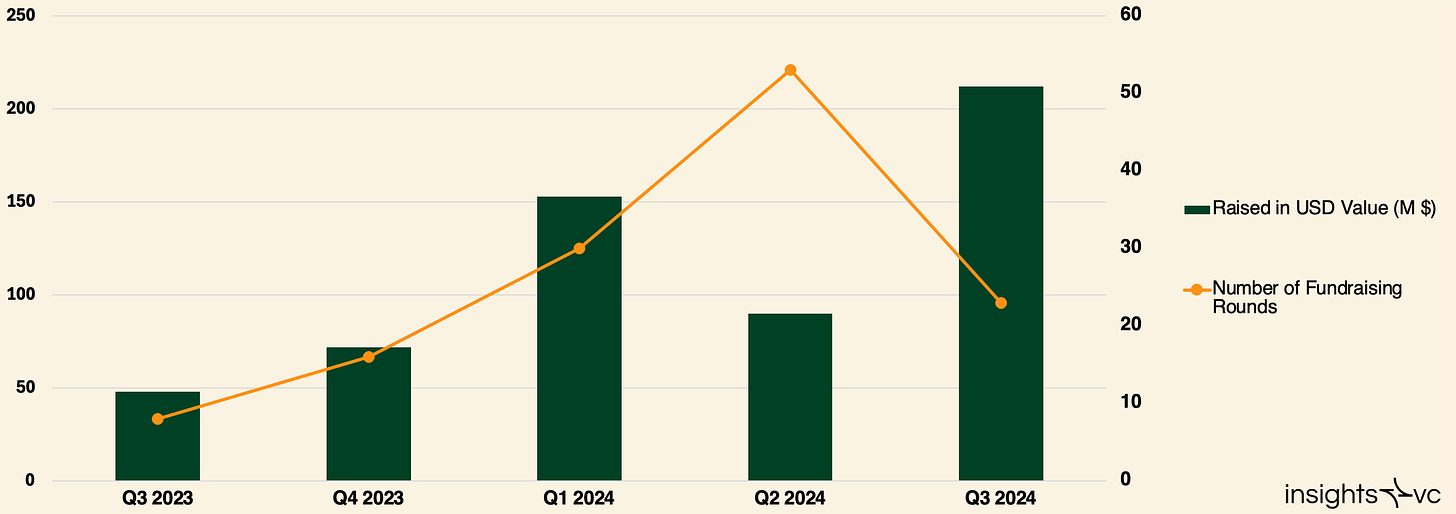

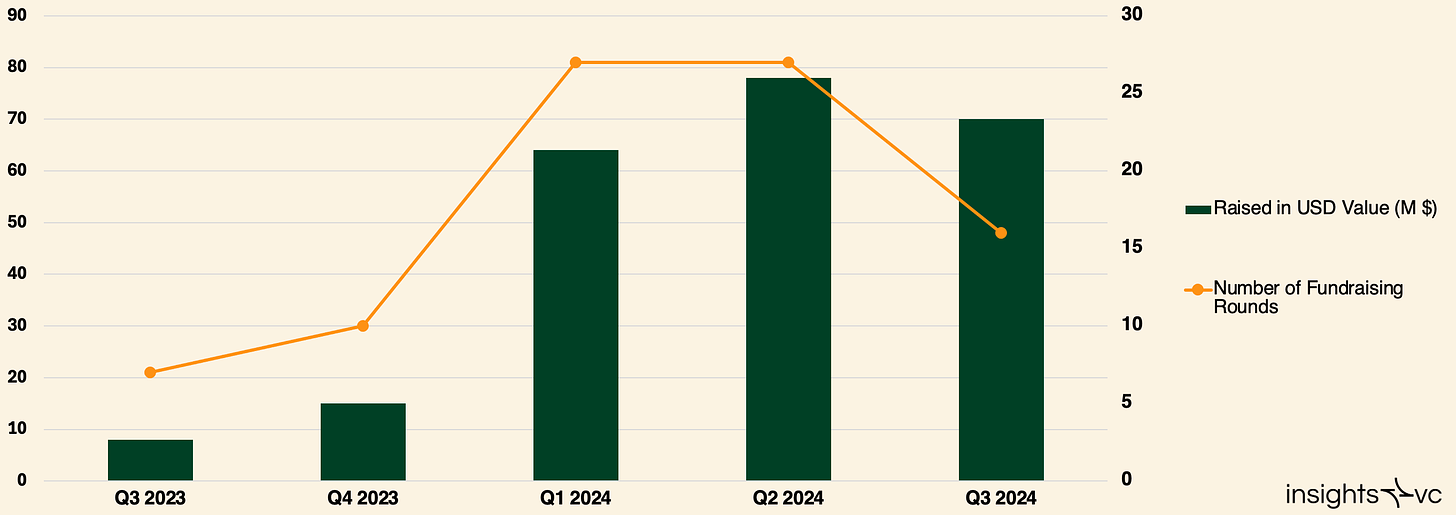

In the third quarter of 2024, AI emerged as a significant theme in venture capital, particularly in terms of year-over-year growth, although it did not dominate in the number of announced rounds. The surge in interest in AI is primarily driven by open-source models, the impact of AI in content creation, and the potential for decentralized reasoning. Funding for AI crypto projects increased by 340% compared to the third quarter of 2023, demonstrating high investor enthusiasm in this area. Leading this trend are companies like Sentient, which raised $85 million, Sahara AI, which secured $37 million, and Balance, which raised $30 million.

Funding amounts for AI cryptocurrency projects from Q3 2023 to Q3 2024

One of the most prominent growth areas is Decentralized Physical Infrastructure Networks (DePIN), with funding in the third quarter of 2024 increasing by 691% compared to the same period in 2023. Major deals include DAWN Internet raising $18 million (for detailed analysis, click here), Project Zero 2050 receiving $12 million, Mawari XR securing $10 million, Pipe Network obtaining $10 million, and Daylight Energy raising $9 million.

Funding situation for DePIN projects from Q3 2023 to Q3 2024

Conclusion

The cryptocurrency venture capital environment in the third quarter of 2024 exhibits a cautiously optimistic attitude, with fundraising activities rebounding and increasing interest from institutional investors. The shift towards mid-sized funds and the continued dominance of emerging managers indicate that the industry is adapting to market changes and maturing gradually. Despite a short-term decline in venture capital and extended fundraising cycles, the sustained focus on early-stage companies and emerging trends like AI integration suggest that the ecosystem is resilient and prepared for future growth. Overall, the industry demonstrates potential strength, signaling the possibility of new developmental momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。